When applying for a position in the financial sector, it is essential to understand the kind of inquiries potential employers will make to assess your expertise and suitability for the role. These conversations often focus on your ability to analyze data, evaluate risks, and make informed decisions that affect the financial health of a company.

In this section, we will explore the types of topics you might face, ranging from practical scenarios to technical challenges, that demonstrate your proficiency in handling complex financial situations. By preparing thoroughly, you can increase your chances of making a strong impression and securing the position.

Each part of the hiring process aims to uncover your approach to solving problems, your understanding of the market, and how well you work under pressure. Emphasizing your experience and demonstrating problem-solving skills will help set you apart as a top candidate.

Credit Analyst Interview Preparation Guide

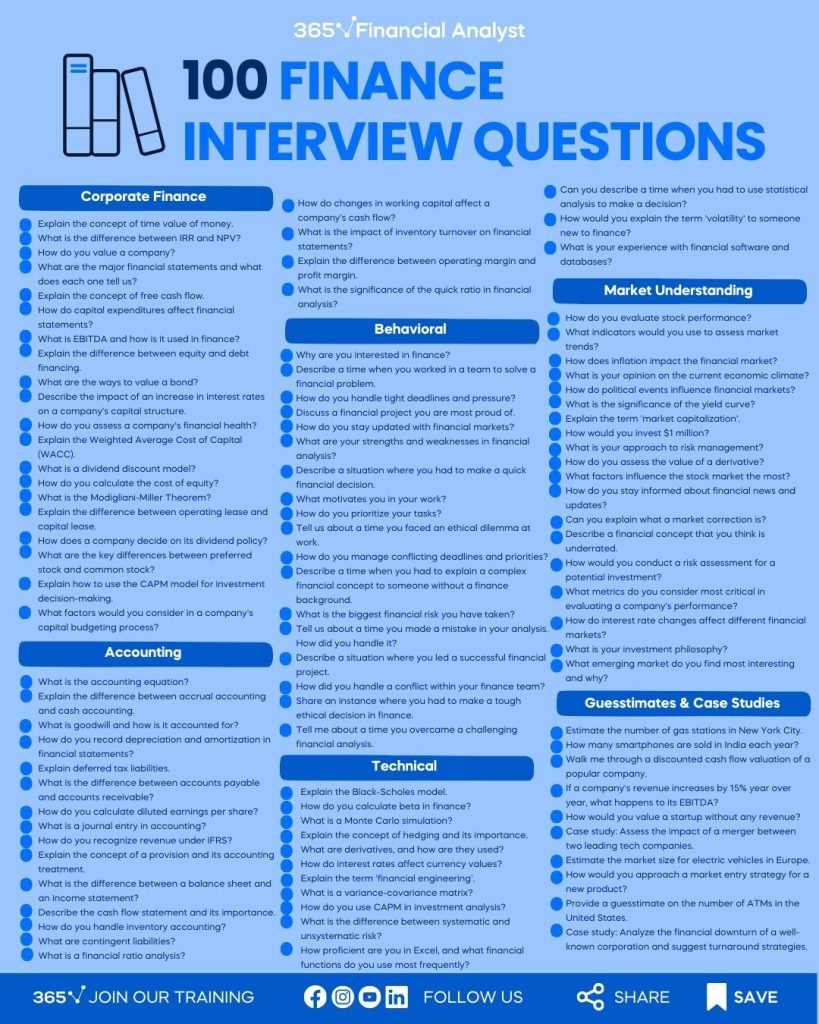

Preparing for a hiring process in the financial sector requires an understanding of the skills and knowledge required by employers. This guide will help you navigate the common expectations for roles that demand expertise in risk assessment, financial reporting, and decision-making. By organizing your thoughts and responses, you can confidently present your qualifications and stand out in a competitive field.

The key to success is not just knowing the technical aspects of the job but also demonstrating your problem-solving ability and your capacity to manage complex financial scenarios. Below, we have outlined important areas to focus on during preparation.

| Area of Focus | Preparation Tips |

|---|---|

| Financial Knowledge | Review key financial concepts, such as risk management, profitability analysis, and capital structure. |

| Technical Skills | Brush up on financial modeling, spreadsheet tools, and software relevant to the role. |

| Behavioral Responses | Prepare examples that showcase your teamwork, leadership, and problem-solving abilities in previous roles. |

| Regulatory Understanding | Be familiar with industry regulations and how they affect financial operations. |

| Communication Skills | Practice clear and concise communication, especially when explaining complex financial data to non-experts. |

By concentrating on these areas and structuring your responses to emphasize both your technical and soft skills, you’ll be better prepared to succeed in the selection process.

