Preparing for assessments in the field of auditing requires a thorough understanding of key concepts, strategies, and the ability to apply knowledge to solve complex problems. Success in such evaluations comes from a combination of theoretical knowledge and practical skills, which need to be refined through careful study and practice. This section provides insights into how to approach these assessments with confidence.

Strategic preparation is essential for excelling in this area. Focusing on core topics, familiarizing oneself with commonly asked scenarios, and practicing how to respond effectively are critical components of the process. By breaking down the material into manageable sections, students can ensure they are well-prepared for any challenge.

Additionally, understanding the structure of the evaluation, including how different types of problems are framed, can significantly improve performance. Knowing what to expect, coupled with practicing under timed conditions, allows individuals to handle pressure and avoid common mistakes that can impact their results.

Auditing Final Exam Questions and Answers

Preparing for assessments in the field of financial oversight requires a deep understanding of both theoretical concepts and practical application. This section focuses on key areas that are commonly tested, highlighting the importance of grasping core principles, as well as the nuances of problem-solving. Mastering these aspects will enhance your ability to navigate any related evaluation with confidence.

Key Areas to Focus On

Identifying the primary topics that often appear in tests is crucial for efficient preparation. Commonly emphasized areas include risk assessment, internal control mechanisms, compliance procedures, and financial reporting. A strong grasp of these topics not only improves your ability to tackle related problems but also provides a solid foundation for answering any scenario-based challenges that may arise.

Effective Preparation Strategies

To maximize performance, it is essential to adopt a strategic approach. Review past practice materials to familiarize yourself with the format and types of challenges typically presented. Simulated practice sessions under timed conditions help improve both speed and accuracy, while refining your ability to think critically under pressure. Focusing on key concepts and learning to apply them efficiently is a proven method to ensure success.

Understanding Auditing Concepts for Exams

Mastering the core principles of financial oversight is key to excelling in related evaluations. A solid foundation in the fundamental concepts is essential, as it enables you to approach various scenarios with clarity and confidence. This section will guide you through essential ideas that are frequently tested, helping you build a thorough understanding of the subject.

Core concepts include risk management, internal controls, compliance standards, and the roles of various stakeholders in the financial process. Grasping these principles ensures you can analyze situations, assess risks, and propose solutions effectively. In addition, understanding how these concepts interconnect allows for a more comprehensive approach to problem-solving.

One crucial aspect is being able to apply theoretical knowledge to practical situations. By practicing with case studies and real-world examples, you will gain insight into how abstract concepts translate into actual scenarios. This skill will be invaluable during assessments, where the ability to make connections between theory and practice is often tested.

Common Topics in Auditing Exams

In assessments related to financial oversight, certain areas consistently emerge as focal points. Understanding the most frequently tested subjects ensures that you are well-prepared to tackle various scenarios. This section highlights the key themes you should prioritize during your studies, as they are commonly explored in various evaluations.

Risk assessment is one of the most crucial topics, focusing on identifying, evaluating, and mitigating potential risks that could affect financial statements. Mastering this area allows you to analyze different situations critically and propose effective solutions. Another important area is internal control systems, which examines the policies and procedures used by organizations to ensure accuracy and prevent fraud.

Compliance with laws and regulations is also a major theme. Understanding the frameworks that govern financial reporting and ensuring that organizations adhere to these standards is key. Furthermore, financial statement analysis, including how to detect inconsistencies or errors, remains a common challenge in these assessments, requiring both theoretical knowledge and practical application.

How to Approach Exam Questions Effectively

Success in assessments hinges on how well you approach each task. Effective preparation is only half the battle; applying the right strategies during the evaluation is equally important. In this section, we explore key methods to help you tackle challenges with clarity and confidence.

- Understand the requirements: Before diving into your responses, carefully read each prompt to ensure you understand what is being asked. Identify keywords and instructions that highlight the core focus.

- Break down complex tasks: If a problem seems overwhelming, break it into smaller, more manageable parts. Address each section individually, making it easier to focus on one aspect at a time.

- Manage your time: Allocate a specific amount of time to each task. Prioritize the more complex ones, but don’t spend too much time on any single item. If you get stuck, move on and return later.

