Preparing for a test on financial topics requires a strong grasp of key concepts that help assess the value and potential of various assets. Success depends on your ability to analyze data, recognize trends, and make informed decisions based on complex information. Whether you’re studying for a certification or aiming for academic success, mastering these fundamental ideas is crucial for performing well.

To excel in these assessments, it’s important to focus on core principles, such as how to evaluate risk, measure returns, and understand the relationships between various financial elements. A clear understanding of asset valuation, market dynamics, and investment strategies will provide you with the tools needed to navigate through difficult tasks. By focusing on the essential skills, you can confidently approach any related challenge.

Investment Analysis Exam Preparation Tips

When preparing for a financial assessment, it’s essential to focus on key areas that will help you understand the various tools and methods used to evaluate assets and markets. A solid grasp of these concepts will give you the confidence to tackle the most challenging tasks. Below are a few strategies to ensure you’re well-prepared for your upcoming test.

Understand Key Financial Concepts

Start by familiarizing yourself with the essential principles of finance. Knowing the basic terminology, as well as how to apply them in practical scenarios, will help you approach the test with clarity. Focus on:

- Risk measurement and its impact on decision-making

- Understanding returns and their calculation methods

- Market structure and asset behavior

Practice with Real-World Scenarios

One of the best ways to prepare is to engage with real-life case studies and practical examples. These will allow you to apply theoretical knowledge to actual financial situations, helping you better understand how to use various tools. Practice using:

- Financial ratios for evaluating companies

- Forecasting techniques for predicting market trends

- Methods for constructing balanced investment strategies

By incorporating these techniques into your study routine, you’ll develop a well-rounded understanding that will serve you well in tackling any related task during your assessment. Keep practicing until you feel confident in your ability to analyze and interpret financial data efficiently.

Key Concepts in Portfolio Management

Building a successful collection of assets involves understanding various principles that guide decision-making and help optimize returns while minimizing risk. The foundation of this process lies in balancing different financial instruments to achieve the best possible results. By mastering key techniques and strategies, you can confidently navigate the complexities of managing multiple assets effectively.

Here are some of the core concepts you should focus on to excel in the field:

| Concept | Description |

|---|---|

| Asset Allocation | Distributing investments across different asset classes to balance risk and return. |

| Risk Diversification | Spreading investments across a range of assets to reduce the impact of a single asset’s poor performance. |

| Return on Investment | Calculating the profitability of an asset by measuring its return relative to the cost of investment. |

| Capital Preservation | Focusing on maintaining the original value of investments while seeking moderate returns. |

| Rebalancing | Adjusting the allocation of assets in a collection to maintain the desired risk-return profile. |

Mastering these concepts will help you design a strategy that balances risk, rewards, and goals. Understanding how to evaluate different assets and adjust allocations over time is essential to success in the long run. Keep practicing these techniques to improve your ability to manage assets effectively and make informed decisions.

Understanding Risk and Return in Investments

When making financial decisions, it’s crucial to comprehend the balance between potential profits and the uncertainty involved. The relationship between risk and return is central to any financial strategy, influencing how assets are selected and managed. Understanding this dynamic allows you to make informed choices and align your goals with the right opportunities.

Risk refers to the possibility of an outcome deviating from expectations, often leading to losses. On the other hand, return is the reward for taking on that uncertainty. Typically, the higher the potential return, the greater the risk. Therefore, it’s essential to evaluate the trade-off carefully when considering various options.

Several key factors influence both risk and return. These include market volatility, economic conditions, asset liquidity, and the time horizon of your financial goals. By assessing these elements, you can gauge whether the potential returns are worth the risks involved and adjust your strategy accordingly.

Common Investment Theories You Should Know

To navigate the world of financial opportunities effectively, it is important to understand the foundational theories that guide decision-making processes. These theories offer valuable insights into how markets behave, how risk is evaluated, and how to maximize returns under varying conditions. Below are several key ideas that every investor should be familiar with to make informed choices.

Modern Portfolio Theory

Modern Portfolio Theory (MPT) is a framework that helps to determine the optimal combination of assets that will maximize returns for a given level of risk. The key principle of MPT is diversification – spreading investments across different types of assets to reduce the overall risk while aiming for the highest return.

- Focuses on risk-return trade-offs

- Helps identify efficient asset combinations

- Relies on statistical measures like standard deviation and correlation

Capital Asset Pricing Model (CAPM)

The Capital Asset Pricing Model (CAPM) is used to determine the expected return of an asset based on its risk relative to the overall market. It emphasizes the relationship between the risk-free rate, the asset’s risk, and the potential return.

