Becoming proficient in financial management tools requires dedication and a clear understanding of the associated concepts. Certification tests are designed to evaluate your practical knowledge and ability to apply these tools effectively in real-world scenarios.

To succeed in these assessments, it is essential to focus on key areas such as system navigation, data organization, and transaction management. Building a strong foundation in these topics not only ensures better results but also enhances your overall expertise.

Preparation plays a crucial role in achieving success. Utilizing practice resources, understanding core features, and familiarizing yourself with potential challenges can significantly improve your performance. With the right strategies and effort, mastering such tests becomes an attainable goal.

Understanding the Certification Assessment

Achieving professional accreditation in accounting software requires more than just familiarity with basic functionalities. These assessments are designed to test your ability to handle complex tasks and solve practical problems efficiently, ensuring a deep understanding of the platform’s capabilities.

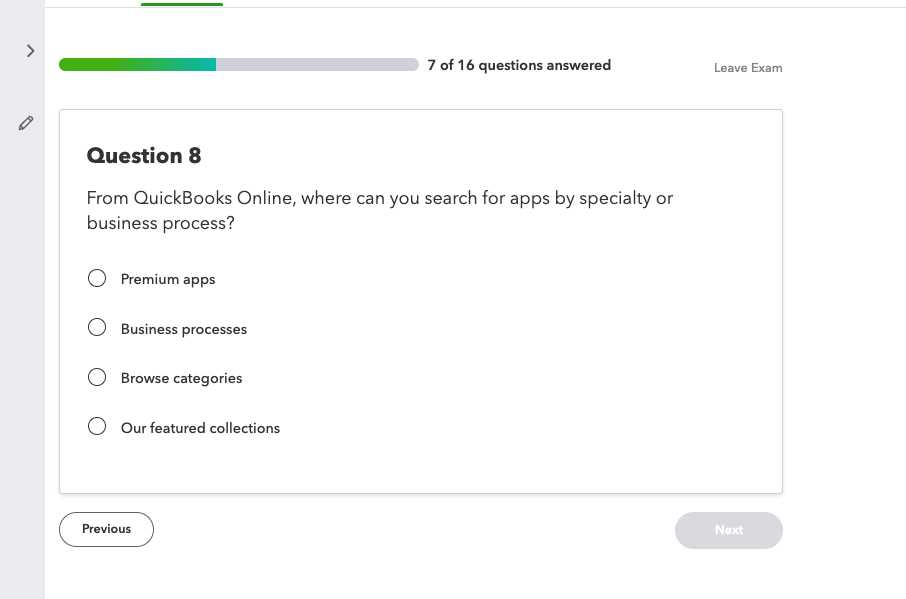

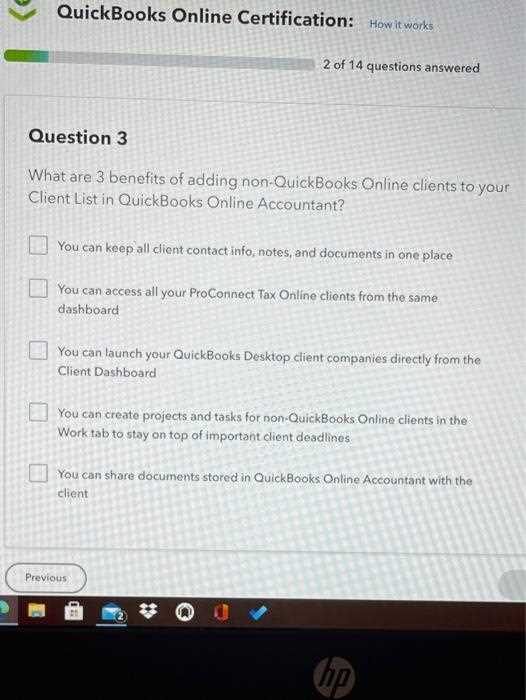

The structure of these evaluations typically includes a combination of scenario-based questions, multiple-choice options, and interactive exercises. This format challenges users to demonstrate their skills in managing financial transactions, creating detailed reports, and organizing data effectively.

Success in such a test depends on a thorough grasp of key concepts such as system setup, process automation, and error troubleshooting. Preparing with practical exercises and study materials tailored to real-world applications can significantly enhance your expertise and confidence.

