Achieving success in any test requires a solid understanding of the core principles. This guide will focus on key topics that frequently appear in assessments, helping you build a strong foundation and boost your confidence. By exploring these fundamental areas, you will be better equipped to handle various types of challenges in the subject.

Throughout the article, we will dive into common scenarios that appear on evaluations, offering tips on how to approach different types of problems. Understanding the underlying theories behind calculations, decision-making processes, and financial analysis is crucial for tackling these tasks efficiently. With focused practice, even the most complex issues can be simplified.

Prepare to enhance your grasp of critical elements, enabling you to approach any task with a clearer mindset and better technique. Whether you’re looking to refine your skills or test your knowledge, mastering these core areas will set you on the right path toward achieving top results.

Understanding the Basics of Financial Management

Grasping the foundational elements of financial oversight is essential for anyone aiming to excel in the field. This area focuses on how businesses track, analyze, and interpret their financial data to make informed decisions. Mastery of the core concepts will serve as a stepping stone for solving more complex problems and providing accurate insights for organizational growth.

Key Concepts to Know

- Cost Behavior: Understanding how costs change with varying levels of activity is crucial for effective decision-making.

- Budgeting: Setting financial targets and tracking performance against those goals helps organizations manage resources efficiently.

- Profitability Analysis: Analyzing revenues and expenses allows businesses to assess their financial health.

Common Tools and Techniques

- Financial Statements: These documents summarize an organization’s financial status and are essential for performance evaluation.

- Variance Analysis: This technique helps identify discrepancies between expected and actual outcomes, guiding corrective actions.

- Break-Even Point: Determining the point where total revenue equals total costs is vital for understanding when a business starts generating profit.

Familiarizing yourself with these key principles and tools lays the groundwork for tackling more complex tasks. Mastery of these basics enables accurate data interpretation and improves decision-making abilities within any organization.

Key Concepts in Cost Management

In any business, understanding the different types of expenses and how they behave is fundamental for effective decision-making. Cost management is the process of planning, controlling, and analyzing these expenditures to ensure resources are used efficiently and profits are maximized. By mastering these concepts, one can develop a clearer picture of financial performance and make informed strategic choices.

One of the most important aspects is distinguishing between various cost categories. Some expenses vary depending on the level of production, while others remain fixed regardless of output. Understanding how costs behave in relation to changes in business activities helps improve budget accuracy and forecasting.

Types of Costs

- Variable Costs: Costs that change in direct proportion to production levels, such as raw materials or direct labor.

- Fixed Costs: Expenses that do not fluctuate with output, like rent or salaries.

- Mixed Costs: A combination of both fixed and variable elements, such as utility bills or maintenance fees.

Cost-Volume-Profit Analysis

This technique helps businesses understand how changes in cost, production volume, and sales affect profits. It allows organizations to determine the level of sales required to cover costs and start generating profit. The break-even point is a key result of this analysis, helping businesses set realistic sales targets and pricing strategies.

Mastering these essential cost-related concepts enables better control over financial outcomes and provides valuable insights for making sound financial decisions in a competitive environment.

Types of Costing Methods Explained

Different approaches to calculating expenses allow businesses to track and allocate costs effectively. Each method serves a unique purpose, helping organizations understand where resources are being consumed and how expenses impact profitability. The choice of method depends on the nature of the business and the level of detail required for accurate financial management.

Each costing approach provides distinct advantages and is suited to particular types of operations. Some methods are more focused on tracking direct costs, while others include both direct and indirect expenditures. By mastering these techniques, businesses can gain clearer insights into their cost structures and make better-informed decisions.

Job Order Costing

This method is commonly used in industries where products or services are customized for individual customers. Costs are assigned to specific jobs, with each order tracked separately. This approach provides a detailed view of the costs associated with each project or order.

In contrast to job order costing, this method is typically used in industries that produce large quantities of identical or similar items. Costs are accumulated over a period and then averaged over all units produced. This method simplifies the allocation process when individual product costs are difficult to distinguish.

Activity-Based Costing

Activity-based costing assigns overhead costs based on the activities that drive those costs. This method allows for a more precise allocation of indirect costs by focusing on activities that consume resources, providing better insight into what drives business expenses.

Understanding these different costing techniques helps organizations choose the most appropriate approach for their operations, leading to more accurate cost control and better strategic decisions.