Common Questions Asked in Interviews

During the hiring process for financial positions, there are several standard inquiries that employers typically make to evaluate your qualifications and decision-making abilities. These topics are designed to assess how well you can handle real-world challenges, apply your knowledge, and align with the company’s needs. Understanding the nature of these inquiries allows you to craft precise, thoughtful responses that highlight your strengths.

Here are some examples of the types of discussions you may encounter, along with tips on how to approach them:

- Tell us about yourself – A chance to provide a brief overview of your background, focusing on relevant experience and skills.

- How do you approach problem-solving in complex scenarios? – Demonstrate your critical thinking and how you handle unexpected challenges.

- Explain a time when you identified a financial risk – Share an example of how you assessed and addressed potential risks effectively.

- How do you stay current with industry trends? – Show your commitment to ongoing learning and adapting to market changes.

- What tools or software are you familiar with? – Highlight your technical expertise and proficiency with relevant programs.

Preparation for these typical topics will help you present yourself confidently, showcasing both your technical skills and your ability to manage tasks under pressure.

Key Skills Employers Look For

When hiring for financial roles, employers focus on a combination of technical expertise and soft skills. These capabilities help individuals assess complex data, make informed decisions, and communicate effectively within a team. In addition to specific industry knowledge, employers seek qualities that ensure candidates can thrive in fast-paced, dynamic environments.

Technical Competencies

Proficiency in financial analysis tools, modeling, and data management is crucial. Employers often look for candidates who can handle detailed numerical data, assess risk factors, and generate actionable insights that support business goals.

Soft Skills

Strong interpersonal and communication skills are just as important as technical knowledge. The ability to collaborate with diverse teams, present findings clearly, and manage time effectively plays a key role in career success.

| Skill | Description |

|---|---|

| Financial Analysis | Ability to evaluate financial reports, understand key metrics, and assess performance. |

| Risk Management | Proficiency in identifying, analyzing, and mitigating potential risks to a business. |

| Communication | Effective verbal and written communication to explain complex financial concepts to non-experts. |

| Attention to Detail | Ability to spot discrepancies in data and ensure accuracy in all financial reports. |

| Problem-Solving | Capacity to think critically and devise solutions to challenges within financial contexts. |

Focusing on these skills will ensure you are well-prepared for the demands of financial roles and can contribute effectively to your future employer’s success.

