Preparing for the certification process in the field of financial assistance requires careful planning and a clear understanding of the essential topics. This step is critical for those seeking to gain professional recognition and competence in helping individuals with their financial situations. Success in this area demands a strategic approach, focused on mastering key concepts and applying knowledge effectively.

Effective preparation involves not only memorizing facts but also understanding the practical application of various rules and guidelines. Knowing how to navigate complex scenarios and answer questions accurately is a valuable skill that can be honed through consistent practice and review. By organizing study sessions and reviewing common challenges, candidates can improve their readiness and boost confidence before facing the test.

In this section, we will provide valuable insights into the most common difficulties encountered during the certification process, along with strategies for overcoming them. From understanding the structure of the test to focusing on specific areas that often pose challenges, this guide will help you tackle each part of the journey with ease.

Tax Preparer Exam Answers: A Complete Guide

Successfully navigating the certification process in the financial assistance field requires more than just a theoretical understanding of the subject matter. Candidates need to develop a comprehensive approach to handling practical situations, where precise knowledge and quick decision-making are essential. This guide will walk you through essential tips and strategies for excelling in the testing environment, covering everything from preparation to execution.

Understanding the Core Topics

At the heart of any certification process is a set of core concepts that must be mastered. These areas form the foundation of the test and are critical for evaluating your ability to assist clients effectively. By focusing on key principles and understanding their real-world applications, you can ensure that you’re ready to tackle various scenarios with confidence. Consistent practice and detailed study of each section will build a strong knowledge base for tackling the assessment.

Strategies for Success During the Test

When faced with the actual testing environment, staying calm and focused is crucial. One of the most effective strategies is to break down each question methodically, ensuring you understand all aspects before selecting an answer. It’s important to read each prompt carefully, eliminating any confusion. Time management also plays a significant role–practice pacing yourself so you can allocate sufficient time for all sections without feeling rushed.

Understanding the Tax Preparer Exam Format

Grasping the structure and layout of the certification process is essential for anyone aiming to succeed. The assessment is designed to test both knowledge and practical skills, ensuring that candidates are prepared for real-world scenarios. By understanding how the test is organized, you can approach it with confidence, knowing exactly what to expect and how to manage your time effectively.

The test typically consists of a series of multiple-choice questions, each designed to assess your proficiency in different areas of financial assistance. These questions may cover a range of topics, from regulations and guidelines to practical application. It is important to familiarize yourself with the type of content that will be covered, as well as the specific format used to present the questions. Understanding these details allows you to approach each section with a clear strategy.

In addition to the types of questions, candidates should also be aware of the time constraints. While it may seem daunting, effective preparation and practice can help you become accustomed to the pace required. Developing a clear approach to answering questions will improve your efficiency and ensure that you complete the test within the allotted time.

Key Topics Covered in the Exam

When preparing for a professional certification assessment, it’s essential to have a clear understanding of the key areas that will be evaluated. The test typically covers a wide range of topics that assess both theoretical knowledge and practical application. Each section is designed to test your grasp of the core principles and how well you can apply them in real-world scenarios.

Here are some of the most important subjects that you can expect to encounter:

| Topic | Description |

|---|---|

| Financial Regulations | Understanding of the rules and guidelines governing financial transactions and client assistance. |

| Client Communication | Ability to explain complex concepts clearly and answer client inquiries effectively. |

| Record Keeping | Familiarity with best practices for organizing and storing client information securely. |

| Applicable Laws | Knowledge of relevant legal frameworks and their impact on client service. |

| Practical Scenarios | Ability to apply theoretical knowledge to solve real-world problems accurately. |

How to Study for the Certification Test

Effective preparation is the cornerstone of success in any professional certification process. To achieve the desired results, it’s important to approach studying with a structured plan and a clear focus on the areas that matter most. By breaking down the study material into manageable sections and dedicating time to practice, you can build a solid understanding and gain confidence in your abilities.

One of the most effective strategies is to identify key topics that are likely to appear in the assessment. Make a list of the major areas, such as regulations, client interactions, and record-keeping, and prioritize your study time accordingly. Consistent review of these topics will help reinforce your knowledge and ensure that you’re prepared for all types of questions.

