Understanding how to align different financial records is a crucial skill for anyone working with financial documents. The ability to reconcile discrepancies between internal accounting ledgers and external financial reports plays a vital role in ensuring accuracy and transparency in business operations. This skill is especially important when preparing for assessments that test knowledge in these areas.

In this section, we will explore the most common challenges and solutions related to this process. By studying various methods, techniques, and common errors, you will gain a deeper understanding of the best practices and strategies for handling such tasks efficiently. The goal is to help you build confidence and proficiency in solving problems commonly encountered in these assessments.

Preparing for these challenges involves a systematic approach to understanding core principles and applying them to realistic scenarios. With the right preparation, you can ensure that you are well-equipped to tackle any task related to comparing financial records and resolving discrepancies.

Essential Financial Comparison Topics

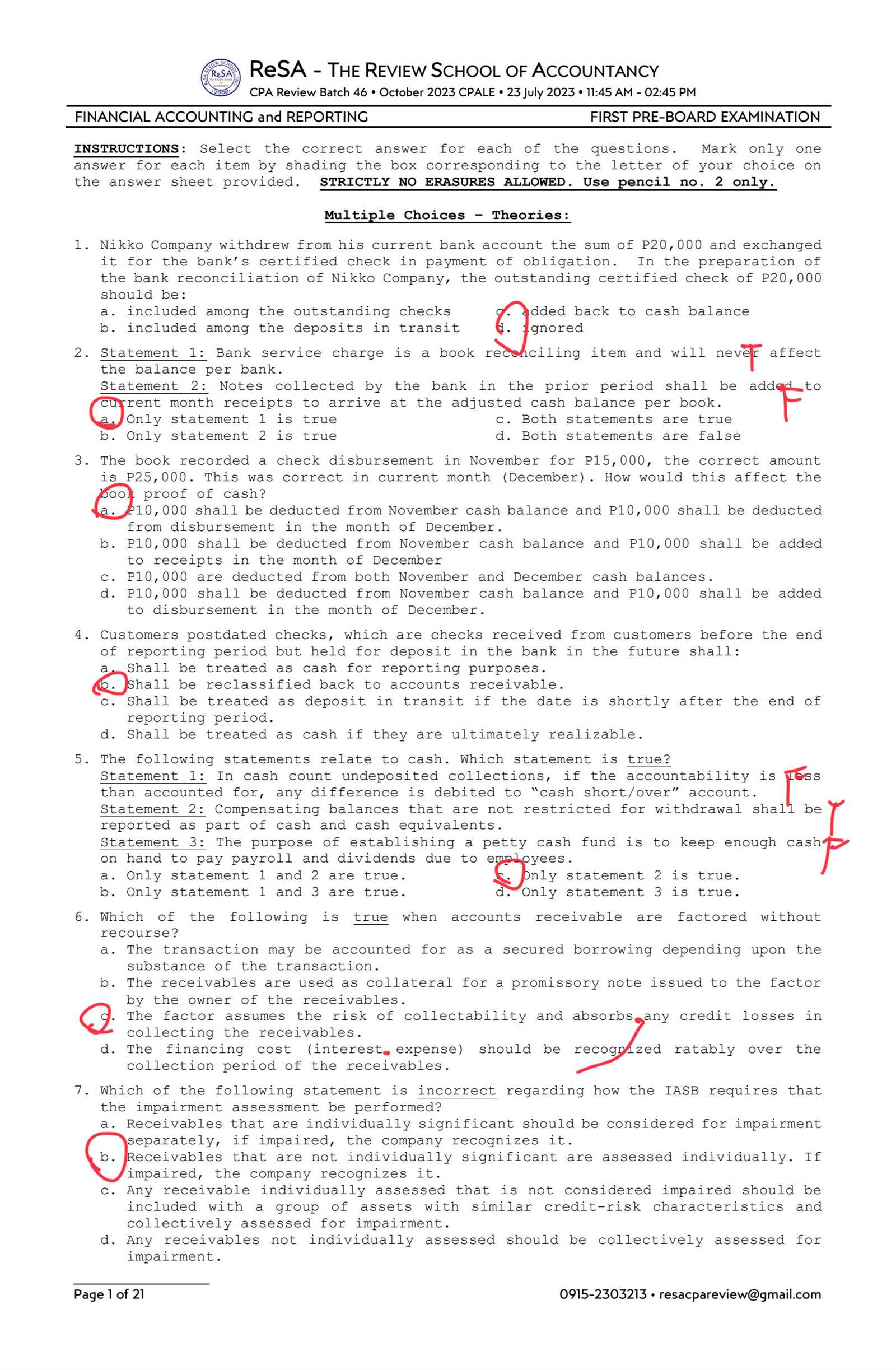

When preparing for assessments in this area, it is important to focus on the core concepts that are frequently tested. These concepts encompass various methods of aligning internal records with external reports, identifying discrepancies, and resolving issues that may arise during the process. Mastery of these topics will provide a strong foundation for tackling related problems efficiently.

Key Concepts to Understand

One of the most crucial aspects involves understanding how to properly adjust figures between different financial statements. Familiarity with common terminology, such as adjustments for errors or timing differences, is essential. A solid grasp of the processes involved helps ensure that the balances match and that no discrepancies remain unresolved.

Techniques for Handling Discrepancies

Another vital topic includes methods for resolving discrepancies between records. This may involve checking for errors in calculations, understanding the impact of delayed transactions, or identifying missing items. Developing strong problem-solving skills in these areas will help ensure accuracy in completing tasks related to this subject.

Understanding Financial Comparison Concepts

Grasping the fundamental principles of matching internal records with external documents is essential for ensuring consistency and accuracy. This process involves not only recognizing discrepancies but also understanding how different transactions impact the final outcome. A clear comprehension of these principles is key for tackling any challenges that may arise during assessments.

At the heart of this process is the need to identify and correct errors or differences that occur due to timing, calculation mistakes, or overlooked entries. By focusing on these core ideas, individuals can develop a systematic approach to resolving mismatches between various financial reports, ensuring that both internal and external statements align perfectly.