- Introduces the concept of beta to measure risk

- Helps in understanding how systematic risk affects asset prices

- Provides a way to evaluate whether an asset is over or under-valued

Understanding these theories is essential to creating a strategy that aligns with both short-term and long-term financial objectives. By integrating them into your decision-making process, you can improve your ability to analyze opportunities and optimize your financial outcomes.

How to Analyze Financial Statements Effectively

Evaluating the financial health of a company is a critical skill that allows you to assess its performance, stability, and future potential. By reviewing key documents that provide insight into a company’s revenue, expenses, and overall financial position, you can make informed decisions. The following steps outline how to effectively interpret these crucial reports.

Key Financial Statements to Review

Three primary documents are essential for understanding the financial situation of a business:

| Statement | Purpose |

|---|---|

| Income Statement | Shows the company’s profitability over a specific period, detailing revenues, expenses, and net income. |

| Balance Sheet | Provides a snapshot of the company’s assets, liabilities, and equity at a specific point in time. |

| Cash Flow Statement | Details the cash inflows and outflows, highlighting how well the company manages its cash to fund operations and growth. |

Analyzing the Data

Once you’ve reviewed the key statements, focus on the following steps to analyze the data:

- Compare financial ratios: Ratios such as profitability, liquidity, and debt ratios give you a quick overview of the company’s health.

- Trend analysis: Look at data over multiple periods to identify trends, such as growth in revenue or increasing expenses.

- Benchmarking: Compare the company’s performance to industry averages or peers to assess how well it is performing in the market.

By mastering these techniques, you will be able to evaluate a company’s financial standing thoroughly and accurately. This knowledge will provide a solid foundation for making strategic decisions and understanding its long-term viability.

Important Ratios for Investment Evaluation

Evaluating the financial viability of an asset requires a clear understanding of various performance indicators. Ratios provide essential insights into a company’s profitability, efficiency, risk, and overall financial health. By examining these figures, you can make informed decisions about whether to engage with an asset or not. Below are some key ratios that every investor should know.

Profitability Ratios

These ratios help to assess how effectively a company generates profit relative to its revenue, assets, or equity. Key profitability metrics include:

- Return on Equity (ROE): Measures how much profit a company generates with the money shareholders have invested.

- Return on Assets (ROA): Indicates how efficiently a company uses its assets to generate profit.

- Net Profit Margin: Shows the percentage of revenue that remains as profit after all expenses are deducted.

Liquidity Ratios

Liquidity ratios measure a company’s ability to meet its short-term obligations. These are critical for assessing a company’s financial stability:

- Current Ratio: Compares current assets to current liabilities, indicating the company’s ability to pay off short-term debts.

- Quick Ratio: A more conservative measure of liquidity that excludes inventory from current assets.

By analyzing these ratios, you can gain a deeper understanding of a company’s financial performance and risk. These metrics are essential for assessing an asset’s potential and making sound decisions for long-term success.

Strategies for Building a Diversified Portfolio

Creating a well-rounded collection of assets is essential for balancing risk while seeking optimal returns. The goal is to spread investments across various sectors, asset classes, and geographic regions, ensuring that the overall performance is not overly dependent on any single factor. By strategically selecting different opportunities, you can reduce volatility and increase the likelihood of steady gains.

Here are a few key approaches to building a diverse collection:

- Asset Class Diversification: Allocate investments across different asset categories, such as stocks, bonds, real estate, and commodities. This spreads risk by ensuring that poor performance in one area doesn’t negatively impact the whole.

- Sector Diversification: Invest in a variety of industries, from technology to healthcare, to avoid sector-specific risks. Different sectors react differently to market events, which helps maintain stability.

- Geographic Diversification: Expand your investments globally to mitigate risks associated with regional economic downturns or political instability. This can provide exposure to emerging markets and international opportunities.

By employing these strategies, you not only safeguard your assets from significant downturns but also increase the potential for long-term growth. A diversified collection reduces exposure to market volatility and enhances your ability to withstand unpredictable economic shifts.

Capital Asset Pricing Model Explained

The Capital Asset Pricing Model (CAPM) is a tool used to determine the expected return on an asset, considering its risk in relation to the overall market. It helps investors understand the potential rewards of holding a particular asset, taking into account both the risk-free rate and the asset’s level of risk compared to the broader market. This model plays a crucial role in making informed decisions about which assets to include in a collection.

The CAPM is based on the assumption that higher risk should be compensated with higher returns. This relationship is captured by the following components:

- Risk-Free Rate: The return on an investment that is considered free of risk, typically represented by government bonds.

