Understanding the principles behind various investment instruments is essential for anyone looking to succeed in assessments related to financial markets. By mastering key concepts and techniques, individuals can enhance their analytical skills and perform well in their evaluations.

The approach to mastering investment-related evaluations involves not just memorization, but the ability to apply theoretical knowledge to real-world scenarios. Topics such as valuation methods, risk analysis, and interest rate effects are fundamental to gaining a comprehensive understanding of these assets. Developing a deep grasp of these areas will allow you to answer complex problems with confidence.

Preparation for such assessments requires a focused study plan, emphasizing both the theoretical and practical aspects of market instruments. Whether dealing with long-term bonds or analyzing risk metrics, it’s vital to engage with various scenarios and familiarize oneself with the challenges typically presented in tests.

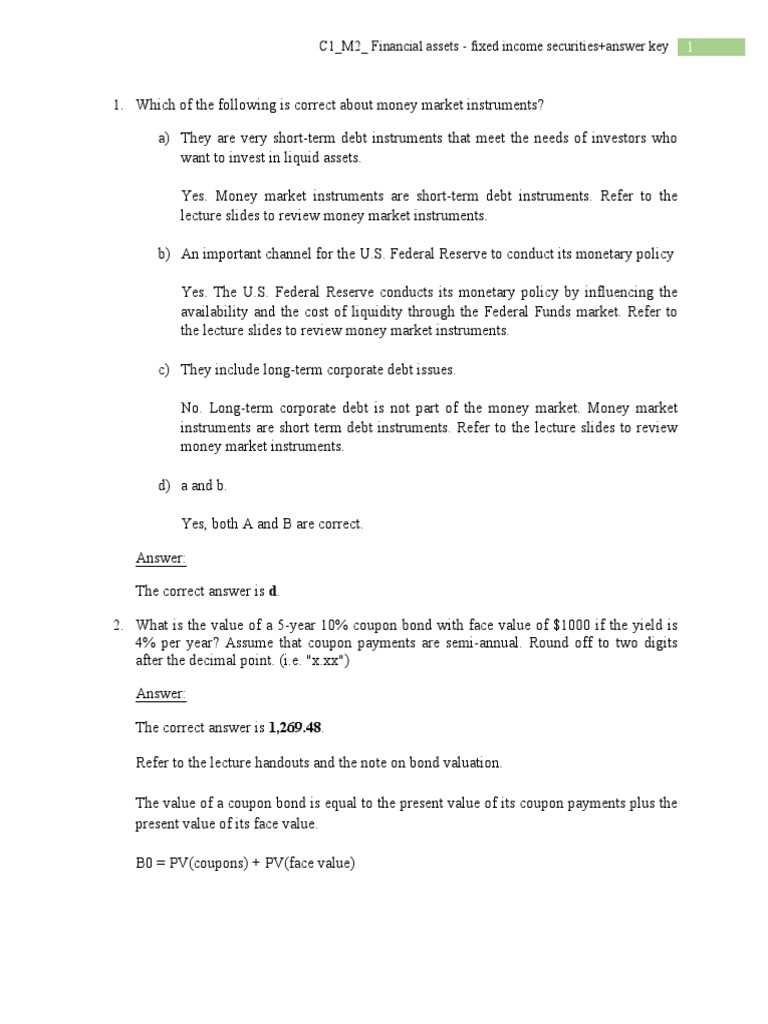

Fixed Income Exam Questions and Answers

Assessing knowledge in financial markets requires a deep understanding of various instruments, their valuation, and the impact of market fluctuations on their performance. To succeed, it is crucial to not only understand key concepts but also be able to apply them in different scenarios that might appear in a testing environment. This section focuses on critical topics that often appear in assessments related to these asset types, offering insights and guidance on how to approach complex problems effectively.

Common Problem Types in Financial Assessments

During evaluations, individuals are typically presented with a range of problem types, from calculating yields to understanding price fluctuations. These problems test your ability to analyze the relationship between different variables, such as interest rates, bond prices, and credit risk. Having a structured approach to solving such problems is essential for success. Understanding the underlying principles behind each problem type helps in recognizing patterns and formulating the correct solutions.

Approach to Effective Study and Preparation

Preparation involves a thorough understanding of both theoretical and practical aspects of market instruments. By practicing with previous test papers, solving model problems, and reviewing the underlying concepts, you can gain confidence in applying your knowledge. It is important to approach these challenges with a clear strategy, focusing on key areas such as duration, yield calculations, and the factors that influence market performance.