Common Mistakes in Financial Comparison Assessments

In the process of matching internal records with external statements, several common errors can arise, often leading to inaccurate results. These mistakes can be costly, especially when preparing for assessments. Recognizing and addressing these issues is crucial for improving accuracy and efficiency when solving related tasks.

- Overlooking Timing Differences: One of the most frequent mistakes is not accounting for timing differences between when transactions are recorded and when they actually occur. This can lead to mismatched figures.

- Misunderstanding Adjustments: Failing to correctly apply necessary adjustments to account for errors or omissions can cause discrepancies that are hard to detect.

- Incorrect Calculations: Simple arithmetic errors, such as adding or subtracting the wrong amounts, are another common mistake that can easily throw off the entire comparison.

- Ignoring Missing Entries: Sometimes, transactions are recorded in one statement but not in the other, leading to incorrect balances if not properly identified and addressed.

- Neglecting Outstanding Items: Failing to account for outstanding transactions that haven’t yet cleared or been recorded can result in incomplete comparisons.

By being aware of these common pitfalls, individuals can take proactive steps to avoid them, ensuring a more accurate and reliable result when performing these tasks in assessments.

How to Approach Financial Comparison Tasks

When faced with tasks involving the alignment of internal and external financial records, having a systematic approach is essential for success. The process requires careful attention to detail, clear problem-solving strategies, and an understanding of common challenges. Developing a structured method can help you manage the complexities and ensure that each step is addressed efficiently.

Start by thoroughly reviewing the information provided, identifying key discrepancies, and ensuring that all necessary adjustments are considered. A step-by-step approach can significantly improve accuracy and minimize errors. The following table outlines a general strategy to follow when tackling these types of tasks:

| Step | Action |

|---|---|

| 1 | Review both sets of records carefully, highlighting any obvious discrepancies. |

| 2 | Identify and apply any adjustments needed, such as correcting errors or accounting for delays. |

| 3 | Double-check calculations to ensure no mistakes were made in adding or subtracting values. |

| 4 | Look for missing or overlooked entries that may not be included in one of the records. |

| 5 | Account for any outstanding transactions that might affect the final figures. |

By following these steps, you can approach each task in a methodical way, increasing the likelihood of arriving at accurate results in a timely manner.

