Preparing for your first economics test requires a solid understanding of the foundational concepts that shape how markets function and individuals make decisions. Whether you’re studying for the first time or revisiting key ideas, it’s important to grasp the essential theories and models that form the basis of economic analysis.

Economic theory delves into various forces at play in the marketplace, from consumer choices to government interventions. Understanding the relationship between supply and demand, the role of competition, and the impact of external factors will help you make sense of complex scenarios. The ability to apply these concepts is crucial for solving problems on the test.

Success in this subject comes from both memorization and comprehension. The ability to critically analyze different market situations, understand how decisions are made, and interpret data is key. By focusing on the core ideas and practicing with real-world examples, you’ll be well-prepared to approach the test with confidence.

Principles of Microeconomics Exam 1 Study Guide

Preparing for your first test in economics involves understanding how various forces influence individual choices and market outcomes. By focusing on key theories and models, you can develop a clear view of how economies function, how resources are allocated, and how different actors–consumers, producers, and governments–interact within the marketplace.

The core focus of this study guide is to help you identify the essential concepts you’ll encounter, from the basics of supply and demand to more complex topics such as market efficiency and the effects of government regulation. By breaking down these ideas and applying them to practical examples, you’ll gain a deeper understanding of economic behavior and decision-making processes.

As you move forward with your preparation, it’s important to concentrate on both theoretical knowledge and its application to real-world scenarios. Understanding how to analyze various market structures and economic policies will not only help you succeed on the test but also give you a more comprehensive grasp of how the world around you functions economically.

