In the world of decision-making, accurate interpretation of numerical data plays a crucial role in shaping outcomes. Whether assessing trends, forecasting future developments, or optimizing operations, being able to analyze complex data is essential. This section provides insights into the key techniques used to extract meaningful information from datasets, enabling better decisions across various fields.

Learning how to apply these methods effectively requires both a theoretical understanding and practical skills. It involves mastering formulas, identifying patterns, and selecting the right approach based on specific challenges. By focusing on core principles, readers can develop a deeper grasp of how data-driven insights influence key choices and strategies in various professional settings.

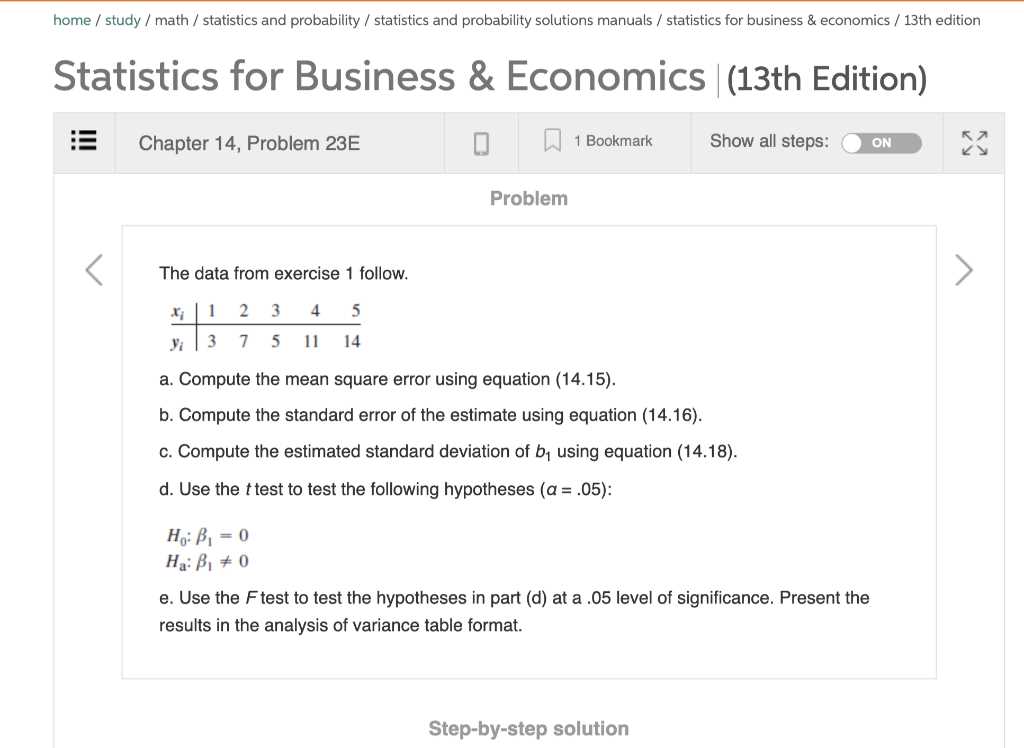

Statistics for Business and Economics 13th Edition Answers

When working with quantitative data, understanding the core principles and techniques used to solve various problems is crucial. Mastery of these methods allows individuals to effectively interpret information, apply it to real-world scenarios, and make informed decisions. In the context of this material, learners are introduced to essential strategies and concepts that guide data analysis in diverse fields.

By focusing on practical examples and step-by-step solutions, this section provides the necessary tools to tackle complex questions. These solutions serve as a guide to better understanding the underlying principles, offering clarity on how to approach challenges efficiently. From foundational methods to advanced techniques, the content is designed to support individuals in refining their analytical skills.

By reviewing this material, learners gain deeper insights into solving problems, reinforcing their knowledge, and applying it effectively in both academic and professional settings. Whether it’s interpreting data sets or evaluating trends, the provided explanations ensure a comprehensive understanding of key concepts, empowering individuals to navigate complex scenarios with confidence.

Key Insights from the 13th Edition

In this section, we explore the most important concepts and methodologies presented in the latest update. The focus is on providing a comprehensive understanding of how various approaches are applied to solve problems. These insights highlight the evolving techniques and tools designed to enhance data analysis and decision-making processes.

New Approaches to Data Interpretation

The updated content introduces refined methods that offer a more accurate and efficient way to interpret numerical information. By emphasizing the importance of correct data handling, these techniques guide individuals in making reliable predictions and informed choices. Practical examples are used to demonstrate how these methods can be applied to real-world scenarios, improving outcomes in various fields.

