Preparing for assessments in record-keeping and financial management can be a challenging yet rewarding experience. It requires a clear understanding of principles, formulas, and concepts that play a vital role in the broader economic landscape.

Mastering this subject goes beyond memorizing facts. It involves developing skills to analyze data, interpret outcomes, and apply methodologies effectively. These abilities not only ensure better performance in evaluations but also lay a strong foundation for real-world applications.

In this guide, you will discover practical tips, essential resources, and illustrative examples designed to simplify the learning process. By focusing on the core elements of preparation, you’ll gain the confidence and clarity needed to achieve success in this field of study.

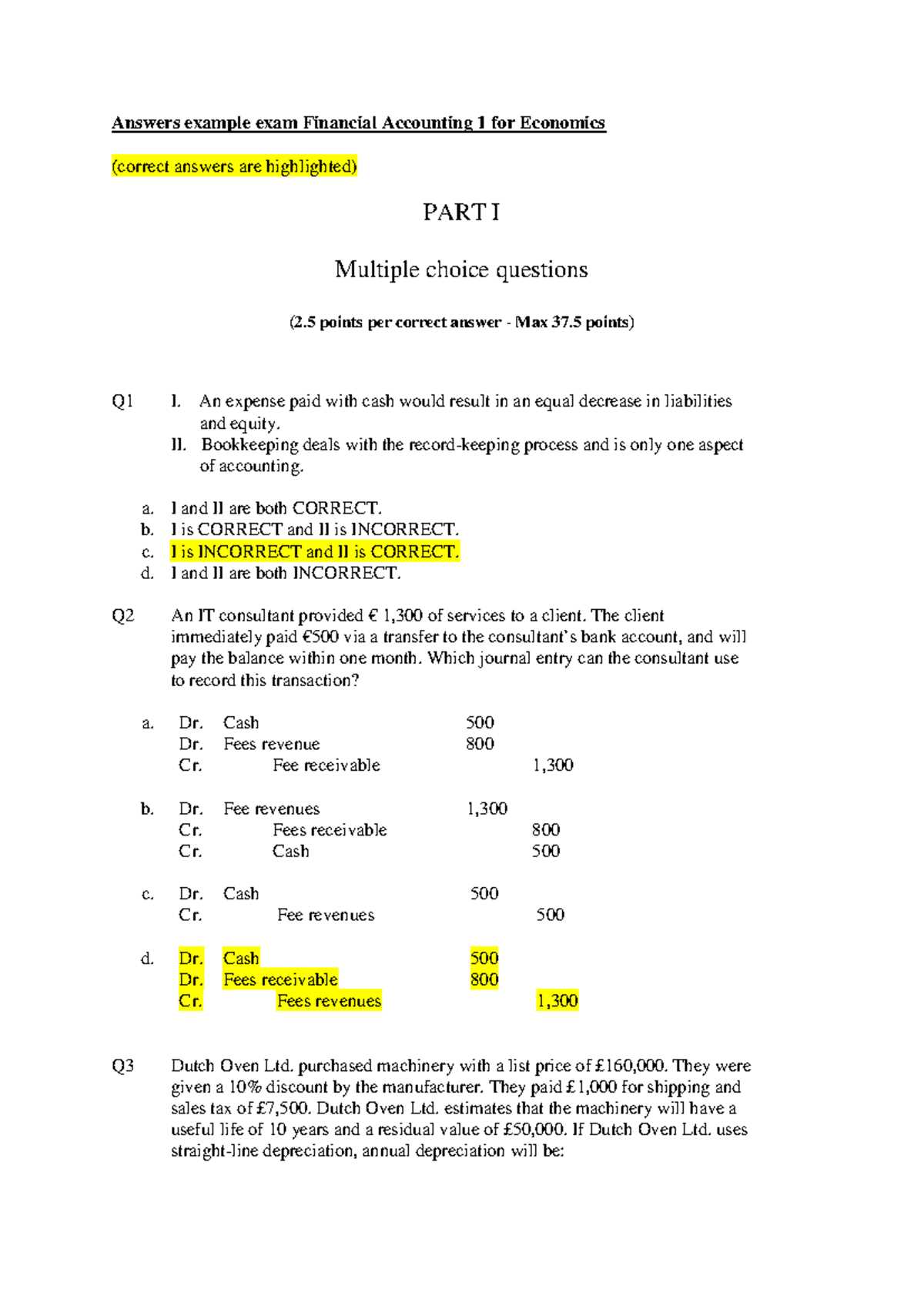

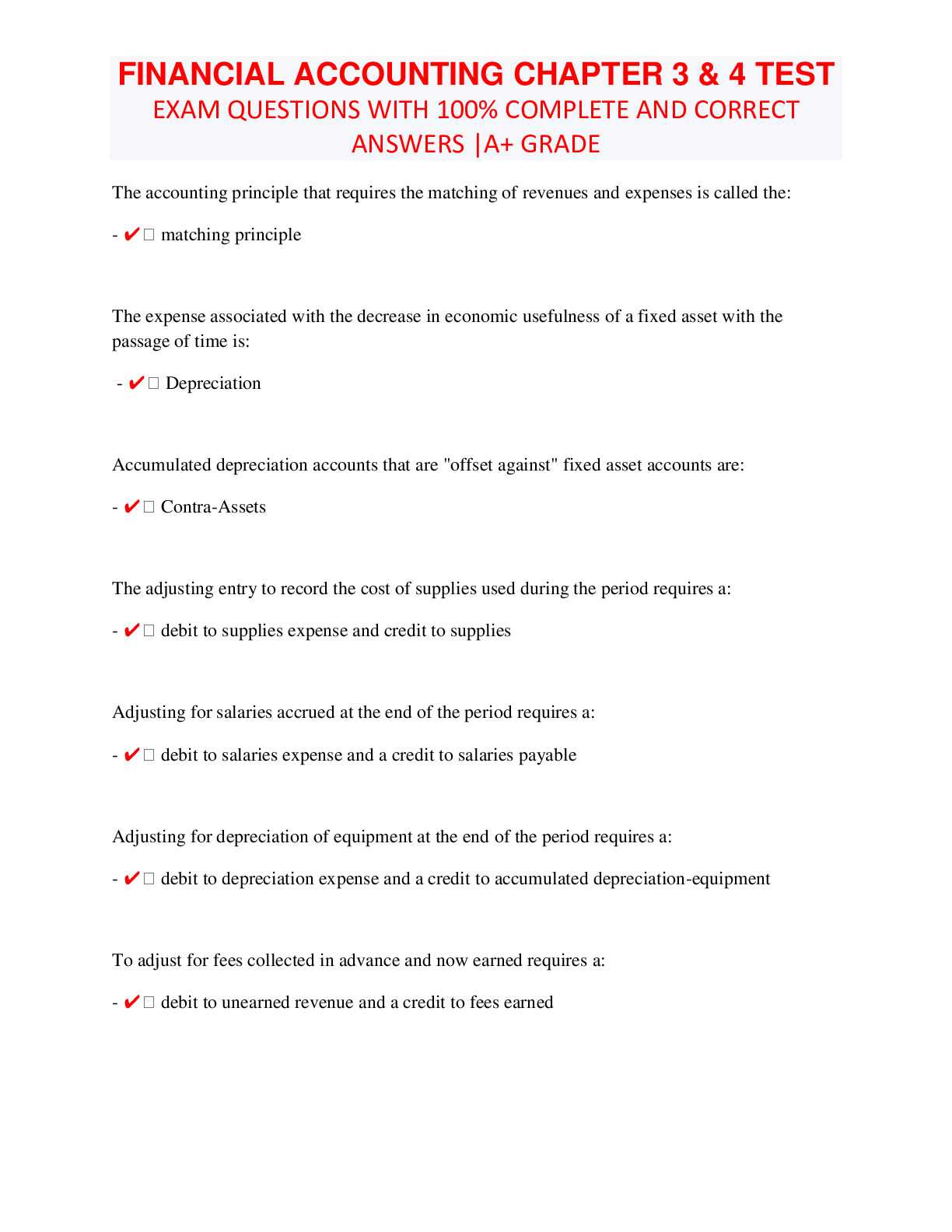

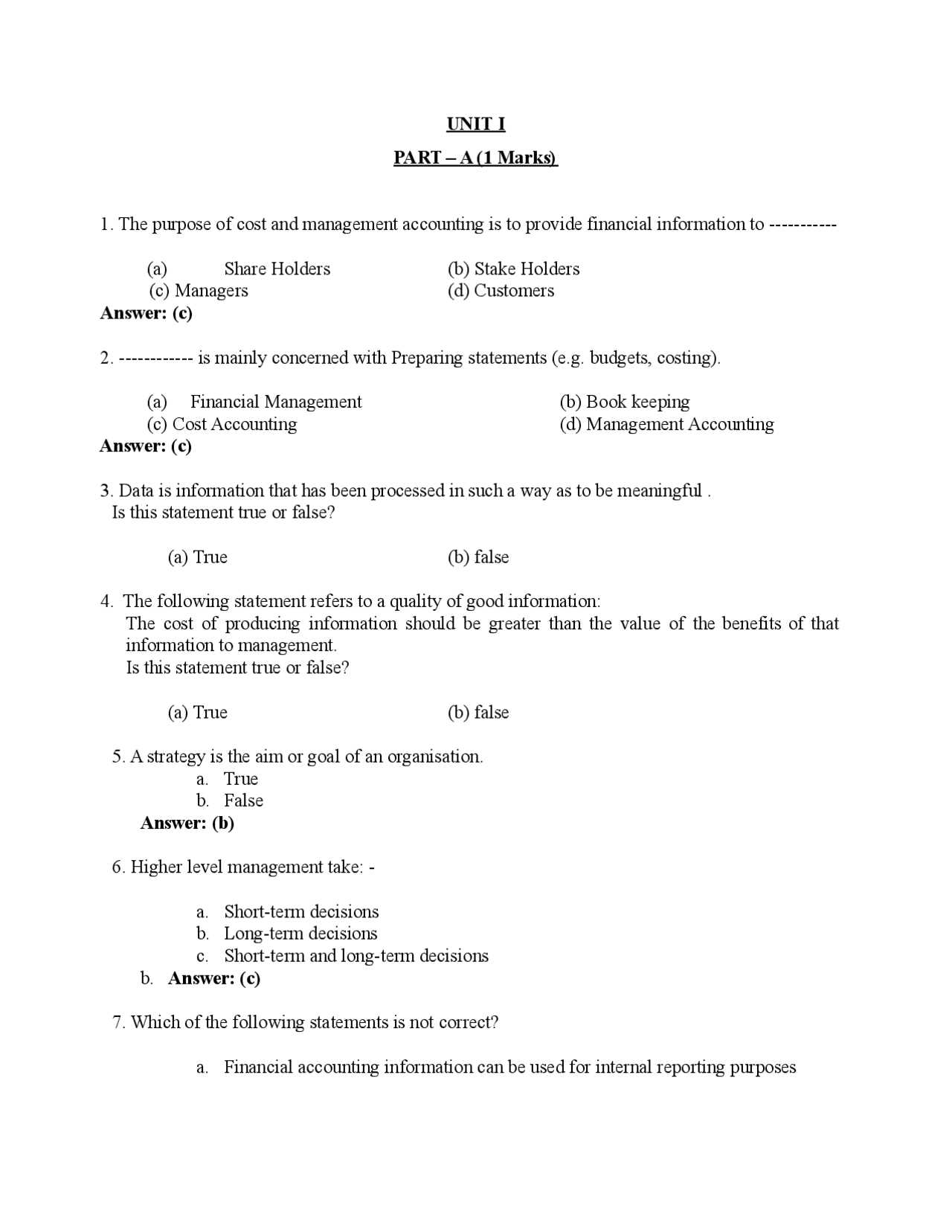

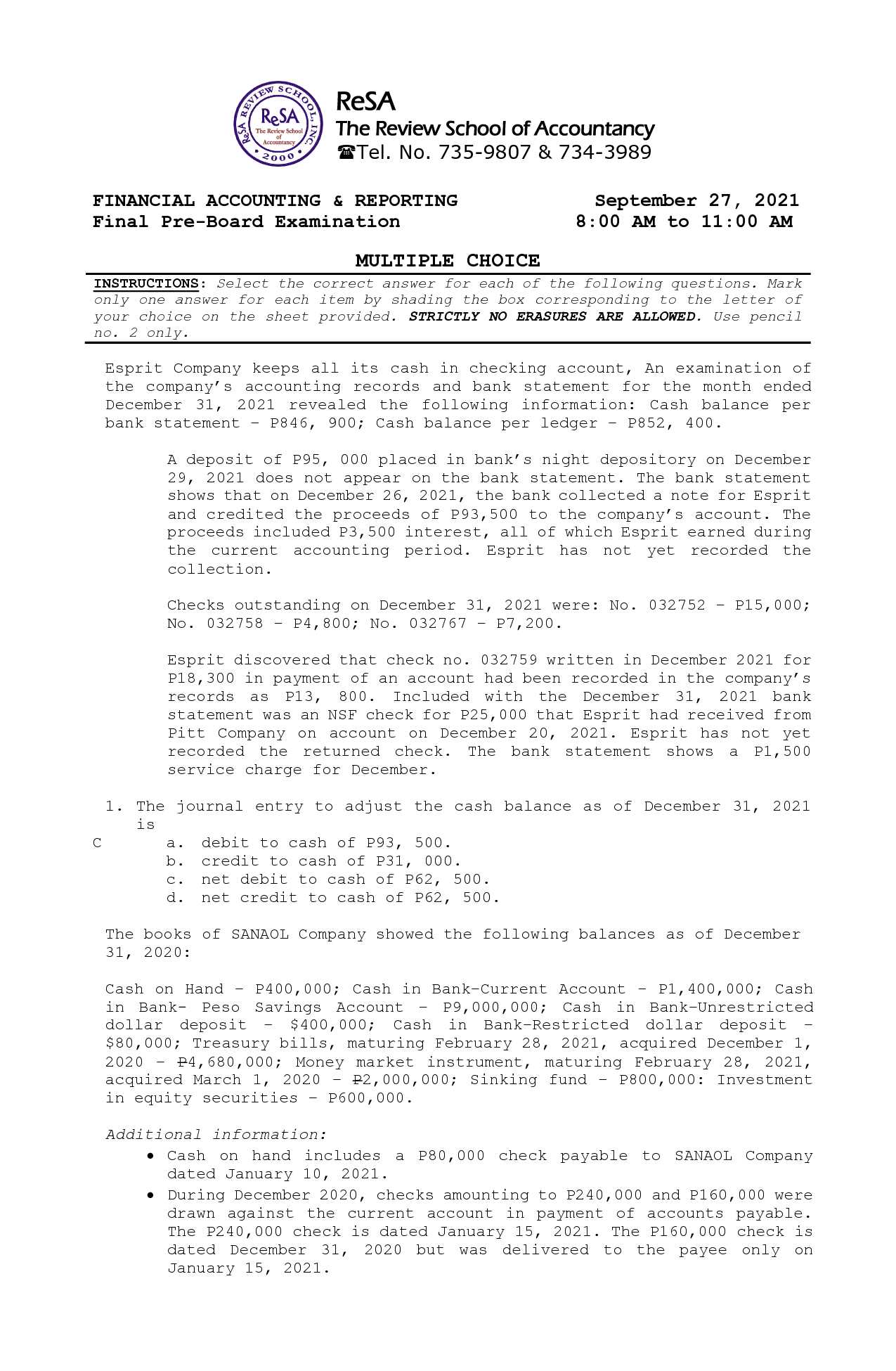

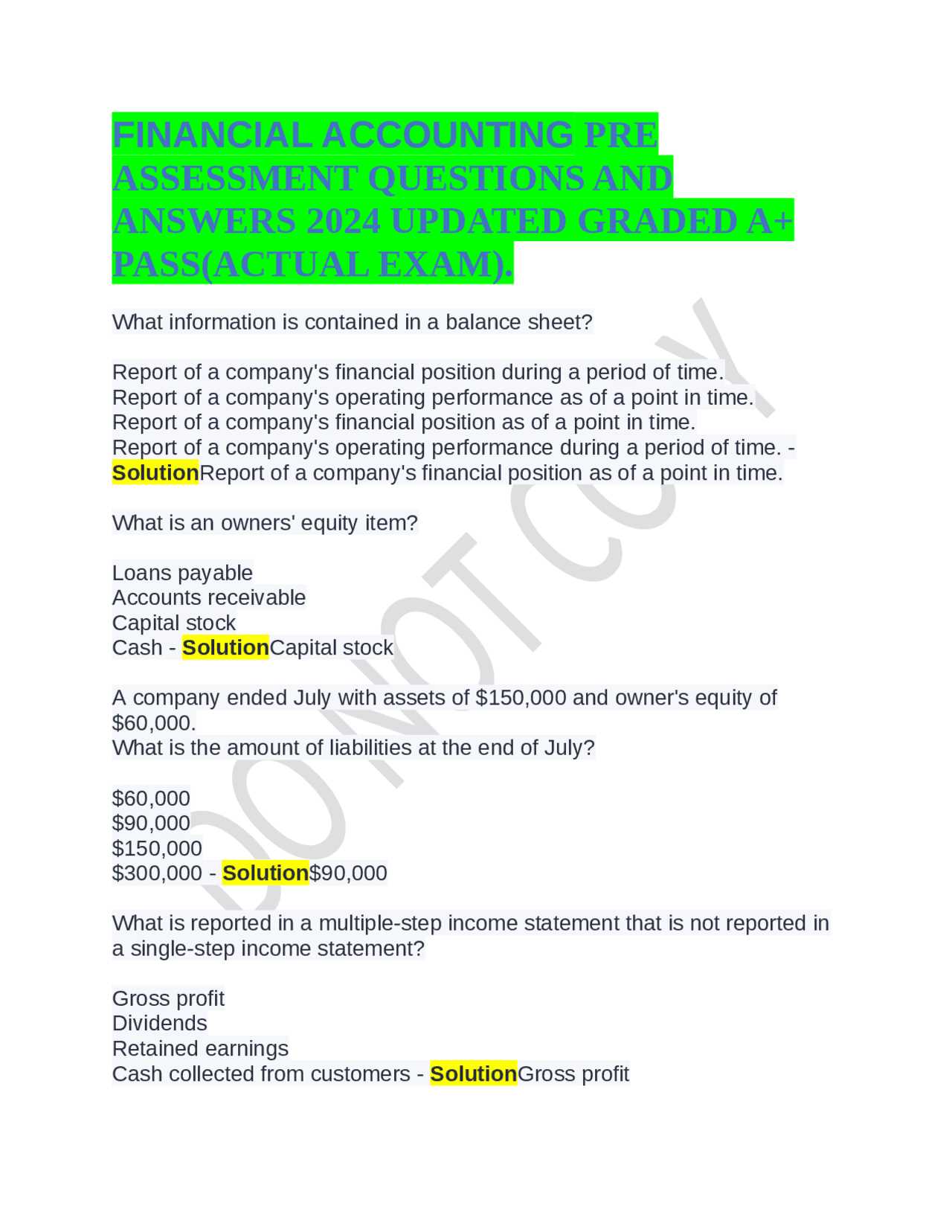

Financial Accounting Exam Questions and Answers

Understanding core elements of bookkeeping and resource management is crucial for those looking to excel in this field. It requires not only theoretical knowledge but also the ability to apply concepts in practical scenarios. By focusing on critical aspects of data organization and interpretation, learners can build a comprehensive skill set.

Mastering Core Principles

Grasping the essentials of transaction recording and reconciliation forms the backbone of this discipline. It is important to recognize patterns, utilize frameworks effectively, and ensure accuracy in reports to meet professional standards.

Preparing for Complex Scenarios

Real-life challenges often mirror what learners face in evaluations. Tackling case-based problems enhances analytical abilities and decision-making skills. This preparation helps align theoretical knowledge with practical applications, providing a deeper understanding of the subject.

Understanding Key Accounting Principles

Grasping the foundational ideas behind managing and tracking resources is essential for success in this domain. These principles serve as the building blocks for analyzing data, ensuring compliance, and making informed decisions in financial contexts.

Core Concepts of Resource Management

Central to this subject are methods for categorizing transactions and maintaining consistency across records. A clear framework helps organize information systematically, making it easier to identify trends and discrepancies in data.

