Preparing for a professional assessment in the field of accounting can be a challenging task. Understanding key concepts, procedures, and standards is essential for achieving success. This guide aims to provide useful insights into how to tackle the various components of the test, enabling candidates to feel confident and well-prepared.

In order to excel, it’s crucial to focus on the core topics that are frequently covered in the test. By identifying common patterns and types of content, candidates can develop strategies for tackling each section efficiently. The path to success lies in a well-rounded approach, combining theoretical knowledge with practical problem-solving skills.

Effective preparation involves understanding the structure of the material and practicing with realistic examples. This approach not only strengthens your grasp of essential concepts but also helps in reducing anxiety during the assessment. The goal is to not just pass, but to master the content and approach the test with confidence.

Understanding the Auditing CPA Exam

Successfully navigating a professional accounting assessment requires a deep understanding of the principles, processes, and standards in the field. This portion of the certification evaluates how well candidates can apply theoretical knowledge to practical scenarios, focusing on various aspects of financial oversight and compliance. The content is designed to assess both technical proficiency and analytical skills.

Each segment of the test is structured to challenge candidates’ ability to think critically and make informed decisions based on complex financial data. To perform well, it is essential to be familiar with the guidelines, regulations, and internal control systems commonly encountered in the industry. A solid grasp of these areas helps in answering tasks accurately and efficiently under time constraints.

Preparation for this part of the certification process should emphasize both learning the material thoroughly and practicing under simulated conditions. By doing so, candidates can build confidence and improve their ability to manage the complexities they will face during the actual assessment.

Key Areas Tested in Auditing

The professional certification assessment in accounting covers a range of essential topics designed to evaluate a candidate’s understanding of various financial procedures and standards. These topics assess both theoretical knowledge and practical application, with an emphasis on accuracy, ethical judgment, and analytical thinking. Below are the primary areas that are typically covered in this section of the certification.

Understanding Financial Reporting

A significant portion of the assessment focuses on the principles and standards governing financial statements. This includes knowledge of the following key areas:

- Proper preparation of balance sheets, income statements, and cash flow statements

- Accounting regulations such as GAAP or IFRS

- Application of financial reporting standards to real-world scenarios

Internal Controls and Risk Management

Another crucial area tested is the candidate’s ability to assess internal control systems and manage potential risks. Key topics include:

- Evaluating risk factors in business operations

- Designing effective internal control mechanisms

- Identifying fraud risks and implementing fraud prevention strategies

Thorough understanding of these topics is essential for success, as they form the foundation of effective financial oversight and help ensure the accuracy and integrity of an organization’s financial reporting.

How to Approach Auditing Questions

When faced with challenging scenarios in the professional certification process, it’s important to approach each problem systematically. Rather than rushing to answer, candidates should take the time to carefully read each task, identify key components, and apply their knowledge strategically. By following a structured approach, it’s easier to determine the correct response and avoid common pitfalls.

A strong strategy involves breaking down the scenario into manageable parts. Focus on the most critical aspects of the situation, such as the procedures involved, regulatory standards, or any potential risks. Prioritize your responses based on the importance of each factor to the overall problem.

| Step | Action | Purpose |

|---|---|---|

| 1 | Read the scenario thoroughly | Ensure full understanding of the context |

| 2 | Identify key elements and concepts | Highlight relevant details for analysis |

| 3 | Apply your knowledge to the situation | Link theory to practical applications |

| 4 | Eliminate incorrect options | Focus on the most likely correct response |

By following this method, candidates can effectively manage their time and increase their chances of providing the most accurate responses. Keep in mind that consistency and careful analysis are key to performing well in this section.

Common Challenges in CPA Auditing Exam

During the certification process, candidates often face a range of obstacles that can make it difficult to perform well. These challenges can arise from the complexity of the material, the time constraints, and the need to balance theoretical knowledge with practical application. Identifying these difficulties early on can help candidates develop strategies to overcome them and improve their performance.

Complexity of Concepts

One of the main hurdles candidates face is the depth and complexity of the topics being tested. The material often requires a strong understanding of regulations, procedures, and guidelines. Some key areas, such as financial reporting standards and internal controls, can be especially challenging due to their technical nature. Effective preparation involves not only learning the concepts but also practicing their application in various scenarios.