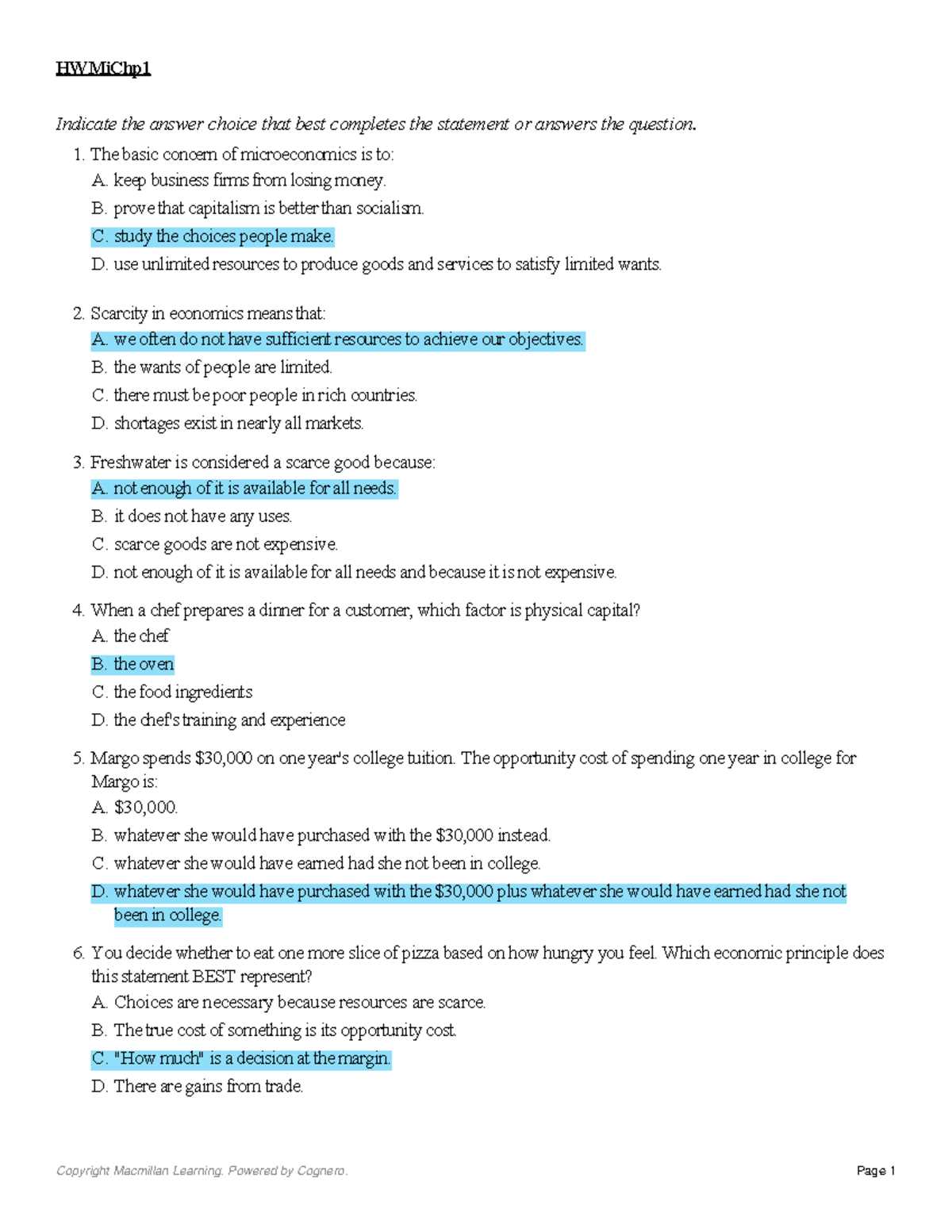

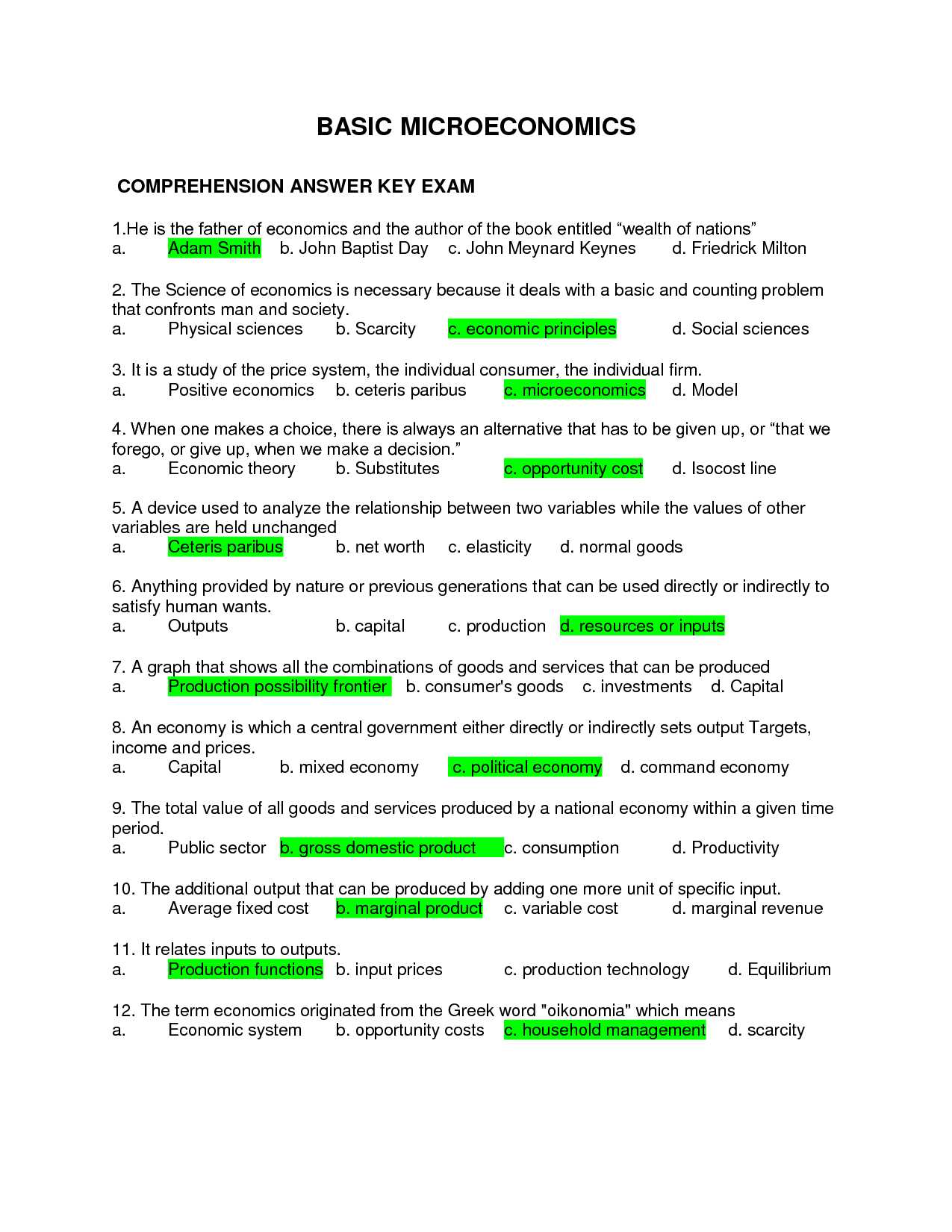

Understanding Basic Economic Principles

At the heart of economic theory lies the study of how individuals, businesses, and governments make choices about the allocation of limited resources. This foundational understanding shapes everything from consumer behavior to the functioning of entire markets. The core ideas you will encounter in this section are essential for analyzing how decisions are made and how they affect the broader economy.

Scarcity is one of the most fundamental concepts, representing the fact that resources are finite while human desires are limitless. This imbalance drives the need for trade-offs, where choices must be made about what to produce, how to produce, and for whom to produce. Additionally, the concept of opportunity cost plays a crucial role in understanding the value of these choices.

Another key concept is the law of supply and demand, which explains how the prices of goods and services are determined by the interaction between the availability of a product and consumer demand for it. These basic ideas form the foundation for more complex economic theories and models that you will encounter throughout your studies.

Key Concepts in Supply and Demand

The relationship between supply and demand is a cornerstone of economic theory, influencing how markets operate and how prices are determined. These forces reflect the behavior of both consumers and producers in a given market. Understanding how shifts in supply and demand can affect equilibrium is crucial for analyzing economic outcomes and making informed predictions about market trends.

Demand refers to the quantity of a good or service that consumers are willing to purchase at various price levels. Typically, as the price of a product decreases, demand increases, which is known as the law of demand. On the other hand, supply refers to the quantity of a good or service that producers are willing to provide at different prices. The law of supply states that as prices rise, the quantity supplied tends to increase as well, since producers are more willing to offer goods at higher prices.

When both demand and supply are in balance, the market reaches an equilibrium price, where the amount consumers want to buy matches the amount producers are willing to sell. However, changes in external factors, such as shifts in consumer preferences or production costs, can lead to fluctuations in both supply and demand, resulting in price changes and market adjustments.

Market Structures and Their Characteristics

The way markets are organized has a significant impact on the behavior of both producers and consumers. Different market structures define the level of competition, pricing strategies, and the efficiency of resource allocation within an economy. Understanding the characteristics of these market types helps to explain how prices are set, how businesses operate, and how consumers are affected by market dynamics.

