Understanding the fundamental principles of global monetary systems is essential for success in any related academic evaluation. This section covers various essential topics, providing a thorough breakdown of complex ideas to help you prepare effectively. Focus is placed on topics that frequently appear in assessments, ensuring you are well-equipped to tackle a broad range of challenges.

Practical application of theoretical concepts is crucial in mastering the material. By delving deep into real-world scenarios and case studies, you will gain valuable insights into how the topics are tested and how to approach them strategically. Developing strong problem-solving skills and clear explanations will significantly enhance your overall performance.

By familiarizing yourself with the typical structure of such evaluations and reviewing common subject areas, you’ll be better positioned to excel. Whether it’s understanding cross-border investments, economic regulations, or managing global risks, this guide serves as a comprehensive tool for your preparation.

Global Monetary System Evaluation Preparation

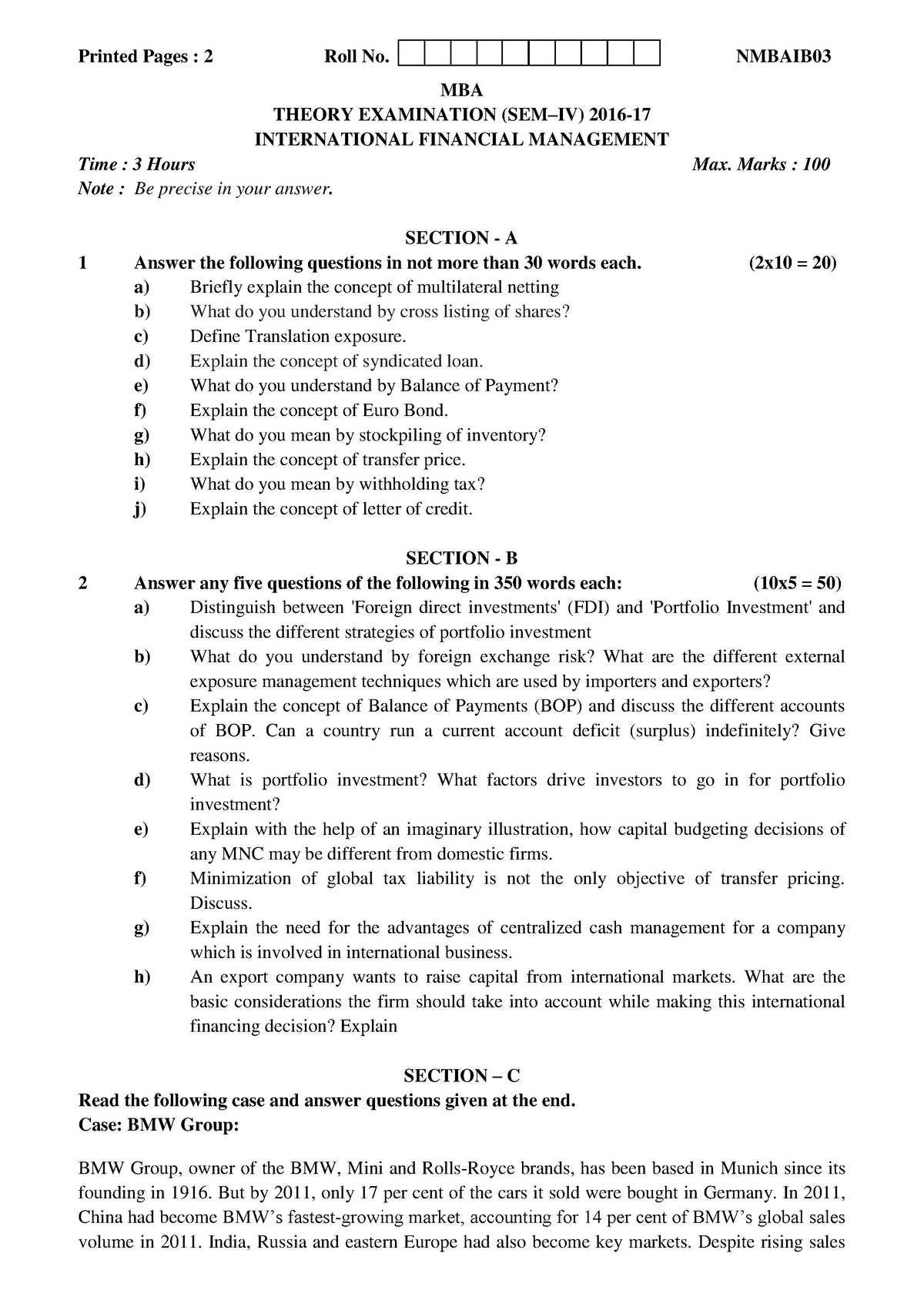

When preparing for evaluations in the realm of global financial studies, it’s important to understand the core concepts that are often tested. Assessments typically focus on areas such as economic policies, market structures, and investment strategies, requiring a deep grasp of various theoretical and practical aspects. Being familiar with these subjects will not only help you navigate the material effectively but also allow you to answer with clarity and precision.

Reviewing practical scenarios and how they are applied in real-world situations plays a key role in successful preparation. Case studies, historical events, and current trends are commonly featured in these tests. Mastery of these topics equips you with the skills to tackle any challenge posed, from understanding economic indicators to evaluating financial transactions on a global scale.

With a strategic approach to preparation, focusing on commonly assessed subjects, you can anticipate the types of challenges you may encounter. A well-rounded understanding will allow you to confidently respond to questions, providing comprehensive and insightful answers that demonstrate your command over the material.

Key Topics in Global Financial Assessments

Mastering the most important subjects is crucial for performing well in evaluations related to global economic systems. These subjects cover a wide range of areas, from market regulations to cross-border investment strategies, each playing a vital role in shaping financial stability and growth. Understanding these core topics not only prepares you for the typical challenges but also enhances your ability to think critically about complex global issues.