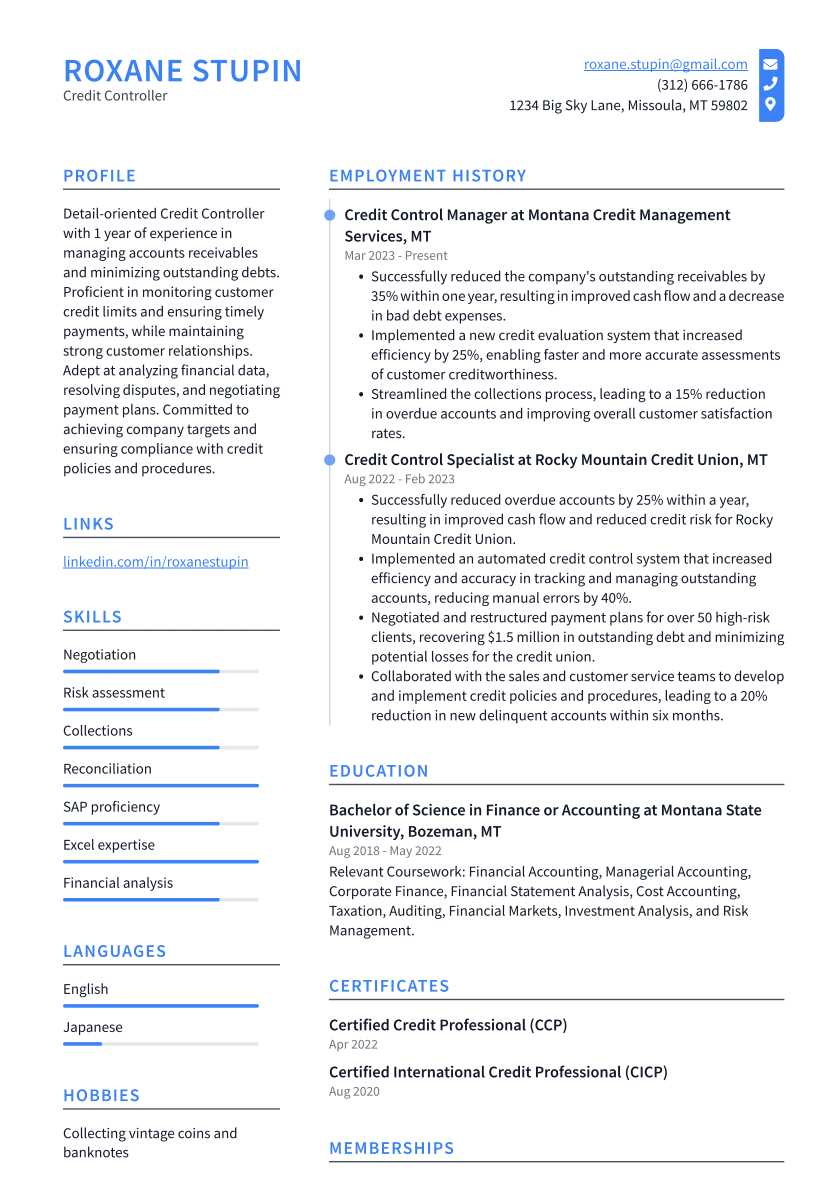

How to Explain Your Experience

When discussing your professional background, it’s essential to present your experiences in a way that highlights your achievements and the value you can bring to a potential employer. This is an opportunity to showcase your practical knowledge, problem-solving skills, and ability to contribute to an organization’s objectives. A well-articulated explanation of your previous roles can demonstrate how you are prepared to handle future challenges.

Focus on Key Achievements

Rather than simply listing your responsibilities, emphasize the key accomplishments you achieved in each role. Focus on specific outcomes, such as how you improved processes, minimized risks, or contributed to financial success. Whenever possible, quantify your results to make your experience more tangible and impactful.

Relate Your Experience to the Job

Tailor your discussion to align with the requirements of the position you’re applying for. Highlight experiences that are directly relevant, showing how your background prepares you to address the challenges of the role. This connection will make it clear why you are the right fit for the job.

Understanding Financial Statement Analysis

Interpreting financial records is crucial for assessing an organization’s economic health and making informed decisions. A deep understanding of financial statements allows you to evaluate profitability, liquidity, and risk. This skill is essential for anyone involved in financial decision-making, as it helps identify trends and potential areas of improvement within a business.

Key Components of Financial Statements

There are three primary documents that form the foundation of financial analysis:

- Income Statement – This provides insights into the company’s profitability over a specified period, detailing revenues, expenses, and net income.

- Balance Sheet – It shows the company’s financial position at a specific point in time, listing assets, liabilities, and equity.

- Cash Flow Statement – This document tracks the inflows and outflows of cash, offering a clear picture of the organization’s liquidity and its ability to meet short-term obligations.

Key Ratios and Metrics to Analyze

To better assess a company’s performance, analysts often use financial ratios. These key indicators provide more context to raw financial data, helping to interpret trends and compare companies. Some of the most commonly used ratios include:

- Profitability Ratios – These measure a company’s ability to generate earnings relative to its sales, assets, or equity (e.g., Return on Assets).

- Liquidity Ratios – These assess the company’s ability to meet its short-term obligations (e.g., Current Ratio, Quick Ratio).

- Solvency Ratios – These determine the company’s capacity to meet long-term debts (e.g., Debt-to-Equity Ratio).

Mastering these concepts allows you to draw accurate conclusions from financial documents and communicate findings effectively.

Answering Behavioral Interview Questions

When facing situational inquiries during a hiring process, employers are interested in understanding how you react in specific work-related situations. These questions focus on past behavior and provide insights into how you might handle similar scenarios in the future. Your responses are crucial for demonstrating your ability to manage challenges, work with teams, and solve problems effectively.

Using the STAR Method

One of the best ways to answer situational questions is by using the STAR method, which helps structure your responses clearly:

- Situation – Describe the context or background of the situation.

