Understanding economic principles is crucial for achieving success in assessments. A solid grasp of fundamental concepts can help students tackle various types of problems efficiently and accurately. The ability to analyze markets, consumer behavior, production costs, and competition is essential for excelling in these evaluations.

Thorough preparation involves studying the core theories and applying them to real-world scenarios. By focusing on essential models and learning to solve related problems, students can sharpen their critical thinking and improve their problem-solving skills. Mastering these key concepts enables individuals to approach tests with confidence and achieve optimal results.

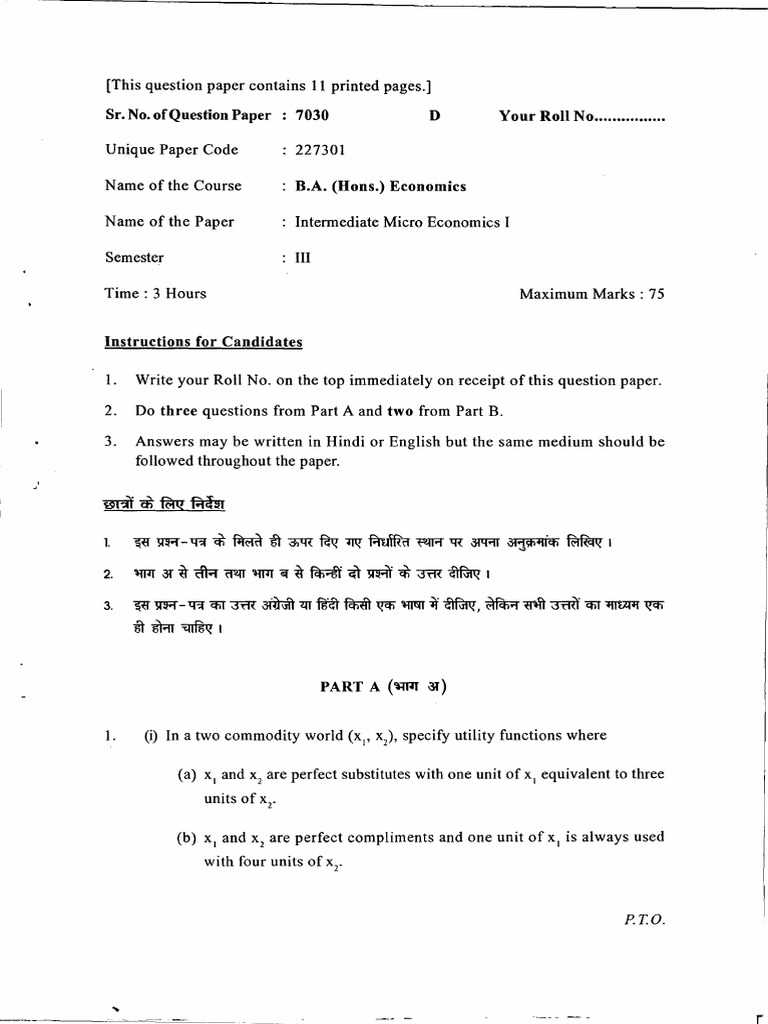

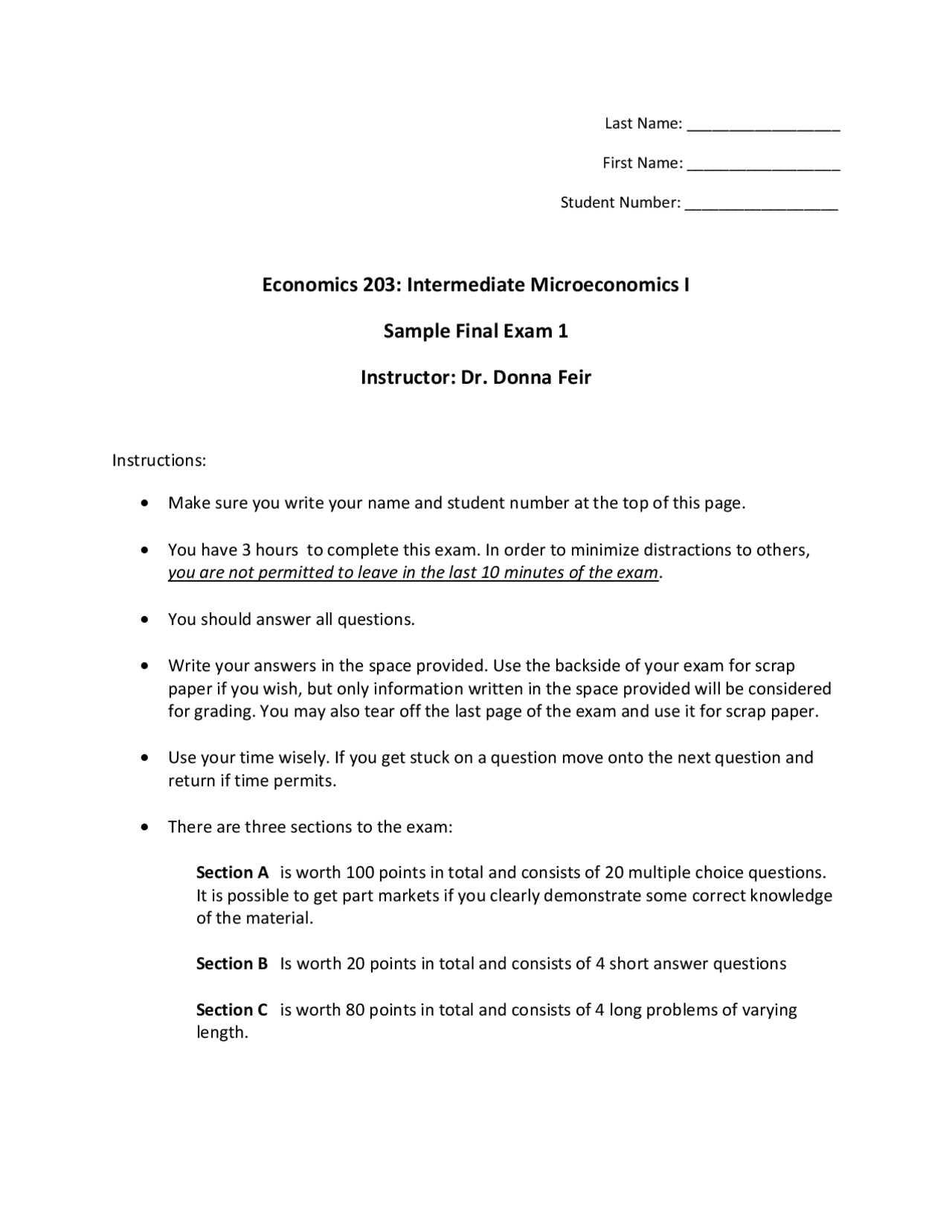

Essential Topics for Economics Assessments

Success in economic assessments relies on mastering key concepts and being able to apply them in various scenarios. It is important to be familiar with the principles governing market behavior, the role of consumers and firms, and the impact of different market structures. Practicing with sample problems helps reinforce the understanding of these core ideas and prepares students for the types of challenges they may encounter.

Commonly Tested Economic Theories

Understanding the basic economic models is essential for any evaluation. Common themes that often appear include consumer choice theory, production and cost analysis, and various types of market structures. Grasping the core mechanics of each model allows for better application in problem-solving situations.

Problem-Solving Strategies

Effective problem-solving requires a clear approach to dissecting the given situation and applying the right models or equations. Developing the ability to break down complex problems into manageable steps is key to solving them efficiently.

| Topic | Key Concept | Application |

|---|---|---|

| Consumer Choice | Utility maximization | Determining optimal consumption bundles |

| Production Theory | Cost minimization | Understanding cost functions and efficiency |

| Market Structures | Price determination | Comparing outcomes under different market conditions |

| Elasticity | Responsiveness of supply and demand | Calculating price sensitivity in markets |

Key Concepts in Microeconomic Theory

In the study of economics, it is essential to understand a variety of foundational ideas that form the basis for analyzing markets and decision-making. These concepts provide the tools needed to explain how individuals, firms, and governments interact in different economic settings. Familiarity with these principles is crucial for solving complex economic problems and evaluating real-world situations.