Core Areas of Focus

- Currency Exchange Systems – A thorough understanding of how currencies are traded, their impact on global economies, and how exchange rates are determined.

- Risk Management Strategies – Identifying various risk types and the methods used to mitigate them in global investments.

- Investment Analysis – Exploring methods used to evaluate potential returns on international ventures and the influence of economic conditions on those investments.

- Cross-Border Regulations – How laws and policies in different regions affect business operations and financial transactions worldwide.

Key Theoretical Concepts

- Capital Flow Dynamics – Understanding the movement of capital between nations and how it influences global economic growth.

- Market Structures and Behaviors – The analysis of different market environments, including monopolies, oligopolies, and competitive markets, and their global impact.

- Global Economic Indicators – Key metrics such as GDP, inflation rates, and unemployment, which help assess economic health on a global scale.

Focusing on these topics will give you a comprehensive understanding of the material and prepare you for any challenges you may encounter during your assessments. A deep dive into these areas equips you with the knowledge to tackle complex scenarios, ensuring your readiness to demonstrate proficiency in global economic systems.

Common Question Formats and Structure

Understanding the typical structure and types of challenges in academic assessments related to global economic systems is essential for effective preparation. Different types of problems test various skills, such as theoretical knowledge, application, and problem-solving abilities. Recognizing the format of these tasks allows you to better organize your study sessions and approach each task with confidence.

The most common formats often include multiple-choice questions, short answers, and case study analysis. Each format is designed to assess specific skills, from recalling key concepts to applying knowledge in real-world scenarios. Knowing how to approach each type of task ensures clarity and accuracy in your responses.

Multiple-Choice Questions

These questions typically present a scenario followed by several possible answers, requiring you to select the most appropriate option. These are often used to test your ability to recall facts and concepts quickly. It’s important to carefully read each option and consider the nuances of the question before making your selection.