- Beta: A measure of the asset’s volatility in relation to the market. A beta greater than 1 means the asset is more volatile than the market, while a beta less than 1 indicates lower volatility.

- Market Return: The overall return expected from the market as a whole, which is typically based on the historical performance of major indices.

According to CAPM, the expected return on an asset can be calculated using the formula:

Expected Return = Risk-Free Rate + Beta * (Market Return - Risk-Free Rate)

This model provides a useful framework for evaluating the risk-reward tradeoff associated with any asset. It is particularly useful when comparing different opportunities, helping investors make choices that align with their risk tolerance and return expectations.

Understanding the Efficient Frontier

The Efficient Frontier is a concept that helps investors identify the optimal mix of assets that provides the highest return for a given level of risk. It represents the set of possible combinations where risk and return are balanced in the most efficient way. By plotting various combinations of assets, investors can visualize the trade-off between risk and reward, ensuring they choose the most efficient strategy.

Here are the key elements to understand when working with the Efficient Frontier:

- Risk-Return Tradeoff: Every combination of assets lies on a curve where the expected return increases with risk. The goal is to select an option that maximizes return without taking on unnecessary risk.

- Diversification: By combining different assets with low correlation, you can reduce risk without sacrificing returns. The Efficient Frontier demonstrates how to achieve the best balance.

- Optimal Asset Allocation: The point on the curve that offers the highest return for a specific level of risk is considered the most efficient. This allocation depends on the investor’s risk tolerance and return goals.

In summary, the Efficient Frontier helps investors make strategic decisions, aiming to optimize performance while minimizing unnecessary risks. It is a fundamental concept for anyone looking to maximize returns in a way that aligns with their risk appetite.

Role of Behavioral Finance in Investment Decisions

Behavioral finance focuses on the psychological factors that influence how people make financial decisions. It challenges the traditional belief that investors always act rationally. Instead, it suggests that emotions, cognitive biases, and social influences often play a significant role in shaping decisions, sometimes leading to irrational behavior that can impact market outcomes. Understanding these psychological factors can help investors avoid common pitfalls and make more informed choices.

Several key psychological tendencies affect how investors approach decision-making:

- Overconfidence Bias: When investors overestimate their ability to predict market movements, leading to excessive risk-taking or overly concentrated holdings.

- Loss Aversion: The tendency to feel the pain of a loss more intensely than the pleasure of a gain, which can cause investors to make overly conservative choices or hold losing assets for too long.

- Herd Behavior: The tendency to follow the crowd, which can result in buying during market bubbles or selling during market crashes, often at the worst possible times.

- Anchoring: The tendency to rely too heavily on one piece of information, such as a past price or performance, which can lead to poor decision-making when that information is no longer relevant.

Recognizing these biases and understanding their impact can help investors create more balanced, rational strategies. By applying the principles of behavioral finance, individuals can avoid common psychological traps and make more disciplined, objective financial decisions.

Analyzing Market Trends for Better Insights

Understanding market trends is crucial for making informed financial decisions. By observing patterns in price movements, economic data, and external factors, investors can gain valuable insights into the direction of the market. This process allows for more accurate predictions, helping to identify opportunities and minimize potential risks. Analyzing trends not only involves looking at historical data but also interpreting how current events and changes affect the overall market sentiment.

There are several approaches to effectively analyzing market behavior:

Identifying Key Indicators

Tracking specific indicators can provide a clear picture of the market’s direction. These include:

- Moving Averages: Smooth out price data to help identify the direction of the trend.

- Momentum Indicators: Measure the speed of price changes, signaling potential trend reversals.

- Volume Analysis: Examining the volume of trading can help confirm whether a trend is likely to continue.

Understanding Market Sentiment

Market sentiment plays a significant role in trend formation. Analyzing how investors feel about market conditions–whether bullish or bearish–can give clues about potential shifts in the market. Tools such as news sentiment analysis and social media monitoring can provide real-time insights into investor psychology.

By combining technical indicators with an understanding of market sentiment, investors can make better decisions about when to enter or exit markets, maximizing returns while managing risk.

Asset Allocation and Its Significance

Distributing resources among various types of financial instruments is a key strategy for balancing risk and reward. The way assets are allocated in a financial plan plays a crucial role in determining the overall performance of the holdings. By spreading investments across different asset types, such as stocks, bonds, real estate, and commodities, individuals can manage volatility and reduce the impact of any single asset’s poor performance on the overall outcome.

Here are some of the main reasons why this distribution is so important:

- Risk Reduction: Allocating across diverse assets helps to mitigate the risks associated with individual investments. When one asset class underperforms, others may compensate for the loss.