Advances in Analytical Tools

One of the key improvements in this version is the integration of advanced tools that facilitate deeper analysis. These tools not only streamline calculations but also provide enhanced clarity when dealing with complex datasets. By leveraging these tools, individuals can gain a more nuanced understanding of patterns and trends, making it easier to assess situations and derive actionable insights.

How to Approach Business Statistics

To effectively solve problems involving numerical data, it’s essential to follow a structured approach that ensures accuracy and clarity. The first step is to understand the core concepts that govern data analysis, such as patterns, distributions, and relationships. A strong foundation in these principles allows individuals to confidently navigate through complex problems, applying the right tools and methods at each stage.

One key to success is breaking down challenges into smaller, more manageable tasks. By focusing on individual components, you can analyze each aspect thoroughly before combining results for the final solution. Critical thinking plays a crucial role in this process, as it helps identify potential pitfalls and ensures the integrity of the analysis.

Another important consideration is the selection of the right techniques. Different types of data require different approaches, so understanding which methods to apply based on the given problem is crucial. Careful examination of the question at hand helps determine whether descriptive, inferential, or predictive tools are best suited for the task.

Understanding Economic Models in Statistics

Economic models are essential tools used to analyze the behavior of different variables within a given system. These models help to predict outcomes based on certain assumptions, allowing decision-makers to evaluate possible scenarios and understand how changes in one element can affect others. By utilizing these frameworks, professionals can create more accurate forecasts and develop strategies based on data-driven insights.

Key Components of Economic Models

At the heart of any model are the variables that represent the key factors influencing the system. These can include anything from prices and supply to demand and consumer preferences. Understanding how each variable interacts is crucial to building a reliable model. Quantitative analysis helps in determining the relationships between these variables and predicting how they will evolve over time.

Applications of Economic Models

Economic models are used in a wide variety of contexts, from forecasting market trends to optimizing resource allocation. The effectiveness of these models depends on the quality of the data used and the accuracy of the assumptions made. By adjusting models to reflect real-world conditions, professionals can improve the precision of their analyses. Refining these models allows for better policy decisions and enhances the understanding of complex economic systems.

Solving Common Business Problems with Statistics

In any organization, addressing everyday challenges requires data-driven solutions that can pinpoint issues, identify trends, and suggest actionable strategies. Analyzing key variables can reveal patterns that directly impact performance, helping to make informed decisions. Whether it’s assessing customer behavior, optimizing resource allocation, or predicting future outcomes, using the right tools to interpret data is essential for successful problem-solving.

By utilizing quantitative methods, businesses can evaluate the effectiveness of different strategies, measure outcomes, and adjust their approach as necessary. A methodical approach helps in breaking down complex situations into manageable components, ensuring a clear path to a solution.

| Problem Type | Solution Method | Expected Outcome |

|---|---|---|

| Customer Satisfaction | Survey analysis and trend tracking | Improved customer retention and loyalty |

| Market Demand | Demand forecasting using past sales data | Optimized inventory management and pricing |

| Resource Allocation | Optimization models and cost-benefit analysis | Reduced waste and increased efficiency |

| Risk Management | Predictive modeling and scenario analysis | Minimized potential risks and improved planning |

Analyzing Data Using Statistical Tools

Effective analysis of data relies heavily on selecting the right tools to extract meaningful insights. These tools allow individuals to identify patterns, relationships, and trends within complex datasets, transforming raw information into actionable knowledge. By applying these techniques, one can draw conclusions that guide decision-making and help forecast future outcomes.

Different tools serve different purposes. Some are used to summarize data, while others help in testing hypotheses or predicting future events. Mastery of these tools enables individuals to navigate through large volumes of data efficiently, making it easier to draw conclusions that are both reliable and relevant to the situation at hand.

Key instruments include measures of central tendency, regression analysis, hypothesis testing, and correlation methods, all of which allow for a deeper understanding of the data’s structure. Each of these tools plays a vital role in interpreting information accurately, ensuring that the results are both meaningful and applicable to the task at hand.

Interpreting Results from Economic Data

Interpreting results from numerical data requires a clear understanding of what the figures represent and how they relate to the broader context. It is essential to go beyond the numbers themselves, examining the underlying patterns and relationships that drive the outcomes. By doing so, individuals can extract valuable insights that inform strategic decisions and help in understanding the dynamics of a particular market or scenario.