Short Answer Problems

In this format, you are required to provide concise responses, often with a focus on key points. These tasks test your understanding of concepts and your ability to express them clearly and succinctly. It’s crucial to answer directly and avoid unnecessary elaboration.

Case Study Analysis

Case studies present real-world scenarios, challenging you to analyze the situation and propose solutions based on your knowledge. These types of questions assess your ability to apply theoretical concepts to practical situations, requiring a deeper understanding and critical thinking.

By familiarizing yourself with these common formats, you will be well-prepared to tackle various challenges, demonstrating a solid grasp of key concepts and the ability to think analytically about global economic issues.

Understanding Currency Exchange in Finance

The movement of money across borders is one of the most fundamental aspects of the global economic landscape. Currency exchange plays a critical role in facilitating trade, investments, and financial operations between nations. This system enables businesses, governments, and individuals to convert one currency into another, ensuring smooth transactions across different markets.

Factors Influencing Exchange Rates

Several factors determine the value of one currency in relation to another. Key drivers include interest rates, inflation, political stability, and economic performance. A strong economy typically supports a stronger currency, while economic instability can lead to depreciation. Understanding these factors is crucial for predicting fluctuations and managing financial decisions effectively.

Types of Exchange Rate Systems

There are different systems used to determine currency values. Under a floating exchange rate system, the value of a currency is determined by market forces–supply and demand. In contrast, a fixed exchange rate system pegs the value of a currency to another currency, such as the US dollar or gold. Hybrid systems may use a mix of both methods.

Understanding these key elements of currency exchange is vital for grasping the broader mechanics of global financial systems. Whether for investment strategies, trading, or policy decisions, currency exchange serves as a cornerstone for managing global economic relationships.

Global Trade and Economic Impact Questions

The dynamics of global trade have a profound effect on economic stability and growth. Understanding how the exchange of goods, services, and capital influences national and global economies is key to analyzing economic development. This section explores the interconnectedness of markets and the far-reaching consequences of trade decisions on economies worldwide.

Effects of Trade Agreements

Trade agreements between nations significantly shape the flow of goods and capital. These agreements can lower barriers, stimulate economic growth, and open up new markets. However, they can also lead to imbalances, where some industries benefit more than others. Understanding the economic outcomes of such agreements is crucial for analyzing both short-term and long-term impacts on global markets.

The Role of Tariffs and Barriers

Tariffs and trade barriers are tools used by governments to protect domestic industries or regulate foreign competition. While these measures can help safeguard local jobs and businesses, they may also lead to higher prices for consumers and strained relationships between trading partners. The economic implications of these barriers are complex and require careful consideration of both domestic and global factors.

Analyzing these topics helps to better understand the intricate relationships between trade policies and global economic shifts. The consequences of such decisions are felt worldwide, affecting everything from employment rates to commodity prices.

Global Investment Strategies Explained

Strategic investment decisions across borders involve assessing opportunities, risks, and potential returns in various markets. Investors must understand diverse investment approaches to maximize gains while mitigating risks associated with global economic factors. This section covers key strategies that guide decision-making in cross-border ventures.

Diversification Across Geographies

Diversification is one of the fundamental principles in investment management, aimed at reducing risk by spreading investments across different regions, industries, and asset classes. By investing in multiple markets, investors can protect themselves from economic downturns in any single country or sector. This strategy allows for better risk management while optimizing potential returns from various economic cycles.

Emerging Market Focus

Investing in emerging markets offers significant growth potential as these regions typically exhibit faster economic expansion compared to developed economies. However, this comes with higher volatility and political risks. Understanding local conditions, government policies, and infrastructure development is crucial for identifying profitable opportunities in these markets while managing the associated risks.

By employing these strategies, investors can make informed decisions that capitalize on opportunities in a complex, interconnected global economy. A strong grasp of market dynamics and careful analysis of potential risks and rewards is essential for long-term success in the world of global investments.