Understanding Fixed Income Securities

In the world of financial markets, various asset types offer steady returns over a predetermined period, making them essential for investors seeking stability. These assets typically provide regular payments in the form of interest and return the principal at maturity. Understanding the mechanics behind these instruments is key to navigating and analyzing market trends effectively.

Key Characteristics of These Financial Instruments

These assets have several defining features that differentiate them from others in the market. Some of the primary characteristics include:

- Coupon Payments: Regular interest payments made to the holder, often semi-annually or annually.

- Maturity Date: The date when the principal amount is returned to the investor.

- Issuer: The entity that issues the asset, typically a government or corporation.

- Credit Risk: The risk that the issuer may fail to make the promised payments.

Why Investors Choose These Instruments

Investors often opt for these assets due to their predictable nature, which contrasts with the volatility found in equity markets. They are an essential part of a diversified portfolio, particularly for those looking for risk mitigation and steady returns. Key reasons for their appeal include:

- Stable Returns: Regular income from interest payments.

- Lower Risk Profile: Generally considered less risky than stocks.

- Capital Preservation: Principal is usually returned at maturity.

Key Concepts in Bond Valuation

Valuing these financial instruments involves understanding how various factors influence their price and yield. The primary goal is to assess the present value of future cash flows, taking into account interest payments and the return of principal. Mastering these concepts is essential for anyone involved in financial assessments or investment decisions, as accurate valuation directly impacts investment strategies and risk management.

Factors Affecting Bond Value

Several key elements influence the price of these instruments in the market:

- Interest Rates: The prevailing interest rates in the market have a significant impact on bond pricing. When rates rise, prices tend to fall, and vice versa.

- Time to Maturity: The length of time until the principal is repaid can affect the bond’s price. Longer durations generally lead to greater price volatility.

- Credit Quality: The financial health of the issuer plays a crucial role in determining the risk and, thus, the price of the asset. A higher credit rating usually correlates with lower yields.

- Coupon Rate: The fixed interest payments offered by the bond influence its attractiveness. A higher coupon rate typically leads to a higher price when interest rates are low.

Discounting Future Cash Flows

The core principle behind bond valuation is discounting future cash flows to their present value. The process involves calculating the present value of both periodic interest payments (coupons) and the final repayment of principal. The appropriate discount rate used in this calculation is often the market rate or yield to maturity. Understanding how to apply this method accurately is essential for determining whether a bond is overvalued or undervalued in the market.

Different Types of Fixed Income Assets

There are several varieties of investment instruments that provide consistent returns over time, each with unique features and risk profiles. Understanding the differences between these assets is crucial for creating a diversified portfolio that aligns with specific financial goals. Each type comes with its own set of characteristics, from the issuer to the repayment structure, which influences both risk and return potential.

Common types include government-issued securities, corporate bonds, and municipal offerings. Each of these instruments offers distinct advantages depending on the investor’s risk tolerance and desired yield. Knowing the nuances of these assets allows investors to make informed decisions that optimize their portfolios for both stability and growth.

Risk Factors in Fixed Income Investing

Investing in debt instruments involves several risks that can affect both returns and the security of the principal. Understanding these risks is essential for investors to make informed decisions and properly manage their portfolios. Various factors can influence the performance of these assets, ranging from macroeconomic conditions to the financial health of the issuing entity.

Some of the primary risks include interest rate fluctuations, credit risk, and liquidity risk. Each of these elements can have a significant impact on the price and yield of the asset. Being able to assess and mitigate these risks is crucial for long-term success in this form of investing.

Important Metrics for Bond Evaluation

When assessing debt instruments, several key metrics are used to evaluate their potential performance and risk. These metrics help investors determine whether the asset aligns with their financial goals and risk tolerance. Understanding and analyzing these factors is essential to making well-informed investment decisions and managing the portfolio effectively.

Some of the most important metrics include yield to maturity, duration, and credit rating. Each metric provides insight into different aspects of the bond’s characteristics, from expected returns to sensitivity to interest rate changes.

| Metric | Description | Importance |

|---|---|---|

| Yield to Maturity (YTM) | Measures the total return an investor can expect if the bond is held until maturity. | Helps determine whether the bond meets the investor’s return expectations. |

| Duration | Indicates the bond’s sensitivity to interest rate changes, measuring how long it takes to repay the bond’s price through its cash flows. | Crucial for understanding price volatility and interest rate risk. |

| Credit Rating | Assigned by rating agencies, this measures the likelihood of default by the issuer. | Helps assess the bond’s risk of default and overall financial stability. |

Interest Rate Impact on Bond Prices

The relationship between interest rates and bond prices is fundamental to understanding how these financial instruments behave in changing market conditions. As interest rates fluctuate, they directly influence the price of bonds. When rates rise, the prices of existing bonds typically fall, and when rates fall, bond prices generally rise. This inverse relationship plays a crucial role in investment decisions and portfolio management.

