Mastering complex topics and passing a professional assessment requires careful preparation and strategic study. By focusing on key concepts and practicing problem-solving techniques, you can gain the confidence needed to succeed. Whether you are a newcomer or have some experience, developing a clear understanding of core subjects is essential to achieving your goal.

Throughout this guide, we will cover crucial themes, offer insights into typical assessments, and provide helpful tips to enhance your readiness. Effective study and smart planning are the cornerstones of success, so it’s important to approach your preparations with a well-rounded strategy. This will allow you to tackle a variety of challenges with ease and precision.

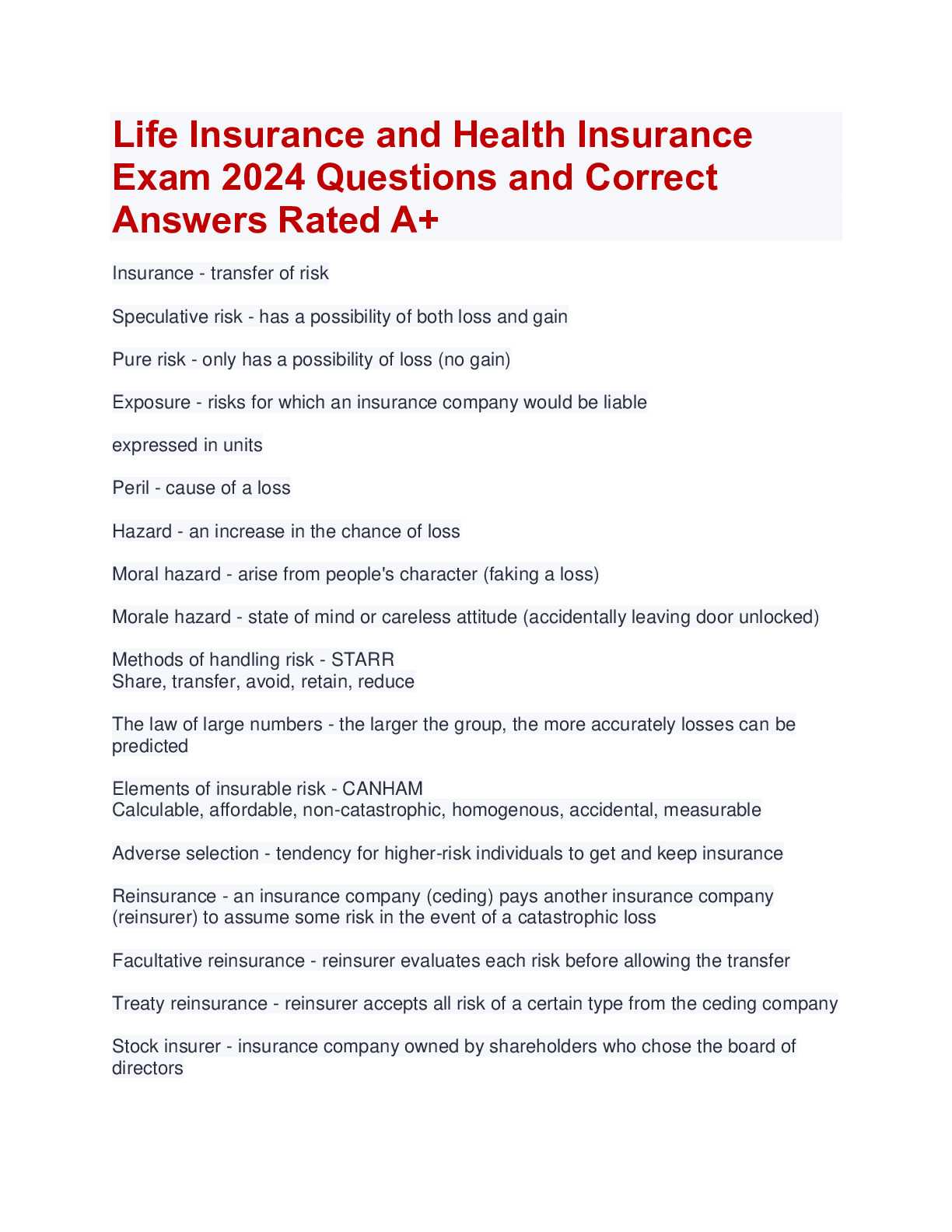

Insurance Exam Questions and Answers Guide

Preparing for a professional assessment requires understanding key concepts and familiarizing yourself with the typical format of the test. By focusing on the fundamental principles and mastering common scenarios, you can enhance your ability to perform well. This section is designed to guide you through the most essential topics, offering a thorough overview and practical tips.

Key Areas to Focus On

To succeed, it’s important to concentrate on specific themes that frequently appear in assessments. These areas are crucial for building a strong foundation and boosting your confidence. Below are some of the major topics you should prioritize:

- Types of coverage

- Policy structures

- Regulatory frameworks

- Risk management principles

- Claims process and procedures

Test-Taking Tips

To excel in your certification process, it’s important to adopt effective strategies during preparation and when tackling the assessment itself. Consider the following helpful strategies:

- Review practice materials regularly to strengthen your knowledge.

- Break down complex topics into manageable sections.

- Time yourself during mock tests to improve efficiency.

- Stay calm and focused to avoid mistakes under pressure.

- Read questions carefully before selecting your responses.

Essential Concepts for Insurance Exams

Grasping fundamental principles is crucial when preparing for any professional assessment. A solid understanding of core ideas lays the foundation for tackling a wide range of scenarios that may appear during the process. This section highlights key concepts that are critical for success, helping you navigate through complex topics with ease.

Focus on the following areas to build a comprehensive knowledge base:

- Risk Assessment: Understanding how risks are evaluated and managed is a fundamental concept that often features prominently in assessments.

- Policy Terms: Familiarity with common terminology, coverage types, and exclusions will ensure clarity when addressing specific inquiries.