Identifying Trends and Patterns

One of the first steps in interpretation is recognizing trends that emerge from the data. Whether it’s a steady increase in sales, fluctuations in consumer behavior, or changes in market conditions, identifying these trends provides a foundation for further analysis. Pattern recognition allows individuals to predict future developments and make informed decisions based on the direction in which the data is moving.

Evaluating the Significance of Results

After identifying trends, it’s crucial to assess the significance of the findings. Not all data patterns are equally important, and understanding the impact of a particular trend requires considering factors such as external influences and the reliability of the data itself. Statistical significance helps determine whether the observed results are likely to reflect true changes or if they are due to random variation.

Statistical Concepts for Business Decision Making

In any organization, making informed decisions hinges on the ability to interpret and apply relevant data effectively. Statistical principles provide the necessary framework for evaluating information, identifying trends, and making predictions that guide strategic choices. These concepts allow decision-makers to move beyond intuition, relying on quantitative evidence to optimize performance and reduce risks.

Understanding Variability and Risk

Every decision comes with a degree of uncertainty, which is why understanding variability is crucial. By analyzing how data points deviate from the average, businesses can estimate potential risks and anticipate future outcomes. This insight is vital for assessing scenarios such as market fluctuations, supply chain disruptions, or customer preferences. Risk management becomes more effective when based on a solid understanding of data variability, helping to mitigate unforeseen challenges.

Using Sampling to Make Inferences

In many cases, it is not feasible to analyze an entire population. Instead, sampling allows businesses to make informed estimates about a larger group based on a smaller subset. The accuracy of these inferences depends on the methods used to select the sample and ensure its representativeness. A well-designed sampling strategy enables businesses to draw meaningful conclusions while saving time and resources.

Practical Applications in Business Economics

Applying data-driven methods in real-world scenarios is key to improving operational efficiency and guiding strategic decisions. By using quantitative techniques, professionals can address a wide range of challenges, from optimizing resource allocation to forecasting market trends. These tools enable organizations to move from theoretical models to actionable insights that directly impact performance and profitability.

One practical application is in the area of market analysis, where data is used to identify customer preferences, monitor competition, and assess demand. By examining historical data, organizations can predict future behavior, allowing them to make proactive decisions. In addition, financial forecasting relies on similar techniques to estimate revenues, costs, and potential profits, giving businesses the clarity needed to plan for future growth.

Another important application is cost analysis, which helps organizations identify inefficiencies in their operations. By analyzing costs in relation to production, distribution, and other activities, businesses can pinpoint areas where expenses can be reduced without sacrificing quality. This leads to better resource management and enhanced profitability in a competitive market environment.

Key Formulas and Equations Explained

Understanding the key mathematical formulas and equations is crucial for interpreting data accurately and making informed decisions. These equations serve as the foundation for analyzing relationships between different variables, allowing professionals to quantify results and predict future trends. Below are some of the most important formulas used in the analysis process, with explanations to help clarify their meaning and application.

1. Mean (Average)

The mean is a measure of central tendency that represents the average value of a dataset. It is calculated by summing all values and dividing by the total number of values in the set.

- Formula: μ = ΣX / N

- Where: μ is the mean, ΣX is the sum of all values, and N is the number of values.

2. Standard Deviation

Standard deviation measures the spread or dispersion of a set of values around the mean. It helps assess the degree of variability in the data.

- Formula: σ = √(Σ(X – μ)² / N)

- Where: σ is the standard deviation, X represents each data point, μ is the mean, and N is the number of data points.

3. Regression Equation

Regression analysis is used to examine the relationship between dependent and independent variables. The regression equation helps predict the value of one variable based on the value of another.

- Formula: Y = a + bX

- Where: Y is the dependent variable, X is the independent variable, a is the intercept, and b is the slope of the line.

4. Coefficient of Determination (R²)

The coefficient of determination indicates how well the regression model explains the variability of the dependent variable. A higher R² value suggests a better fit of the data to the model.

- Formula: R² = 1 – (Σ(Y – Ŷ)² / Σ(Y – μ)²)

- Where: Y is the observed value, Ŷ is the predicted value, and μ is the me

Essential Statistical Methods for Business Analysis

To make informed decisions, companies rely on a range of quantitative methods that allow them to assess data, identify trends, and forecast future outcomes. These techniques provide valuable insights into operations, customer behavior, and market conditions. The most commonly used methods help analyze relationships between variables, assess performance, and predict risks, guiding decision-making processes across various departments.