- Stay concise: Avoid over-explaining. Stick to the essential points and provide clear, direct responses. Focus on answering the task fully without unnecessary elaboration.

- Review your work: If time allows, review your responses for accuracy. Check that you’ve addressed all aspects of the task and made no critical mistakes.

By applying these strategies, you will be able to approach each problem with a focused, efficient mindset, increasing your chances of success.

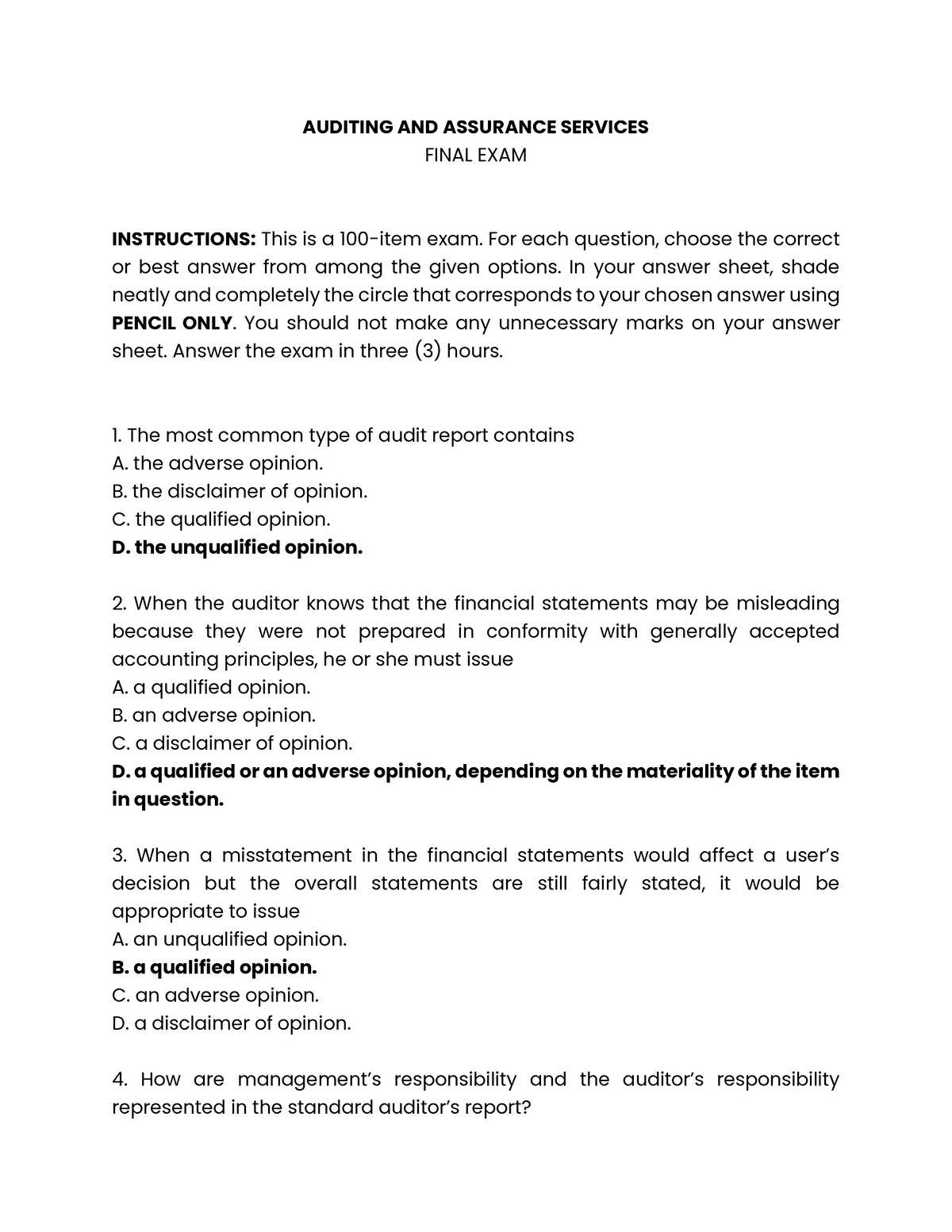

Tips for Answering Multiple Choice Questions

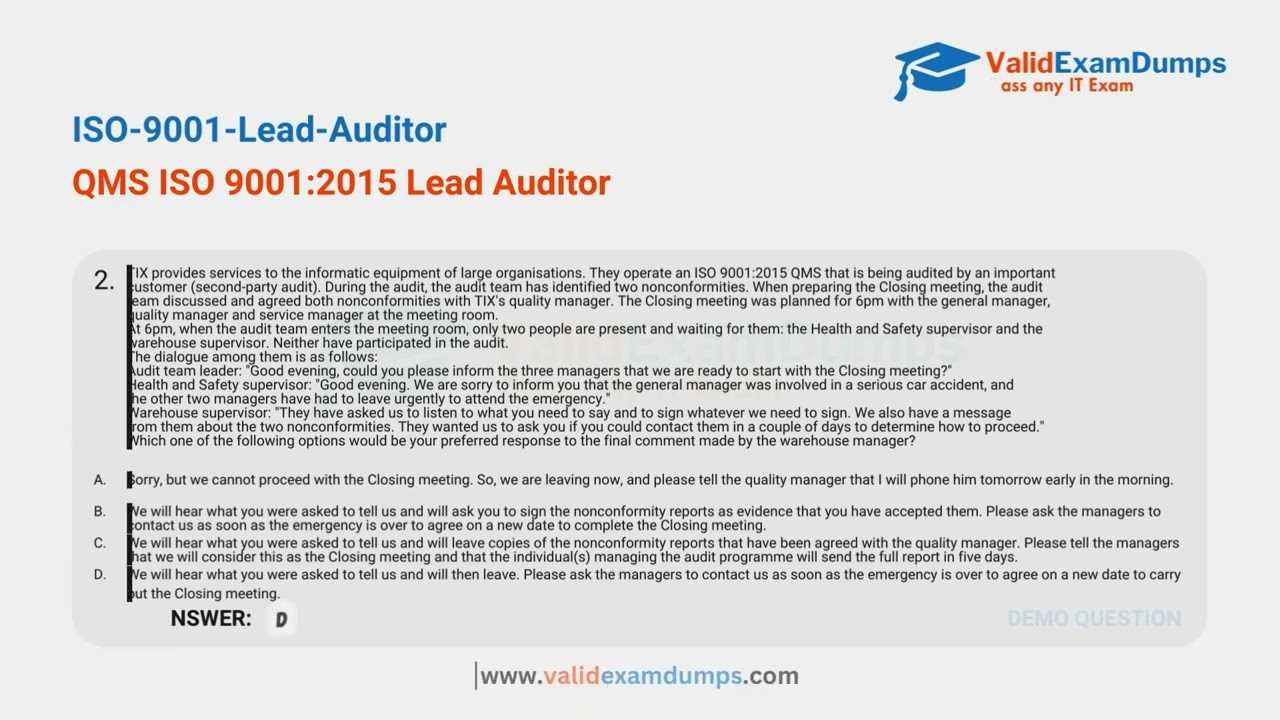

Multiple-choice tasks often test your ability to recognize the correct solution from a set of options. While these tasks may seem straightforward, they require careful analysis and strategy to maximize accuracy. In this section, we will discuss effective techniques to help you navigate through multiple-choice challenges with confidence.

Read Each Option Carefully

When presented with a set of possible answers, it’s essential to examine all options before making a choice. Avoid rushing to select the first option that seems correct. Pay attention to subtle differences between similar answers, as they could reveal the key to the right choice.

Eliminate Incorrect Answers

One of the most effective techniques is to rule out answers you know are wrong. This process narrows down your options and increases the likelihood of choosing the correct response. Even if you’re unsure, eliminating one or two clearly incorrect options will improve your chances of guessing correctly if necessary.

By taking your time and carefully analyzing each choice, you can improve your ability to select the most accurate answer and avoid common pitfalls.