Time Management Issues

Another common difficulty is managing time effectively during the test. With multiple sections to complete under strict time limits, it’s easy to get stuck on challenging tasks. The ability to quickly assess each scenario and determine the most efficient approach is essential. Prioritizing tasks based on their complexity and point value can help candidates navigate through the assessment without feeling rushed.

By recognizing these challenges early, candidates can develop a more focused study plan and approach the test with greater confidence.

Effective Study Strategies for Auditing

To succeed in the accounting certification process, a well-structured study plan is essential. It’s not enough to simply memorize material; candidates must actively engage with the content, applying it to practical situations. A strategic approach that combines targeted practice with time management can make all the difference when preparing for the assessment.

Focused Topic Mastery

One of the most effective study strategies is focusing on mastering each major topic individually. Break down the material into smaller, manageable sections and prioritize areas where you may have less experience. Spend more time on complex subjects, such as internal control systems or risk management, while also reviewing foundational principles regularly to keep your knowledge fresh.

Practice with Simulated Scenarios

Practice is key to reinforcing theoretical knowledge and building confidence. Working through practice scenarios that mimic real test conditions helps improve speed and accuracy. This strategy enables candidates to identify their strengths and weaknesses, allowing them to focus on areas that need more attention. Incorporating timed drills and mock sessions can significantly improve test readiness.

By following these strategies, candidates can approach their studies with greater efficiency and ensure that they are fully prepared to tackle the challenges they will face in the certification process.

Effective Study Strategies for Auditing

To succeed in the accounting certification process, a well-structured study plan is essential. It’s not enough to simply memorize material; candidates must actively engage with the content, applying it to practical situations. A strategic approach that combines targeted practice with time management can make all the difference when preparing for the assessment.

Focused Topic Mastery

One of the most effective study strategies is focusing on mastering each major topic individually. Break down the material into smaller, manageable sections and prioritize areas where you may have less experience. Spend more time on complex subjects, such as internal control systems or risk management, while also reviewing foundational principles regularly to keep your knowledge fresh.

Practice with Simulated Scenarios

Practice is key to reinforcing theoretical knowledge and building confidence. Working through practice scenarios that mimic real test conditions helps improve speed and accuracy. This strategy enables candidates to identify their strengths and weaknesses, allowing them to focus on areas that need more attention. Incorporating timed drills and mock sessions can significantly improve test readiness.

By following these strategies, candidates can approach their studies with greater efficiency and ensure that they are fully prepared to tackle the challenges they will face in the certification process.

Time Management Tips for Auditing Section

Effective time management is critical when tackling any professional certification challenge. With strict time limits and multiple sections to complete, it’s essential to stay organized and allocate time wisely to ensure every part of the test is addressed thoroughly. Mastering time management allows candidates to approach the test with confidence and avoid feeling rushed.

Prioritize Based on Complexity

One of the best approaches is to prioritize questions based on their complexity and point value. Start with the questions that seem straightforward and less time-consuming, as this will allow you to gain momentum. Leave the more challenging questions for later, once you’ve built up confidence and saved enough time to focus on them carefully.

Practice Time-Limited Drills

Simulating the test environment with timed practice sessions can greatly improve time management skills. By practicing under time constraints, you’ll develop a better sense of how long each section typically takes and how to pace yourself. This will help you avoid spending too much time on any one section and ensure that you have adequate time for review.

By applying these time management tips, candidates can increase their efficiency and reduce anxiety during the certification process, ultimately improving their chances of success.

How to Analyze Exam Questions Correctly

Understanding how to break down a task or scenario is a crucial skill for performing well in any professional certification. The ability to quickly identify key details and discern the underlying requirements is essential for providing the right response. A structured approach to analysis helps prevent misinterpretation and ensures that each part of the question is addressed effectively.

Here are some key steps to follow when analyzing each problem:

- Read the scenario carefully: Make sure to fully understand the situation presented, noting any important figures, terms, or conditions.

- Identify the main issue: Determine what the core problem or decision is. Focus on what the task is asking you to solve or determine.

- Break the problem into components: Divide the scenario into smaller sections to make it easier to manage. Look for relevant facts and eliminate unnecessary details.