The Importance of Accuracy and Consistency

Reliable reporting depends on precision and uniformity. Adhering to established guidelines ensures that records are transparent and trustworthy, which is critical for both evaluations and real-world applications.

How to Analyze Financial Statements

Interpreting organizational reports requires a deep understanding of their structure and purpose. These documents provide critical insights into a company’s performance, resource management, and overall stability.

To effectively evaluate these reports, focus on key metrics such as profitability, liquidity, and operational efficiency. Understanding relationships between different sections helps uncover trends and potential areas for improvement. This process involves both quantitative analysis and contextual interpretation to form a complete picture.

By mastering the ability to extract meaningful information from these records, you can make informed decisions and contribute to more effective financial strategies.

Tips for Preparing for Accounting Exams

Success in resource management studies depends on consistent effort and strategic preparation. Building a strong understanding of core ideas and practicing problem-solving techniques are essential steps toward achieving excellent results.

Focus on Core Concepts

Start by reviewing the fundamental principles and ensuring clarity in how they are applied. Prioritize areas where you feel less confident and seek examples to deepen your comprehension.

Practice Application Techniques

Working through sample problems and real-world scenarios helps reinforce theoretical knowledge. Focus on time management during practice sessions to simulate the experience and improve efficiency.

Common Mistakes in Accounting Tests

Understanding frequent errors can help you navigate assessments with greater confidence. Avoiding typical pitfalls ensures better precision and enhances your overall results.

- Mistaking Classification: Misallocating entries or mislabeling categories disrupts the logic of the task. Carefully assess where each piece of data belongs.

- Skipping Steps: Failing to follow through with all required calculations or processes can lead to incomplete work. Take your time to cover each part thoroughly.

- Neglecting Context: Solving problems in isolation without considering the broader situation may result in flawed outcomes. Always keep the bigger picture in mind.

- Inconsistent Formats: Using mismatched methods or templates can create confusion and errors. Stick to one clear, structured approach throughout the task.

- Misreading Values: Errors in copying or interpreting figures can c

Solving Complex Accounting Problems

Addressing intricate scenarios requires a structured approach and a clear understanding of the task at hand. Breaking down the problem into manageable parts can make even the most challenging tasks more approachable.

Understanding the Problem Fully

Begin by carefully reviewing the details provided. Identify all necessary data and clarify any unclear elements before starting. Misinterpreting information is a common issue that can lead to incorrect outcomes.

Step-by-Step Resolution

Divide the task into smaller, logical segments. Solve each part individually, ensuring accuracy at every step. Consistently check your progress to confirm that calculations align with the overall goal.

By maintaining a methodical approach, you can simplify seemingly complicated tasks and achieve precise results with greater confidence.

Mastering the Trial Balance Process

The process of balancing books plays a crucial role in ensuring financial accuracy. This stage helps identify discrepancies and ensures that all figures are in harmony before proceeding to more advanced tasks.

Step-by-Step Approach

Start by listing all the ledger accounts with their corresponding balances. Separate debits and credits carefully, and ensure that each account is properly represented. This creates the foundation for a balanced trial.

Identifying and Correcting Errors

Once the trial balance is completed, compare the totals of debits and credits. If there is an imbalance, systematically check for possible mistakes such as transposed numbers or omitted entries. Correcting these errors early prevents further complications.

By practicing this methodical approach, you will develop a clear understanding of the balancing process, making it easier to identify and resolve issues quickly.

Importance of Ledger Entries in Exams

Recording transactions accurately is essential for success in evaluations. Properly documenting each entry ensures clarity and allows for easy tracing of financial activities, which is crucial in assessments.

Why Ledger Entries Matter

Ledger entries serve as the foundation for preparing statements and reports. Here’s why they are significant:

- Accuracy: They help ensure that every transaction is recorded correctly, avoiding potential errors in calculations.

- Traceability: Clear entries allow you to trace back every amount to its source, making it easier to verify your work.

- Organization: Proper entries provide a structured approach, allowing you to organize your work effectively during evaluations.

Common Mistakes to Avoid

To avoid jeopardizing your performance, be mindful of these common mistakes when making ledger entries:

- Omitting essential details such as dates or amounts.

- Recording transactions in the wrong accounts, leading to inaccuracies.

- Failing to balance entries properly, resulting in discrepancies.

Mastering the proper method of recording transactions ensures success and helps demonstrate your understanding of core concepts during assessments.