Additionally, practice exams can play a crucial role in the preparation process. They provide an opportunity to simulate the actual testing environment and help you familiarize yourself with the format and types of questions. Through repetition, you can identify areas that need further attention, allowing you to focus on improving your weak spots.

Finally, creating a study schedule that allows for both in-depth review and practice is essential. Time management will help you stay on track and ensure that you cover all necessary topics without feeling rushed as the test day approaches.

Common Mistakes to Avoid During the Test

During any certification assessment, even small errors can lead to a significant impact on your final score. Recognizing and avoiding common pitfalls is key to performing well. By being aware of the most frequent mistakes, you can take proactive steps to avoid them and improve your chances of success.

One of the most common errors is rushing through questions without fully understanding the prompt. It’s easy to misinterpret a question under time pressure, but reading each one carefully is essential to providing the correct response. Take the time to analyze the details before selecting an answer to ensure you’re addressing the question accurately.

Another frequent mistake is failing to manage time effectively. Many candidates spend too long on difficult questions and leave insufficient time for others. Prioritize questions that you are confident in and revisit tougher ones later. This approach helps you complete the test without rushing toward the end.

Additionally, neglecting to double-check your answers can lead to avoidable mistakes. While it may seem tempting to submit your responses quickly, it’s important to review your work, especially if you’re unsure about certain choices. Double-checking your selections can help catch simple errors and increase your overall score.

Tips for Answering Multiple Choice Questions

Multiple-choice questions are a common feature in many professional assessments. While they may seem straightforward, they require careful attention and strategic thinking. A systematic approach to answering these questions can significantly improve your chances of selecting the correct response. The key is to understand the structure of the question and use logical reasoning to eliminate incorrect options.

Key Strategies for Success

Here are some valuable tips to enhance your performance with multiple-choice questions:

| Tip | Explanation |

|---|---|

| Read Carefully | Always read the entire question and all answer choices before selecting an option to avoid misinterpretation. |

| Eliminate Wrong Choices | Cross out obviously incorrect options to narrow down your choices, improving your odds of selecting the correct one. |

| Look for Keywords | Focus on keywords or phrases in the question that can guide you to the right answer, especially when choices seem similar. |

| Manage Your Time | If you’re unsure about a question, move on and come back to it later, ensuring you have enough time for all questions. |

Avoiding Common Pitfalls

While it’s important to employ effective strategies, it’s equally crucial to avoid common mistakes. Many test-takers fall into the trap of overthinking or choosing the first answer that seems correct. Stay focused on the question at hand, and trust your initial judgment unless there is clear evidence to the contrary.

Best Resources for Exam Preparation

Preparing for a professional certification test requires more than just dedication–it also involves using the right resources to study effectively. There are a variety of tools available that can help reinforce key concepts, provide practice opportunities, and guide you through the material. Using high-quality study materials can enhance your understanding and help you perform better during the actual assessment.

Top Study Materials and Tools

Here are some of the best resources you can use to prepare:

| Resource | Description |

|---|---|

| Practice Tests | Simulate the actual testing environment and identify areas that need improvement through practice questions. |

| Study Guides | Comprehensive manuals that break down essential topics and provide detailed explanations of each subject. |

| Online Courses | Interactive courses that offer step-by-step instructions, video lectures, and quizzes to help reinforce knowledge. |

| Flashcards | Compact tools that focus on key facts and concepts, ideal for quick review and memorization. |

| Forums and Discussion Groups | Online communities where you can ask questions, share insights, and learn from others’ experiences. |

Additional Learning Platforms

In addition to the primary study materials, various online platforms offer courses, tutorials, and resources tailored to the certification process. These platforms often provide structured learning paths, allowing you to track your progress and focus on areas that require further study. Combining these tools with traditional study methods can significantly improve your preparation.

What to Expect on the Test Day

The day of your certification assessment is an important milestone in your professional journey. Understanding what to expect can help reduce stress and ensure you’re fully prepared to perform at your best. From the moment you arrive at the testing center to the final submission of your answers, there are several key elements to be aware of that will guide you through the process.