Market structures can be classified into several types, each with distinct features. These types range from highly competitive markets with many firms to monopolies where a single producer controls the entire market. Below is a summary of the main market structures and their characteristics:

| Market Structure | Number of Firms | Product Differentiation | Entry Barriers | Price Control |

|---|---|---|---|---|

| Perfect Competition | Many | None | None | None |

| Monopolistic Competition | Many | Some | Low | Limited |

| Oligopoly | Few | Some | High | Moderate |

| Monopoly | One | None | Very High | Complete |

Each market structure operates under different conditions, influencing the behavior of firms and consumers. For example, in perfect competition, prices are determined purely by supply and demand, and firms are price takers. In contrast, a monopoly allows a single producer to set prices and control supply without competition. The characteristics of each structure play a critical role in shaping economic outcomes, such as pricing strategies, innovation, and market efficiency.

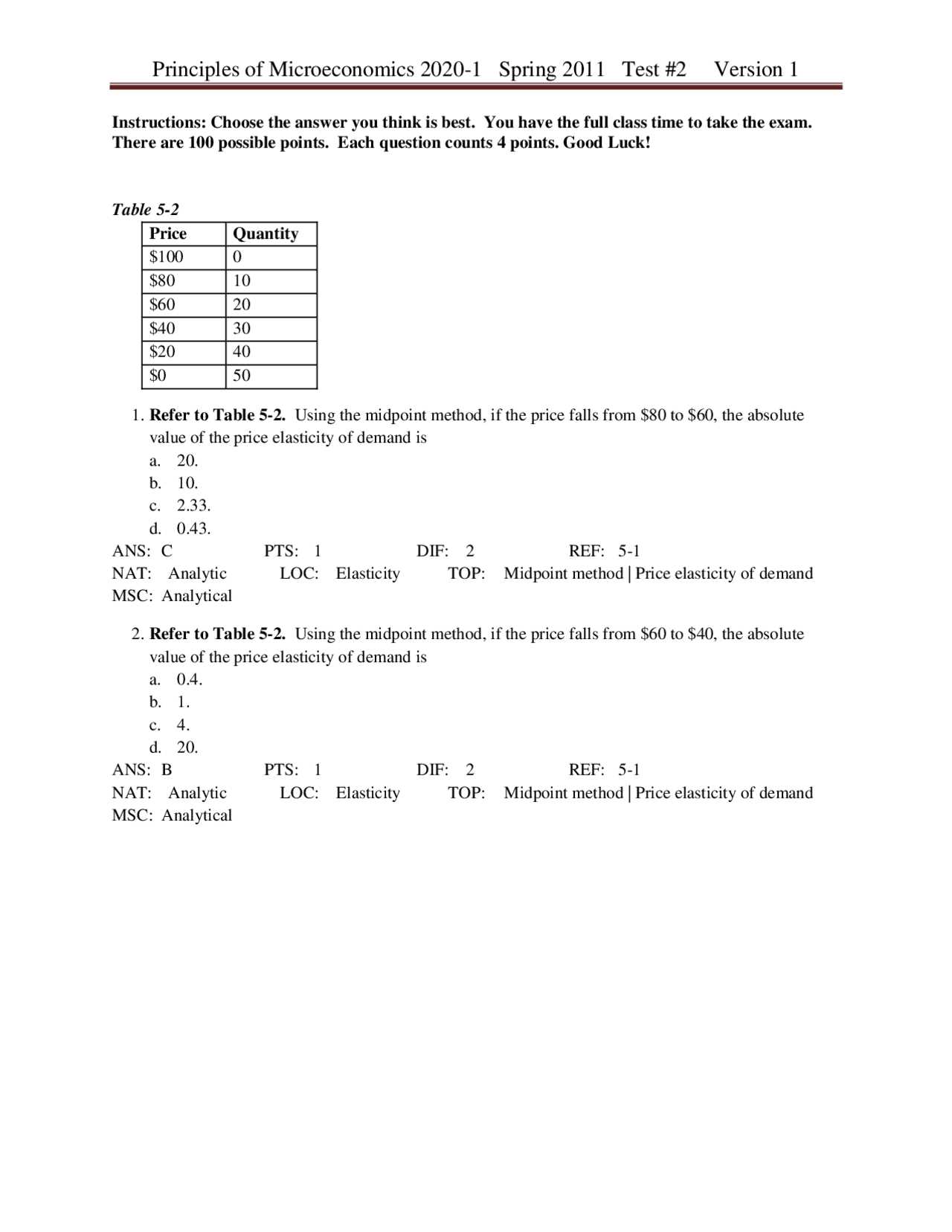

Price Elasticity of Demand Explained

Understanding how the price of a product influences consumer behavior is essential for analyzing market dynamics. Price elasticity of demand measures the responsiveness of the quantity demanded of a good to changes in its price. It helps businesses and policymakers predict how price adjustments will affect demand and revenue, making it a crucial concept for decision-making.

Factors Influencing Price Elasticity

Several factors determine how elastic or inelastic the demand for a product is. The most significant ones include:

- Availability of Substitutes: If alternatives to a product are easily available, demand tends to be more elastic.

- Necessity vs. Luxury: Goods considered necessities tend to have inelastic demand, as consumers will buy them regardless of price changes. Luxury goods, on the other hand, are more price-sensitive.

- Time Horizon: Over a longer period, demand for some goods becomes more elastic as consumers have time to adjust their behavior.

- Proportion of Income: Products that take up a larger share of a consumer’s income typically have more elastic demand, as price changes will significantly impact purchasing decisions.

Elastic vs Inelastic Demand

Demand can be categorized as either elastic or inelastic based on its price sensitivity:

- Elastic Demand: When the quantity demanded changes significantly in response to a price change. For example, if a 10% price decrease leads to a 15% increase in quantity demanded, demand is considered elastic.

- Inelastic Demand: When the quantity demanded changes little or not at all in response to price changes. A common example is essential medicines or utilities, where price increases have minimal effect on consumption.

