Understanding financial thresholds is a crucial skill for both students and professionals. It involves calculating critical points that determine success in financial endeavors. This knowledge is essential for evaluating business strategies and making informed decisions.

In this guide, you will find practical explanations and effective methods for tackling problems related to cost management and profitability. These insights aim to enhance comprehension and prepare you for real-world applications.

Explore detailed discussions, step-by-step examples, and proven strategies designed to simplify challenging calculations. With these tools, you can confidently approach related problems and achieve clarity in this vital area of financial literacy.

Understanding Financial Threshold Calculation for Assessments

Mastering the concepts behind determining critical points where revenue equals costs is essential for tackling related problems. This ability is fundamental to evaluating business performance and decision-making. Students should focus on interpreting data, identifying key factors, and applying appropriate formulas.

In academic settings, it’s important to recognize how costs and profits interact. Students must be able to solve problems that test their understanding of these relationships, often requiring a blend of practical knowledge and theoretical understanding.

| Factor | Definition |

|---|---|

| Fixed Costs | Costs that remain constant regardless of the level of production or sales. |

| Variable Costs | Costs that change in direct proportion to the level of production or sales. |

| Contribution Margin | The amount remaining from sales revenue after variable costs are deducted. |

| Target Profit | The desired profit a company aims to achieve after covering all costs. |

By understanding these elements, you will be better equipped to approach questions on this topic and apply the appropriate methods. It’s also crucial to practice interpreting graphs and charts, as they often accompany such problems.

Key Concepts of Financial Threshold Calculation

Understanding the fundamental elements involved in identifying the point where costs match income is essential for mastering related topics. These concepts provide a framework for evaluating the financial viability of a business or project. Grasping these principles will help you approach complex problems with confidence and clarity.

The core ideas revolve around distinguishing between different types of costs, understanding how they interact, and calculating the pivotal moment when a business moves from loss to profit. This foundation is crucial for solving problems effectively in both theoretical and practical contexts.

| Concept | Explanation |

|---|---|

| Fixed Costs | Expenses that do not change with the level of production or sales, such as rent or salaries. |

| Variable Costs | Costs that fluctuate depending on production output, such as materials or labor. |

| Contribution Margin | The revenue left after subtracting variable costs, contributing to covering fixed costs. |

| Target Profit | The amount of profit a business aims to achieve after covering all costs. |

Familiarity with these terms allows you to solve a variety of problems efficiently, whether calculating the point where costs equal income or determining the financial success of different ventures.

Common Exam Questions on Profitability

Evaluating profit-related scenarios requires an understanding of how costs, revenue, and other financial factors interact. These topics test both analytical skills and the ability to apply theoretical knowledge to practical situations. Mastering key methods and strategies is essential for success.

Typical Scenarios to Solve

- Calculating the revenue needed to achieve a specific profit goal.

- Determining the impact of cost changes on profitability.

- Identifying the effect of price adjustments on overall margins.

Steps to Approach Problems

- Identify all fixed and variable costs in the given scenario.

- Calculate total revenue and how it compares to expenses.

- Analyze how adjustments, such as cost reductions or price increases, affect outcomes.

Focusing on these key areas helps build confidence and ensures readiness for a variety of tasks. Practicing with realistic examples and reviewing core principles will improve your ability to evaluate financial situations accurately.

