Preparing for a financial assessment requires a solid grasp of various essential concepts. Whether you are a beginner or looking to brush up on your knowledge, mastering the basics is crucial for success. Navigating through the rules and regulations can be challenging, but breaking them down into manageable sections makes the process more approachable.

In this guide, we will explore various elements that are critical to understanding the core of the subject. You will learn about common scenarios, essential formulas, and the differences between specific deductions and credits. Through clear explanations and practical examples, you will be equipped to handle the intricacies of tax-related topics with confidence.

Key terminology and important concepts will be explained in detail, so you can familiarize yourself with the language often used in these assessments. Whether it’s for professional purposes or personal knowledge, mastering this material is essential for anyone dealing with financial responsibilities.

Prepare to dive deep into the material and get ready to tackle the challenges with a clear understanding of the fundamental principles. The following sections will guide you step by step through the necessary components for successful preparation.

Federal Income Tax Exam Questions and Answers

Understanding the various scenarios and rules related to financial filings is crucial for anyone preparing for assessments in this field. The complexity of these topics can sometimes be overwhelming, but breaking them down into manageable segments allows for easier comprehension. To help you succeed, we will walk you through several common situations you may encounter, providing practical explanations and examples to clarify the concepts.

Common Filing Situations

When it comes to handling filings, different situations require different approaches. Each individual’s circumstances may lead to unique challenges, such as understanding applicable deductions, credits, and exemptions. Below is a table outlining common scenarios and their corresponding solutions based on guidelines.

| Situation | Explanation | Solution |

|---|---|---|

| Self-Employed Filing | Individuals who work for themselves must report business income and expenses. | Use Schedule C to report income and deductions. Pay self-employment tax via Schedule SE. |

| Itemized Deductions | Taxpayers who opt to itemize their deductions rather than taking the standard deduction. | Fill out Schedule A to report deductible expenses like mortgage interest, medical costs, and donations. |

| Education Credits | Credits available for educational expenses to reduce overall liability. | Use Form 8863 to claim credits like the American Opportunity Credit or Lifetime Learning Credit. |

Important Considerations

While preparing for assessments, it’s important to remember that the guidelines are subject to frequent changes. Tax reforms, new laws, and adjustments to existing regulations may influence how you approach the filing process. Familiarizing yourself with the most current information and staying updated on changes will significantly improve your ability to handle any situation that arises during testing.

Understanding Federal Income Tax Basics

Grasping the fundamentals of the financial reporting system is essential for anyone preparing for assessments in this field. At its core, the process involves understanding the different types of earnings, applicable deductions, and how various credits can influence one’s final obligations. This section will guide you through the primary components, providing a solid foundation to build upon as you advance in your study.

Key Concepts in Financial Filing

Before diving into the more complex aspects, it’s important to first familiarize yourself with the core components that shape the filing process. These include reporting income, applying allowable deductions, and utilizing credits to reduce the final payment due. The table below outlines essential concepts and their respective explanations to help clarify their role in the process.

| Concept | Description |

|---|---|

| Gross Earnings | The total amount of income earned before any deductions are made. |

| Adjustments to Income | Reductions made to gross earnings, such as contributions to retirement accounts or student loan interest. |

| Standard Deduction | A fixed amount that reduces taxable earnings for those who do not itemize their deductions. |

| Taxable Earnings | The portion of income that is subject to the applicable rate after all deductions. |

| Tax Liability | The total amount of money owed based on the calculated taxable income. |

Filing Process Overview

Once the core concepts are understood, the next step is learning how to apply them in the context of the filing process. This involves selecting the appropriate form, determining eligibility for deductions and credits, and calculating the amount due. By following the proper steps and staying informed about any changes to the rules, anyone can navigate this process efficiently and effectively.

Common Taxpayer Deductions Explained

Understanding the various deductions available to taxpayers is crucial for reducing overall financial liability. These reductions are designed to lower the amount of taxable income, ultimately decreasing the amount owed. Many individuals are eligible for deductions that can significantly reduce their final calculation, depending on their personal situation and applicable criteria.

Below are some of the most common types of deductions available to those preparing their filings:

- Standard Deduction – A fixed amount that can be subtracted from total earnings without needing to itemize specific expenses.

- Medical Expenses – Costs related to healthcare, including insurance premiums, medical bills, and certain treatments, that exceed a specific percentage of total income.

- Charitable Contributions – Donations to qualified organizations can often be deducted, helping both the taxpayer and charitable causes.