Core Economic Models

Several key models form the backbone of economic analysis, each offering insights into specific areas of study. These models allow economists to simplify complex real-world phenomena and identify the underlying principles at play.

- Demand and Supply: Describes how prices and quantities are determined in competitive markets.

- Consumer Theory: Focuses on how individuals make choices based on their preferences and budget constraints.

- Production Theory: Analyzes how firms determine the optimal combination of inputs to produce goods and services.

- Cost Theory: Examines the costs of production and how they influence firm behavior.

Market Structures

Different market structures reflect the level of competition within a market, and each structure has its own implications for pricing and output decisions. Understanding these structures helps in analyzing how firms operate under varying degrees of competition.

- Perfect Competition: A market structure with many firms, identical products, and no barriers to entry.

- Monopoly: A market dominated by a single firm with significant control over prices.

- Oligopoly: A market with a small number of firms, where each firm’s decisions impact the others.

- Monopolistic Competition: A market structure with many firms offering differentiated products.

Understanding Market Structures

The way markets are organized plays a crucial role in shaping the behavior of both producers and consumers. Different market environments create varied conditions for competition, pricing, and output. Recognizing the characteristics of each structure is essential for analyzing how goods and services are distributed and priced in the economy.

Types of Market Structures

Markets can be classified into distinct categories based on the number of firms, the nature of the product, and the barriers to entry. Understanding these types allows for a deeper insight into how economic forces operate in different settings.

- Perfect Competition: A market with many sellers offering identical products, where no single firm has control over price.

- Monopoly: A market dominated by one producer, giving them significant power to set prices and control supply.

- Oligopoly: A market dominated by a few large firms, where decisions made by one firm affect the others.

- Monopolistic Competition: A market with many sellers offering differentiated products, each with some degree of pricing power.

Impact of Market Structures on Pricing

Each market structure has a distinct effect on the pricing behavior of firms. In competitive markets, prices are typically driven by supply and demand, while in monopolistic or oligopolistic markets, producers may influence prices based on their market power.

- Competitive Markets: Prices are typically low and are determined by the interaction of supply and demand.

- Monopolies: Firms set prices higher due to lack of competition, often leading to inefficiencies.

- Oligopolies: Firms may engage in strategic pricing, often through price leadership or tacit agreements.

- Monopolistic Competition: Prices are slightly above cost due to product differentiation, allowing firms to charge a premium.

Supply and Demand Curves Explained

The relationship between the quantity of a good or service available and the price at which it is sold is fundamental to understanding how markets function. The interaction between buyers and sellers determines the equilibrium price and quantity, which is illustrated through the supply and demand curves. These curves show how the amount of a product supplied by producers and the quantity demanded by consumers change with price fluctuations.

The demand curve generally slopes downwards, indicating that as prices decrease, consumers are willing to purchase more. On the other hand, the supply curve typically slopes upwards, reflecting that as prices increase, producers are willing to supply more of the product to the market. The point where these two curves intersect represents the market equilibrium.

| Curve | Direction | Key Insight |

|---|---|---|

| Demand | Downward sloping | As price decreases, quantity demanded increases |

| Supply | Upward sloping | As price increases, quantity supplied increases |

| Equilibrium | Intersection of both curves | The price and quantity where supply equals demand |

Consumer Behavior and Utility Maximization

Understanding how individuals make choices based on their preferences and available resources is central to economic analysis. Consumers aim to allocate their limited income in a way that maximizes satisfaction, known as utility. This process involves evaluating different goods and services, considering their benefits, and making decisions that lead to the highest possible utility given their budget constraints.

Consumers face trade-offs between different options, and their behavior is guided by the principle of diminishing marginal utility, which suggests that the additional satisfaction gained from consuming one more unit of a good decreases as more of that good is consumed. This concept is crucial for understanding how people prioritize their spending and make rational decisions to maximize their overall happiness.

Production and Cost Analysis

In economics, understanding the relationship between inputs and outputs is essential for analyzing how firms produce goods and services. The process of transforming raw materials into finished products involves both fixed and variable costs, which must be carefully managed to achieve maximum efficiency. Analyzing production and costs allows businesses to determine the optimal combination of resources to minimize expenses while maximizing output.

