Success in financial assessments requires a clear understanding of the key principles and the ability to apply them under pressure. Whether you’re preparing for a comprehensive certification or enhancing your knowledge for professional development, mastering the material is essential. Structured preparation and strategic studying are crucial components for achieving a top score and advancing in your career.

Effective study habits and a well-rounded approach to revising core concepts can make all the difference. With the right resources, techniques, and mindset, you can navigate through complex questions with confidence and accuracy. Practice plays a significant role in reinforcing your understanding and improving problem-solving skills.

By familiarizing yourself with the typical question formats and mastering the necessary formulas, you can improve your ability to handle even the most challenging problems. This guide provides the tools and insights you need to approach your assessment with clarity and determination, setting you up for success in the financial field.

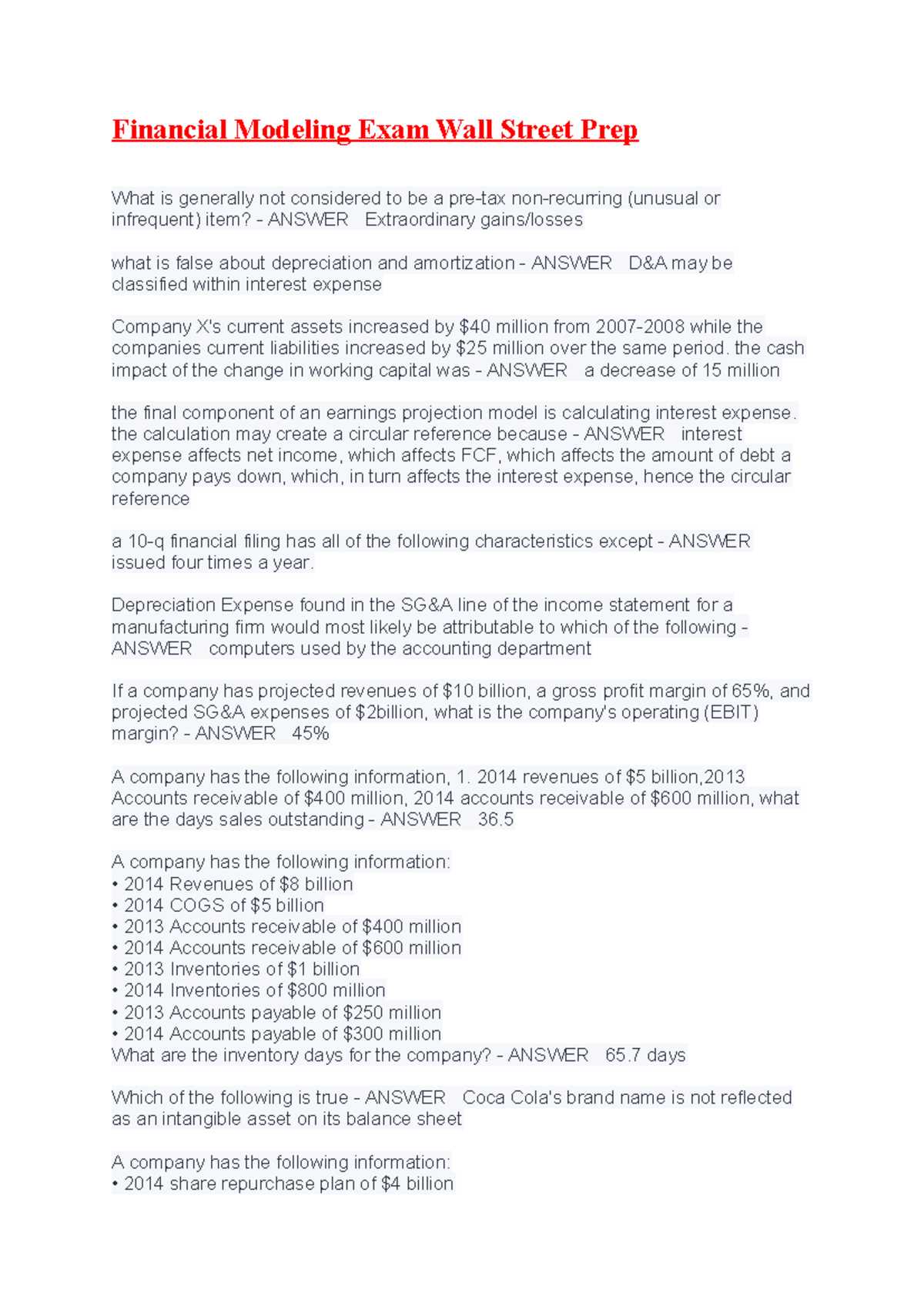

Wall Street Prep Accounting Exam Overview

The assessment process for financial certifications typically involves a combination of theory and practical application, designed to test your understanding of fundamental concepts and your ability to implement them effectively. The content of the evaluation is structured to reflect real-world scenarios, focusing on the key principles that govern financial analysis and decision-making. To succeed, you must not only grasp the theoretical aspects but also be able to solve complex problems accurately under timed conditions.

Structure and Format

The test is organized into different sections, each covering specific areas of financial knowledge. The questions are designed to assess your analytical thinking, comprehension, and proficiency in applying financial formulas and methods. Below is an overview of the structure:

| Section | Description | Weight |

|---|---|---|

| Financial Reporting | Understanding of balance sheets, income statements, and cash flow statements. | 30% |

| Financial Analysis | Skills in ratio analysis, forecasting, and evaluating financial performance. | 25% |

| Corporate Finance | Knowledge of capital structure, investments, and corporate budgeting. | 20% |

| Market & Economic Principles | Understanding of market trends, economic factors, and their influence on financial decisions. | 15% |

| Ethics and Professional Standards | Awareness of ethical principles and regulations within the financial industry. | 10% |

