Mastering the core principles of financial evaluation is essential for success in any assessment related to this field. The ability to understand complex concepts and apply them effectively is crucial for performing well under pressure. The process of preparing involves not only learning the theoretical aspects but also becoming proficient in solving practical problems.

Practical exercises play a key role in familiarizing oneself with various challenges. Through consistent practice, you can build confidence in applying the principles to real-world scenarios. Focused preparation allows you to break down difficult topics into manageable segments, improving both your speed and accuracy when faced with similar tasks.

It’s important to approach the material with a systematic mindset, reviewing important techniques and identifying key areas where improvement is needed. By mastering the necessary skills and understanding the patterns of common problems, you can ensure that you are well-equipped to handle any challenge that comes your way.

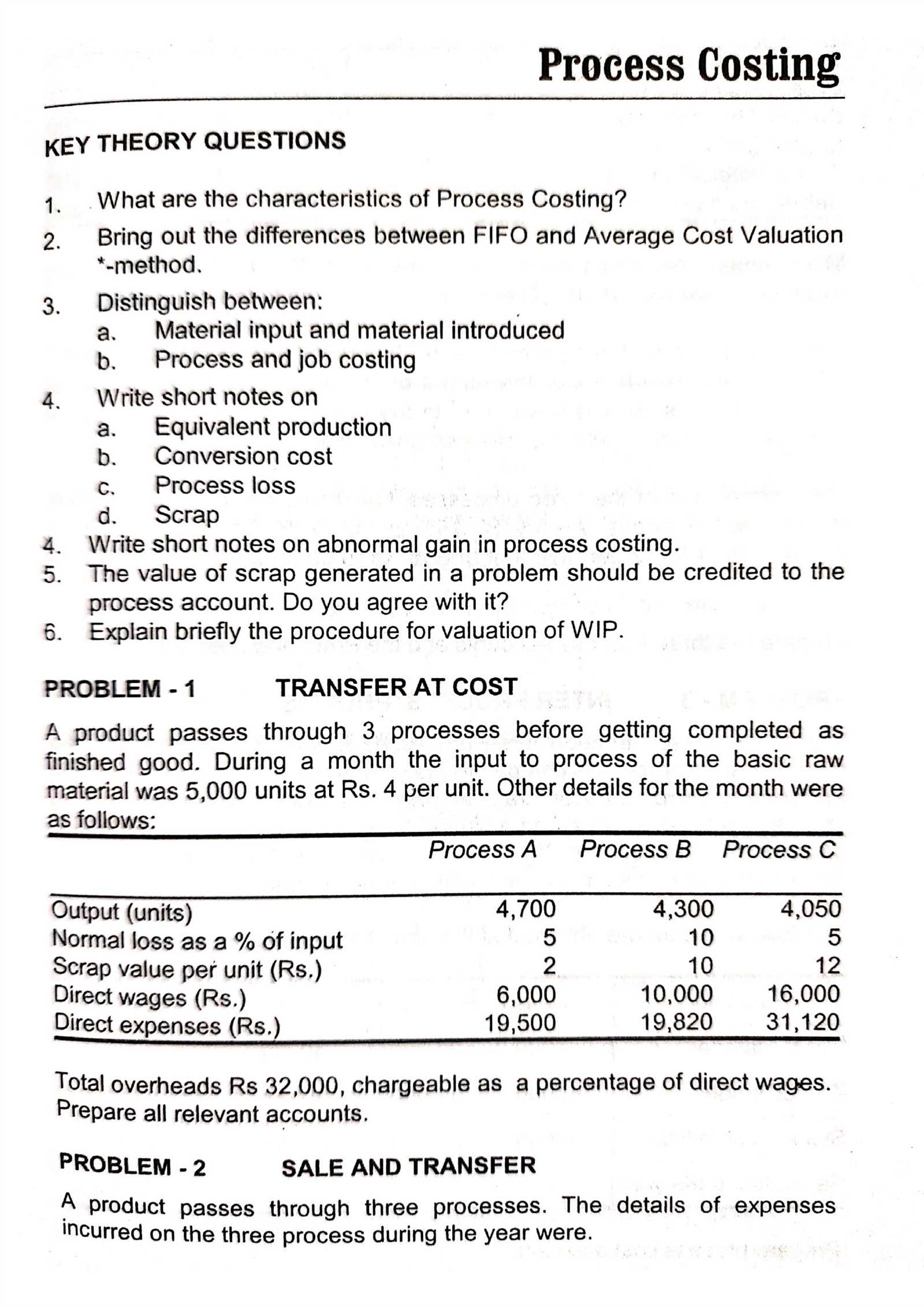

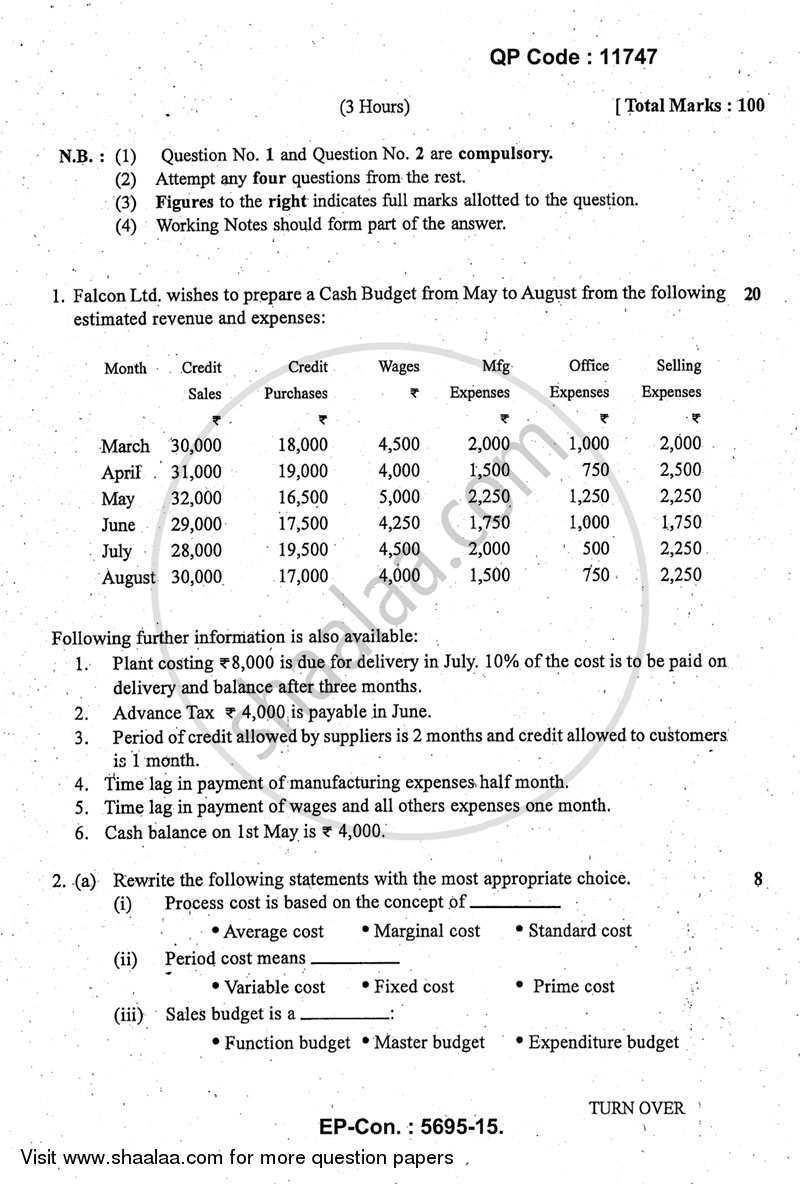

Cost Accounting Exam Questions and Answers

To excel in financial assessments, it’s essential to familiarize oneself with the typical tasks that may arise. These challenges often test your ability to apply theoretical knowledge in practical scenarios, requiring a deep understanding of underlying principles. Mastering the core concepts prepares you to tackle a wide variety of problems with confidence and precision.