The reason for this relationship lies in the fixed nature of coupon payments. As new bonds are issued at higher or lower interest rates, the attractiveness of existing bonds changes. If new bonds offer higher yields, existing bonds with lower yields become less appealing, causing their prices to drop. Conversely, when new bonds offer lower yields, older bonds with higher coupon rates become more valuable, pushing their prices up.

How to Calculate Yield to Maturity

Yield to maturity (YTM) is one of the most important metrics for evaluating the potential return on a debt instrument. It represents the total return an investor can expect if the asset is held until its maturity date, assuming all interest payments are made as scheduled and the principal is repaid in full. Calculating this value allows investors to assess the profitability of a bond relative to other investment opportunities.

To calculate the YTM, you need to take into account several key factors: the current market price of the asset, the coupon payments, the par value, and the time remaining until maturity. The formula can be complex, but it essentially solves for the interest rate that equates the present value of all future cash flows (coupons and principal repayment) to the current price.

Formula for Yield to Maturity:

The calculation is typically done using a financial calculator or spreadsheet software, but it can be approximated with the following formula:

Price = (Coupon Payment / (1 + YTM)^1) + (Coupon Payment / (1 + YTM)^2) + … + (Coupon Payment + Par Value / (1 + YTM)^n)

Where:

- Price: Current market price of the bond

- Coupon Payment: Regular interest payment

- Par Value: Amount to be repaid at maturity

- YTM: Yield to maturity (the value we are solving for)

- n: Number of periods remaining until maturity

Once you have all the variables, the formula can be solved either through iteration or by using financial tools that simplify the process. The YTM gives you the internal rate of return (IRR) for the bond, which reflects the annualized return you can expect if you hold the bond until it matures.

Bond Duration and Its Significance

Duration is a crucial measure used to assess the sensitivity of a bond’s price to changes in interest rates. It helps investors understand the potential risk associated with interest rate movements and provides insights into how long it will take for the bondholder to recover the initial investment through coupon payments and principal repayment. In simple terms, it gives a measure of the bond’s price volatility in response to rate fluctuations.

Understanding bond duration is essential for investors who aim to manage interest rate risk effectively. A higher duration typically implies greater price sensitivity to interest rate changes, while a lower duration indicates less sensitivity. This metric is important not only for assessing individual bonds but also for constructing well-diversified portfolios that balance risk and return.

Types of Duration

There are several types of duration, each serving a different purpose in bond analysis:

- Macaulay Duration: Measures the weighted average time to receive the bond’s cash flows. It is the most commonly used form of duration and reflects the average time it will take to recover the investment.

- Modified Duration: Indicates the percentage change in the bond’s price for a 1% change in yield. This version of duration provides a more direct measure of price volatility due to interest rate changes.

- Effective Duration: Used for bonds with embedded options, such as callable bonds. It accounts for the possibility that the issuer may redeem the bond before maturity.

Why Duration Matters

Duration is critical because it helps investors assess potential price fluctuations in a changing interest rate environment. For instance, if interest rates rise, a bond with a longer duration will experience a larger price drop compared to a bond with a shorter duration. By considering duration, investors can better align their bond holdings with their risk tolerance and investment horizon, optimizing their portfolios for stability or growth based on interest rate expectations.

Common Fixed Income Exam Questions

When preparing for an assessment on debt instruments, there are several key concepts and calculations that frequently appear in the tests. These concepts often focus on understanding the relationship between bonds and interest rates, as well as evaluating the risks and returns associated with different types of debt securities. Mastering these topics is essential for achieving success in any related evaluation.

Some common areas of focus include the calculation of yield, bond pricing, duration, and the assessment of credit risk. Additionally, questions often test the ability to apply theoretical knowledge to real-world investment scenarios. Being able to analyze bonds, their prices, and yields is critical to performing well in such evaluations.

Typical Concepts Tested

Below are some of the core topics that are often included in assessments related to debt markets:

- Yield to Maturity (YTM): Understanding how to calculate the yield based on the bond’s current price, coupon payments, and time to maturity.