Understanding price elasticity allows firms to make strategic pricing decisions. By analyzing whether demand is elastic or inelastic, businesses can adjust prices to optimize revenue and market share. Additionally, policymakers can use elasticity data to assess the potential impact of taxes or subsidies on consumer behavior.

The Role of Consumer Behavior in Economics

Consumer behavior plays a central role in shaping economic outcomes. It reflects how individuals make decisions about spending their income based on their preferences, needs, and the prices of goods and services. By understanding how consumers respond to changes in market conditions, businesses and policymakers can predict demand patterns and adjust their strategies accordingly.

Factors Influencing Consumer Choices

Several factors affect how consumers decide what to buy, when to buy, and how much to spend. These factors include income, preferences, and external influences like advertising and social trends. Additionally, the availability of alternatives and the perceived value of products significantly impact purchasing decisions.

| Factor | Influence on Consumer Behavior |

|---|---|

| Income | Higher income generally leads to increased demand for goods and services. |

| Preferences | Consumers tend to favor goods that match their tastes, lifestyle, and needs. |

| Price Sensitivity | Consumers often adjust their purchases based on price changes, especially for non-essential items. |

| External Influences | Advertising, social norms, and trends can heavily influence consumer choices. |

Understanding Consumer Decision-Making

Consumer decisions are not always straightforward. People often make choices based on perceived benefits, which may not always align with rational economic theory. This behavior can be influenced by psychological factors such as emotions, peer pressure, or advertising. As a result, businesses must understand these subtleties to anticipate demand fluctuations and tailor their products and marketing strategies accordingly.

In economics, understanding consumer behavior allows for better predictions about how markets will react to changes in prices, income, and external factors. It provides insights into demand curves, price elasticity, and the overall functioning of markets. By studying how consumers make choices, firms can optimize their pricing strategies, while policymakers can design better regulations that align with consumer interests.

Understanding Producer Theory and Cost

Producer theory focuses on the behavior of firms in the production process, particularly how they make decisions about what to produce, how to produce, and in what quantity. This involves analyzing the costs associated with production and how firms allocate resources to maximize profit. A deep understanding of these concepts helps explain how businesses respond to changes in the market, including shifts in demand and supply conditions.

The cost structure of a firm is critical to its decision-making process. Costs can be categorized into fixed and variable costs, each playing a unique role in how a firm plans its production. Fixed costs remain constant regardless of the level of output, while variable costs change depending on the quantity produced. Together, these costs determine the overall cost of production and influence pricing decisions, as firms seek to cover their expenses while maximizing profitability.

Understanding the relationship between production and cost is also essential for analyzing economies of scale. As firms increase production, they may experience lower average costs, which can lead to more competitive pricing in the market. However, at a certain point, firms may encounter diseconomies of scale, where costs per unit rise as production continues to expand.