Arriving at the Testing Center

On the day of the test, plan to arrive early to allow yourself enough time for check-in procedures. You will likely be asked to provide identification and sign in before entering the testing area. It’s a good idea to bring any required documents and follow the instructions provided by the testing center staff. Being well-prepared and calm upon arrival will set a positive tone for the rest of the day.

During the Test

Once inside the testing room, you will be assigned a workstation. The environment is typically quiet and focused, so it’s important to stay calm and concentrate. Be sure to manage your time effectively, taking advantage of any breaks offered, but remember that the clock is ticking. The questions will vary in difficulty, so pace yourself to ensure you have enough time to complete everything.

Throughout the test, stay mindful of the rules and guidelines, including any restrictions on personal items. Focus on answering the questions to the best of your ability, using all the preparation you’ve done. After completing the assessment, follow the steps to submit your responses, and remember that the outcome will be a reflection of the effort you’ve put into your preparation.

Time Management Strategies for Success

Effective time management is a critical factor in achieving success during any professional assessment. Properly allocating your time ensures you can address all questions, avoid unnecessary stress, and make well-informed decisions. By following a strategic approach, you can optimize your preparation and increase your chances of a successful outcome.

Planning Your Approach

Before starting, it’s essential to have a plan in place. A structured approach will help you stay organized and focused throughout the test. Here are a few key strategies:

- Prioritize Questions – Quickly scan through the questions to identify those you are most confident in. Answer these first to build momentum.

- Allocate Time Per Section – Set a time limit for each section or set of questions. This will prevent you from spending too long on one area and allow for balanced progress.

- Use the Process of Elimination – If you’re unsure about a question, eliminate obviously incorrect answers to narrow down your options and save time.

Managing Time During the Test

Once the test begins, managing your time effectively is crucial. These strategies will help you stay on track:

- Track Your Time – Keep an eye on the clock to ensure you’re on schedule. Allocate extra time for questions that require more thought, but avoid spending too long on any one question.

- Don’t Get Stuck – If a question feels too challenging, move on and return to it later. This ensures that you don’t waste precious minutes on a single issue.

- Take Advantage of Breaks – If breaks are allowed, use them to recharge. A brief pause can help you reset and approach the remaining questions with a clear mind.

By implementing these time management strategies, you can maximize your efficiency and reduce the risk of feeling rushed, ultimately setting yourself up for success.

