In the world of finance and decision-making, numerous concepts guide how individuals, businesses, and governments allocate resources. These fundamental ideas help explain how markets function, how prices are determined, and how people make choices under limited conditions. By mastering these concepts, one can better navigate complex situations in both theoretical and practical environments.

Whether it’s analyzing the impact of a new policy or understanding consumer behavior, the ability to break down real-life scenarios into manageable solutions is crucial. This involves applying theoretical models to everyday situations, using them as tools to predict outcomes, solve issues, or optimize strategies. Exploring these methods can significantly enhance one’s grasp of economic reasoning.

Effective problem-solving in this field requires not only knowledge but also the ability to think critically about how various factors influence one another. By examining specific case studies or hypothetical scenarios, it becomes clearer how abstract concepts translate into tangible outcomes, offering valuable insights into the decisions we make daily.

Principles of Economics Problems and Applications Answers

In the realm of financial analysis and decision-making, certain key ideas serve as the foundation for understanding how systems work, how resources are distributed, and how individuals or organizations make choices. These concepts form the basis of solving real-world issues, from pricing strategies to supply chain management. By breaking down these core elements, one can gain insight into the mechanics that drive economic behaviors and outcomes.

Core Concepts in Financial Decision-Making

To effectively tackle real-world scenarios, it is important to first familiarize oneself with the key principles that guide choices in any given market or environment. These core concepts allow us to analyze the behavior of individuals, companies, and governments, revealing patterns that can help in crafting optimal solutions.

- Supply and Demand: The relationship between the availability of a product and consumer demand directly impacts its value and how resources are allocated.

- Scarcity: Limited resources force decision-makers to prioritize certain needs, which shapes the structure of markets and consumer behavior.

- Cost-Benefit Analysis: Assessing the trade-offs between different options helps in making decisions that maximize benefits while minimizing drawbacks.

- Market Equilibrium: Understanding how prices adjust to reflect the balance between supply and demand is crucial for determining the value of goods and services.

Applying Theoretical Concepts to Real-World Scenarios

Once the foundational concepts are understood, they can be applied to real-life challenges to provide solutions and guide decision-making. By examining specific cases, individuals and businesses can identify the most effective strategies for navigating complex situations.

- Policy Evaluation: Governments often use these principles to assess the impact of new policies on markets, such as tax changes or environmental regulations.

- Investment Decisions: Understanding risk, return, and the cost of capital is essential for businesses when making investment choices.

- Pricing Strategies: Companies can leverage supply-demand models to set optimal prices for their goods or services, balancing profitability with consumer interest.

- Resource Allocation: The process of distributing limited resources effectively is central to ensuring efficiency and meeting societal or business goals.

By integrating these fundamental principles with practical applications, one can not only solve problems more effectively but also make informed decisions that lead to better outcomes across various sectors of society.

Understanding Economic Theories and Their Impact

In the study of how markets function and resources are distributed, various concepts offer frameworks for interpreting real-world behavior. These frameworks help explain the decisions made by individuals, firms, and governments and the effects these decisions have on society. Understanding these models is essential for analyzing how different forces shape economic outcomes and influence policy choices.

Theoretical models serve as tools for predicting future trends, testing ideas, and making sense of complex interactions within markets. While these theories may not always perfectly reflect reality, they provide valuable insights into how systems can work under certain assumptions. By examining their outcomes, we can better understand the impact of various actions and the likely consequences for stakeholders involved.

Each theory offers a distinct lens through which to view economic behavior, from the way supply and demand interact to the role of government intervention in stabilizing or guiding market dynamics. These theories are critical in shaping policies that affect everything from consumer prices to national economic growth.

Common Challenges in Economics Problem Solving

When attempting to address issues in the realm of resource allocation and market behavior, many obstacles arise that can complicate the decision-making process. These challenges often stem from the complexity of the systems being analyzed, the unpredictability of human behavior, and the interplay of various factors that must be considered. Overcoming these difficulties requires a blend of analytical thinking, critical evaluation, and the ability to work with imperfect data.

Identifying Relevant Variables

One of the most common hurdles is determining which variables are most important when analyzing a situation. With so many factors potentially influencing an outcome, it can be difficult to isolate the key elements that drive decision-making. Understanding the relationships between these variables is essential for creating accurate models and predicting results.

- In complex systems, it may be unclear which inputs are most influential.

- External factors such as political changes or global events can introduce additional layers of uncertainty.

- Overlooking secondary influences can lead to incomplete or skewed conclusions.

Dealing with Uncertainty and Data Limitations

Another significant challenge in tackling real-world issues is the inherent uncertainty present in most scenarios. Often, the data available is incomplete or imprecise, making it difficult to form definitive conclusions. In such cases, assumptions must be made, which can introduce bias into the analysis. The ability to work with limited or imperfect data while still providing useful insights is a critical skill in this field.

- Unpredictable shifts in market conditions can make forecasting outcomes particularly challenging.

- Inconsistent or incomplete data can lead to inaccurate results if not handled carefully.

- Models built on assumptions may fail to account for unforeseen variables.

Despite these challenges, by refining the techniques used to analyze situations and carefully considering all potential factors, it’s possible to develop practical solutions and gain a deeper understanding of the underlying dynamics at play.

Real-World Applications of Economic Principles

Theoretical frameworks are not just abstract concepts; they are tools that can be applied to solve tangible issues in everyday life. From business strategies to government policies, the insights derived from these concepts play a crucial role in shaping decisions that affect markets, industries, and individuals. By translating these ideas into practical solutions, decision-makers can optimize outcomes in diverse settings.

Business Strategy and Market Competition

In the business world, understanding how supply, demand, and pricing interact helps companies optimize their strategies and remain competitive. Whether it’s determining the ideal price for a product or evaluating the potential for entering a new market, the application of economic concepts can lead to better decision-making and increased profitability. Companies rely on these insights to forecast trends, anticipate consumer behavior, and allocate resources effectively.

- Companies use pricing models to maximize revenue while staying competitive.

- Market analysis helps firms understand consumer demand and adjust their offerings.

- Strategic planning often involves evaluating the risks and returns associated with investments.