- Consider the applicable rules or guidelines: Refer to any relevant principles or regulations that apply to the situation at hand. This helps you form the correct solution.

- Eliminate obvious distractions: Remove any options or elements that do not directly relate to the question’s core issue.

By following these steps, candidates can approach each challenge methodically, ensuring they address every important detail and reduce the chance of overlooking critical information.

Understanding Auditing Standards for CPA

In the realm of professional certification, a solid understanding of the standards that govern financial assessments is essential. These guidelines set the framework for ethical practice, ensuring transparency, accuracy, and accountability in reporting. Familiarity with these standards is crucial for any individual aspiring to achieve certification, as they form the basis of many practical scenarios that are tested.

These standards encompass various principles, including rules for assessing the integrity of financial statements, testing internal controls, and identifying potential risks. They also provide guidelines on how to evaluate a company’s compliance with regulations and how to ensure that all necessary procedures are followed correctly. By understanding these standards thoroughly, candidates can make informed decisions when faced with real-world financial assessments during the certification process.

Mastering these principles will not only help in passing the certification but also prepare candidates for a successful career in the field of accounting and financial oversight.

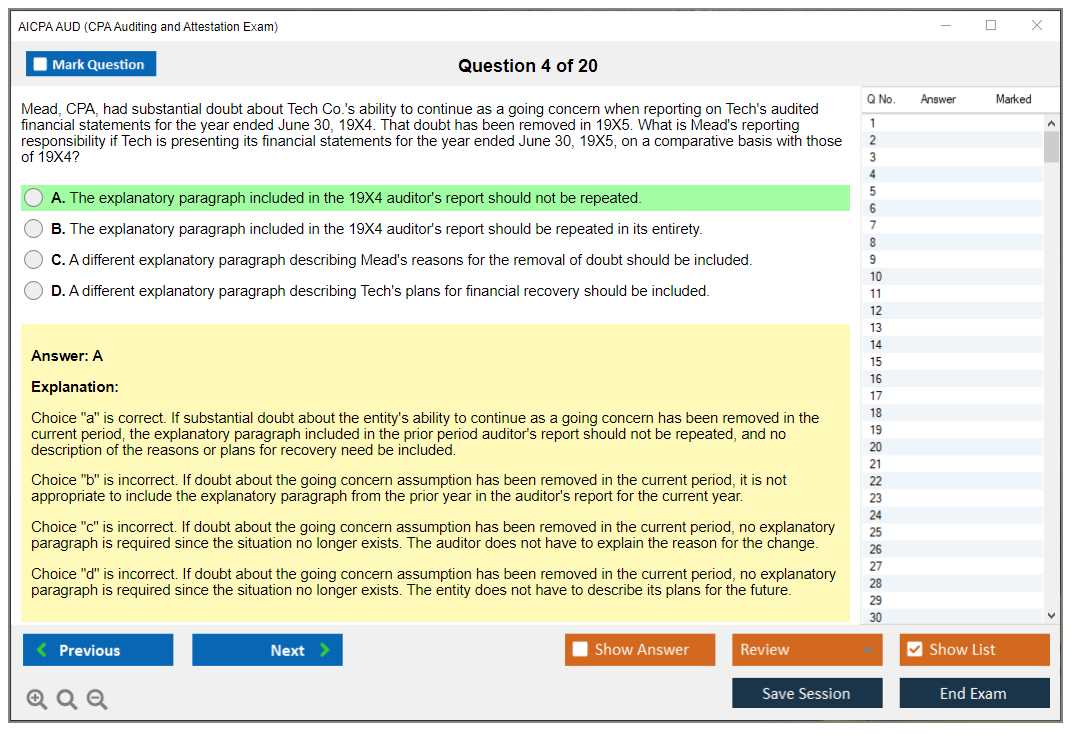