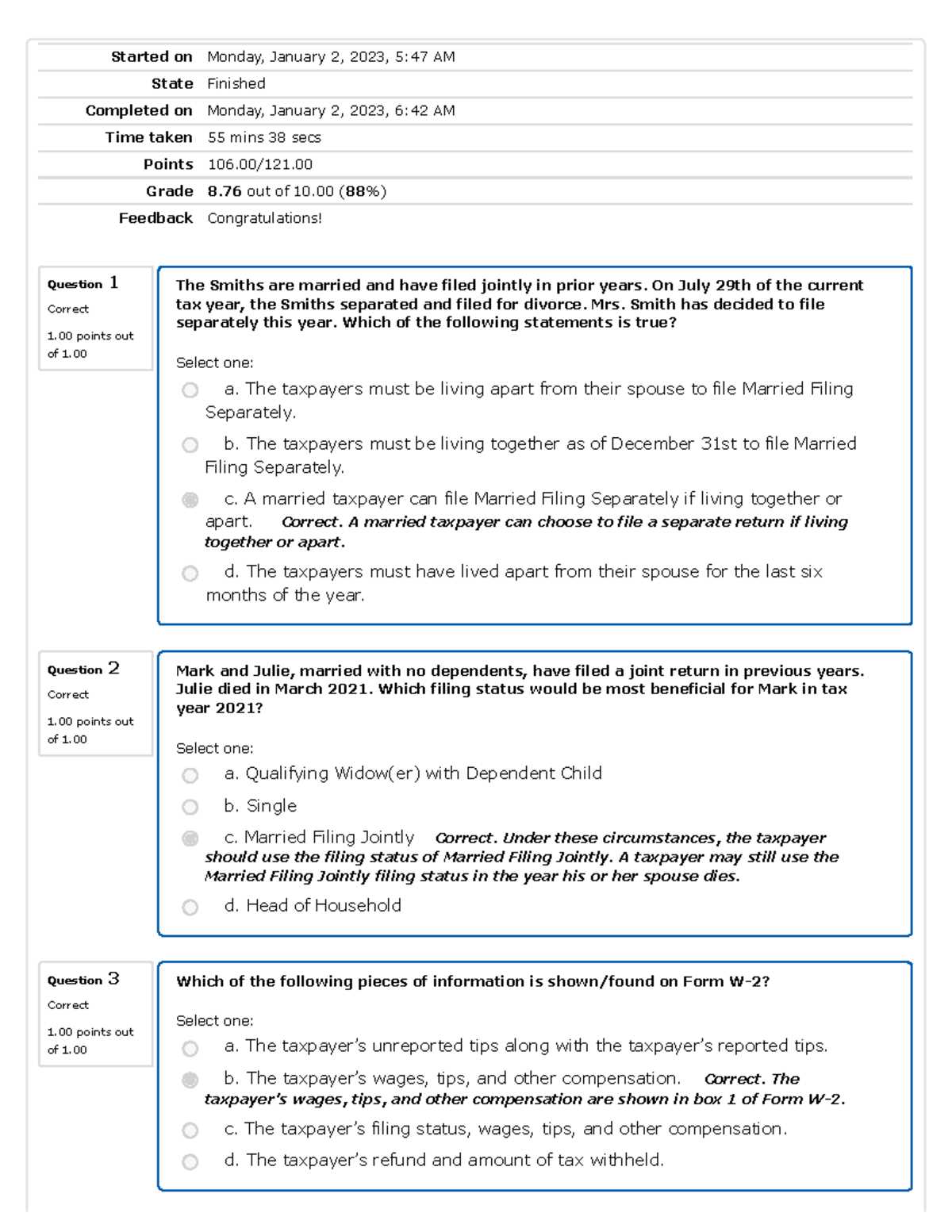

Importance of Practice Exams for Tax Preppers

Engaging with practice assessments is a key component in preparing for any certification process. These mock tests simulate real-life conditions and help individuals become familiar with the format, timing, and pressure of the actual assessment. By regularly testing your knowledge, you can pinpoint areas for improvement and build confidence in your abilities.

Benefits of Practice Tests

Participating in mock tests offers several advantages that can positively impact your preparation:

- Improved Familiarity – Practice exams give you a clear idea of what to expect on test day, helping you feel more comfortable and less anxious.

- Time Management Skills – By simulating timed conditions, you can practice managing your time effectively, ensuring you complete all sections within the allotted time.

- Better Retention – Repeated exposure to the material through practice tests reinforces key concepts and helps retain information more effectively.

- Identification of Weak Areas – These tests highlight areas where you may need further study, allowing you to focus on specific topics that require attention.

Maximizing the Effectiveness of Practice Tests

To get the most out of your practice tests, consider the following strategies:

- Simulate Real Conditions – Take the tests under actual testing conditions, including strict time limits, to build endurance and reduce anxiety.

- Review Mistakes – After completing a practice test, thoroughly review any incorrect answers to understand why they were wrong and how to improve.

- Take Multiple Practice Tests – Repetition is key to reinforcing your knowledge. The more you practice, the more confident you will become.

By integrating practice assessments into your study routine, you can significantly enhance your preparation and increase your chances of success on the actual assessment.

How to Handle Difficult Questions

When faced with challenging questions during an assessment, it’s important to stay calm and focused. Struggling with a question can lead to frustration, but having a strategy in place will help you navigate through difficult moments. The key is to approach tough questions with a clear and systematic method to maximize your chances of success.

Steps to Approach Difficult Questions

Here are a few strategies to help you handle tough questions effectively:

- Stay Calm and Confident – Take a deep breath and resist the urge to panic. Confidence plays a key role in making clear decisions under pressure.

- Read the Question Carefully – Ensure you fully understand what the question is asking. Look for keywords or phrases that may guide you toward the correct answer.

- Break It Down – Break the question into smaller parts. Analyzing each component separately can often make the overall question easier to tackle.