Production is often studied through the concept of marginal product, which refers to the additional output produced by adding one more unit of input. Similarly, understanding costs is crucial for firms to determine their profitability, as they balance the trade-off between producing more goods and the associated costs of production.

| Cost Type | Definition | Example |

|---|---|---|

| Fixed Costs | Costs that do not change with the level of output | Rent, salaries |

| Variable Costs | Costs that vary directly with the level of production | Raw materials, labor |

| Total Cost | The sum of fixed and variable costs | Rent + raw materials + wages |

| Marginal Cost | The cost of producing one more unit of output | Additional raw materials and labor for one more unit |

Perfect Competition and Efficiency

In a perfectly competitive market, numerous buyers and sellers interact under conditions that lead to efficient outcomes. In such markets, no single participant has the power to influence prices, and goods are offered at prices determined purely by supply and demand. This structure ensures that resources are allocated in the most efficient way, where the quantity produced and consumed aligns with societal needs and wants.

Characteristics of Perfect Competition

A perfectly competitive market is defined by several key traits that distinguish it from other market structures. These characteristics create an environment where efficiency is maximized, and there is little to no market power held by individual firms.

- Many Buyers and Sellers: The market contains numerous participants, ensuring no single participant can influence the price.

- Homogeneous Products: All goods are identical, making it impossible for a firm to differentiate itself based on product offerings.

- Free Entry and Exit: Firms can enter or leave the market without significant barriers, maintaining competitive pressure.

- Perfect Information: All buyers and sellers have access to all relevant information about the products and market conditions.

Achieving Efficiency in Perfect Competition

In a perfectly competitive market, both allocative and productive efficiency are achieved, ensuring the best possible outcomes for society. Allocative efficiency means that resources are distributed in such a way that consumers get the maximum benefit from the available goods. Productive efficiency occurs when firms produce goods at the lowest possible cost, using the fewest resources for the greatest output.

- Allocative Efficiency: The price of the good equals the marginal cost of production, ensuring that resources are allocated where they are most valued.

- Productive Efficiency: Firms operate at the minimum point of their average cost curve, producing the maximum output at the lowest cost.

Monopoly and Market Power

When a single firm dominates an entire industry or market, it can exercise significant control over prices, production, and the availability of goods. This concentration of power leads to a situation where the firm is the primary decision-maker, often resulting in inefficiencies and potential market distortions. In such markets, the lack of competition gives the firm the ability to set prices higher than would be possible in more competitive environments.

Characteristics of Monopoly

A monopoly exists when one company or entity is the sole provider of a particular product or service, with no close substitutes. The absence of competition allows this firm to influence the market in ways that other market structures cannot. Some key features of a monopoly include:

- Single Seller: One firm controls the entire supply of the good or service, leaving consumers with no alternatives.

- High Barriers to Entry: New firms cannot easily enter the market due to high costs, government regulation, or control over critical resources.

- Price Maker: The monopolist has significant control over the price of the product, setting it above the competitive level.

- Lack of Substitutes: The good or service offered by the monopoly has no close substitutes, further strengthening its market power.

Effects of Market Power

Market power allows monopolists to set prices higher than would be possible in a competitive market. This often results in several negative outcomes for consumers and the economy, including:

- Higher Prices: Consumers are forced to pay more for goods and services than they would in a competitive market.

- Reduced Consumer Choice: With no competitors, consumers have limited options for alternatives or improvements in product quality.

- Allocative Inefficiency: Resources are not allocated to their most efficient use, leading to a loss of total welfare.

- Productive Inefficiency: The monopolist may not have the same incentive to reduce costs or innovate, as there is no competition pushing for improvements.

Oligopoly and Game Theory Basics

In markets where only a few firms dominate the industry, the behavior of each firm can significantly influence the outcomes for others. This interdependence leads to strategic decision-making, as firms must consider not only their own actions but also the potential reactions of their competitors. In such scenarios, understanding the dynamics of cooperation and competition becomes crucial for achieving optimal outcomes, and game theory offers a framework for analyzing these situations.