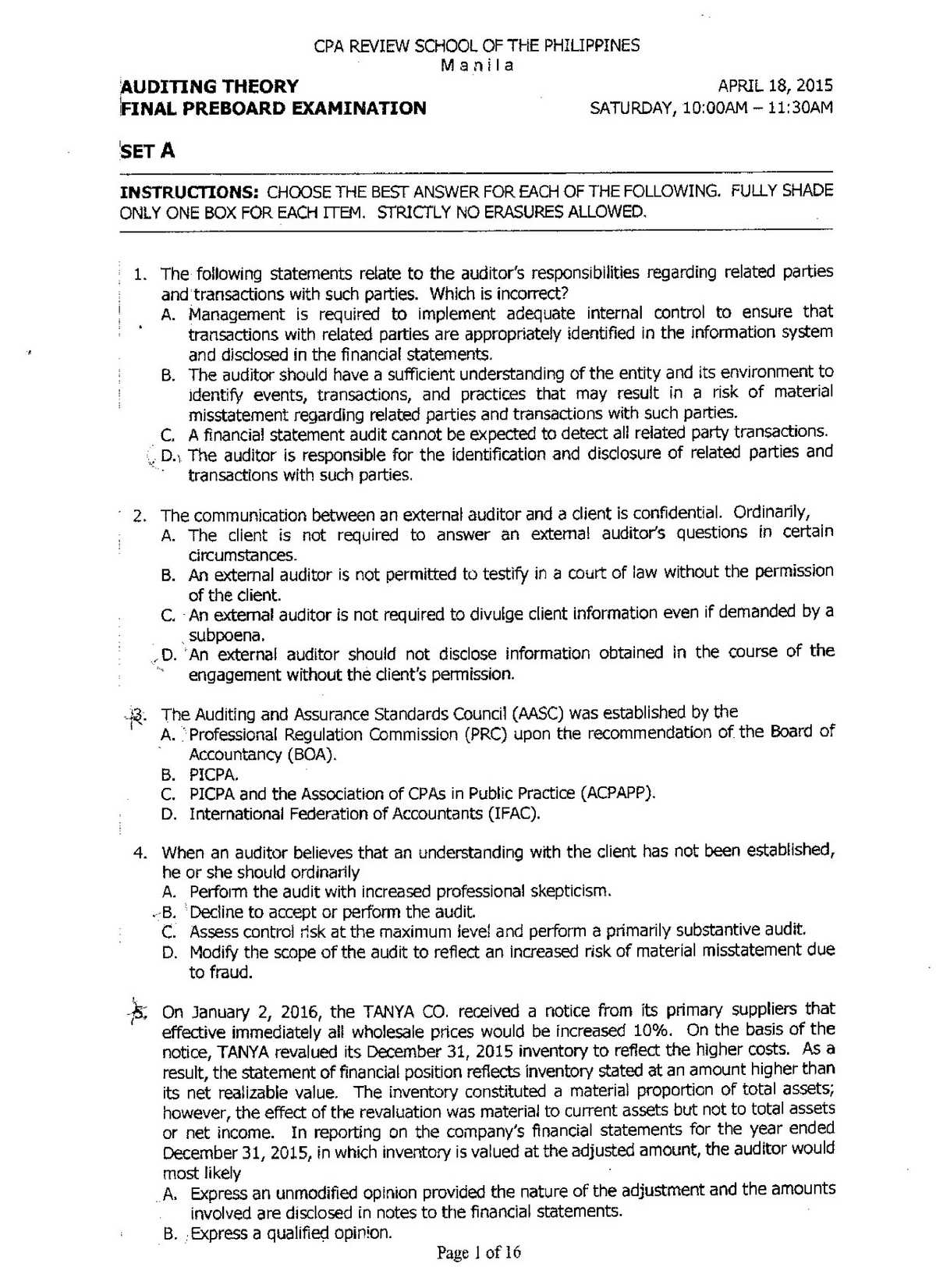

Practical Examples of Auditing Questions

Understanding how theoretical knowledge applies to real-world scenarios is essential for successful performance in professional assessments. By reviewing practical examples, candidates can enhance their ability to tackle various situations and improve their problem-solving skills. Below are several examples that illustrate how to approach common challenges and apply key concepts in practice.

| Scenario | Objective | Approach |

|---|---|---|

| A company has reported its revenue figures, but some transactions are unusually large. | Evaluate the validity of the reported figures. | Examine the supporting documentation for these transactions, ensuring they align with industry standards and regulatory requirements. |

| A client’s internal controls seem weak, especially in the area of financial reporting. | Assess the effectiveness of the internal control system. | Test the controls by reviewing past audits and comparing findings with established benchmarks. |

| An organization is undergoing a financial statement review, but some data appears inconsistent with previous reports. | Identify the cause of discrepancies and determine their impact. | Perform a detailed comparison of financial statements, identifying any unusual trends or discrepancies that require further investigation. |

By practicing with these types of scenarios, candidates can refine their analytical skills and gain confidence in their ability to apply theory to real situations. Such practical examples are invaluable in preparing for the challenges that lie ahead in professional assessments.