- Eliminate Obvious Wrong Answers – If possible, rule out the answers that you know are incorrect. This increases your chances of selecting the right one, even if you’re uncertain.

What to Do If You’re Stuck

If you find yourself stuck on a question, here are a few additional tips:

- Move On and Return Later – If a question is too challenging, skip it for the moment and return to it later. Often, you’ll gain clarity after answering easier questions first.

- Trust Your First Instinct – Often, your initial answer is the right one. If you’ve eliminated other options and feel unsure, stick with your first choice.

- Manage Your Time – Don’t spend too long on any one question. Manage your time effectively to ensure you have enough for all parts of the assessment.

By applying these strategies, you can better manage difficult questions and maintain your composure during your assessment, ultimately enhancing your performance.

Understanding the Scoring System

Knowing how your performance is evaluated is crucial for approaching any certification process effectively. The scoring system determines how your responses are assessed, which can guide you in prioritizing areas of focus during preparation. Understanding this system helps in making informed decisions during the test and knowing what to expect when receiving your results.

How Scores Are Calculated

The method used to calculate your score typically involves evaluating each response and assigning points based on accuracy. Here are some key factors that contribute to your final score:

- Correct Responses – Each correct answer adds to your score, contributing directly to the overall result.

- Incorrect Responses – Some assessments may subtract points for incorrect answers, while others may not penalize wrong responses. It’s important to understand the specific rules for the assessment you’re taking.

- Unanswered Questions – Depending on the test, unanswered questions may be left blank or result in no penalty. However, unanswered questions do not contribute to your score.

Factors Affecting Your Final Score

Beyond just right or wrong answers, several factors may influence your total score:

- Weight of Questions – Some questions may be worth more points than others based on their difficulty or complexity. High-weight questions are typically more challenging but can have a greater impact on your score.

- Time Constraints – Your ability to manage time effectively can influence how many questions you can answer, indirectly impacting your final score.

- Question Format – The type of questions–such as multiple-choice or short-answer–can affect how responses are scored, especially if partial credit is given for partially correct answers.

By understanding the scoring system, you can better navigate the test, strategically focusing on answering as many questions as possible while managing time and accuracy effectively.

Preparing for Law Changes

Staying updated with the latest legal changes is crucial for anyone involved in financial assessments or advising. Laws can shift, and understanding these updates ensures that you remain compliant and prepared to handle new situations. In this section, we’ll discuss strategies for staying informed and adapting to these changes, so you can navigate any legal shifts confidently and efficiently.

One of the most effective ways to prepare for new regulations is to regularly review official resources and legal publications. These sources provide the latest updates on the rules and regulations that may impact your work. Additionally, keeping an eye on news related to legislative changes can help you anticipate upcoming adjustments before they take effect.

Another key element is continuous education. Participating in workshops, webinars, or courses that focus on recent legal developments can enhance your understanding and ability to apply new knowledge. By keeping your skills sharp and being proactive in your learning, you can be well-prepared to adjust to any changes that arise.

Finally, connecting with industry peers and experts can be valuable. Networking allows you to exchange insights and advice, which can be crucial for staying ahead of legal updates. Whether through professional groups, online forums, or conferences, engaging with others in the field will help you share resources and stay informed about best practices for managing new laws.

Effective Note-taking During Study Sessions

Taking organized and thorough notes is a powerful tool for retention and understanding complex material. When preparing for assessments, how you document your study sessions can significantly influence your ability to recall important information. In this section, we will explore strategies that can help you make the most out of your note-taking process, ensuring it supports both active learning and efficient review.

One effective method is to use the Cornell Note-taking System. This approach divides the page into sections for key points, detailed notes, and summaries, allowing you to categorize information efficiently. The process of reviewing and summarizing after the session strengthens comprehension and aids in long-term retention.

Another important strategy is to focus on highlighting key concepts rather than writing down everything verbatim. Identify the core ideas, terms, and principles, as these are often what the material revolves around. This will not only streamline your notes but also make it easier to review essential information quickly when preparing for a test.

Additionally, incorporating visual aids like charts, diagrams, and mind maps can greatly enhance your notes. Visual representations of data and concepts often make it easier to grasp relationships and see the bigger picture. These tools can be especially helpful for complex topics that require visual understanding.