One of the key approaches involves hypothesis testing, where businesses test assumptions or claims about a population based on sample data. This method allows companies to evaluate the validity of predictions, test the effectiveness of marketing strategies, and assess product performance.

Another essential technique is correlation analysis, which measures the strength and direction of relationships between different factors. By understanding how variables influence one another, companies can make more accurate forecasts and improve their strategies. For example, this method is useful when analyzing how changes in one market variable, like price, may affect another, such as demand.

Regression analysis is a powerful tool used to understand the relationships between dependent and independent variables. By creating a model based on historical data, companies can predict future trends and make data-driven decisions that optimize business outcomes. This technique is particularly valuable in pricing, supply chain management, and financial forecasting.

Moreover, sampling techniques play a critical role in minimizing costs while obtaining accurate data. By selecting representative samples from larger populations, businesses can gather meaningful insights without the need for complete data collection, saving both time and resources.

Lastly, probability analysis helps businesses manage uncertainty by providing a framework to assess risks and predict the likelihood of various events. This is particularly useful in areas like risk management, financial planning, and project management, where uncertainty plays a significant role in decision-making.

Incorporating these methods into everyday business practices enables organizations to enhance their decision-making process, improve operational efficiency, and adapt to changing market conditions with confidence.

Mastering Probability in Business Economics

Understanding probability is a key component in navigating uncertainty and making informed decisions within an organization. By calculating the likelihood of various outcomes, companies can better anticipate challenges, identify opportunities, and mitigate risks. This essential tool empowers decision-makers to act with greater confidence, whether forecasting demand, managing inventories, or assessing financial risks.

One of the primary applications of probability in this context is risk analysis. Risk assessment techniques allow businesses to quantify potential hazards and develop strategies to either minimize or capitalize on them. For example, probability is used to assess the likelihood of product failures, market downturns, or fluctuations in supply costs.

In operations management, probability plays a significant role in optimizing processes and improving efficiency. Companies use probability to model various production scenarios, helping them understand the chances of delays, production errors, or supply chain disruptions. This allows managers to plan accordingly and ensure smoother operations.

Probability also aids in decision-making through tools such as expected value, which calculates the average outcome of various decisions based on their likelihood and impact. This approach helps businesses choose the most profitable options while minimizing potential losses. Here are some examples of how this method can be applied:

- Evaluating investment opportunities by considering both the potential return and the probability of success.

- Analyzing insurance premiums based on the probability of certain claims occurring.

- Making pricing decisions based on consumer behavior and market conditions.

Additionally, in marketing strategies, probability is often used to forecast customer behavior, helping businesses predict how likely it is that a customer will make a purchase, respond to promotions, or switch to a competitor. This enables organizations to target the right customers with the right offers, increasing the effectiveness of their campaigns.

Ultimately, mastering probability allows organizations to approach uncertainty with a structured mindset, turning unpredictability into a strategic advantage. With the ability to estimate and manage potential outcomes, businesses are better positioned to make sound decisions and achieve long-term success.

Using Regression Analysis in Business Solutions

Regression analysis is a powerful tool used to explore the relationships between variables and predict future outcomes. By examining how different factors influence one another, companies can make informed decisions based on data patterns. This method is particularly valuable in identifying trends, estimating potential growth, and optimizing operational processes.

One common application of regression is in forecasting sales. By analyzing historical data, businesses can predict future demand based on factors such as seasonality, price changes, and market conditions. This allows companies to adjust inventory levels, optimize pricing strategies, and align production schedules with expected sales.

Regression analysis is also useful in pricing strategies. By modeling the relationship between price and demand, businesses can determine the optimal price point that maximizes revenue or profit. It helps answer key questions such as: How will a price increase affect sales? What price will attract the most customers while maintaining profitability?

Another critical application is in evaluating the impact of marketing campaigns. By assessing how different marketing efforts–such as advertising spend, promotional offers, or customer engagement–affect sales or customer acquisition, businesses can optimize their marketing budgets. Regression models can help quantify the return on investment (ROI) for various promotional strategies, enabling more effective resource allocation.

In addition to these applications, regression analysis is commonly used in risk management. By analyzing historical data on market fluctuations, economic indicators, or customer behavior, businesses can better understand potential risks and their likelihood. This allows companies to develop strategies that mitigate those risks, whether through diversification, hedging, or adjusting operational practices.