- Mortgage Interest – Homeowners can deduct the interest paid on a mortgage, which is especially beneficial in the early years of homeownership.

- Student Loan Interest – Payments made on student loans may be deductible, depending on income level and other factors.

- Retirement Contributions – Contributions to certain retirement accounts, like IRAs, can reduce taxable income in the year they are made.

Each of these deductions has specific eligibility requirements and limitations. Understanding these rules is key to ensuring that they are applied correctly and to your benefit. In the next sections, we will explore these options in greater detail to help you maximize available opportunities and minimize your financial responsibility.

Key Tax Terms You Should Know

To navigate the financial filing process effectively, it is essential to become familiar with the terminology used in this area. Understanding key terms helps clarify the steps involved, from determining eligibility for certain reductions to calculating the amount owed. This section will cover the fundamental concepts that you must understand before diving into more complex topics.

Essential Concepts

Before proceeding with any filing, it is crucial to know the basic terms that will frequently appear throughout the process. These definitions provide the foundation for making informed decisions and ensuring accuracy. Below are some of the most important terms that individuals must familiarize themselves with:

- Gross Earnings – The total amount earned before any reductions or deductions are applied.

- Adjusted Earnings – The amount remaining after certain deductions, such as retirement contributions, are taken from gross earnings.

- Standard Reduction – A set amount that reduces the total income without needing to itemize specific expenses.

- Itemized Deductions – Specific deductions that require detailed documentation, such as medical costs, property taxes, and charitable donations.

- Taxable Earnings – The portion of income that remains after deductions and exemptions are applied and is subject to applicable rates.

- Tax Burden – The total amount an individual owes after calculating taxable earnings and applying relevant rates.

Advanced Terms to Understand

In addition to these basic terms, there are more advanced concepts that can influence how you approach the filing process. These terms are typically encountered in more complex situations, such as for business owners or those claiming specific credits. Understanding these terms will help ensure that all potential deductions and credits are accounted for properly.

- Self-Employment Levy – The amount owed by individuals who work for themselves, covering both the employer and employee portions of social security taxes.

- Alternative Minimum Calculation – A method used to ensure that individuals with high income still pay a minimum amount, regardless of deductions or credits.

- Dependent Exemption – A reduction in taxable earnings based on the number of dependents a taxpayer claims.

By understanding these essential terms, you can confidently navigate the filing process and make informed decisions that maximize potential benefits and minimize liabilities.

Filing Status and Its Importance

Choosing the correct filing classification is a fundamental step in the financial reporting process. This decision influences several factors, such as eligibility for deductions, credits, and the overall amount owed. Understanding the different options available is crucial, as it can have a significant impact on the final result of your submission.

There are several categories from which taxpayers can choose, each suited to different personal circumstances. Selecting the right category ensures that you receive the maximum benefits and minimize your financial obligations. Below are the main filing statuses, each with its own set of rules and advantages.

- Single – Generally applies to individuals who are not married and do not have dependents. This status offers a standard set of benefits and tax rates.

- Married Filing Jointly – This option is available to married couples who choose to file together, often providing more favorable tax rates and higher deduction limits.

- Married Filing Separately – Married couples may choose to file separately if it offers a financial advantage or if they wish to maintain individual responsibility for their returns.

- Head of Household – This status is available to individuals who are unmarried and support a dependent, offering better rates and higher deductions compared to filing as single.

- Qualifying Widow(er) – This status applies to individuals whose spouse has passed away in the last two years and who are supporting dependent children.

Filing status not only determines your eligibility for various deductions and credits, but also affects the tax brackets that apply to your earnings. By selecting the correct option, you can optimize your filing and ensure that you are taxed fairly based on your personal situation.

Taxable and Nontaxable Income Overview

Understanding what qualifies as taxable versus nontaxable earnings is a crucial step in managing one’s financial obligations. While most forms of income are subject to payment requirements, there are certain types that are exempt from this responsibility. Knowing the distinction between these two categories can help you ensure that you only report the amounts required, potentially reducing your liabilities.

Taxable Earnings

Taxable income includes all forms of earnings that are subject to the applicable financial contribution rates. These include wages, salaries, bonuses, and other forms of compensation for services rendered. Additionally, investment earnings such as interest, dividends, and capital gains are typically included in taxable income. The following types of earnings are commonly taxed:

- Wages and Salaries – Payments received for employment services, typically subject to withholding.

- Bonuses – Extra financial rewards, often tied to performance or company profits, are included in taxable earnings.

- Interest Income – Money earned from savings accounts, bonds, and other investments is subject to taxation.

- Rental Income – Earnings from leasing or renting out property are taxable and must be reported.

- Capital Gains – Profits made from the sale of assets such as stocks or real estate are generally taxable.

Nontaxable Earnings

On the other hand, certain forms of income are not subject to financial contributions. These exceptions are often tied to specific circumstances or public policy goals, such as promoting savings or supporting charitable endeavors. Here are some common nontaxable forms of earnings:

- Gifts – Money or property received as a gift, which is not considered taxable income unless it exceeds certain thresholds.

- Inheritance – Assets passed on after a person’s death are generally not taxed as income.

- Life Insurance Payouts – Amounts received from life insurance policies after a policyholder’s death are not taxable.

- Child Support Payments – Financial support payments made by one parent to another are not considered taxable income.

- Welfare Benefits – Public assistance payments designed to support those in need are typically excluded from taxable income.

Knowing the difference between taxable and nontaxable earnings is key to ensuring that you meet your obligations without overpaying. Always consult the latest regulations to confirm the status of specific income types, as exemptions and rules may change over time.

Understanding the IRS Tax Forms

When it comes to filing your financial reports, understanding the necessary paperwork is crucial for ensuring accuracy and compliance. There are various forms that individuals and businesses must use to report different types of financial data. These forms are essential for correctly calculating what you owe or what you are entitled to receive. Each form serves a unique purpose, and knowing which one to use can simplify the process.

Common Forms for Individuals

For most individuals, the paperwork required for filing can be broken down into a few common forms. Each form is designed to collect specific information, such as earnings, deductions, or credits, which are then used to calculate the final amount owed or refunded.

- Form 1040 – This is the primary form used by individuals to file their reports. It gathers personal details, earnings, deductions, and credits to calculate the final amount due or refunded.

- Form 1040-SR – A version of Form 1040 designed for seniors, with larger text and simpler language to make it easier for older taxpayers to understand.

- Form 1040EZ – Previously used by individuals with straightforward financial situations (no dependents, only wage income, and no deductions). This form has been phased out and replaced by Form 1040 in its simplest version.

- Form W-2 – Issued by employers, this form reports wages earned and taxes withheld from an employee’s paycheck throughout the year.

- Form 1099 – Used to report various types of income other than wages, including freelance earnings, interest, dividends, and retirement income.

Forms for Business Owners

For those who own or operate a business, the paperwork required becomes more complex. Business owners must file forms that account for their income, expenses, deductions, and any other business-related financial data.

- Form 1065 – Used by partnerships to report their earnings, deductions, and other financial activities. Partners report their share of income separately on their individual forms.

- Form 1120 – Used by corporations to file their earnings, deductions, and taxes owed. This form is specific to C-corporations.

- Form 941 – A quarterly form used by employers to report wages paid and taxes withheld, including Social Security and Medicare contributions.

- Form 1099-MISC – Used to report income paid to independent contractors or for other business-related payments outside of wages.

Each of these forms serves a different function, depending on your personal or business financial situation. Ensuring that you use the correct form can help prevent errors and delays in the processing of your financial report.

How to Calculate Taxable Income

Calculating what you owe begins with determining the amount of your earnings that are subject to contributions. While not all forms of revenue are taxable, knowing how to separate those that are from those that aren’t is essential. The process involves several steps to ensure that the right amount is calculated based on your financial situation.

The first step in determining what you owe is to identify your total earnings. This includes all wages, investments, and other forms of compensation you have received during the year. Once you have your total earnings, you can proceed to apply any exemptions or deductions that apply to your case.

Step-by-Step Process

- Start with Gross Earnings – Gather all sources of income including wages, freelance earnings, investment returns, and other financial gains.

- Apply Adjustments – Certain adjustments may reduce your total earnings, such as retirement contributions, student loan interest, or other allowable expenses.

- Subtract Deductions – You can either take a standard deduction or itemize your eligible deductions, which might include mortgage interest, medical expenses, or charitable donations.

- Consider Tax Credits – Tax credits reduce the amount you owe directly and may include credits for education, child care, or other qualifying expenses.

Taxable amount is derived after applying these deductions and credits to your total earnings. This final figure represents the portion of your earnings that will be used to calculate the amount you owe, based on the applicable rates and rules. It is important to correctly apply all eligible deductions and credits to ensure you are not overpaying or underreporting your financial obligations.

Credits vs. Deductions in Tax Filing

When it comes to filing your financial documents, understanding the difference between credits and deductions is crucial for minimizing the amount you owe. Both credits and deductions can reduce your final liability, but they work in different ways. Recognizing how each one affects your total amount due can help you navigate the filing process more efficiently and ensure you pay only what is necessary.

How Deductions Work

Deductions reduce your overall earnings before the applicable contribution rates are applied. This process lowers your taxable amount, which in turn reduces the amount that you owe. Some deductions are standard, while others may be itemized based on specific expenses such as medical costs, charitable contributions, or mortgage interest. The more deductions you are eligible for, the less you may have to contribute in the end.

- Standard Deduction – A flat amount that can be deducted from your total earnings, based on your filing status.

- Itemized Deductions – Specific deductions based on actual expenses such as medical costs, property taxes, or donations to charity.

- Retirement Contributions – Contributions made to retirement accounts can often be deducted from your earnings, lowering the amount that is taxable.

How Credits Work

Unlike deductions, credits directly reduce the amount you owe after your taxable earnings have been calculated. Essentially, a tax credit provides a dollar-for-dollar reduction of your liability, making them especially valuable. There are two types of credits: nonrefundable and refundable. Nonrefundable credits reduce your owed amount to zero, but no further. Refundable credits, however, can result in a refund if they exceed your total liability.

- Nonrefundable Credits – These credits can only reduce the amount you owe to zero; any remaining balance is forfeited.

- Refundable Credits – These credits can not only reduce the amount you owe but may also result in a refund if the credit exceeds your total liability.

- Common Credits – Examples include the Child Tax Credit, Education Credits, and Earned Income Credit.

In conclusion, both credits and deductions are valuable tools in reducing what you owe, but they function differently. Deductions lower the amount of earnings subject to contribution, while credits directly reduce the amount of money you are required to pay. Understanding how both work and taking full advantage of all available options can help ensure that you pay as little as legally required.

Common Mistakes in Tax Filing

Filing financial documents can be a complex process, and even small errors can lead to significant consequences. Many individuals unknowingly make mistakes that can delay processing, result in overpayments, or trigger audits. Understanding these common errors is the first step in ensuring that your submission is accurate and compliant with regulations.

Common Filing Errors

One of the most frequent issues arises from incorrect personal information, such as misspelled names or incorrect identification numbers. These seemingly minor mistakes can cause delays in processing and prevent timely updates to your records. Another common issue involves failing to claim all available deductions or credits, which can result in paying more than necessary.

- Incorrect Personal Details – Ensure names, addresses, and identification numbers are accurate to avoid delays or rejections.

- Missing Deductions or Credits – Not applying for eligible deductions or credits can lead to overpayment of liabilities.

- Incorrect Filing Status – Misunderstanding your filing status can affect your deductions, credits, and overall tax burden.

Errors in Calculations and Reporting

Mathematical errors, especially when calculating totals or applying deductions, are another common mistake. Whether it’s failing to add or subtract correctly or applying the wrong rates, incorrect calculations can lead to discrepancies in the final amount owed. Additionally, failing to report all sources of revenue, either intentionally or unintentionally, can result in penalties or audits.

| Common Mistake | Impact |

|---|---|

| Incorrect Calculation of Total Earnings | Leads to incorrect contribution amounts or overpayment. |

| Failure to Report All Revenue | Can trigger audits or penalties for underreporting. |

| Missed Deadlines | Can incur fines or interest on unpaid amounts. |

By being mindful of these common mistakes and double-checking your filing for accuracy, you can ensure that your submission is processed correctly and avoid unnecessary complications down the line.

Tax Rules for Self-Employed Individuals

Self-employment comes with a unique set of responsibilities, especially when it comes to handling your financial obligations. Unlike salaried employees, those who run their own businesses or work as freelancers must follow specific guidelines for reporting earnings, claiming deductions, and making contributions. Understanding these rules can help ensure compliance and prevent issues with authorities.

One of the key differences for self-employed individuals is the responsibility for both employer and employee contributions to various funds. Instead of having these contributions automatically deducted from paychecks, self-employed individuals must calculate and remit these amounts themselves. This can include contributions to social security, healthcare, and other mandatory fees.

Additionally, self-employed individuals have the ability to deduct a wider range of business-related expenses. These may include costs for office space, equipment, business-related travel, and even a portion of home utility costs if they work from home. Knowing which expenses qualify can significantly reduce the amount owed, making it essential to keep thorough records and consult with a tax professional when needed.

In summary, the rules governing the financial obligations of self-employed individuals differ from those of salaried employees. By understanding how to manage earnings, contributions, and deductions, self-employed individuals can avoid errors and take advantage of the available opportunities for reducing their overall liabilities.

How to Handle Tax Audits

Facing a financial review can be an intimidating experience, but understanding the process and knowing how to respond can help ease the stress and ensure a smoother resolution. An audit is essentially a detailed examination of financial records to verify that all filings are accurate and complete. While audits are not always an indication of wrongdoing, it’s important to approach them with preparedness and professionalism.

Steps to Take Before an Audit

The first step in handling a review is ensuring that all your records are organized and complete. This includes keeping thorough documentation of income, expenses, deductions, and any other relevant financial information. It’s also wise to review your submissions carefully to ensure there are no mistakes or inconsistencies that might raise flags.

- Keep Detailed Records – Maintain a clear, organized system of receipts, invoices, and any other supporting documents.

- Understand Your Submissions – Familiarize yourself with the forms you’ve filed and the figures you’ve reported.

- Seek Professional Help – Consult a tax expert or accountant for guidance if necessary.

During the Audit Process

Once the review begins, it’s important to remain calm and cooperative. Respond promptly to requests for additional documentation and be prepared to provide any clarifications if needed. Auditors are there to ensure that everything is in order, not to penalize individuals without cause, so transparency and clear communication are key.

- Respond Promptly – Address any requests for documents or clarifications as quickly as possible.

- Stay Professional – Keep all interactions respectful and focused on resolving the matter at hand.

- Keep a Record of Correspondence – Document every communication for future reference.

In the event that discrepancies are found, don’t panic. An audit does not necessarily mean you owe additional funds. There may be opportunities for negotiation, corrections, or adjustments to your filing. If necessary, you can appeal any decisions that you believe are unfair or inaccurate.

Understanding the Alternative Minimum Tax

The Alternative Minimum Tax (AMT) is a parallel set of rules that ensures taxpayers with certain income levels pay at least a minimum amount, even if they qualify for deductions or credits that significantly reduce their regular liability. The goal of this system is to prevent high-income individuals from using deductions, exemptions, and other financial strategies to reduce their tax obligations to zero. The AMT operates separately from the standard tax system, and it can apply in situations where a taxpayer’s deductions or credits are substantial.

One of the key aspects of the AMT is the calculation of income and allowable deductions. Unlike the regular tax system, where specific expenses can be deducted, the AMT limits the amount of deductions that can be claimed. For example, the AMT doesn’t allow certain deductions, such as state and local taxes or personal exemptions, which can significantly impact the final tax bill.

How AMT is Calculated

To determine if the AMT applies, the taxpayer’s regular liability is compared with the minimum required amount. If the regular tax amount is less than the AMT, the taxpayer is required to pay the difference. The process involves adding back certain deductions and income adjustments, then calculating the AMT based on a separate rate schedule.

The AMT rate typically starts at a lower level but increases as the income level rises. However, once the income reaches a certain threshold, the rate can become quite significant, which is why individuals subject to the AMT often see a higher overall tax liability. The key is to understand the potential triggers for the AMT and plan accordingly, especially when it comes to deductions and other tax benefits.

Strategies to Minimize the Impact of AMT

There are strategies available to reduce the risk of being subjected to the AMT. One approach is to carefully manage deductions, especially those that are disallowed under the AMT rules. Another tactic is to consider the timing of income or large deductions, as certain actions can be shifted to future years to avoid triggering the AMT in the current period.

- Monitor Your Deductions – Be mindful of deductions that may not be allowed under the AMT system.

- Timing Matters – Consider deferring certain income or deductions to a future tax year to minimize AMT exposure.

- Consult a Professional – Working with a tax advisor can help in understanding how the AMT applies to your specific situation.

While the AMT was designed to ensure that high-income earners pay a fair share, it can affect middle-income individuals as well, particularly when there are significant deductions or credits involved. Therefore, understanding how the AMT works is crucial for proper tax planning and avoiding unexpected liabilities.

Important Tax Law Changes to Know

Recent changes to the legal framework governing financial obligations have significant implications for individuals and businesses alike. These adjustments may affect the way you report earnings, claim deductions, or qualify for credits, which in turn could impact your overall financial picture. Understanding the most important changes can help you avoid penalties and maximize benefits, ensuring that your filings remain compliant and optimal.