- Legal Framework: Knowledge of relevant laws and regulations is essential, as they govern industry standards and practices.

- Claims Processing: Being able to explain the steps and requirements involved in processing claims is critical for demonstrating practical knowledge.

- Premium Calculations: Understanding how premiums are calculated based on various factors can provide insight into the decision-making processes within the field.

Top Insurance Topics You Must Know

To succeed in any professional assessment related to this field, you must have a deep understanding of the most important subjects. These areas cover a broad spectrum of knowledge and will prepare you to answer a variety of scenarios. Below are the key topics that form the backbone of many evaluations, and mastering them is essential for your success.

- Coverage Types: Familiarize yourself with the different kinds of policies available and their unique features. This includes life, health, property, and liability options.

- Risk Management: Understand how risks are identified, assessed, and mitigated through various strategies. This is a critical concept that appears frequently in assessments.

- Regulatory Environment: Knowledge of the laws and regulations governing the industry is crucial. Stay updated on national and international standards.

- Claims Procedures: Be prepared to explain how claims are initiated, processed, and resolved, along with the documentation and timelines involved.

- Policyholder Rights: Understanding the rights and responsibilities of individuals covered under various policies is key to answering related questions effectively.

- Financial Management: Be able to calculate premiums, assess payouts, and understand the financial stability of organizations offering coverage.

Key Terms in Insurance to Remember

To excel in your professional assessment, it’s crucial to understand the terminology used in the field. Familiarizing yourself with the essential terms will not only help you interpret complex topics but also enhance your ability to answer specific queries. Below are some fundamental expressions that every candidate should know to navigate through evaluations with confidence.

Important Concepts to Understand

- Premium: The amount paid periodically to maintain coverage under a policy.

- Deductible: The initial amount the policyholder must pay out-of-pocket before the insurer covers the rest.

- Underwriting: The process by which an insurer evaluates the risk of insuring a person or entity.

- Claim: A request made by the policyholder to the insurer for compensation after a loss.

- Exclusion: Specific conditions or circumstances that are not covered under the terms of the policy.