Understanding the Key Concepts

The ability to break down complex problems into smaller, more manageable components is crucial. Focus on mastering the key principles such as calculating expenses, evaluating profit margins, and applying cost allocation methods. With practice, these techniques will become second nature, enabling you to approach problems swiftly and accurately.

Practice Makes Perfect

To truly prepare, engaging with a variety of sample tasks is vital. These exercises provide an opportunity to test your knowledge, refine your skills, and uncover any areas where further study is needed. By simulating the experience of real-world challenges, you can ensure that you are well-prepared for any situation during the assessment.

Key Concepts for Cost Accounting Exams

Understanding the foundational elements is crucial for performing well in assessments related to financial management. The core ideas provide a structured approach to evaluating expenses, analyzing profitability, and making strategic decisions. Grasping these concepts allows you to solve complex problems with clarity and precision, ensuring success in any financial evaluation task.

Key topics include the classification of expenses, methods for allocating overheads, and techniques for calculating breakeven points. These principles form the backbone of most tasks you’ll encounter and require a solid understanding for effective application. Additionally, mastering the calculation of margins and understanding the behavior of different financial elements will enable you to address a wide range of scenarios.

Continuous practice with these core principles is essential. The more familiar you become with their application, the more confident you’ll be when faced with various financial challenges. Familiarizing yourself with the different methodologies and learning to apply them in various situations will help you refine your approach and ensure thorough preparation.

Understanding Fixed and Variable Costs

In financial assessments, it’s essential to distinguish between different types of expenditures, as this affects both decision-making and performance evaluation. Some costs remain constant regardless of production levels, while others fluctuate based on the volume of activity. Understanding this difference allows for better budget management and forecasting, leading to more accurate financial planning.

Fixed expenses remain stable, regardless of output or sales. These include expenses like rent, insurance, and salaries of permanent staff. On the other hand, variable expenses change in direct proportion to the level of business activity, such as raw materials or hourly wages. Both types of expenses play a crucial role in determining overall financial health and profitability.

Mastering how to identify and manage these two categories is essential for anyone looking to excel in financial evaluations. By understanding how each type affects the bottom line, you can make more informed decisions that optimize resource allocation and improve financial outcomes.

Preparing for Cost Allocation Questions

When preparing for tasks related to the distribution of expenses, it is important to understand how to properly assign various charges to different departments, products, or services. These assignments allow for more accurate financial analysis and ensure that resources are allocated efficiently. Mastering these techniques is essential for anyone aiming to perform well in related tasks and achieve accurate results.

Key Methods of Allocation

There are several methods used to allocate expenses, including direct allocation, step-down allocation, and activity-based approaches. Each method has its own advantages and is suited to different organizational structures and goals. Familiarizing yourself with these techniques will help you decide the most effective way to handle specific scenarios.

Examples of Allocation Scenarios

Practice with real-world examples helps solidify understanding. Below is an example of how different expenses are allocated across departments using the direct method:

| Department | Direct Expense Allocation | Indirect Expense Allocation |

|---|---|---|

| Sales | $5,000 | $2,000 |

| Production | $8,000 | $3,500 |

| Marketing | $3,500 | $1,500 |

By practicing these allocation techniques, you will be better prepared for challenges that require you to determine the proper distribution of expenses across different areas of a business.

Common Mistakes in Cost Accounting Exams

During assessments that involve financial evaluations, many students tend to make errors that can affect their overall performance. These mistakes often stem from misunderstandings of key concepts, misapplication of methods, or simple calculation errors. Identifying and addressing these common pitfalls can significantly improve your accuracy and efficiency in solving related problems.

One frequent mistake is neglecting to account for all relevant factors when determining the total amount of an expense. Another common issue is failing to differentiate between fixed and variable elements in financial tasks. These mistakes can lead to inaccurate results, which may ultimately impact the final outcome.