Common Mistakes in Auditing Exams

During any professional certification process, it’s easy to fall into traps that can hinder performance. Many individuals overlook key aspects of the assessment, leading to errors that can affect their scores. Recognizing these common mistakes is an essential step toward improving your approach and achieving success.

Overlooking Key Details

One of the most frequent mistakes is failing to carefully read the provided material or scenario. Often, candidates rush through the content, missing critical facts or nuances that are necessary to answer the task correctly. Always ensure that every piece of information is thoroughly understood before proceeding with your response.

Misinterpreting the Requirements

Another common error is misunderstanding what the task is asking for. This can happen when individuals focus too heavily on the details and fail to identify the core issue or the objective of the question. Take time to analyze what is truly being asked, ensuring that your response addresses the correct problem or scenario.

By being mindful of these common mistakes and taking the time to approach each task carefully, candidates can avoid pitfalls and improve their chances of success during the certification process.

Tips for Improving Answer Accuracy

Achieving accurate responses in any professional certification assessment requires more than just memorizing facts. It involves applying critical thinking, careful analysis, and a methodical approach. By refining certain strategies, candidates can significantly enhance their ability to provide precise and correct solutions to the challenges they face.

1. Focus on Understanding the Problem: It’s essential to thoroughly understand the task before beginning your response. Skimming through can lead to misinterpretation. Take the time to analyze the problem in detail, identifying key elements and what is truly being asked.

2. Review Relevant Concepts: Ensure that you are well-versed in the key principles and guidelines that govern the area being tested. Refresh your knowledge before starting and refer to these principles as you work through each challenge. This will help you apply the correct reasoning and avoid mistakes.

3. Eliminate Wrong Options: When faced with multiple possibilities, start by eliminating options that are clearly incorrect. This process narrows your choices and increases your chances of selecting the right one. If unsure, go with the most logical answer based on your knowledge.

4. Double-Check Your Work: If time permits, always review your responses. Even a small oversight can result in a wrong answer. Rechecking ensures that you’ve addressed all aspects of the task and haven’t missed any important details.

5. Practice Regularly: The more you practice, the more confident and accurate you will become. Try solving sample tasks or reviewing past assessments to improve both your speed and accuracy over time.

By applying these tips consistently, you can boost your ability to deliver more accurate responses and improve your overall performance in the assessment process.

How to Memorize Auditing Procedures

Mastering the steps involved in professional assessments requires not only understanding but also retaining a significant amount of detailed information. Memorizing complex processes can be challenging, but with the right strategies, it becomes much easier. Below are several approaches to help improve retention and recall of essential procedures.

Use Mnemonic Devices

One effective way to memorize key steps is by creating mnemonic devices. These memory aids help simplify complex concepts and make them easier to remember. For example:

- Acronyms: Create an acronym using the first letter of each step or principle.

- Visualization: Picture the process as a flowchart or series of images to help reinforce the sequence.

- Rhymes: Make a rhyme or song to make the material more memorable.

Break Down the Process

Large, intricate procedures can feel overwhelming if you try to memorize them all at once. Break the task into smaller chunks:

- Step-by-Step Approach: Memorize one step at a time and move on to the next only when you feel confident.

- Chunking: Group similar procedures together and focus on mastering each chunk before moving on to the next.

- Teach What You Learn: Try explaining the steps to someone else. Teaching reinforces your understanding and helps retain information longer.

By using these methods, you can make the memorization of complex processes more manageable and increase your retention for long-term success.

How to Master Internal Controls Questions

Mastering the concept of internal safeguards is critical for anyone preparing for a professional certification. These questions often require a deep understanding of both theoretical principles and their practical application in various organizational settings. To excel, it is essential to focus on the key components, procedures, and risks involved in effective control systems.