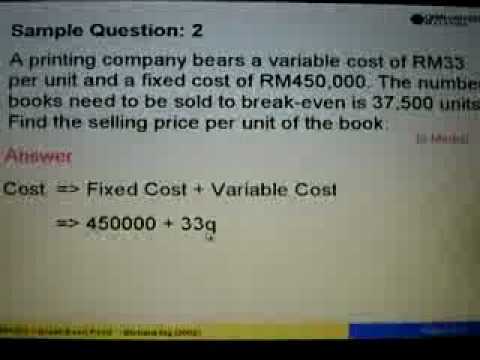

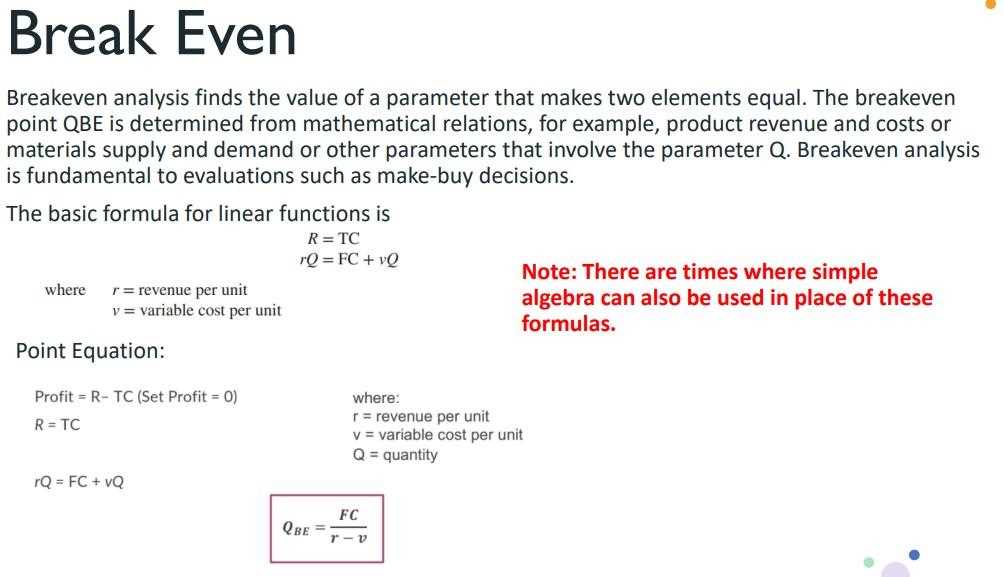

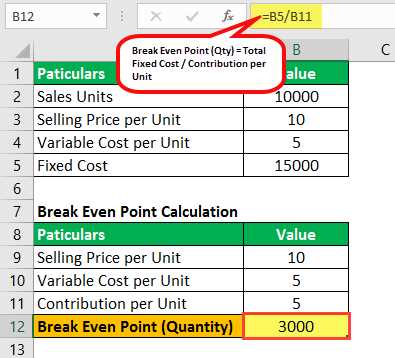

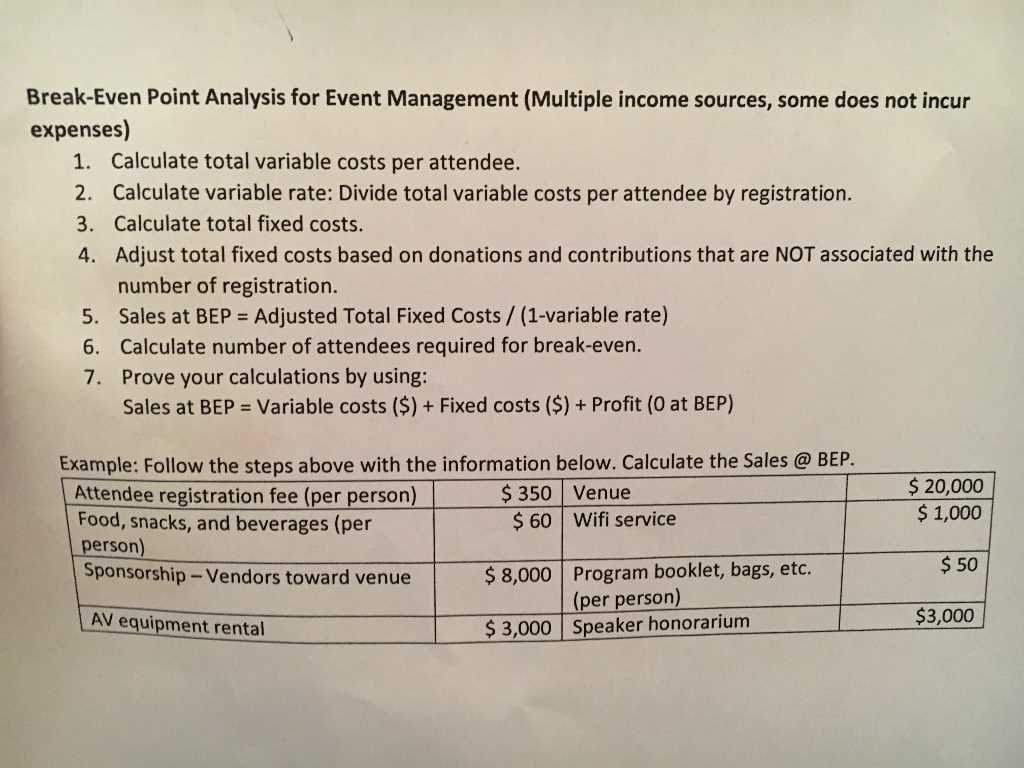

How to Calculate Profitability Threshold

To determine when a business shifts from a loss to profitability, understanding the relationship between costs and revenue is key. This calculation identifies the point at which total revenue equals total expenses, helping businesses assess their financial viability. The process is straightforward and involves basic arithmetic, but a clear understanding of each component is essential for accurate results.