Understanding Risk Management in Finance

Effective risk management is essential for safeguarding investments and maintaining the stability of financial operations. In the world of global markets, various risks can impact returns and the overall health of an economy. It is critical to identify, assess, and mitigate these risks to ensure financial sustainability and to maximize profitability. This section explores key principles and strategies in managing risks within the financial landscape.

Types of Risks in Financial Markets

- Market Risk – The potential for losses due to changes in market conditions, such as fluctuating interest rates, currency values, or commodity prices.

- Credit Risk – The possibility that a borrower may fail to meet their obligations, leading to a default.

- Operational Risk – Risks arising from failures in internal processes, systems, or external events that affect business operations.

- Liquidity Risk – The risk of being unable to buy or sell assets quickly enough without causing a significant impact on their price.

Risk Management Strategies

- Diversification – Spreading investments across different asset classes, industries, or geographic regions to minimize exposure to any single risk.

- Hedging – Using financial instruments such as derivatives to offset potential losses from price fluctuations in assets.

- Risk Transfer – Shifting the financial risk to another party, for example, through insurance or outsourcing certain operations.

- Risk Avoidance – Altering business strategies or decisions to avoid high-risk situations or uncertain markets.

By implementing these strategies, businesses and investors can manage their exposure to risks while protecting their investments. A thorough understanding of risk factors and the use of appropriate tools and methods for risk mitigation can significantly improve financial decision-making and ensure long-term success.

Essentials of Foreign Direct Investment

Foreign Direct Investment (FDI) is a critical component in the global economic system, allowing capital to flow between countries and fostering economic growth. When businesses or individuals invest in assets or operations across borders, they help create jobs, transfer technology, and stimulate market competition. This section covers the fundamental aspects of FDI and how it impacts both the investing and recipient countries.

Types of Foreign Direct Investment

FDI can take several forms, each with its own benefits and challenges. The primary types include:

- Greenfield Investment – This involves establishing new operations, such as setting up a factory or a branch office in a foreign market. It is often seen as a long-term commitment.

- Mergers and Acquisitions – This form of investment occurs when a foreign company acquires or merges with a local business to gain a foothold in the market.

- Joint Ventures – A partnership between a foreign investor and a local business, where both share the risks and rewards of the investment.

Benefits and Challenges of Foreign Direct Investment

FDI offers numerous advantages to both investors and host countries:

- For Investors: Access to new markets, increased brand recognition, and cost advantages such as lower labor costs.

- For Host Countries: Economic growth, technology transfer, enhanced employment opportunities, and increased competition that drives innovation.

However, FDI also poses challenges, including political risk, currency fluctuations, and regulatory barriers. It is essential for investors to thoroughly assess the stability of the market, legal environment, and potential return on investment before committing capital.

Understanding the dynamics of FDI allows businesses to make informed decisions when expanding into new markets and can help guide policies in host countries to attract global capital.

Financial Market Regulations and Policies

The stability and integrity of financial markets rely heavily on regulatory frameworks and policies designed to ensure fair practices, transparency, and protection of investors. These regulations are crucial for maintaining public confidence and preventing market manipulation or financial crises. This section delves into the primary regulations that govern markets and the policies that shape them.

Key Regulatory Bodies

Various institutions are responsible for overseeing market activities and enforcing compliance with laws. Some of the most prominent regulatory bodies include:

- Central Banks – These institutions manage monetary policy, interest rates, and money supply to stabilize the economy.

- Financial Conduct Authorities – Agencies that regulate financial markets, protect consumers, and ensure fair competition.

- Securities Commissions – Regulatory bodies focused on maintaining the integrity of securities markets by preventing fraud, insider trading, and market manipulation.

Types of Financial Market Policies

Policies in financial markets are designed to promote stability, prevent excessive risk-taking, and safeguard economic growth. Common policy tools include:

- Monetary Policy – Adjusting interest rates and money supply to control inflation, stabilize the economy, and promote sustainable growth.