Government Policy and Public Welfare

Governments around the world apply these models to create policies that support economic growth and public welfare. Whether it’s designing tax structures, implementing subsidies, or regulating industries, the objective is often to balance competing needs and ensure the efficient use of public resources. These decisions can have widespread effects, influencing everything from job creation to environmental sustainability.

- Regulatory measures ensure fair competition and protect consumers from monopolistic practices.

- Tax policies are designed to redistribute wealth and fund public services.

- Government spending plans aim to stimulate growth and manage inflation.

The real-world implementation of these ideas helps guide both private and public sector actions, leading to more efficient markets and improved societal outcomes.

How to Approach Microeconomic Problems

When analyzing individual markets or the behavior of specific economic agents, it is crucial to break down the situation into manageable parts. The goal is to understand how decisions made by consumers and producers shape supply, demand, and pricing dynamics. By following a structured approach, you can identify the key factors at play and determine the most effective solutions.

Step-by-Step Approach to Analyzing Situations

The first step in tackling any issue in this field is to clearly define the scope of the problem. This involves identifying the key variables involved and understanding the relationships between them. Once you have a clear picture, you can begin to apply relevant models or theories to predict outcomes and evaluate different scenarios.

- Identify the market structure: Determine whether the market is competitive, monopolistic, or somewhere in between. This will influence the behavior of suppliers and consumers.

- Analyze demand and supply: Assess how changes in price or other external factors affect the quantity demanded and supplied.

- Consider external influences: Account for factors such as government regulations, technological advancements, or shifts in consumer preferences.

Using Models to Make Predictions

Once you have identified the key components, the next step is to use established models to predict how the system will behave under different conditions. These models provide a simplified representation of reality, allowing you to test various assumptions and analyze potential outcomes.

- Price elasticity: Examine how responsive consumers and producers are to price changes, which can help determine optimal pricing strategies.

- Cost structures: Analyze production costs and how they affect a company’s ability to compete or enter new markets.

- Consumer behavior: Study how consumers make purchasing decisions based on preferences, income, and the prices of alternatives.

By following these steps, you can gain a deeper understanding of market dynamics, predict potential shifts, and develop strategies that are more likely to lead to success in a competitive environment.

Macroeconomic Concepts and Practical Uses

At a broader level, understanding the dynamics of large-scale economies helps policymakers, businesses, and consumers make informed decisions. The central focus is on understanding how national income, inflation, unemployment, and fiscal policies interact to shape overall economic performance. By analyzing these variables, decision-makers can predict economic trends and devise strategies to ensure stability and growth across sectors.

Key Macroeconomic Indicators

Macroeconomic analysis involves tracking various indicators that provide insight into the health of an economy. These figures reflect the effectiveness of policies, market trends, and overall economic stability. Understanding these key metrics allows both public and private sectors to react proactively to changing conditions.

| Indicator | Description | Practical Use |

|---|---|---|

| Gross Domestic Product (GDP) | The total value of goods and services produced in a country within a given time period. | Used to assess the economic performance of a country and make comparisons across different economies. |

| Unemployment Rate | The percentage of the labor force that is unemployed but actively seeking work. | Indicates the health of the labor market and helps policymakers adjust fiscal or monetary policies. |

| Inflation Rate | The rate at which the general level of prices for goods and services rises, leading to a decrease in purchasing power. | Helps businesses, consumers, and governments plan for the future by adjusting wages, prices, and interest rates. |

| Interest Rates | The cost of borrowing money, typically set by central banks. | Influences consumer spending, business investment, and overall economic growth. |

Real-World Implications of Macroeconomic Theories

Theoretical models in this field help guide real-world decision-making at both the national and global levels. For example, central banks use these theories to manage inflation through monetary policies, while governments craft fiscal strategies to stimulate or slow down economic activity. By understanding how various elements of the economy interact, policymakers can predict the outcomes of their decisions and adjust accordingly.

Businesses also rely on macroeconomic analysis to make long-term investment decisions, plan for future growth, and mitigate risks associated with economic downturns. Understanding shifts in inflation, unemployment, and economic output enables organizations to optimize their strategies in a constantly changing environment.