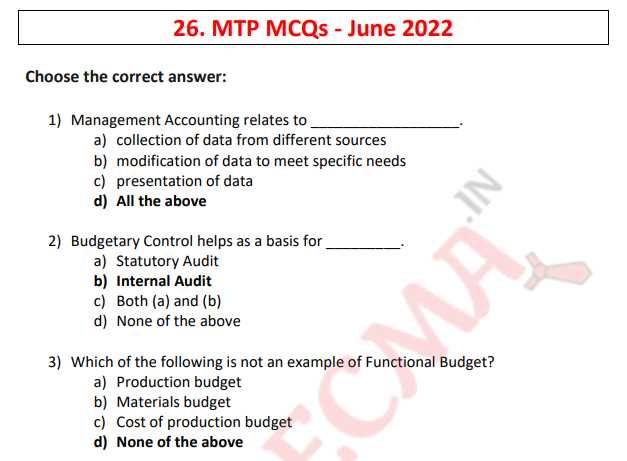

Common Questions on Budgeting

Budgeting is a critical component of financial planning, and understanding how to create, manage, and analyze budgets is essential for anyone involved in financial oversight. The ability to predict future financial needs and allocate resources effectively is often tested in various scenarios. These topics often focus on calculations, analysis, and the application of budgeting techniques to real-life situations.

Being familiar with the typical tasks related to budget preparation can help you approach such scenarios with confidence. It’s important to practice interpreting data, making projections, and adjusting for potential financial changes in a structured way.

Creating a Simple Budget

A common challenge is creating a budget based on given income and expense details. Typically, this involves listing all sources of revenue, estimating costs, and ensuring that the total expenses do not exceed the available funds. It’s also important to include provisions for unexpected expenditures.

Variance Analysis in Budgeting

Another common task involves identifying and analyzing variances between budgeted and actual figures. In these cases, you’ll often be asked to explain the reasons behind any discrepancies and suggest corrective actions. Understanding why actual costs differ from planned amounts is crucial for improving future budgeting accuracy.

Mastering these types of questions enables you to confidently manage budget creation and analysis, essential skills for financial decision-making in any organization.

Variance Analysis and Its Importance

Variance analysis is a powerful tool used to assess the difference between expected and actual financial performance. By comparing the forecasted numbers with actual results, businesses can identify areas that require attention and make informed decisions for future planning. This process helps to uncover inefficiencies, highlight opportunities for improvement, and provide valuable insights into financial management.

The key to variance analysis lies in understanding why certain discrepancies occur. Whether positive or negative, variances can point to problems or success stories within the operations. By analyzing these differences, businesses can take corrective actions or build on successful strategies.

Types of Variances

- Price Variance: This occurs when the actual cost of materials or labor differs from the budgeted price. It helps identify whether inefficiencies are related to procurement or labor management.

- Quantity Variance: This variance happens when the quantity of materials used or labor hours worked differs from the budgeted amount. It can signal issues with waste or productivity.

- Efficiency Variance: A measure of how well resources are being utilized compared to the original expectations, indicating areas where productivity can be enhanced.

Benefits of Variance Analysis

- Performance Evaluation: Helps managers evaluate how well the business is performing relative to its budget and targets.

- Cost Control: Identifies areas where costs are higher than expected, prompting managers to investigate and take corrective actions.

- Strategic Planning: By understanding the causes of variances, businesses can adjust future strategies, improve forecasting, and optimize resource allocation.

Variance analysis is a crucial aspect of financial oversight, helping businesses stay on track and ensuring that resources are used efficiently. By mastering this tool, organizations can improve their overall financial management and drive better decision-making.

Break-Even Analysis for Beginners

Understanding the point at which revenue equals costs is crucial for any business. Break-even analysis helps determine this crucial threshold, showing how much of a product or service must be sold to cover all fixed and variable expenses. This concept is vital for making pricing decisions, setting sales targets, and assessing the financial health of a business.

At its core, break-even analysis allows businesses to assess the minimum performance needed to avoid losses. It helps to clarify the relationship between costs, revenue, and profits, providing a clear benchmark for financial decisions. By understanding the break-even point, businesses can plan better, manage risks, and optimize their operations.

Key Components of Break-Even Analysis

- Fixed Costs: These costs remain constant regardless of the level of output, such as rent, insurance, or salaries.

- Variable Costs: Costs that vary directly with production levels, like raw materials or direct labor.

- Sales Price per Unit: The price at which each unit of a product or service is sold, which directly impacts the break-even point.