Key Terms in Financial Comparison Assessments

When preparing for tasks involving the comparison of financial records, it is essential to familiarize yourself with the key terminology that frequently appears. A solid understanding of these terms will not only help you navigate the material more effectively but also ensure that you approach the task with the right knowledge and confidence.

- Outstanding Transactions: These are entries that have been recorded in one set of records but have not yet been processed or reflected in the other set.

- Adjusting Entries: Corrections made to account for errors, omissions, or changes in timing between the records.

- Timing Differences: Discrepancies that arise due to transactions occurring at different times but being recorded in different periods.

- Errors of Omission: Transactions that were recorded in one statement but not in the other, often leading to an imbalance.

- Uncleared Items: Transactions that have been initiated but not yet finalized or cleared by the bank or internal system.

- Reversal Entries: Adjustments made to correct previous entries, typically when an error is identified after the initial recording.

- Balance Differences: The gap between the figures in two sets of records that requires resolution through adjustments or investigation.

Understanding these terms will provide a solid foundation for solving related tasks and ensure that you are well-equipped to handle discrepancies, adjustments, and other challenges that may arise in the process.

Top Strategies for Assessment Preparation

Successfully tackling tasks that involve matching internal and external financial records requires more than just understanding the concepts. Effective preparation involves adopting the right strategies to ensure you are ready to address any challenge that may arise. By mastering key techniques and refining your approach, you can confidently navigate any task that requires comparing financial documents.

Organize Your Study Materials

One of the first steps in preparing for assessments is organizing all relevant study materials. A clear structure helps streamline your study sessions and ensures that you don’t miss any essential topics. Consider these tips:

- Gather all resources: Collect textbooks, practice papers, online materials, and notes to cover all potential areas of focus.

- Create a study plan: Break down your preparation into manageable segments, focusing on one topic at a time to avoid feeling overwhelmed.

- Highlight key concepts: Identify and mark important terms, methods, and procedures that are likely to appear in the assessment.

Practice with Real-Life Scenarios

One of the most effective ways to prepare is by practicing with real-life examples. These exercises will help you develop problem-solving skills and increase your familiarity with the types of challenges you may face. Consider the following strategies:

- Use past cases: Work through previous case studies or sample tasks to gain insight into typical problems.

- Time yourself: Practice under timed conditions to improve your speed and efficiency.

- Simulate real conditions: Mimic the assessment environment by eliminating distractions and focusing solely on the task at hand.

By implementing these strategies, you can improve your preparation, build confidence, and approach the task with a structured, focused mindset.

Analyzing Financial Statement Discrepancies

When reviewing financial statements, identifying discrepancies between internal records and external reports is a crucial step. These mismatches often arise from timing differences, errors, or omitted transactions, and understanding how to analyze them effectively is key to ensuring accurate reporting. By approaching these discrepancies methodically, you can identify the root cause and resolve the issue efficiently.

To accurately analyze discrepancies, it’s essential to follow a systematic process. Here are some common steps to consider:

- Identify the Source of Discrepancy: Carefully review both sets of records to determine where the differences are originating. Check for missing or duplicated entries, calculation errors, and timing issues.

- Examine Timing Differences: Look for transactions that may have been recorded in different periods in either set of records. Understand how these timing differences can cause temporary mismatches.

- Check for Errors of Omission: Review both sets of statements to ensure that no entries were left out. Missing transactions can lead to inaccurate totals and misaligned figures.

- Verify Outstanding Transactions: Ensure that all outstanding transactions have been accounted for. These may not yet appear in one of the records but could affect the final balance.

- Review Adjusting Entries: Double-check any adjustments made in either set of records, ensuring they were applied correctly and reflect the true financial picture.

By following these steps, you can systematically identify and address discrepancies in financial statements, ensuring a more accurate and consistent outcome.

