Understanding the core principles behind evaluating business performance is crucial for anyone aiming to excel in this field. The ability to interpret and assess financial records provides insights into an organization’s health and operations. Whether preparing for a test or enhancing your expertise, grasping essential ideas is vital for success.

In this guide, we’ll explore essential techniques for evaluating economic data and developing a strong foundation. By focusing on the most important measures, you can sharpen your skills and improve your analytical capabilities. With structured practice and targeted exercises, mastering these concepts becomes an achievable goal.

Learning how to navigate through financial documents and identify key indicators of growth and stability is an indispensable skill. Practice will allow you to gain confidence in interpreting various reports, making the process smoother and more intuitive.

Whether you’re preparing for a certification or enhancing your professional knowledge, these insights will help you refine your approach and deepen your understanding of business performance evaluation.

Key Concepts in Financial Statement Analysis

Understanding the fundamental elements of evaluating a company’s economic data is essential for anyone looking to assess its financial health. Key metrics and methods help interpret and highlight crucial aspects of performance. These concepts form the foundation for making informed decisions based on the information presented in various reports.

Core Metrics and Their Significance

To properly evaluate an organization’s financial condition, several key measures must be considered. These indicators allow a deeper understanding of its profitability, stability, and operational efficiency. Below are some of the most important concepts to grasp:

- Profitability Indicators: These metrics provide insight into how effectively a company generates profit relative to its revenue, assets, or equity.

- Liquidity Ratios: These ratios help assess a company’s ability to meet short-term obligations, giving a snapshot of its immediate financial health.

- Solvency Measures: These indicators highlight the long-term financial stability and capacity of a business to meet its long-term debts.

- Efficiency Ratios: These measures focus on how effectively a company uses its resources to generate sales or profit.

Interpreting Key Reports

In addition to metrics, interpreting key financial documents plays a significant role in understanding a company’s performance. Key reports include:

- Income Report: Provides a summary of a company’s revenue, costs, and expenses over a given period, reflecting its profitability.

- Balance Overview: Shows the financial position of a company at a specific point in time, detailing its assets, liabilities, and equity.

- Cash Flow Record: Details the inflows and outflows of cash, highlighting a company’s ability to generate cash and meet its financial obligations.

By mastering these concepts and learning to interpret reports effectively, you gain the ability to assess a company’s financial condition with confidence, making informed decisions based on a thorough understanding of its economic standing.

Understanding Financial Ratios and Their Use

Ratios serve as powerful tools for evaluating a company’s performance and financial health. These numerical measures allow for a clear understanding of various aspects of a business, such as profitability, risk, and efficiency. By comparing different figures within a company’s records, ratios provide a snapshot of its operational effectiveness and financial stability.

Commonly Used Ratios

Different types of ratios serve various purposes. Some focus on a company’s ability to generate profit, while others highlight its liquidity or solvency. Below are some of the most widely used ratios:

| Ratio | Purpose | Formula |

|---|---|---|

| Profit Margin | Measures profitability relative to revenue | Net Income / Revenue |

| Current Ratio | Assesses short-term liquidity | Current Assets / Current Liabilities |

| Quick Ratio | Evaluates immediate liquidity, excluding inventory | (Current Assets – Inventory) / Current Liabilities |

| Debt-to-Equity Ratio | Indicates the financial leverage and long-term stability | Total Liabilities / Shareholders’ Equity |

| Return on Assets | Shows how efficiently assets generate profit | Net Income / Total Assets |

How Ratios Inform Decision-Making

Ratios provide essential insights that influence strategic decisions. For example, a low current ratio may suggest that a company struggles with short-term liquidity, prompting management to address working capital concerns. Similarly, a high profit margin may indicate operational efficiency and strong pricing power. By understanding and interpreting these ratios, investors, analysts, and managers can make better-informed choices to drive business growth and stability.