Additional Terms to Familiarize With

- Beneficiary: The person or entity designated to receive benefits from a policy.

- Coverage Limit: The maximum amount an insurer will pay for a covered loss.

- Policyholder: The individual or entity that owns an active policy.

- Liability: The legal responsibility for damages or injury caused to others.

- Reinsurance: The practice of transferring some of the risks to another insurer to reduce the burden of large losses.

Understanding Policy Types for Exams

Having a clear grasp of the different types of coverage is crucial when preparing for assessments in this field. Each category of protection serves a specific purpose, and understanding their distinctions will help you navigate through various scenarios. This section will guide you through the key policy categories, highlighting their unique features and benefits to ensure you’re fully prepared.

Main Policy Categories

| Policy Type | Description | Common Use |

|---|---|---|

| Life Protection | Covers the policyholder’s life, providing a benefit to beneficiaries upon death. | Common for personal planning and family security. |

| Health Coverage | Helps pay for medical expenses, including doctor visits, hospital stays, and prescriptions. | Essential for medical care and health-related expenses. |

| Property Safeguard | Protects against damage to property caused by natural disasters, theft, or other incidents. | Frequently used for homes, cars, and business assets. |

| Liability Coverage | Provides financial protection in the event the policyholder is responsible for causing injury or damage to another person. | Important for individuals and businesses to mitigate legal risks. |

| Disability Protection | Offers income replacement if the policyholder is unable to work due to illness or injury. | Helps maintain financial stability in case of sudden incapacity. |

Understanding the Differences

Each policy type provides different levels of protection depending on the needs of the policyholder. Whether it’s safeguarding assets, ensuring health coverage, or securing income, understanding how these policies function will enable you to make informed decisions and respond appropriately to related queries during the assessment.