- Fiscal Policy – Government spending and taxation decisions aimed at influencing economic activity, employment, and inflation.

- Capital Requirements – Regulations that mandate financial institutions to maintain a certain level of capital to protect against market downturns and ensure solvency.

Understanding these regulations and policies is essential for anyone engaged in market activities, as they shape the functioning and performance of economies. By ensuring that markets are transparent, competitive, and stable, these frameworks create a secure environment for investments and economic development.

Capital Budgeting in International Context

Capital budgeting is a crucial process that helps businesses determine the most effective way to allocate resources for long-term investments. In a globalized environment, the complexity of investment decisions increases, as companies must consider multiple factors, such as currency fluctuations, political risks, and diverse regulatory landscapes. This section explores the essential components of capital budgeting when making investment decisions in a cross-border setting.

Key Considerations in Global Capital Budgeting

When companies evaluate potential investments beyond their domestic borders, they must factor in various elements that differ significantly from local markets. Some of the most important considerations include:

- Currency Risk – The value of foreign currencies can fluctuate, affecting the return on investment and creating additional risk for companies operating internationally.

- Political Stability – The political climate of the host country can impact the security of investments, influencing decisions related to nationalization, regulation, or even civil unrest.

- Regulatory Environment – Different countries have varying laws regarding taxation, labor, environmental regulations, and corporate governance, all of which can influence the cost and feasibility of a project.

Evaluating Investment Projects Globally

Investors and managers must use specialized tools to evaluate investment projects that span different countries. Common techniques include:

- Net Present Value (NPV) – A calculation that helps determine the profitability of a project by discounting future cash flows to their present value, considering exchange rates and inflation.

- Internal Rate of Return (IRR) – The rate at which the present value of future cash flows equals the initial investment, offering a benchmark for comparing global investment opportunities.

- Adjusted Present Value (APV) – This approach separates the value of the base project from the impact of financing decisions, useful when dealing with cross-border financial structures.

By carefully considering these elements, companies can make more informed decisions about capital allocation in international markets, optimizing their investment strategies and minimizing potential risks.

Global Financial Institutions and Roles

Financial institutions play a central role in the functioning of the global economy. These entities provide essential services such as lending, investment management, currency exchange, and market regulation. Understanding their functions and how they interact with each other is critical for anyone involved in global economic activities. This section will explore key financial institutions and the important roles they serve across different markets.

Major Financial Institutions

Several key players dominate the global financial system, each with specific responsibilities and functions. Below is an overview of some of the most influential institutions:

| Institution | Primary Role |

|---|---|

| World Bank | Provides loans and grants to developing countries for infrastructure projects and economic development. |

| International Monetary Fund (IMF) | Monitors global economic stability, offers financial assistance to countries in crisis, and promotes international monetary cooperation. |

| Bank for International Settlements (BIS) | Supports central banks by fostering monetary and financial stability through international cooperation. |

| European Central Bank (ECB) | Manages the euro and oversees the monetary policy of the European Union to ensure financial stability. |

| Federal Reserve | Regulates and supervises financial institutions in the U.S., ensures economic stability, and sets monetary policy. |

Functions and Impact of Global Institutions

These institutions provide critical support to the functioning of markets and the global economy by maintaining financial stability, encouraging economic growth, and facilitating cross-border investments. Their actions can influence national economies, international trade, and global financial markets. For example, the World Bank’s efforts to alleviate poverty and promote economic development through funding have far-reaching effects on the development of infrastructure and social welfare systems in low-income countries. Similarly, the IMF’s role in offering emergency financial assistance helps stabilize economies facing crises, while the ECB’s monetary policies impact inflation rates and interest rates in the Eurozone.

By understanding the roles and impact of these institutions, individuals and organizations can better navigate global financial markets and align their strategies with the broader economic environment.