The calculation typically requires knowledge of fixed costs, variable costs per unit, and the price at which the product or service is sold. By applying a simple formula, you can find the point where the total revenue covers both fixed and variable costs, indicating the moment when a business becomes profitable.

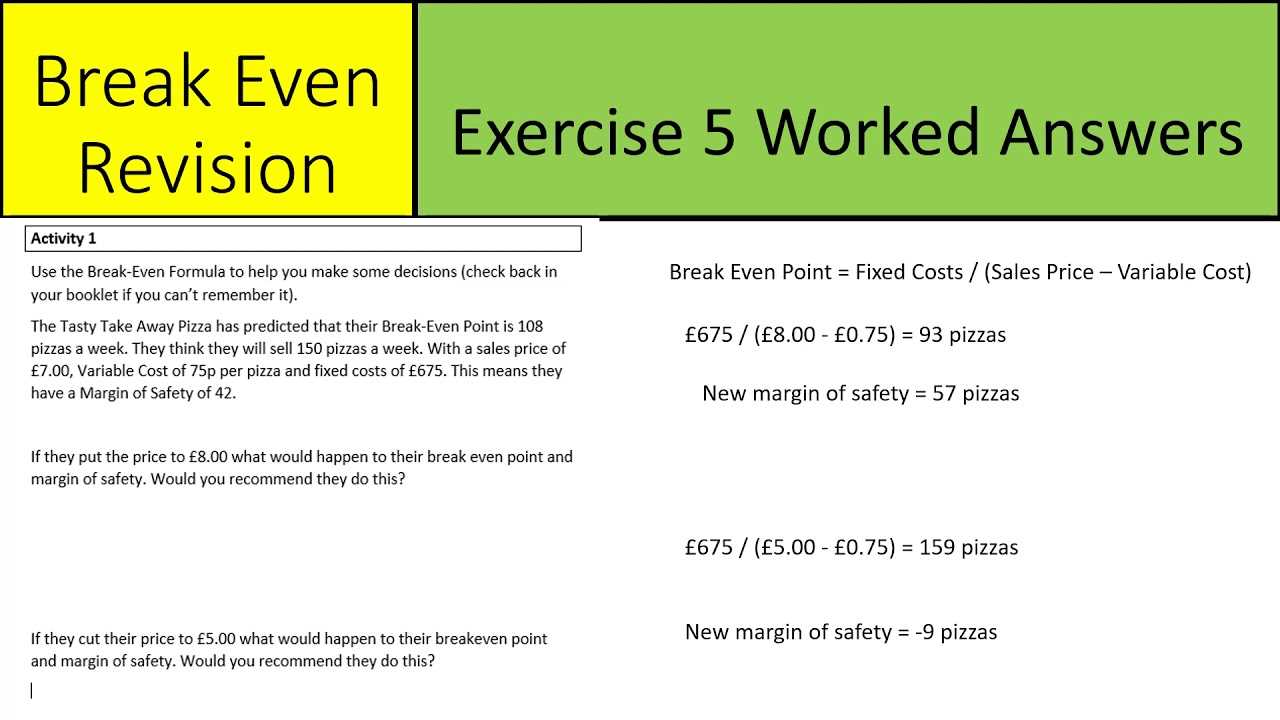

Once you have the necessary values, the formula to calculate the profitability threshold is:

Break-Even Point = Fixed Costs / (Price per Unit – Variable Cost per Unit). This formula gives you the number of units that must be sold to cover all costs.

Identifying Fixed and Variable Costs

Understanding the distinction between costs that remain constant and those that fluctuate with production is essential for analyzing financial performance. This differentiation helps in planning budgets and predicting how changes in operations affect profitability. Both types of expenses play a significant role in financial calculations and decision-making.

Characteristics of Fixed Costs

- Remain unchanged regardless of production or sales levels.

- Examples include rent, salaries, and insurance premiums.