Common Calculation Techniques in Financial Comparison

Accurate calculations are essential for aligning internal records with external statements. Common techniques in this process help identify discrepancies, ensure correct balances, and facilitate proper adjustments. Mastering these methods is crucial for effectively analyzing financial documents and resolving issues that arise during the comparison process.

Here are some of the most frequently used calculation techniques when working with financial records:

- Arithmetic Adjustments: Basic addition and subtraction are often required to adjust the figures, especially when errors in calculation or omitted entries are identified.

- Outstanding Transaction Calculations: The total value of transactions not yet processed must be added or subtracted to reflect their impact on the overall balance.

- Timing Difference Calculation: Identifying differences caused by transactions recorded in one period but affecting the balance in another is essential for correcting temporary discrepancies.

- Percentage-Based Adjustments: In cases where values need to be recalculated based on percentage differences, using multiplication and division helps in determining the correct amounts.

- Balance Reconciliation: A comprehensive calculation method that involves matching figures from two sources and adjusting for any missing or incorrect entries to ensure the totals align.

By applying these techniques, you can efficiently correct discrepancies, streamline the comparison process, and ensure the accuracy of the final figures.

Handling Adjustments in Financial Comparison

When discrepancies arise between two financial records, adjustments are often necessary to bring them into alignment. These corrections can involve a variety of changes, including adding missing transactions, modifying errors, or accounting for timing differences. Understanding how to handle these adjustments is key to ensuring that both sets of records reflect the true financial position.

Types of Adjustments

There are several types of modifications that may be required during the comparison process:

- Correction of Errors: Mistakes in recording figures, such as entering the wrong amount or misplacing decimal points, need to be fixed to avoid further discrepancies.

- Adjustments for Timing Differences: Some transactions may be recorded in one set of records but not yet reflected in the other. These require careful handling to ensure the correct balance is achieved.

- Outstanding Items: Items that have not yet been cleared or processed, such as deposits or payments, should be adjusted accordingly in the records to reflect their future impact.

- Manual Adjustments: In cases where specific transactions were not recorded, manual additions or subtractions might be necessary to balance both sets of records.

Steps for Making Adjustments

Once you’ve identified the discrepancies, it’s important to follow a systematic approach to adjust the records:

- Review Both Records: Thoroughly compare both internal and external records to pinpoint the differences.

- List the Required Changes: Make note of each adjustment that needs to be applied, whether it’s correcting an error, adding a transaction, or resolving a timing difference.

- Apply Adjustments Sequentially: Adjust one entry at a time to avoid confusion. Ensure each change is clearly documented and accurate.

- Recheck the Balances: After making adjustments, recalculate the totals to verify that both records now align correctly.

By following these steps and understanding the types of adjustments needed, you can effectively manage discrepancies and ensure that the financial records are accurate and complete.