Preparation Tips

Successful completion of the evaluation requires not just a theoretical understanding, but also the ability to solve problems efficiently. It is crucial to familiarize yourself with typical question types, practice under timed conditions, and review key formulas regularly. Focus on areas where you feel less confident, and make use of available resources like study guides, practice tests, and expert advice to ensure that you are fully prepared when the time comes to sit for the assessment.

Understanding the Exam Structure

The assessment process is carefully designed to evaluate your proficiency across various aspects of financial analysis. The structure is organized in a way that tests both your theoretical knowledge and practical application, ensuring that you are well-rounded in all key areas. Familiarizing yourself with the layout and format of the test will help you prepare more effectively and approach each section with confidence.

Generally, the test is divided into several distinct sections, each with a specific focus. These sections are arranged to gradually increase in complexity, assessing your ability to handle more advanced concepts as the test progresses. Below is a breakdown of the main components of the assessment:

- Multiple Choice Questions (MCQs): These are designed to test your basic knowledge and ability to recall financial concepts quickly.

- Problem-Solving Scenarios: In these questions, you’ll be required to apply your understanding to real-world situations, using formulas and analysis to arrive at solutions.

- Case Studies: These sections simulate actual business scenarios where you need to demonstrate a thorough understanding of financial decision-making processes.

- Short-Answer Questions: These questions assess your ability to explain financial concepts concisely and clearly.

- Essay Questions: Less common but included to evaluate your ability to write and justify your financial reasoning in detail.

To succeed, it is crucial to understand the weight of each section and how much time should be allocated accordingly. Here is a general overview of the time allocation:

- Multiple Choice Questions: 40% of total time

- Problem-Solving Scenarios: 30% of total time

- Case Studies: 15% of total time

- Short-Answer Questions: 10% of total time

- Essay Questions: 5% of total time

Each part of the test serves a specific purpose in evaluating different skills, so it’s important to practice each type of question in advance. Developing strategies for each format will increase your chances of success and help you navigate the assessment with greater ease.