- Price Sensitivity: Examining how price changes in response to interest rate fluctuations, typically measured through duration and convexity.

- Credit Risk Analysis: Evaluating the likelihood of default and assessing credit ratings from agencies.

- Bond Types: Understanding different bond structures such as government bonds, corporate bonds, and municipal bonds, along with their respective risk profiles.

Sample Problems

The following table outlines some typical scenarios and problems that might be encountered in such assessments:

| Scenario | Concept Tested | Sample Calculation |

|---|---|---|

| A bond with a 5% coupon and a 10-year maturity is priced at 90. What is the yield to maturity? | Yield to Maturity Calculation | Use the bond price formula and solve for YTM based on the bond’s current price and coupon payments. |

| If interest rates rise by 1%, what will happen to the price of a bond with a 7-year duration? | Price Sensitivity via Duration | Calculate the approximate price change using the formula: % change in price = – Duration * Change in interest rates. |

| A corporate bond has been downgraded. How would this affect its yield and price? | Credit Risk Assessment | Analyze the impact of the credit rating downgrade on the bond’s yield and market price. |

By familiarizing yourself with these concepts and types of problems, you will be well-equipped to handle typical questions in a debt-related evaluation.

Analyzing Credit Risk in Bonds

Assessing the risk associated with debt securities is a vital part of the investment decision-making process. The primary concern for investors is the possibility that the issuer may default on its obligations, leading to potential financial loss. Credit risk analysis helps determine the likelihood of such an event and assesses the relative safety of a bond. Understanding this risk allows investors to make more informed decisions and manage their portfolios more effectively.

Several factors contribute to the level of credit risk a bond carries, including the financial health of the issuer, economic conditions, and the industry in which the issuer operates. Credit ratings provided by agencies like Moody’s, S&P, and Fitch offer valuable insights into the issuer’s ability to meet its debt obligations. However, it is also important to look beyond these ratings and conduct a thorough analysis of the issuer’s financial stability and business environment.

Key Factors in Credit Risk Assessment

When evaluating the credit risk of a bond, consider the following key elements:

- Issuer’s Credit Rating: Ratings from agencies indicate the likelihood of default. Bonds rated as ‘AAA’ or ‘A’ are considered safer, while ‘BB’ or lower may indicate a higher risk of default.

- Debt Levels: The amount of existing debt held by the issuer can impact its ability to make timely payments. A higher debt-to-equity ratio may suggest more risk.

- Cash Flow and Profitability: A company’s ability to generate consistent cash flow is crucial. Investors should look at profitability metrics and trends to assess the issuer’s capacity to pay interest and repay principal.

- Economic and Industry Conditions: Broader economic factors and the health of the issuer’s industry also play a significant role in credit risk. A downturn in the industry could increase the likelihood of default.

Mitigating Credit Risk

Investors can reduce credit risk by diversifying their bond portfolio across different issuers and industries. Additionally, focusing on higher-rated bonds and those with strong financials can help lower exposure to potential defaults. Another strategy is to assess the covenant structure of the bond, as stronger covenants can provide added protection for bondholders in the event of financial distress.

Fixed Income Investment Strategies

Investing in debt securities offers various strategies that cater to different investment goals, risk appetites, and market conditions. These approaches allow investors to achieve a balance between income generation and risk management. By employing specific strategies, investors can enhance returns, reduce volatility, or ensure capital preservation, depending on their objectives. Understanding these strategies is essential for anyone seeking to optimize their debt portfolio.

Common strategies typically include laddering, barbell, and bullet strategies, each of which has its own set of advantages based on interest rate expectations and investment horizons. These approaches help manage duration risk, interest rate risk, and credit risk, all of which are key factors in a debt-focused portfolio.

Laddering Strategy

The laddering strategy involves spreading investments across multiple bonds with varying maturities. This method helps manage interest rate risk by ensuring that bonds are maturing periodically, allowing for reinvestment at current market rates. Investors can adjust their portfolio’s risk and yield based on market conditions over time.

- Benefits: Reduced interest rate risk, more frequent opportunities to reinvest, and greater liquidity.

- Risks: Returns may be lower in a rising interest rate environment, as shorter-term bonds generally offer lower yields.

Barbell Strategy

The barbell strategy involves investing in both short-term and long-term bonds, while avoiding intermediate maturities. This approach benefits from the higher yields offered by long-term bonds and the liquidity and lower volatility of short-term bonds.

- Benefits: Increased yield potential with long-term bonds, combined with safety and flexibility from short-term bonds.