To avoid these errors, it is essential to focus on detail and consistency. Thoroughly reviewing your work before submission can help catch overlooked factors. Below is a table outlining some common mistakes and strategies for avoiding them:

| Mistake | Possible Outcome | Solution |

|---|---|---|

| Overlooking fixed vs. variable expenses | Incorrect analysis of profitability | Ensure clear understanding of each type and apply correctly |

| Incorrect allocation of indirect costs | Inaccurate departmental cost reports | Review allocation methods carefully and use correct formulas |

| Not revising calculations after completion | Minor errors affecting overall results | Double-check calculations and rework any suspicious areas |

By recognizing these common mistakes and applying the suggested solutions, you can improve both your approach and the quality of your results during financial assessments.

How to Approach Break-even Analysis

Break-even analysis is a fundamental tool used to determine the point at which revenues cover all expenses, and any additional sales result in profit. Understanding this concept allows you to assess the viability of a business model and make informed decisions about pricing, production levels, and sales strategies. Approaching this analysis with a clear method will help ensure that you correctly calculate the point where income equals outlay.

The first step is identifying fixed and variable expenses. Fixed costs remain constant regardless of output, while variable costs fluctuate depending on the volume of production. Once these are established, you can calculate the break-even point using the formula: Break-even point = Fixed Costs / (Selling Price per Unit – Variable Cost per Unit). This formula provides a clear answer to how many units need to be sold to cover all expenses.

Additionally, understanding the implications of different production volumes on profit can help refine decision-making. For example, knowing the break-even point helps you evaluate whether a proposed price increase or cost reduction will improve profitability. By thoroughly practicing these calculations, you can approach related problems with confidence and accuracy.

Mastering Standard Costing Techniques

Standard costing is a powerful method used to estimate the expected expenses of producing goods or services. By establishing predetermined values for materials, labor, and overhead, businesses can compare actual performance to set standards, allowing for easier identification of variances. Mastering this technique helps streamline financial evaluations and improve budget accuracy.

Setting Benchmarks for Efficiency

The first step in mastering standard costing is to accurately set benchmarks for all relevant factors. This includes calculating the expected amount of materials, labor hours, and overhead that should be used in the production process. By having reliable benchmarks, you can easily assess whether the actual input aligns with expectations or if discrepancies need further investigation.

Analyzing Variances

Once benchmarks are established, the next step is to regularly compare actual expenses with the set standards. Any differences, or variances, can then be analyzed to determine the cause. For example, if material costs are higher than expected, it may signal inefficiencies in procurement or usage. This analysis is key to improving operational performance and controlling spending.

Exam Tips for Cost-Volume-Profit Analysis

Cost-volume-profit (CVP) analysis is an essential tool for understanding the relationship between sales, production, and profitability. Mastering this analysis allows you to determine how changes in business activity affect profits. Whether you’re analyzing how a price increase impacts your bottom line or calculating the break-even point, CVP analysis provides valuable insights for decision-making. To excel in tasks related to this topic, there are several strategies to keep in mind.

Key Steps to Success

When preparing for tasks involving CVP analysis, it’s important to follow a systematic approach. Here are some essential steps to keep in mind:

- Understand the basic components: fixed costs, variable costs, selling price, and volume.

- Be able to calculate the break-even point using the formula: Break-even point = Fixed Costs / (Selling Price per Unit – Variable Cost per Unit).

- Know how to assess the impact of changes in sales price or volume on profitability.

Common Mistakes to Avoid

During tasks, students often make errors that can lead to incorrect conclusions. Here are a few common pitfalls to avoid:

- Forgetting to account for all fixed costs when calculating the break-even point.

- Overlooking the impact of variable costs on profit margins.

- Failing to consider how changes in sales volume can affect total profit.

By carefully following these steps and avoiding common mistakes, you can increase your accuracy and confidence in applying CVP analysis to real-world scenarios.

Time Management During Accounting Exams

Effective time management is crucial when tackling any assessment involving financial calculations and analysis. Properly allocating your time ensures that you can complete all tasks within the given timeframe, while also maintaining accuracy and minimizing errors. By creating a structured approach to how you use your time, you can stay organized and confident throughout the assessment.