- Task – Explain the task or challenge you faced.

- Action – Outline the steps you took to resolve the issue or achieve the goal.

- Result – Share the outcome of your actions, highlighting any successes or lessons learned.

Emphasizing Key Strengths

While responding to these types of questions, make sure to highlight your strengths that align with the role you are applying for. Whether it’s teamwork, adaptability, problem-solving, or leadership, focus on traits that demonstrate your ability to contribute positively to the organization.

By framing your responses in this structured manner, you can effectively show how your past experiences have prepared you for the role you are pursuing.

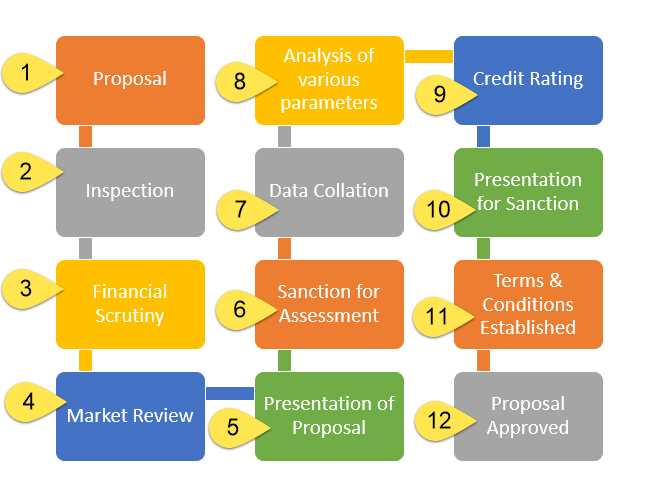

How to Discuss Credit Risk Assessment

When discussing how to evaluate financial risk, it’s essential to show your understanding of the key factors that influence decision-making. Evaluating the likelihood of default or financial loss requires a systematic approach that takes into account both quantitative and qualitative elements. By demonstrating your ability to assess these factors, you can showcase your expertise in minimizing potential financial risks for an organization.

Key Elements of Risk Assessment

To provide a thorough analysis, focus on the main areas that affect the overall risk profile of an entity. Here are the most important elements to consider:

- Financial Health – Assess the financial stability of an entity, including liquidity, profitability, and cash flow patterns.

- Credit History – Review past borrowing behavior and repayment track record to gauge reliability.

- Industry Factors – Consider the economic environment and the performance of the industry the entity operates in.

- Management and Governance – Evaluate the effectiveness of leadership and governance practices within the organization.

- Economic Conditions – Understand the broader economic factors that could affect the risk of default, such as interest rates and market volatility.

Risk Mitigation Strategies

Once you have identified potential risks, it’s important to discuss strategies for mitigating them. Here are some common methods:

- Diversification – Spreading investments across different sectors or assets to reduce exposure to any single risk.

- Collateral Requirements – Securing loans with assets to reduce the risk of financial loss.

- Monitoring – Regularly tracking financial performance and market conditions to proactively identify any issues.

- Adjusting Terms – Modifying loan terms, such as increasing interest rates or shortening repayment periods, to balance risk levels.

By addressing these key factors and mitigation strategies, you can show a comprehensive understanding of how to effectively assess and manage financial risks.

What to Expect in Technical Interviews

In a specialized hiring process, technical evaluations are designed to test your proficiency in industry-specific skills and problem-solving abilities. These assessments focus on your knowledge of key tools, methodologies, and your capacity to apply technical concepts in real-world scenarios. It’s important to approach these conversations with confidence, showcasing both your expertise and your ability to think critically under pressure.

Common Types of Exercises

During these assessments, you may encounter a variety of challenges that test different aspects of your technical capabilities:

- Case Studies – You’ll be asked to analyze a hypothetical scenario or past situation, demonstrating your ability to apply concepts and provide practical solutions.

- Problem Solving – Expect to work through specific challenges or numerical problems, where your analytical thinking and accuracy will be tested.

- Data Interpretation – You may be asked to interpret complex data sets or financial reports, drawing conclusions and presenting findings clearly.

- Technical Simulations – Some interviews may involve hands-on tasks or simulations where you’re expected to demonstrate your technical skills in real-time.

How to Prepare

Preparation is key to succeeding in these assessments. Focus on understanding the core concepts relevant to the role, and practice applying them to practical scenarios. Review any tools or software that are commonly used in your field, and be ready to discuss how you’ve utilized them in previous experiences.