Lastly, reviewing and organizing your notes regularly is critical. Revisit them shortly after the study session to reinforce your memory, and make sure they are clearly organized so that you can easily find the information you need when it’s time for a review. The act of revisiting your notes not only solidifies your learning but also keeps you prepared for any changes or updates in the material.

How to Improve Your Knowledge in Financial Regulations

Enhancing your understanding of financial rules and laws requires consistent effort and a structured approach. Whether you’re aiming to deepen your knowledge for professional growth or preparing for an assessment, there are various strategies you can use to improve your expertise in this area. This section provides insights into effective methods for gaining a more comprehensive grasp of financial regulations and practices.

Engage in Continuous Learning

One of the most important steps to improving your knowledge is engaging in ongoing education. Take advantage of online courses, seminars, and workshops that cover the latest updates in the field. Many educational platforms offer specialized programs that focus on legal and regulatory aspects, helping you stay up-to-date with changes. Additionally, reading books, articles, and case studies can deepen your understanding of key principles and provide real-world applications.

Utilize Practical Resources and Tools

Alongside formal learning, utilizing practical resources such as guides, databases, and industry publications can further boost your knowledge. These materials often provide examples, templates, and detailed explanations of complex regulations. It’s also helpful to make use of interactive tools like financial calculators and software, which simulate real-world scenarios and provide hands-on experience with applying principles.

Regularly reviewing key materials, participating in discussions, and applying your knowledge to case studies or hypothetical situations will also enhance your comprehension. By actively engaging with both theoretical and practical aspects of financial regulations, you will continuously improve your understanding and confidence in the field.

Reviewing Your Mistakes After Practice Tests

Reviewing the errors made during practice sessions is a crucial part of the learning process. Understanding why certain answers were incorrect helps to identify knowledge gaps and improve overall performance. This section outlines effective strategies for analyzing mistakes after completing practice assessments and using that feedback to enhance your skills.

Identify Patterns in Mistakes

Start by reviewing each incorrect answer carefully. Look for patterns or recurring themes in the mistakes you’ve made. Are they related to specific topics, or are they due to misunderstanding certain concepts? Identifying these patterns can help you focus your future study efforts on areas that require more attention.

Analyze the Reasoning Behind Errors

After recognizing the pattern, delve deeper into the reasoning behind each mistake. Ask yourself the following questions:

- Was the mistake due to misreading the question or overlooking key details?

- Did I misapply a principle or law in my answer?

- Was there a lack of knowledge or understanding of certain material?

Understanding the root cause of your errors helps you avoid repeating them in the future. It also gives you a better sense of which concepts need further clarification or study.

Take Notes for Future Reference

As you review your mistakes, take detailed notes. Write down the correct reasoning or steps for each question. This will serve as a reference guide for similar questions in the future. Creating a dedicated section in your study materials for commonly made mistakes and the correct approaches can help solidify your understanding.

By consistently reviewing and learning from your mistakes, you’ll improve your accuracy and confidence over time, leading to better preparation for the actual assessment.

Benefits of Taking Professional Certification Assessments

Engaging in professional certification assessments can provide significant advantages for those seeking to advance in a specific field. These evaluations not only measure knowledge and expertise but also offer various personal and professional growth opportunities. This section highlights the key benefits of pursuing such assessments.

Career Advancement Opportunities

One of the most significant benefits of completing professional assessments is the opportunity for career advancement. Obtaining certification demonstrates expertise in the field, making you a more attractive candidate for job promotions, higher-paying positions, or new career opportunities. Employers often value certified professionals as they can contribute more effectively and efficiently to the organization.

Enhanced Knowledge and Skills

Preparing for and taking these assessments allows individuals to deepen their knowledge of the field. The process requires thorough study, which helps reinforce core principles and updates understanding of current trends or regulations. This enhances overall competence and can improve your ability to solve complex problems or handle challenging situations in your professional role.

Furthermore, certification assessments provide a structured way to learn, helping professionals to stay current and relevant in their industry. This lifelong learning approach not only boosts confidence but also establishes credibility with clients, employers, and colleagues alike.