Key Topics Covered in the Exam

In order to perform well on a financial assessment, it’s important to be familiar with the key areas of knowledge that will be tested. The content typically spans a range of fundamental concepts and technical skills, designed to evaluate both your theoretical understanding and your ability to apply that knowledge to real-world financial situations. Understanding these core topics will give you a clear focus for your preparation efforts.

Financial Statements and Reporting

This section covers the creation and analysis of essential financial documents, such as balance sheets, income statements, and cash flow statements. It tests your ability to interpret and explain the figures presented, as well as how they reflect a company’s financial health. Mastery of these documents is crucial for evaluating financial performance and making informed decisions.

Financial Analysis and Ratios

Understanding financial ratios and analysis is vital for comparing performance metrics and identifying trends over time. Topics in this area include liquidity ratios, profitability ratios, and leverage ratios. Proficiency in interpreting these ratios allows for more effective evaluation of company performance and financial stability. This area also tests your ability to use various tools and techniques to analyze financial data.

Other critical areas include:

- Corporate Finance: Understanding capital budgeting, financing decisions, and valuation techniques.

- Investment Principles: Knowledge of portfolio theory, asset pricing, and risk management strategies.

- Market Economics: How economic factors like inflation, interest rates, and GDP affect financial markets and business strategies.

- Ethics and Standards: Awareness of professional conduct, regulations, and industry best practices.

Being familiar with these core topics will help you build a strong foundation for the assessment and improve your overall performance. Tailoring your study approach to address each of these key areas will ensure a more comprehensive preparation and increase your confidence on test day.

Essential Study Materials for Success

Preparing for a financial assessment requires more than just a general understanding of concepts; it involves using targeted study materials that cover key topics and help reinforce your knowledge. The right resources will guide you through complex ideas and provide practice to ensure you’re ready for any challenge. A combination of textbooks, practice tests, and online resources can provide the well-rounded preparation needed for success.

Recommended Resources

When preparing for a professional financial test, the following materials are essential:

| Resource Type | Purpose | Recommended Materials |

|---|---|---|

| Textbooks | In-depth coverage of theoretical concepts and financial models. | “Financial Statement Analysis,” “Corporate Finance Theory and Practice” |

| Practice Tests | Simulates the testing environment and helps identify weak areas. | Online mock tests, sample problem sets from study guides |

| Study Guides | Summarizes key points and offers concise explanations. | “Financial Analyst Study Guide,” “CPA Review Materials” |

| Online Resources | Interactive tools for learning and revising financial concepts. | Websites like Investopedia, Khan Academy, Coursera |

Additional Tips for Success

Along with these materials, consistent practice and a well-structured study plan are vital. Using a variety of resources ensures a deeper understanding of topics and offers multiple approaches to difficult concepts. Supplement your materials with notes, flashcards, and group discussions to reinforce your learning.

How to Approach Financial Accounting Questions

When tackling questions related to financial principles and reporting, it is crucial to have a structured approach. Understanding the key concepts is only part of the process; applying that knowledge efficiently and accurately under time pressure is equally important. Developing a strategy for approaching each question will help streamline your thought process and ensure you don’t miss critical details.

Step-by-Step Approach

Here are some steps to follow when working through problems related to financial analysis and reporting:

- Read the Question Carefully: Pay attention to every detail. Often, the wording of a question can provide subtle clues to the correct method or solution.

- Identify Key Information: Highlight or note the critical data that will be needed to solve the problem, such as figures, formulas, or financial terms.

- Choose the Right Method: Based on the type of question, determine whether you need to use ratio analysis, balance sheet reconciliation, or another technique.

- Perform Calculations: Carefully work through the problem, ensuring all steps are logical and you’re using the correct figures. Double-check your math as you go.

- Review Your Answer: Once you’ve arrived at a solution, take a moment to review your work. Ensure the answer makes sense within the context of the question.

Common Mistakes to Avoid

There are several pitfalls that can cause errors when answering financial questions. Being aware of these can help you avoid common mistakes:

- Overlooking Units: Always double-check the units of measurement (e.g., thousands, millions) to avoid calculation errors.