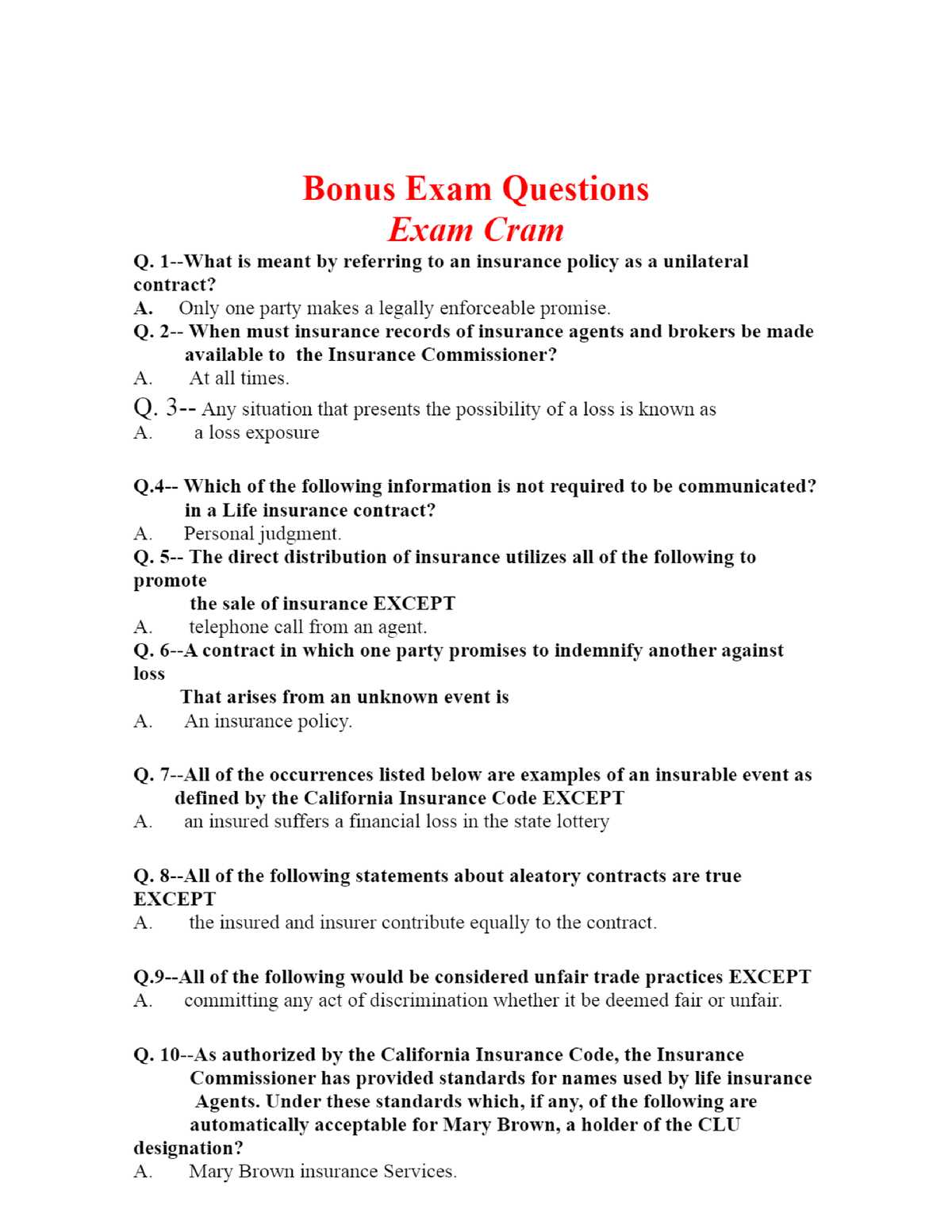

Commonly Asked Questions in Insurance Tests

During assessments related to this field, certain topics tend to come up more frequently. These inquiries are designed to test your understanding of fundamental concepts, as well as your ability to apply knowledge in practical scenarios. Below are some typical themes that often appear, along with insights on how to approach them effectively.

Be prepared to encounter questions on the following subjects:

- Policy Coverage: Expect to explain the differences between various types of policies and their coverage limits. For example, how life or health protection differs from property safeguarding.

- Risk Assessment: Inquiries may ask you to identify how different risks are evaluated or to outline the factors that affect risk management strategies.

- Claims Process: You may be asked to describe the steps involved in filing a claim, the documentation required, and the timelines typically followed.

- Premium Calculations: Questions might require you to calculate premium costs based on certain variables or adjust them according to policy terms.

- Legal Implications: Expect to answer questions regarding the legal framework governing policies, including exclusions, regulations, and the rights of policyholders.

These themes are integral to ensuring a comprehensive understanding of the subject matter. Mastering them will help you approach each question with confidence and accuracy.

How to Study Effectively for Insurance Exams

Preparing for a professional assessment in this field requires a strategic approach to ensure success. Effective study habits can make a significant difference, enabling you to grasp key concepts, retain important details, and perform confidently. Below are some essential tips that will help you organize your preparation and maximize your chances of success.

Key Strategies for Success

- Create a Study Schedule: Develop a clear, structured plan that allocates specific time slots for each topic. Break down complex subjects into manageable chunks.

- Focus on Core Concepts: Concentrate on understanding the foundational principles that often appear in assessments. Prioritize key areas such as risk management, policy types, and claims procedures.

- Use Practice Materials: Complete sample tests and practice questions to familiarize yourself with the test format and identify areas that need improvement.

- Review Regularly: Consistent review helps reinforce memory. Set aside time each week to go over previously studied material to solidify your knowledge.

- Study in Short Sessions: Short, focused study sessions are more effective than long, drawn-out periods. Aim for 45-60 minutes of concentrated study followed by a short break.

Additional Tips for Effective Preparation

- Take notes while studying to actively engage with the material.

- Join study groups to share insights and clarify doubts with peers.

- Stay organized by keeping track of important terms, definitions, and examples.

- Maintain a healthy study-life balance to avoid burnout and stay motivated.

- Stay calm and positive–confidence is key during the assessment process.

By following these strategies and staying disciplined, you’ll increase your chances of success and approach the assessment with confidence and clarity.