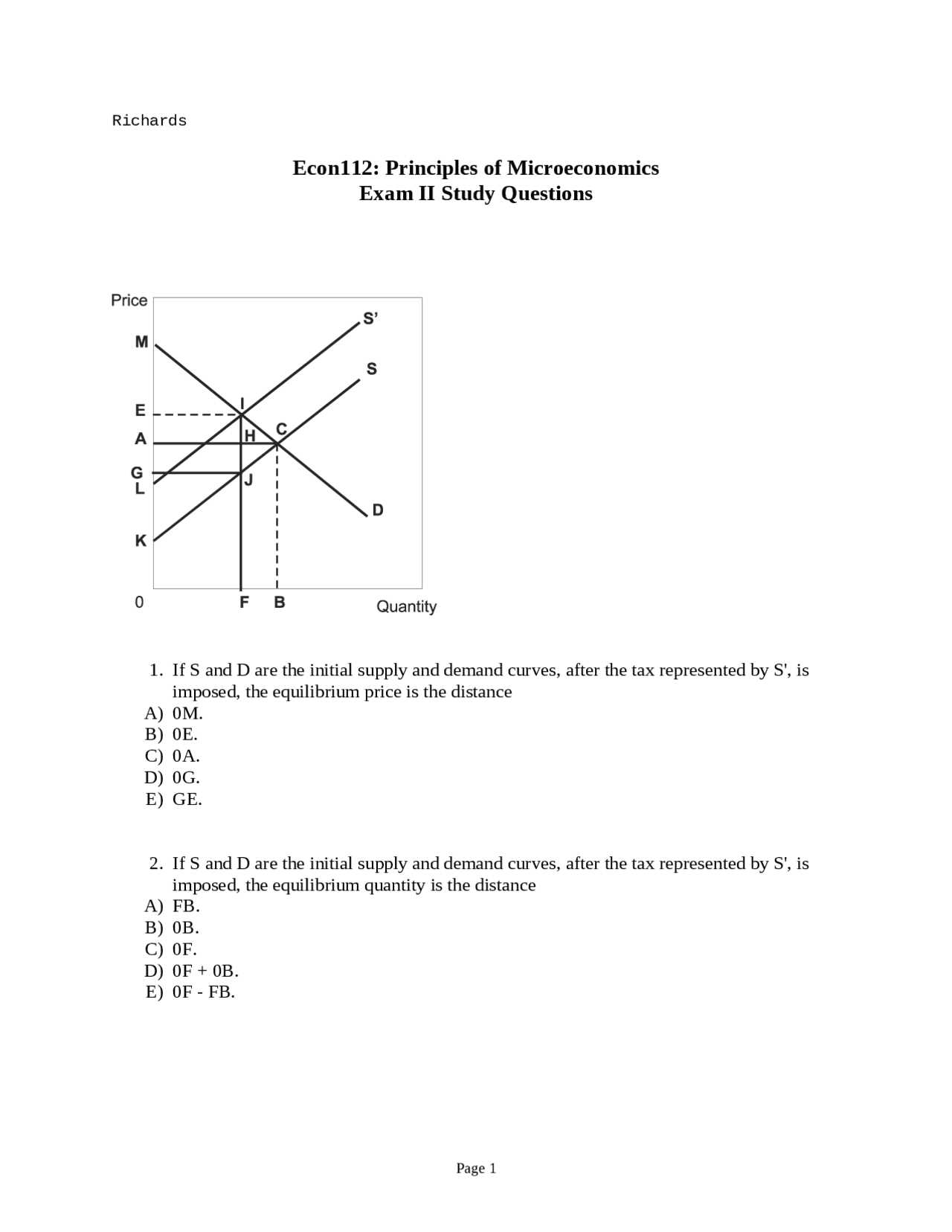

The Impact of Government on Markets

Governments play a significant role in shaping how markets function by influencing both the supply and demand sides through various interventions. These interventions can take many forms, such as setting regulations, imposing taxes, offering subsidies, or directly controlling prices. The objective of these actions is to correct market failures, promote economic stability, and achieve social welfare goals.

One of the most common ways governments impact markets is through the regulation of industries to ensure fair competition and protect consumers. Anti-monopoly laws, environmental standards, and labor regulations are examples of how governments set boundaries for business operations. In addition, governments can use fiscal policies, like tax incentives or subsidies, to encourage certain types of production or consumption, thus directing resources toward preferred sectors of the economy.

Another significant effect comes from government intervention in the form of price controls. For instance, governments may impose price ceilings to prevent prices from rising too high on essential goods or price floors to guarantee that producers receive a minimum amount for their products. While such policies aim to protect consumers or producers, they can also lead to unintended consequences, such as shortages or surpluses in the market.

Market Failures and Government Intervention

Market failures occur when the allocation of goods and services by a free market is not efficient, leading to negative outcomes for society. In such cases, the market may fail to provide the right amount of a good or service, or it may allocate resources in ways that are harmful to the public. This is where government intervention becomes essential. The government steps in to correct inefficiencies and promote a more equitable distribution of resources.

There are several common causes of market failures, which include:

- Externalities: These occur when the actions of individuals or firms have unintended side effects on third parties, such as pollution or public health risks.

- Public Goods: Certain goods, like national defense or clean air, are non-excludable and non-rivalrous, meaning no one can be excluded from using them, and one person’s use doesn’t diminish availability for others.

- Monopolies: When a single firm controls the entire supply of a good or service, it can limit competition and lead to higher prices and lower output.

- Asymmetric Information: When one party in a transaction has more or better information than the other, it can result in poor decision-making and inefficiencies, such as in the case of misleading advertising or product safety concerns.

To address these failures, governments implement various policies:

- Regulation: Governments set rules to limit harmful behaviors and ensure fair practices, such as environmental regulations or consumer protection laws.

- Taxation: Taxes can be used to reduce negative externalities, such as pollution, by increasing the cost of harmful activities.

- Subsidies: Governments may provide financial incentives for activities that benefit society, such as renewable energy production or education.

- Public Provision: In some cases, the government may directly provide goods and services, especially those that

How to Analyze Economic Models

Analyzing economic models is crucial for understanding how various factors influence the behavior of markets and the overall economy. Economic models simplify complex real-world scenarios, allowing economists to focus on key relationships and test hypotheses. The process of analyzing these models involves identifying their assumptions, understanding their structure, and evaluating the results in the context of actual economic conditions.

To effectively analyze an economic model, it is important to follow a structured approach. Here are some key steps involved in the analysis:

- Identify the Assumptions: Every model starts with assumptions about the economic environment, such as the behavior of consumers, firms, or government. These assumptions help define the scope and limits of the model. For example, the model might assume perfect competition or rational behavior from participants.

- Understand the Variables: Models typically use variables to represent different elements of the economy. These variables might include prices, quantities, costs, or incomes. Understanding how these variables are defined and how they interact is crucial to analyzing the model’s predictions.

- Evaluate the Relationships: Most models describe relationships between key economic factors, such as the interaction between supply and demand or the effect of price changes on consumer behavior. Analyzing these relationships helps to identify cause-and-effect patterns within the model.

- Test Predictions: Once you understand the relationships within a model, it’s important to test its predictions against real-world data. Does the model accurately predict market behavior in different situations? If not, adjustments may be needed to improve its accuracy.

- Consider Limitations: No model is perfect, and every model has limitations. It is essential to recognize these limitations and understand how they affect the model’s relevance and accuracy. For example, a model that assumes all consumers are rational may not account for psychological factors that influence decision-making.

By following these steps, analysts can gain insights into how various forces shape economic outcomes and make more informed decisions. Economic models provide a powerful tool for understanding market behavior, but their usefulness depends on the clarity of the assumptions, the accuracy of the variables, and the soundness of the relationships they represent.

Elasticity and its Real-World Applications

Elasticity is a key concept in economics that helps measure how sensitive the demand or supply of a good or service is to changes in different factors such as price, income, or the price of related goods. This idea plays a central role in understanding consumer and producer behavior in various markets, guiding decisions related to pricing, taxes, and market regulation. In practice, elasticity helps determine how price changes or shifts in income will affect the quantity of goods and services people are willing to buy or sell.

Price Sensitivity and Consumer Behavior

One of the most common types of elasticity is price elasticity of demand, which focuses on how the quantity demanded of a good changes in response to a change in its price. The degree of responsiveness can vary greatly depending on the nature of the product and the availability of substitutes.

- Luxury Goods: Products like high-end electronics or designer fashion tend to have elastic demand. A small increase in price can lead to a significant decrease in the quantity demanded as consumers may choose not to buy these goods when their prices rise.