- Risks: Exposure to interest rate changes, especially when short-term rates rise or long-term rates fall.

Bullet Strategy

The bullet strategy involves purchasing bonds with the same maturity date, allowing for a concentrated payout at the maturity of the bonds. This approach is typically used for investors seeking a specific payout at a defined time.

- Benefits: Predictability in cash flow, and a clear end point for the investment horizon.

- Risks: Limited flexibility and reinvestment options in a fluctuating interest rate environment.

Each of these strategies can be tailored to suit an investor’s specific objectives, whether focused on maximizing returns, minimizing risk, or managing a predictable cash flow. Understanding how these strategies interact with market conditions is key to their successful implementation in a diversified portfolio.

Understanding Yield Curves and Spreads

Yield curves and spreads are essential concepts for evaluating the performance and risk of debt securities. These tools help investors understand the relationship between bond yields and their maturities, as well as the differences in yields across various types of bonds. By analyzing the shape of the yield curve and comparing yields between different securities, investors can make informed decisions based on economic conditions and market expectations.

The yield curve represents the relationship between the interest rate (or yield) of bonds and their time to maturity. It provides a snapshot of market expectations regarding future interest rates, economic growth, and inflation. Spreads, on the other hand, are the differences in yields between two or more securities, often used to assess credit risk or liquidity risk associated with different debt instruments.

Types of Yield Curves

There are several common types of yield curves that investors use to analyze bond markets. Each type provides valuable insights into economic conditions and interest rate expectations:

- Normal Yield Curve: An upward-sloping curve indicating higher yields for longer-term bonds. This typically suggests investor confidence in economic growth and rising interest rates.

- Inverted Yield Curve: A downward-sloping curve where short-term bonds offer higher yields than long-term ones. This can signal a potential economic slowdown or recession.

- Flat Yield Curve: A flat curve where short-term and long-term yields are similar. This may indicate uncertainty in the economy or a transition period between different phases of economic cycles.

Bond Spreads

Spreads are a key measure used to compare the relative risk of different bonds. They reflect the additional yield an investor requires to take on extra risk. Several common spreads are analyzed in bond markets:

- Credit Spread: The difference between the yield on a corporate bond and the yield on a government bond of similar maturity. A wider credit spread indicates higher perceived credit risk associated with the corporate bond.

- Yield Spread: The difference in yields between bonds with different maturities or issuers. It is often used to compare government bonds with corporate or municipal bonds.

- Option-Adjusted Spread (OAS): A spread that accounts for the potential impact of embedded options in bonds, such as call or put options. OAS adjusts the spread to reflect the bond’s price sensitivity to interest rate changes.

Both yield curves and spreads offer critical information for understanding market sentiment, forecasting economic trends, and evaluating the relative risk of bonds. By considering these metrics, investors can tailor their strategies to align with their risk tolerance and financial goals.

Tax Implications for Fixed Income Investments

Investors need to consider the tax consequences of their debt securities when evaluating their overall returns. Different types of bonds and interest income are subject to various tax treatments, which can significantly impact an investor’s net gains. Understanding how taxes affect the returns on bonds is essential for making informed decisions and optimizing investment strategies.

Taxes on interest income, capital gains, and other related factors play a critical role in assessing the profitability of debt securities. Different types of bonds, such as government bonds, corporate bonds, and municipal bonds, may have distinct tax treatments depending on the jurisdiction and applicable tax laws. This section explores the key tax considerations that investors should be aware of when investing in debt instruments.

Taxation of Interest Income

Interest income generated from bonds is generally subject to taxation, though the rate at which it is taxed can vary depending on the type of bond and the investor’s tax bracket. Key points to consider include:

- Corporate Bonds: The interest paid on corporate bonds is typically taxed as ordinary income at the investor’s marginal tax rate.

- Government Bonds: Interest income from government-issued bonds, such as U.S. Treasury bonds, may be exempt from state and local taxes but still subject to federal taxes.

- Municipal Bonds: Municipal bonds offer tax advantages for certain investors. In many cases, the interest income from municipal bonds is exempt from federal taxes and may be exempt from state and local taxes if the investor resides in the issuing state.

Capital Gains and Tax-Advantaged Accounts

When bonds are bought and sold before maturity, investors may incur capital gains or losses. The tax treatment of these gains depends on how long the bond was held and the investor’s tax bracket:

- Short-Term Capital Gains: If a bond is sold within one year of purchase, any gain is considered short-term and taxed at ordinary income rates.