Exam Strategies for Insurance Students

When preparing for any assessment in this field, developing effective strategies is essential to maximize your performance. A well-thought-out approach can help you manage your time, reduce stress, and increase your chances of success. This section will provide you with some key techniques to approach the test with confidence and efficiency.

Essential Techniques to Apply

- Time Management: Allocate sufficient time to each section based on its complexity and importance. Avoid spending too long on any one topic to ensure you have time for all sections.

- Understand Key Areas: Identify core concepts that are most likely to be tested, such as policy types, risk management strategies, and claims procedures. Focus your efforts on mastering these topics.

- Answering Strategy: Read each question carefully before answering. Eliminate obviously incorrect options and focus on choosing the most accurate response based on your knowledge.

- Stay Calm Under Pressure: Maintain a calm demeanor during the test. Deep breathing or taking a moment to refocus can help reduce anxiety and improve concentration.

- Review Your Work: If time allows, go back and double-check your responses, especially on questions where you had to make an educated guess.

Additional Tips for Success

- Read the instructions thoroughly before starting.

- Take short breaks between study sessions to refresh your mind.

- Practice with mock tests to familiarize yourself with the format and timing.

- Focus on understanding, not memorization. It’s essential to apply knowledge in practical scenarios.

- Stay positive and confident in your preparation. A positive mindset will improve your performance.

By using these strategies, you can approach the assessment with a sense of preparedness and control, increasing your chances of achieving a successful result.

Best Resources for Insurance Exam Preparation

To effectively prepare for any assessment in this field, having the right tools and materials is essential. The right resources can help you understand complex concepts, reinforce your knowledge, and increase your confidence. In this section, we’ll explore some of the best study materials and platforms that can aid in your preparation.

Top Study Materials

- Textbooks and Study Guides: Comprehensive books that cover all major topics provide a solid foundation for understanding core concepts. Look for study guides tailored to the specific test you’re preparing for.

- Online Practice Tests: Many websites offer mock assessments that mimic the actual format. Taking these practice tests helps familiarize you with the structure and timing of the real thing.

- Flashcards: These are an excellent tool for memorizing important terms, definitions, and formulas. Digital flashcards can be particularly helpful for quick revision on-the-go.

- Video Tutorials: For visual learners, video explanations of complex topics can provide clarity. Many platforms offer free and paid video courses that break down challenging concepts.

- Study Apps: Mobile apps designed for this field can provide interactive practice, quizzes, and track your progress to ensure you’re consistently improving.

Other Helpful Platforms

- Online forums and communities where students share insights and discuss tricky topics.

- Professional organizations often offer seminars, webinars, and additional study materials.

- Social media groups and channels that provide tips, success stories, and expert advice.

- Interactive platforms that allow you to engage with instructors or peers for real-time clarifications.

By leveraging these resources, you can create a well-rounded study plan and ensure that you are well-prepared for the assessment ahead.

Practice Questions to Test Your Knowledge

One of the most effective ways to reinforce your learning and assess your readiness is through practical exercises. Practicing with sample scenarios allows you to identify areas of strength and areas that need improvement. This approach helps you become familiar with the format, improves time management, and boosts your confidence for the actual assessment.

Below is a set of practice exercises designed to help you test your understanding of the key concepts. Use them to simulate the testing environment and track your progress.

| Topic | Scenario | Correct Answer |

|---|---|---|

| Risk Management | Which of the following methods is used to minimize risk in an organization? | Diversification |

| Policy Types | What type of coverage protects against damages caused by natural disasters? | Catastrophic Coverage |

| Claims Procedures | When filing a claim, which document is most commonly required as proof? | Claim Form |

| Legal Framework | What law governs the process of policy cancellations? | Cancellation Act |

| Coverage Limits | What is the maximum amount a policyholder can claim for a specific loss? | Coverage Limit |

Test yourself regularly with these scenarios, and use them to evaluate your understanding of the concepts. If you find certain areas challenging, focus more time on reviewing them until you feel confident.