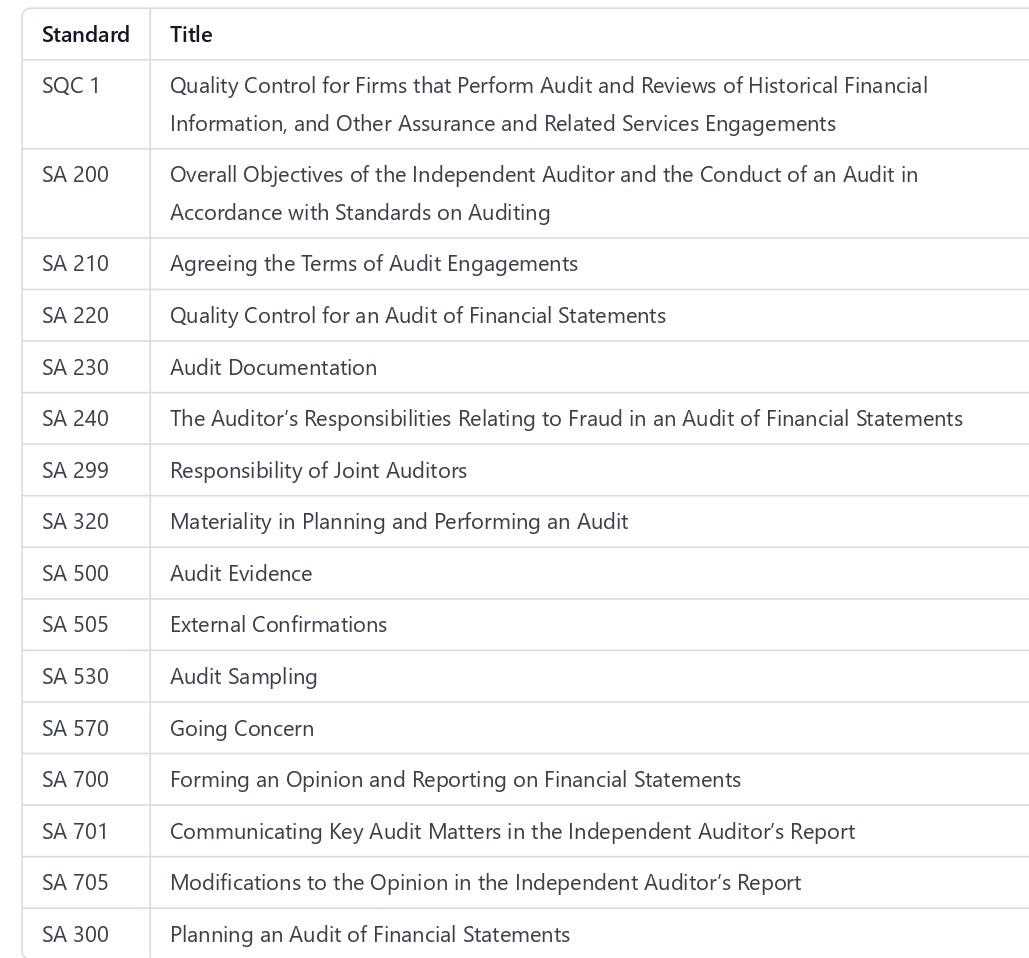

Key Terminology in Auditing Exams

In any assessment related to financial oversight, a strong grasp of essential terms is vital for understanding the tasks at hand. Familiarity with key terminology not only helps you interpret the questions correctly but also ensures that you can express your responses clearly and precisely. This section highlights some of the most important terms you need to know.

Risk assessment refers to the process of identifying and evaluating potential threats that could affect the financial integrity of an organization. Being able to assess these risks effectively is crucial for identifying weaknesses and proposing corrective measures.

Internal controls are the procedures and policies implemented by organizations to safeguard assets, ensure accurate reporting, and promote operational efficiency. Understanding how these controls work is critical for evaluating their effectiveness and identifying areas for improvement.

Another important concept is compliance, which involves adhering to established laws, regulations, and standards. In the context of assessments, it is vital to understand the rules governing financial practices and ensure that they are being followed accurately.

Best Study Practices for Auditing Exams

Effective preparation is essential for mastering any subject, especially in areas related to financial oversight. Developing the right study habits can greatly improve retention, enhance understanding, and boost performance during the assessment. This section outlines some of the most effective strategies to help you study smarter, not harder.