- Basic Necessities: Goods like food, water, and medicine typically have inelastic demand. Price increases do not significantly reduce the quantity demanded since consumers will continue to purchase these essentials regardless of price hikes.

- Availability of Substitutes: The more alternatives available, the more elastic the demand for a product becomes. If the price of one brand of cereal increases, consumers may simply switch to a different brand that offers a similar product.

Impact of Income on Demand

Income elasticity of demand measures how changes in consumer income affect the demand for a good. Understanding this type of elasticity is important for predicting how economic cycles–such as recessions or booms–affect various markets.

- Normal Goods: These goods experience an increase in demand as consumer income rises. For example, luxury cars and high-end restaurants typically see higher sales when consumers have more disposable income.

- Inferior Goods: Products such as store-brand groceries or public transportation services may see a decrease in demand as consumers’ incomes rise, as people shift towards more expensive alternatives.

Cross-Price Elasticity and Market Relationships

Cross-price elasticity of demand is concerned with how the demand for one good changes in response to the price change of a related good. This can highlight the interconnections between products in a market, especially for substitutes and complements.

- Substitutes: Goods that serve as alternatives for each other, such as tea and coffee, have a positive cross-price elasticity. If the price of coffee rises, the demand for tea might increase as consumers switch to the cheaper alternative.

- Complements: Products that are often used together, such as printers and ink cartridges, h

Perfect Competition vs Monopoly

Markets can be organized in different ways, and these structures significantly influence how goods and services are priced, produced, and consumed. Two such structures, perfect competition and monopoly, represent extreme ends of the market spectrum. While the former is characterized by many firms competing with similar products, the latter is marked by a single company controlling the entire market. These structures present contrasting dynamics that affect everything from pricing to innovation and consumer choice.

In a perfectly competitive market, firms have no power to set prices and must accept the market price as given. This is due to the high level of competition, where many businesses offer identical products, making it impossible for any single firm to influence prices. Consumers benefit from low prices, a wide selection of goods, and innovation driven by the constant pressure of competition.

In contrast, a monopoly exists when one firm holds significant control over the entire market. Without competition, the monopolist has the power to set prices higher than in a competitive market, limiting consumer options. Barriers to entry, such as high startup costs or exclusive access to essential resources, prevent other companies from entering the market and offering alternatives to consumers.

Characteristics of Perfect Competition

Perfect competition is an idealized concept, rarely seen in the real world, but it provides an important benchmark for understanding market efficiency. Its key features include:

- Numerous Sellers: There are many firms in the market, none of which can influence the price on their own.

- Identical Products: All firms sell the same product, making it easy for consumers to switch between suppliers.

- Low Barriers to Entry: New firms can easily enter the market, ensuring that no single firm can dominate.

- Price Takers: Firms accept the market price as determined by supply and demand, with no ability to raise or lower prices independently.

Features of a Monopoly

In a monopoly, a single firm controls the entire supply of a particular product or service. Some of the defining characteristics of this market structure include:

- Single Seller: Only one company provides the product, and there are no direct competitors.

- Unique Product: The monopolist offers a product with no close substitutes, leaving consumers with few alternatives.

- High Barriers to Entry: Significant obstacles prevent o

Monopolistic Competition and Oligopoly

Market structures can range from highly competitive environments with numerous firms to markets dominated by just a few players. Two such structures, monopolistic competition and oligopoly, represent intermediate forms where firms have some control over pricing but still face varying levels of competition. These markets often feature differentiated products and strategic decision-making, influencing both pricing strategies and market outcomes.

In a market characterized by monopolistic competition, many firms operate, but each offers a product that is slightly different from the others. This differentiation allows firms to have some degree of pricing power, even though there is still competition present. Consumers can choose from a variety of similar goods or services, and firms often focus on branding and advertising to set themselves apart from their competitors. The ease of entry and exit in this market type ensures that long-term profits tend to normalize as new firms enter or leave the market based on success or failure.

On the other hand, an oligopoly exists when a small number of firms dominate the market. In these markets, each firm’s decisions are highly influenced by the actions of the others, often leading to strategic behavior such as price wars, collusion, or product differentiation. The limited number of firms makes it possible for them to exert a significant degree of control over pricing and output, which can lead to less competition compared to more fragmented markets. Barriers to entry are usually higher in oligopolies, and new firms find it difficult to enter due to the strong presence of the dominant players.

Features of Monopolistic Competition

Monopolistic competition combines elements of both perfect competition and monopoly. It is characterized by the following features:

- Numerous Sellers: Many firms operate in the market, each offering a product that is somewhat unique, which allows for some pricing power.

- Product Differentiation: Each firm offers products that are slightly different from competitors, whether in terms of quality, features, or branding.

- Free Entry and Exit: There are low barriers to entering or leaving the market, making it easy for firms to enter if profits are high and exit if profits are low.

- Non-price Competition: Firms often compete through advertising, promotions, and brand loyalty rather than solely on price.

Characteristics of Oligopoly

Oligopolistic markets are dominated by a few firms, each with significant market share. Their key features include:

- Few Sellers: A small number of firms dominate the market, which gives each firm significant influence over prices and output.

- High Barriers to Entry: Due to factors like economies of scale, brand loyalty, or control over

The Economics of Public Goods and Services

In a well-functioning economy, certain goods and services are critical for societal welfare but cannot be efficiently provided by the private sector alone. These goods typically benefit all members of a society, regardless of their individual contributions, and are often funded or regulated by the government. As a result, understanding the economic implications of public goods and services is essential for ensuring that society’s basic needs are met without market failures.

