Understanding financial reports is essential for anyone preparing for assessments in accounting and finance. This section provides an in-depth look at how to approach these reports effectively, ensuring that you grasp the key concepts and can apply them with confidence.

Throughout this guide, we will explore various aspects of these financial documents, focusing on the crucial elements that often appear in evaluation exercises. You’ll learn to identify, analyze, and interpret important figures, making the process more manageable and less intimidating. Practical examples and tips will help you build your skills and improve your performance.

Whether you’re preparing for a test or refining your knowledge, mastering these concepts will significantly enhance your ability to tackle complex scenarios. By understanding the underlying principles and practicing with real-life examples, you’ll gain the expertise needed to succeed in any challenge involving financial reporting.

Income Statement Exam Questions and Answers

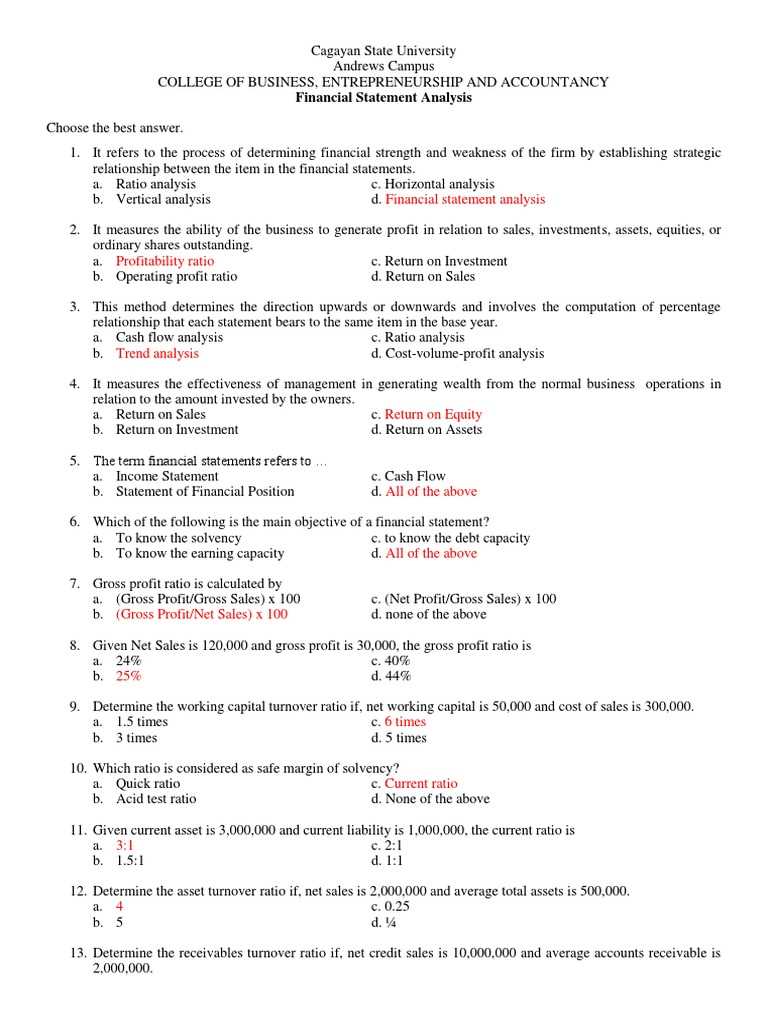

In this section, we dive into the various scenarios and exercises that evaluate your understanding of financial reports. By exploring common challenges and their solutions, you’ll learn to navigate the complexities that often appear in evaluations. Through targeted practice, you will develop a strong grasp of how to interpret key figures and apply your knowledge accurately.

Approaching Financial Report Challenges

When faced with tasks involving these documents, it’s important to first break down the components. Focus on understanding the roles of various elements, such as revenues, expenses, and profits. By practicing how to identify these in different contexts, you’ll be prepared to answer with precision and clarity.

Practical Solutions and Step-by-Step Methods

In order to ensure you tackle each problem effectively, we recommend following a structured approach. First, identify the question’s main objective. Next, apply the appropriate formulas and concepts to reach the correct answer. Lastly, verify your calculations and assumptions to ensure accuracy, avoiding common mistakes that can arise under time constraints.

Key Concepts of Income Statements

In this section, we will explore the foundational elements that make up financial reports, focusing on the key areas that drive financial performance analysis. These components are essential for understanding how businesses track and report their financial activities over a specific period. Mastery of these concepts is crucial for accurate interpretation and decision-making in assessments.

Understanding the Core Components

Every financial document contains several core components that reflect a company’s financial health. These typically include figures such as total revenue, expenses, and net results. Each of these figures plays a significant role in determining the profitability and operational efficiency of the organization.

| Component | Description |

|---|---|

| Total Revenue | Represents all earnings from the sale of goods and services, minus returns or allowances. |

| Operating Expenses | Costs related to the day-to-day functioning of the business, including salaries and rent. |

| Net Profit | The final result after all expenses are deducted from revenue, indicating the company’s financial success. |