Understand the Frameworks and Principles

Before diving into specific scenarios, ensure you are familiar with the core frameworks that govern internal control systems, such as:

- Control Environment: Understand how organizational culture and policies support effective controls.

- Risk Assessment: Learn how to identify and assess risks that could affect financial integrity.

- Control Activities: Know the procedures that help mitigate risks, like authorizations and approvals.

- Information and Communication: Comprehend how critical data flows through an organization to ensure informed decision-making.

- Monitoring: Familiarize yourself with ongoing evaluations to ensure that controls remain effective over time.

Apply Real-World Scenarios

One of the most effective ways to solidify your understanding is to practice with real-world examples. Focus on:

- Case Studies: Study past examples of both successful and failed internal control systems to understand their impact.

- Simulations: Participate in simulated tasks that replicate the challenges of identifying control weaknesses or recommending improvements.

- Problem-Solving: Practice solving problems that require you to identify gaps in controls and suggest corrective actions.

By building a strong foundational knowledge and continuously applying that knowledge through practice, you will improve your ability to analyze and respond to questions related to internal control systems.

Trends in Auditing Questions Over Time

The field of accounting assessments has evolved significantly over the years, reflecting changes in both regulatory environments and business practices. As new standards emerge and technologies advance, the way professionals are tested on their knowledge has also shifted. Understanding how topics and methodologies have changed can help candidates better prepare for the challenges they face in these evaluations.

Shifts in Topic Emphasis

In recent years, the focus of assessments has been adjusted to reflect growing complexities in business environments. Some key trends include:

- Increased Focus on Technology: As businesses integrate more sophisticated software, the understanding of digital tools and cybersecurity has gained prominence.

- Emphasis on Ethical Considerations: The importance of ethics, compliance, and corporate governance has been more heavily tested as organizations face increasing scrutiny.

- Complexity of Financial Reporting: With international accounting standards continuously evolving, assessments now include more complex financial reporting scenarios.

- Integration of Risk Management: There has been a greater focus on identifying and mitigating risks in various operational and financial contexts.

Methodological Changes

The structure of assessments has also adapted to better reflect real-world challenges. For example:

- Case-Based Approaches: Scenarios involving real business cases have become more common, requiring candidates to apply theory to practical situations.

- Scenario-Based Simulations: Practical exercises that simulate actual work environments have grown in frequency, allowing for more hands-on testing of candidates’ skills.

- Data-Driven Assessments: There is a growing reliance on data analysis as part of the evaluation process, reflecting the increasing importance of data in decision-making.

By recognizing these shifts, candidates can focus their study efforts on the most relevant and emerging topics in the field. Staying aware of these trends ensures that future professionals are well-prepared for the evolving demands of the profession.

Post-Exam Review and Analysis Tips

Once an assessment is completed, it’s important to take the time to carefully review the results and identify areas for improvement. Reflecting on performance allows individuals to understand which sections were handled well and which require more attention for future success. A thorough post-assessment analysis is key to refining study strategies and enhancing performance on subsequent attempts.

Steps for Effective Post-Assessment Reflection

Following a thorough review, candidates can focus on the following steps to identify key takeaways and adjust their approach:

- Analyze Mistakes: Look at incorrect responses and identify patterns in the errors. Were they caused by misinterpretation, lack of knowledge, or time pressure?

- Understand Correct Answers: Don’t just focus on what went wrong. Review the questions answered correctly to ensure understanding of the underlying concepts.

- Seek Clarification: If there were areas of confusion, consult study materials or seek expert help to clarify misconceptions.

- Review Time Management: Evaluate how time was allocated during the assessment. Were any sections rushed or overly time-consuming?

Creating a Plan for Future Improvement

Post-assessment analysis should lead to actionable steps for enhancing future performance. This includes:

| Action | Description |

|---|---|

| Refine Study Plan | Adjust study habits by focusing more on weaker areas and reviewing missed topics in-depth. |

| Practice with Similar Content | Engage in practice exercises or simulations that reflect the style and structure of the evaluation. |

| Work on Time Management | Simulate the actual conditions of the assessment to improve the pacing and time management skills. |

By taking a systematic approach to post-assessment reflection, candidates can ensure steady progress and increase their readiness for future assessments. Continuous improvement is essential for long-term success in the field.