Organize Your Study Time

Creating a structured study schedule is key to ensuring consistent progress. Break down the material into manageable sections and allocate specific time slots for each topic. This approach prevents cramming and allows you to focus on one concept at a time, enhancing both understanding and retention.

Practice with Past Materials

Working through past practice tests and sample tasks is one of the best ways to prepare. This helps familiarize you with the types of challenges that may appear and allows you to refine your problem-solving techniques. Additionally, reviewing these materials provides insight into which areas require more attention and where you may need to improve.

By implementing these study practices, you can approach your preparations with confidence, ensuring you are well-equipped to tackle any challenge that arises.

Time Management During Auditing Exams

Proper time management is a crucial aspect of performing well in any evaluation, especially in subjects that involve complex problem-solving. Effectively allocating your time ensures that you can complete each task with enough attention to detail, while still leaving time to review your responses. In this section, we will explore strategies to help you manage your time effectively during the assessment.

Prioritize Tasks Based on Difficulty

Start by assessing the difficulty of each task and allocate more time to the challenging ones. This ensures that you spend enough time on complex scenarios, while easier tasks can be completed more quickly. It’s important to not get stuck on any single task for too long, as this may affect your overall performance.

Use a Time Allocation Strategy

A practical approach is to set a time limit for each section of the test. You can break down the total available time into smaller blocks, assigning a specific amount of time to each part of the evaluation. This prevents you from spending excessive time on any one section and helps you stay on track.

| Section | Suggested Time Allocation |

|---|---|

| Introduction/Overview | 5 minutes |

| Complex Scenarios | 40 minutes |

| Shorter Tasks/Multiple-Choice | 30 minutes |

| Review and Adjustments | 15 minutes |

By following a time management strategy like this, you can ensure that you make the most of your available time, giving yourself the best chance for success.

How to Prepare for Essay Questions

Essay tasks test your ability to critically analyze topics, present well-structured arguments, and demonstrate a deep understanding of the subject. Proper preparation for these types of challenges requires both knowledge and strategy. In this section, we will discuss effective approaches to help you perform well in writing tasks that require extended responses.

The key to preparing for essay-based tasks is to focus on understanding the core concepts thoroughly. It’s important to organize your thoughts before you start writing, as this will allow you to present your ideas in a coherent and logical manner. A clear structure is essential for guiding the reader through your argument.

| Step | Action |

|---|---|

| Understand the Topic | Research the subject thoroughly to understand the context, key terms, and relevant theories or concepts. |

| Plan Your Response | Draft a rough outline to organize your main points and structure your argument in a logical sequence. |

| Support with Examples | Include relevant examples, case studies, or data to back up your arguments and demonstrate a practical understanding of the material. |

| Review and Revise | Review your essay for clarity, coherence, and logical flow. Make necessary revisions to improve the overall quality of your response. |

By following these steps, you can ensure that your responses are clear, structured, and supported by solid evidence, helping you score well on essay-based tasks.

Common Mistakes to Avoid in Auditing Exams

When preparing for assessments in financial oversight, it’s important to be aware of common pitfalls that can negatively impact performance. By recognizing these mistakes, you can avoid them and improve your approach to the evaluation process. This section highlights some of the most frequent errors students make and offers tips on how to steer clear of them.

One of the most common mistakes is rushing through the tasks without fully understanding what is being asked. This often leads to incomplete or incorrect responses, especially when critical details are overlooked. It’s essential to read each instruction carefully, ensuring that you fully grasp the requirements before proceeding.

Another mistake is failing to manage time effectively. Many students spend too much time on a single section or question, leaving insufficient time to address others. To avoid this, it’s important to allocate your time wisely and move on once you’ve answered a task to the best of your ability.

Finally, neglecting to review your responses before submitting them can lead to avoidable errors. It’s easy to miss simple mistakes such as typos or calculation errors, so taking a few minutes at the end to double-check your work can make a significant difference in your final score.