- Provide stability but require careful management to avoid overextension.

Characteristics of Variable Costs

- Change directly with the level of production or sales.

- Examples include raw materials, direct labor, and shipping expenses.

- Offer flexibility but require monitoring to maintain profitability.

To identify these costs, examine expense reports and categorize each item based on its behavior in relation to production levels. This classification is crucial for accurate financial planning and ensuring sustainable operations.

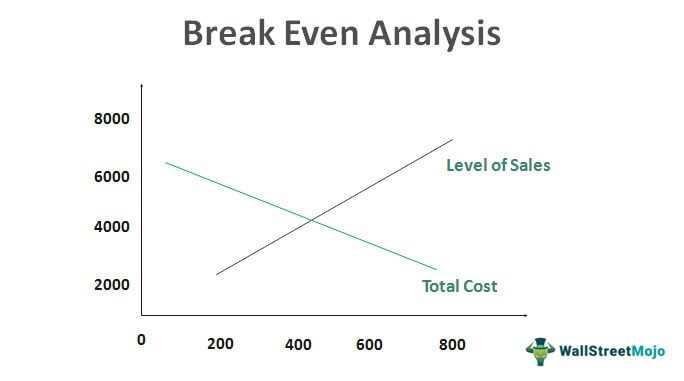

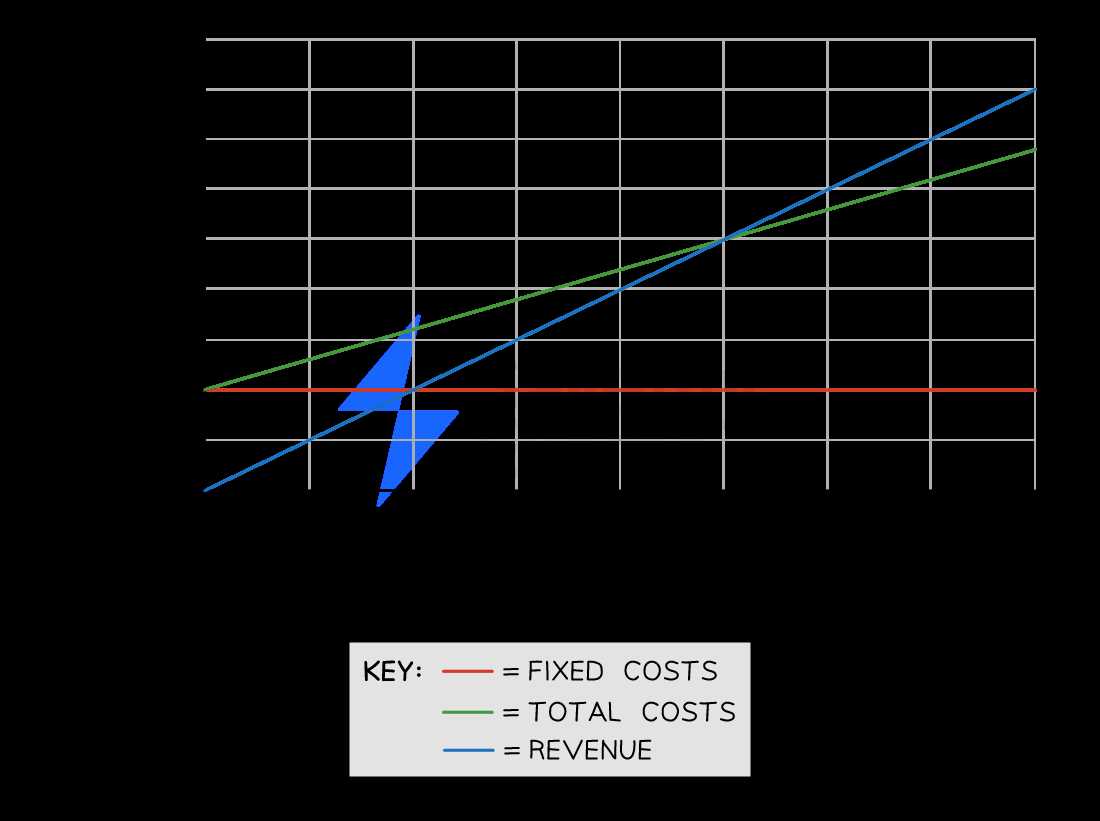

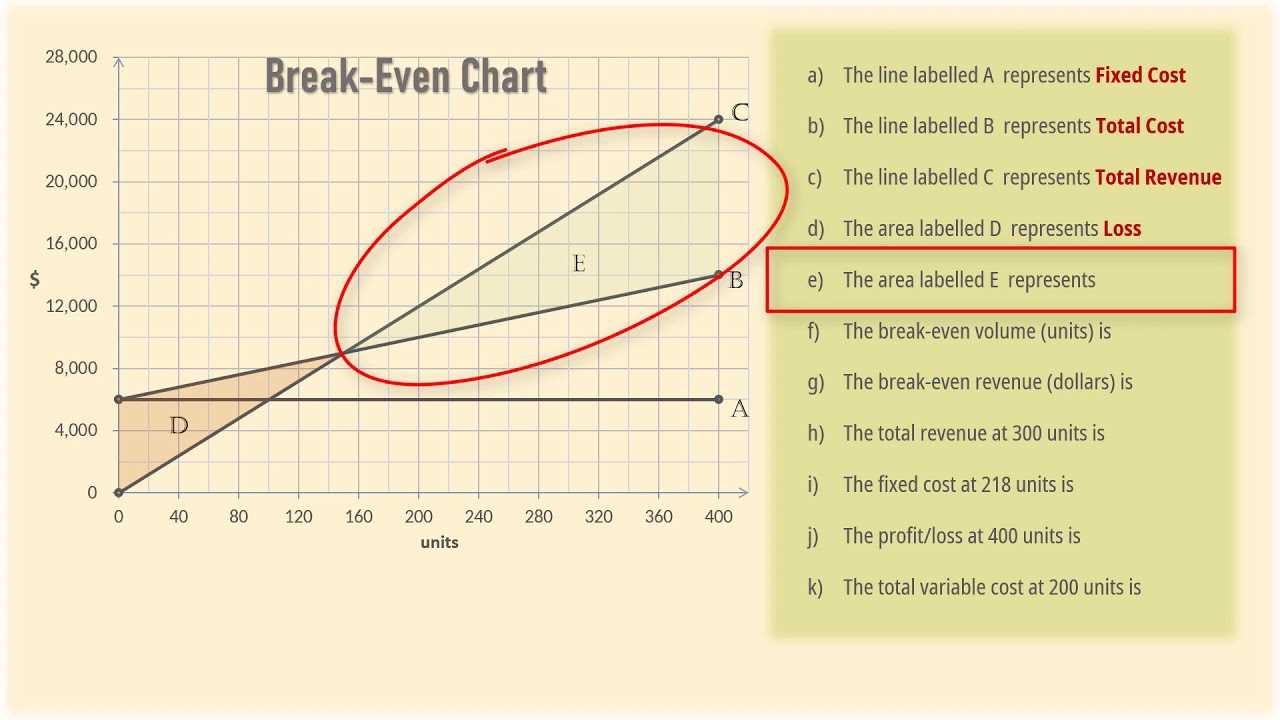

Analyzing Profitability Graphs in Tests

Interpreting financial graphs that display the point at which revenue covers costs is a crucial skill for any financial assessment. These graphs provide a visual representation of how income, costs, and profit levels interact over various production or sales volumes. By understanding the key elements, you can draw insights that simplify complex calculations and improve decision-making.

Understanding the Components

- The horizontal axis typically represents the number of units sold or produced.

- The vertical axis shows the total revenue and costs.

- The intersection of the revenue line and cost line indicates the point where profit begins.

Key Steps for Interpreting the Graph

- Identify the point where the total cost line crosses the revenue line.

- Note the corresponding sales volume or revenue at this point.

- Evaluate how changes in fixed or variable costs would affect this intersection.

By practicing with these graphs, you can quickly identify the financial balance points and predict the outcomes of various scenarios. Mastering this skill ensures efficient problem-solving during financial assessments.

Importance of Margin of Safety

The margin of safety is a critical concept for assessing the financial stability of a business. It provides a cushion that helps measure how much sales can decline before the company reaches a point of no profitability. Understanding this margin allows businesses to navigate potential risks and make informed decisions to maintain financial health.

This margin is especially useful when considering the potential for fluctuations in sales, as it helps assess the risk of losses during unfavorable market conditions. A higher margin of safety indicates a greater buffer against changes in revenue, ensuring the company remains in the profitable zone for longer.