How to Interpret Income Statements

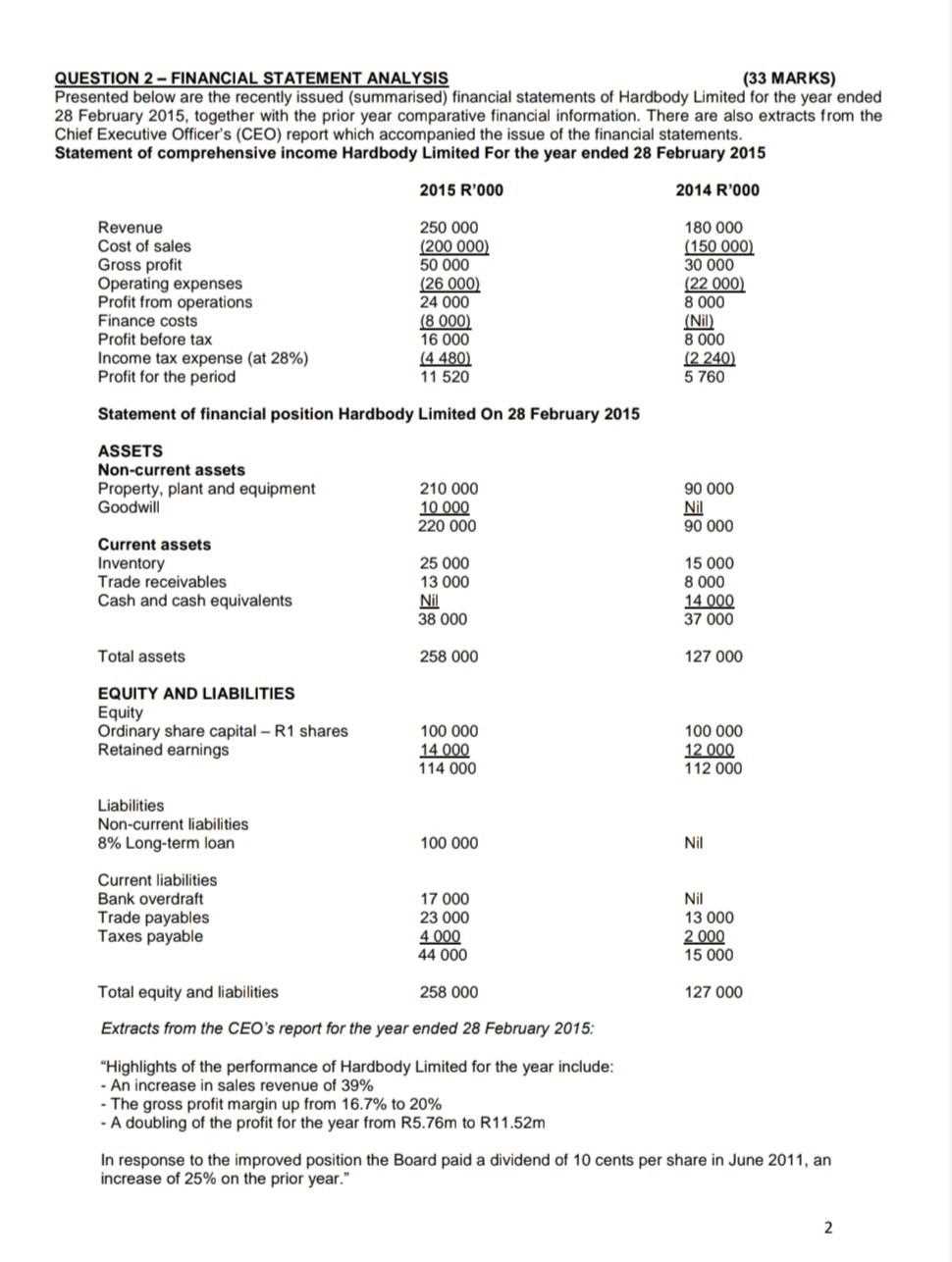

Understanding how to read and interpret an income overview is crucial for evaluating a company’s performance over a specific period. This document highlights the organization’s revenue, expenses, and profit, offering insights into its operational efficiency and profitability. By focusing on key areas, you can gain a clear understanding of how well the company is managing its resources.

Key Components to Focus On

When reviewing an income overview, several components provide the most critical information. Below are the main sections to consider:

- Revenue: This represents the total earnings from the company’s primary activities, such as product sales or service income.

- Cost of Goods Sold (COGS): This includes all direct costs associated with the production of goods or services sold during the period.

- Gross Profit: The difference between revenue and COGS, indicating how efficiently a company produces its goods or services.

- Operating Expenses: These are the costs related to running day-to-day operations, such as salaries, rent, and marketing expenses.

- Net Profit: The final figure after subtracting all costs and expenses from total revenue, representing the company’s profitability.

Interpreting the Data

When analyzing the numbers, it’s essential to look at trends and ratios to understand the company’s financial health. Here’s how to interpret the key figures:

- Profitability: A high net profit indicates strong financial performance, while a decline may suggest inefficiency or increasing costs.

- Cost Management: If the cost of goods sold or operating expenses is rising faster than revenue, it could point to poor cost control.

- Gross Margin: A healthy margin means that a company is effectively managing production costs, while a low margin may raise concerns about pricing or operational inefficiencies.

By comparing these figures over time and against industry benchmarks, you can assess the overall financial health and growth potential of a company.

Balance Sheet Analysis for Beginners

Understanding how to evaluate a company’s financial position at a specific point in time is essential for anyone new to the field. A balance overview provides a snapshot of what the company owns (assets), what it owes (liabilities), and the equity left for the owners. Learning how to read and interpret these elements will help you gain a deeper insight into the organization’s financial health and stability.

Key Components of a Balance Overview

The balance overview is divided into three main sections: assets, liabilities, and equity. Here’s a breakdown of each component:

| Component | Description | Example |

|---|---|---|

| Assets | Resources owned by the company that are expected to provide future economic benefits. | Cash, inventory, property |

| Liabilities | Obligations that the company must settle in the future, typically in the form of debt. | Loans, accounts payable |

| Equity | The residual value of the company’s assets after liabilities are deducted. Represents the owners’ claim. | Common stock, retained earnings |

How to Interpret the Data

Once you are familiar with the basic components, the next step is interpreting the data within the context of the company’s operations. Below are some tips on how to read the information effectively:

- Assets vs. Liabilities: A key indicator of financial stability is how much the company owes compared to what it owns. A healthy balance is when assets exceed liabilities.