Changes to these regulations often introduce new categories for exemptions, adjustments, or eligibility criteria that could either increase or decrease the amount owed. Furthermore, some of these revisions are designed to simplify the filing process or provide relief for taxpayers facing hardship. Whether you are an individual taxpayer or a business owner, staying informed about these changes is crucial for effective financial planning.

New Eligibility for Key Credits

Recent amendments have expanded eligibility for several important credits, which directly reduce the amount of tax owed. For instance, certain credits previously available only to high-income individuals are now open to more people based on adjusted criteria. Additionally, there are updates to income thresholds that determine who qualifies for credits such as the child and dependent care or educational assistance credits.

Revised Deduction Limits

Several deductions that were previously available have seen changes in their limits or eligibility criteria. This includes adjustments to allowances for home office deductions and business expenses. Individuals and entrepreneurs will need to reassess their financial records to ensure they are taking full advantage of these changes while staying within the new limits.

Remaining aware of these important legislative shifts will ensure that taxpayers are not only compliant but can also optimize their financial situation according to the latest rules. With strategic planning, it’s possible to manage your obligations effectively, ensuring that you’re paying only what is required under the current framework.

Preparing for Your Tax Exam Effectively

When it comes to preparing for any assessment related to financial obligations, a structured approach can make a significant difference in your success. Effective preparation not only helps in understanding complex rules but also boosts confidence and reduces anxiety. Whether you’re studying for a certification or aiming to refine your knowledge for practical application, there are key strategies that can guide your process.

One of the best ways to approach this preparation is by breaking down the material into manageable sections. Focusing on smaller, more digestible portions makes the content easier to absorb and remember. Below are several strategies that can help you organize your study sessions efficiently.

Study the Key Concepts Thoroughly

Understanding the core principles is essential for any financial assessment. Focus on the following key areas:

- Legal Frameworks: Familiarize yourself with the specific regulations that govern various financial activities.

- Eligibility Criteria: Ensure you know who qualifies for specific benefits, exemptions, or deductions.

- Calculation Methods: Practice the formulas and methodologies used for determining obligations.

- Important Deadlines: Keep track of any critical dates that affect filings or decisions.

Utilize Practice Materials

Practice is a vital component of effective preparation. Work through past materials or sample scenarios that reflect the types of challenges you may encounter. This will help reinforce your understanding of concepts, as well as provide insight into the format and style of questions you might face. It is also useful to test yourself under timed conditions to simulate the actual experience.

Finally, staying organized and consistent in your study routine can help you retain more information over time. Approach your preparation step-by-step, focusing on one area at a time, and continually review material to reinforce your knowledge.

Tax Filing Requirements for Businesses

When it comes to managing the financial obligations of a business, understanding the filing requirements is crucial. Different types of entities are subject to varying regulations and reporting criteria, and staying compliant is essential for avoiding penalties or issues with authorities. Whether you’re a sole proprietor, partnership, corporation, or another business structure, it’s important to understand what documentation is required, when it must be submitted, and how to complete the forms accurately.

Each business type has unique filing requirements that can be influenced by factors such as the size of the company, its earnings, and the state or region where it operates. Below are the key filing requirements for various business structures.

Sole Proprietors

Sole proprietors, individuals who operate their businesses on their own, have relatively simple filing obligations. However, they must still report earnings and expenses to ensure compliance. These are the basic steps:

- File an individual return: Most sole proprietors will report their business income and expenses on their personal return.

- Schedule C: Use this schedule to detail the income and expenses from the business.

- Self-employment tax: Be prepared to pay self-employment taxes, which cover Social Security and Medicare contributions.

Partnerships

Partnerships require more complex filing since the profits or losses of the business are passed on to the partners. Here’s what needs to be done:

- Form 1065: This form is used to report income, deductions, gains, and losses from the partnership.

- Schedule K-1: Each partner receives this document to report their share of the business’s income and deductions.

- Self-employment tax: Partners may also be required to pay self-employment tax on their share of the business’s earnings.

Corporations

Corporations are treated as separate legal entities, so they have distinct filing obligations compared to individuals or partnerships:

- Form 1120: This form is used to report corporate income, gains, losses, and other relevant information.

- Double taxation: Corporations may be subject to double taxation, meaning the company is taxed on its profits, and shareholders are taxed on dividends.

- Estimated payments: Corporations may need to make quarterly estimated payments depending on their income levels.

It’s important to keep thorough records throughout the year, as accurate documentation will be necessary to meet these filing requirements. Whether you are filing as a sole proprietor or a larger entity, understanding the deadlines and details of your filing requirements will help ensure that your business remains compliant with applicable regulations.