By anticipating these types of challenges, you can approach technical evaluations with a clear mindset and the confidence to showcase your expertise effectively.

Important Knowledge About Financial Models

In any role that involves financial decision-making, understanding how to create, interpret, and use financial projections is critical. These models serve as a tool to estimate future financial performance based on historical data, assumptions, and variables. Whether you’re building projections for budgeting, valuation, or investment analysis, it’s essential to have a clear understanding of how financial models work and how they can be applied in various scenarios.

Types of Financial Models

There are several key types of models that are commonly used across industries, each with its specific purpose and methodology:

- Forecasting Models – These are used to predict future financial performance based on historical data. They often involve creating multiple scenarios to estimate different outcomes.

- Valuation Models – Commonly used in investment analysis, these models assess the value of a company or asset. Examples include Discounted Cash Flow (DCF) and comparable company analysis.

- Budgeting Models – These help organizations plan their future expenses and revenues, ensuring that resources are allocated efficiently over a given period.

- Risk Assessment Models – Used to evaluate potential risks in investment or lending decisions, these models incorporate various risk factors, such as market volatility and creditworthiness.

Key Components of Financial Models

When building or analyzing a financial model, several essential components should be understood and accurately represented:

- Assumptions – These are the foundational inputs, such as expected growth rates, interest rates, or market conditions, that drive the model’s projections.

- Data Sources – Financial models rely heavily on accurate and timely data, whether historical financial statements, market data, or macroeconomic indicators.

- Formulas and Functions – Mastery of financial functions, such as Present Value (PV), Future Value (FV), or Internal Rate of Return (IRR), is essential for creating accurate models.

Understanding these aspects will ensure you can not only create reliable financial models but also interpret the results and make sound decisions based on the projections they provide.

How to Showcase Analytical Thinking

Demonstrating the ability to think critically and break down complex problems is a vital skill in many roles. Analytical thinking involves examining data, identifying patterns, drawing insights, and applying logical reasoning to make informed decisions. Showing how you approach challenges methodically can set you apart in a professional setting.

Approach to Problem Solving

To effectively showcase analytical thinking, it’s essential to highlight your structured approach to problem-solving. Here’s how to do so:

- Define the Problem – Start by identifying the core issue and understanding its context. Clarify the objectives to ensure the right problem is being addressed.

- Gather Data – Collect relevant information that will help you assess the situation accurately. Use both qualitative and quantitative data where possible.

- Analyze the Data – Break down the information into manageable parts, looking for patterns, trends, and relationships. Use analytical tools to help interpret the data.

- Consider Alternatives – Evaluate different options and solutions, weighing the pros and cons of each. Consider both short-term and long-term outcomes.

- Make Informed Decisions – Based on your analysis, decide on the best course of action, ensuring it aligns with the overall objectives and goals.

Communicating Analytical Results

It’s not enough to just solve the problem–you need to effectively communicate your thought process and conclusions. Here are ways to present your findings clearly:

- Use Data Visualizations – Charts, graphs, and tables can help present complex information in an easy-to-understand format.

- Provide Logical Explanations – When discussing your findings, explain your reasoning in a clear, step-by-step manner so others can follow your thought process.

- Support with Evidence – Use data and examples to back up your conclusions. The more evidence you provide, the stronger your analysis will appear.

By following these steps, you can effectively showcase your analytical thinking abilities, demonstrating your capacity to approach problems logically, make data-driven decisions, and communicate your results persuasively.

Handling Situational Interview Scenarios

When faced with real-world scenarios during assessments, your ability to respond effectively can make a significant difference. Employers often present hypothetical situations to gauge how you approach challenges, make decisions, and manage pressure. Responding thoughtfully demonstrates not only your problem-solving skills but also your capacity to stay calm and focused under stress.

Understanding the Context

Before offering a solution, it’s important to fully grasp the situation at hand. Here’s how to approach these scenarios:

- Listen Carefully – Pay close attention to the details of the situation. Often, critical elements are embedded in the way the scenario is framed.

- Clarify the Situation – If any part of the scenario is unclear, don’t hesitate to ask for additional context or specifics. It’s better to clarify than to make assumptions.

- Identify the Key Factors – Determine the core issues that need resolution. Recognize the underlying challenges and the desired outcome.