Overall, regression analysis helps organizations move from intuition-based decisions to data-driven strategies. It provides the insights necessary to navigate complex business environments, enhance decision-making accuracy, and drive growth. Through the careful application of regression models, businesses can uncover hidden patterns in data and gain a competitive edge in the market.

Understanding Statistical Inference Techniques

Statistical inference techniques are essential methods used to draw conclusions about a population based on sample data. These techniques help make predictions or generalizations, allowing analysts to test hypotheses, estimate parameters, and assess relationships between variables. By applying these methods, businesses can make informed decisions even in uncertain environments.

One of the key concepts in statistical inference is hypothesis testing. This process involves proposing a hypothesis, gathering data, and using statistical tests to determine whether the hypothesis holds true. Common tests include the t-test, chi-square test, and ANOVA, each designed to evaluate different types of data and research questions.

Another important aspect of inference is confidence intervals. These provide a range of values within which a population parameter is likely to fall, based on sample data. The wider the interval, the more uncertainty there is about the true value. By estimating confidence intervals, businesses can assess the precision of their estimates and make more reliable predictions.

In addition to these, regression analysis plays a crucial role in statistical inference. It allows businesses to examine relationships between multiple variables and determine the strength and direction of these associations. This technique is commonly used to understand how different factors influence outcomes, such as how marketing efforts impact sales or how employee satisfaction affects productivity.

Finally, the concept of p-values is central to statistical inference. A p-value measures the strength of evidence against a null hypothesis. A low p-value (typically below 0.05) suggests strong evidence to reject the null hypothesis, while a high p-value indicates insufficient evidence. This is a crucial tool in determining whether observed patterns in data are statistically significant or due to random chance.

By mastering these inference techniques, businesses can enhance their decision-making processes, minimize risks, and optimize strategies based on reliable data insights. These methods help convert raw data into actionable knowledge, providing a solid foundation for strategic planning and operations.

Advanced Statistical Methods for Economists

In-depth quantitative techniques are essential for understanding complex patterns within data and making informed predictions. These sophisticated methods allow professionals to explore multifaceted relationships, assess hypotheses, and forecast future trends based on past information. Mastery of such techniques provides the ability to handle intricate datasets, revealing insights that drive decision-making and strategic planning.

Key Methods in Multivariate Data Analysis

When multiple factors influence an outcome, advanced multivariate approaches are critical for analyzing their combined effects. These tools help uncover hidden interactions and relationships, enabling a clearer understanding of how various elements influence one another. The following methods are widely used:

- Multiple Linear Regression: This method evaluates the impact of several predictors on a single dependent variable, allowing for a nuanced understanding of relationships.

- Principal Component Analysis (PCA): PCA simplifies large datasets by reducing dimensionality, helping to identify the most significant underlying factors while retaining essential information.

- Cluster Analysis: By grouping similar observations, this technique helps identify patterns or segments within the data that may not be immediately obvious.

Time Series Forecasting Techniques

Analyzing data collected over time presents unique challenges, such as accounting for trends, seasonality, and random fluctuations. Time series analysis methods are designed to handle these complexities, making them essential for accurate forecasting. Below are several powerful tools used in time series modeling:

- ARIMA (AutoRegressive Integrated Moving Average): This model is used to forecast future values in time-dependent data by combining autoregressive terms and moving averages.

- Seasonal Decomposition: This technique breaks down time series da

How to Tackle Business Case Studies

Approaching complex scenarios in a structured way is essential to formulating practical solutions. Whether dealing with challenges related to operations, marketing, or management, a methodical approach ensures all relevant factors are considered. By systematically analyzing the information, recognizing the core issues, and proposing actionable strategies, individuals can develop effective solutions that address the key concerns while demonstrating strong problem-solving capabilities.

Start by fully understanding the case. Thoroughly review all provided materials, focusing on the main issues and their context. Identify the critical factors affecting the situation, distinguishing between short-term problems and long-term challenges. This initial step is essential for creating a solid foundation upon which to build your analysis. Next, delve into the data–whether qualitative or quantitative–looking for patterns or inconsistencies that could offer insight into possible causes or solutions.

Approach Steps

Follow these key steps to effectively solve a case:

- Clarify the Main Issue: Clearly define the problem you’re addressing. It’s important to ensure the correct focus by isolating the root cause from surrounding details.

- Examine Available Data: Analyze the provided figures, trends, and narratives. Look for patterns, correlations, and anomalies that reveal deeper insights into the problem.

- Generate Possible Solutions: After your analysis, brainstorm potential solutions. Evaluate each option based on feasibility, impact, and practicality in the given context.