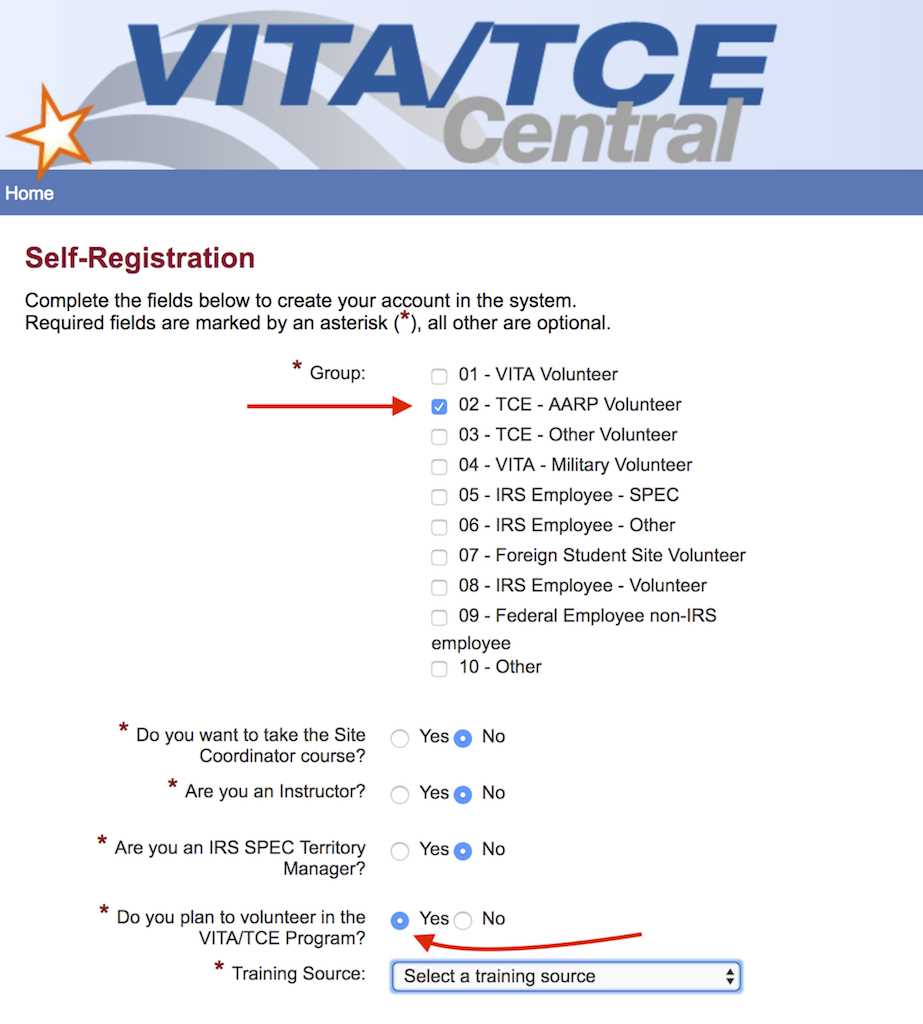

Post-Assessment Steps and Certification Process

After completing the professional assessment, the next steps are crucial for validating your knowledge and gaining official recognition. This section covers what to do following the assessment and the process of obtaining certification. Completing these steps ensures you meet all the requirements for professional acknowledgment and advancement in your field.

Receiving Your Results

Once the assessment is complete, you will typically receive your results within a specified timeframe. These results provide a detailed analysis of your performance, showing areas of strength and where improvement may be needed. If successful, you will be notified that you have met the necessary standards for certification. However, in some cases, additional documentation or clarification may be requested to confirm your eligibility.

Applying for Certification

After receiving a passing score, the next step is to apply for official certification. This involves submitting an application to the relevant certifying body, often accompanied by proof of your qualifications, results, and any additional required documents. The application process may also include verifying your professional experience or completing continuing education requirements to demonstrate ongoing commitment to the field.

Once approved, you will receive a certification that serves as a recognized symbol of your expertise, enhancing your credibility and career prospects. Regular renewals or continuing education may be required to maintain your certification and stay current with industry standards.