How to Prepare for the Final Test

Success in certification assessments relies heavily on effective preparation. A well-structured study plan and hands-on practice ensure that you are ready to tackle a variety of challenges and showcase your expertise.

Start by identifying the key topics that will be evaluated, such as transaction processing, financial reporting, and data management. Break these into smaller sections and allocate specific time for each to ensure comprehensive coverage of the material.

Utilize resources like practice scenarios, guided tutorials, and sample questions to familiarize yourself with the test format. Pay special attention to areas where you feel less confident, and make use of detailed guides to reinforce your understanding. Consistent practice and review will build the confidence needed to achieve outstanding results.

Key Topics Covered in Certification Assessments

Certification evaluations focus on crucial skills and knowledge areas necessary for managing financial operations effectively. They are designed to test both practical capabilities and theoretical understanding.

Below is an overview of the core subjects typically included:

| Category | Focus Area | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Account Configuration | Setting up user access, chart of accounts, and company details. | ||||||||||||||||||||||

| Expense Tracking |

| Platform | Features |

|---|---|

| LinkedIn Learning | In-depth courses with interactive content and quizzes. |

| Udemy | Comprehensive video lessons, downloadable resources, and quizzes. |

| Coursera | Expert-led courses with certificates upon completion. |

Books and Study Guides

For those who prefer self-paced study, books and guides can be a great option. Many offer detailed explanations, examples, and practice problems that allow for in-depth learning at your own pace.

- Look for books that offer a blend of theory and practical exercises.

- Choose guides that include practice questions at the end of each chapter.

- Consider books that are specifically tailored to certification preparation.

By utilizing these effective resources, you can gain a deeper understanding of the material and improve your readiness for the certification process.

Breaking Down Accounting Software Features

Understanding the essential tools and functions of accounting software is critical for users aiming to improve their financial management skills. The software provides a variety of features designed to streamline business processes and increase efficiency. Let’s break down the core elements that make these programs effective for managing financial data.

One of the main features is the ability to manage finances by organizing transactions, tracking expenses, and generating detailed reports. This can help businesses stay on top of their cash flow and make more informed decisions. In addition, many platforms offer invoicing capabilities, which allow businesses to quickly create and send professional invoices to clients.

Another useful feature is the automated bank feeds, which sync with your bank accounts to import transactions directly into the software. This eliminates manual data entry, reducing the chance for errors and saving valuable time. Furthermore, these tools often allow users to track payments, create budgets, and monitor financial health with ease.

Lastly, inventory tracking is a key function for businesses that need to manage stock levels. Accounting software can provide real-time updates on stock quantities, ensuring businesses can efficiently manage their supply chains and avoid running out of crucial items.

Best Strategies for Answering Assessment Questions

Successfully tackling assessment questions requires more than just knowledge; it involves a strategic approach to ensure accurate and efficient responses. By applying certain methods, you can increase your chances of providing the correct solutions while managing your time effectively.

One key strategy is to thoroughly read each question before attempting to answer. Understanding the full context and the specific requirements of each question is essential. Make sure to highlight or underline key terms that will guide you in formulating the right response.

Another important technique is time management. Start by allocating time to each section based on its difficulty and length. If you encounter a particularly challenging question, don’t hesitate to move on and return to it later with a fresh perspective. This approach prevents wasting time on one difficult item while ensuring that you answer the easier ones efficiently.

When answering, focus on clarity and accuracy. Avoid over-complicating your responses. Stick to the point and ensure that your answers directly address what is being asked. If necessary, support your response with specific examples or relevant concepts.

Lastly, reviewing your answers before submission is crucial. If time permits, double-check for any errors or incomplete responses. This final review gives you an opportunity to correct mistakes and ensure that your answers align with the instructions provided.

How to Manage Time During the Test

Efficiently allocating your time during a testing session is essential for optimal performance. Balancing your focus across all sections and questions helps ensure you answer each one thoughtfully without rushing through or leaving any incomplete. By setting a structured approach to how you manage your time, you can avoid unnecessary stress and improve your overall outcome.

Organize Your Approach

At the beginning, take a moment to survey the entire test. Assess the number of questions and their level of difficulty, then decide how much time to dedicate to each part. Prioritize easier questions that you can answer quickly to build confidence, leaving more time for complex ones. Having a clear plan will help you stay on track and prevent wasting precious minutes.