Common Mistakes to Avoid on Exams

When preparing for any assessment, it is important to be aware of common pitfalls that can affect your performance. These mistakes often stem from lack of preparation, stress, or mismanagement of time. By understanding these errors, you can better navigate your way through the test and avoid setbacks that could hinder your success.

Here are some common mistakes to watch out for during your preparation and on the day of the test:

- Not Reading Instructions Carefully: Skipping over instructions can lead to confusion and incorrect responses. Always take a moment to thoroughly read the guidelines before starting each section.

- Mismanaging Time: Spending too much time on difficult questions can leave you with insufficient time for the easier ones. Allocate your time wisely and ensure you complete every section.

- Overthinking the Answer: Second-guessing your initial responses can lead to unnecessary changes. Trust your first instinct unless you are certain an error was made.

- Ignoring Review Opportunities: If time permits, go back and review your answers. Many errors can be caught during a second look.

- Not Practicing Enough: Failing to simulate the test environment or practice with sample scenarios can leave you unprepared. Regular practice helps familiarize you with the question format and improves your response time.

- Being Unprepared for Stress: Anxiety can hinder your performance. Practice relaxation techniques to stay calm and focused throughout the assessment.

- Skipping Questions: Avoid leaving any question unanswered. If you’re unsure, try to eliminate incorrect options and make your best guess.

By recognizing these common errors, you can adjust your approach and enter the assessment feeling more prepared and confident. Focus on avoiding these mistakes to ensure a smoother testing experience and better outcomes.

Time Management Tips for Insurance Exams

Efficiently managing your time during a test is essential to ensuring you complete all sections while maintaining accuracy. Without a clear strategy, you may spend too much time on difficult questions, leaving the easier ones unfinished. Here are some practical tips to help you stay on track and make the most of your allotted time.

- Familiarize Yourself with the Format: Before starting, review the structure of the test. Knowing how many sections there are and the type of questions you’ll face will help you allocate time accordingly.

- Set Time Limits per Section: Divide your total available time by the number of sections. For example, if you have 90 minutes for 3 sections, plan to spend no more than 30 minutes on each. Stick to this limit to avoid getting bogged down.

- Start with the Easiest Questions: Begin with questions you feel most confident about. This boosts your morale and ensures that you rack up easy points early on.

- Don’t Get Stuck: If a question is taking too long, move on. Mark it and come back to it later if time allows. Spending too much time on a single item can hurt your overall performance.

- Use a Watch or Timer: Keep track of time with a wristwatch or a timer on your phone. This will help you monitor how much time remains and adjust accordingly if you’re falling behind.

- Practice with Timed Mock Tests: Simulate the real environment by practicing with timed mock scenarios. This builds your ability to pace yourself effectively during the actual test.

- Review at the End: Always leave a few minutes at the end to review your answers. Checking over your work allows you to catch any mistakes or missing details.

By implementing these time management strategies, you can approach your test with greater confidence and efficiency. Proper pacing ensures that you complete all tasks while maintaining the quality of your responses.

How to Answer Multiple Choice Questions

Multiple-choice items are common in many assessments and require specific techniques to navigate successfully. Rather than simply guessing, a thoughtful approach can significantly improve your chances of selecting the correct option. Knowing how to analyze each choice and eliminate the unlikely answers can give you an advantage, even when you are unsure.

- Read the Question Carefully: Before looking at the options, ensure you fully understand what is being asked. Pay attention to key terms, like “always,” “never,” or “usually,” which can alter the meaning of the statement.

- Eliminate Incorrect Choices: Start by ruling out any answers that are clearly wrong. This narrows down your options and increases the likelihood of choosing correctly.

- Look for Keywords in Options: Sometimes, the right choice will contain key words or phrases that directly relate to the question. Pay attention to these details to help guide your decision.

- Don’t Overthink: Trust your initial judgment. Often, your first instinct is correct, and second-guessing can lead to mistakes.