- Stabilizing Returns: A well-diversified mix smooths out fluctuations in returns, making it easier to achieve long-term financial goals without dramatic ups and downs.

- Improving Performance Potential: By selecting asset types with different performance characteristics, it’s possible to capture gains from various sources while minimizing exposure to extreme volatility.

- Aligning with Financial Goals: Proper distribution helps tailor a strategy that aligns with risk tolerance, time horizon, and investment objectives, ensuring that financial goals can be met effectively.

In summary, a well-thought-out approach to resource allocation is one of the most effective ways to build a resilient financial strategy, providing stability while optimizing the potential for growth over time.

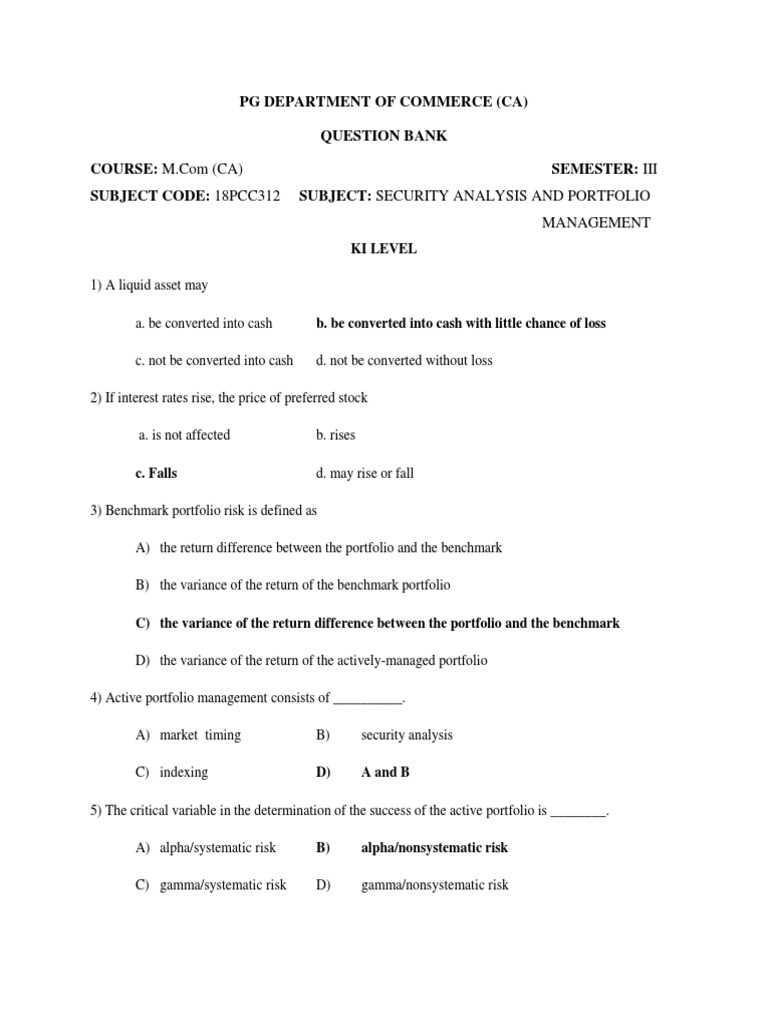

Preparing for Different Types of Exam Questions

When preparing for assessments in this field, it’s crucial to be ready for various types of inquiries that test different aspects of your knowledge. Understanding the types of questions that may appear and practicing your responses can help ensure success. The most common question formats include multiple-choice, short answer, case studies, and problem-solving tasks, each requiring a distinct approach for effective preparation.

Here’s how you can prepare for each type:

Multiple-Choice Questions

These questions test your ability to quickly recall key concepts and apply them to specific scenarios. To prepare effectively, focus on:

- Understanding definitions: Make sure you know key terms and their applications.

- Recognizing patterns: Many multiple-choice questions involve recognizing trends or concepts from earlier material.

- Eliminating wrong answers: Narrow down choices by identifying clearly incorrect options.

Case Studies and Problem-Solving Tasks

Case studies often present real-world scenarios that require you to analyze data, make decisions, and justify your reasoning. To tackle these effectively:

- Break down the problem: Start by analyzing the key points of the case and identifying the main issue.

- Use relevant frameworks: Apply appropriate methods, such as risk assessments or cost-benefit analysis, to organize your response.