Calculating the Break-Even Point

The break-even point is calculated using the following formula:

Break-even point = Fixed Costs ÷ (Sales Price per Unit - Variable Cost per Unit)

This calculation gives the number of units that need to be sold to cover all costs. Once sales exceed this point, the business begins generating profit.

Mastering break-even analysis provides a clear understanding of the financial dynamics of a business, helping to make informed pricing, production, and investment decisions. It is an essential tool for both new and established companies.

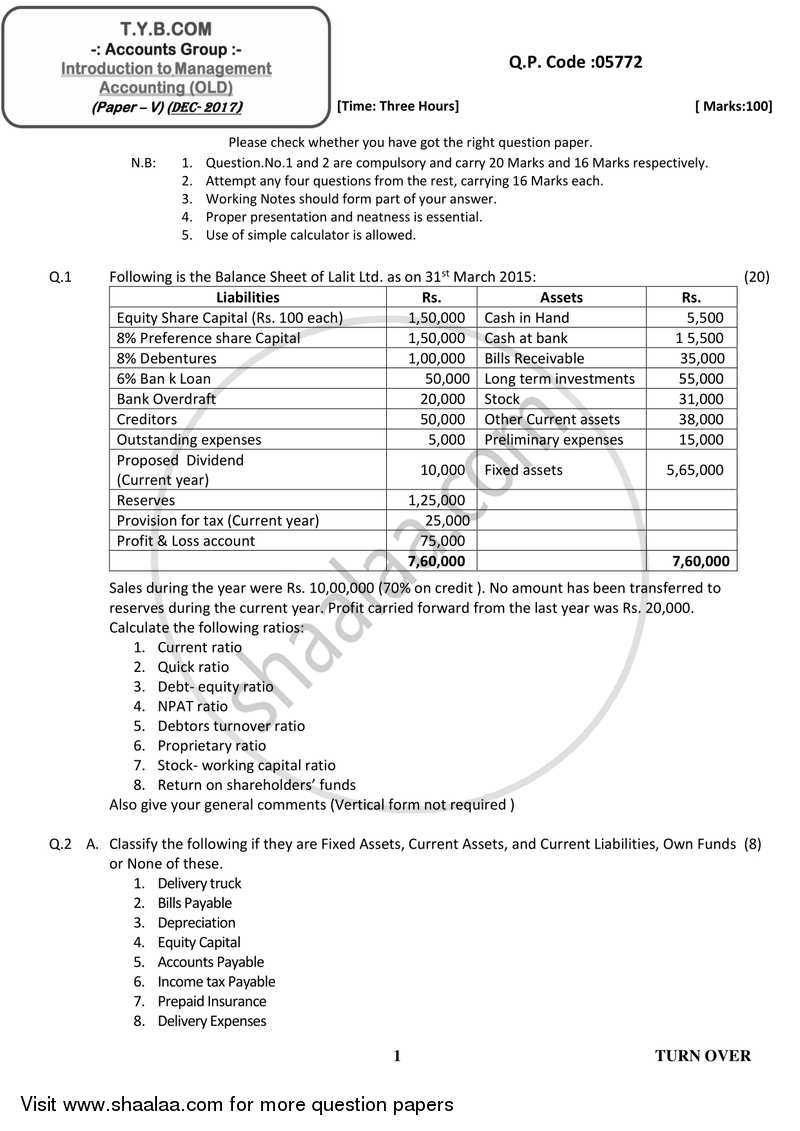

Interpreting Financial Statements in Exams

Understanding how to analyze financial reports is a critical skill for anyone studying financial management. These documents provide key insights into a company’s performance, stability, and profitability. In a testing environment, being able to accurately interpret balance sheets, income statements, and cash flow reports is essential for demonstrating your financial analysis skills.

When reviewing financial statements in an assessment setting, it’s important to focus on both the quantitative and qualitative aspects. It’s not just about calculating figures, but also understanding what those numbers signify in terms of business health and strategic direction.

Key Areas to Focus On

- Profitability: Analyze metrics such as gross profit margin, operating profit, and net income to gauge how well the business is generating earnings from its operations.

- Liquidity: Assess the company’s ability to meet short-term obligations by looking at ratios like current ratio and quick ratio.

- Leverage: Review debt-related indicators such as the debt-to-equity ratio to understand the business’s financial risk and capital structure.

- Cash Flow: Look at the cash flow statement to determine the company’s ability to generate cash, and how effectively it manages cash inflows and outflows.