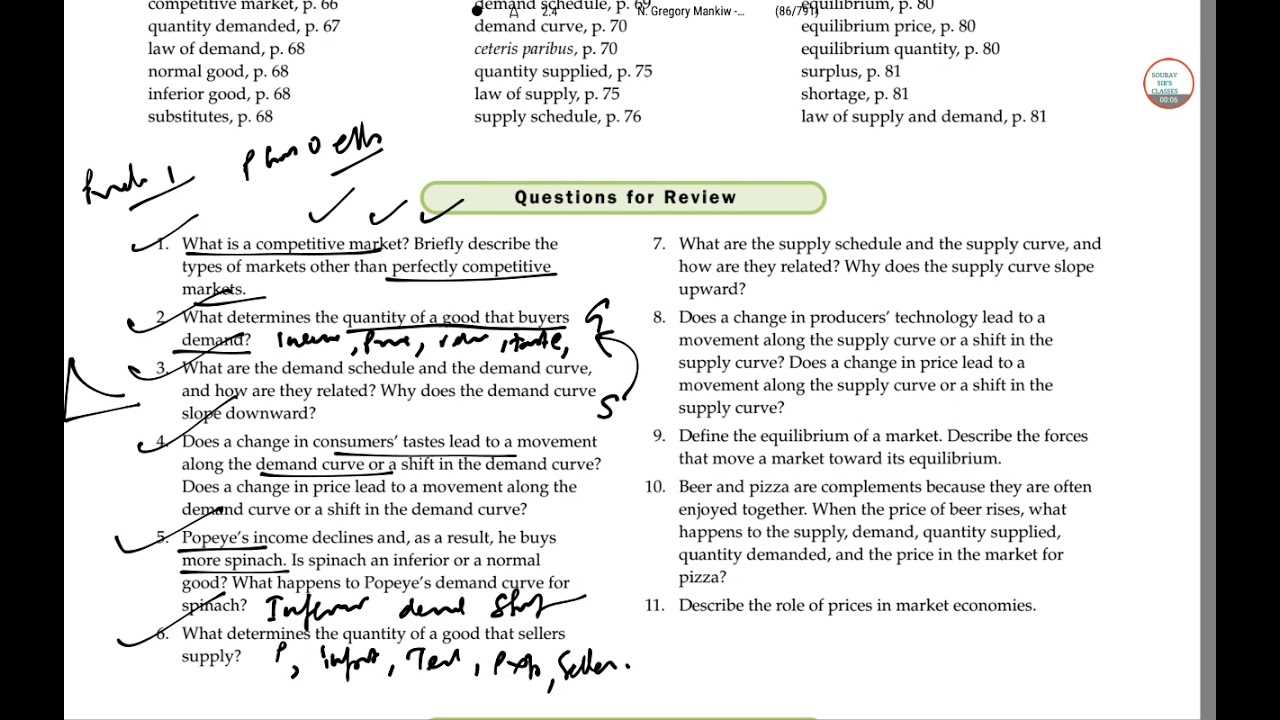

Breaking Down Supply and Demand Curves

The interaction between supply and demand plays a critical role in determining the price and quantity of goods and services in a market. By understanding how shifts in these curves occur, one can better predict market outcomes and how external factors influence price levels. The supply curve shows the relationship between the price of a good and the quantity producers are willing to offer, while the demand curve reflects consumer willingness to purchase at various prices.

Understanding the Demand Curve

The demand curve illustrates how the quantity of a good or service demanded by consumers changes in response to price variations. Typically, this curve slopes downward, indicating that as the price decreases, consumers are more likely to buy more of a product. This relationship is based on the principle of diminishing marginal utility, where each additional unit of a good offers less satisfaction.

- Price Decrease: A lower price encourages higher demand.

- Substitute Goods: The presence of alternatives can shift the demand curve.

- Income Levels: As consumer income increases, demand for many goods rises.

Understanding the Supply Curve

The supply curve, on the other hand, represents how much of a good or service producers are willing to offer at different price points. It usually slopes upwards, reflecting the idea that as prices rise, producers are more willing to increase production to take advantage of higher potential profits.

- Price Increase: Higher prices incentivize producers to supply more of the good.

- Production Costs: Changes in input costs can shift the supply curve, making it harder or easier to produce goods.

- Technological Improvements: Advancements can reduce production costs, leading to increased supply.

Market Equilibrium

When the supply and demand curves intersect, the market reaches equilibrium. At this point, the quantity demanded equals the quantity supplied, and the price stabilizes. Any shift in either curve will lead to a new equilibrium price and quantity, which reflects the market’s response to changes in external conditions, such as consumer preferences or production costs.

- Demand Increase: If demand increases, the equilibrium price and quantity both rise.

- Supply Decrease: A reduction in supply leads to a higher price and a lower quantity at equilibrium.

Understanding these dynamics allows businesses and policymakers to predict how changes in market conditions can affect prices and availability, providing valuable insights for decision-making.

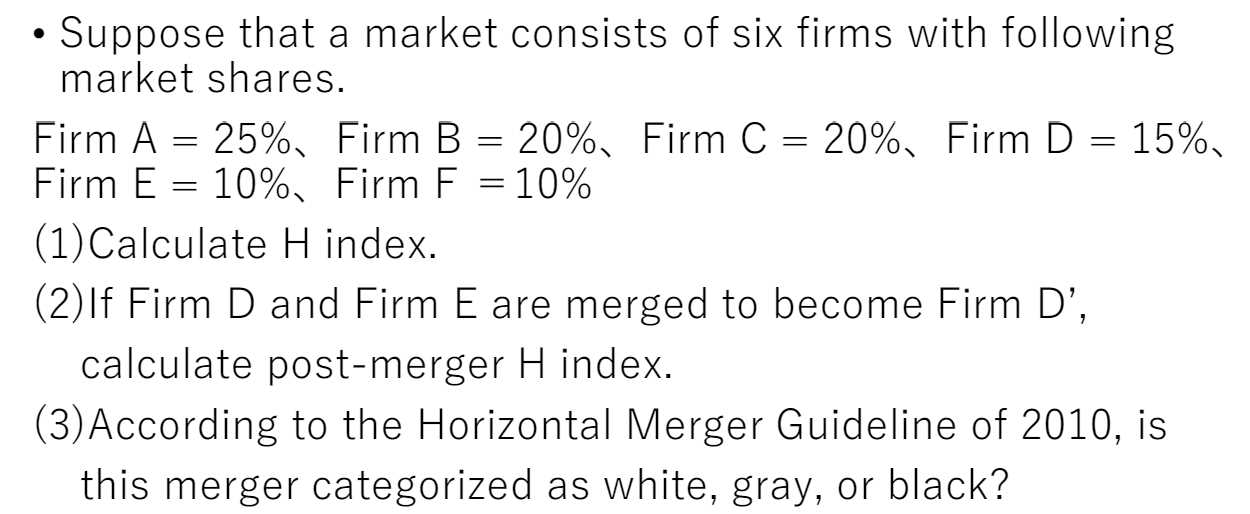

Solving Problems in Market Structures

Different market structures present unique challenges that require tailored strategies for effective problem-solving. Whether in competitive markets or monopolistic environments, understanding the underlying dynamics helps identify the right approach to manage prices, output, and efficiency. By analyzing the characteristics of each structure, one can address inefficiencies, prevent market failures, and optimize resource allocation.

Identifying Key Features of Market Structures

Each market type–whether perfectly competitive, monopolistic, or oligopolistic–has distinct characteristics that shape how businesses interact with consumers and each other. Recognizing these features allows for targeted problem-solving techniques, depending on the context. The key variables include the number of firms, the type of products offered, and the level of price control available to businesses.

| Market Type | Characteristics | Typical Issues |

|---|---|---|

| Perfect Competition | Many firms, identical products, no barriers to entry | Price wars, low profit margins |

| Monopolistic Competition | Many firms, differentiated products, some market power | Excessive advertising, product differentiation costs |

| Oligopoly | Few firms, interdependent pricing, significant market power | Collusion risks, price rigidity |

| Monopoly | One firm dominates, unique product, high barriers to entry | Price fixing, lack of innovation |

Addressing Inefficiencies in Market Structures

Each market structure has its own set of inefficiencies that can be managed through strategic interventions. In competitive markets, businesses may struggle with price wars, while in monopolistic settings, high prices and limited choice may emerge. Policymakers can use regulatory measures such as price controls, anti-trust laws, or subsidies to correct market failures and promote fair competition.

- Perfect Competition: Reduce unnecessary competition by promoting efficiency and ensuring firms meet minimum standards.

- Monopolistic Competition: Encourage innovation and minimize excessive marketing costs.

- Oligopoly: Introduce anti-collusion regulations and encourage transparency in pricing.

- Monopoly: Implement price ceilings or promote market entry to increase competition.

By understanding the dynamics of each market structure, businesses and regulators can develop strategies that correct inefficiencies, improve consumer welfare, and ensure a more equitable allocation of resources.

The Role of Government in Economic Solutions

The involvement of the government in market functions is crucial to ensure stability, fairness, and long-term growth. By implementing various policies and regulations, the government can address imbalances, promote social welfare, and maintain a competitive marketplace. Its actions can influence everything from inflation and unemployment to income distribution and access to essential services.

Government Interventions in Market Systems

Governments can intervene in several ways to rectify market inefficiencies or failures. The most common methods include fiscal policies, monetary measures, regulations, and welfare programs. Each intervention aims to create a balance between economic efficiency and social equity, ensuring that markets do not lead to negative externalities like inequality or environmental degradation.

| Policy Type | Purpose | Common Tools |

|---|---|---|

| Fiscal Policy | Manage economic activity by adjusting government spending and taxation | Tax incentives, public spending, subsidies |

| Monetary Policy | Control inflation and stabilize currency | Interest rates, money supply adjustments |

| Regulation | Ensure fair competition, protect consumers, and manage externalities | Antitrust laws, environmental regulations, labor laws |

| Welfare Programs | Reduce inequality and support vulnerable populations | Unemployment benefits, healthcare programs, income support |

Impact of Government Actions on the Economy

The effect of government policies can be far-reaching, impacting everything from business cycles to individual livelihoods. Well-designed interventions can stabilize an economy in times of crisis, but poorly implemented policies can create unintended consequences, such as inflation or market distortions. Hence, it is crucial for policymakers to carefully evaluate the expected outcomes of each action.

- Stabilizing Business Cycles: Government spending and fiscal measures can mitigate the impacts of recessions or inflationary periods.

- Encouraging Innovation: Support for research, technology, and infrastructure can drive long-term economic development.

- Redistributing Wealth: Social programs can help balance income inequality and provide a safety net for the most vulnerable citizens.

- Environmental Protection: Regulatory measures can ensure sustainable resource use and reduce harmful pollution.

In conclusion, the government plays a vital role in shaping economic outcomes by crafting policies that foster a balanced, fair, and competitive environment. By intervening strategically, it can address challenges in both the short and long term, benefiting both businesses and society at large.

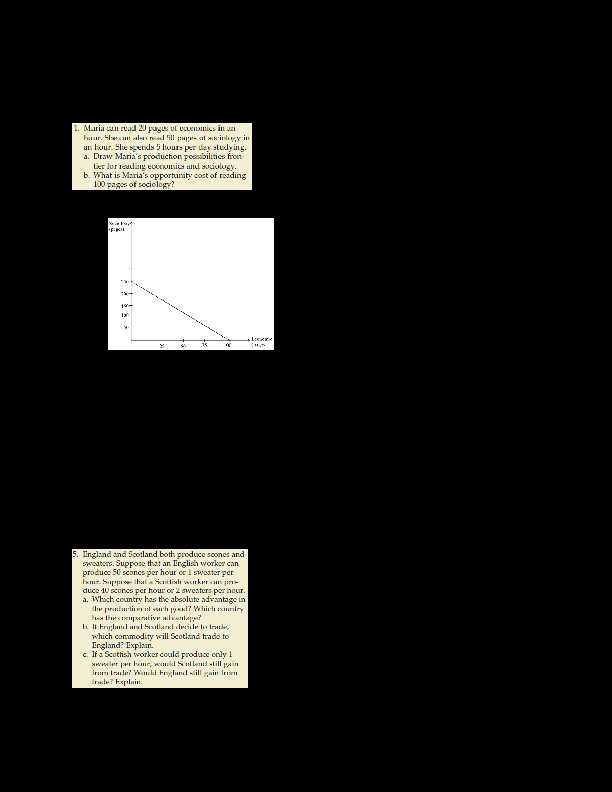

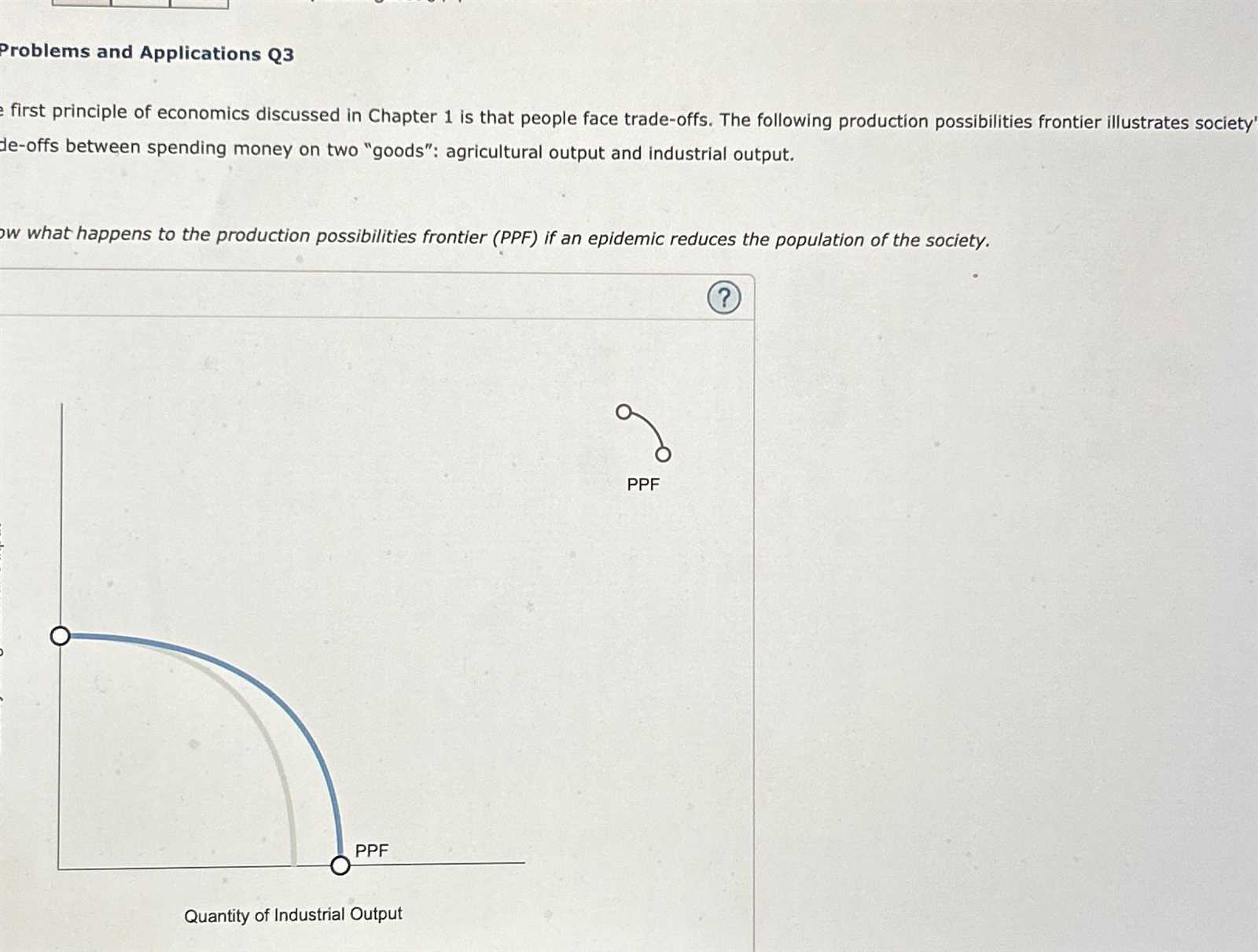

Examining Opportunity Cost in Decision Making

When making choices, individuals, businesses, and governments often face trade-offs between different alternatives. The concept of opportunity cost plays a central role in understanding these decisions. It refers to the value of the next best option that is forgone when one course of action is chosen over another. This idea helps in assessing the true cost of decisions and understanding what is sacrificed when resources are allocated to a particular use.

Understanding the Impact of Opportunity Cost

Opportunity cost is not always measured in monetary terms. It can also reflect time, resources, or potential benefits that could have been derived from an alternative choice. Recognizing the hidden costs in every decision enables better resource allocation and prioritization. The understanding of opportunity cost can influence personal choices, business strategies, and public policy formulation.

- Time Management: Choosing between spending time on work, leisure, or personal projects involves assessing what is given up when one option is selected over another.

- Business Strategy: Companies must decide how to use their capital, labor, and other resources, weighing the benefits of one investment or project against the potential gains of other alternatives.

- Public Policy: Governments often face decisions about allocating funds to different sectors, where the opportunity cost includes the benefits lost by not investing in other areas like healthcare, education, or infrastructure.

Evaluating Opportunity Cost in Practical Scenarios

Whether you’re choosing between taking a job or continuing your education, investing in a new project, or purchasing a product, considering opportunity costs helps provide clarity on what is truly at stake. By weighing the potential benefits of different choices, individuals and organizations can make more informed decisions that align with their goals and available resources.

- Choosing Between Job Offers: A person may have to choose between two job opportunities. The opportunity cost would be the salary and benefits of the job not taken, as well as the potential career growth or satisfaction they miss out on.

- Investing in Projects: A company may need to decide between two possible investments. The opportunity cost would be the returns generated by the alternative investment that was not chosen.

- Government Spending: When a government chooses to invest in defense, the opportunity cost may be the potential investment in education or healthcare that is not made.

In summary, understanding opportunity cost allows for more efficient decision-making by shedding light on the real trade-offs involved in each choice. Whether at a personal, business, or governmental level, this concept is an essential tool for evaluating the consequences of any decision that involves the use of limited resources.