Impacts of Inflation on Global Finance

Inflation affects economies in multiple ways, influencing everything from purchasing power to investment strategies. As prices rise, both consumers and businesses feel the pressure, and the broader financial landscape can experience significant shifts. In this section, we will explore the effects of inflation on economic systems, global markets, and investment decisions.

Effects on Purchasing Power

One of the most immediate consequences of inflation is a reduction in purchasing power. When prices increase, the value of money decreases, meaning consumers can afford fewer goods and services. This can lead to a decrease in overall demand, which can, in turn, slow economic growth. For businesses, rising costs can erode profit margins, forcing companies to adjust their pricing strategies or absorb losses. On a global scale, countries with higher inflation rates may see a decline in their currency value relative to others, further impacting international trade.

Impact on Investment and Capital Flows

Inflation has a significant influence on both investment behavior and capital movement across borders. In high-inflation environments, investors may seek assets that protect against inflation, such as real estate, commodities, or inflation-linked bonds. These shifts can affect the allocation of capital globally, with investors moving their funds to countries or markets where inflation is lower, or where returns are more attractive relative to the inflation rate.

Furthermore, central banks often raise interest rates in response to inflation, which can make borrowing more expensive. This, in turn, can slow down investments in projects that rely on cheap credit. For multinational corporations, inflation can impact the cost of financing operations and the ability to expand, especially in emerging markets where inflationary pressures are more volatile.

In summary, inflation has wide-reaching effects on global economic stability, influencing everything from daily consumer behavior to complex investment strategies. Understanding these impacts is crucial for businesses and policymakers to navigate the challenges posed by inflation in the global economy.

Interest Rates and International Banking

Interest rates play a pivotal role in shaping the global financial landscape. They influence borrowing, lending, investment decisions, and the overall stability of the banking sector. In the context of cross-border financial transactions, the level of interest rates can significantly impact the movement of capital, international trade, and the strategic decisions made by multinational banks. This section explores how interest rates affect the banking industry globally and their broader economic implications.

Impact of Interest Rates on Global Banking

The level of interest rates directly affects the cost of borrowing and the return on investments. When rates rise, borrowing becomes more expensive, which can slow down economic activity and reduce credit demand. Conversely, when interest rates are low, it encourages borrowing and investment, stimulating economic growth. For banks, these fluctuations impact their profitability and risk management strategies, especially in global markets where rates can vary significantly between countries.

Interest Rate Differentials and Capital Flows

One key factor in international banking is the difference in interest rates between countries. These differentials influence global capital flows, as investors often seek the highest returns on their investments. A country with higher interest rates tends to attract foreign capital, while lower rates may lead to capital outflows. This dynamic can affect currency values, trade balances, and the financial stability of nations. Below is a table that highlights how interest rate differentials influence capital flows across major global markets:

| Country | Interest Rate | Capital Flow Trend |

|---|---|---|

| United States | 4.5% | Attracts foreign investment due to relatively higher returns |

| European Union | 1.0% | Lower returns may lead to outflows of capital to higher-yielding markets |

| Japan | 0.5% | Minimal capital inflows due to low returns and low interest rate environment |

| Brazil | 7.5% | Higher rates may attract foreign investment but can increase inflation risks |

As seen in the table, differences in interest rates between countries have a significant influence on how capital is allocated globally. Financial institutions must constantly monitor these shifts to make informed lending, investment, and risk management decisions in order to maintain profitability and stability in international markets.

Balance of Payments and Economic Health

The balance of payments is a crucial economic indicator that provides insights into a country’s financial interactions with the rest of the world. It reflects the inflow and outflow of funds related to trade, investments, and other financial transactions. This data is essential for evaluating a country’s economic health, as it helps policymakers, businesses, and investors assess the overall stability and performance of an economy.