- Consider “All of the Above” or “None of the Above”: These choices can be tricky. If you’re sure that two or more answers are correct, then “All of the Above” is likely the right option. Conversely, if none of the options seem correct, “None of the Above” might be your best choice.

- Check for Negatives or Exceptions: Pay attention to words like “except,” “not,” or “only” in both the question and the answers. These can change the direction of your response and can be the key to identifying the correct answer.

- Guess Strategically: If you have no idea, eliminate the obviously incorrect answers and make an educated guess from the remaining options. Avoid random guessing whenever possible.

By employing these strategies, you can tackle multiple-choice items more effectively, giving you the best chance of achieving the highest possible score.

Insurance Laws and Regulations for Exams

Understanding the legal framework governing the field is crucial when preparing for assessments in this area. Regulations ensure that practices are conducted fairly, transparently, and ethically, protecting all parties involved. Being familiar with the key laws will not only help in answering related questions but also provide a solid foundation for any professional career in the field.

Key Laws to Know

There are several important regulations that you must be well-versed in to succeed in assessments. These laws cover a wide range of topics, from consumer rights to business practices, and play a major role in guiding the practices of companies and professionals alike. Some of the most critical ones include:

- The Affordable Care Act (ACA): A landmark reform that regulates health coverage, aiming to provide more accessible and affordable healthcare options.

- The Dodd-Frank Act: This law was enacted to reduce risks in the financial system, regulating industries such as banking, securities, and others affecting the field.

- The Gramm-Leach-Bliley Act: It focuses on protecting consumer financial information, establishing privacy protections, and preventing unauthorized disclosure.

Understanding Regulatory Bodies

In addition to laws, it’s essential to be familiar with the key organizations that enforce these regulations. These bodies oversee the practices of providers, ensuring compliance with standards, consumer protection, and fair play. Some of the most notable include:

- The National Association of Insurance Commissioners (NAIC): This organization is responsible for coordinating regulatory policies across different states.

- The Securities and Exchange Commission (SEC): This body regulates companies and brokers, enforcing laws to ensure the protection of investors and consumers.

- The Financial Industry Regulatory Authority (FINRA): FINRA regulates broker-dealers and ensures that their practices meet the necessary legal standards.

Familiarity with these laws and regulatory organizations will ensure you are prepared to address any related questions and scenarios during assessments. Knowing the role each plays in maintaining fairness and integrity within the industry is essential to your success.

Preparing for Case Study Questions

Case studies are an essential part of assessments, as they test your ability to apply theoretical knowledge to real-world scenarios. These tasks often present complex situations that require careful analysis, critical thinking, and decision-making. Understanding how to approach these exercises will help you demonstrate your problem-solving skills effectively.

Steps to Tackle a Case Study

To succeed in answering case study-based prompts, it’s important to follow a structured approach. Here’s how you can effectively analyze and address case studies:

- Read the scenario thoroughly: Begin by understanding all the details of the case. Take note of key facts, stakeholders involved, and the underlying issues that need to be addressed.

- Identify the problem: Once you’ve gathered all the relevant information, pinpoint the main problem or challenge presented in the case. This is the focus of your response.

- Consider potential solutions: Think critically about different ways to resolve the issue. Draw upon your knowledge of best practices, laws, and industry standards to come up with feasible options.

- Justify your decision: When you select a solution, ensure you explain why it is the most appropriate choice based on the case details and relevant concepts.

Common Pitfalls to Avoid

While preparing for case studies, be mindful of these common mistakes that can negatively impact your responses:

- Overlooking key details: Missing out on crucial information can lead to incorrect conclusions. Be sure to read every part of the scenario carefully.

- Rushing through your response: Take your time to consider all possible outcomes and carefully explain your reasoning. Rushed answers often miss critical analysis.

- Focusing on one solution: It’s important to present a range of potential solutions and weigh their pros and cons before making a final recommendation.

By following these strategies and avoiding common mistakes, you can approach case study questions with confidence and clarity. Practice analyzing different case scenarios to sharpen your skills and enhance your preparedness.