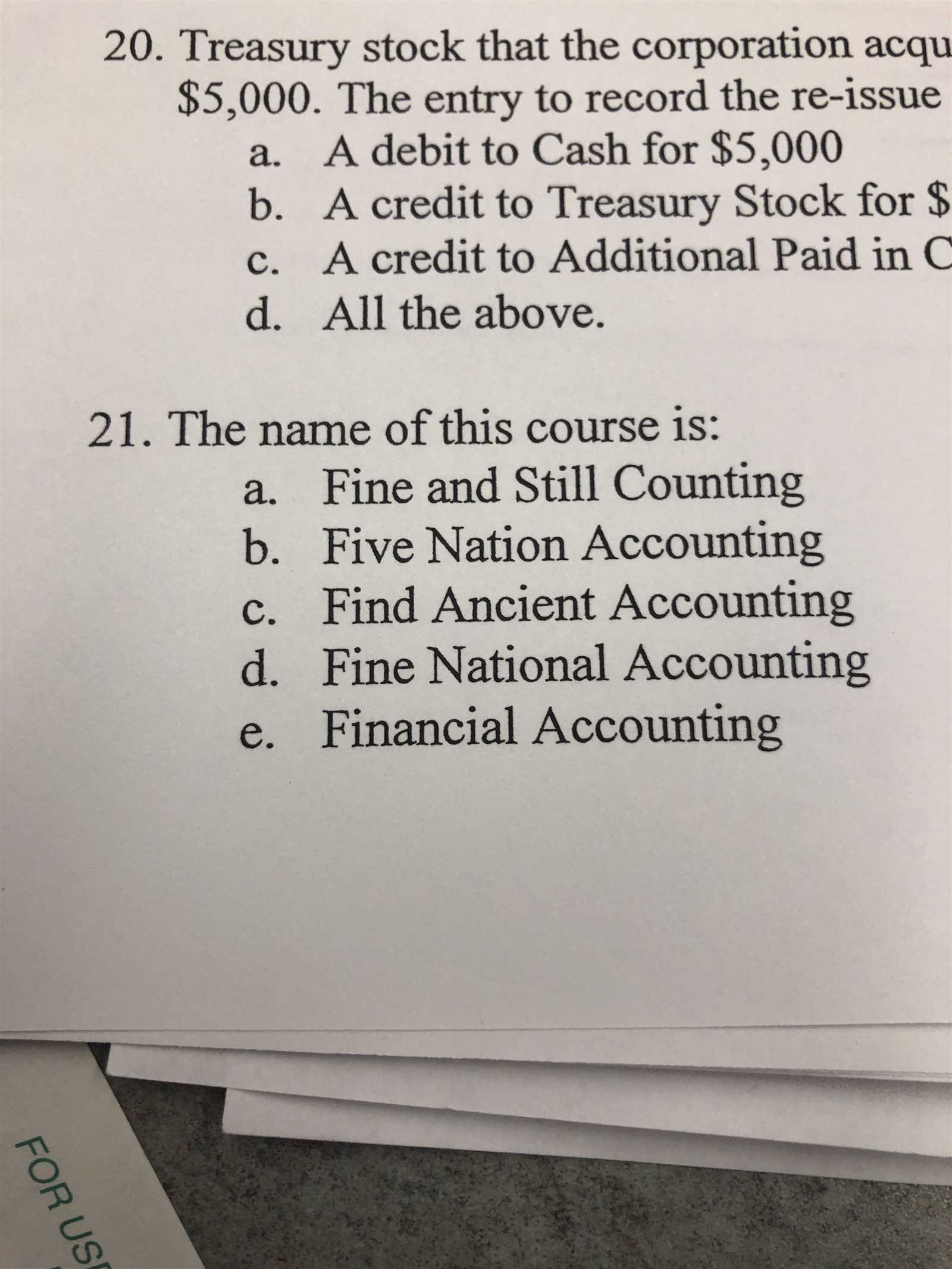

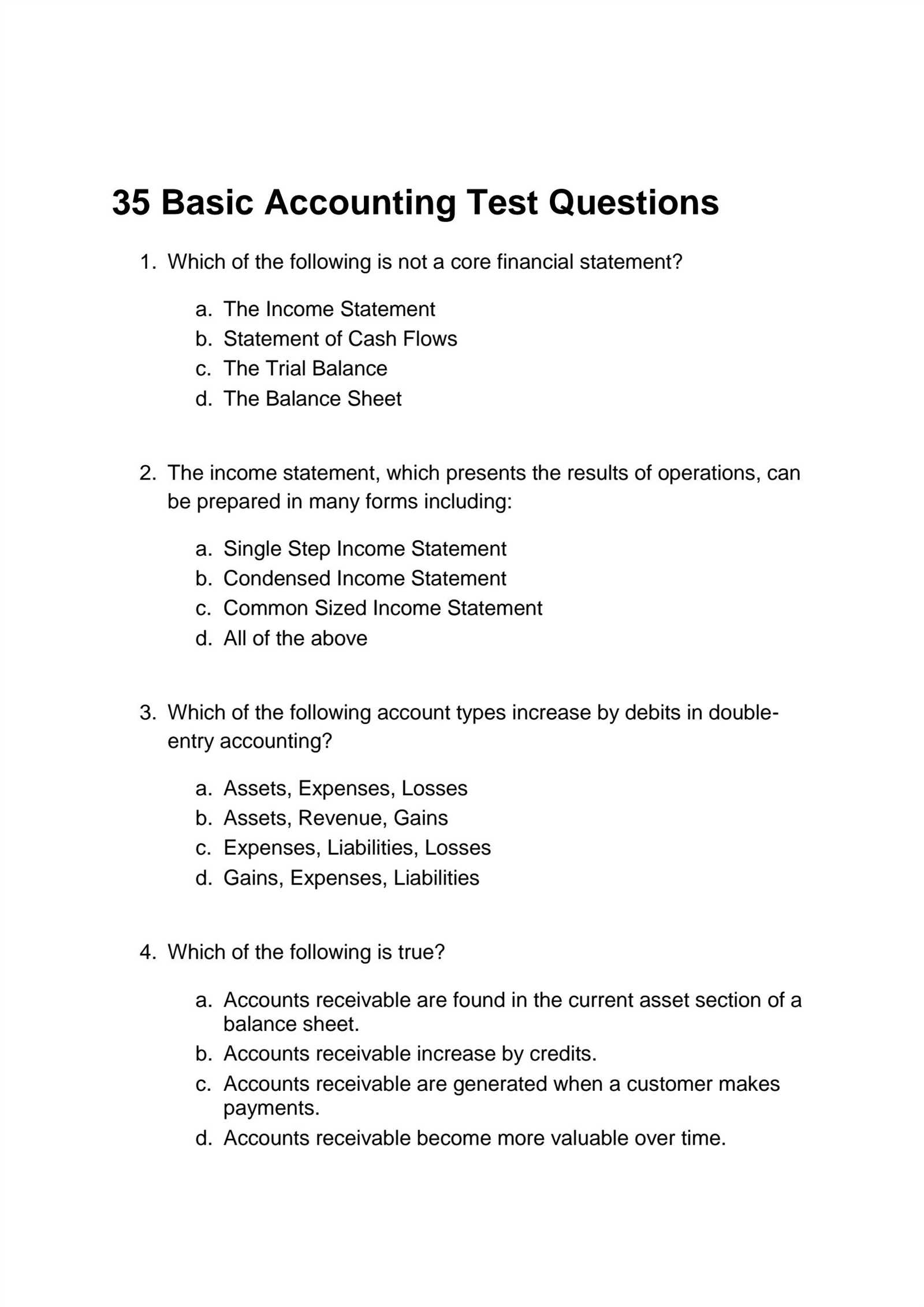

Preparing for Multiple-Choice Questions

To excel in multiple-choice assessments, a solid strategy is essential. It’s not just about knowing the content; it’s about understanding how to approach each option methodically. This approach allows you to maximize your chances of selecting the correct choice, even when you’re unsure of the answer at first glance.

One effective method is to eliminate obviously incorrect options, narrowing down the choices. Additionally, it’s crucial to pay attention to keywords in the question stem and options. These subtle cues often guide you toward the most accurate response.

Another important strategy is to manage your time wisely. Don’t dwell too long on a single item. If you’re unsure, make an educated guess and move on, ensuring you leave enough time to revisit difficult questions later.

Finally, regular practice is vital. Familiarize yourself with the types of questions you may encounter and review key concepts. The more you practice, the more confident you’ll feel in handling multiple-choice items effectively.

Explaining the Role of Journal Entries

Journal entries are essential in maintaining the flow of records within the accounting system. They serve as the first step in the process of tracking financial transactions. Each entry captures the details of a specific transaction, ensuring that the information is accurately transferred to other parts of the ledger for further analysis and reporting.

The primary role of journal entries is to document every financial event in the correct accounts. This ensures the organization’s books are up-to-date and in compliance with internal policies and external regulations. Proper journal entries are vital for producing accurate financial statements, making them a cornerstone of sound financial management.

Components of a Journal Entry

A typical journal entry consists of several important components. These include the date of the transaction, the accounts affected, the debit and credit amounts, and a brief description of the transaction. The entries ensure that the accounting equation remains balanced, reflecting the dual aspect of each transaction.