- Liquidity: Assess how quickly a company can convert its assets into cash to meet short-term obligations. High liquid assets, like cash, are essential for this purpose.

- Equity Health: A higher equity figure generally means a company is financially strong and has enough value left for its shareholders after liabilities are settled.

By reviewing the balance sheet regularly, you can identify trends in a company’s financial position, providing critical insights for decision-making and performance evaluation.

Cash Flow Statement Breakdown

Understanding how money flows in and out of a company is essential for evaluating its liquidity and overall financial health. The cash flow record highlights how cash is generated from operational activities, invested in assets, or used to pay off liabilities. This overview is crucial for assessing whether a company can sustain its operations, meet its obligations, and fund future growth.

Key Sections of a Cash Flow Record

The cash flow overview is divided into three main sections, each focusing on different aspects of cash movement within the business:

- Operating Activities: This section reflects the cash generated or spent on the company’s core business operations, such as sales, production, and day-to-day expenses.

- Investing Activities: Includes cash used for purchasing or selling assets like equipment, property, or securities. This section reveals how much is invested in long-term growth.

- Financing Activities: Shows how cash is raised or returned to stakeholders, including debt issuance or repayment, and dividend payments.

Interpreting Cash Flow Data

By evaluating the cash flow in each of these areas, you can gain a clearer picture of a company’s ability to generate and manage its resources. Here are key things to look for:

- Positive Cash Flow: A positive figure in operating activities indicates that the company is generating sufficient cash from its core business, which is crucial for maintaining daily operations.

- Investing Activities: A negative cash flow in this section may be a sign that the company is heavily investing in future growth, which could be a good sign if managed wisely.

- Financing Activities: If cash is flowing out (e.g., repaying debt), it could suggest the company is reducing leverage. Conversely, inflows may indicate taking on more debt or issuing stock to raise capital.

By consistently reviewing the cash flow data, you can assess how well a company is managing its liquidity and whether it has enough cash to continue operations and fund future initiatives.

Common Pitfalls in Financial Analysis

When evaluating a company’s financial position and performance, it’s easy to fall into certain traps that can lead to misleading conclusions. Misinterpretation of data or over-reliance on specific metrics without proper context can result in poor decision-making. It’s essential to recognize these common mistakes to ensure a more accurate and holistic understanding of a company’s financial health.

Common Mistakes to Avoid

Several issues can distort the true picture of a company’s financial standing. Below are some common pitfalls:

| Pitfall | Explanation | Impact |

|---|---|---|

| Focusing Only on One Metric | Relying solely on one indicator, such as profitability, can ignore other key factors like liquidity and solvency. | Leads to a narrow perspective and overlooks the company’s overall financial health. |

| Ignoring Non-Recurring Items | Excluding one-time gains or losses can skew the analysis of a company’s regular earnings performance. | Can result in overestimating or underestimating the company’s sustainable profitability. |

| Misunderstanding Depreciation | Not properly accounting for depreciation can mislead about asset values and future cash flow potential. | May overstate the company’s net worth and distort financial projections. |

| Overlooking Industry Comparisons | Failing to benchmark against industry peers can result in unrealistic performance expectations. | Skews the understanding of whether a company is underperforming or excelling relative to others. |

How to Avoid These Pitfalls

To ensure a more accurate assessment, it’s important to take a comprehensive approach when reviewing a company’s financial data. Here are some steps to avoid common pitfalls:

- Use Multiple Metrics: Don’t rely on just one figure. Combine profitability ratios with liquidity and solvency ratios for a full picture.

- Adjust for Non-Recurring Events: Always account for exceptional gains or losses to get a clearer view of the company’s ongoing performance.

- Factor in Depreciation: Properly include depreciation to avoid overstating asset values and financial health.

- Compare with Peers: Benchmark the company against industry norms to assess relative performance.

By being aware of these common mistakes, you can make better-informed decisions and more accurately assess a company’s financial position.

Important Metrics for Financial Health

When assessing a company’s ability to sustain operations, grow, and weather economic fluctuations, several key figures provide crucial insights. These metrics help investors, analysts, and managers understand the company’s liquidity, profitability, and overall risk exposure. By focusing on the right indicators, you can gauge the organization’s long-term viability and its capacity to create value for stakeholders.

Key Ratios to Monitor

There are several critical metrics that provide a clear view of a company’s financial condition. Here are some of the most important to focus on:

- Current Ratio: This measures the company’s ability to pay off short-term obligations with its short-term assets. A ratio above 1.0 indicates that the company can cover its current liabilities with current assets.

- Quick Ratio: Also known as the acid-test ratio, it measures liquidity by excluding inventory from assets, providing a more stringent view of a company’s ability to meet its immediate liabilities.