Understanding the Components of the Balance of Payments

The balance of payments is typically divided into several key sections, each representing different aspects of economic transactions. These include:

- Current Account: Tracks the flow of goods, services, income, and current transfers. A surplus or deficit in this account indicates whether a country is exporting more than it imports or vice versa.

- Capital Account: Records the movement of capital assets, including foreign direct investment and portfolio investments. A positive balance indicates an inflow of capital, which can boost economic growth.

- Financial Account: Reflects changes in ownership of financial assets, such as stocks and bonds. It plays a critical role in assessing long-term economic health and investor confidence.

The Link Between Balance of Payments and Economic Well-Being

A healthy balance of payments is essential for long-term economic stability. If a country experiences persistent deficits, it may lead to rising debt and a decrease in its currency value. On the other hand, consistent surpluses can lead to an accumulation of foreign reserves, strengthening the national economy. Below are some key points illustrating the connection between the balance of payments and economic health:

- Impact on Currency Value: A surplus in the current account typically strengthens the currency, as foreign demand for goods and services increases. A deficit may weaken the currency.

- Investment Confidence: A balanced or surplus balance of payments signals economic stability, encouraging foreign investment. A deficit, however, may raise concerns about a country’s financial position.

- Debt Levels: A persistent imbalance, especially a current account deficit, can lead to an increase in external debt, potentially affecting a country’s creditworthiness.

Understanding the balance of payments and its role in reflecting a nation’s economic standing is vital for both domestic policymakers and global investors. By analyzing these trends, one can gauge the risks and opportunities within an economy and make more informed decisions for future planning and investments.

International Finance Case Study Approach

The case study method is a practical approach that provides in-depth insights into real-world financial situations, helping individuals understand complex concepts and the challenges businesses face in a global context. By examining specific examples, students and professionals can explore the impact of various financial decisions, policies, and market conditions. This hands-on analysis allows for a comprehensive understanding of economic scenarios, which can be applied to both theoretical learning and practical problem-solving.

Benefits of the Case Study Approach

One of the key benefits of using the case study method is its ability to illustrate theoretical concepts in a real-world setting. Through case studies, learners can:

- Develop Critical Thinking Skills: Case studies challenge individuals to analyze data, assess risks, and develop strategies to solve financial problems. This fosters critical thinking and decision-making skills.

- Apply Theories to Practical Situations: Rather than simply memorizing theories, students can see how these concepts are applied in actual business environments, making the learning experience more relevant and engaging.

- Understand Complex Financial Decisions: Financial decisions often involve multiple variables and long-term consequences. Case studies help learners understand how to weigh these factors in a controlled environment.

How to Approach a Case Study

Approaching a financial case study involves several steps to ensure thorough analysis and meaningful insights:

- Identify the Key Issues: Begin by clearly defining the financial challenges or opportunities presented in the case. This could involve market conditions, regulatory changes, or financial strategies.

- Analyze the Data: Review all available data, including financial statements, market trends, and external factors. Understanding the numbers and their context is crucial for making informed decisions.

- Consider Multiple Perspectives: Look at the situation from various angles, including the company’s internal strategies, external economic factors, and the impact on stakeholders.

- Develop Recommendations: Based on the analysis, propose solutions or strategies to address the financial challenges or capitalize on opportunities. These recommendations should be backed by data and logical reasoning.

By using the case study approach, individuals can gain valuable experience in evaluating financial situations and make better-informed decisions in their future careers. This method is essential for developing a comprehensive understanding of the financial world and its complexities.

Tips for Answering Complex Finance Questions

When confronted with challenging financial problems, having a structured approach can make all the difference in delivering clear, concise, and well-thought-out responses. Mastering the ability to break down complicated issues into manageable parts allows for better analysis and more accurate solutions. The following strategies can help guide individuals through even the most intricate financial scenarios.

Step-by-Step Approach

One of the most effective ways to tackle complex problems is by following a systematic approach:

- Understand the Question: Carefully read the question to ensure clarity. Identify key terms, concepts, and what is being asked. Breaking down the question into smaller components can often make it less overwhelming.