Component Description Date Indicates when the transaction occurred. Accounts Lists the accounts that are impacted by the transaction (e.g., cash, revenue). Debit Denotes the amount to be entered on the left side of the accounting system. Credit Represents the amount to be entered on the right side of the accounting system. Description Provides a brief explanation of the transaction. In essence, journal entries are not just a record-keeping tool; they are a critical part of a broader system designed to ensure transparency, accuracy, and consistency in financial reporting.

How to Interpret Balance Sheet Data

Interpreting balance sheet data is crucial for understanding the financial health of an organization. This document provides a snapshot of a company’s assets, liabilities, and equity, helping stakeholders assess its stability, liquidity, and long-term viability. By analyzing the relationships between these components, one can gain valuable insights into how well the company manages its resources and obligations.

The balance sheet is divided into two main sections: assets and liabilities. The assets section shows what the company owns, while the liabilities section shows what it owes. The difference between the two represents the owner’s equity. A well-structured balance sheet helps to assess whether the company is over-leveraged or whether it has a solid foundation for future growth.

Key Components of a Balance Sheet

Understanding the individual elements that make up the balance sheet is essential. The primary components include:

Component Description Assets Resources owned by the company, such as cash, equipment, and inventory. Liabilities Obligations the company must fulfill, such as loans, accounts payable, and debts. Equity The ownership interest in the company, calculated as assets minus liabilities. How to Analyze the Balance Sheet

To effectively analyze a balance sheet, it’s important to look at key ratios and relationships between the components. For instance, the debt-to-equity ratio helps to understand the proportion of financing that comes from debt versus equity. Similarly, liquidity ratios like the current ratio give insights into the company’s ability to cover short-term liabilities with its current assets.

Overall, interpreting balance sheet data provides a comprehensive view of a company’s financial standing, revealing not just its ability to meet short-term obligations but also its capacity for long-term growth and sustainability.