- Debt-to-Equity Ratio: This compares the company’s total liabilities to its shareholder equity, offering insights into its financial leverage and risk.

- Return on Assets (ROA): This ratio measures how efficiently a company is using its assets to generate profit. A higher ROA indicates effective management of resources.

- Profit Margin: It shows the percentage of revenue that turns into profit, helping to evaluate overall cost management and pricing strategies.

Interpreting These Metrics

Understanding what these ratios reveal about a company is essential for making informed decisions. Here’s how to interpret these figures:

- Liquidity Ratios: A strong current or quick ratio suggests the company is in a good position to meet its short-term obligations, reducing the risk of insolvency.

- Leverage Ratios: A high debt-to-equity ratio could indicate that a company is over-leveraged, increasing its financial risk. On the other hand, a low ratio suggests conservative debt usage.

- Profitability Ratios: High profitability ratios generally point to effective cost control and good market positioning, though they should be compared with industry norms to gauge competitiveness.

By keeping an eye on these essential figures, you can assess how well a company is managing its resources, sustaining growth, and mitigating financial risks.

Steps to Analyze Profitability Ratios

Evaluating how well a company generates profit from its operations is key to understanding its efficiency and market performance. Profitability ratios help assess whether the business is maximizing its revenue, controlling costs, and managing its resources effectively. By following a structured approach, you can interpret these metrics to gauge the company’s long-term profitability potential.

Key Profitability Ratios to Focus On

Several ratios are commonly used to assess profitability. Each one provides unique insights into how a company is performing in terms of profit generation and operational efficiency:

- Gross Profit Margin: This ratio shows the percentage of revenue that exceeds the cost of goods sold. A higher margin indicates better efficiency in production and pricing strategies.

- Operating Profit Margin: This measures the percentage of revenue left after covering operational costs, excluding interest and taxes. It reflects the company’s operational efficiency.

- Net Profit Margin: The ultimate profitability metric, it shows the percentage of revenue that remains as profit after all expenses. A high net margin indicates strong overall management and cost control.

- Return on Assets (ROA): This ratio shows how effectively a company uses its assets to generate profit. Higher ROA values indicate efficient use of resources.

- Return on Equity (ROE): It reflects the profitability in relation to shareholder equity. A high ROE indicates that the company is effectively using investors’ funds to generate returns.

Steps to Evaluate Profitability Ratios

Here’s a step-by-step guide to help you analyze profitability ratios effectively:

- Gather Relevant Data: Collect the company’s income statement and other related financial documents. Ensure you have the necessary data, such as sales figures, costs, and expenses.

- Calculate the Ratios: Use the appropriate formulas to calculate each profitability ratio. This will allow you to benchmark performance and compare it to industry averages.

- Compare with Historical Data: Look at the company’s profitability trends over the past few years. A consistent upward trend in profitability is a positive indicator.

- Analyze Industry Benchmarks: Compare the company’s ratios with those of competitors or industry averages. This will provide context for understanding whether the company is outperforming or underperforming its peers.

- Evaluate Profitability in Context: Consider external factors such as market conditions, the company’s competitive position, and its strategic initiatives when interpreting profitability ratios.

By following these steps, you can gain a comprehensive understanding of a company’s ability to generate profit and its operational effectiveness. Profitability ratios provide essential insights for investors and business leaders aiming to assess long-term financial success.

Assessing Liquidity in Financial Reports

Understanding a company’s ability to meet short-term obligations is crucial for evaluating its financial health. Liquidity ratios provide insights into whether a company has sufficient assets to cover its liabilities, reducing the risk of insolvency. By examining these figures, stakeholders can assess the company’s operational flexibility and its capacity to withstand economic fluctuations.

Key Liquidity Ratios to Review

To assess liquidity, several ratios are commonly used. These ratios highlight the company’s ability to pay off short-term debts and provide a quick snapshot of its financial position:

- Current Ratio: This ratio compares a company’s current assets to its current liabilities. A ratio higher than 1 indicates that the company can cover its short-term obligations with its assets.

- Quick Ratio: Known as the acid-test ratio, it measures the ability to meet short-term obligations with liquid assets, excluding inventory. A ratio above 1 is considered healthy.

- Cash Ratio: This is the most conservative liquidity measure, as it only considers cash and cash equivalents against current liabilities. A higher ratio suggests stronger liquidity.

Interpreting Liquidity Ratios

Interpreting these ratios is vital for understanding the company’s financial stability. Here are some key takeaways:

- High Ratios: A higher ratio typically indicates better short-term financial health. However, extremely high liquidity ratios may suggest that the company is not efficiently utilizing its assets or generating returns.

- Low Ratios: Low liquidity ratios might signal potential difficulties in covering short-term debts, which can raise concerns about the company’s solvency.

- Context Matters: Liquidity ratios should be analyzed alongside industry standards and historical data. A ratio that is deemed healthy for one industry might be insufficient for another.

By closely monitoring these ratios, investors and analysts can assess a company’s ability to meet immediate financial obligations, ensuring that it remains financially stable in the face of short-term challenges.