- Skipping Steps: It may be tempting to rush, but skipping intermediary steps can lead to incorrect answers. Always follow through each calculation fully.

- Misinterpreting Data: Ensure that you understand the information provided in the question–misunderstanding key details can result in incorrect conclusions.

By developing a systematic approach and being mindful of common mistakes, you will be able to approach financial problems with more confidence and precision.

Time Management Tips for Exam Day

Effective time management during an assessment is crucial for success. Properly allocating time for each section allows you to answer all questions with the attention they require, without feeling rushed. Preparing a strategy ahead of time can help you stay focused and ensure that you don’t spend too much time on any one problem, leaving enough time for the more complex questions.

Before the Test

Preparation starts well before the day of the assessment. Taking the right steps before the test can set you up for success:

- Know the Format: Familiarize yourself with the structure of the test. Understand how much time is allocated for each section and how many questions you will need to answer.

- Practice Time Management: During practice sessions, simulate real test conditions. Time yourself while completing mock questions to build your pacing skills.

- Prepare Your Materials: Ensure that all necessary tools (calculators, pens, IDs) are ready and easily accessible before the test starts.

During the Test

Once you are in the testing environment, it’s important to stick to your time management plan to ensure you complete everything effectively:

- Read the Questions Thoroughly: Quickly skim through all the questions to understand what is being asked. This will help you allocate time appropriately for each part.

- Set Time Limits: Allocate a specific amount of time for each question or section. If you get stuck, move on to the next one and come back later if time permits.

- Prioritize Easy Questions: Start with the questions you find easiest. This will help you build momentum and secure early points before tackling more complex problems.

- Monitor Your Progress: Regularly check the clock to ensure you’re on track. Aim to have a rough idea of how much time you should spend on each section.

- Leave Time for Review: Always allocate a few minutes at the end to review your answers, especially for the more challenging questions you may have rushed through.

By applying these time management strategies, you’ll be better equipped to handle the pace of the test, answer each question with focus, and avoid the stress of running out of time.

Common Mistakes to Avoid During the Test

During a financial assessment, even small errors can have a significant impact on your overall performance. Being aware of common pitfalls and avoiding them can help you manage your time and accuracy more effectively. By staying vigilant and following a well-thought-out approach, you can reduce the chances of making mistakes that might otherwise hinder your progress.

Frequently Overlooked Errors

Some mistakes are easily avoidable with a bit of attention and preparation. Here are some common errors to be mindful of:

- Misunderstanding the Question: Always take the time to read each question carefully before starting your calculations. Sometimes key details are hidden in the wording, and rushing through them can lead to incorrect answers.

- Skipping Steps: Avoid skipping intermediate steps, even if the solution seems obvious. Missing small steps in the process can lead to major errors in your final answer.

- Incorrect Use of Formulas: Ensure that you are using the correct formulas for the given problem. Misapplying a formula is a common mistake that can lead to a wrong outcome.

- Not Reviewing Answers: Always leave a few minutes at the end to review your answers. A fresh look at your responses can help catch overlooked errors.

Handling Time Pressure

Time constraints can lead to hurried decisions and careless mistakes. To prevent this, consider the following:

- Rushing Through Problems: Avoid rushing through questions just to finish quickly. It’s better to pace yourself and address each question thoughtfully.

- Overthinking Complex Questions: If a question is particularly challenging, don’t dwell on it for too long. Move on and return to it later if time permits.

- Ignoring Instructions: Pay close attention to any instructions regarding format or approach. Failing to follow directions can result in deductions, even if your answer is technically correct.

By being mindful of these common mistakes, you can ensure a smoother and more efficient test-taking experience, ultimately improving your performance.

