Understanding the critical principles behind managing assets and financial strategies is crucial for anyone looking to excel in their field. Whether you’re preparing for an academic challenge or refining your professional expertise, being familiar with essential topics can greatly enhance your confidence and performance.

Proper preparation requires not only theoretical knowledge but also the ability to apply it in real-world situations. A solid grasp of core ideas will allow you to navigate complex scenarios, solve problems effectively, and make informed decisions when tested. This guide will help you cover the most important subjects you should be familiar with.

Practicing key material through targeted exercises can solidify your understanding, making it easier to tackle difficult concepts and scenarios. By focusing on the right topics, you will develop the skills needed to analyze, evaluate, and solve various challenges with confidence.

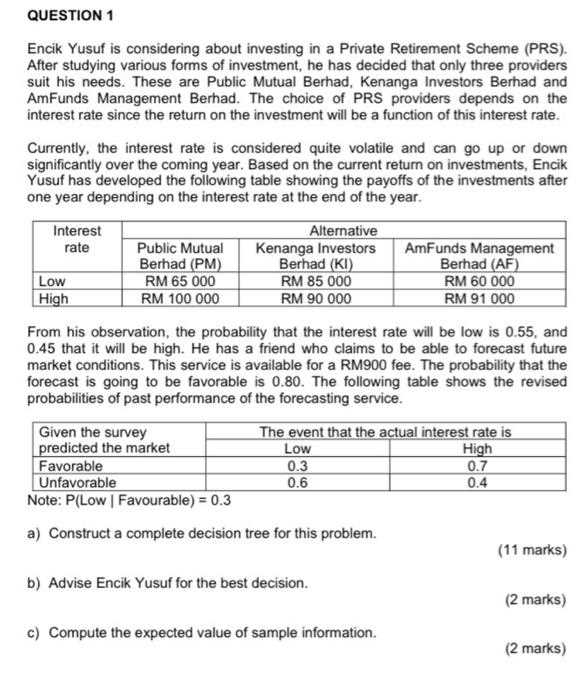

Investment Exam Questions and Answers

Mastering financial assessments requires a deep understanding of essential concepts and the ability to approach various problems with clarity. To succeed, it is vital to familiarize yourself with the type of material that often appears in these challenges. By practicing scenarios and solving problems, you can build the expertise needed to excel in this area.

Below are some commonly encountered areas, along with sample problems and solutions that reflect the topics frequently tested in financial assessments.

| Topic | Sample Problem | Solution |

|---|---|---|

| Risk Analysis | What is the impact of diversification on risk? | Diversification reduces risk by spreading investments across different assets, which lowers the chances of a significant loss. |

| Valuation | How do you determine the value of a stock? | The value of a stock can be determined by analyzing its earnings, growth potential, and comparing it to industry standards. |

| Portfolio Management | What is the benefit of maintaining a balanced portfolio? | A balanced portfolio helps manage risk by allocating assets across different sectors, thus stabilizing returns over time. |

| Financial Ratios | What does the P/E ratio indicate? | The price-to-earnings (P/E) ratio indicates the valuation of a company, comparing its current share price to its earnings per share. |

By working through such examples, you can gain a stronger understanding of the material and prepare more effectively for any related challenges you might face.

Understanding Investment Basics

Gaining a solid foundation in managing financial resources is crucial for making informed decisions and ensuring long-term success. This knowledge allows individuals to evaluate opportunities, assess risks, and allocate resources wisely to maximize returns. Grasping the core principles is essential before tackling more advanced strategies or specific tools.

The Role of Risk in Financial Planning

One of the key elements in wealth management is understanding the balance between potential returns and risk. Risk is inherent in every financial decision, but it can be mitigated with proper planning. The ability to identify, measure, and manage risks can significantly impact overall success in building wealth.

Different Types of Assets

Understanding the different types of assets, such as stocks, bonds, or real estate, is critical to constructing a well-rounded financial strategy. Each asset class has its own characteristics, offering various levels of risk and return. A diversified portfolio often includes a mix of assets to balance these factors, reducing the overall risk while pursuing optimal returns.

Once you grasp these fundamentals, you will be better equipped to navigate the world of finance and make decisions that align with your financial goals.

Key Concepts in Investment Analysis

To effectively navigate the world of financial opportunities, it’s important to understand the fundamental principles that drive decision-making processes. These core ideas help in evaluating various choices and assessing their potential for growth. By mastering these concepts, individuals can make more informed choices, leading to better financial outcomes.

Risk and Return

The relationship between risk and potential return is central to any financial analysis. Understanding how to evaluate the level of risk associated with an opportunity and how it correlates with the possible return is essential for making sound decisions.

Market Efficiency

Market efficiency refers to the idea that prices reflect all available information. A good understanding of this principle helps investors assess whether assets are underpriced or overpriced based on the data at hand.

| Concept | Description | Example |

|---|---|---|

| Risk Premium | The extra return expected for taking on additional risk | Investing in a startup versus a government bond |

| Diversification | Spreading investments across various assets to reduce risk | Mixing stocks, bonds, and real estate |

| Time Value of Money | The idea that money today is worth more than the same amount in the future | Investing $1,000 today rather than receiving $1,000 in 5 years |

| Valuation | The process of determining the current worth of an asset | Calculating the price-to-earnings ratio of a stock |

By understanding these key concepts, anyone can gain a better perspective on how to approach financial opportunities, manage risk, and maximize returns over time.