Efficiency Ratios and Their Impact

Efficiency ratios help evaluate how effectively a company utilizes its resources to generate sales and profits. These ratios are vital for understanding operational performance and provide valuable insights into the company’s ability to maximize its resource usage. By analyzing these figures, stakeholders can gauge how well the company is converting its investments into productive outcomes.

Key Efficiency Ratios to Consider

Several key ratios help assess a company’s operational efficiency. These ratios focus on how well a company uses its assets and liabilities to generate revenue:

- Asset Turnover Ratio: This ratio measures the efficiency with which a company uses its assets to generate sales. A higher ratio indicates that the company is using its assets effectively.

- Inventory Turnover Ratio: This ratio indicates how often a company sells and replaces its inventory within a period. A higher value suggests efficient inventory management and quicker sales cycles.

- Receivables Turnover Ratio: This ratio assesses how efficiently a company collects revenue from its credit sales. A higher ratio shows that the company collects receivables more quickly, improving liquidity.

- Payables Turnover Ratio: This ratio reflects how quickly a company pays off its suppliers. A lower ratio may indicate that the company is taking longer to pay, which could impact supplier relationships.

Impact of Efficiency Ratios on Performance

Efficiency ratios are not only critical for assessing internal operations but also for understanding a company’s overall market performance. Here are a few key impacts:

- Operational Effectiveness: High efficiency ratios generally indicate that the company is managing its resources well, leading to improved profitability and competitiveness.

- Resource Utilization: Poor efficiency ratios suggest that the company may not be utilizing its assets and resources effectively, which can result in higher costs and lower profitability.

- Cash Flow Management: Efficient operations often lead to better cash flow management, reducing the need for external financing and improving financial stability.

By monitoring and analyzing efficiency ratios, stakeholders can gain deeper insights into how well a company leverages its assets, manages costs, and optimizes its operations to drive growth and profitability.

Leverage Ratios and Financial Stability

Leverage ratios play a crucial role in understanding how much debt a company has used to finance its operations. These ratios are essential for evaluating a company’s financial risk and stability, as they reflect the level of dependence on external financing versus internal equity. A careful assessment of these metrics helps stakeholders gauge whether a company is overexposed to debt, potentially jeopardizing its long-term financial health.

Common Leverage Ratios to Monitor

Several key ratios are used to assess a company’s reliance on borrowed funds. These ratios provide insight into how much debt a company is carrying in relation to its equity or assets:

- Debt-to-Equity Ratio: This ratio compares the company’s total debt to its shareholders’ equity. A higher ratio suggests that the company is more heavily financed by debt, which could increase financial risk.

- Debt Ratio: This ratio shows the proportion of a company’s assets that are financed by debt. A higher ratio indicates a higher reliance on borrowed funds, which may signal potential risk if the company faces financial challenges.

- Equity Multiplier: This ratio reflects the level of debt a company uses to finance its assets. A higher equity multiplier indicates that the company is using more debt relative to equity to fund its operations.

- Interest Coverage Ratio: This ratio measures a company’s ability to meet its interest payments on outstanding debt. A higher ratio indicates that the company can comfortably cover its interest expenses.

Impact of Leverage on Financial Health

Leverage ratios significantly influence a company’s financial stability and risk profile. Understanding these ratios can help investors and analysts make informed decisions about the company’s future prospects:

- Risk Assessment: High leverage ratios increase a company’s financial risk. If earnings are not sufficient to cover interest or debt obligations, the company may face liquidity issues or bankruptcy.

- Growth Potential: While high leverage can increase risk, it can also allow a company to leverage borrowed funds for expansion and growth. However, it is essential to balance risk with potential return.

- Investor Confidence: A company with moderate leverage may inspire more confidence among investors, signaling that it is effectively managing its debt while maintaining financial stability.

By monitoring and understanding leverage ratios, stakeholders can assess a company’s ability to manage debt effectively and ensure long-term financial sustainability. These metrics help reveal the balance between risk and return, guiding strategic decisions for both management and investors.

Valuation Ratios in Financial Analysis

Valuation ratios are essential tools for determining the market value of a company relative to various financial metrics. These ratios help investors assess whether a company’s stock is overvalued, undervalued, or fairly priced. By examining these ratios, analysts can gauge the company’s market position, its potential for future growth, and how attractive it is as an investment opportunity.

Key Valuation Ratios to Consider

Several ratios are widely used to assess the market valuation of a company. These ratios focus on comparing the price of the company’s stock to its earnings, assets, and other financial figures:

- Price-to-Earnings (P/E) Ratio: This ratio compares the company’s share price to its earnings per share (EPS). A high P/E ratio could indicate that the company is overvalued, or that investors expect high future growth.

- Price-to-Book (P/B) Ratio: This ratio compares the market value of a company’s stock to its book value. A lower P/B ratio may suggest that the stock is undervalued, potentially offering a good investment opportunity.

- Price-to-Sales (P/S) Ratio: This ratio compares a company’s market capitalization to its revenue. A lower P/S ratio indicates that investors are paying less for each unit of revenue, which may suggest an undervalued company.