How to Handle Complex Accounting Problems

Tackling complex financial scenarios requires a combination of clear thinking, structured problem-solving, and effective time management. These problems often involve multiple concepts, requiring you to navigate through calculations, formulas, and financial statements. The key to handling these challenges lies in breaking down the problem into manageable steps and staying organized throughout the process.

Step-by-Step Approach to Problem Solving

When faced with intricate financial issues, following a systematic approach can make the task much easier. Consider the following steps:

- Understand the Problem: Before diving into calculations, take a moment to thoroughly read and understand the question. Identify the key information and what is being asked.

- Break It Down: Divide the problem into smaller, more manageable parts. Focus on solving each part individually before combining the results.

- Apply the Correct Techniques: Ensure you’re using the right financial principles, formulas, or methods for the problem. This could include working with ratios, balance sheets, or cash flow statements.

- Perform Calculations Methodically: Double-check your math as you go. Perform calculations step by step to avoid errors in your final solution.

- Verify the Results: After solving the problem, review your solution to ensure that it aligns with the question. Make sure your final answer makes logical sense given the context.

Common Challenges and How to Overcome Them

While solving complex financial problems, certain obstacles may arise. Here are some common challenges and tips for overcoming them:

- Multiple Variables: Problems with multiple variables can seem overwhelming. Focus on isolating each variable and solving for one at a time to avoid confusion.

- Interpreting Financial Statements: If the problem involves interpreting financial statements, make sure you understand how to read the figures and how they relate to each other. Look for trends and relationships between different items.

- Time Constraints: If you’re under time pressure, don’t panic. Prioritize questions based on difficulty. Start with simpler ones to secure early points and return to more complex ones if time permits.

By staying organized, breaking down complex problems into smaller steps, and maintaining a calm approach, you can effectively manage and solve even the most challenging financial scenarios.

Effective Review Strategies for the Exam

Reviewing material effectively before a challenging assessment is essential for reinforcing your understanding and identifying areas that need further focus. A well-structured review plan can help you retain key concepts and feel confident when you face the test. By using strategic techniques, you can maximize your study sessions and ensure that you are fully prepared for any questions that may arise.

Key Techniques for Efficient Review

To optimize your revision efforts, incorporate the following methods into your study routine:

- Active Recall: Test yourself regularly on the material you’ve studied. Instead of simply rereading notes, try to recall the information without looking at your resources. This reinforces your memory and highlights areas that need further attention.

- Spaced Repetition: Review the content at spaced intervals. This technique improves long-term retention by revisiting material multiple times over a period of days or weeks.

- Practice with Mock Questions: Complete practice questions or past assessments to simulate real test conditions. This will help you become familiar with the types of questions you might encounter and identify any weak points in your knowledge.

- Teach the Material: Explain key concepts to a peer or even to yourself. Teaching is one of the most effective ways to reinforce your understanding, as it forces you to clarify your thoughts and approach the material from a different perspective.

Final Review Tips

In the final stages of your preparation, consider these tips to ensure that you are as prepared as possible:

- Focus on Weak Areas: Spend extra time on topics where you feel less confident. Prioritize your weaker areas to ensure they are well understood before the test.

- Review Key Formulas and Concepts: Make sure that important formulas, definitions, and concepts are fresh in your mind. Create quick reference sheets or flashcards to help you review these elements.

- Take Breaks: Avoid cramming nonstop. Regular breaks will help prevent burnout and allow your brain to process the material more effectively.

By incorporating these strategies into your review process, you will be able to study efficiently, retain information better, and tackle the assessment with confidence.

Utilizing Practice Tests for Preparation

Practice tests are one of the most effective tools for reinforcing knowledge and assessing readiness before a major assessment. They provide a real-time opportunity to familiarize yourself with the structure of questions, enhance problem-solving skills, and identify areas that require further review. Incorporating practice tests into your preparation routine allows you to simulate actual test conditions, which can help reduce anxiety and improve performance on the day of the assessment.

Benefits of Using Practice Tests

Engaging with mock tests offers several advantages in your study strategy:

- Familiarity with Question Types: Regular practice helps you understand the format and style of questions you may face. This prepares you to approach each question with the correct mindset and approach.