Public goods are unique because they are non-rivalrous and non-excludable, meaning one person’s consumption does not reduce the availability for others, and individuals cannot be excluded from using them. Examples include things like clean air, national defense, and public parks. Due to these characteristics, private markets struggle to supply these goods at an adequate level, as individuals have little incentive to pay for them, leading to what is known as the “free rider” problem. This is where some people benefit from a good without directly contributing to its cost.

Key Characteristics of Public Goods

Public goods possess certain features that make them distinct from private goods, and understanding these characteristics helps explain why governments are often involved in their provision:

- Non-excludability: It is not possible to prevent individuals from accessing the good once it is made available. For instance, once national defense is provided, it benefits all citizens, regardless of whether they pay for it.

- Non-rivalrous consumption: The consumption of the good by one individual does not reduce its availability for others. An example is street lighting–one person benefiting from the light does not limit others from using it as well.

- Free rider problem: Since public goods are non-excludable, some individuals may take advantage of the good without contributing to its cost, which can lead to underproduction or inefficient allocation in a market setting.

Government’s Role in Providing Public Goods

Because of the unique nature of public goods, governments often intervene to ensure that these goods are provided in sufficient quantities. Government involvement is crucial in overcoming the free rider problem and ensuring that the benefits of these goods are accessible to all members of society. Public goods are typically funded through taxes, and the government ensures their efficient distribution and maintenance. Here are some common examples:

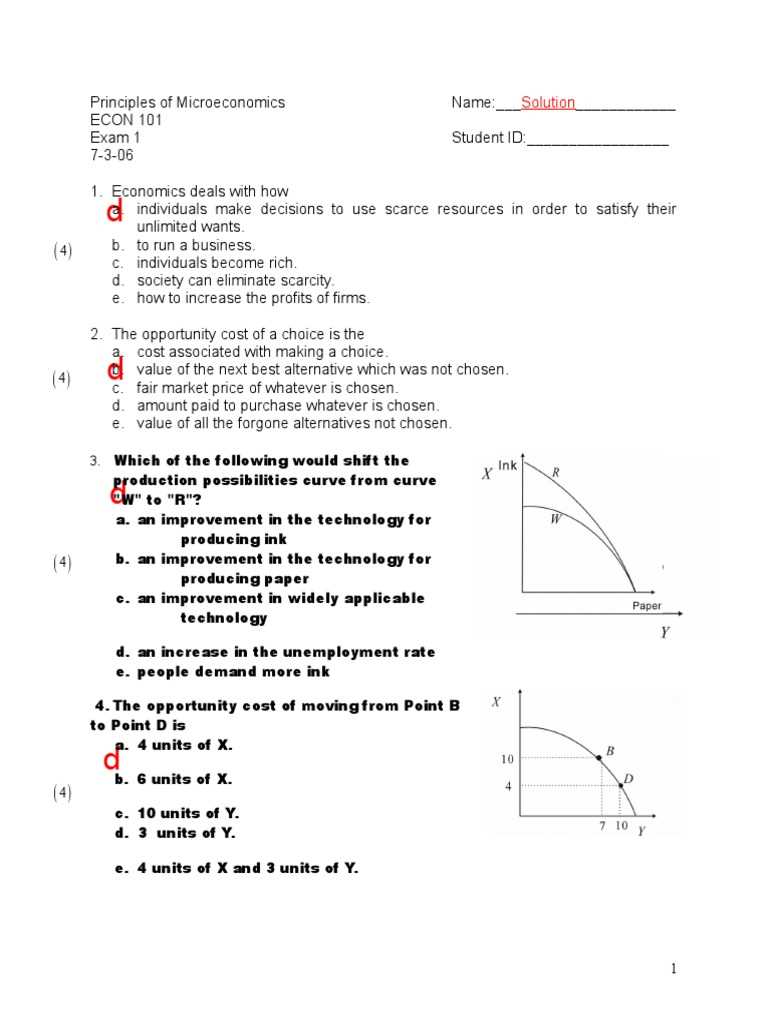

Opportunity Cost in Decision Making

Every decision involves a trade-off. When we choose one option, we forgo others that could have also brought value. This concept, often referred to as opportunity cost, plays a crucial role in decision-making by emphasizing the value of the alternatives that are left behind. Recognizing opportunity cost helps individuals and businesses make more informed choices, ensuring that resources–whether time, money, or effort–are used efficiently.

In essence, opportunity cost refers to the potential benefits that are sacrificed when one course of action is chosen over another. It encourages decision-makers to weigh not just the immediate costs of a choice, but also the value of what they are giving up in the process. Whether it’s deciding how to allocate time between work and leisure or choosing between different investment opportunities, understanding the trade-offs involved is key to making the best possible decision.

Consider an individual deciding whether to attend a concert or stay home to study for an exam. The opportunity cost of attending the concert is the potential benefit the person might have gained from studying, such as a higher exam score. Conversely, the opportunity cost of staying home is the enjoyment and experience missed by not attending the concert. Both options come with their respective costs, and understanding these trade-offs can help guide the decision.

Opportunity cost is not just about financial decisions. It extends to personal, social, and professional choices. The concept can apply to both major decisions, like buying a house or starting a business, and everyday decisions, like choosing how to spend leisure time. By considering what is being sacrificed in each decision, individuals and organizations can prioritize the option that maximizes overall benefit.

Utility Maximization and Budget Constraints

When making purchasing decisions, individuals aim to maximize their satisfaction, or utility, given the resources available to them. However, these decisions are often constrained by their income or budget, which limits the range of goods and services they can afford. Understanding how utility maximization works within these budgetary constraints is essential for making rational economic choices that provide the highest possible benefit.