Don’t Get Stuck on Difficult Questions

If you come across a challenging question, don’t dwell on it for too long. It’s easy to get frustrated, but focusing on one question for an extended period can prevent you from completing the test. Mark questions you’re unsure about, move on, and return to them later if time allows. This strategy ensures you cover everything before the deadline.

Track Your Time by keeping an eye on the clock or using a timer if permitted. This will help you monitor how much time you’ve spent and how much is left, ensuring you don’t lose track. It’s helpful to allocate specific time slots for each section based on its difficulty and point value.

By using these techniques, you’ll be able to manage your time more effectively, allowing you to approach each question with confidence and complete the test thoroughly.

Real-Life Applications of Accounting Software Skills

Mastering financial management software offers valuable skills that can be applied in various professional environments. Understanding how to manage financial data, track expenses, and generate reports can help streamline operations and ensure businesses stay organized. These abilities can lead to improved decision-making and provide professionals with the tools to manage finances efficiently, whether in small businesses or large corporations.

Key Areas of Application

Here are some of the most common fields where financial software skills are crucial:

| Industry | Application | Benefits |

|---|---|---|

| Small Business | Track income and expenses, generate financial reports | Better financial oversight and more informed decision-making |

| Accounting | Prepare tax returns, reconcile accounts, manage payroll | Efficient financial operations and reduced errors |

| Nonprofit Organizations | Manage donations, budgeting, and fund allocation | Ensure transparency and compliance with regulations |

| Freelancers | Invoice clients, track payments, manage tax filings | Streamlined income tracking and tax preparation |

Enhancing Professional Efficiency

Financial software is not just a tool for businesses; it also improves individual productivity. Professionals can automate repetitive tasks, reducing the time spent on manual calculations and allowing more focus on strategy and growth. By leveraging the software’s capabilities, businesses and freelancers alike can operate more smoothly and make more informed financial decisions.