Structuring Your Response

Once you have a clear understanding of the situation, it’s time to organize your response. Here’s how to structure it logically:

- Outline Your Thought Process – Walk the interviewer through your decision-making process step by step, showing how you arrived at your conclusion.

- Consider Possible Outcomes – Discuss the potential consequences of your decision. Explain how your solution benefits the situation in both the short and long term.

- Show Adaptability – Situations rarely go according to plan. Highlight your ability to adapt and pivot when circumstances change or new information arises.

By presenting a clear, structured response to situational scenarios, you can demonstrate your ability to think critically, handle challenges, and adapt to shifting circumstances. This approach will help you stand out as a well-rounded and capable candidate.

How to Discuss Credit Reports

Discussing financial assessments requires a solid understanding of how reports reflect an individual’s or organization’s financial history. Being able to explain and interpret these documents in a clear and concise manner is essential for making informed decisions. Whether you’re presenting your analysis or explaining specific components to others, being precise and thorough is key.

Key Elements to Cover

When discussing financial assessments, focus on the most important aspects of the report. Here are the critical components you should address:

- Overall Financial Health – Discuss the person’s or business’s general financial standing, based on the information presented in the document.

- Outstanding Obligations – Highlight any significant debts or outstanding payments. Provide context for these amounts and what they mean in the larger financial picture.

- Payment History – Emphasize how payments have been managed over time, including whether they have been on time, delayed, or missed.

- Recent Activity – Point out any recent changes or notable trends, such as a significant increase in debt or a recent payment default.

- Key Ratios – If applicable, mention key financial ratios that help assess creditworthiness, such as debt-to-income or utilization rates.

How to Explain Your Findings

When presenting or discussing financial assessments, it’s important to explain your analysis clearly and confidently. Follow these tips for a well-rounded discussion:

- Break Down Complex Information – If the report contains complex data or technical jargon, simplify it so your audience can easily understand.

- Provide Context – Relate the information back to the overall financial situation. Explain how various elements (e.g., income, expenses, debt) influence one another.

- Discuss Potential Implications – Be clear about how the findings might impact future financial decisions or strategies.

- Use Visual Aids – Where possible, use charts or graphs to visually represent key points and make the information easier to digest.

By covering these key points and using a clear, organized approach, you’ll be able to effectively discuss financial reports and provide valuable insights. Always focus on clarity and relevance to ensure your audience understands the full picture.

Best Practices for Answering Financial Questions

Responding to financial inquiries requires a combination of clarity, precision, and confidence. Understanding the nuances of financial data, interpreting key metrics, and conveying complex information in a simple yet effective manner are essential skills. The way you address such questions can reflect your analytical capabilities and your ability to communicate financial concepts clearly.

Effective Communication Techniques

Here are some best practices for providing clear and thoughtful responses:

- Be Concise – While it’s important to explain your reasoning, avoid unnecessary details. Stay focused on the core issues and keep your response to the point.

- Clarify the Context – Before diving into numbers, ensure that you explain the context of the situation. Discuss the factors that may influence the financial data you’re referencing.

- Use Examples – When possible, use real-world examples to support your answers. Illustrating your points with familiar scenarios makes your response more relatable and easier to understand.

Demonstrating Analytical Thinking

Financial inquiries often require a deeper analysis. To showcase your ability to interpret and apply financial concepts, consider the following tips:

- Break Down Complex Data – When discussing complicated financial figures, break them into smaller, digestible parts. Explain how each component contributes to the overall picture.

- Highlight Key Metrics – Identify and focus on the most relevant metrics that directly impact the situation. Emphasize how these indicators guide decision-making.

- Anticipate Follow-up Questions – Think ahead to potential follow-ups that may arise based on your initial response. Be prepared to explain your reasoning or provide additional details if necessary.

By following these best practices, you’ll ensure that your responses are both informative and easy to follow. Focusing on clarity, context, and analysis will help you demonstrate your proficiency and communication skills effectively.

How to Talk About Regulatory Compliance

Discussing adherence to industry standards and government regulations is a critical aspect of many roles. It demonstrates your understanding of the legal framework within which financial transactions and assessments occur. Being able to articulate your knowledge of rules, guidelines, and compliance frameworks is essential, as it reflects your commitment to maintaining integrity in financial practices.