Analyzing Profitability and Performance

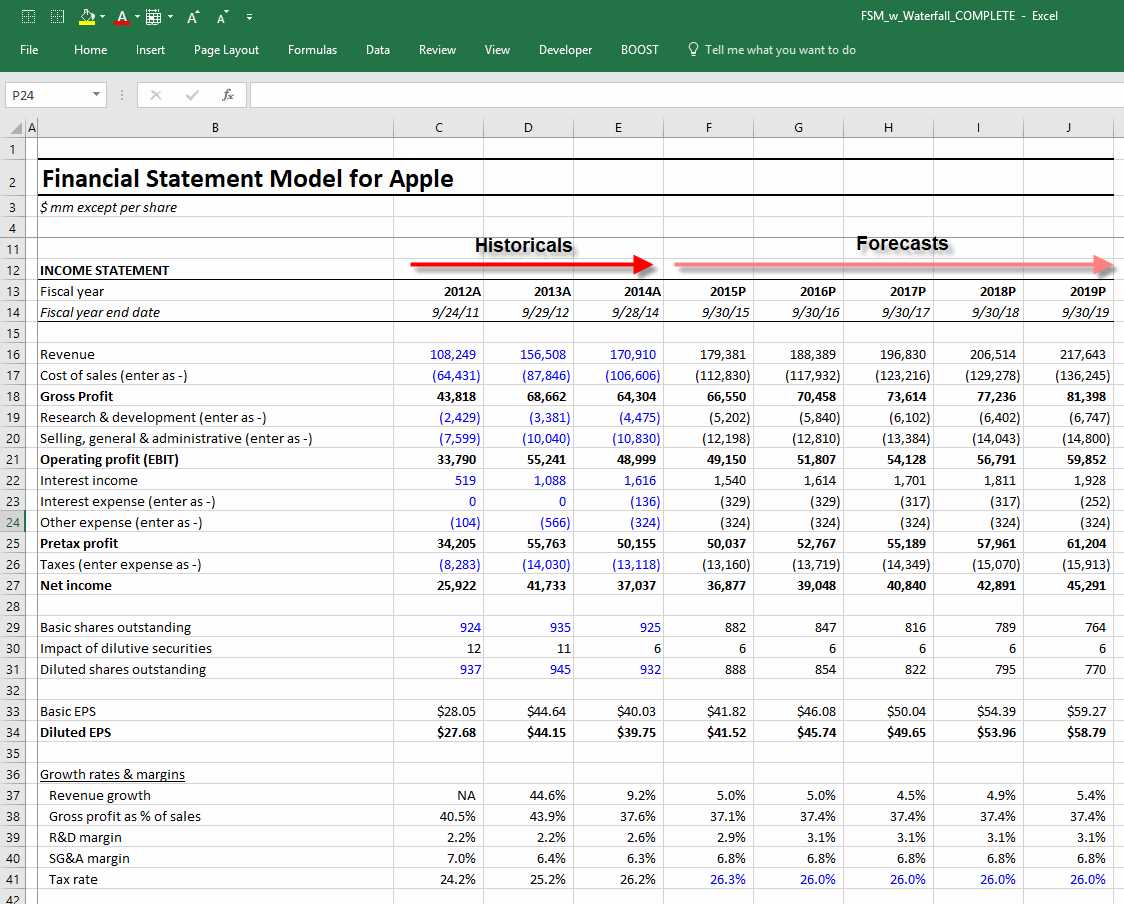

Understanding how to assess profitability through these documents is vital for accurate evaluation. By comparing different periods or entities, you can determine the efficiency and growth of a business. This evaluation helps to highlight areas for improvement and guide strategic decisions for future success.