Real-Life Examples for Practice

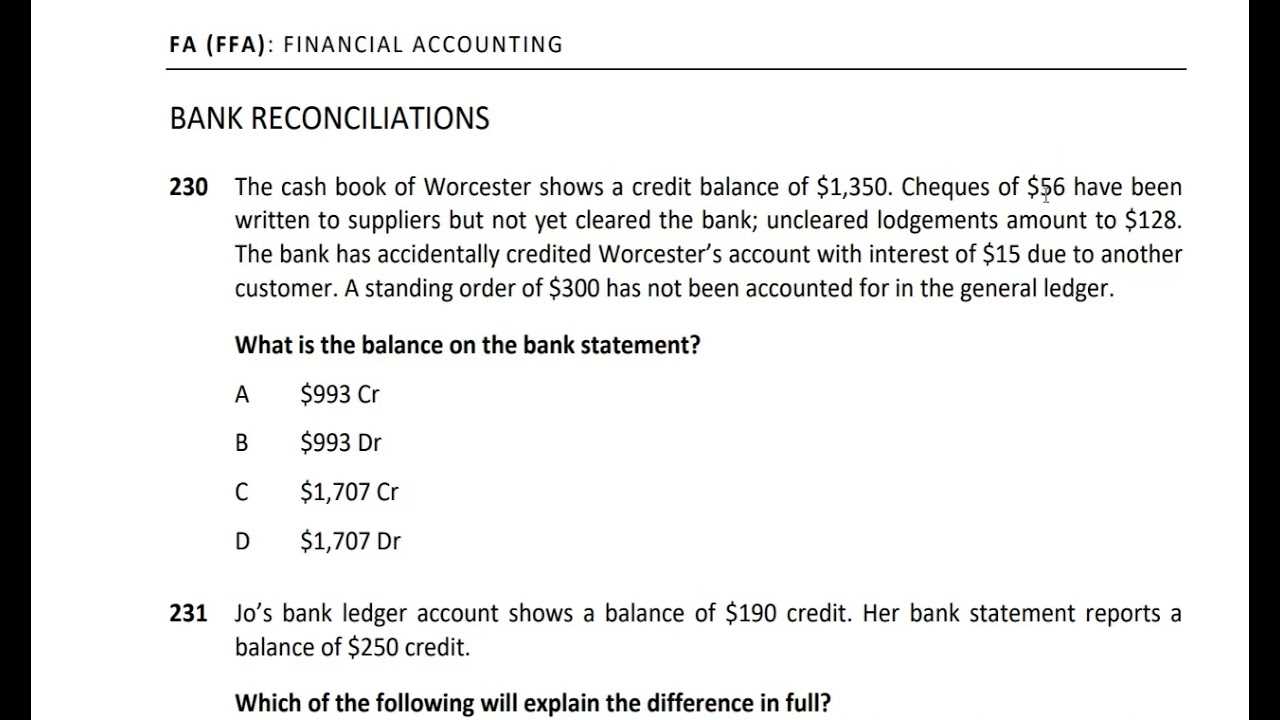

To truly master the process of aligning internal records with external statements, practicing with real-life examples can be extremely beneficial. These scenarios help illustrate common issues that may arise during the process, allowing you to develop a deeper understanding and improve your problem-solving skills. By working through practical examples, you can gain the confidence needed to address any discrepancies effectively.

Below are some examples that can help you prepare for real-world applications:

- Example 1: Missing Transaction – A payment of $1,500 was made, but it hasn’t been recorded in the external statement. How would you adjust the internal records to reflect this payment?

- Example 2: Bank Fees – The external statement shows a bank fee of $30 that was not previously recorded in the internal records. How would you account for this fee?

- Example 3: Outstanding Deposits – An outstanding deposit of $2,000 is listed in the internal records but has not yet cleared. How should this be addressed during the alignment process?

- Example 4: Double Entry Error – A transaction was accidentally recorded twice in the internal records, showing a total of $500 more than it should. How can this error be corrected?

- Example 5: Timing Differences – A transaction recorded in the external statement is dated after the close of the internal accounting period. How do you manage this timing difference when adjusting the records?

By practicing with such examples, you can refine your technique and approach to resolving discrepancies, preparing yourself for a wide range of scenarios you may encounter in real-world financial situations.

Practical Tips for Time Management

Effective time management is essential when dealing with complex tasks, especially those that require careful attention to detail and a systematic approach. Managing your time wisely can help you stay organized, meet deadlines, and reduce stress. Below are some practical tips to help you improve your time management skills when working through tasks that require precision and problem-solving.

- Prioritize Tasks: Start by identifying the most important tasks and tackle them first. Focus on completing high-priority items before moving on to less urgent ones.

- Set Time Limits: Allocate specific time blocks for each task to prevent spending too much time on any one aspect. Setting a timer can help you stay focused and on track.

- Break Tasks into Smaller Steps: Large tasks can feel overwhelming. Break them down into smaller, manageable steps to make the process less daunting and keep momentum going.

- Avoid Multitasking: Multitasking can decrease efficiency and increase errors. Focus on one task at a time to ensure accuracy and speed.

- Take Breaks: Regular breaks are essential to maintaining focus. Step away from your work for a few minutes to recharge, which will help you stay productive in the long run.

- Stay Organized: Keep all necessary resources and documents organized to minimize time spent searching for information. This will help you stay focused and work more efficiently.