The key to managing your time efficiently during such assessments is to prioritize questions based on their difficulty and point value. Start by quickly reviewing the entire test to identify easier tasks that you can tackle first. This helps build confidence and saves time for more complex problems. Once you’ve completed the simpler questions, move on to the more challenging ones, ensuring you leave enough time for careful analysis and double-checking your work.

Another important strategy is to set specific time limits for each section or problem. Allocate more time for questions requiring detailed calculations or critical thinking, and set shorter limits for straightforward tasks. This method keeps you on track and prevents spending too much time on any one item.

How to Solve Overhead Allocation Problems

Overhead allocation involves distributing indirect expenses across different products or departments to ensure accurate financial reporting. Properly solving these types of problems requires understanding the basis for allocation and applying the correct methods to achieve fair distribution. By following a structured approach, you can simplify complex allocation tasks and improve accuracy in cost analysis.

Steps to Solve Allocation Problems

To effectively solve allocation problems, it’s essential to break down the process into manageable steps. Here’s a systematic approach:

- Identify the overhead costs: Begin by listing all indirect expenses that need to be allocated, such as utilities, rent, and administrative salaries.

- Select the allocation base: Choose a relevant factor for allocating overhead, such as labor hours, machine hours, or production volume.

- Determine the allocation rate: Calculate the rate by dividing the total overhead costs by the chosen allocation base (e.g., overhead costs per labor hour).

- Distribute the overhead: Apply the allocation rate to the appropriate departments or products based on their usage of the allocation base.

Common Challenges and Solutions

During the allocation process, you may encounter specific challenges that can affect the accuracy of your calculations. Here are some common issues and strategies for overcoming them:

- Uneven distribution of overhead: If the allocation base doesn’t accurately reflect the consumption of overhead, consider using multiple bases or refined cost drivers.

- Difficulty in identifying appropriate bases: When the allocation base is not straightforward, research historical data or consult with relevant department heads to determine the most appropriate method.

- Complexity of multiple overhead categories: For scenarios involving different types of overhead (e.g., fixed vs. variable), break the costs into separate categories and apply distinct rates to each category for greater precision.

By following these steps and addressing potential challenges, you can ensure that overhead allocation is both accurate and efficient, helping to provide a clearer picture of total expenses and profitability.

Understanding Cost Behavior Patterns

Understanding how expenses react to changes in activity levels is crucial for effective financial management. Different types of expenses behave in unique ways when production or sales volume changes. Recognizing these patterns allows businesses to make more informed decisions regarding budgeting, forecasting, and pricing strategies.

Types of Expense Behaviors

Expenses generally follow one of three patterns: fixed, variable, or mixed. Each type responds differently to changes in activity levels. The table below illustrates the characteristics of each behavior:

| Expense Type | Behavior Description | Example |

|---|---|---|

| Fixed | Expenses that remain constant regardless of changes in activity level. | Rent, Salaries |

| Variable | Expenses that change in direct proportion to changes in activity level. | Raw Materials, Direct Labor |

| Mixed | Expenses that have both fixed and variable components. | Utilities (fixed base + variable usage) |

Analyzing Expense Behavior

To properly manage financial operations, it’s important to identify the correct behavior of each expense. By separating fixed, variable, and mixed expenses, you can calculate break-even points, forecast profitability, and make strategic decisions about pricing and cost-cutting measures. For example, understanding how certain expenses will behave as production volume changes can help predict the impact on overall profitability.

Effective Use of Costing Methods

Utilizing appropriate financial methods is essential for accurately tracking expenses and determining the profitability of a business. Different techniques allow businesses to allocate resources efficiently and make data-driven decisions about pricing, budgeting, and resource management. Understanding when and how to apply these methods ensures better financial planning and operational success.

Popular Financial Allocation Methods

Several methods are commonly used to allocate costs, each suited to different types of business models and operations. Below are the most effective approaches:

- Job Order Allocation: Ideal for businesses producing unique, custom products. Costs are assigned to each individual job or project.