Understanding Cash Flow Statement Questions

When evaluating the performance of a business, one of the key elements to consider is its ability to generate cash. The cash flow statement offers insights into how money moves through a company, highlighting the inflows and outflows of cash within a specific period. Analyzing the different sections of this statement helps identify how well the business can maintain liquidity and fund its operations, investments, and financing activities.

Understanding cash flow-related queries involves recognizing the three primary activities covered in the statement: operating activities, investing activities, and financing activities. Each of these categories provides a detailed look at where the company’s money is coming from and how it’s being used, which is critical for making informed decisions about its financial health.

Effective Study Techniques for Accounting

Mastering the principles of numbers and financial reports requires a strategic approach to learning. By employing the right study techniques, individuals can deepen their understanding, improve retention, and enhance their problem-solving abilities in this field. It’s important to focus on both theoretical knowledge and practical application to excel in the subject matter.

Organizing Study Sessions

Breaking down complex concepts into manageable parts and reviewing them consistently can significantly enhance comprehension. Here are some key strategies:

- Active Learning: Instead of passively reading notes, engage with the material by solving problems and explaining concepts aloud.

- Practice Regularly: Consistent practice through sample problems helps reinforce key principles and improve problem-solving skills.

- Time Management: Create a study schedule that balances revision with rest, ensuring each topic is covered thoroughly.

Collaborating with Others

Working with peers can also improve understanding, as discussions can highlight different perspectives and clarify difficult points. Here are some benefits of collaboration:

- Group Study Sessions: Collaborative learning allows for the exchange of ideas, helping to reinforce concepts and fill gaps in knowledge.

- Peer Teaching: Explaining difficult concepts to others can deepen your own understanding.

Strategies for Time Management During Exams

Effective time management is crucial when facing assessments. By planning ahead, allocating sufficient time for each task, and staying focused, individuals can maximize their performance. Proper time allocation not only helps in covering all topics but also ensures that you have time for reviewing and finalizing your responses. Developing a strategic approach to time can alleviate stress and boost confidence.

Prioritize Tasks and Questions

One of the most effective ways to manage your time during an assessment is by prioritizing tasks. Here’s how to approach it:

- Read Through All Tasks: Quickly scan all the instructions and questions before starting. This gives you an idea of which sections may require more time.

- Start with Easier Questions: Tackling simpler tasks first allows you to build momentum, ensuring you don’t waste time on difficult ones at the start.

- Allocate Time for Each Section: Set a time limit for each section or task to ensure balanced attention to all areas.

Avoiding Overthinking and Staying on Track

While it’s important to be thorough, overthinking can lead to wasted time. Maintain a steady pace by following these tips:

- Set Time Limits: Once you’ve allocated time to each question or section, stick to it. If you find yourself getting stuck, move on to the next one.

- Stay Calm: Don’t let difficult questions or tasks create stress. Keeping a calm mindset allows you to stay focused and more efficient.

Insights into Ratio Analysis Questions

Ratio analysis is a powerful tool for assessing the performance and financial health of a business. Understanding how to interpret these ratios and their significance is essential for tackling related tasks. This process involves evaluating relationships between different elements of financial data, allowing you to uncover key trends and make informed decisions. Grasping the formulas and their meanings helps in efficiently addressing related inquiries and solving problems that require these calculations.

Key Ratios to Focus On

When approaching tasks involving ratio analysis, there are several important ratios to focus on. These ratios help to measure liquidity, profitability, efficiency, and solvency:

Ratio Formula Purpose Current Ratio Current Assets / Current Liabilities Measures liquidity and short-term financial health Return on Equity (ROE) Net Income / Shareholder’s Equity Indicates the profitability relative to equity Debt to Equity Ratio Total Debt / Total Equity Measures the company’s leverage Profit Margin Net Income / Revenue Shows profitability as a percentage of revenue Interpreting the Results

Once you have calculated the relevant ratios, interpreting the results is crucial. It’s not just about performing the calculations; understanding the context and implications of each ratio is essential for drawing meaningful conclusions. For example:

- Higher Current Ratio: Generally indicates a better ability to cover short-term obligations.

- High ROE: Can suggest effective management and strong returns on invested capital.

- Excessive Debt to Equity Ratio: May signal higher financial risk due to dependence on debt.

Applying Accounting Standards in Exams

Incorporating relevant standards into your responses is crucial when tackling challenges that require an understanding of specific principles. These standards provide the framework for proper financial reporting and decision-making, ensuring consistency and transparency in the preparation of statements. Mastering how to apply these regulations in practical situations is key to achieving success in related tasks.

When addressing inquiries related to these guidelines, it is important to follow specific procedures and guidelines that are set out in the rules. This includes being familiar with the key concepts and knowing when to apply each standard appropriately. Below are some essential considerations for applying such standards:

- Understand the Core Principles: Be clear on the fundamental rules behind the standards, such as how revenue should be recognized or when expenses are recorded.

- Follow the Standardization Process: Ensure that all calculations and presentations adhere to the standardized methods outlined in the relevant regulations.

- Identify Key Areas: Know which areas of the task require specific application of these standards, such as asset valuation or liability recognition.

Moreover, practicing the application of these standards through example problems can help solidify your understanding. Recognizing the common situations where these principles apply will increase efficiency and confidence during performance.