By focusing on these critical components, you can not only answer questions more effectively but also provide a comprehensive analysis that showcases your ability to interpret financial data accurately. Practice with sample reports and develop a systematic approach to ensure you’re ready for any scenario presented in your studies.

Fundamentals of Activity-Based Costing

Activity-based costing (ABC) provides a more accurate way to assign indirect costs to products or services. Unlike traditional costing methods, which often allocate overhead based on simplistic metrics like labor hours or machine usage, ABC assigns costs based on the actual activities that drive those costs. This method helps organizations gain a clearer understanding of how resources are consumed and allows for better cost management decisions.

By identifying specific activities that contribute to overhead, businesses can see how much each activity costs and how it impacts the overall cost structure. This method provides more detailed insights into where and why costs are incurred, leading to better pricing, cost control, and resource allocation strategies.

Key Components of Activity-Based Costing

- Activities: These are the actions that incur costs, such as processing orders, handling customer service, or maintaining machinery.

- Cost Drivers: The factors that cause costs to increase or decrease, such as the number of machine setups or the volume of customer orders.

- Cost Pools: These represent groups of costs associated with specific activities, such as the costs of all machine maintenance activities.

Benefits of Activity-Based Costing

- Improved Cost Accuracy: By tracing costs to the activities that generate them, businesses get a clearer picture of the true cost of production.

- Better Decision-Making: Accurate cost information leads to more informed pricing and budgeting decisions.

- Increased Efficiency: Identifying high-cost activities allows businesses to streamline processes and reduce waste.

Understanding the fundamentals of ABC is essential for businesses that want to improve cost accuracy and operational efficiency. By applying this method, companies can enhance their financial decision-making and better manage resources.

Preparing for Performance Management Questions

Success in financial assessments often relies on the ability to demonstrate a deep understanding of how to evaluate and improve business performance. Preparing for questions related to this area involves familiarizing yourself with key performance indicators, methods for assessing efficiency, and techniques for optimizing resources. Being able to interpret various performance metrics will allow you to provide insightful answers that reflect your grasp of operational efficiency.

To effectively prepare, it is crucial to understand the different ways in which performance can be measured, from financial outcomes to operational effectiveness. You must also be able to identify the factors that influence performance, such as cost control, productivity, and organizational strategy. A solid grasp of these concepts will enable you to address various scenarios and challenges that may arise in testing situations.

Key Areas to Focus On

- Key Performance Indicators (KPIs): Understand how to use KPIs to track a company’s progress toward its strategic goals.

- Variance Analysis: Be able to assess the difference between planned performance and actual results, identifying areas of underperformance and success.

- Benchmarking: Know how to compare a company’s performance against industry standards or competitors to evaluate its relative efficiency.

Common Techniques for Improving Performance

- Cost Reduction: Explore strategies for lowering operational expenses without sacrificing quality or service.

- Process Optimization: Study methods for streamlining workflows, improving employee productivity, and enhancing overall efficiency.

- Employee Motivation: Learn how performance can be influenced by workforce engagement, leadership, and incentivization programs.

Mastering these areas will allow you to confidently answer performance-related questions, showcasing your ability to analyze, measure, and recommend improvements for an organization’s performance. Consistent practice and a clear understanding of these concepts are key to performing well in assessments.

How to Tackle Decision-Making Problems

When faced with complex challenges, the ability to make informed and effective decisions is essential. Solving decision-making problems requires a structured approach that balances quantitative data with qualitative judgment. By breaking down problems into manageable steps, you can analyze potential outcomes and choose the best course of action to achieve your objectives.

The key to successful decision-making lies in understanding the factors that influence your options. This includes evaluating the costs, benefits, and risks associated with each choice, as well as considering the broader impact on your goals. Developing a clear framework for analysis can help simplify complex situations and ensure that decisions are well-supported by evidence.

Steps to Approach Decision-Making Problems

- Identify the Problem: Clearly define the issue you need to address, ensuring that you understand all the relevant details.

- Gather Information: Collect data, review historical trends, and assess the current environment to inform your choices.

- Evaluate Alternatives: Compare different options based on their potential outcomes, costs, and benefits.

- Make the Decision: Select the most viable solution that aligns with your goals and available resources.

- Monitor and Review: After implementing the decision, track results and adjust strategies as necessary.