- Justify your decisions: Provide logical explanations for your choices, showing your ability to make informed judgments.

| Question Type | Preparation Strategy |

|---|---|

| Multiple-Choice | Review key concepts, practice recall, eliminate incorrect answers. |

| Case Studies | Analyze scenarios, apply frameworks, justify decisions. |

| Problem Solving | Focus on methodology, understand data, show clear reasoning. |

By using these strategies, you can approach each type of question with confidence, ensuring that you are prepared for a variety of assessments that test both your knowledge and practical application of concepts.

Exam Time Management Tips for Success

Efficiently managing your time during assessments is key to maximizing your performance. Being able to allocate sufficient time for each section of the test, while maintaining focus and avoiding rushing, can make a significant difference in the results. The ability to control the pace of your work is just as important as knowing the content itself. With a solid strategy in place, you can navigate the test confidently and thoughtfully.

Here are some tips to help you make the most of your time:

Prioritize the Questions

Start by reading through all the tasks and questions carefully. Prioritize them based on their difficulty and point value. Tackling the questions you find easiest first allows you to build confidence and secure quick points, leaving more time for the harder sections.

Allocate Time for Each Section

Set a clear time limit for each section of the test. By giving yourself a strict timeline for every part, you reduce the chances of spending too much time on one question at the expense of others. This ensures that you’ll have time to attempt all parts of the assessment.

- For longer tasks: Break them into smaller chunks and set mini deadlines for each part.

- For shorter questions: Answer them quickly and move on to maximize your overall time efficiency.

Avoid Perfectionism

While it’s important to provide thoughtful responses, trying to perfect every answer can eat up precious time. If you find yourself getting stuck on a particular question, move on and come back to it later. This helps you stay on track without compromising your overall performance.

Review Your Work

Leave time at the end to review your answers. Even a brief final check can help you catch any mistakes, ensure clarity, and refine your responses before submission. Use this time to correct any errors or add any missing details that could improve your score.

By following these strategies, you can manage your time effectively, reducing stress and giving yourself the best chance for success. With the right preparation and focus, you’ll approach the assessment with confidence and clarity.

Common Mistakes to Avoid During Exams

When facing a challenging assessment, it’s easy to fall into common traps that can negatively impact your performance. Recognizing these pitfalls before the test and learning how to avoid them can help you stay focused and ensure your answers are clear and accurate. Simple mistakes often stem from rushing, misunderstanding the requirements, or neglecting the structure of your responses.

Misunderstanding the Instructions

One of the most frequent errors is not fully understanding the instructions for each section. Skimming through the guidelines can lead to missing crucial details, such as word limits, required formats, or the specific aspects to focus on in your answers. Always read the instructions carefully and ensure you comprehend what is being asked before you begin writing.

Spending Too Much Time on One Task

It can be tempting to spend extra time perfecting a difficult question, but this often leads to running out of time for other sections. To avoid this, allocate a specific amount of time to each task and stick to it. If you encounter a challenging question, move on and return to it later, ensuring you cover all areas of the test within the available time frame.

By being mindful of these common mistakes, you can approach the test with more confidence and efficiency. Careful planning, time management, and attention to detail can make all the difference in achieving the results you’re aiming for.

Recommended Resources for Further Study

To deepen your understanding and enhance your skills, it’s important to utilize a variety of resources that provide both theoretical knowledge and practical insights. Whether you’re looking for textbooks, online courses, or industry tools, a well-rounded approach to studying will help reinforce key concepts and keep you up-to-date with current trends. Here are some resources that can guide your continued learning.

Books and Textbooks

Books are a solid foundation for any study plan. They offer comprehensive explanations and examples that help build a deep understanding of the topics. Some notable textbooks to consider include:

- Financial Markets and Institutions by Frederic S. Mishkin – Provides an in-depth exploration of financial systems and their impact on global economies.

- Corporate Finance: Theory and Practice by Aswath Damodaran – Focuses on essential financial theories with practical applications in decision-making processes.

- The Intelligent Investor by Benjamin Graham – A classic that offers timeless strategies for evaluating financial assets.

Online Courses and Tutorials

Online learning platforms provide a flexible and accessible way to build your knowledge. Many platforms offer courses that are specifically designed to target financial concepts, covering everything from the basics to advanced strategies. Consider these platforms:

- Coursera – Offers courses from top universities on topics such as financial modeling, risk management, and financial economics.

- edX – Features courses on finance, asset valuation, and quantitative analysis from renowned institutions like Harvard and MIT.

- Udemy – A wide variety of courses focusing on practical skills like financial statement analysis, market forecasting, and more.

By combining the knowledge gained from books and online courses with hands-on practice, you’ll be well-prepared for your future endeavors in the field. Continuing to explore these resources will help you stay current and refine your expertise over time.