- Review Progress Regularly: Regularly check your progress to ensure that you’re on track to meet deadlines. Adjust your approach if necessary to stay efficient and avoid last-minute rushes.

By implementing these strategies, you can better manage your time, reduce stress, and increase the quality and efficiency of your work. Time management is a valuable skill that, when practiced, can make complex tasks more manageable and lead to greater success in your efforts.

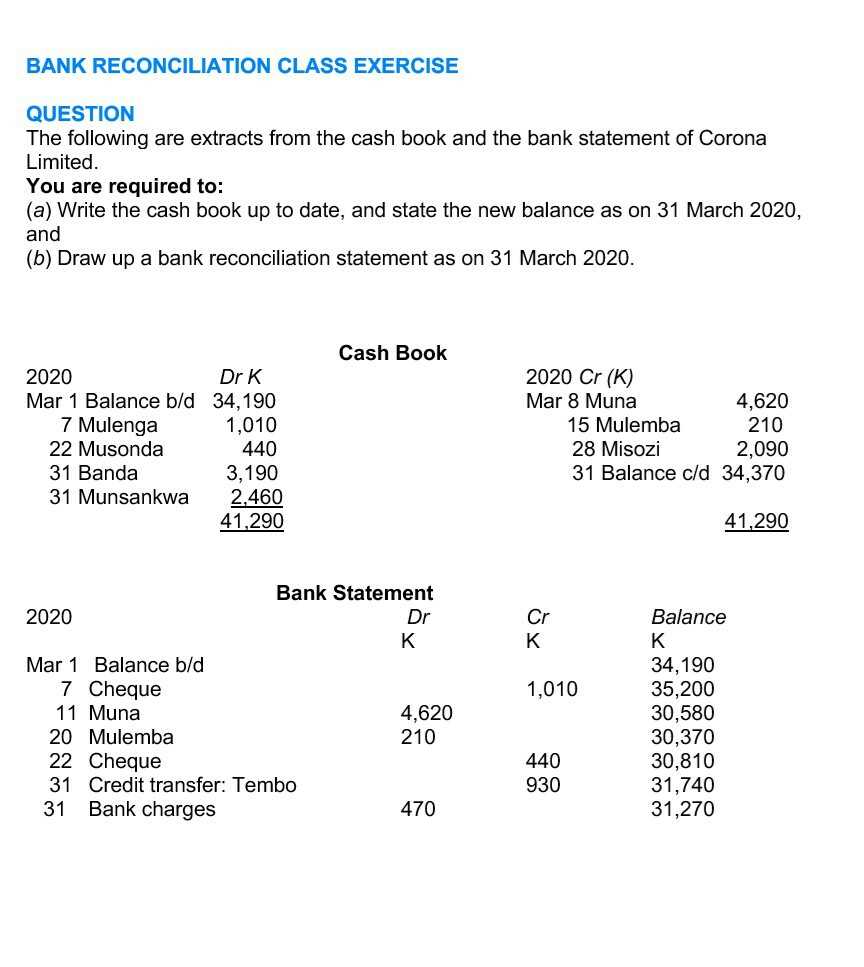

Exploring Case Studies

Case studies provide real-world examples that illustrate the common challenges faced when aligning internal and external financial records. These practical scenarios help deepen your understanding of the process and offer insight into how different issues are resolved. By examining detailed case studies, you can learn from past experiences and improve your ability to handle similar situations effectively.

Below is a case study that highlights key issues and solutions during the process of matching records:

| Case Study | Issue | Solution |

|---|---|---|

| Case 1: Timing Discrepancies | Transactions listed in the internal records but not yet appearing in the external statement. | Reconcile the timing differences and make necessary adjustments once the transactions are reflected in the statement. |

| Case 2: Unrecorded Fees | Bank fees or charges not recorded in internal accounting. | Review the statement for fees and update internal records to match the charges listed in the external document. |

| Case 3: Incorrectly Logged Payment | A payment recorded in the internal records but marked incorrectly in the external statement. | Verify the payment details and correct the misentry in the internal records to align with the external statement. |

| Case 4: Outstanding Deposits | A deposit made that appears in internal records but has not yet cleared the financial institution. | Mark the deposit as outstanding and ensure it is reconciled once it clears the financial institution in the following cycle. |

Exploring such case studies allows you to grasp the complexities of financial record alignment and learn effective methods for resolving common issues. By practicing with these scenarios, you can build the skills necessary to address discrepancies with accuracy and confidence.