- Time Management: By working within a time limit, you develop the ability to manage time effectively during the real assessment, ensuring you can allocate enough time to each section.

- Self-Assessment: Practice tests offer a clear picture of your strengths and weaknesses, allowing you to focus your study efforts on areas that need the most attention.

- Confidence Boost: Completing multiple practice tests can reduce test anxiety by helping you become accustomed to the pressure of performing under time constraints.

How to Maximize the Effectiveness of Practice Tests

Simply taking practice tests is not enough. To get the most out of them, consider these strategies:

- Simulate Real Conditions: Take the practice tests in an environment similar to the actual test conditions. Avoid distractions, set a timer, and follow the instructions as if it were the real test.

- Review Incorrect Answers: After completing a practice test, carefully review all the incorrect answers. Understanding why a mistake was made helps prevent similar errors in the future.

- Take Multiple Tests: Repetition is key. The more practice tests you take, the better you will become at recognizing patterns and improving your accuracy and speed.

- Track Progress: Keep track of your results to see how you improve over time. Monitoring progress will show you which areas need more focus and highlight your overall improvement.

By integrating practice tests into your study plan, you can enhance your readiness, increase your confidence, and ensure that you are fully prepared for the actual assessment.

Maximizing Your Score with Smart Techniques

Achieving a high score on a challenging assessment requires more than just memorizing facts–it involves strategic preparation, efficient time management, and effective problem-solving techniques. By applying smart strategies, you can optimize your performance and ensure that you are making the best use of your knowledge. This section explores several techniques that can help boost your score on test day.

Effective Techniques for Scoring High

To maximize your performance, consider using the following methods:

- Prioritize High-Value Topics: Focus your study efforts on the most heavily weighted sections. Review the material that is most likely to appear on the test, ensuring that you are prepared for the majority of the questions.

- Stay Calm Under Pressure: Maintaining composure during the test allows you to think clearly and answer questions more effectively. Practice relaxation techniques, such as deep breathing, to manage stress and keep your mind sharp.

- Answer Easy Questions First: Begin by tackling the questions you find easiest. This approach boosts your confidence and ensures that you are securing points early on, which leaves more time for challenging questions.

- Use the Process of Elimination: If you’re unsure of an answer, eliminate the obviously incorrect choices first. This increases the likelihood of selecting the correct answer even when you’re uncertain.

Advanced Strategies to Improve Accuracy

In addition to basic techniques, the following advanced strategies can help refine your approach and improve your score:

- Double-Check Your Work: If time allows, go back and review your answers. A second look can often reveal mistakes that were overlooked the first time.

- Break Down Complex Problems: When faced with a difficult question, break it into smaller parts. Solve each part step-by-step, and then combine the results to arrive at the final solution.

- Make Educated Guesses: If you encounter a question where you are completely unsure, make an educated guess by narrowing down your options. Use logical reasoning to increase the likelihood of a correct answer.

- Manage Your Time Effectively: Keep track of time and pace yourself. Allocate enough time for each section, but don’t spend too long on any single question. If you’re stuck, move on and return to it later if possible.

By combining these strategies with consistent preparation, you can improve your chances of achieving the best possible score and approaching your assessment with confidence.

Tips for Mastering Financial Ratios

Understanding and interpreting financial ratios is a crucial skill for evaluating the health and performance of businesses. These ratios provide insights into profitability, liquidity, efficiency, and solvency, which are essential for making informed decisions. Mastering these calculations and knowing when and how to use them can significantly improve your ability to analyze financial statements effectively.

Key Steps for Mastering Financial Ratios

To become proficient in calculating and interpreting financial ratios, follow these practical tips:

- Understand the Fundamentals: Before diving into complex formulas, ensure you have a solid understanding of basic financial statements like the balance sheet, income statement, and cash flow statement. This will provide the context for the ratios you calculate.