Practice Scenarios for Financial Oversight Assessments

Engaging in practice exercises is one of the most effective ways to prepare for any type of assessment in the field of financial oversight. By working through sample scenarios, you can gain a deeper understanding of the concepts, enhance your problem-solving skills, and familiarize yourself with the format of potential tasks. This section will focus on some practical examples to help you refine your skills and boost your confidence.

These practice scenarios cover various aspects of financial analysis and risk management. They are designed to mimic the real-world challenges you might face during the actual assessment, giving you the opportunity to apply theoretical knowledge to practical situations. As you work through these tasks, focus on accurately interpreting the information provided and developing well-reasoned conclusions based on that data.

By regularly practicing these scenarios, you can strengthen your critical thinking abilities, improve your time management, and ultimately perform better in your evaluation.

Focus Areas for Financial Oversight Success

Achieving strong results in assessments related to financial oversight involves mastering several key areas that are often emphasized in such evaluations. A focused study strategy that targets the most important topics can help boost confidence and ensure a comprehensive understanding of the subject matter. This section outlines the essential focus areas that are crucial for success in these types of assessments.

Core Topics to Master

To perform well in financial oversight assessments, it is vital to prioritize the following key concepts:

- Risk Management: Understanding how to identify, evaluate, and mitigate risks that may affect financial performance is essential for demonstrating your analytical abilities.

- Internal Control Systems: Being familiar with how organizations design and maintain control mechanisms to protect their assets and ensure accurate reporting will be critical for success.

- Regulatory Compliance: A thorough understanding of laws, regulations, and standards governing financial practices is vital to ensure ethical and lawful conduct within a business environment.

- Financial Statements Interpretation: Knowing how to interpret balance sheets, income statements, and other financial reports will help in assessing the overall health and performance of a company.

Preparation Tips for Success

To strengthen your grasp on these areas, consider these effective study approaches:

- Practice with Case Studies: Work through real-world scenarios and case studies that apply theoretical concepts to practical situations.

- Review Previous Tests: Familiarize yourself with past evaluations to identify patterns in the topics covered and the types of tasks expected.

- Manage Your Time: Develop a strategy for pacing yourself during the evaluation to ensure that each section is addressed thoroughly and within the allotted time frame.

By focusing on these essential areas, you will increase your chances of excelling and demonstrate your competency in the field of financial oversight.