What to Expect in Insurance Exam Interviews

When preparing for assessments that include interviews, it’s essential to understand the format and the types of interactions that might take place. These interviews are designed to gauge your practical knowledge, communication skills, and ability to think critically under pressure. Knowing what to expect will help you stay focused and confident during the process.

Types of Questions You May Encounter

During these interviews, you can expect to be asked a variety of questions that test both your technical understanding and your problem-solving abilities. Some common categories of questions include:

- Situational questions: These assess how you would respond to hypothetical scenarios related to the field. You might be asked to discuss how you’d handle a specific situation, such as advising a client or addressing a dispute.

- Behavioral questions: These focus on your past experiences and actions. Interviewers might inquire about how you’ve dealt with challenges or succeeded in certain tasks to understand your approach and capabilities.

- Conceptual questions: You will be asked to demonstrate your grasp of key principles and theories, explaining complex concepts in simple terms to show your depth of knowledge.

How to Prepare for the Interview

To succeed in these interviews, preparation is key. Here are some tips to help you perform at your best:

- Know your material: Review key concepts, principles, and best practices. Make sure you can discuss them clearly and apply them to practical situations.

- Practice mock interviews: Simulate interview scenarios to get comfortable with the format. This will help you refine your responses and boost your confidence.

- Prepare questions: Be ready to ask insightful questions that show your interest in the role or the industry. This can also demonstrate your critical thinking and curiosity.

By understanding the structure and preparing strategically, you can approach these interviews with confidence and showcase your expertise effectively.

Test-Taking Techniques for Insurance Exams

When approaching any type of assessment, having effective strategies in place is essential for maximizing performance. Understanding how to manage your time, how to approach different types of tasks, and how to stay calm under pressure can make a significant difference in your results. By applying the right techniques, you can tackle even the most challenging sections with confidence.

Time Management Tips

Time management plays a critical role in ensuring that you complete all sections without feeling rushed. Follow these tips to optimize your time:

- Read instructions carefully: Before starting, take a moment to thoroughly read all instructions. This helps to avoid misinterpretation of tasks and ensures you’re aware of any special requirements.

- Prioritize easier tasks: Begin with sections or questions that seem straightforward to you. Completing these quickly will help you build confidence and give you extra time for more complex problems.

- Monitor your time: Keep an eye on the clock throughout the test. Allocate a specific amount of time per section or question and stick to it as closely as possible.

Approach to Multiple-Choice Items

Multiple-choice items are commonly found in many assessments. Use these strategies to maximize your chances of selecting the correct option:

- Eliminate obviously incorrect options: Start by crossing out the answers you know are incorrect. This will narrow down your choices and increase your odds of guessing correctly if necessary.

- Look for clues in the wording: Carefully read each choice for subtle hints that could indicate the right answer. Words like “always,” “never,” or “usually” can sometimes give you insights into the accuracy of an option.

- Guess intelligently: If you’re unsure, make an educated guess based on your understanding. Eliminate choices that don’t fit the context, and use logical reasoning to pick the best option.

By implementing these techniques, you can approach each part of the assessment with confidence, effectively managing your time and decision-making processes to achieve the best possible outcome.

Final Review Checklist Before the Exam

Before sitting for any assessment, it’s important to perform a final review to ensure you’re fully prepared. This checklist helps you stay organized and covers the essential areas that need attention. By systematically going through these steps, you can feel confident and ready to tackle the challenges ahead.

| Task | Status |

|---|---|

| Review key concepts and principles | ✔️ |

| Check all required materials (ID, pens, etc.) | ✔️ |

| Ensure you understand the test format | ✔️ |

| Go through practice problems or mock tests | ✔️ |

| Review your notes or summaries | ✔️ |

| Double-check the test schedule and location | ✔️ |

| Prepare mentally and stay calm | ✔️ |

By ensuring that each task is checked off, you will go into the assessment with everything you need. A final review is a key step in making sure that nothing is overlooked and that you’re as prepared as possible for what lies ahead.