Utility maximization refers to the process by which consumers allocate their limited resources in such a way that they achieve the greatest possible level of satisfaction. This involves comparing the satisfaction derived from each potential purchase and adjusting consumption choices to get the best value for their money. However, these decisions are always subject to the limitation of available income, creating a budget constraint that sets boundaries on what can be purchased.

The budget constraint represents the various combinations of goods and services a person can afford given their income and the prices of the goods. It is typically illustrated as a line or curve on a graph, where the consumer’s income determines the slope, and the prices of the goods determine the positioning. The key is finding the point at which the consumer can maximize their utility without exceeding their budget.

To demonstrate this concept, consider the following example:

Product Price Quantity Total Cost Product A $10 2 $20 Product B $15 1 $15 Product C $5 3 $15 In this example, the consumer has $50 to spend. By analyzing the total cost of each product combination, they can determine the best choice that maximizes their utility while remaining within the budget. For example, purchasing two units of Product A and one unit of Product B would result in a total cost of $35, which leaves room to consider alternative purchases or savings.

Ultimately, the goal of utility maximization is to achieve the highest satisfaction given the budget available. The consumer will adjust their purchases based on the relative utility of different products and their costs, aiming to reach the most efficient consumption bundle. This approach helps individuals make optimal choices and maximize their well-being within the constraints of their financial situation.

Strategic Pricing in Competitive Markets

In highly competitive environments, businesses must carefully consider their pricing strategies to maintain profitability while remaining attractive to consumers. The right price can help a company capture market share, outperform rivals, and secure a sustainable position in the marketplace. Understanding how to set prices strategically is crucial for firms to achieve success amidst constant competition.

Key Factors Influencing Pricing Decisions

Strategic pricing is influenced by several key factors that businesses must account for when determining their approach. These include:

- Market Demand: The demand for a product or service plays a significant role in setting prices. If demand is high, companies may have the flexibility to increase prices without losing customers. Conversely, lower demand may require firms to reduce prices to stimulate sales.

- Cost of Production: Companies must cover their costs, which include production, labor, and marketing expenses. The pricing strategy must ensure that the price is high enough to cover these costs while generating a reasonable profit.

- Competition: In a competitive market, companies often look at the pricing strategies of their competitors. If a competitor offers a similar product at a lower price, it may force other firms to adjust their pricing in response to maintain market share.

- Consumer Behavior: Understanding the price sensitivity of consumers helps businesses decide whether to price aggressively or focus on value-added features that justify higher prices.

Common Pricing Strategies in Competitive Markets

Firms can employ various pricing strategies to maintain a competitive edge, each with its benefits and risks:

- Penetration Pricing: This strategy involves setting a low price initially to attract customers and build market share. Once a customer base is established, businesses may gradually increase prices.

- Price Skimming: With this approach, companies set a high initial price, often targeting early adopters who are willing to pay more for the novelty or uniqueness of the product. Over time, prices may be lowered to attract a broader market.

- Competitive Pricing: Companies monitor their competitors and set prices that are in line with market standards. This helps maintain competitiveness while avoiding price wars.

- Loss Leader Pricing: In some cases, businesses may price certain products below cost to attract customers. The goal is to entice consumers into the store or website with the hope that they will purchase other higher-margin products.

By implementing the right pricing strategy, businesses can balance the need to be competitive with the goal of maximizing their revenue and long-term profitability. Strategic pricing is not just about adjusting prices–it’s about understanding the broader market dynamics and positioning a firm’s offerings effectively within that landscape.

Preparing for Your Economics Test

Successfully preparing for a test in economics requires a strategic approach to studying and understanding key concepts. Whether it’s reviewing basic theories or analyzing complex models, effective preparation ensures you can apply your knowledge accurately and confidently during the assessment. The key to success lies in both mastering the material and practicing the types of questions you might encounter.

Essential Steps for Preparation

To optimize your study sessions and ensure a comprehensive understanding, follow these essential steps:

- Review Key Concepts: Start by revisiting the core principles, focusing on the foundational theories and terms. Make sure you understand the definitions and applications of key concepts such as supply and demand, market equilibrium, and elasticity.

- Understand Graphs and Models: Many economics problems require interpreting and analyzing graphs. Familiarize yourself with supply and demand curves, cost structures, and other visual aids that represent economic concepts. Practice reading and interpreting these graphs to reinforce your understanding.

- Practice with Problem Sets: Doing practice problems helps reinforce your understanding of how to apply theoretical knowledge to real-world scenarios. Focus on exercises that challenge you to solve problems involving costs, market structures, and consumer behavior.

- Study with Peers: Group study can be beneficial for clarifying difficult concepts. Discussing topics with others can help you gain different perspectives and identify any areas where you may need further review.

- Utilize Online Resources: Many educational platforms offer additional explanations, practice quizzes, and video lessons that can help clarify complex topics. Take advantage of these resources to reinforce what you’ve learned.

Test-Taking Strategies

In addition to preparing effectively, employing the right strategies during the test itself is crucial for maximizing your performance:

- Time Management: Plan your time wisely. Allocate sufficient time to each section based on the number of questions and the complexity of the material. Don’t spend too long on one problem–move on and return to it later if needed.

- Read Questions Carefully: Ensure you understand what each question is asking before attempting to answer. Look for keywords and make sure you address all parts of the question.

- Show Your Work: If the test involves problem-solving, clearly show your steps to demonstrate your understanding. This can often earn you partial credit even if your final answer is incorrect.

- Stay Calm and Focused: During the test, try to stay relaxed. If you encounter a difficult question, don’t panic–move on to the next one and come back to it later with a fresh perspective.

By following these strategies, you’ll be well-equipped to approach your economics test with confidence, ensuring a solid performance on both theoretical and applied questions.