How to Interpret Financial Alignment Reports

Understanding the details within financial alignment reports is essential for accurately matching records between internal documentation and external statements. These reports contain important information that highlights any discrepancies, adjustments, or updates needed to ensure consistency between both sets of records. By interpreting these reports effectively, you can identify errors, track pending transactions, and ensure your financial information is accurate and up-to-date.

Here are key components to focus on when reviewing these reports:

- Starting and Ending Balances: Verify the starting balance from the previous period and compare it with the ending balance from the current period. Ensure they match, taking into account all adjustments made during the period.

- Outstanding Transactions: Check for transactions that appear in internal records but have not yet been processed or reflected in external statements. These may include pending checks, deposits, or transfers.

- Adjustments: Look for any necessary adjustments made to account for errors, such as discrepancies in amounts, missed entries, or unrecorded fees. Ensure these adjustments align with the changes required to reconcile the two sets of records.

- Unrecorded Fees or Charges: Identify any fees or charges from the financial institution that have not been documented internally. These charges must be added to the internal records to ensure complete alignment.

- Cleared Transactions: Confirm that all transactions listed in the report have been cleared through the external financial institution. Any transaction still pending should be noted and tracked for future reconciliation.

By carefully analyzing these sections, you can pinpoint any issues, discrepancies, or unaccounted-for transactions, enabling you to take the necessary steps for accurate record-keeping. Understanding how to interpret these reports is crucial for maintaining financial integrity and ensuring that all records align properly.

Understanding the Impact of Errors

Errors in financial records, whether from simple mistakes or overlooked discrepancies, can have significant consequences on the accuracy and integrity of overall accounting systems. Small miscalculations or omissions can snowball, leading to larger issues such as inaccurate reports, faulty decision-making, and a lack of trust in financial statements. Identifying and understanding the sources and effects of these errors is crucial for maintaining a reliable financial system.

Here are some common ways errors can impact your records:

- Inaccurate Financial Statements: A minor mistake in recording transactions can lead to a misrepresentation of assets, liabilities, or equity, resulting in misleading financial statements that could affect both internal decision-making and external evaluations.

- Operational Disruptions: Errors can disrupt day-to-day operations by causing delays in processing transactions or requiring extra time and effort to locate and correct mistakes. This can lead to inefficiencies, higher costs, and potential customer dissatisfaction.

- Compliance Risks: Unresolved discrepancies in financial data can lead to non-compliance with regulatory standards and tax laws. This can result in penalties, fines, or legal actions, affecting the credibility of the organization.

- Budgeting and Forecasting Issues: When errors are present in the financial records, it becomes difficult to accurately forecast future expenditures or income. This can lead to poor budgeting decisions and inaccurate financial projections.

- Impact on Stakeholder Trust: Repeated or unaddressed errors can lead to a loss of trust among stakeholders, including investors, auditors, and creditors. A lack of confidence in the accuracy of financial records can negatively impact business relationships and opportunities.

Understanding these potential impacts highlights the importance of careful monitoring, thorough review processes, and prompt error correction to safeguard the financial health of an organization. Ensuring that all records are free from mistakes will help maintain operational efficiency and build trust with stakeholders.