When addressing this topic, it’s important to show that you are not only familiar with relevant regulations but also able to apply them in practice. This includes understanding key legislation, staying current with changes in the regulatory environment, and knowing how to manage compliance risks. Below are some strategies for talking about this topic effectively:

1. Understand Key Regulations

Start by discussing the most important laws and regulations relevant to the industry. Highlight your awareness of rules that govern operations, reporting standards, and risk management practices. Examples include:

- Financial Reporting Standards – Explain how these impact decision-making and ensure transparency in financial statements.

- Consumer Protection Laws – Discuss how these safeguard clients and mitigate risks for the organization.

- Data Privacy Regulations – Emphasize how protecting sensitive data is integral to maintaining customer trust.

2. Demonstrate Practical Knowledge

Employers want to see that you can apply theoretical knowledge in real-world scenarios. Share examples of how you have ensured compliance in past roles or how you would approach it in future situations. For instance:

- Policy Implementation – Mention how you helped implement internal policies to comply with new laws or standards.

- Monitoring and Auditing – Explain your approach to regularly reviewing processes to ensure ongoing adherence to regulations.

- Risk Mitigation – Describe strategies you’ve used to minimize the impact of regulatory breaches.

3. Show Adaptability

Regulatory environments evolve, so it’s important to convey that you can adapt to new rules and processes. Highlight your ability to stay informed about changes in the regulatory landscape and adjust strategies accordingly.

By demonstrating a strong understanding of compliance requirements, practical experience in applying them, and the ability to adapt to regulatory changes, you position yourself as a valuable asset to any organization that places high importance on legal and ethical standards.

Improving Your Communication Skills

Effective communication is essential in any professional setting. Whether conveying complex ideas, collaborating with colleagues, or presenting findings to clients, your ability to express yourself clearly and confidently can make a significant difference. This section highlights key strategies for enhancing communication skills, enabling you to engage with others more effectively and leave a lasting impression.

1. Active Listening

Listening is just as crucial as speaking in any conversation. Active listening involves fully concentrating on what the other person is saying, understanding their message, and responding thoughtfully. Practice giving your full attention to the speaker, asking clarifying questions, and reflecting on their words before replying. This demonstrates respect and ensures that you truly understand the information being shared.

2. Clear and Concise Messaging

In any professional environment, especially when discussing intricate concepts, clarity is key. Avoid jargon or overly complex terminology that may confuse your audience. Focus on delivering your message in a straightforward and concise manner, breaking down complex ideas into simpler, more digestible points. Practice summarizing key points to ensure your communication remains focused and effective.

By improving these two areas–listening actively and presenting ideas clearly–you will significantly enhance your ability to engage with others and present yourself as a confident and professional communicator. These skills not only help in day-to-day conversations but also play a vital role in building trust and fostering positive working relationships.

Interview Tips for Fresh Graduates

Starting a career right after graduation can feel like a daunting task, but with the right preparation, it can be a rewarding experience. Many recent graduates face challenges when entering the workforce for the first time, especially when it comes to expressing their skills, experiences, and potential to employers. This section provides useful tips to help fresh graduates shine in professional conversations and land their first full-time position.

1. Research the Company

Before attending any meeting, it’s important to learn about the company you’re applying to. Understanding the organization’s values, culture, products, and industry position will allow you to ask insightful questions and align your responses with what the company seeks in an employee. It shows initiative and interest beyond the job description.

2. Highlight Transferable Skills

As a fresh graduate, you may not have years of experience, but that doesn’t mean you’re without skills. Focus on the transferable abilities you’ve gained during your studies, such as problem-solving, teamwork, and time management. Demonstrating how these skills are applicable to the role can help you stand out even without direct work experience.

3. Practice Your Responses

While you can’t predict every question, practicing common interview topics can help you gain confidence. Focus on framing your responses clearly and concisely. Highlight specific examples from your academic or internship experiences to illustrate your skills and approach to challenges.

4. Stay Positive and Enthusiastic

Employers want to see passion and a positive attitude. Approach each conversation with enthusiasm and a willingness to learn. Your eagerness to grow within the company can often be just as valuable as your technical expertise.

5. Be Ready for Behavioral Scenarios

Employers may ask you to describe how you’ve handled certain situations in the past, even if they come from academic settings or volunteer work. Prepare for these types of questions by reflecting on your experiences and how you’ve overcome challenges or worked in teams.