Decision-Making Tools and Techniques

Several tools can help streamline the decision-making process, ensuring that decisions are based on sound analysis. Here is an example of how different methods can be used to evaluate alternatives:

| Decision Criteria | Option A | Option B | Option C |

|---|---|---|---|

| Cost | $5,000 | $3,000 | $4,500 |

| Benefit | High | Medium | High |

| Risk | Low | Medium | High |

| Time to Implement | 1 Month | 2 Weeks | 1.5 Months |

By evaluating each option against the set criteria, you can make a well-rounded decision that best meets your objectives. Structured decision-making processes, combined with careful analysis, lead to more consistent and confident choices.

Standard Costing in Management Accounting

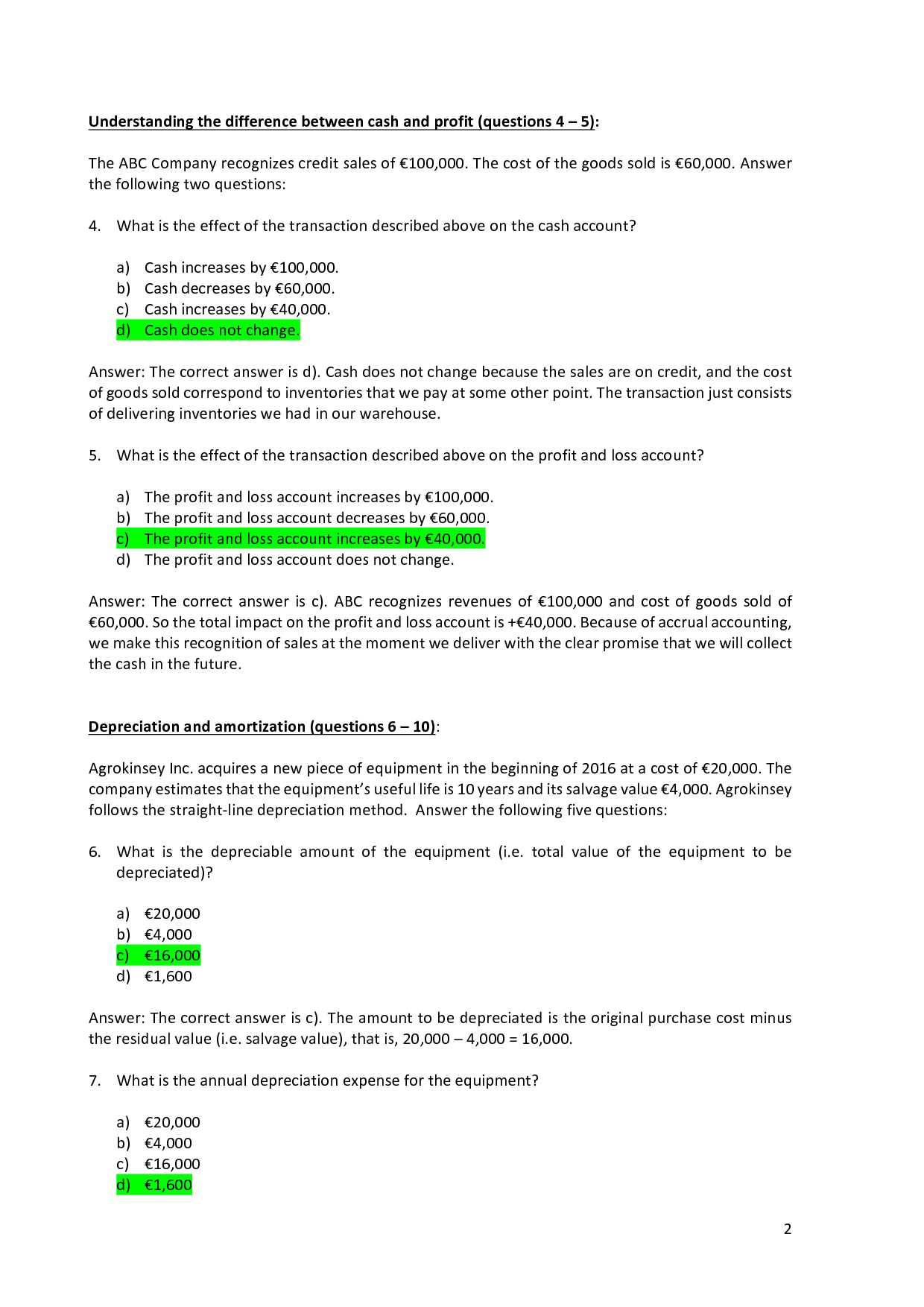

Standard costing is a technique used to estimate the expected costs of production and compare them with actual costs. By setting predefined benchmarks, businesses can assess their financial performance more accurately and take corrective actions when necessary. This method helps identify variances, providing insights into areas where operations can be improved or costs reduced.