- Make a Recommendation: Choose the best course of action, supporting your decision with evidence gathered from the analysis. Present a clear, actionable solution that aligns with the problem.

- Consider Potential Risks: Assess the possible risks and challenges associated with your recommendation. Prepare contingency plans to address obstacles that could arise during implementation.

Common Mistakes to Avoid

While working through case studies, there are several common pitfalls to avoid:

- Getting Lost in Details: Focus on the most relevant aspects of the case rather than getting sidetracked by peripheral information.

- Neglecting the Bigger Picture: Always consider the wider context, including industry trends, organizational culture, and external factors that may influence the outcome.

- Relying on Assumptions: Avoid making decisions based purely on assumptions. Use data and evidence to guide your analysis and conclusions.

- Providing Vague Solutions: Ensure that your proposed solutions are specific, realistic, and clearly actionable, rather than offering general or ambiguous suggestions.

By following this structured method, you can confidently tackle case studies, uncovering insights that lead to effective problem resolution and demonstrating strong analytical skills.

Guidelines for Completing Homework and Assignments

Successfully completing assignments requires a structured approach, which helps in breaking down complex tasks into manageable components. By following specific strategies, individuals can enhance their time management skills, improve the quality of their work, and meet deadlines with ease. Developing a solid plan for tackling homework ensures that all necessary steps are taken to fully understand the topic and deliver the best possible outcome.

Start by reviewing all instructions carefully. Understanding the requirements before diving into the task is crucial to avoid missing important details or directions. Prioritize the tasks based on their difficulty and deadlines, allocating sufficient time for each. A clear roadmap will guide you through the work, making the process more efficient and less stressful.

Effective Strategies

Follow these proven strategies to ensure successful completion of assignments:

- Review Instructions Thoroughly: Carefully read the guidelines to make sure you understand the scope and expectations of the assignment.

- Break the Task into Steps: Divide the assignment into smaller, manageable chunks. This prevents feeling overwhelmed and helps to focus on one section at a time.

- Set Deadlines: Create a timeline that outlines when each step should be completed. Stay realistic about the time required to finish each part.

- Gather Necessary Resources: Collect all required materials such as textbooks, articles, notes, or online resources before starting to work on the assignment.

- Focus on Understanding: Ensure you fully understand the concept before attempting to answer questions or solve problems. If you’re unsure, seek clarification from resources or peers.

- Stay Organized: Keep your notes, drafts, and sources well-organized. This makes it easier to find information when needed and keeps your work on track.

- Review Your Work: Always double-check your answers and solutions to ensure accuracy. Look for any mistakes, missing details, or areas that need improvement.

Common Mistakes to Avoid

To improve the quality of your assignments, avoid these common errors:

- Procrastination: Avoid leaving the work until the last minute. Procrastination can lead to rushed, incomplete, or low-quality results.

- Ignoring Instructions: Ensure that all aspects of the task are addressed as per the guidelines. Missing small details can negatively impact your grade.

- Overcomplicating Solutions: Keep your approach clear and simple. Overcomplicating your work might lead to confusion and unnecessary errors.

- Organize your process: Keep all data and steps clearly structured to minimize errors. A

Common Mistakes and How to Avoid Them

In any complex analytical process, errors are inevitable, but understanding where these mistakes typically occur can help in preventing them. By identifying common pitfalls, individuals can enhance their approach, making it more efficient and accurate. In this section, we will explore frequent missteps and offer guidance on how to address them, ensuring better outcomes in problem-solving and decision-making processes.

Typical Mistakes in Analytical Work

The following table highlights some of the most common errors made during tasks and provides strategies to minimize or avoid them:

Common Mistake How to Avoid It Misinterpretation of Data Ensure proper understanding of the data before drawing any conclusions. Always verify the context, sources, and any limitations associated with the information. Ignoring Key Assumptions Clearly outline assumptions made during analysis and test their validity. Challenging assumptions can provide more reliable results. Overreliance on Software Tools While tools can assist, they should not be relied on solely. Understanding the underlying processes ensures more accurate outcomes. Omitting External Factors Consider all relevant factors, both internal and external, when analyzing data. Excluding crucial context can distort conclusions. Failure to Review Results Always allocate time to review the work. A second look, especially after some time has passed, can help uncover overlooked errors. Practical Tips to Improve Accuracy

In addition to avoiding common mistakes, the following tips can further improve the quality and accuracy of your work: