Understanding the principles behind financial systems is a crucial skill for anyone navigating this complex field. Whether you’re preparing for professional evaluations or simply expanding your expertise, delving into these foundational topics can provide immense value.

This article explores common scenarios and practical examples to enhance your comprehension of financial processes. By breaking down key concepts into manageable pieces, you’ll gain confidence and clarity in tackling related challenges.

Through practice exercises and illustrative examples, you’ll discover effective strategies for approaching various problem-solving tasks. These insights are designed to support your learning journey and help you achieve your goals with precision.

Preparation Guide for Financial Assessments

Effective preparation is essential for success in understanding financial regulations and their applications. Building a strong foundation in the core principles not only enhances comprehension but also boosts confidence in tackling related challenges.

Begin by identifying the key topics you need to review, focusing on areas that require additional practice. Organize your study materials and allocate time to work through practical examples and case studies. This structured approach ensures thorough coverage of important subjects.

Incorporate active learning techniques, such as solving practice scenarios and reviewing real-world examples. These methods help reinforce concepts and improve problem-solving skills. Consistent effort and attention to detail are crucial for achieving your objectives.

Key Concepts for Taxation Exams

A deep understanding of financial rules and their practical implications is fundamental for achieving success in this field. Grasping the essential ideas helps in building a strong base for analyzing scenarios and applying relevant methods effectively.

Focus on core areas such as classifications of revenue, allowable reductions, and compliance requirements. These topics often form the backbone of assessments and are crucial for demonstrating proficiency in the subject.

Additionally, familiarize yourself with common frameworks and legal references that guide financial decisions. By mastering these fundamental principles, you can confidently approach more complex topics and real-world applications.

Understanding Income Tax Filing Requirements

Comprehending the necessary steps for submitting financial documents is essential for maintaining compliance with regulations. Knowing the criteria and timelines ensures accuracy and avoids potential complications.

The process often involves gathering relevant details about earnings, deductions, and obligations. Organizing these elements systematically helps streamline the submission procedure, reducing errors and delays. It’s crucial to verify that all data aligns with official standards.

Pay attention to specific rules that apply based on individual circumstances, such as employment status or regional guidelines. These distinctions can significantly influence the preparation and submission process, making it vital to stay informed and meticulous.

Common Mistakes in Tax Exams

Avoiding frequent errors is key to achieving accuracy and confidence during assessments. Many oversights occur due to a lack of preparation or misunderstanding fundamental concepts. Recognizing these pitfalls can help improve performance significantly.

- Misinterpreting requirements: Carefully read each scenario to ensure full understanding before providing a solution.

- Omitting details: Neglecting to include essential figures or explanations can lead to incomplete or incorrect responses.

- Improper calculations: Double-check all mathematical work to prevent errors in totals or deductions.

- Ignoring regulations: Failure to apply the correct rules to specific situations may result in inaccurate outcomes.

- Time mismanagement: Spending too long on one section can lead to rushed or skipped portions later.

By practicing careful analysis, verifying work, and managing time effectively, these common issues can be minimized, paving the way for successful results.

Effective Strategies for Answering Questions

Developing a structured approach is essential for addressing assessment tasks with precision and confidence. A clear plan helps in breaking down complex scenarios into manageable steps, ensuring that each part is addressed thoroughly.

Analyze the Problem Carefully

Begin by reading the scenario attentively to grasp the key details. Identify the main requirements and any additional information that could influence your solution. Highlighting crucial points can help maintain focus while solving.

Organize Your Response

Structure your solution logically, ensuring it follows a clear flow. Start with a brief outline, then delve into specific steps, calculations, or explanations as needed. This clarity not only improves accuracy but also demonstrates thorough understanding.

Lastly, allocate time for review. Recheck your calculations, verify that all required elements are included, and confirm compliance with guidelines. Careful attention to detail can make a significant difference in achieving successful outcomes.

Exploring Tax Deduction Scenarios

Understanding how various expenses can impact financial calculations is crucial for making accurate decisions. Different situations may present opportunities for reducing obligations, but recognizing them requires careful analysis of available options.

- Business Expenses: Certain costs incurred while operating a business can be subtracted, such as equipment purchases or operational overheads.

- Charitable Contributions: Donations made to qualified organizations may provide relief in financial assessments, offering deductions based on contribution amounts.

- Medical Expenses: In some cases, medical costs that exceed a specified threshold can be subtracted from the total calculation.

- Homeownership: Home-related expenses, like mortgage interest or property taxes, might be eligible for deductions in specific conditions.

Each of these scenarios requires an understanding of eligibility and limitations. By studying various cases, you can better identify when to apply such deductions to optimize your financial outcomes.

Tips for Memorizing Tax Laws

Retaining complex regulations requires a strategic approach to studying. The key is to break down dense material into manageable segments and find techniques that enhance long-term recall. Here are a few effective methods to help with retention.

- Create Associations: Link new information with something familiar to make it easier to remember. Mnemonics or visual aids can help solidify concepts in your mind.

- Chunk Information: Divide the content into smaller, more digestible parts. Focusing on one topic at a time prevents overwhelm and improves focus.

- Practice Regularly: Repetition is essential for long-term retention. Review the material consistently to reinforce your understanding and memory.

- Teach Others: Explaining concepts to others forces you to organize your thoughts clearly, helping to reinforce your own knowledge.

- Use Flashcards: Write key terms and definitions on flashcards and quiz yourself frequently. This technique encourages active recall, which strengthens memory.

By implementing these methods into your study routine, you can improve your ability to remember important regulations and apply them effectively when needed.

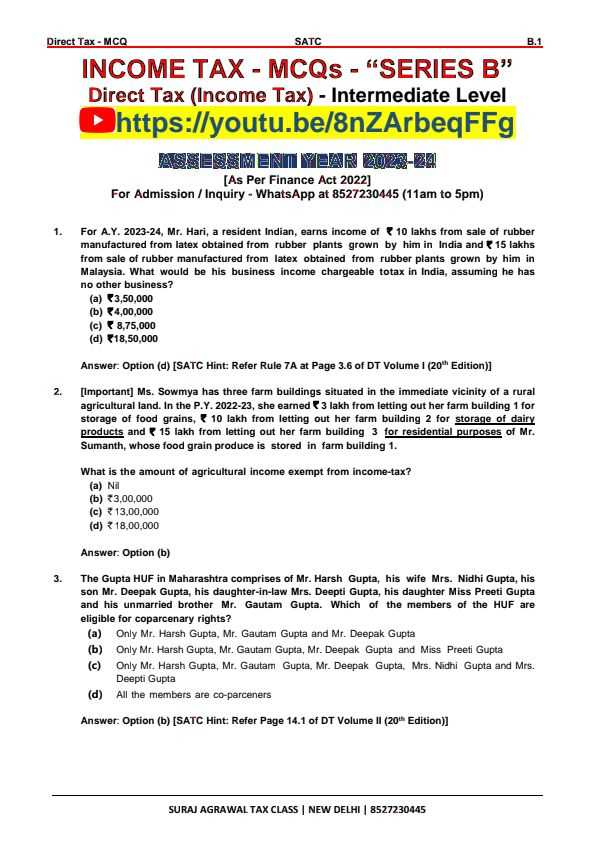

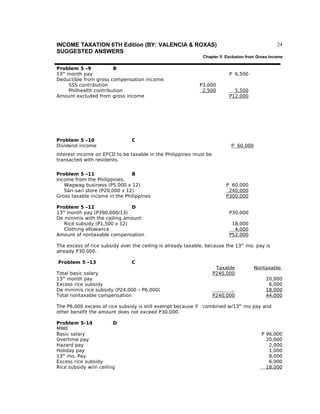

Practice Problems for Tax Computation

Working through real-world scenarios is a crucial step in strengthening your ability to calculate obligations. By solving practice problems, you can refine your skills and develop a deeper understanding of how different factors influence calculations.

Problem 1: Calculating Deductions

A taxpayer with a total of $50,000 in earnings has various allowable subtractions. These include $5,000 in business expenses, $2,000 for healthcare costs, and $1,500 for charitable donations. Calculate the adjusted figure after applying the allowable reductions.

Problem 2: Applying Rates to Earnings

An individual earns $80,000, and their applicable rate structure includes a 10% rate for the first $50,000 and a 20% rate for any amount over that. Compute the total amount due based on this tiered system.

Solving such problems sharpens your ability to apply theoretical knowledge to practical situations. The more you practice, the better prepared you’ll be to navigate complex calculations with confidence and accuracy.

Legal Aspects of Income Taxation

Understanding the legal framework behind financial obligations is crucial for anyone involved in the field. Various laws and regulations set the boundaries and determine the methods by which individuals and businesses are held accountable for their contributions. These legal considerations govern everything from eligibility criteria to the enforcement of compliance.

Key Legal Principles

Legal systems around the world adopt distinct approaches to govern fiscal contributions. The most common principles include fairness, equality, and transparency. These ensure that all taxpayers are subject to the same rules and that their rights are protected under the law.

| Legal Principle | Definition | Application |

|---|---|---|

| Fairness | Ensuring no one is unfairly burdened | Equitable distribution of financial duties |

| Equality | Treating all individuals impartially | Uniform application of legal obligations |

| Transparency | Clear, understandable rules and enforcement | Public access to relevant regulations and enforcement processes |

Enforcement and Compliance

Compliance with these legal frameworks is essential for maintaining order and fairness in society. Governments often establish agencies tasked with monitoring and enforcing adherence to the established guidelines. Non-compliance can lead to penalties or legal action, emphasizing the importance of understanding one’s obligations.

How to Interpret Tax Forms Correctly

Understanding the content of financial documents is crucial for ensuring proper compliance. These forms are designed to gather necessary information and present it in a structured way, making it essential to read each section carefully to avoid errors. Knowing how to approach these documents can significantly impact the accuracy of your submissions.

Start by identifying the sections that request personal or financial details. It’s important to differentiate between fields that require fixed data and those that depend on specific calculations. Some parts of the form may seem complicated, but breaking them down into smaller components can make the process more manageable.

Additionally, always pay attention to any supplementary instructions that accompany the forms. These notes provide context and clarity, guiding you through specific actions required for accurate completion. Be cautious of deadlines and ensure all fields are filled out correctly to avoid penalties or the need for re-submission.

Lastly, if any sections seem unclear or too complex, consider seeking advice from a professional to avoid misunderstandings. It’s better to ask for clarification than to submit incorrect information that could result in future complications.

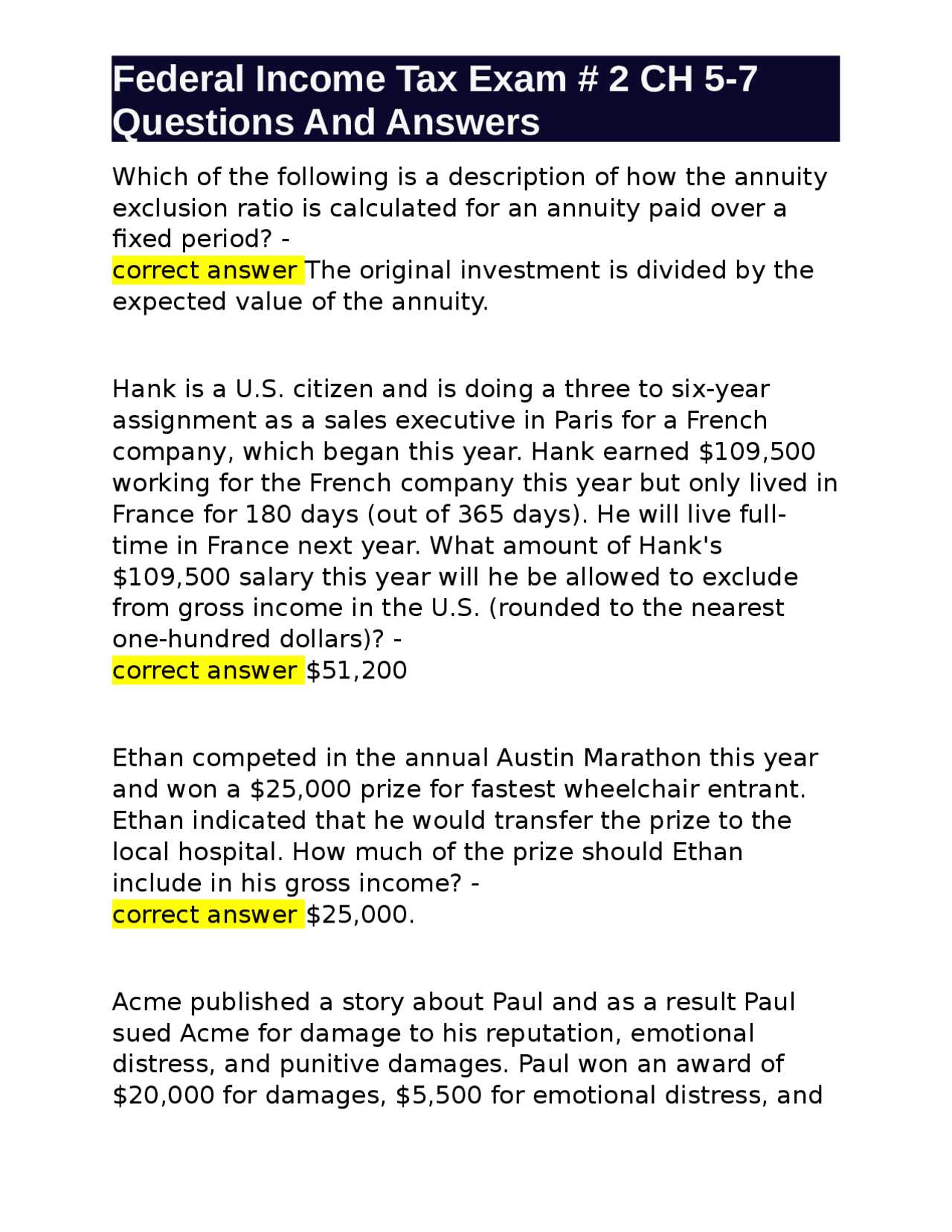

Insights on Taxable and Non-Taxable Income

Understanding the distinction between earnings that are subject to obligations and those that are exempt is crucial for accurate reporting. Some forms of remuneration are considered part of the financial framework and must be declared, while others may fall outside this scope. It’s essential to know which sources require disclosure and which ones are excluded from such requirements.

Generally, payments that are earned through regular work, investments, or services rendered are usually categorized as taxable. These include wages, salaries, business profits, and income from property rentals. On the other hand, certain benefits and receipts may be categorized as non-taxable, depending on jurisdiction and specific conditions. For example, gifts, certain scholarships, or government-provided assistance in some cases may be exempt from obligations.

To avoid any confusion, it’s important to familiarize yourself with the specific rules and guidelines that govern these classifications. This ensures that the correct items are included in your filings, while others that qualify for exemption are appropriately excluded.

Ultimately, understanding the full scope of what is required can help prevent costly mistakes and ensure compliance with relevant regulations. Being well-versed in these categories will enable a smoother financial process, avoiding unnecessary complications down the line.

Examining Case Studies in Taxation

Analyzing real-life examples provides valuable insights into how various rules and guidelines are applied in specific scenarios. By studying case studies, individuals can better understand complex concepts and see the practical effects of different financial situations. These case studies highlight how the laws are interpreted and enforced, offering a clear picture of how they impact individuals and businesses alike.

Case Study 1: Business Deduction Scenario

In this scenario, we examine how a small business owner can claim deductions for expenses related to running their operations. The key takeaway is understanding which expenses are considered valid and how they should be reported to ensure compliance with regulations.

Case Study 2: Personal Exemption Application

This case study explores how an individual may qualify for certain exemptions based on their circumstances, such as dependents, medical expenses, or education. It sheds light on the various factors that influence eligibility and the paperwork involved in claiming these exemptions.

| Scenario | Action Taken | Outcome |

|---|---|---|

| Business Deduction | Claimed legitimate business expenses | Received a reduction in obligations |

| Personal Exemption | Filed for exemption based on dependents | Exempt from specific financial duties |

By exploring these cases, individuals can develop a deeper understanding of how rules apply to everyday situations, helping them navigate the complexities of the financial system with confidence and accuracy.

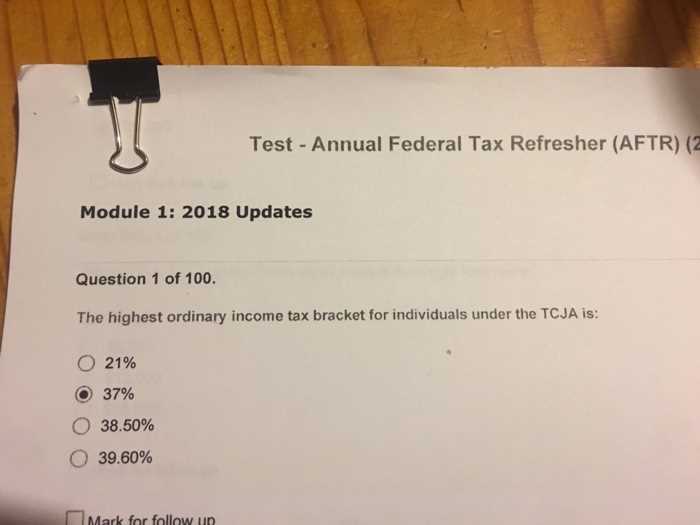

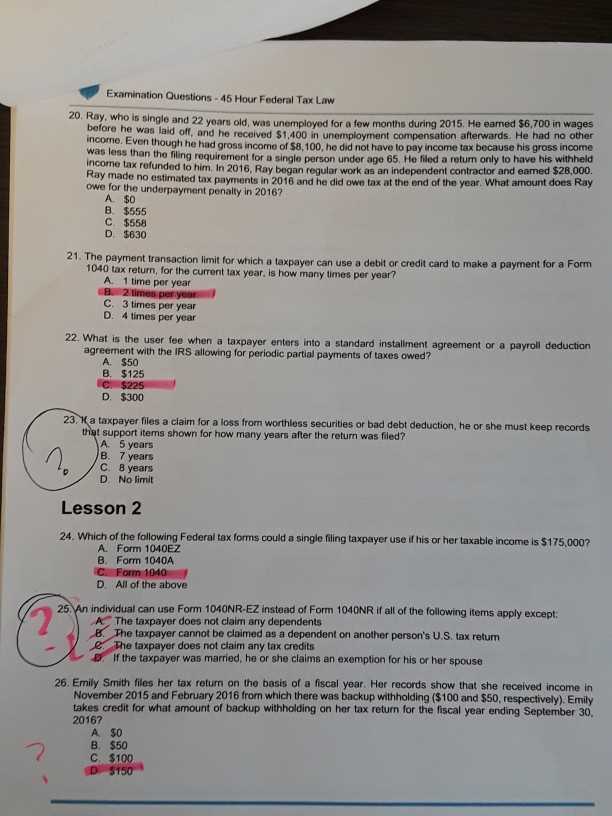

Frequently Asked Tax Exam Questions

In preparation for assessments related to financial regulations, individuals often encounter similar inquiries. These common topics help assess one’s understanding of key principles and how they apply to various scenarios. Knowing the typical questions that arise can significantly improve readiness and performance.

How are exemptions applied?

This question typically tests an individual’s understanding of how different types of exemptions, such as personal or dependent exemptions, are claimed. It also examines how eligibility is determined based on specific criteria.

What are deductible expenses?

Another frequent inquiry involves the types of expenses that can be deducted from a total liability. This question explores the concept of allowable deductions and how individuals or businesses can reduce their overall obligations by applying legitimate expenses.

By familiarizing oneself with these commonly posed queries, individuals can better prepare for assessments, ensuring they are well-versed in the principles that govern financial obligations and reductions.

Breaking Down Complex Tax Problems

Dealing with intricate financial calculations can be challenging, especially when multiple components are involved. Understanding how to break these problems into manageable steps is crucial for finding accurate solutions. This process involves analyzing each element carefully and applying the appropriate rules and methods to each part of the problem.

Step-by-step approach: The first step in solving complicated scenarios is to identify the key variables and understand their relationships. Once the essential information is outlined, it becomes easier to apply the correct principles systematically. This method helps to ensure that no detail is overlooked and that every factor is considered appropriately.

Practical tips: It is often helpful to simplify the problem into smaller sections. For example, focusing on one calculation at a time and checking each result along the way can help avoid confusion. Additionally, revisiting foundational concepts can offer clarity when faced with complex scenarios.

By breaking down complex problems in a structured way, individuals can approach them with confidence and achieve accurate results efficiently.

Maximizing Scores in Taxation Exams

Achieving high scores in financial assessments requires a combination of strategy, preparation, and a solid understanding of the material. Success in these evaluations is not just about knowing the facts but also about applying them effectively in a structured manner. This section focuses on techniques to enhance performance and improve outcomes.

Effective Preparation Techniques

Proper preparation is the cornerstone of success. It involves not only reviewing key concepts but also practicing problem-solving techniques and learning how to approach different types of tasks. Here are some steps to enhance preparation:

- Practice regularly: Solving sample problems helps reinforce learning and improve speed and accuracy.

- Understand the format: Familiarity with the structure of the assessment can help reduce anxiety and optimize time management.

- Revise key concepts: Regularly revisiting core principles ensures that essential knowledge is firmly in place.

Time Management During the Test

Effective time management is crucial for maximizing performance during the evaluation. Ensuring that enough time is allocated for each section without rushing is key. Here’s how to manage your time efficiently:

- Prioritize questions: Start with the ones that are easiest for you to answer to build confidence.

- Keep track of time: Use a watch or timer to avoid spending too much time on any single task.

- Review your work: If time allows, always leave a few minutes at the end to review your responses and make necessary corrections.

Common Mistakes to Avoid

Avoiding common pitfalls can significantly boost performance. Some frequent errors to be mindful of include:

- Overthinking: It’s important to trust your knowledge and avoid second-guessing yourself excessively.

- Neglecting to check calculations: Small mistakes in computation can have a big impact on your results.

- Skipping questions: Even if unsure, attempt all questions to maximize your potential score.

Strategies for Last-Minute Review

In the days leading up to the assessment, focus on reviewing key concepts and fine-tuning problem-solving skills. It’s important to avoid cramming and instead prioritize strategic revision.

By employing these strategies, individuals can enhance their chances of excelling and ultimately maximize their performance in financial assessments.

Exploring Advanced Tax Planning Concepts

Mastering the complexities of strategic financial management requires an in-depth understanding of sophisticated techniques that can optimize financial outcomes. These advanced methods go beyond basic compliance and focus on maximizing efficiency while minimizing liabilities. In this section, we explore these advanced concepts and how they can be effectively implemented to achieve greater financial success.

Key Strategies for Efficient Financial Planning

Advanced financial strategies involve a deeper level of planning, analysis, and forecasting. Here are some key approaches:

- Income splitting: Distributing income among family members or entities to take advantage of lower rates.

- Deferred compensation: Structuring compensation in a way that defers tax liabilities to future periods when they may be lower.

- Tax deferral strategies: Using certain financial instruments to defer tax payments to future periods.

- Utilizing tax credits and deductions: Leveraging available credits to reduce overall liabilities.

Advanced Investment Strategies

Investing strategically can help minimize the impact of financial obligations. Below are a few techniques used in advanced investment planning:

- Tax-efficient investing: Investing in vehicles that are taxed at favorable rates, such as municipal bonds.

- Capital gains management: Timing the sale of assets to reduce the taxable gain realized on investments.

- Investment in tax-deferred accounts: Contributing to accounts that offer tax deferral, such as certain retirement plans.

- Global tax planning: Taking advantage of international tax laws and treaties to minimize exposure to higher taxes.

Balancing Risk and Reward in Tax Planning

Effective financial management involves balancing risk with reward. While advanced strategies can offer substantial benefits, they also come with higher risks. It’s important to assess each strategy carefully, taking into account potential returns as well as the risks involved.

By applying these advanced strategies and carefully considering each option, individuals and businesses can optimize their financial position and significantly reduce liabilities in the long run.

Resources for Enhancing Tax Knowledge

Expanding one’s understanding of financial laws and regulations can be achieved through a variety of learning resources. These tools provide both foundational insights and advanced strategies for those looking to deepen their expertise. Whether through reading materials, online platforms, or interactive workshops, there are numerous ways to enhance one’s knowledge in this field.

Books and Publications

Books offer in-depth discussions on various concepts and are often written by experts in the field. They serve as both reference guides and educational tools for beginners and advanced learners alike. Below are some essential resources:

- Comprehensive financial guides: These books explain core principles, real-world applications, and the latest trends in financial management.

- Law journals and periodicals: These publications feature articles on the latest regulatory changes, case studies, and expert opinions on financial strategies.

- Study materials and workbooks: These resources provide practice problems, case studies, and practical exercises to help solidify understanding of complex topics.

Online Courses and Platforms

Interactive learning platforms offer the flexibility of self-paced study combined with expert-led tutorials. Here are some platforms that can enhance knowledge and skills:

- Online certification programs: Many platforms offer structured programs that lead to certifications upon completion, proving one’s expertise in financial regulations.

- Webinars and live sessions: These are often hosted by professionals and are great for gaining insights into current practices and trends in financial management.

- Video tutorials: Accessible on platforms like YouTube, these videos offer explanations of difficult concepts in an engaging and visual manner.

By leveraging these resources, individuals can significantly improve their grasp of financial principles and strategies, building a strong foundation for further learning and professional development.