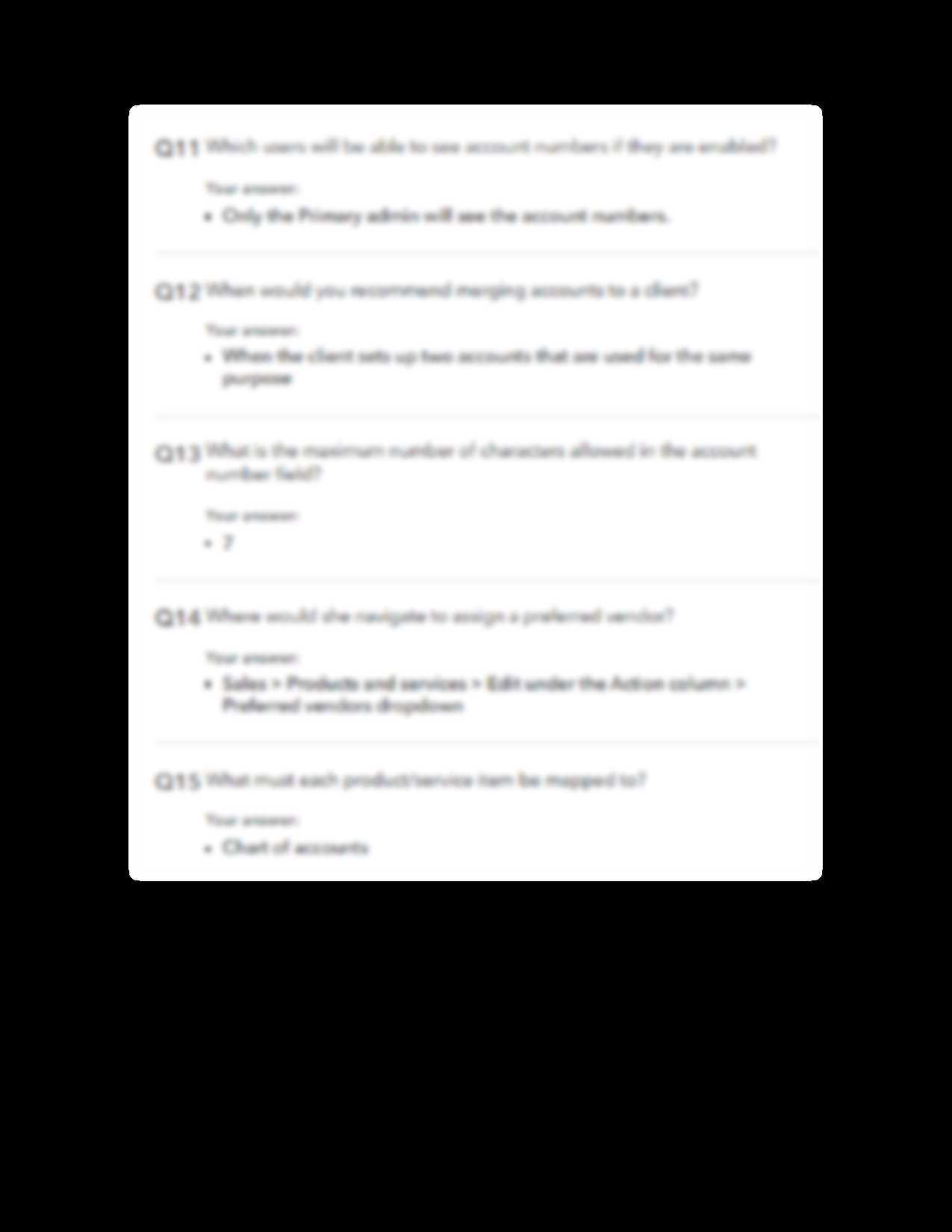

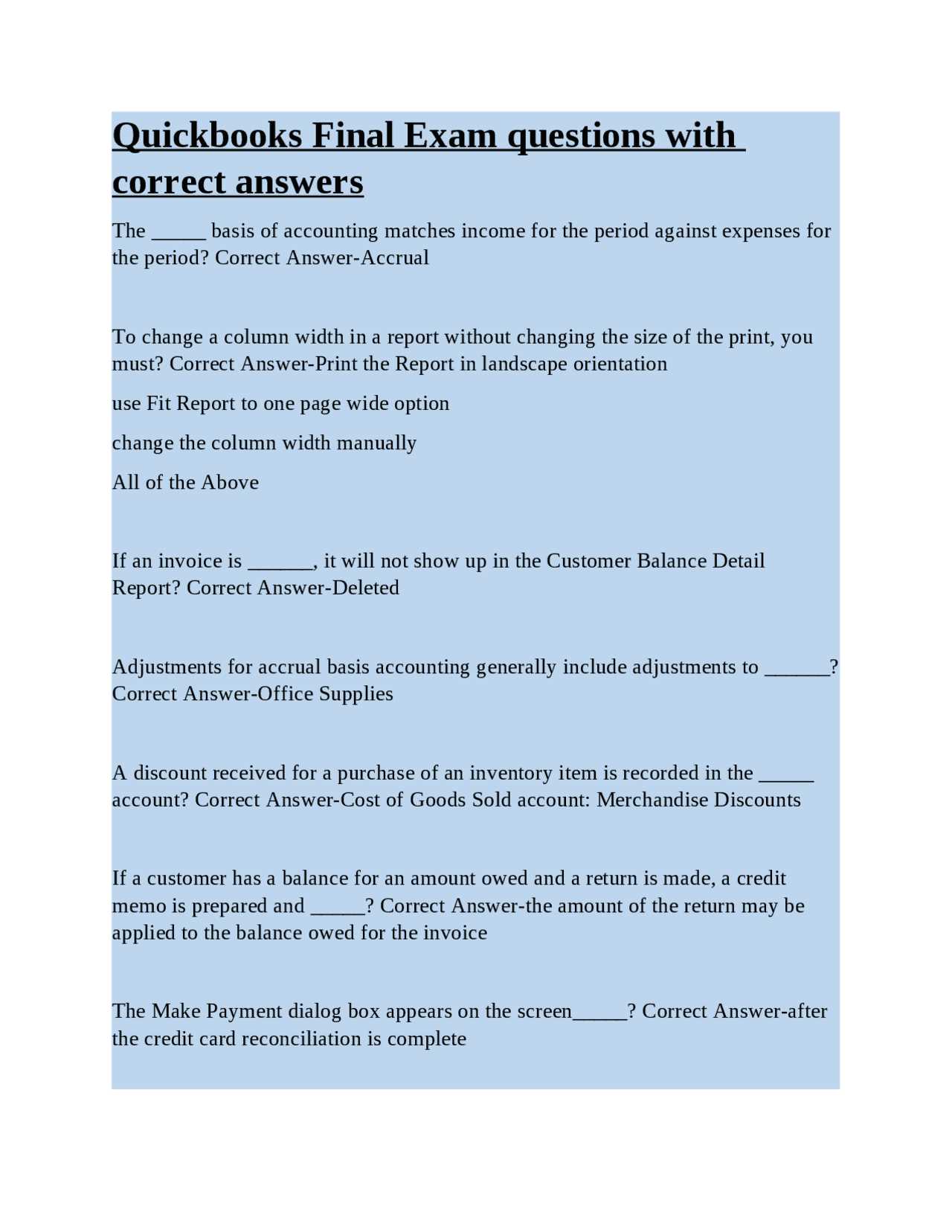

Analyzing Past Assessment Question Trends

Studying patterns from previous assessments can provide valuable insights into the types of questions that are commonly asked and the topics that are emphasized. By reviewing past questions, candidates can identify recurring themes and prepare more effectively. This method helps focus efforts on the areas most likely to appear in future evaluations, enhancing readiness and boosting confidence.

Key Areas Often Tested

Through the analysis of past questions, certain themes and topics tend to emerge repeatedly. These areas are often crucial to understanding the fundamentals and key concepts within the subject matter. Here are a few areas that are commonly tested:

- Financial statement preparation and analysis

- Transaction recording and classification

- Budgeting and forecasting techniques

- Tax calculation and compliance

- Software functionalities and troubleshooting

How to Use This Analysis Effectively

Once trends have been identified, it is important to create a focused study plan. Allocate more time to areas that frequently appear in past questions while ensuring a well-rounded understanding of the material. Practice with sample questions and mock assessments to simulate real-world conditions and test your knowledge in these common areas.

Essential Tools Every User Should Know

In the world of financial management software, there are several tools that users should be familiar with to streamline processes and improve efficiency. These features provide powerful functions to manage accounting tasks, simplify record-keeping, and ensure accuracy. Understanding and utilizing these tools can make day-to-day tasks much easier, whether for personal finances or business operations.

Key Features to Master

Here are some essential tools that every user should know to effectively navigate financial management software:

- Dashboard – Provides a snapshot of your financial data, offering quick access to key metrics like income, expenses, and profits.

- Invoicing – Allows users to create, send, and track invoices, ensuring timely payments from clients or customers.

- Expense Tracking – Helps monitor and categorize business expenses, making it easier to track spending and prepare for tax season.