In practice, calculating this margin involves subtracting the break-even sales from actual sales and dividing the result by actual sales. This ratio gives a clear picture of how much sales can drop before reaching a loss.

| Sales | Break-even Sales | Margin of Safety |

|---|---|---|

| $200,000 | $150,000 | 25% |

| $300,000 | $200,000 | 33.33% |

By regularly calculating and monitoring this margin, businesses can better prepare for potential downturns, adjust pricing strategies, and optimize resource management to safeguard against financial instability.

Profitability Threshold and Financial Decision Making

Understanding the point at which a company’s total revenue covers its total costs plays a vital role in shaping effective financial decisions. This critical point allows managers to evaluate the financial health of a business and make informed decisions regarding pricing, production levels, and investment strategies.

By knowing where revenue matches costs, companies can set more accurate sales targets, plan for profitability, and assess the risks associated with different business strategies. This insight is particularly useful when determining how much sales can drop before a company starts operating at a loss. It also helps in deciding whether to cut costs or adjust pricing strategies to maintain profitability.

Incorporating this knowledge into decision-making processes ensures that businesses are better equipped to handle market fluctuations, optimize operations, and sustain long-term financial success. Understanding this financial threshold helps guide choices in areas such as product development, marketing, and overall resource allocation.

Types of Questions on Contribution Margin

When it comes to evaluating a company’s financial health, understanding the contribution margin is essential. This figure helps determine how much money is available to cover fixed costs after covering variable costs. Questions surrounding this metric often focus on how to calculate, interpret, and use it effectively in decision-making processes.

One common area of focus is calculating the contribution margin per unit. These questions typically require candidates to identify the variable costs and the selling price of a product and then use this information to compute the margin. Another common type involves calculating the overall contribution margin for a company based on total revenue and total variable costs, often asking for a percentage or ratio of this margin in relation to sales.

In some cases, questions may involve analyzing how changes in pricing, costs, or sales volume impact the contribution margin. These types of questions assess a person’s ability to make strategic decisions based on changes in costs or market conditions, providing a practical understanding of how to maintain or improve profitability.

Understanding Profitability Threshold in Real Life

In real-life scenarios, reaching the point where a business’s income exactly matches its expenditures is a key milestone for ensuring sustainability. This concept is not just a theoretical model; it plays a crucial role in daily decision-making for businesses across various industries. By understanding this threshold, companies can navigate their operations with greater clarity, ensuring they remain profitable as market conditions evolve.

For example, a startup might use this concept to assess the viability of a new product. By calculating how many units need to be sold to cover all fixed and variable costs, they can set sales targets and determine how long it will take to achieve profitability. Similarly, established businesses rely on this knowledge when planning expansions, launching new services, or making pricing adjustments, as it helps them identify how changes in cost structures or sales volumes will affect their overall profitability.

Real-life application of this knowledge helps companies prepare for fluctuating market conditions, avoid risky financial decisions, and ensure they can cover all costs while making a profit. With accurate insight into the profitability threshold, businesses can make informed decisions that align with their long-term financial goals.

Common Mistakes in Profitability Calculations

Calculating the point at which a company’s revenue covers its total costs is a straightforward task, but errors can easily occur, leading to inaccurate results. These mistakes can impact business decisions and financial strategies. Recognizing and avoiding these common pitfalls is crucial for achieving reliable calculations and making informed choices.

Some of the most frequent mistakes include incorrect classification of costs, improper use of formulas, and overlooking key factors such as changing sales prices or variable costs. These errors can distort the final result, leading to misguided decisions about pricing, production, or resource allocation.

Common Mistakes

- Misclassifying Fixed and Variable Costs: Failing to accurately separate costs that remain constant from those that fluctuate with production can lead to incorrect profitability estimates.

- Using the Wrong Formula: Incorrectly applying formulas or mixing up units of measurement can cause major discrepancies in results.

- Ignoring Changes in Costs: Failing to account for changes in costs, such as fluctuating raw material prices, can affect the accuracy of the profitability threshold.

- Not Accounting for Non-Operating Costs: Sometimes, businesses overlook non-operating expenses, such as interest payments or taxes, which can affect the true profitability level.

By carefully reviewing cost classifications and ensuring the correct application of formulas, businesses can avoid these mistakes and gain a clearer understanding of their financial position. Awareness of potential errors helps businesses maintain financial accuracy and make smarter decisions moving forward.