Oligopoly, characterized by a small number of firms that control the market, presents unique challenges because each firm’s decisions affect the profits and strategies of others. The behavior of firms in an oligopoly is not independent, making it a perfect context for applying game theory, which studies strategic interactions where the outcome for each participant depends on the choices made by others.

Market Failures and Externalities

Markets do not always function efficiently, and sometimes they fail to allocate resources in a way that maximizes social welfare. These failures can occur for various reasons, such as incomplete information, market power, or the inability of markets to account for all costs and benefits. When these failures arise, it often leads to outcomes that are less than optimal, harming both consumers and producers.

Externalities, which are side effects of economic activities that affect third parties, are one of the primary sources of market failure. When the costs or benefits of a transaction are not fully reflected in the market prices, it can lead to overproduction or underproduction of goods and services. Addressing these externalities through government intervention or market-based solutions is critical to improving overall economic efficiency and ensuring that all parties involved bear the full costs or enjoy the full benefits of their actions.

Public Goods and Government Intervention

Some goods and services are unique in that they cannot be efficiently provided by the private market. These goods are typically non-excludable and non-rivalrous, meaning that individuals cannot be prevented from using them, and one person’s consumption does not reduce availability for others. As a result, the private sector often underproduces these goods, leaving them underprovided for society. In these cases, government intervention is necessary to ensure that these goods are made available to all members of society.

Characteristics of Public Goods

Public goods possess distinct features that make them different from other goods in the economy. These characteristics create challenges for market provision and necessitate state involvement to ensure their availability.

- Non-excludability: It is not possible to prevent individuals from using the good once it is provided, regardless of whether they contribute to its funding.

- Non-rivalry: One person’s use of the good does not diminish its availability for others, meaning that multiple people can use the good simultaneously without affecting its supply.

The Role of Government

Governments step in to provide public goods when the private sector is unable or unwilling to do so effectively. By funding these goods through taxes or other means, governments can ensure that all individuals benefit from them. This is crucial for promoting overall social welfare, as these goods often contribute to the well-being of society in ways that are not captured by market prices.

- Provision of Essential Services: Governments often provide goods like national defense, public education, and clean air, which benefit all members of society.

- Addressing Market Failures: When private firms cannot produce enough of a good due to the free rider problem, government intervention ensures these goods are available.

Labor Markets and Wage Determination

The labor market plays a crucial role in determining the allocation of human resources across different industries and sectors. It is where employers seek workers, and workers offer their skills in exchange for compensation. The wages paid to workers are influenced by a variety of factors, including supply and demand, worker productivity, and the skills required for different types of jobs. Understanding how wages are set and how labor is allocated in an economy is essential for grasping the dynamics of income distribution and employment.

Factors Influencing Wage Determination

Wages are not determined in isolation but are the result of a complex interaction of various forces. Several factors influence the compensation levels for different jobs, and these can vary depending on the industry, region, and specific skillset of workers.

- Supply and Demand for Labor: The number of workers available for a particular job and the demand for those workers by employers are primary determinants of wage levels. Higher demand for a skill combined with a limited supply often results in higher wages.

- Human Capital: Workers with higher education, specialized training, or years of experience generally command higher wages due to their increased productivity and expertise.

- Job Characteristics: Jobs that are dangerous, require unusual hours, or are highly demanding may offer higher wages to attract workers.

The Role of Unions and Collective Bargaining

Unions play an important role in labor markets by negotiating on behalf of workers for better wages, benefits, and working conditions. Collective bargaining helps ensure that workers’ interests are represented, especially in industries with low supply of skilled labor or in situations where individual workers might have limited bargaining power.

- Negotiation of Wages: Unions negotiate with employers to secure higher wages and better benefits for their members.

- Workplace Standards: In addition to wages, unions often focus on improving overall working conditions, ensuring job security, and enhancing employee benefits.

Price Discrimination and Its Effects

Price discrimination occurs when a seller charges different prices to different consumers for the same good or service, based on factors other than differences in cost. This practice can be seen across a range of industries, from airlines to software providers, where companies adjust prices based on factors like consumer willingness to pay, location, or usage patterns. The objective of price discrimination is to maximize revenue by capturing consumer surplus, but its effects on consumers and the market are diverse.