The system of standard costing involves calculating the expected cost of each unit of production and comparing it with the actual cost incurred. Discrepancies, known as variances, are analyzed to understand the reasons behind them. These insights are essential for managing costs effectively, improving budgeting accuracy, and enhancing financial control.

Types of Variances in Standard Costing

- Material Cost Variance: The difference between the expected cost of materials and the actual cost incurred for production.

- Labor Cost Variance: The difference between the standard labor cost and the actual labor cost for the period.

- Overhead Variance: The difference between the allocated overhead cost and the actual overhead expenses.

Example of Standard Costing Calculation

The following table illustrates how standard costs are calculated and compared to actual costs, resulting in variances that help identify areas for improvement:

| Cost Category | Standard Cost | Actual Cost | Variance |

|---|---|---|---|

| Materials | $10 per unit | $12 per unit | $2 unfavorable |

| Labor | $15 per hour | $14 per hour | $1 favorable |

| Overhead | $5 per unit | $6 per unit | $1 unfavorable |

As shown in the table, variances are calculated by comparing the standard costs with actual costs. These variances can be classified as either favorable (where actual costs are lower than expected) or unfavorable (where actual costs exceed the standard). Identifying and understanding these variances helps businesses manage their resources more effectively and optimize operations.

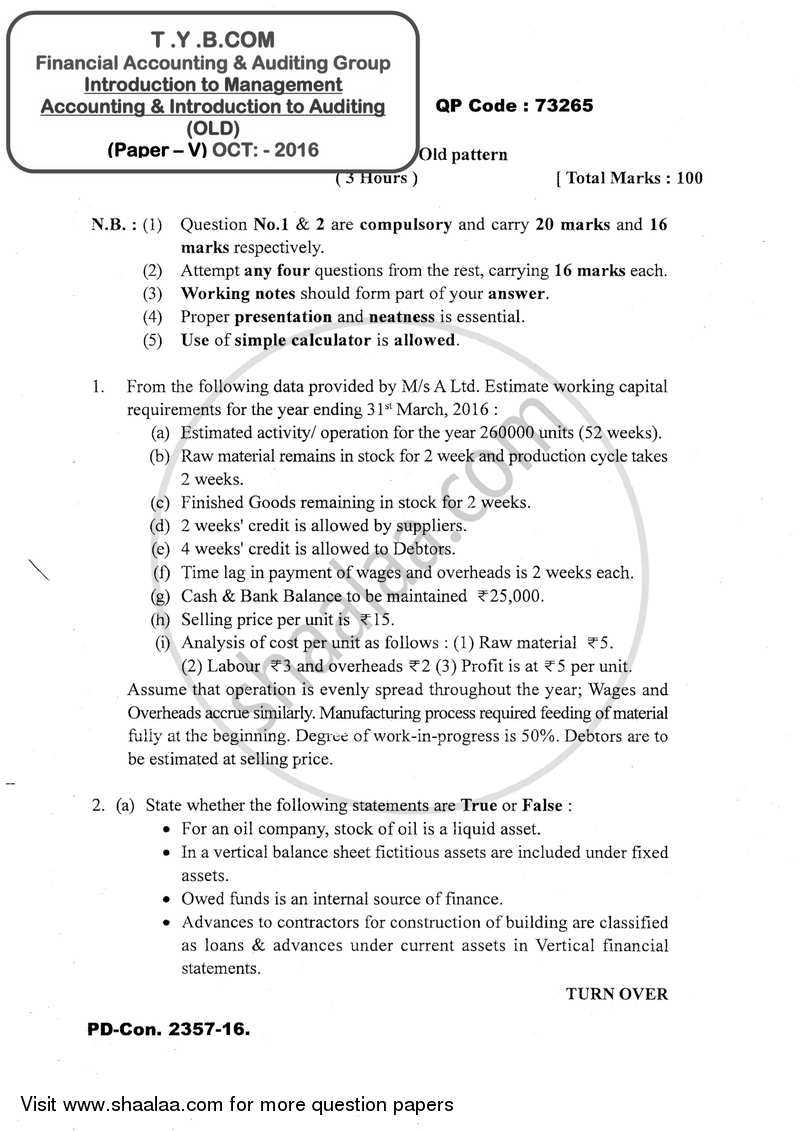

Mastering Cash Flow and Capital Budgeting

Understanding cash flow and capital budgeting is crucial for any business or individual involved in long-term financial planning. These concepts focus on managing the inflow and outflow of funds and making strategic investment decisions. Effective control of cash flow ensures that a business has enough liquidity to meet its short-term obligations, while capital budgeting helps assess the viability of long-term investments and projects.