- Bank Reconciliation – Ensures that your bank transactions match with your financial records, reducing errors and discrepancies.

- Reporting – Provides detailed reports on financial performance, which can assist with decision-making and ensure accuracy in accounting records.

How to Leverage These Tools Effectively

To maximize the value of these features, take time to explore each tool and understand its functions. Consistently using them for your regular accounting tasks will help you save time and improve the accuracy of your records. Additionally, exploring advanced settings and customizations can further streamline your workflows and allow you to tailor the software to meet your specific needs.

Frequently Asked Questions About Certification

As individuals prepare for professional credentials in financial management software, many have common questions about the certification process. These queries often revolve around preparation methods, eligibility requirements, and the overall benefits of obtaining a certification. Here, we address some of the most frequently asked questions to help you navigate the journey with confidence.

What are the prerequisites for certification?

Before pursuing certification, candidates must meet certain prerequisites. This typically includes having a basic understanding of accounting principles and familiarity with the software in question. Some programs may require prior experience or completion of introductory courses to ensure readiness for the certification process.

How can I best prepare for the certification process?

The most effective preparation involves a combination of study materials, practice tests, and hands-on experience. Many users find it beneficial to take official training courses offered by the software provider, which are often structured to align with the certification requirements. Additionally, practice exams can help assess your knowledge and identify areas that need further focus.

What are the benefits of certification?

Obtaining certification can significantly enhance your professional credibility. It demonstrates your expertise and knowledge in using financial management software, which can lead to better job opportunities, higher earning potential, and greater confidence in handling complex tasks. Employers often seek certified professionals to ensure accuracy and efficiency in financial operations.