- Learn the Key Ratios: Focus on mastering the most important financial ratios, such as profitability ratios (e.g., net profit margin), liquidity ratios (e.g., current ratio), and solvency ratios (e.g., debt-to-equity ratio). Understanding these core ratios is essential for any financial analysis.

- Practice Calculating Ratios: Regular practice is crucial for gaining confidence and accuracy in ratio calculations. Work through a variety of problems to become comfortable with the formulas and improve your speed.

- Know the Industry Benchmarks: Ratios can vary significantly across industries, so it’s important to understand the average or benchmark ratios for the specific sector you’re analyzing. This allows you to make meaningful comparisons and assessments.

Advanced Tips for Applying Financial Ratios

Once you’re comfortable with basic calculations, consider these advanced strategies to enhance your ratio analysis:

- Look for Trends: Instead of focusing solely on individual ratios, analyze trends over time. Examining how ratios change year over year or quarter over quarter can provide deeper insights into a company’s financial trajectory.

- Use Ratios in Combination: Financial ratios are most powerful when used together. For example, a high return on equity (ROE) combined with a low debt-to-equity ratio can indicate a well-managed company with strong profitability and low risk.

- Understand Limitations: Ratios are not foolproof; they have limitations, especially when used in isolation. Always consider the broader financial context, including market conditions, company strategies, and qualitative factors.

By mastering financial ratios and applying them strategically, you can enhance your financial analysis skills and gain a more comprehensive understanding of a company’s performance. Consistent practice and a strong grasp of the underlying concepts are key to success in this area.

Understanding Accounting Principles for the Exam

Grasping the fundamental concepts that govern financial reporting is essential for success. These principles form the backbone of how financial data is recorded, reported, and analyzed, and they are critical for making informed decisions in a business context. Whether you’re dealing with asset valuation, revenue recognition, or the treatment of liabilities, understanding these core principles is key to tackling complex questions effectively.

Key Principles to Focus On: Several core principles serve as the foundation for all financial reporting. Familiarizing yourself with these rules will ensure that you’re prepared to address various problems and scenarios that may arise during testing. The following principles are the most commonly tested:

- Consistency Principle: Financial reports should be consistent over time, ensuring comparability across periods. This principle helps prevent discrepancies in financial information and makes it easier to analyze trends.

- Revenue Recognition Principle: Revenue should be recognized when it is earned, not necessarily when payment is received. Understanding how and when to recognize income is vital for accurate financial reporting.

- Matching Principle: Expenses should be recorded in the same period as the revenues they help generate. This principle ensures that profit is accurately measured during a given time frame.

- Cost Principle: Assets should be recorded at their original cost, not their current market value. This principle provides stability and reliability in financial reporting.

- Conservatism Principle: When faced with uncertainty, it’s prudent to choose the option that results in the lower asset value or higher liability. This cautious approach ensures that financial reports are not overly optimistic.

How to Apply These Principles Effectively: In preparation for the test, focus on understanding how each principle applies to real-world scenarios. This will help you recognize how to handle various situations, such as adjustments for prepaid expenses or depreciation. It’s not just about memorizing definitions; it’s about understanding how these principles guide financial decision-making and reporting.

By mastering these principles, you’ll be better equipped to approach any problem that comes your way. A strong understanding of these foundational concepts will help you answer questions with confidence and accuracy, ensuring a higher level of success in your studies and assessments.

How to Stay Calm Under Exam Pressure

Staying composed under pressure is crucial for performing well in any test. The stress and anxiety that often accompany assessments can cloud your judgment, making it difficult to focus and recall important information. However, with the right techniques, it’s possible to maintain a calm and focused mindset, enabling you to tackle challenges with confidence.

Effective Techniques to Manage Stress

Adopting strategies to manage stress can significantly improve your ability to remain calm and focused during high-pressure situations. Here are some practical tips to help you stay centered:

- Breathing Exercises: Deep breathing can instantly calm the mind and body. By focusing on slow, deep breaths, you can reduce feelings of anxiety and regain control of your emotions.