Cash flow refers to the movement of money into and out of a business, providing insight into its ability to operate smoothly. Capital budgeting, on the other hand, involves evaluating potential investments and deciding where to allocate resources in a way that maximizes returns over time. By mastering these areas, businesses can ensure financial stability and growth, avoid liquidity problems, and make informed decisions about future expansion.

Understanding Cash Flow Statements

The cash flow statement is an essential tool that outlines how cash moves through a business. It provides a detailed breakdown of cash generated or used by operating, investing, and financing activities. Analyzing this statement helps to determine the financial health of a business and how well it manages its day-to-day operations.

Key Capital Budgeting Techniques

- Net Present Value (NPV): NPV calculates the difference between the present value of cash inflows and outflows, helping to assess the profitability of an investment.

- Internal Rate of Return (IRR): IRR is the rate at which the net present value of future cash flows equals zero, used to compare investment options.

- Payback Period: This method measures the time it takes for an investment to repay its initial cost, indicating the risk and liquidity of a project.

By using these techniques, businesses can prioritize projects that align with their long-term goals while maintaining sufficient cash reserves for operational needs. Proper cash flow management ensures that a company can survive financial stress, while effective capital budgeting ensures sustainable growth and profitability.

Risk Assessment and Accounting Adjustments

Identifying potential risks and making necessary adjustments to financial reports are fundamental processes for maintaining the integrity and accuracy of business decisions. Risk assessment involves evaluating uncertainties that could impact an organization’s financial position, while accounting adjustments ensure that the financial records reflect a true and fair view of the company’s performance and situation. Together, these processes enable companies to mitigate risks and maintain reliable financial reporting.

Through effective risk assessment, businesses can foresee challenges that may affect cash flow, profitability, and long-term sustainability. Adjustments to financial statements, such as provisions for doubtful debts or revaluation of assets, are necessary to account for these potential risks and reflect a more realistic view of financial health. These adjustments allow decision-makers to respond proactively to changing conditions and ensure compliance with regulatory standards.

Types of Risk Assessments

- Market Risk: The risk of changes in market conditions that can impact financial performance, such as fluctuations in interest rates or commodity prices.

- Credit Risk: The possibility of losses due to the failure of clients or customers to meet their financial obligations.

- Operational Risk: Risks arising from failures in internal processes, systems, or external events that disrupt business operations.

- Liquidity Risk: The risk that an organization will not have enough liquid assets to meet its short-term financial obligations.

Common Accounting Adjustments

- Depreciation Adjustments: The allocation of the cost of tangible assets over their useful life, ensuring that the value of assets is accurately reflected in the financial statements.

- Bad Debt Provisions: Adjustments made to account for anticipated uncollectible debts, ensuring that revenue is not overstated.

- Inventory Valuation: Adjusting the value of inventory to reflect changes in market conditions, ensuring the accurate presentation of assets.

- Foreign Exchange Adjustments: Modifications made to account for fluctuations in exchange rates that affect the value of international transactions.

Risk assessment coupled with timely accounting adjustments not only helps businesses navigate uncertainties but also promotes transparency and accuracy in financial reporting, fostering confidence among stakeholders and ensuring compliance with financial regulations.

Using Financial Ratios in Exam Responses

Incorporating key financial ratios into written responses can greatly enhance the clarity and depth of analysis. These ratios provide valuable insights into a company’s performance, helping to assess profitability, liquidity, efficiency, and solvency. When used effectively, they can offer concrete evidence to support conclusions and demonstrate a solid understanding of financial concepts. Understanding how to calculate and interpret these ratios is essential for addressing questions that require financial analysis.

By applying ratios, you can break down complex financial data into more manageable and understandable metrics. Whether evaluating a company’s profitability or its ability to meet short-term obligations, these ratios help highlight key trends and areas of concern. Presenting these insights clearly in responses not only strengthens the analysis but also showcases analytical skills, which are crucial in many financial assessments.