- Dividend Yield: This ratio shows the percentage return a shareholder receives in the form of dividends relative to the stock price. A higher yield often indicates a more attractive investment for income-focused investors.

Impact of Valuation Ratios on Investment Decisions

Valuation ratios provide significant insights into the market’s perception of a company’s future prospects and its overall financial health. Here’s how these ratios impact investment choices:

- Investment Valuation: These ratios help investors decide whether the current market price reflects the true value of the company, guiding their decisions to buy or sell stocks.

- Market Sentiment: A high valuation may indicate that the company is overvalued, with expectations of significant future growth, while a low valuation may signal that the stock is undervalued or facing challenges.

- Comparative Analysis: Valuation ratios are useful when comparing companies within the same industry, helping investors choose companies with better growth prospects at more reasonable prices.

By understanding valuation ratios, investors can make more informed decisions about the companies they invest in, identifying opportunities and avoiding overpriced stocks. These ratios provide a deeper understanding of how the market values a company’s potential and current financial standing.

Analyzing Changes in Financial Statements

Tracking variations in key financial documents over time is crucial for understanding a company’s performance and identifying potential areas of concern. Changes in these records can reflect shifts in operational efficiency, profitability, liquidity, or leverage, offering valuable insights for stakeholders. By carefully reviewing the year-to-year differences, analysts can assess the effectiveness of management decisions and predict future trends.

These changes can stem from various factors, including shifts in revenue, expenses, or capital structure. Recognizing the reasons behind these fluctuations helps create a more accurate picture of the company’s long-term financial health. Comparing historical figures with current data allows for identifying patterns, which is essential for making informed business or investment decisions.

To thoroughly understand these changes, it’s important to focus on key areas where variations are most likely to occur:

- Revenue Growth or Decline: A significant change in income could indicate alterations in customer demand, market conditions, or pricing strategies. Assessing the reasons behind revenue fluctuations helps evaluate a company’s market position.

- Cost and Expense Trends: Changes in operational costs, such as raw material prices or labor expenses, can significantly impact profit margins. Monitoring expense trends helps in determining whether the company is managing its resources effectively.

- Capital Structure Adjustments: Shifts in debt or equity financing reflect changes in how a company raises funds. An increase in debt could indicate higher financial risk, while a reduction in leverage might suggest a more conservative approach to financing.

- Asset and Liability Management: Changes in asset composition, like an increase in property or equipment, can indicate growth, while a rise in liabilities might suggest higher borrowing levels. Understanding these changes is key to assessing overall financial stability.

By systematically analyzing how these factors evolve over time, stakeholders can gain a deeper understanding of a company’s operational effectiveness and financial viability. This approach is essential for assessing not only the company’s past performance but also its potential to succeed in the future.

Common Mistakes in Financial Statement Analysis

When evaluating a company’s performance based on its financial reports, it is easy to overlook certain details or make assumptions that can lead to inaccurate conclusions. Even experienced analysts can fall into traps that distort their interpretation of key data. Being aware of these common mistakes is crucial for ensuring a more accurate and reliable assessment of a company’s true financial health.

Several missteps are frequently observed during the review of key financial records. These errors can lead to misleading insights, affecting decisions related to investment, credit, and strategy. Below are some of the most common pitfalls:

Overlooking Contextual Factors

- Ignoring Industry Benchmarks: Comparing a company’s metrics solely against its own historical performance, without considering industry standards, can create a skewed perspective. Different industries have varying capital structures, risk profiles, and profit margins.

- Failure to Adjust for Inflation: When analyzing data over multiple years, not accounting for inflation can distort the real value of financial figures. This is especially critical for companies with long-term capital investments.

- Not Considering Seasonal Variations: Many businesses experience fluctuations due to seasonal demand. Failing to adjust or account for these seasonal factors can result in misjudging a company’s year-round performance.

Relying on Single Metrics

- Overvaluing Profitability Ratios: Focusing exclusively on profitability can obscure other important aspects like liquidity and solvency. It is important to look at a range of metrics to gain a holistic view of a company’s position.

- Neglecting Cash Flow: Profit figures may not always reflect the true financial health of a company. Analyzing only profitability without considering cash flow can be misleading, as it doesn’t capture issues related to liquidity.

- Misinterpreting Leverage Ratios: High leverage ratios are not always indicative of poor financial health. While excessive debt can be a risk, strategic use of debt can also lead to higher returns on equity, depending on the company’s business model and risk appetite.

Avoiding these common mistakes requires a comprehensive approach to reviewing financial documents, one that looks beyond isolated figures and takes into account industry conditions, economic factors, and the overall strategy of the company. By understanding and addressing these common errors, analysts can ensure more accurate evaluations and make better-informed decisions.