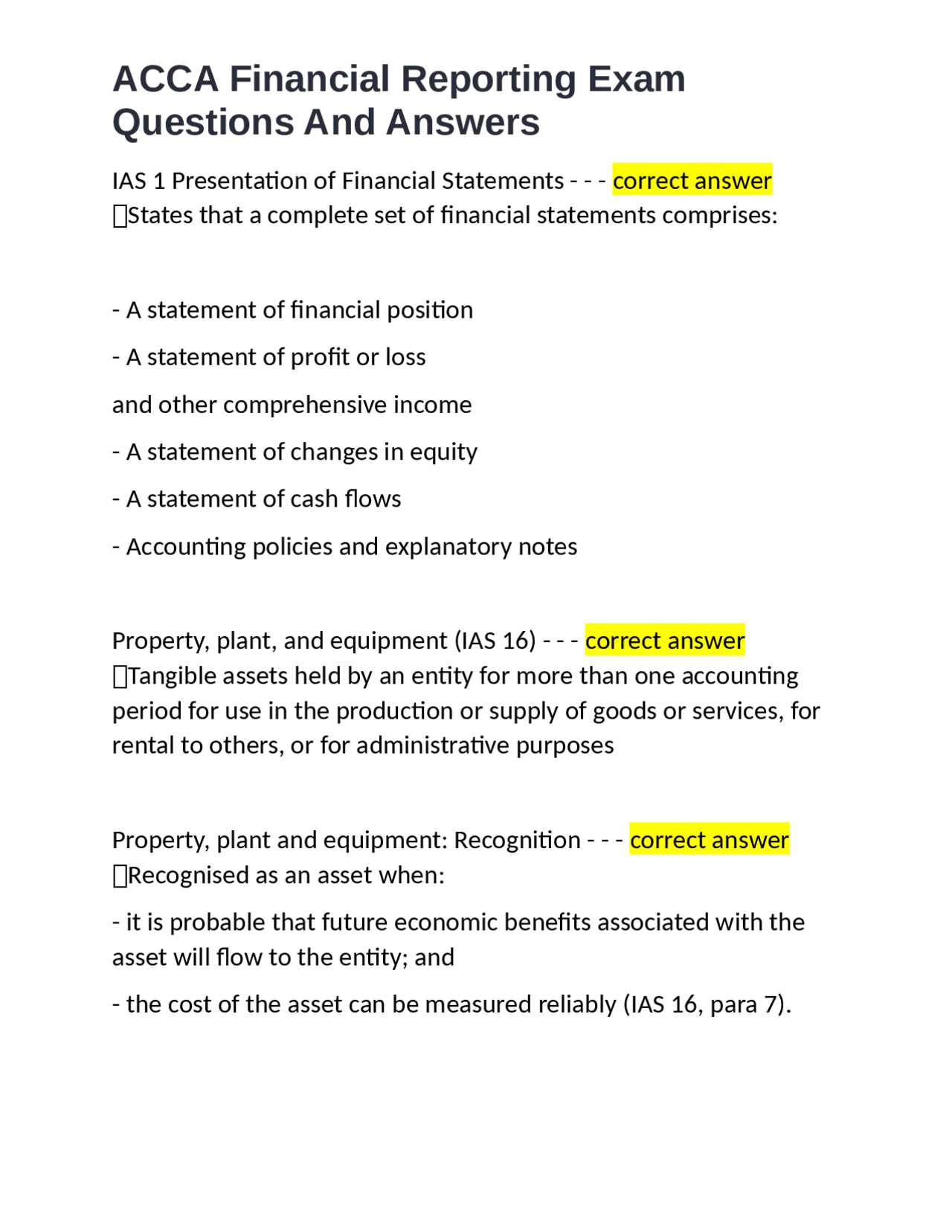

Understanding Revenue Recognition Principles

Revenue recognition is a fundamental concept in financial reporting that determines when revenue should be recorded. It outlines the conditions under which a business can recognize earnings from sales or services, ensuring that the timing aligns with the actual completion of the transaction. This principle is crucial for presenting accurate financial performance over a specific period.

Key Guidelines for Recognizing Revenue

There are several guidelines that help in determining when revenue can be recognized. These guidelines ensure consistency and accuracy in reporting. The following conditions are typically met before recognizing revenue:

- The earnings process is complete or nearly complete.

- The amount of revenue can be measured reliably.

- The risks and rewards of ownership have been transferred to the buyer.

- Collection of payment is reasonably assured.

Common Methods of Revenue Recognition

There are various methods that businesses use to recognize revenue depending on the nature of the transaction. Each method ensures that revenue is recorded at the appropriate time to reflect the true financial state of the business.

- Point of Sale: Revenue is recognized when goods are delivered or services are performed.

- Completed Contract: Revenue is recognized when a contract is completed in full, often used in long-term projects.

- Percentage of Completion: Revenue is recognized progressively as a project progresses, based on completion milestones.

Common Pitfalls in Income Statement Exams

When tackling financial assessments, there are several common errors that can lead to incorrect conclusions. These mistakes often stem from misunderstandings of the core principles or from rushing through complex calculations. Being aware of these pitfalls is crucial for improving accuracy and achieving better results.

Misinterpreting Key Figures

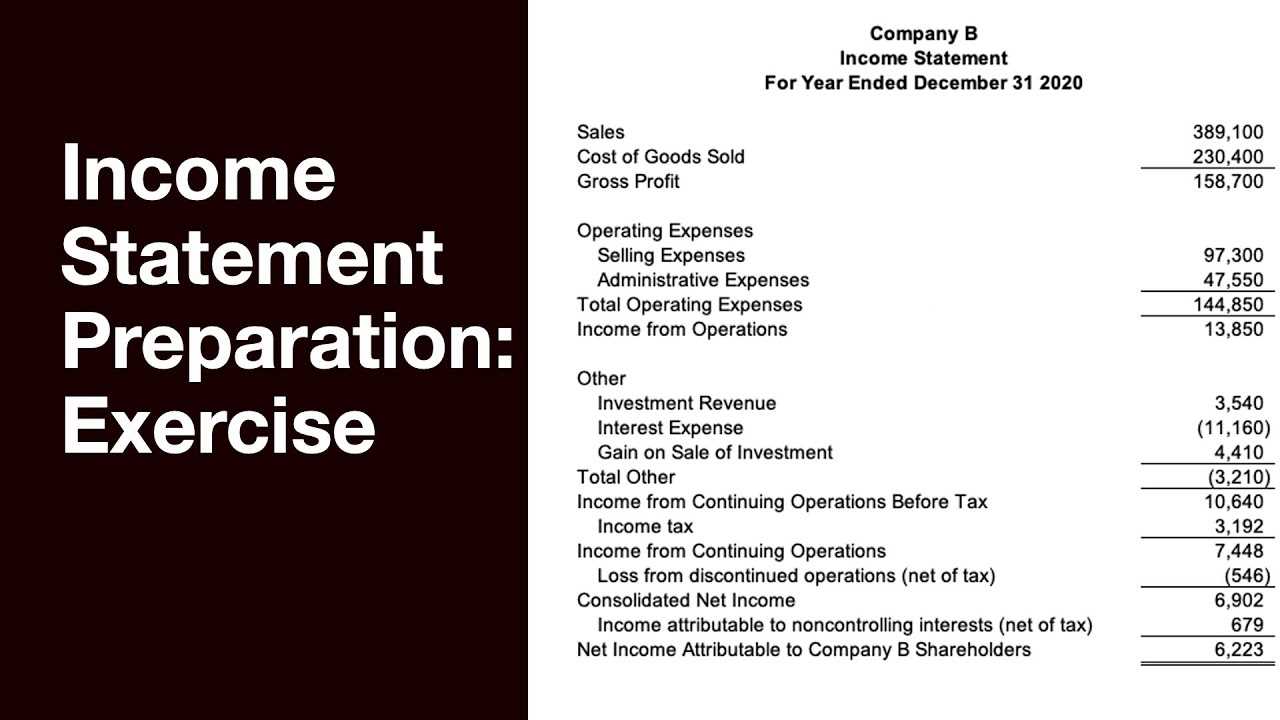

One of the most common mistakes is misinterpreting the key figures that determine the financial outcome. This can include confusing gross profit with net profit or failing to account for non-operating items that affect the bottom line. Clear understanding of the difference between these figures is essential to avoid errors in calculation.

- Confusing gross profit with operating profit

- Omitting non-operating expenses from calculations

- Overlooking one-time gains or losses

Incorrect Treatment of Expenses

Another frequent issue arises when dealing with expenses. It’s important to distinguish between fixed and variable costs and understand how they affect profitability. Failing to properly allocate or categorize expenses can lead to significant discrepancies in final results.

- Underestimating depreciation or amortization

- Misclassifying operating expenses

- Not accounting for deferred expenses

How to Analyze Income Statement Items

Effectively analyzing financial report components is key to understanding a company’s performance. By breaking down each element, you can identify trends, assess profitability, and make informed decisions. This process involves recognizing which items impact the bottom line most significantly and understanding their interrelationships.

Start by focusing on revenue figures, as they form the foundation of profitability analysis. Next, evaluate expenses to determine whether costs are in line with expectations. Finally, analyze the net result, which offers a snapshot of the company’s financial health. Paying attention to changes in these areas can help highlight potential issues or growth opportunities.

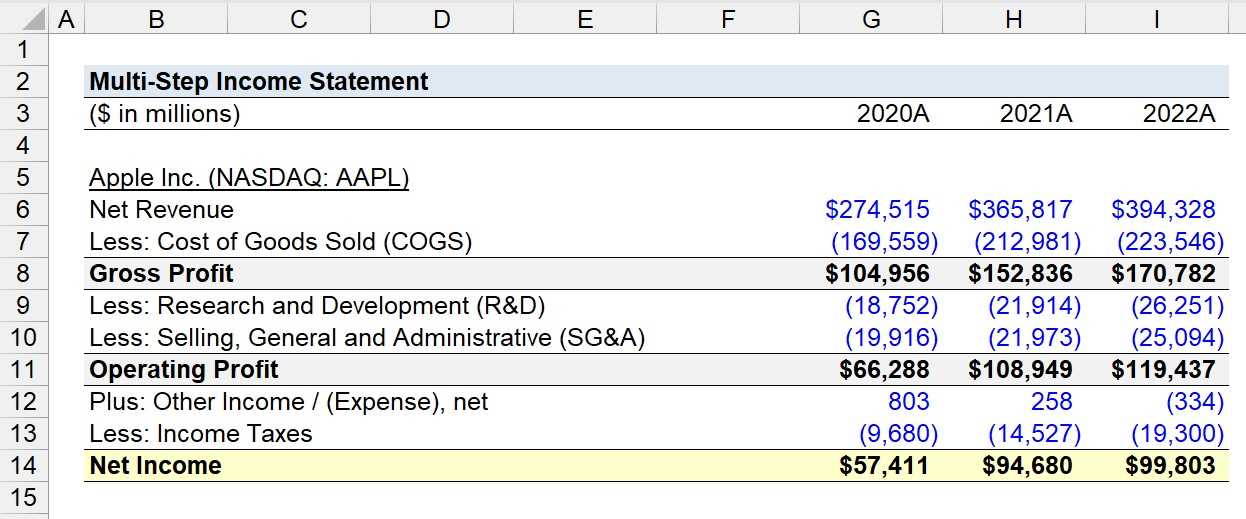

Important Formulas for Income Statements

Understanding the key formulas used in financial analysis is essential for evaluating business performance accurately. These mathematical relationships allow for quick insights into profitability, efficiency, and financial health. By mastering these equations, you can effectively interpret financial documents and make informed decisions.

Here are some important formulas to consider when analyzing financial results:

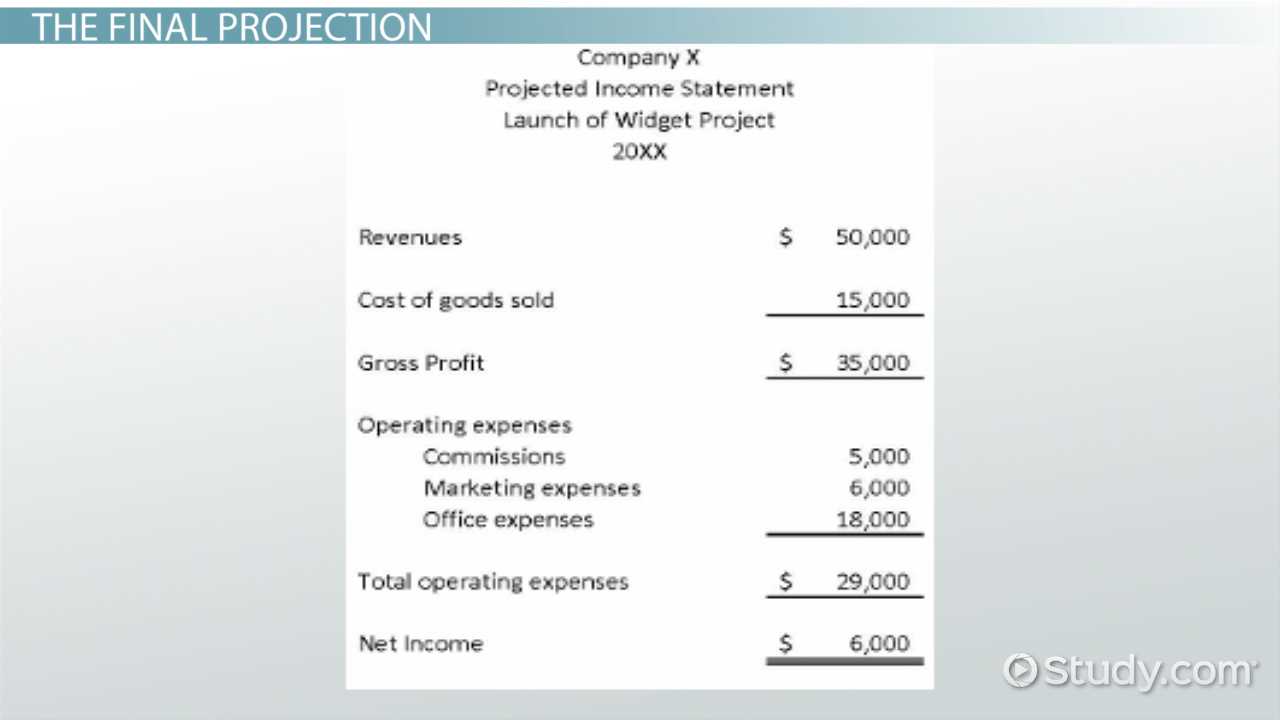

- Gross Profit = Total Revenue – Cost of Goods Sold

- Operating Profit = Gross Profit – Operating Expenses

- Net Profit = Operating Profit – Taxes – Non-Operating Costs

These formulas provide a basic framework for assessing the financial well-being of a company, helping to highlight key areas of focus for further analysis. Understanding how each formula works is crucial for accurate reporting and financial forecasting.

Adjustments in Income Statement Questions

Adjustments are often necessary when analyzing financial reports to ensure accuracy and reflect changes that occurred during the reporting period. These modifications account for various factors that may not be immediately obvious, but are critical for presenting a true picture of a company’s financial position. Understanding how to make these adjustments is crucial for interpreting results correctly.

Types of Adjustments

There are several common types of changes that may need to be reflected in financial analysis:

- Accrual Adjustments: Adjusting for revenue and expenses that have been earned or incurred, but not yet recorded.

- Depreciation and Amortization: Allocating the cost of long-term assets over time to reflect their gradual decrease in value.

- Deferred Revenues: Recognizing income that has been received but not yet earned.

- Provision for Doubtful Debts: Adjusting for expected bad debts that may not be collected.

Making Correct Adjustments

To make adjustments correctly, you should follow these guidelines:

- Identify all transactions that impact the financial period, including both cash and non-cash events.

- Ensure that each adjustment follows the appropriate accounting standard or principle.

- Accurately calculate the amounts that need to be added or subtracted, keeping detailed records of changes.

By making these adjustments, you ensure that the financial report reflects the true financial condition of the company. Failure to account for adjustments properly can lead to misleading interpretations of profitability and financial health.

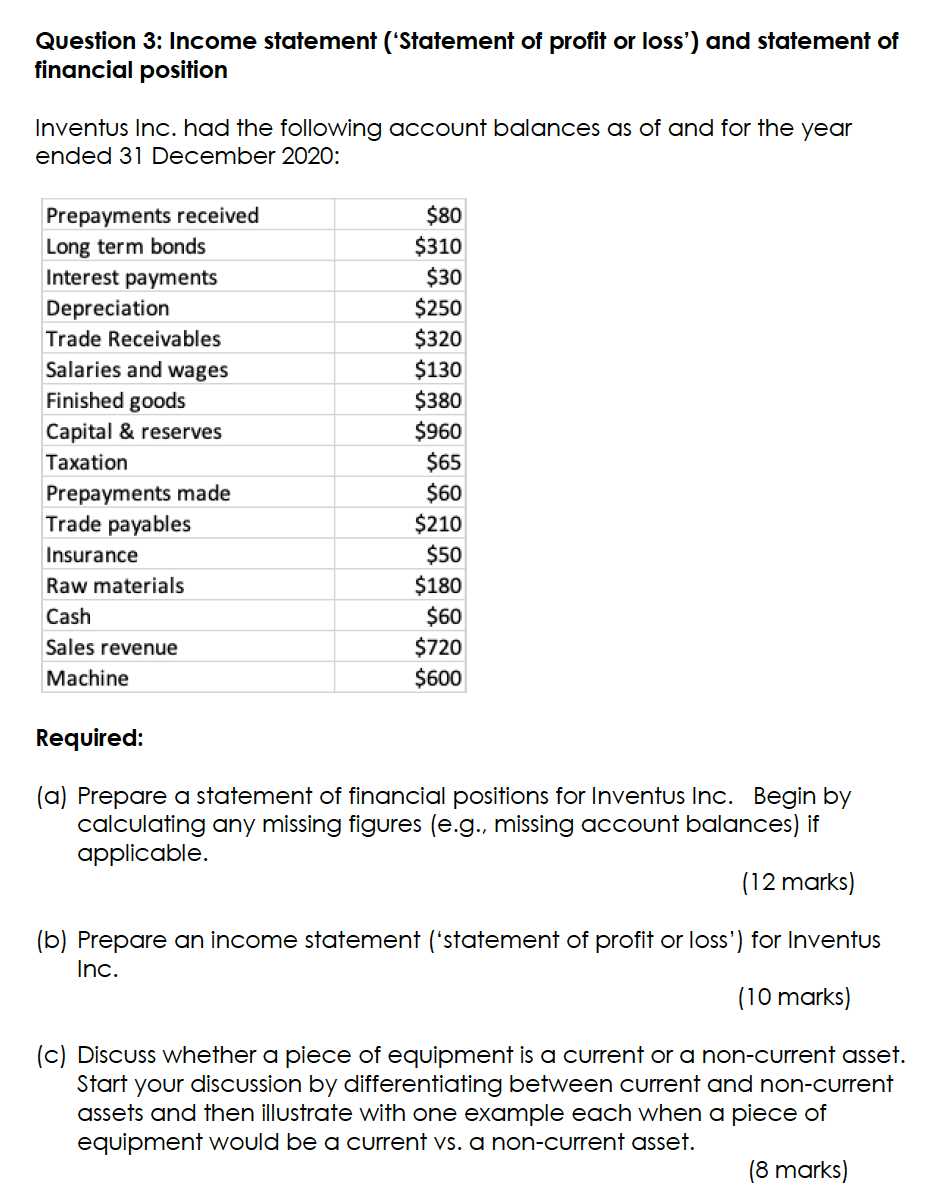

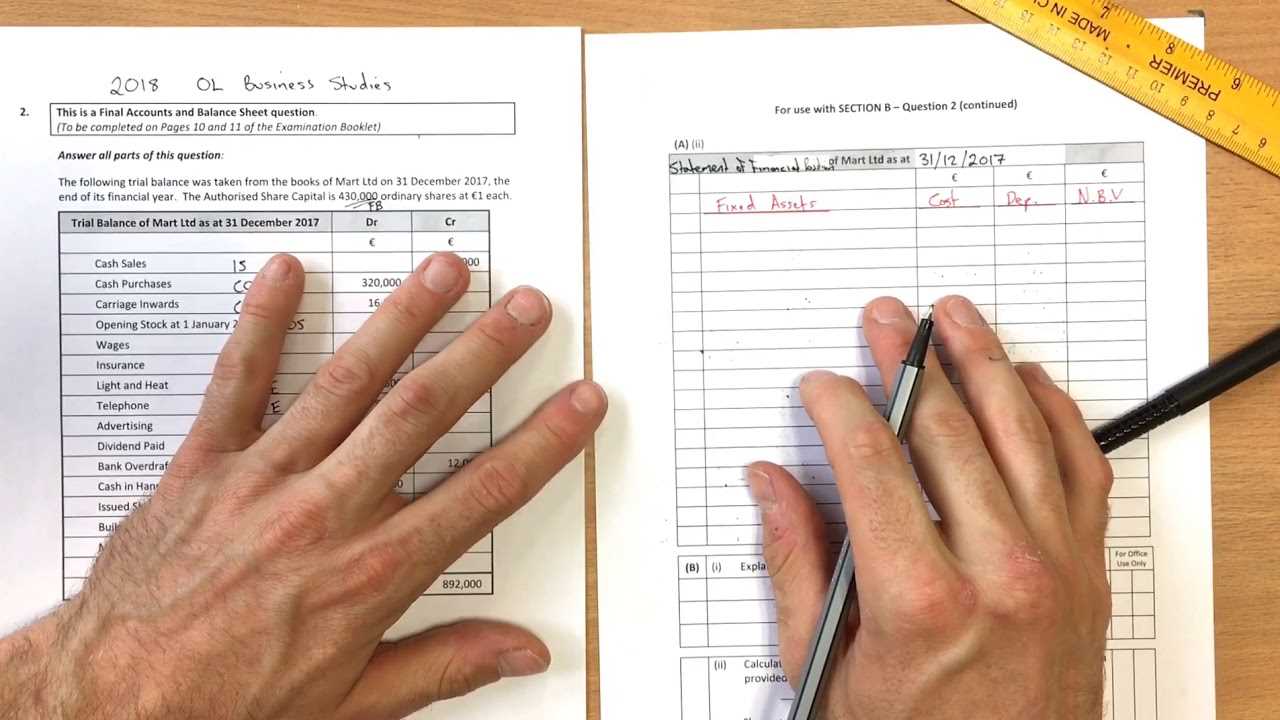

Practical Examples of Income Statement Problems

When analyzing financial reports, it’s helpful to work through real-world scenarios to understand common challenges. These practical examples highlight the types of problems that may arise and how to approach them. Solving such problems will improve your ability to interpret and analyze reports with accuracy.

Example 1: Adjusting for Revenue Recognition

In this example, a company received a payment in December for services to be provided in January. According to accounting standards, the company must recognize the revenue in January, not December. Here’s how the transaction impacts the financial report:

| Account | Amount |

|---|---|

| Cash | $10,000 |

| Deferred Revenue | $10,000 |

As the service is provided in January, the revenue should be recognized in that month. The deferred revenue account will be adjusted accordingly in the next period.

Example 2: Depreciation Adjustment

Suppose a company purchased a machine for $50,000 with a 5-year useful life. The company must recognize depreciation for each year. The depreciation expense can be calculated as follows:

| Account | Amount |

|---|---|

| Depreciation Expense | $10,000 |

| Accumulated Depreciation | $10,000 |

This example illustrates the process of recognizing a depreciation expense over the asset’s useful life. Each year, a portion of the asset’s value is allocated as depreciation, which reduces its book value.

Exam Tips for Income Statement Accuracy

Achieving precision in financial analysis requires a methodical approach and attention to detail. By mastering certain techniques, you can ensure that your reports are accurate and reflective of the company’s financial performance. Here are some key tips to help you navigate through the process with confidence.

Double-check Calculations

Always verify your calculations before finalizing the report. Mistakes in basic arithmetic or formulas can lead to significant discrepancies. Ensure that all totals, margins, and percentages are correct by reviewing each step of the process.

Understand the Principles

Familiarity with accounting principles, such as revenue recognition and expense matching, is crucial. Understanding how different factors impact financial results will help you interpret the data more effectively and make accurate adjustments when necessary.

Review Key Figures

Focus on the major elements of the report–revenue, cost of goods sold, operating expenses, and net income. Small errors in these categories can affect the overall outcome. Ensure each number aligns with the supporting documents and reflects accurate calculations.

Be Consistent

Consistency in applying accounting methods is vital for accuracy. Ensure that the same criteria are used across different periods and scenarios. This will not only improve the accuracy but also enhance the comparability of reports.

By following these tips, you can strengthen your ability to produce reliable and accurate financial analyses, helping you to tackle any challenge that arises in the process.

Impact of Taxes on Income Statements

Taxes play a significant role in determining a company’s profitability and financial outcomes. Understanding how taxes affect various components of financial reports is essential for accurately assessing the performance of a business. In this section, we will explore the key elements that illustrate the effect of taxation on financial results.

Understanding Tax Deductions and Liabilities

The calculation of taxes owed is influenced by several factors, including revenue, expenses, and applicable deductions. These deductions can reduce the amount of taxable income, thereby lowering the overall tax burden. However, failing to account for all deductions can result in an inflated tax liability.

- Taxable Income: The base figure upon which taxes are calculated, after accounting for allowable expenses.

- Tax Rate: The percentage applied to the taxable income to determine the total tax liability.

- Deferred Taxes: Amounts that represent taxes owed but not yet paid, affecting future periods.

How Taxes Affect Net Profit

After calculating the tax liabilities, the next step is to determine the impact on a company’s net earnings. Taxes reduce the gross profit, leading to a lower net profit. This reduction is essential for providing an accurate picture of the business’s financial health.

- Corporate Tax Impact: A company’s corporate tax rate influences the bottom line. High tax rates can significantly reduce net profit.

- Adjustments for Tax Credits: Tax credits, when applied, can offset liabilities and improve net income.

- Tax Planning: Effective tax planning and strategies can minimize the impact on earnings.

Taxes are a vital component that must be accurately represented in financial reports to reflect true profitability. A clear understanding of how taxes are calculated and their effect on results is essential for sound financial decision-making.

Operating vs Non-Operating Income Explained

When assessing the financial performance of a company, it’s crucial to distinguish between earnings generated from regular business activities and those stemming from other, less consistent sources. This distinction provides a clearer view of the company’s core operations and its overall financial health.

The primary source of profits for most businesses comes from their everyday activities, such as selling goods or providing services. On the other hand, additional revenue may come from activities unrelated to the main business functions, which can fluctuate and are often seen as one-time or irregular earnings. Understanding both types of earnings is essential for a comprehensive analysis of a company’s financial standing.

Operating Revenue: The Core Earnings

Operating revenue is the money a company earns through its primary business activities. This category is a reflection of the company’s ability to generate consistent sales or service income, making it a key indicator of operational success.

- Sales Revenue: The total earnings from selling products or services.

- Service Fees: Income generated from providing specialized services.

- Recurring Income: Consistent earnings from long-term customer contracts or subscriptions.

Non-Operating Revenue: The Supplemental Earnings

Non-operating income comes from activities that are not part of a company’s regular business functions. These earnings can be irregular and may include items like interest income, gains from investments, or proceeds from the sale of assets. While important, they do not reflect the business’s ongoing operations.

- Interest Income: Earnings from interest on loans or investments.

- Investment Gains: Profits from the sale of securities or assets.

- Asset Sales: Income generated from selling property or equipment.

Recognizing the difference between these two categories is vital for stakeholders who wish to understand how a business is performing based on its primary activities versus supplementary earnings. Operating income is typically a more reliable indicator of financial health, while non-operating income can introduce volatility.

How to Handle Expense Calculations

Accurately calculating costs is essential for understanding a company’s financial health and ensuring that profitability is clearly reflected. Expenses must be carefully identified and classified, as they directly impact overall performance assessments. From direct costs of production to operational expenses, proper management of these figures is crucial for maintaining transparency and making informed decisions.

Types of Expenses

There are several categories of expenses that must be tracked and calculated, depending on their nature and purpose within the company. These expenses can be fixed, variable, or a combination of both, each affecting the company’s bottom line differently.

- Fixed Costs: These expenses remain consistent regardless of the level of production or sales, such as rent or salaried wages.

- Variable Costs: These costs fluctuate with the level of production, such as raw materials or commission-based compensation.

- Operational Costs: Ongoing costs necessary to run day-to-day business activities, including utilities, insurance, and supplies.

- Non-Operational Costs: Expenses that are not part of regular business activities, such as interest on loans or losses from asset sales.

Calculating Total Expenses

To calculate the total expenses, you must add up all applicable costs for a given period. This total should include both fixed and variable expenses, ensuring that no category is overlooked. Here’s a simple breakdown for handling expense calculations:

- Identify Fixed Costs: List all recurring fixed expenses such as rent, insurance premiums, and salaries.

- Account for Variable Costs: Track costs that change with production levels, such as materials and labor.

- Sum All Expenses: Add fixed and variable expenses together to obtain the total cost for the period.

- Review for Missing Items: Double-check that all relevant operational and non-operational expenses are included in the calculation.

By following these steps, you can ensure that expenses are accounted for accurately, providing a clear picture of the business’s financial obligations. Proper expense management also aids in forecasting future spending and setting realistic profitability goals.

Income Report for Different Business Types

Each business has its unique operational structure, and the financial reports it generates reflect these differences. While the underlying principles of financial reporting remain constant, the specific items and their classifications can vary greatly depending on the type of business. Understanding how to prepare financial records for different industries is essential for accurate reporting and effective financial decision-making.

Service-Based Businesses

Service-oriented businesses generally have fewer direct costs compared to product-based businesses, focusing primarily on labor and operational expenses. Their financial reports often reflect income derived from the provision of services, and expenses related to labor, utilities, and business development.

- Revenue: Generated through offering services like consulting, repair, or personal care.

- Costs: Primarily labor costs, marketing, and overhead expenses such as rent and utilities.

- Operating Profit: Calculated by subtracting operational expenses from revenue.

Product-Based Businesses

In contrast to service companies, businesses dealing with physical products have additional layers of complexity when it comes to reporting, as they need to account for inventory, production costs, and supply chain expenses. These businesses will typically incur costs for raw materials, manufacturing, and distribution, all of which influence their financial outcomes.

- Revenue: Generated through the sale of goods, often in large volumes.

- Cost of Goods Sold: Includes all expenses related to producing or purchasing products for sale, such as raw materials and production labor.

- Gross Profit: The difference between revenue and the cost of goods sold.

Retail Businesses

Retailers, whether operating in physical stores or online, deal with high volumes of inventory and sales transactions. Their financial reports reflect not only product revenue but also costs tied to inventory management, logistics, and customer service. Key expenses also include marketing campaigns and sales commissions.

- Revenue: Derived from product sales, either in-store or through e-commerce platforms.

- Inventory Costs: Cost to purchase, store, and manage products for sale.

- Operating Expenses: Includes rent, utilities, wages, and advertising costs.

Key Takeaways

While the format of the financial report may be similar across different types of businesses, the content varies significantly depending on the nature of the business. Service companies focus on labor and operational costs, product businesses emphasize production and inventory, while retailers balance inventory management with sales expenses. Tailoring the report to reflect these nuances ensures a clearer picture of financial performance in the context of each business type.