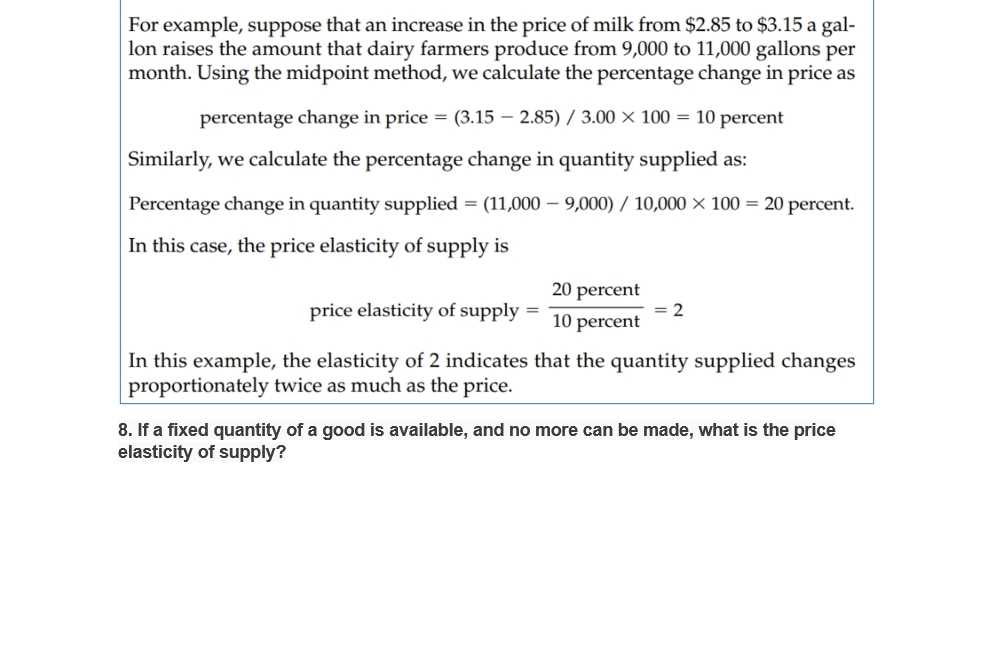

Understanding Elasticity and Its Applications

Elasticity refers to the responsiveness of one variable to changes in another. In the context of market behavior, it measures how the quantity demanded or supplied of a good changes when its price shifts. Understanding this concept is crucial for making informed decisions in pricing strategies, taxation, and regulation. It helps businesses, consumers, and governments predict how market changes will impact supply and demand dynamics.

Types of Elasticity

There are several types of elasticity, each reflecting different relationships between price changes and consumer or producer behavior. The most common types include price elasticity of demand, price elasticity of supply, income elasticity, and cross-price elasticity. Each type has its own significance, helping to determine how sensitive buyers and sellers are to price changes or external factors.

- Price Elasticity of Demand: This measures how much the quantity demanded of a good changes when its price increases or decreases.

- Price Elasticity of Supply: This evaluates how much the quantity supplied by producers changes in response to price changes.

- Income Elasticity: This gauges how demand changes with variations in consumer income.

- Cross-Price Elasticity: This measures how the price change of one good affects the demand for another related good.

Real-World Uses of Elasticity

Elasticity plays a vital role in shaping business practices and government policies. For businesses, understanding elasticity can help optimize pricing strategies and predict consumer behavior. Governments use elasticity to design effective tax policies and to understand the effects of price controls or subsidies. Below are some of the ways in which elasticity is applied:

- Pricing Strategies: Companies can adjust prices based on how responsive customers are to price changes. If demand is elastic, lowering prices may increase sales and revenue.

- Taxation Policies: Governments consider elasticity when setting taxes. For example, goods with inelastic demand (like essential medicines) are less affected by tax increases, while elastic goods may see a larger drop in consumption.

- Subsidies and Price Controls: Subsidies for goods with elastic demand can lead to higher consumption, while price controls can distort supply and demand if not carefully managed.

In conclusion, understanding elasticity provides valuable insights into the responsiveness of markets and guides decision-making for businesses, policymakers, and consumers alike. By considering how price changes influence supply and demand, stakeholders can better navigate the complexities of market dynamics.

Factors Affecting Economic Growth and Stability

The expansion of an economy and its ability to maintain balanced progress are influenced by numerous internal and external factors. These elements determine not only how quickly an economy can grow but also how well it can withstand shocks and maintain sustainable development over time. Understanding these drivers is crucial for both policymakers and businesses to navigate challenges and maximize long-term prosperity.

Key Drivers of Economic Growth

A variety of forces contribute to an economy’s growth trajectory. Some of the primary drivers include:

- Human Capital: The skills, knowledge, and productivity of the workforce are essential for boosting economic output. Investment in education and training can lead to higher efficiency and innovation.

- Technology and Innovation: Advances in technology enable businesses to improve production processes, reduce costs, and create new products. Innovation fosters competition, leading to a more dynamic and productive economy.

- Capital Investment: Investment in physical infrastructure such as roads, factories, and machinery contributes to long-term growth by enhancing production capacity and facilitating trade.

- Government Policies: Taxation, spending, monetary policies, and regulations all influence economic conditions. Pro-growth policies can stimulate investment and consumer spending, while restrictive policies may stifle expansion.

Factors Influencing Economic Stability

Stability is equally important for maintaining a healthy economy. Various factors can impact an economy’s ability to stay balanced and avoid excessive volatility:

- Inflation Control: Maintaining low and stable inflation ensures the purchasing power of currency remains predictable, reducing uncertainty in investment and consumption decisions.

- Fiscal Health: A government’s ability to manage public debt and deficits influences economic stability. High debt levels can lead to inflationary pressures and a loss of investor confidence.

- Global Economic Conditions: External factors such as trade relations, commodity prices, and global financial markets can directly impact national stability. A downturn in one region can quickly spread to others.

- Political Stability: Stable governance fosters investor confidence and encourages long-term economic planning. Political uncertainty can lead to reduced investments and hinder growth prospects.

In summary, economic growth and stability are shaped by a complex interplay of factors that influence both short-term outcomes and long-term trends. A strong, well-functioning economy requires the careful balancing of these influences to create a prosperous environment for businesses and individuals alike.

Analyzing Cost-Benefit Decisions in Economics

Making informed choices requires evaluating the trade-offs between the benefits of a decision and the associated costs. This process is essential in determining the most efficient allocation of resources, whether on an individual, business, or governmental level. By carefully weighing both tangible and intangible factors, one can make decisions that maximize value while minimizing waste.

The Role of Costs in Decision Making

In any decision-making scenario, understanding costs is crucial. Costs can take many forms, including:

- Monetary Costs: These are the direct financial expenditures involved in a decision. For example, the price of raw materials or labor costs are considered monetary costs.

- Opportunity Costs: This refers to the potential benefits lost when choosing one alternative over another. It emphasizes the importance of considering what is foregone when making a decision.

- Time Costs: Time is a valuable resource, and the time spent on one activity could have been used for another more productive task. This must be factored into the decision process.

- Environmental Costs: Some decisions may result in long-term negative effects on the environment, which can carry hidden costs for future generations.

Weighing Benefits and Making the Choice

On the flip side, evaluating the potential benefits is just as important. Benefits might include:

- Increased Revenue: The primary objective of many business decisions is to generate more income. This could result from higher sales, reduced costs, or new market opportunities.

- Enhanced Efficiency: Streamlining operations and improving processes can lead to higher productivity, reduced waste, and better use of available resources.

- Social or Environmental Benefits: Sometimes, the greatest benefits come from contributing positively to society or the environment, even if it does not result in immediate financial gain.