- Process Allocation: Best for industries with continuous production of homogeneous products. Costs are spread evenly across all units produced during a period.

- Activity-Based Allocation: Suitable for companies with complex processes. Expenses are linked to specific activities or tasks, providing a more accurate reflection of how resources are consumed.

- Standard Allocation: Focuses on pre-determined costs. This method helps in comparing expected performance against actual outcomes, highlighting variances for management analysis.

Choosing the Right Method

Selecting the most appropriate method depends on the nature of the business and the specific goals of financial management. Factors such as production processes, the complexity of products, and business size play a significant role in deciding which method to implement. For example, a company focusing on custom orders would benefit from job order allocation, while a company involved in large-scale production might find process allocation more suitable.

By leveraging the correct costing methods, businesses can improve their decision-making processes, better understand their cost structures, and achieve higher profitability with optimized resource management.

Important Formulas for Cost Analysis

In order to make informed financial decisions, understanding key mathematical formulas is essential. These formulas help in calculating profitability, determining resource allocation, and assessing the financial health of an organization. Having a strong grasp of these calculations allows for more accurate forecasting and budgeting, which can significantly impact business success.

Essential Formulas

Below are some of the most commonly used formulas that help businesses track financial performance:

- Break-even Point: The point at which total revenues equal total expenses, resulting in no profit or loss.

Formula: Break-even Point = Fixed Expenses / (Selling Price per Unit – Variable Expenses per Unit) - Contribution Margin: Represents the amount each unit sold contributes to covering fixed costs and generating profit.

Formula: Contribution Margin = Selling Price per Unit – Variable Expenses per Unit - Margin of Safety: Shows how much sales can drop before a business reaches its break-even point.

Formula: Margin of Safety = (Actual Sales – Break-even Sales) / Actual Sales - Net Profit Margin: Measures how much of each dollar of revenue is converted into profit.

Formula: Net Profit Margin = (Net Profit / Total Revenue) x 100 - Return on Investment (ROI): Indicates the profitability of an investment relative to its cost.

Formula: ROI = (Net Profit / Investment Cost) x 100

Application of These Formulas

These formulas play a crucial role in determining various financial metrics that inform decision-making. Whether calculating how many units need to be sold to break even, or measuring the efficiency of investments, applying these formulas accurately ensures a clearer understanding of financial performance. Mastering these calculations is crucial for anyone involved in business strategy, management, or financial planning.

Practice Questions for Financial Assessments

Practicing different types of problems is crucial for improving your skills and confidence in financial assessments. These exercises will help sharpen your ability to analyze scenarios, apply key concepts, and arrive at the correct conclusions efficiently. Regular practice will familiarize you with the types of challenges you might encounter and allow you to strengthen areas where you may need more focus.

Sample Practice Scenarios

Here are some practice problems designed to test your understanding of key financial principles:

- Scenario 1: A company has fixed expenses of $50,000 per year. The selling price per unit is $100, and the variable expenses per unit are $60. Calculate the break-even point in units.

- Scenario 2: A business sells a product for $150 per unit. The variable cost per unit is $80. Calculate the contribution margin ratio.

- Scenario 3: If the actual sales are $500,000, and the break-even sales are $400,000, what is the margin of safety?

- Scenario 4: A firm’s total revenue is $600,000, and the net profit is $90,000. What is the net profit margin percentage?

- Scenario 5: An investment costs $200,000, and the net profit from it is $50,000. Calculate the return on investment (ROI).

How to Approach These Problems

To solve these problems, it’s important to understand the formulas involved and approach each scenario methodically. Start by identifying the known values, then apply the relevant formula to calculate the desired result. Practice will help you refine your ability to spot key data points and make accurate computations under time pressure.

Key Topics in Activity-Based Costing

Activity-based costing (ABC) provides a more accurate method of allocating resources by identifying the activities that drive expenses. By focusing on the resources consumed by each activity, organizations can more precisely assign overhead costs to products and services. This approach helps businesses better understand the true cost of operations and make more informed decisions regarding pricing, resource allocation, and process improvements.