Common Ratios to Use

- Current Ratio: Measures a company’s ability to cover its short-term liabilities with its short-term assets. A higher ratio indicates better liquidity.

- Return on Equity (ROE): Indicates how efficiently a company generates profit from its shareholders’ equity. A higher ROE suggests effective management.

- Debt-to-Equity Ratio: Assesses the financial leverage of a company by comparing its total liabilities to its equity. A lower ratio is generally considered less risky.

- Gross Profit Margin: Shows the percentage of revenue that exceeds the cost of goods sold. A higher margin indicates better efficiency in production.

Best Practices for Using Ratios

- Contextualization: Always provide context for the ratio results. Compare ratios to industry standards or historical data to draw meaningful conclusions.

- Clarity: Clearly explain the significance of each ratio used and how it relates to the overall financial health of the company.

- Integration: Integrate multiple ratios into a cohesive analysis to present a well-rounded evaluation, addressing both strengths and weaknesses.

Incorporating financial ratios into your responses demonstrates not only your ability to interpret financial data but also your capacity to present that data in a meaningful and impactful way. This approach can make your analysis more structured and insightful, thus enhancing your performance in any financial assessment.

Time Management Tips for Accounting Exams

Effectively managing your time during assessments is crucial for ensuring that you can complete all tasks accurately and thoroughly. By prioritizing questions, allocating sufficient time to each section, and avoiding unnecessary stress, you can optimize your performance. Proper time management helps in maintaining focus, reducing errors, and ensuring you have enough time to review your work.

Whether you’re tackling complex calculations or analytical tasks, a clear strategy can make all the difference. Planning ahead and sticking to a set schedule ensures that you can navigate through the test without feeling rushed or overwhelmed. Below are some key tips to help you manage your time efficiently and maximize your potential during any assessment.

Effective Time Allocation Strategies

- Understand the Structure: Familiarize yourself with the layout of the test before you begin. Knowing how many questions or sections there are allows you to allocate time accordingly.

- Prioritize Tasks: Start with the questions or sections you are most confident about. This helps build momentum and saves time for more challenging tasks later.

- Set Time Limits: Allocate specific time for each section or question based on its difficulty level. Use a timer to keep track and avoid spending too much time on one part.

- Leave Time for Review: Reserve the last 10-15 minutes of your session to review your answers, check calculations, and ensure you’ve addressed everything fully.

Dealing with Difficult Sections

- Don’t Get Stuck: If you encounter a difficult question, move on and come back to it later. Spending too much time on a single problem can waste valuable minutes.

- Keep Calm: Stay calm and focus on the next step. Panicking over a tough question can slow you down. Take deep breaths and continue working through the paper.

- Use All Available Time: Even if you finish early, don’t rush through the last few questions. Use any remaining time to double-check your answers and refine your responses.

With these strategies, you’ll be better prepared to handle any assessment efficiently and confidently. Time management is not just about working faster, but about working smarter and using the available time to its fullest potential.

Final Review of Key Exam Topics

As you approach the final stages of your preparation, it’s essential to revisit the core areas that are frequently tested. A focused review of the most important concepts will help consolidate your knowledge and boost your confidence. Prioritizing topics based on their relevance and complexity ensures that you allocate your time effectively during the final hours before the assessment.

To maximize your performance, it is vital to refresh your understanding of key principles and ensure that you’re familiar with the types of tasks you may encounter. Below is a summary of the critical areas that deserve your attention, organized for quick and efficient revision.

| Topic | Key Concepts | What to Focus On |

|---|---|---|

| Cost Behavior | Fixed, variable, and mixed costs | Understand how costs react to changes in activity levels and identify cost patterns |

| Break-Even Analysis | Fixed costs, contribution margin, profit-volume relationship | Be able to calculate the break-even point and understand its significance in decision-making |

| Budgeting | Static, flexible, and master budgets | Know how to prepare and analyze budgets, and the role of variances in performance evaluation |

| Variance Analysis | Material, labor, and overhead variances | Focus on interpreting variances and understanding their implications for business performance |

| Cost Allocation | Direct vs. indirect costs, cost pools, and cost drivers | Ensure you can apply different methods of allocating overhead costs accurately |

As you review, pay particular attention to the relationships between these topics and how they may be tested in combination. A strong grasp of these key areas will provide a solid foundation for tackling more complex scenarios that may arise. Remember to take breaks during your revision to avoid burnout and ensure that you retain the information effectively.