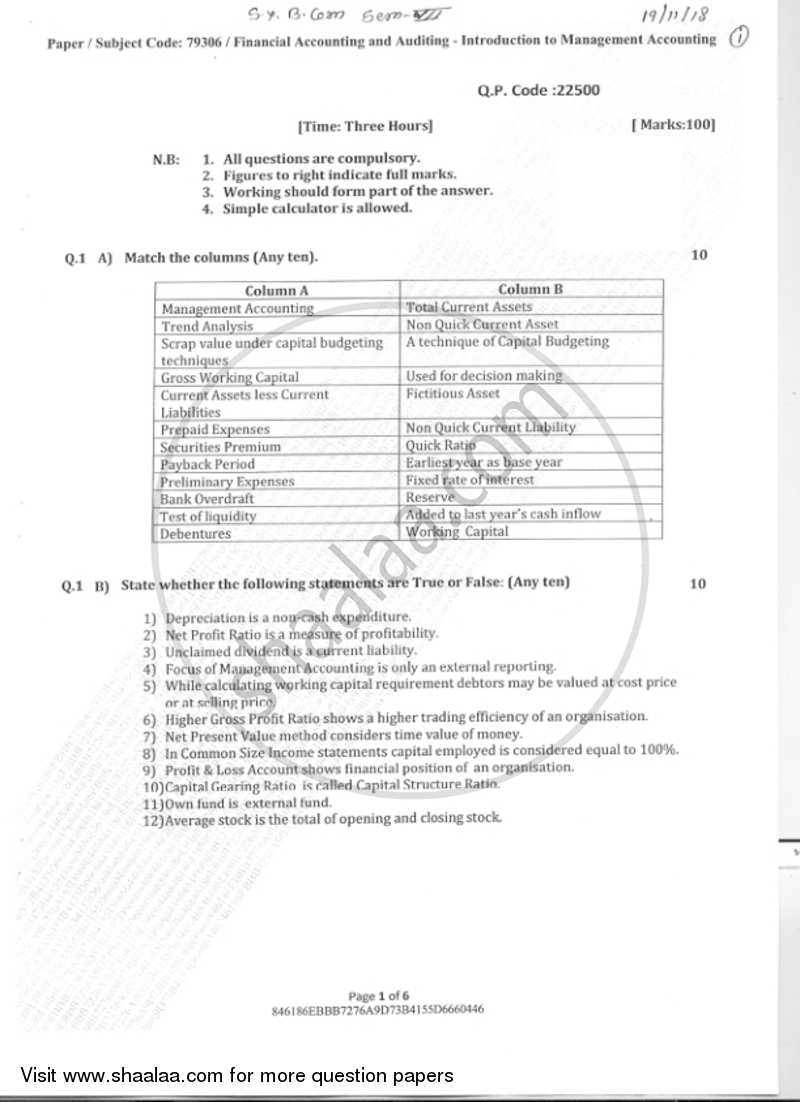

Reviewing Past Papers for Insights

Looking back at previously administered assessments is an effective way to identify patterns, common themes, and types of challenges that typically appear. By engaging with past materials, you can gain a deeper understanding of the topics that are emphasized and the approach needed to tackle each section successfully. This process helps to refine your strategies and enhances your readiness for upcoming evaluations.

Benefits of Reviewing Past Papers

There are several key advantages to revisiting old materials:

- Recognize Key Themes: By reviewing past papers, you can pinpoint recurring subjects or areas that are frequently tested, helping you focus your study efforts on the most critical concepts.

- Familiarize with Format: Understanding the typical structure of assessments allows you to anticipate how the material will be presented. This can reduce uncertainty and improve your ability to respond effectively.

- Identify Weak Areas: Past papers can reveal areas where you may need additional practice or review. This insight enables you to devote more time to strengthening weaker points before your own assessment.

- Enhance Time Management: Practicing with past content under timed conditions helps you develop strategies for managing your time more efficiently, ensuring that you allocate the right amount of attention to each section.

Strategies for Effectively Using Past Papers

To maximize the benefits of reviewing past materials, consider the following methods:

- Simulate Real Conditions: When working through past papers, set a timer and complete them within the allotted time. This helps you practice pacing and improves your ability to work efficiently under pressure.

- Review Solutions Thoroughly: After attempting the tasks, go through the provided solutions carefully. Understand why certain responses are correct and how to avoid common mistakes. This reflection deepens your understanding of the material.

- Focus on Repeated Topics: Pay special attention to subjects or types of

Understanding the Marking Scheme

Grasping how responses are evaluated is crucial for tailoring your approach to the tasks at hand. Each evaluation follows a specific structure, determining how marks are distributed based on the quality, completeness, and relevance of your responses. By understanding the criteria used for assessment, you can better focus your efforts on areas that will yield the most points and ensure your responses align with the expectations set by the markers.

Key Components of the Marking System

Most assessments use a systematic approach to allocate points, and these are typically based on the following factors:

- Clarity and Precision: Clear, concise answers that directly address the prompt are valued. Avoid unnecessary information or vague responses that might dilute your main point.

- Depth of Knowledge: A well-rounded answer demonstrates comprehensive understanding. Be sure to cover all aspects of the topic, providing examples or explanations when necessary to strengthen your argument.

- Application of Concepts: Showing how theoretical ideas can be applied to practical scenarios is often rewarded. Make sure to connect theory with real-world situations where relevant.

- Logical Structure: Organize your response logically, with a clear introduction, main body, and conclusion. A coherent structure helps markers follow your argument and enhances your chances of scoring higher marks.

- Accuracy: Ensure your facts, calculations, or any technical details are correct. Inaccurate information, even if the approach is otherwise solid, can lead to point deductions.

How to Maximize Your Score

To make the most of your marks, consider the following strategies when responding to tasks:

- Read the Instructions Carefully: Ensure you fully understand what is being asked before you start writing. Misinterpreting the prompt could result in answering the wrong question.

- Focus on Key Points: Pay attention to the weight of different sections. If a task is worth more points, allocate more time and detail to it. This shows markers that you