- Positive Visualization: Picture yourself succeeding. Visualizing a positive outcome can help reduce fear and boost your self-assurance before tackling difficult questions.

- Time Management: Planning your time wisely during the test can prevent you from feeling overwhelmed. Allocate specific time blocks for each section, and stick to your schedule to avoid rushing at the last minute.

- Take Breaks: If you feel overwhelmed during the test, it’s important to take short mental breaks. A few seconds of relaxation can help clear your mind and reset your focus.

Maintaining Focus When Stress Levels Rise

When anxiety begins to rise, the key is to regain your focus quickly. It’s easy to become distracted or frustrated, but staying present is essential for accurate decision-making. Here are a few additional strategies to help maintain focus:

- Stay Present: Focus on the question at hand, and avoid thinking about the overall difficulty of the test. Breaking down each question into manageable parts can make the task feel less daunting.

- Don’t Dwell on Mistakes: If you encounter a challenging question or make an error, don’t linger on it. Move forward, and tackle the next question with a fresh perspective.

- Stay Hydrated and Energized: Physical well-being plays a major role in mental clarity. Drinking water and having a light snack before or during the test can help you stay alert.

By integrating these strategies into your routine, you can minimize stress and improve your ability to think clearly under pressure. Remember, staying calm is not about eliminating stress completely–it’s about managing it effectively so that it doesn’t hinder your performance.

Resources to Enhance Your Learning

Utilizing a variety of learning tools can significantly improve your preparation and understanding of complex topics. There are numerous resources available that cater to different learning styles, whether you prefer interactive tutorials, video lessons, or traditional reading materials. By taking advantage of these resources, you can deepen your knowledge, strengthen your skills, and increase your confidence going into any assessment.

Here are some valuable resources that can aid in mastering the necessary content:

- Online Courses: Many platforms offer comprehensive courses with structured lessons, quizzes, and practice tests that can guide you through each topic step by step.

- Textbooks and Study Guides: Well-established textbooks provide detailed explanations, examples, and practice problems that can clarify challenging concepts.

- Practice Questions and Mock Tests: Practicing with real-world questions helps reinforce your understanding and exposes you to the types of challenges you might encounter in an actual assessment.

- Flashcards: Digital or physical flashcards can be a great way to test your knowledge of key concepts, terminology, and formulas quickly and effectively.

- Study Groups: Collaborative learning with peers allows for discussion and problem-solving, which can provide valuable insights and enhance understanding.

By combining multiple resources and consistently reviewing the material, you can ensure a thorough and well-rounded preparation process. Select the tools that best match your learning style and commit to using them regularly to maximize your results.

What to Do After the Exam

Once you have completed your assessment, it’s essential to take the right steps to ensure a smooth transition from testing to post-exam reflection. The period after an assessment can significantly influence your overall performance, so it’s important to manage your time and emotions effectively. Whether you’re waiting for results or preparing for future challenges, the actions you take in this period can help maintain focus and readiness for the next step in your journey.

Here are some key things you should do after completing your assessment:

- Relax and Decompress: Take time to unwind and avoid overanalyzing the test. Give yourself space to recharge mentally and emotionally before diving into future tasks.

- Reflect on the Experience: After some time off, review the areas where you excelled and those that could use improvement. This will help you grow and prepare better for next time.

- Learn from Mistakes: If there were sections that caused difficulty, make a note of them. Understanding your weaknesses will allow you to focus on those areas for future improvement.

- Celebrate Your Effort: Regardless of the outcome, celebrate the effort you put in and the progress you’ve made. Acknowledge your hard work and perseverance.

- Prepare for the Future: If you’re planning to take another test or move on to a new stage, begin your preparation early. Review your results when they arrive, and set new goals based on the feedback received.

Taking proactive steps after an assessment is crucial for personal growth and continued success. Use this time to reflect, recharge, and plan ahead.