Types of Price Discrimination

There are several forms of price discrimination, each with distinct characteristics and implications for consumers and firms. The three most common types are:

- First-Degree Price Discrimination: Also known as personalized pricing, this occurs when a seller charges each consumer the maximum price they are willing to pay, capturing the entire consumer surplus.

- Second-Degree Price Discrimination: In this form, prices vary based on the quantity consumed or the product version. Examples include bulk discounts or different pricing for basic versus premium versions of a product.

- Third-Degree Price Discrimination: This involves segmenting the market based on observable characteristics like age, location, or income, and charging different prices to different groups. Examples include student or senior discounts.

Economic and Social Impacts

Price discrimination can have both positive and negative effects, depending on the market context and the manner in which it is implemented.

- Increased Efficiency: In some cases, price discrimination can lead to a more efficient allocation of goods, as it allows firms to serve a broader range of consumers, including those who might not be able to afford the product at a single price point.

- Consumer Harm: For some consumers, especially those in less advantaged segments of the market, price discrimination may lead to higher prices, reducing their purchasing power and welfare.

- Market Expansion: By offering products at different price points, firms can increase overall sales and enter new market segments, benefiting both the firm and some consumers.

Elasticity of Demand and Supply

The concept of elasticity measures how sensitive the quantity demanded or supplied of a good is to changes in price or other economic factors. Understanding elasticity helps businesses and policymakers predict how changes in prices, income, or other variables will affect the market. The responsiveness of demand and supply can vary significantly depending on the type of product and the time frame in question. Elasticity is a crucial tool for analyzing how markets function under different conditions and how resources are allocated.

Price Elasticity of Demand

Price elasticity of demand (PED) refers to how much the quantity demanded of a good changes in response to a change in its price. If a small change in price leads to a large change in the amount demanded, the good is considered elastic. Conversely, if demand changes little in response to price fluctuations, the good is inelastic.

- Elastic Demand: When the absolute value of elasticity is greater than 1, indicating that consumers are highly responsive to price changes.

- Inelastic Demand: When the absolute value of elasticity is less than 1, meaning consumers are less responsive to price changes.

- Unitary Elasticity: When elasticity equals 1, meaning the percentage change in demand is exactly proportional to the percentage change in price.

Price Elasticity of Supply

Price elasticity of supply (PES) measures how much the quantity supplied of a good changes in response to a change in its price. Similar to demand, supply can be elastic or inelastic depending on how responsive producers are to price changes. The elasticity of supply can also vary with time, as firms may take time to adjust production levels to price changes.

- Elastic Supply: When the percentage change in quantity supplied is greater than the percentage change in price.

- Inelastic Supply: When the percentage change in quantity supplied is less than the percentage change in price.

- Unitary Elasticity of Supply: When the percentage change in quantity supplied is exactly equal to the percentage change in price.

Profit Maximization in Different Markets

Profit maximization is a core goal for firms operating in any type of market. The methods to achieve maximum profits can vary significantly depending on the structure of the market in which a firm competes. Understanding how firms adjust their pricing, output, and other strategies according to the competitive environment is essential for both business owners and economists alike. The primary objective is always to balance revenue generation and cost control to reach the highest possible return.

In markets with different levels of competition, the approach to maximizing profits can change. For instance, in perfectly competitive markets, firms must accept the market price and focus on efficiency, while in monopolistic or oligopolistic markets, firms have more control over pricing strategies. The ability to influence prices and output depends largely on the firm’s market power and the nature of competition.

Profit Maximization in Perfect Competition

In a perfectly competitive market, firms are price takers, meaning they have no control over the market price of their goods or services. The key to maximizing profit in such a market is to optimize the level of production where marginal cost (MC) equals marginal revenue (MR). At this point, the firm cannot increase profits by changing the price or output. In the long run, economic profit tends to zero as new firms enter the market, driven by the absence of barriers to entry.

Profit Maximization in Monopoly

In a monopoly, a single firm dominates the market, which gives it significant control over pricing and output decisions. To maximize profits, monopolists set the price where marginal revenue equals marginal cost, but they can charge a higher price than would occur in a competitive market. This allows for the generation of positive economic profits in both the short and long run, as barriers to entry prevent other firms from entering the market.