- Organize Your Thoughts: Before diving into calculations or solutions, outline your approach. Consider what methods or formulas you may need, and think about how the concepts are related.

- Start with Simple Elements: Begin by addressing the straightforward aspects of the problem. This may involve identifying known variables, assumptions, or basic calculations that can form the foundation for more complex reasoning.

- Show Your Work: Document each step you take. In complex problems, it’s essential to communicate your thought process clearly, even if the final answer seems apparent. This shows your ability to reason and follow through logically.

Key Strategies for Complex Financial Problems

Certain strategies can help navigate through particularly challenging scenarios:

- Break Down Complex Formulas: In finance, calculations can be intricate, but it’s often helpful to break formulas down into simpler parts. Understand the meaning of each component and tackle them one by one.

- Use Real-World Context: Relate theoretical concepts to actual business scenarios or current market trends. Applying real-world context can often illuminate complex issues and make abstract problems more tangible.

- Check for Consistency: Cross-check your results for consistency and logical accuracy. Ensure that your solution aligns with your initial assumptions and the overall structure of the problem.

- Time Management: Allocate time to each section of the problem. Prioritize areas that carry more weight or require more time to analyze, but don’t neglect the smaller components.

By following these methods, you can approach difficult financial questions with greater confidence and clarity, ensuring that your solutions are both thorough and accurate. Practice is key to mastering these techniques and becoming more adept at solving complex financial scenarios.

Preparing for Exam Day: Strategies

Success in any challenging evaluation requires a combination of effective planning, focused review, and mental preparedness. The key to tackling difficult problems confidently lies in systematic preparation. By implementing a few practical strategies, you can ensure a smooth approach to the assessment day, reducing stress and improving your chances of success.

Creating a Study Plan

A well-structured study plan is essential for effective preparation. By organizing your study sessions ahead of time, you can ensure that all necessary material is covered thoroughly without feeling rushed.

- Start Early: Begin preparing well before the assessment date. Spreading out your study sessions over time helps in retaining information and understanding complex concepts.

- Focus on Key Topics: Identify and prioritize the most important areas. Pay attention to subjects that carry more weight or have been frequently covered in past assessments.

- Use Active Learning: Engage with the material by testing yourself, discussing with peers, or applying concepts to practical scenarios. This approach improves comprehension and retention.

- Divide Study Time: Break study sessions into manageable chunks, such as 25-30 minute intervals, followed by short breaks. This will help you stay focused and prevent fatigue.

Mental Preparation for Success

Preparing your mind is as important as preparing your knowledge. A positive mindset and calmness under pressure can significantly enhance performance during the assessment.

- Stay Confident: Maintain a positive attitude towards your preparation and your ability to perform well. Confidence is crucial when faced with challenging tasks.

- Practice Time Management: Simulate timed conditions while practicing to get accustomed to managing your time effectively during the assessment.

- Calm Your Nerves: On the day of the assessment, take deep breaths and stay calm. Mental clarity is essential for focusing on each task without feeling overwhelmed.

On the Day of the Assessment

On the actual day of the assessment, there are a few key strategies to help optimize performance:

| Tip | Details |

|---|---|

| Prepare Ahead | Ensure all necessary materials, such as writing tools, ID, or any required documents, are packed the night before. |

| Eat Well | Have a balanced meal to fuel your brain. Avoid heavy meals or excessive sugar, as they can lead to sluggishness. |

| Arrive Early | Arrive at the location with plenty of time to spare to reduce stress and allow for settling in. |

| Read Instructions Carefully | Before answering any questions, ensure you understand the instructions thoroughly to avoid making errors. |

By combining structured preparation, strategic time management, and a calm mindset, you can approach any challenging task with confidence and composure. These strategies will not only help you during the assessment but also prepare you for future challenges in your academic or professional journey.