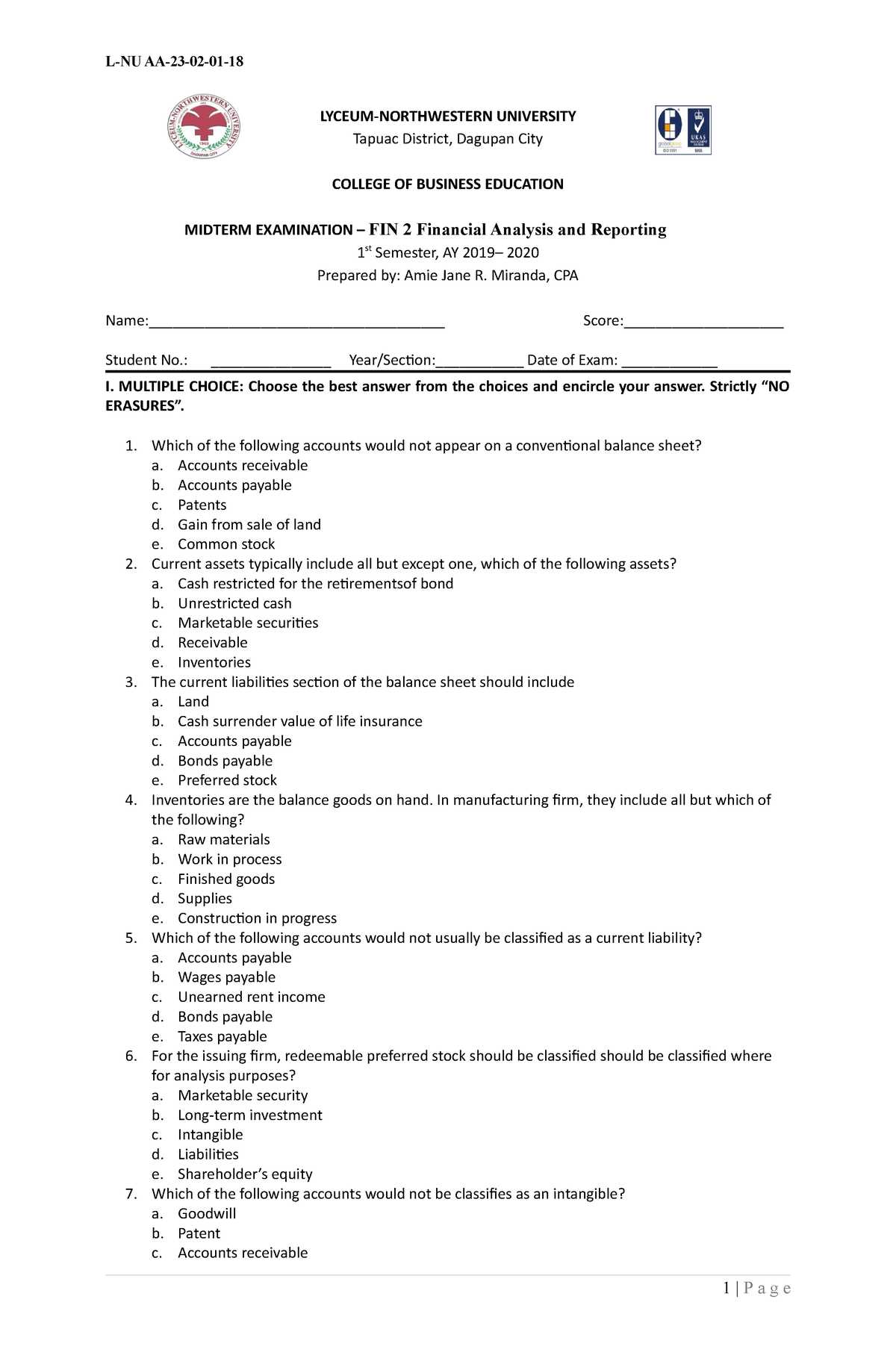

Practice Questions for Financial Analysis

Practicing with real-life scenarios and exercises is an essential way to strengthen your understanding of key metrics and improve your decision-making abilities. By tackling various problems, you can sharpen your skills and learn how to interpret data more effectively. Below are some practical scenarios and questions designed to test and enhance your ability to assess a company’s financial performance.

Scenario-Based Exercises

- Evaluate the Profitability: Given a company’s income and expense data, calculate the gross margin, operating margin, and net profit margin. How would these ratios help assess the company’s profitability?

- Analyze Debt Levels: A company reports a debt-to-equity ratio of 1.5. What does this indicate about the company’s financial structure? What potential risks or benefits does this pose?

- Assess Liquidity: Using the current and quick ratios, evaluate the company’s ability to meet short-term obligations. What might a ratio below 1 suggest about the company’s financial position?

Data Interpretation Challenges

- Cash Flow Review: The company’s cash flow statement shows positive operating cash flow, but negative investing and financing cash flows. How would you interpret this information? What does it tell you about the company’s financial strategy?

- Comparative Performance: Compare the revenue growth rate and profit growth rate of two companies in the same industry. Which metric would you prioritize for evaluating the long-term financial health of each company?

- Efficiency Assessment: A company has a high asset turnover ratio, but its inventory turnover ratio is low. What could this combination suggest about the company’s operational efficiency and inventory management?