Profit Maximization in Oligopoly

In an oligopolistic market, a few firms control the market share, which means that each firm’s decision affects the others. Profit maximization in this environment is influenced by strategic interactions, including price-setting behavior, product differentiation, and the use of game theory to predict competitors’ actions. Firms may engage in collusion to set prices or maintain market share, though this is illegal in many regions. The key strategy for profit maximization here often involves anticipating competitors’ moves while managing costs effectively.

Equilibrium and Disequilibrium Analysis

Understanding market stability involves analyzing the balance between supply and demand. When supply equals demand, the market is said to be in equilibrium, where there is neither surplus nor shortage. In contrast, disequilibrium occurs when there is an imbalance–either too much supply or insufficient demand. These conditions lead to price adjustments, which guide the market back towards equilibrium. By studying both states, we can better understand how markets respond to changes in external factors and how firms and consumers adapt.

Market Equilibrium

Market equilibrium occurs when the quantity supplied by producers matches the quantity demanded by consumers at a specific price level. At this point, the forces of supply and demand are in balance, and there is no incentive for price changes. In a perfectly competitive market, this equilibrium price reflects the most efficient allocation of resources, as no surplus or shortage exists. Changes in external factors, such as shifts in consumer preferences or production costs, can cause shifts in both supply and demand, thereby moving the market to a new equilibrium.

Disequilibrium and Its Effects

Disequilibrium happens when there is a mismatch between the quantity demanded and the quantity supplied at the current price level. A common form of disequilibrium is a price ceiling or price floor, which can prevent the market from reaching its natural equilibrium. For example, when prices are artificially held below the equilibrium level (price ceiling), shortages may occur. Conversely, price floors (such as minimum wage laws) can result in surpluses, as the price remains higher than the equilibrium price. In both cases, markets must adjust over time, either through price changes or other corrective measures.

| Type of Disequilibrium | Cause | Market Response |

|---|---|---|

| Surplus | Price set too high, leading to excess supply | Firms reduce prices to eliminate unsold goods |

| Shortage | Price set too low, leading to excess demand | Prices rise, leading to a balance between supply and demand |

| Price Ceiling | Government-imposed maximum price | Shortages arise, and markets may become inefficient |

| Price Floor | Government-imposed minimum price | Surpluses arise, leading to inefficiencies |

Common Mistakes in Assessments

During assessments, students often make certain errors that can negatively impact their performance. These mistakes may arise from misinterpreting key concepts, overlooking important details, or applying incorrect methods to solve problems. Understanding these common pitfalls can help in avoiding them and ensure a more accurate approach to problem-solving. The following outlines some frequent mistakes students make and how to overcome them.

Misunderstanding Key Concepts

One of the most common mistakes is misunderstanding essential principles such as market equilibrium, elasticity, or profit maximization. When concepts are not fully grasped, students might misapply them in different contexts. For example, confusing the difference between short-run and long-run production functions or failing to recognize the distinction between different types of market structures can lead to incorrect conclusions. A clear understanding of fundamental theories and their real-world implications is crucial.

Incorrect Mathematical Application

Another frequent issue is making errors in mathematical calculations or failing to properly apply formulas. This may involve forgetting to carry out all necessary steps, using the wrong equation, or making simple arithmetic mistakes. It’s important to take time to double-check calculations and ensure that all variables are accounted for. Additionally, ensure that you understand the assumptions behind the formulas and how they relate to the question at hand.

Overlooking Graphical Representation

Many students also fail to correctly interpret or draw graphs that represent economic concepts. Whether it’s supply and demand curves, cost curves, or utility maximization, inaccurate or incomplete graphs can lead to misunderstandings. Always pay attention to the scales, labels, and axes when drawing or interpreting graphs. A properly labeled and accurate graph can often be the key to solving complex problems.

Neglecting the Broader Context

Lastly, it’s essential to always relate your answers to the broader context of the question. Focusing solely on calculations or technical details, while ignoring the economic implications or assumptions, can result in an incomplete or irrelevant answer. Be sure to connect your answer back to the economic theory and explain why the solution is appropriate in the given context.