Profitability Threshold in Cost-Volume-Profit Models

In financial modeling, understanding the relationship between costs, sales volume, and profit is critical for making informed business decisions. One of the most powerful tools for visualizing and calculating this relationship is through cost-volume-profit (CVP) models. These models help businesses determine how changes in cost structures or sales volumes impact overall profitability, with the profitability threshold playing a central role in these analyses.

By using a CVP model, businesses can predict the minimum level of sales needed to cover all costs, both fixed and variable. This helps in setting realistic sales targets, planning for different production scenarios, and identifying the impact of price changes on overall profitability. The model highlights how sales volume and cost management interact to influence the bottom line.

Key Components in CVP Models

- Fixed Costs: These costs do not change with the volume of goods or services produced. They must be covered regardless of sales performance.

- Variable Costs: These costs fluctuate based on the number of units produced. As production increases, so do variable costs.

- Contribution Margin: The amount remaining from sales after covering variable costs. This amount contributes toward covering fixed costs and generating profit.

- Sales Volume: The number of units sold that impacts both revenue and the ability to cover all costs.

Incorporating profitability thresholds into cost-volume-profit models provides businesses with a powerful tool for financial planning and decision-making. By calculating this threshold, companies can make informed choices about pricing strategies, production volumes, and cost management to maximize profitability and minimize risk.

How to Interpret Profitability Graphs

Graphs illustrating profitability are essential tools for understanding the financial dynamics of a business. These visual representations offer insights into how costs and revenue interact over different levels of production or sales volume. Interpreting such graphs allows stakeholders to make informed decisions about pricing, production strategies, and cost management. The key lies in understanding the relationships between the different components represented, such as fixed costs, variable costs, and revenue.

Identifying Key Points on the Graph

- Break-Even Point: The point where total costs and total revenue intersect. It indicates the level of sales at which a business covers all its costs but does not yet generate profit.

- Profit Area: The region of the graph above the break-even point where total revenue exceeds total costs, signifying a profit.

- Loss Area: The region below the break-even point, where total costs exceed total revenue, indicating a loss.

Understanding the Slopes and Curves

- Revenue Line: Typically shown as a straight upward slope, this line illustrates how revenue increases with higher sales or production levels.

- Cost Lines: The total cost line includes both fixed and variable costs. The fixed cost line remains horizontal, while the variable cost line slopes upward as production increases.

- Contribution Margin: The distance between the revenue line and total cost line after the break-even point represents the contribution margin, showing how much of each additional unit sold contributes to profit.

By studying these graphs, businesses can quickly determine their financial standing, identify risks, and adjust their strategies accordingly to ensure long-term profitability and sustainability.

Strategies for Answering Profitability Calculations

When faced with questions related to financial equilibrium, a structured approach can ensure clarity and precision in your responses. These types of problems often require calculating different elements, such as fixed costs, variable costs, revenue, and profit margins. By following a systematic method, you can effectively tackle these challenges, ensuring each component is addressed correctly.

Step-by-Step Approach

- Read the Question Carefully: Understand all the data provided and what is being asked. Pay attention to key figures like unit costs, selling price, and total fixed costs.

- Identify the Relevant Formulas: Be familiar with common formulas for profit, contribution margin, and the point where costs and revenues meet.

- Break Down the Components: Divide the problem into manageable parts. For example, calculate fixed costs first, followed by variable costs, and finally revenue. This ensures no detail is overlooked.

- Show All Work: Document each calculation step to demonstrate your understanding. This will also help you spot mistakes if something seems off.

- Check Your Results: Once the calculation is complete, review it. Ensure that your final answer makes logical sense in the context of the question.

Key Tips for Success

- Familiarize Yourself with Graphs: Practice interpreting graphs related to cost, volume, and profitability. Being able to read these visuals quickly will save time in solving problems.

- Use Approximation for Quick Checks: If unsure, use estimates to quickly check whether the results make sense. A rough estimate of the break-even point or profit margin can serve as a good sanity check.

- Stay Organized: Present your work clearly, labeling each step of the calculation. This will make your reasoning easy to follow and improve your chances of earning full marks.

By practicing these strategies, you can approach financial problems with confidence and efficiency, ensuring that your answers are both accurate and well-supported by logical steps.