By practicing with these types of exercises, you can improve your ability to draw meaningful conclusions from financial data. It is crucial to not just perform calculations, but also to understand the context and implications of each result. Practicing regularly with different types of problems will build confidence and help you develop a comprehensive understanding of financial performance metrics.

Preparing for Financial Analysis Exams

Effective preparation is key to succeeding in any assessment related to financial evaluation. To ensure that you can confidently apply your knowledge, it is essential to approach your study sessions with a strategic plan. Below are some helpful tips and steps to guide you in your preparation process, so you can perform at your best when faced with questions on company performance metrics and other related topics.

Key Study Areas to Focus On

When preparing for evaluations on financial performance, it’s important to focus on the following key areas:

- Understanding Key Ratios: Ensure you have a solid grasp of various ratios such as profitability, liquidity, and leverage. Be comfortable calculating and interpreting them in different scenarios.

- Working with Statements: Practice reading and interpreting income, balance, and cash flow statements. Understanding the relationship between these documents is crucial for comprehensive analysis.

- Concepts and Formulas: Memorize the key formulas used in financial calculations, as well as the underlying concepts. This includes understanding how each metric is derived and its purpose in evaluating a company.

Study Techniques and Strategies

Here are some approaches to enhance your study sessions:

- Practice with Past Papers: Look for previous assessments or mock exams to familiarize yourself with the format and types of questions you may encounter.

- Break Down Complex Scenarios: When studying, try to break down complex problems into smaller, manageable parts. This will help you focus on individual components such as revenue, expenses, and assets.

- Group Study Sessions: Collaborate with peers to discuss challenging topics. Group discussions can help clarify doubts and offer new perspectives on difficult concepts.

Time Management Tips

Proper time management can make a significant difference in how effectively you prepare:

- Create a Study Schedule: Plan your study time in advance. Allocate specific hours for each topic to ensure balanced coverage.

- Prioritize Difficult Topics: Identify the areas where you are weakest and dedicate extra time to them. Start with challenging topics and then move to those you find easier.

- Take Breaks: Avoid burnout by scheduling regular breaks during study sessions. This will help maintain focus and increase retention.

With these strategies, you can build confidence and refine your skills, ultimately improving your ability to apply knowledge during assessments on company performance and financial health. Consistent practice and understanding the underlying principles will set you up for success.

Resources for Mastering Financial Analysis

To truly excel in evaluating business performance, it is crucial to leverage the right materials and tools. Whether you’re looking to deepen your understanding or refine specific skills, a variety of resources are available to help you master the techniques involved in measuring and interpreting financial health. Below, we explore some valuable resources that can significantly enhance your knowledge and practical expertise.

Books and Textbooks

Books remain a fundamental resource for building foundational knowledge and gaining detailed insights. Consider exploring the following types of books:

- Introductory Guides: These books focus on core principles, such as understanding key performance indicators and the relationship between various business metrics.

- Advanced Textbooks: Books that delve deeper into specific analytical techniques, including ratio analysis, trend analysis, and the interpretation of complex reports.

- Case Studies: These books present real-world examples that allow you to apply the concepts you’ve learned to actual business scenarios.

Online Courses and Tutorials

Online platforms offer a wealth of structured learning opportunities, ranging from beginner to advanced levels. Consider using these platforms to supplement your studies:

- MOOCs (Massive Open Online Courses): Websites like Coursera and edX offer courses taught by experts in the field. Many of these courses are free or come at a reasonable cost and cover a wide range of topics, from basic financial literacy to advanced techniques.

- YouTube Channels: Several financial analysts and educators provide free tutorials on YouTube, explaining complex concepts in an easy-to-understand format.

- Interactive Learning Platforms: Websites like Investopedia and Khan Academy offer interactive lessons that allow you to practice and test your knowledge in real-time.

Practice Tools and Software

Utilizing financial software can help you practice and apply what you’ve learned in a more dynamic and hands-on environment. Here are a few tools to consider:

- Excel/Google Sheets: These tools are invaluable for performing calculations, creating models, and analyzing data sets.

- Financial Modeling Software: Programs like Microsoft Power BI or Tableau are powerful tools for visualizing data and performing advanced financial analyses.

- Simulators: Some websites offer simulations of real-life financial situations where you can make decisions and track the impact of those choices on performance metrics.

Communities and Forums

Joining online communities can provide you with additional support and insight from others in the field. These resources include:

- Online Forums: Platforms like Reddit or The Analyst Exchange allow you to connect with other learners and professionals to discuss challenges and share resources.

- LinkedIn Groups: Join financial groups and discussions where you can ask questions, share ideas, and stay updated on industry trends.

- Professional Associations: Organizations like the CFA Institute or AICPA offer certifications, resources, and networking opportunities for those pursuing careers in financial evaluation.

By combining these resources, you can build a robust understanding and expertise that will enhance your ability to assess business performance accurately and effectively. Whether you’re learning independently or seeking structured guidance, these tools will provide the support you need to succeed.