- Improved Reputation: Decisions that prioritize quality or ethical standards can build trust and enhance the long-term brand value of a company or individual.

Ultimately, making cost-benefit decisions involves balancing these various factors to arrive at the option that offers the greatest overall benefit relative to its cost. This methodical approach helps ensure the efficient use of resources, both in the short term and in the long run.

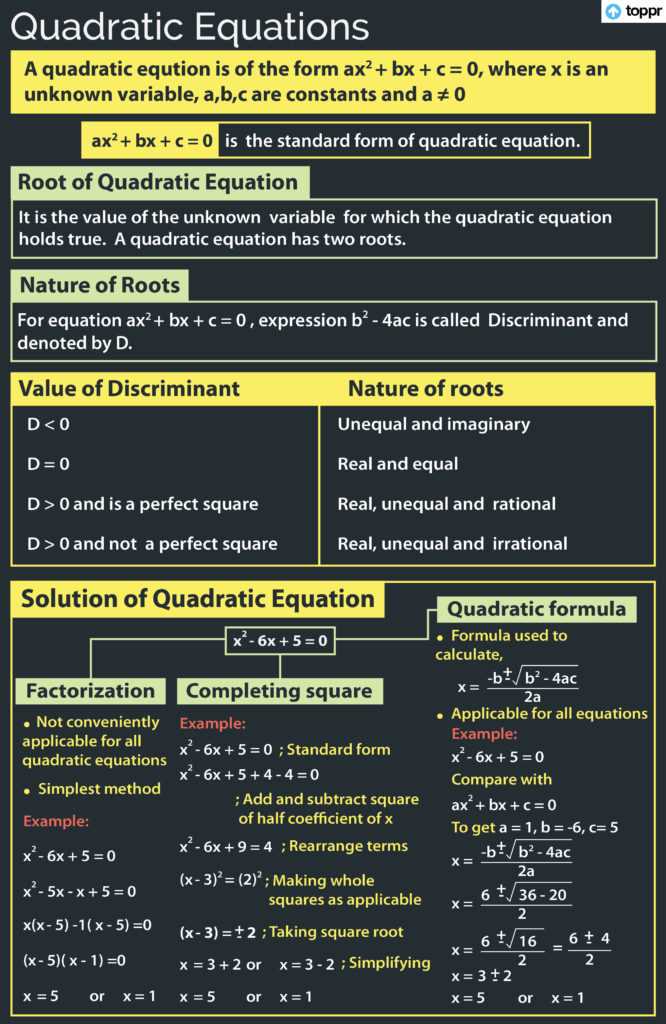

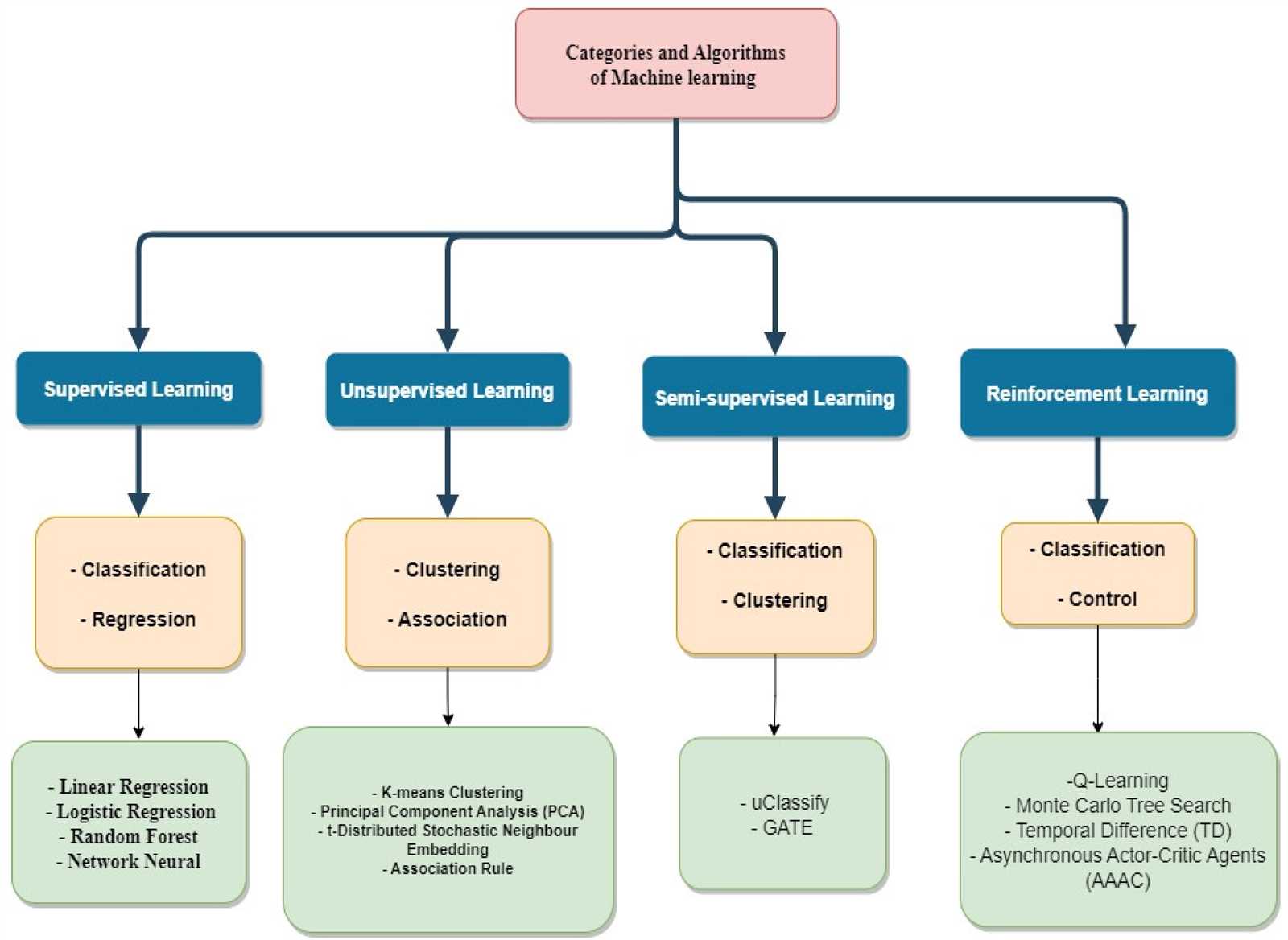

Using Models to Solve Economic Problems

Models play a crucial role in simplifying complex situations and providing a structured approach to analyzing real-world issues. By representing intricate systems with simplified variables and relationships, these models help in predicting outcomes, identifying patterns, and informing decisions. Whether for individuals, firms, or governments, they offer valuable insights that guide actions based on logical assumptions and data-driven analysis.