Factors Affecting Profitability Threshold

Several variables influence the point at which a company covers its costs and starts generating profit. Understanding these factors is crucial for making informed business decisions and optimizing financial performance. Changes in certain elements, such as costs and pricing, can significantly shift this critical threshold.

Cost Variables

The two primary types of costs–fixed and variable–play a significant role in determining the point where a company’s total revenue matches its total expenses.

- Fixed Costs: These costs remain constant regardless of production levels. Rent, salaries, and insurance are examples. Any increase in fixed costs will raise the profitability threshold, requiring higher sales to reach the same financial goal.

- Variable Costs: These fluctuate with production or sales volume. Materials and labor directly tied to product output are considered variable costs. A rise in variable costs means that more sales will be needed to cover these additional expenses.

Pricing Strategy

Setting the right price for products or services is essential in determining the number of units required to cover costs. If prices are too low, the sales volume required to reach profitability increases, while higher prices reduce the volume needed. However, setting prices too high can affect demand.

- Pricing and Competitiveness: Companies must consider their competitors’ pricing to ensure their offerings remain attractive while maintaining profitability.

- Discounts and Promotions: Temporary reductions in price can affect overall revenue and sales volumes, influencing the profitability threshold.

Market Demand

Demand for a product or service directly impacts the ability to reach a profitable state. Higher demand typically reduces the number of sales needed to cover costs. Fluctuating demand can also necessitate changes in pricing or cost structure to maintain profitability.

- Seasonality: Many businesses experience fluctuations in demand depending on the time of year. These changes may require adjustments in strategies to maintain a consistent revenue stream.

- Consumer Preferences: Shifts in consumer behavior and preferences can either increase or decrease demand, which in turn affects how quickly costs are covered.

By understanding these factors, businesses can better manage their pricing strategies, cost structure, and sales projections to optimize profitability and improve financial outcomes.

Profitability Calculation for Multiple Products

When a company offers more than one product, determining the profitability threshold becomes more complex. Unlike a single-product scenario, the costs and revenues must be allocated and analyzed for each product to understand the overall financial position. This requires careful consideration of the contribution margin for each product and how they collectively impact total fixed costs and the sales volume required to cover them.

Contribution Margin per Product

Each product will have its own contribution margin, which is calculated as the difference between the selling price and the variable costs. The contribution margin is crucial in determining how much each product contributes to covering the fixed costs.

| Product | Selling Price | Variable Costs | Contribution Margin |

|---|---|---|---|

| Product A | $20 | $10 | $10 |

| Product B | $15 | $5 | $10 |

| Product C | $30 | $12 | $18 |

Calculating the Overall Profitability Point

To determine the sales volume required to cover all fixed costs when selling multiple products, the weighted average contribution margin must be calculated. This involves factoring in the sales mix, or the proportion of each product sold. The formula is as follows:

- Weighted Average Contribution Margin = (Product A Contribution Margin x Sales Mix A) + (Product B Contribution Margin x Sales Mix B) + (Product C Contribution Margin x Sales Mix C)

- Required Sales Volume = Total Fixed Costs / Weighted Average Contribution Margin

This method allows businesses to determine the total number of units across all products that must be sold to cover fixed expenses, while also taking into account the different profit margins contributed by each product.

Practical Tips for Preparing for Assessments

Preparing for financial assessments can be challenging, but with the right approach, you can improve your chances of success. Understanding key concepts and practicing problem-solving techniques is essential. The more you familiarize yourself with the material, the more confident you will feel when faced with questions on the subject. Below are several useful strategies that can help streamline your preparation process.

Focus on Key Concepts

Rather than trying to memorize every detail, focus on mastering the core concepts. Grasping the foundational principles will make it easier to tackle different types of problems. For instance, understanding cost structures, revenue generation, and how to calculate profit thresholds is crucial. Make sure you are comfortable with the underlying formulas and calculations that are commonly tested.

Practice Regularly

Practice is essential when preparing for any type of assessment. Work through as many sample problems and past exercises as you can. This will not only help you get familiar with the format of the tasks but also improve your ability to apply concepts under time pressure. Set a study schedule and stick to it, allowing enough time to review different topics without feeling rushed.

- Review past material and focus on areas where you feel less confident.

- Work through practice problems to build familiarity with the content.

- Time yourself when completing exercises to improve speed and accuracy.

By utilizing these techniques and remaining consistent in your preparation, you can significantly improve your performance on assessments and feel more prepared for any financial analysis-related challenges.