Importance of Net Profit in Exams

Net profit is often regarded as one of the most critical figures in financial analysis. Its significance goes beyond just representing a company’s ability to generate revenue after all expenses. For students or professionals preparing for assessments, understanding the importance of net profit is essential, as it serves as a clear indicator of financial health and operational success.

In assessments, net profit is frequently used to evaluate the overall performance of a business, showing the effectiveness of its management in controlling costs and maximizing revenue. It is the final figure that reflects the company’s success in generating value for stakeholders. A strong net profit suggests efficient operations, while a weak one may indicate underlying issues, such as excessive costs or poor revenue generation.

Key Reasons for Net Profit’s Importance

- Performance Indicator: Net profit reveals how well a business is performing, serving as a direct measure of profitability after all deductions.

- Financial Health: This figure plays a vital role in determining the long-term viability of a business, influencing investor decisions and creditworthiness.

- Tax Implications: Net profit is used to calculate tax liabilities, making it a crucial element in financial reporting and planning.

Practical Applications

In practical scenarios, net profit is often the key focus in many financial calculations and decisions. From investment evaluations to assessing cost-cutting measures, this figure provides a snapshot of a company’s ability to generate surplus value. In assessments, students should focus on deriving this figure correctly, as it often has a direct impact on other financial metrics and ratios.

Revenue and Expense Matching Techniques

Accurately pairing revenues with related expenses is crucial for maintaining a clear financial picture of a business’s performance. This process ensures that the financial reports reflect the true profitability of a company over a specific period, aligning earned revenue with the costs incurred to generate it. This method aids in providing a more precise measure of operational efficiency and financial success.

By following effective techniques for matching, businesses can ensure that they are not only reporting accurate profit figures but also making informed decisions about budgeting, forecasting, and strategic planning. Understanding how and when to match revenues and expenses is essential for anyone involved in financial analysis or reporting.

Common Matching Methods

- Accrual Method: This method matches revenues to expenses in the period when they occur, regardless of when the actual cash flow happens. It is commonly used for businesses that operate on credit or have long-term projects.

- Cash Basis Method: Under this method, revenues and expenses are matched when the cash is actually received or paid, making it simpler but potentially less accurate in reflecting long-term profitability.

- Cost Matching: This approach involves directly linking specific costs to specific revenue streams, such as direct materials or labor costs to the products sold or services provided.

Techniques to Improve Accuracy

- Use of Allocations: For expenses that are not directly tied to a single revenue source, businesses can allocate costs based on activity or usage to ensure a more accurate match.

- Regular Adjustments: Periodic adjustments for deferred or accrued expenses are essential to maintain accuracy, especially when dealing with long-term contracts or seasonal revenues.

- Review of Contract Terms: In cases where revenue is tied to specific milestones, carefully reviewing the terms of contracts can ensure that the corresponding costs are properly recognized at the same time.

Mastering the art of matching revenues with their related costs is essential for producing reliable financial records and making sound decisions based on true business performance.

Understanding Comprehensive Income in Exams

Comprehensive financial performance captures the full scope of a company’s economic activities over a period, extending beyond the traditional measures of profitability. It includes all changes in equity that result from non-owner sources, providing a broader view of financial health. In assessments, understanding this concept is essential, as it involves identifying various elements that contribute to overall financial success.

By recognizing the components of total financial activity, you gain deeper insight into factors such as unrealized gains, currency translation adjustments, and pension liabilities. This knowledge helps you analyze a company’s performance more effectively, even if some of its most significant changes are not immediately apparent in conventional measures of financial success.

Key Elements of Comprehensive Performance

- Unrealized Gains and Losses: These arise from changes in market values of assets that are not yet realized through a transaction, such as fluctuations in securities or investments held by the company.

- Foreign Currency Adjustments: If a company operates internationally, it may experience changes in the value of foreign currency transactions, which can impact the company’s total financial results.

- Pension Adjustments: Changes in pension plan obligations can also contribute to comprehensive performance, particularly in companies with defined benefit plans.

Why It Matters in Assessments

- Broader Financial Analysis: Understanding total performance allows you to analyze both realized and unrealized financial changes, giving you a more complete understanding of a company’s financial health.

- Distinguishing Between Regular Profit and Comprehensive Performance: It’s crucial to differentiate between the regular profits derived from core operations and the broader financial performance, as this distinction impacts decision-making and valuation.

Grasping the concept of total performance in assessments is vital for anyone tasked with evaluating a company’s complete financial standing. It allows for a more nuanced interpretation of performance, aiding in better decision-making and a deeper understanding of business dynamics.

Reviewing Practice Questions for Mastery

Effective preparation requires consistent practice, especially when trying to master complex topics related to financial performance and analysis. One of the most efficient methods to reinforce knowledge is through structured practice. By tackling simulated problems, individuals can develop a better understanding of key concepts and refine their analytical skills. This method also helps in identifying common pitfalls and familiarizing oneself with various problem-solving techniques.

Why Practice Matters

- Reinforces Learning: Repetition of concepts through practice enables individuals to internalize critical ideas and formulas, making them easier to recall when needed.

- Boosts Confidence: Successfully solving problems builds confidence, making it easier to handle more complex scenarios during assessments.

- Improves Speed: Regular practice helps improve time management skills, allowing individuals to solve problems more quickly and efficiently.

Sample Practice Problem Breakdown

| Problem | Solution Steps | Outcome |

|---|---|---|

| Calculate the total expenses given the following: |

|

Total Expenses = $500,000 |

| Determine the profit margin based on provided data. |

|

Profit Margin = 25% |

By reviewing such examples and practicing similar problems, individuals can improve their ability to analyze financial data accurately and efficiently. Mastery comes with continuous application, ensuring readiness for any analytical task or scenario that may arise.