Types of Models Used for Analysis

There are various models used to address different types of situations, each focusing on specific aspects of the market or decision-making process. Some of the most common models include:

- Demand and Supply Models: These models examine the relationship between the quantity of goods and services available and the desire for those goods, helping to predict price movements and equilibrium conditions.

- Cost-Benefit Analysis: This approach compares the costs of a decision with its potential benefits to determine whether a certain course of action is worthwhile.

- Game Theory: A strategic decision-making tool used to understand the choices of different players within competitive environments, such as firms in a market.

- Input-Output Models: These models describe the flow of resources between sectors of an economy, showing how changes in one sector can impact others.

Practical Applications of Models

Models are widely applied in various sectors to enhance decision-making and improve strategic planning. They help in forecasting future trends, managing risks, and allocating resources effectively. Below is an example of how a typical input-output model might be used to evaluate the impact of changes in one industry on others:

| Sector | Initial Output | Impact on Other Sectors |

|---|---|---|

| Agriculture | $500,000 | Increased demand for machinery, labor, and fertilizers |

| Manufacturing | $700,000 | Increased production of goods, higher wages |

| Retail | $400,000 | Higher consumer spending from increased wages |

In the example above, the input-output model helps visualize how a change in one sector can affect others, providing a comprehensive picture of the broader economic impact. Such models are invaluable for policymakers and businesses to understand potential consequences of their decisions and plan accordingly.

Behavioral Economics and Real-World Impact

In today’s complex world, human decision-making often deviates from what traditional models predict. This shift is largely due to psychological factors, biases, and emotions influencing choices, especially in situations that involve uncertainty or long-term outcomes. This field examines how these non-rational elements affect the way individuals make choices in various contexts, ranging from personal finance to public policy, and seeks to better understand the discrepancy between theoretical predictions and real-world behavior.

The traditional assumption in many analytical frameworks is that individuals act rationally, always seeking to maximize utility. However, in practice, people often make decisions that appear irrational. These decisions are shaped by factors like cognitive biases, social influences, and heuristics – mental shortcuts that simplify decision-making. Recognizing these elements helps policymakers and businesses design more effective strategies that align with real human behavior, rather than theoretical assumptions.

Impact on Consumer Behavior

One of the most notable areas where behavioral insights have made a significant difference is in consumer behavior. For example, individuals often fail to save adequately for retirement, even when it is in their best interest. Behavioral theories suggest that this is partly due to procrastination, lack of self-control, and the tendency to discount future rewards. By understanding these tendencies, companies and governments can implement strategies, such as automatic enrollment in retirement plans or nudges that encourage healthier financial habits.

Policy Implications and Business Strategies

Governments around the world have begun using behavioral insights to improve public policy. Programs that encourage energy conservation, for example, often involve informing people about their energy usage compared to that of similar households. This simple comparison taps into the human tendency to conform to social norms, leading to greater energy savings without requiring drastic changes in behavior.

Similarly, businesses have embraced these insights to enhance customer satisfaction and increase sales. By structuring pricing, product placement, or even the language used in marketing to appeal to emotions and cognitive shortcuts, companies can influence consumer decisions more effectively. This approach has become a cornerstone of modern marketing strategies, from subscription models to loyalty programs.

Steps to Mastering Economic Problem Solving

Mastering the art of analyzing and solving complex decision-making scenarios requires a structured approach. By breaking down the steps, individuals can better understand how to navigate challenges, whether it’s determining optimal resource allocation or predicting market shifts. With a combination of critical thinking, practice, and strategic tools, anyone can refine their ability to tackle these challenges effectively.

The process begins with understanding the basic concepts and frameworks that drive decision-making. From there, it’s essential to identify the core issue at hand, gather relevant data, and apply logical reasoning. Finally, testing assumptions and adapting strategies based on results ensures that solutions remain relevant and effective in the long term.

Step 1: Understand the Context

The first step is to gain a clear understanding of the environment in which the challenge exists. This involves looking at the broader situation, considering the factors that influence outcomes, and recognizing patterns in behavior. Whether dealing with individual choices or large-scale systemic issues, understanding the context is key to creating a solid foundation for decision-making.

Step 2: Identify Key Variables

Next, it’s crucial to pinpoint the key variables that directly impact the situation. This could include factors like supply, demand, time constraints, or external influences such as government regulations. By identifying these components, it’s easier to understand how changes in one area might affect others. This step also involves prioritizing which variables are most important to focus on.

Step 3: Analyze Available Data

Gathering relevant data is central to effective problem solving. This could mean looking at historical trends, analyzing market behavior, or running simulations. By using this information, individuals can make more informed decisions, test hypotheses, and refine their approach to solving challenges. Analyzing data from multiple angles ensures a more comprehensive understanding of the situation at hand.

Step 4: Develop Solutions and Test Hypotheses

Once the data is collected, the next step is to develop potential solutions. This process requires creativity and critical thinking, as different approaches may yield different results. It’s important to test assumptions and hypotheses to determine which solution best addresses the issue. Running small-scale experiments or using predictive models can help forecast outcomes before implementing large-scale changes.

Step 5: Evaluate and Adjust

After implementing a solution, it’s vital to continuously monitor and evaluate its effectiveness. If the expected outcomes do not materialize, adjustments should be made. This iterative process ensures that the solution is refined and improved over time, leading to more effective decision-making and problem-solving.