- Long-Term Capital Gains: Bonds held for over a year may qualify for long-term capital gains treatment, which is typically taxed at a lower rate than short-term gains.

- Tax-Advantaged Accounts: Investing in bonds through tax-advantaged accounts such as IRAs or 401(k)s can defer taxes on interest income and capital gains until the funds are withdrawn, potentially reducing the immediate tax burden.

Understanding the tax treatment of debt securities is crucial for optimizing returns and minimizing tax liabilities. By carefully considering the tax implications of different bonds and investing strategies, investors can enhance the overall efficiency of their portfolios.

Preparing for Fixed Income Exams Effectively

Successfully preparing for assessments in the realm of debt securities requires a focused approach that integrates theoretical knowledge with practical understanding. The vast array of concepts, including valuation techniques, risk factors, and market strategies, can be overwhelming. However, with the right preparation strategy, students can master these areas and approach the test with confidence.

To excel, it’s essential to break down the material into digestible segments, actively engage with real-world examples, and practice problem-solving. A strategic study plan ensures that all major topics are covered and helps improve retention and application of key concepts. This section provides guidance on how to prepare effectively for tests related to debt market instruments and their valuation.

Developing a Study Plan

Creating a structured study schedule is the first step towards effective preparation. By breaking down topics and allocating specific times for each, students can focus on mastering one concept at a time. The following steps can help create an efficient study plan:

- Prioritize Topics: Focus on high-yield subjects that frequently appear in assessments, such as bond pricing, yield to maturity, and credit risk analysis.

- Set Realistic Goals: Establish achievable milestones for each study session, such as completing a set of problems or reviewing a particular concept.

- Review Regularly: Spaced repetition helps reinforce key principles and improve memory retention.

Practical Application and Practice Tests

In-depth theoretical knowledge alone is not enough. Applying concepts through practice tests and case studies is crucial for reinforcing learning. Taking simulated assessments helps build confidence and identifies areas that require further review. Some tips for maximizing practice sessions include:

- Time Management: Simulate real-time test conditions to practice pacing yourself. Focus on completing questions within the allotted time to improve efficiency.

- Review Mistakes: After each practice test, carefully review incorrect answers to understand the reasoning behind them and avoid similar mistakes in the future.

- Real-World Scenarios: Relate theoretical knowledge to practical scenarios in the bond market to enhance conceptual understanding.

By adopting a disciplined study routine and actively engaging with practice materials, students can approach their assessments with a thorough understanding of debt securities and confidently apply their knowledge under exam conditions.

Reviewing Answering Techniques for Bond Exams

Mastering the art of effectively responding to questions related to debt securities involves more than just knowing the content. It requires a strategic approach to ensure that the information is conveyed clearly and accurately under exam conditions. Whether you’re facing multiple-choice, short answer, or long-form questions, developing the right techniques can significantly improve performance and confidence.

In this section, we will explore effective strategies for answering assessments focused on debt instruments, helping you structure your responses, manage your time, and maximize your score. The key lies in understanding the nuances of each question type and applying the correct method to showcase your knowledge efficiently.

Understanding Question Types

Before diving into your response, it’s essential to understand the format of the questions. Different types of prompts require different answering techniques:

- Multiple-Choice Questions: These questions test your ability to identify key facts quickly. Focus on eliminating clearly incorrect options and double-checking for the most precise answer.

- Short-Answer Questions: These typically require concise explanations. Be sure to directly address the question by stating the most relevant concept first, followed by a brief justification or example.

- Essay-Type Questions: These demand deeper analysis. Structure your response with a clear introduction, body, and conclusion, ensuring that each point made is supported with a logical explanation or calculation.

Effective Response Strategies

Once you understand the question, it’s time to implement the most effective strategy to craft your answer:

- Be Clear and Concise: Avoid unnecessary details. Stick to the core concepts and express your understanding in a straightforward manner. For example, when explaining bond valuation, focus on the key factors that influence the price and yield, without diverging into unrelated aspects.

- Show Your Work: For calculations, always provide a step-by-step explanation of your method. This not only shows your understanding but also helps you earn partial credit if the final answer is incorrect.

- Use Examples: When appropriate, illustrate your answers with real-world examples. This demonstrates practical knowledge and strengthens your response.

- Time Management: Keep an eye on the clock. Allocate time for each section based on its complexity, and be sure to leave a few minutes at the end for review.

By understanding the different question formats and employing these effective answering strategies, you’ll be able to approach assessments on debt securities with greater confidence and accuracy, leading to better results.