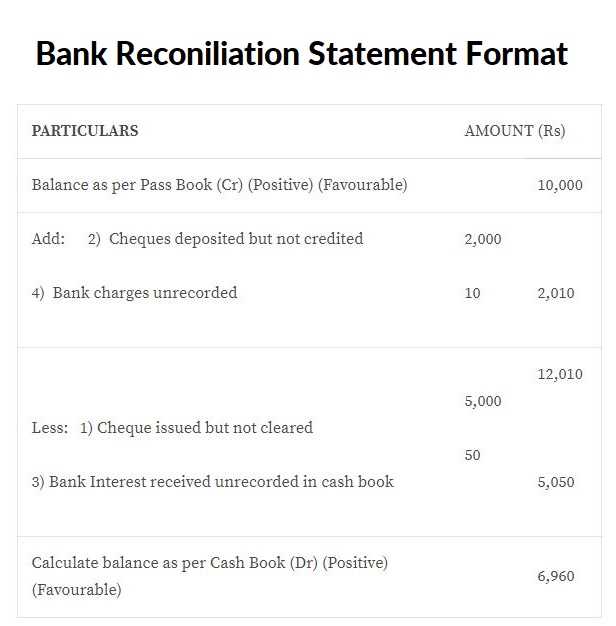

Examining Adjustments in Bank Balances

When reviewing financial records, it is essential to understand the adjustments made to account balances. These changes are often necessary to ensure that the actual balance matches the expected figures, taking into account various transactions that have not been recorded or processed yet. Adjustments can stem from timing differences, errors, or accounting practices, and they play a key role in maintaining the accuracy of financial reporting.

Types of Adjustments

Adjustments to balances can occur in several forms, each impacting the final calculation in different ways:

- Outstanding Transactions: These include deposits and withdrawals that have been initiated but not yet processed by the financial institution. They may affect the reported balance temporarily until the transaction is fully completed.

- Bank Fees: Fees charged by financial institutions for services such as account maintenance or overdrafts often go unrecorded in the business’s books. These must be added to the balance to reflect the true amount available.

- Errors in Recording: Mistakes can occur during the recording of deposits or withdrawals, such as entering an incorrect amount or omitting a transaction entirely. Correcting these errors is critical to maintaining accurate financial records.

- Interest Adjustments: Banks often apply interest to accounts, which may not immediately be reflected in the company’s records. These adjustments ensure the reported balance reflects the actual amount after interest is accounted for.

Impact of Adjustments on Financial Accuracy

Understanding how and why adjustments are made is crucial for ensuring that the recorded balances align with the true financial position. Without proper adjustments, discrepancies can arise that may lead to misstatements in financial reporting, which in turn affects decision-making, budgeting, and compliance. By carefully monitoring and reconciling all adjustments, businesses can safeguard the integrity of their financial data.

How to Solve Complex Reconciliation Problems

When faced with intricate issues involving discrepancies between records and actual figures, it is crucial to apply a structured approach to resolve the differences. Complex problems often arise due to various factors such as unprocessed transactions, errors, or even differences in reporting formats. A systematic method can help identify the root cause of the problem and ensure accurate financial reporting.

Steps to Approach Difficult Issues

Here is a step-by-step guide to help break down and solve intricate problems in financial data matching:

- Gather All Necessary Documents: Ensure you have access to all relevant documents, including transaction records, statements, and any supporting notes that could provide insight into discrepancies.

- Identify Missing or Unprocessed Transactions: Review the records to identify any transactions that have not yet been recorded or completed. Outstanding deposits or withdrawals may be the cause of discrepancies.

- Check for Errors: Thoroughly examine both sets of records for any potential errors, such as incorrect amounts, duplicate entries, or missing data.

- Calculate the Adjustments: Apply necessary adjustments, such as fees or interest, that may not have been reflected in the initial records. Ensure the balances are properly updated to reflect these changes.

- Reconcile the Data: Once all discrepancies are addressed, attempt to reconcile the records, ensuring the final balance matches the expected figure. This is often achieved by balancing both sets of records through careful calculations.

Example of a Complex Problem

Below is an example of how a typical reconciliation problem might be addressed:

| Transaction | Company Record | Bank Statement | Adjustment |

|---|---|---|---|

| Deposit | $500 | $500 | – |

| Withdrawal | $200 | $250 | $50 (Error) |

| Fee | $0 | $30 | $30 (Adjustment) |

| Interest | $0 | $10 | $10 (Adjustment) |

In this example, errors and missing adjustments are identified, and the final balance is adjusted accordingly. By following a clear process, complex discrepancies can be resolved efficiently, ensuring accurate records.