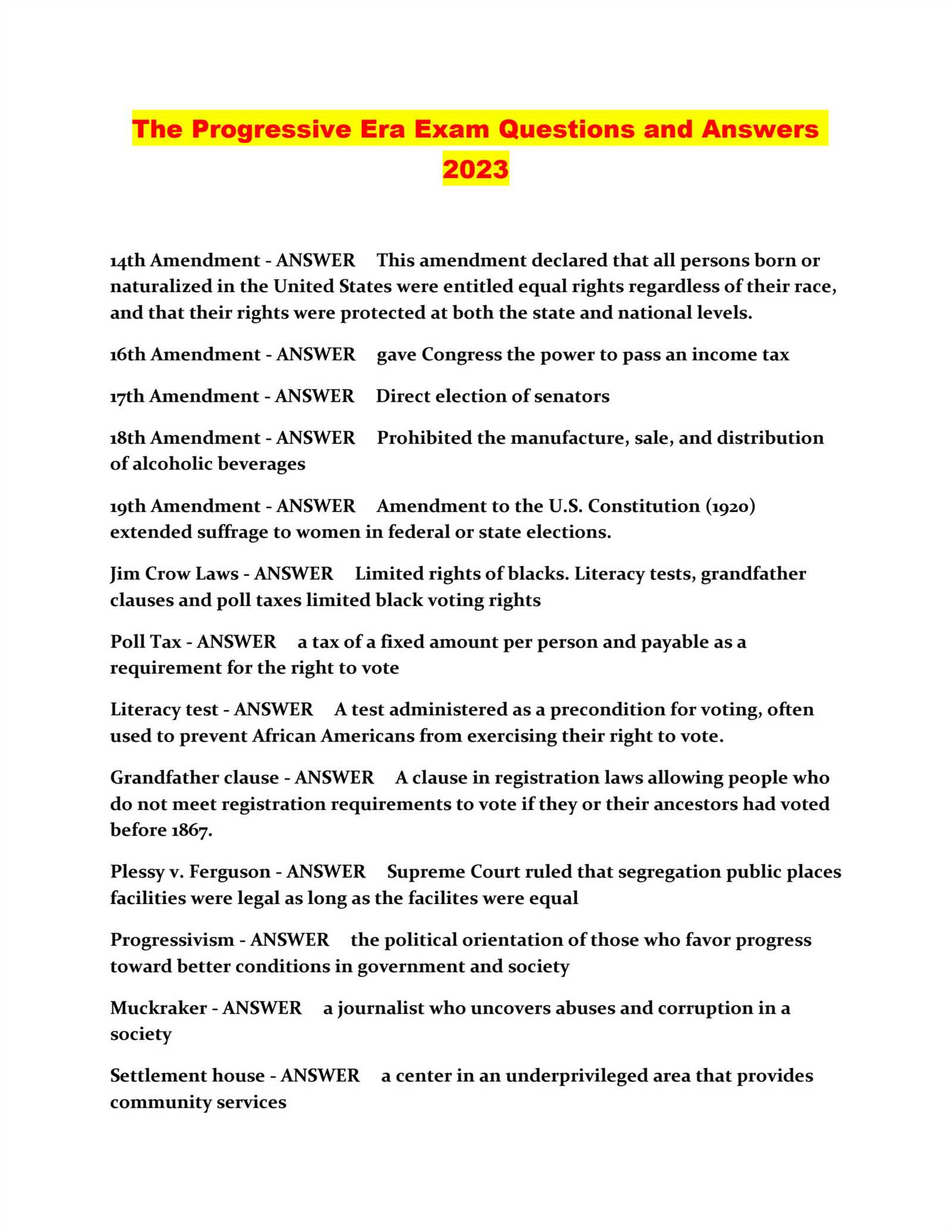

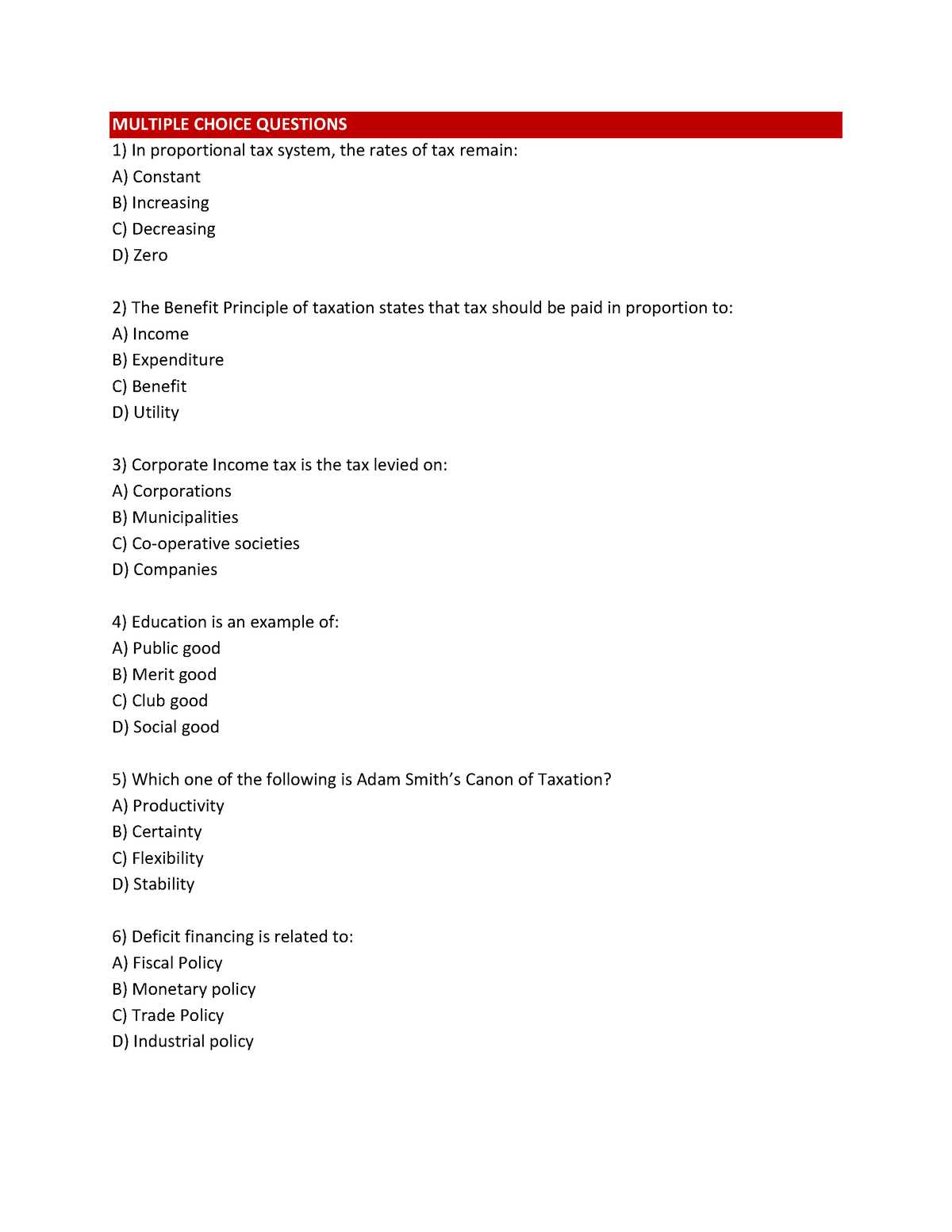

Common Federal Tax Exam Questions

When preparing for any type of assessment related to financial obligations and reporting, it’s important to understand the most common types of inquiries that can arise. These questions often focus on the principles of reporting, calculating, and verifying different forms of financial data, ensuring that individuals or businesses comply with necessary regulations. Below is a list of common questions and topics that often come up in these types of evaluations.

Key Topics to Understand

- Types of Filing Status: What are the different statuses available, and how do they impact the calculation of the amount owed or refunded?

- Deduction vs. Credit: How do deductions differ from credits, and which one provides more direct financial benefit to the filer?

- Reporting Employment Income: How is compensation from different sources, including freelance work or salaried positions, reported on returns?

Common Inquiries and Their Solutions

- What is the difference between gross and net income?

Gross income includes all earnings before deductions, while net income is the amount remaining after mandatory deductions, such as retirement contributions or insurance premiums.

- How do you calculate self-employment taxes?

Self-employment taxes are calculated by determining the net earnings from self-employed work and applying the prescribed rate for Social Security and Medicare contributions.

- What types of business expenses can be deducted?

Common deductible expenses include operational costs like office supplies, business-related travel, and certain vehicle expenses. It is important to keep receipts and accurate records to substantiate these claims.

Understanding these topics can help prepare individuals for assessments, ensuring they grasp the concepts of filing, reporting, and complying with regulations. By focusing on the common issues above, one can approach financial assessments with greater confidence and accuracy.