Core Concepts in Activity-Based Costing

Understanding the fundamental components of ABC is essential for applying it effectively. Here are some key concepts:

- Activities: These are the tasks or processes that consume resources and create costs. Identifying key activities is the first step in implementing ABC.

- Cost Drivers: Factors that cause costs to increase or decrease. For example, the number of machine hours may be a cost driver for manufacturing costs.

- Cost Pools: Grouping similar costs into pools to facilitate easier allocation. Each pool represents costs associated with a particular activity.

- Resource Consumption: ABC examines how different products or services use resources, providing a clearer picture of their true cost.

Steps to Implement ABC

Successfully adopting ABC involves several stages to ensure accuracy and efficiency:

- Identify Activities: Map out all key activities within the organization, from production to support services.

- Determine Cost Drivers: For each activity, identify what factors influence its costs, such as labor hours, machine time, or material use.

- Assign Costs to Pools: Group costs by activity type, such as manufacturing overhead or administrative support.

- Allocate Costs to Products: Use the cost drivers to assign the appropriate share of overhead to each product or service.

Strategies for Revision in Cost-Related Assessments

Effective revision techniques are crucial for mastering complex topics and performing well in assessments. Focusing on key concepts, practicing problem-solving skills, and reinforcing knowledge through consistent study are fundamental strategies to help you succeed. A strategic approach to revision ensures that you retain information and feel confident during the test.

Effective Study Techniques

To prepare effectively, consider adopting these study techniques that focus on deepening your understanding and application of important topics:

- Break Down Complex Topics: Divide your study material into smaller, manageable sections. This will help prevent overwhelm and make the material easier to digest.

- Practice with Past Problems: Solve previous practice problems or sample scenarios to gain a better understanding of the types of challenges you may encounter.

- Utilize Study Groups: Collaborating with peers can help you gain different perspectives and reinforce your knowledge through discussion.

- Focus on Weak Areas: Identify the areas where you’re struggling and allocate more time to reviewing these sections to ensure mastery.

Revision Planning

Time management and organization are essential for effective revision. A well-structured plan ensures that you cover all the necessary topics before the assessment:

| Day | Topics to Cover | Review Time |

|---|---|---|

| Monday | Key Principles and Concepts | 2 hours |

| Tuesday | Application of Methods | 2 hours |

| Wednesday | Practice Problems | 3 hours |

| Thursday | Review Weak Areas | 2 hours |

| Friday | Mock Test | 3 hours |

Adopting these strategies will help you stay organized, focused, and well-prepared for your upcoming assessment.

Commonly Asked Inquiries in Financial Management Assessments

When preparing for assessments related to financial management, certain topics and problem types tend to appear more frequently. Understanding these key areas can significantly enhance your ability to perform well. In this section, we will discuss the most common inquiries, providing insights on how to approach each one and effectively solve them during assessments.

Many assessments focus on understanding financial strategies, the application of key principles, and the ability to perform various calculations. Common topics include understanding the relationship between fixed and variable elements, determining the impact of different strategies on profitability, and applying specific methodologies to solve real-world financial problems.

- How to determine break-even points: A common inquiry often involves calculating the break-even point for a business or project, determining when total revenues equal total expenses.

- How to allocate overhead costs: Allocating indirect expenses based on appropriate drivers is a frequent challenge. Questions typically require students to apply relevant allocation methods.

- What are the advantages of various costing techniques? Assessments often ask about the pros and cons of different methodologies like direct allocation, activity-based allocation, or absorption costing.

- How to analyze the impact of pricing decisions: Some inquiries focus on evaluating how price changes affect profitability, especially in terms of contribution margins and total profits.

- How to calculate contribution margin ratios: Understanding how to calculate and interpret contribution margins is a crucial skill, often tested in problem-solving exercises.

By familiarizing yourself with these typical inquiries and practicing problem-solving in these areas, you will be better prepared for any assessment. Focus on understanding the underlying principles and formulas, as well as their real-world applications.