Following these tips will not only help fresh graduates feel more confident but also leave a lasting impression on potential employers. The key is to highlight what you can bring to the table and approach each opportunity with optimism and preparation.

How to Prepare for Financial Case Studies

When preparing for case studies in a professional setting, it’s crucial to focus on how you approach complex financial problems and demonstrate your analytical thinking. These exercises test not only your technical knowledge but also your ability to make informed decisions under pressure. The goal is to showcase your problem-solving skills, attention to detail, and ability to communicate financial insights effectively.

1. Understand the Basics of Financial Statements

Before diving into case studies, ensure you have a solid understanding of financial statements. This includes balance sheets, income statements, and cash flow statements. These documents form the foundation of most financial cases, so being comfortable with them will allow you to quickly assess a company’s performance and identify key areas for improvement.

2. Develop a Structured Approach

It’s essential to approach each case with a structured method. Start by identifying the key issues and goals. Break the problem into smaller, manageable components and tackle them one by one. For example, assess the financial health of a company, evaluate market conditions, and analyze potential risks. A clear, methodical process will help you stay organized and focused throughout the case.

3. Focus on Key Metrics

In financial case studies, certain metrics are crucial for analysis. Common ones include profitability ratios, liquidity ratios, and solvency ratios. Understanding these metrics and knowing how to interpret them will give you a clear picture of a company’s financial standing and its ability to meet obligations.

4. Practice with Real-Life Scenarios

To prepare effectively, practice with real-life case studies or scenarios. Look for case studies from financial reports, past research papers, or industry examples. The more practice you get, the better equipped you’ll be to handle unexpected questions or scenarios during assessments.

5. Communicate Your Thought Process Clearly

One of the most important aspects of case study preparation is the ability to articulate your thought process. Whether you’re presenting your analysis verbally or in writing, ensure that you explain each step clearly. Discuss how you arrived at conclusions, backed up by data and your analysis, and outline possible solutions or recommendations.

By following these guidelines, you’ll be well-prepared to tackle financial case studies confidently. The key is practice, organization, and effective communication. Show that you can apply your financial knowledge to real-world challenges and offer solutions that make sense from a business perspective.

How to Handle Stress During Interviews

Facing a high-pressure situation, such as a selection process, can be daunting for many individuals. Managing stress is essential to ensure you perform at your best. The ability to remain calm, focused, and confident will not only help you present yourself effectively but also show your resilience and problem-solving capabilities under pressure. Being well-prepared and adopting strategies to manage anxiety will significantly improve your chances of success.

1. Preparation is Key

The more you prepare, the less likely stress will overwhelm you. Take the time to research the company, understand the role you’re applying for, and practice your responses to potential scenarios. Familiarity with the situation will help reduce uncertainty, allowing you to feel more in control and less anxious.

2. Mindfulness Techniques

Practicing mindfulness can help you stay grounded when feeling stressed. Simple breathing exercises or visualizing a calm environment can reduce anxiety. Take a few deep breaths before starting, and if you feel overwhelmed during the discussion, take a brief pause to collect your thoughts and regain composure.

3. Develop Positive Self-Talk

Stress often comes from negative thoughts or self-doubt. Replacing these thoughts with positive affirmations can shift your mindset. Remind yourself of your strengths and achievements, and focus on the value you bring to the role. Positive self-talk boosts confidence and can help you stay focused on your goals.

4. Practice Active Listening

When the conversation becomes intense, staying present and actively listening can prevent miscommunication and unnecessary stress. Make sure to understand the question fully before responding, and if you’re unsure, it’s okay to ask for clarification. This approach helps keep you grounded in the discussion and allows you to give more thoughtful responses.

5. Maintain a Relaxed Body Language

Your body language can also reflect your stress levels. To manage this, practice good posture, make eye contact, and avoid fidgeting. A calm and confident demeanor can positively influence how you’re perceived and can also help you feel more in control.

6. Learn from the Experience

Finally, remember that each interaction is a learning opportunity. If you feel stressed during the process, it’s helpful to reflect afterward on what triggered those feelings and think of ways to improve next time. With each experience, you’ll become more adept at managing stress and performing under pressure.

By integrating these techniques into your preparation, you’ll be better equipped to handle stress and navigate challenging situations with composure. Embrace the process and stay focused on showcasing your skills and expertise.