Top Strategies for Investment Success

Achieving long-term success in managing financial assets requires more than just knowledge of the market. It involves developing effective approaches that focus on both growth and stability. The best strategies combine careful planning, disciplined execution, and a clear understanding of risk and reward. By applying proven methods, anyone can improve their chances of reaching their financial goals.

A strong foundation starts with a clear plan, but it’s also crucial to stay adaptable. As markets evolve, being able to adjust strategies based on changing conditions can make a significant difference in overall performance. Below are some key approaches that can lead to success.

Diversify Your Portfolio

Spreading investments across different asset classes can reduce risk and increase the chances of achieving a stable return. A well-diversified portfolio balances exposure to various sectors, industries, and geographical regions, ensuring that poor performance in one area does not drastically affect the overall strategy.

Focus on Long-Term Goals

Short-term market fluctuations can often lead to emotional decision-making, but staying focused on long-term objectives helps to avoid knee-jerk reactions. Consistency over time tends to yield better results than constantly adjusting based on temporary changes.

Regularly Review and Rebalance

To ensure your approach remains aligned with your goals, regular reviews and adjustments are necessary. Rebalancing helps maintain the desired level of risk while taking advantage of emerging opportunities or addressing underperforming assets.

Stay Educated and Informed

Continuous learning is essential to keep up with market trends, new tools, and evolving strategies. Whether through reading, attending workshops, or seeking advice from experts, staying informed enables better decision-making and helps to avoid common pitfalls.

Common Investment Mistakes to Avoid

In the pursuit of financial success, many individuals make errors that can negatively impact their progress. These mistakes are often the result of poor planning, emotional decision-making, or a lack of understanding of the markets. Recognizing and avoiding common pitfalls can significantly improve one’s ability to manage resources effectively and achieve long-term goals.

Chasing Quick Gains

One of the most common mistakes is focusing on short-term profits rather than sustainable growth. This often leads to high-risk decisions, such as investing in volatile assets without fully understanding the consequences. Aiming for quick wins can undermine long-term stability and lead to significant losses.

Neglecting Diversification

Failing to spread investments across various asset types can expose an individual to unnecessary risks. Without proper diversification, a downturn in one area can have a major impact on the overall portfolio. It’s important to balance exposure to different sectors, industries, and geographical regions to protect against market fluctuations.

By being aware of these common errors, individuals can avoid costly missteps and create a more resilient financial strategy. Thoughtful decision-making, careful planning, and a focus on long-term goals are essential to building wealth and managing risk effectively.

Essential Tools for Investment Research

In order to make well-informed financial decisions, it is crucial to utilize the right tools that provide accurate data, analysis, and insights. These resources help to evaluate opportunities, understand market trends, and manage risk effectively. By using the appropriate instruments, individuals can gain a deeper understanding of the markets and improve their decision-making process.

Below are some of the most important tools for conducting thorough research and analysis in the financial world:

| Tool | Purpose | Example |

|---|---|---|

| Stock Screeners | Help filter and analyze stocks based on specific criteria like market cap, price-to-earnings ratio, etc. | Finviz, Yahoo Finance |

| Financial News Websites | Provide up-to-date news and analysis on financial markets, companies, and economic indicators. | CNN Business, Bloomberg |

| Charting Software | Enable users to track price movements, identify trends, and make informed technical analysis. | TradingView, MetaTrader |

| Analyst Reports | Offer in-depth analysis and forecasts for specific assets, industries, or markets. | Morningstar, S&P Capital IQ |

| Portfolio Management Tools | Help track the performance of a portfolio and ensure diversification goals are met. | Personal Capital, Betterment |

By using these tools, individuals can access critical information, make more educated decisions, and manage their financial strategies more effectively.

How to Interpret Investment Data

Understanding financial data is a crucial skill for evaluating the performance of assets and making informed decisions. Data can come in many forms, including numbers, charts, and ratios, all of which provide valuable insights into market trends, company health, and potential growth. The ability to correctly interpret this information allows individuals to assess risks, identify opportunities, and make more strategic choices.

Effective interpretation begins with understanding the key metrics and indicators that drive market behavior. Some data points provide a snapshot of a company’s financial health, while others reveal broader market trends or economic conditions. By focusing on the most relevant information, one can form a clear picture of the potential for success or failure.

Some key factors to consider when interpreting financial data include:

- Price-to-Earnings Ratio (P/E Ratio): This ratio helps assess if an asset is overvalued or undervalued by comparing its market price to its earnings per share.

- Debt-to-Equity Ratio: This ratio indicates how much debt a company has relative to its equity, providing insight into financial stability.

- Return on Equity (ROE): ROE measures a company’s profitability by comparing net income to shareholder equity.

- Market Trends: Understanding macroeconomic trends, such as inflation rates or interest rates, can help predict market shifts and influence investment decisions.

By learning to read and analyze these metrics, individuals can make more informed financial decisions, reducing uncertainty and enhancing the chances of achieving desired outcomes.

Understanding Risk in Investments

Every financial decision carries some level of uncertainty. The key to successful wealth management is understanding, measuring, and managing these uncertainties. Risk in the financial world can stem from many sources, including market fluctuations, economic changes, and company-specific challenges. Recognizing the different types of risk allows individuals to make informed choices and build strategies that balance potential returns with acceptable levels of uncertainty.

Types of Financial Risk

There are several different types of risk that investors face, each requiring a specific approach to mitigate or manage. Market risk, which includes changes in interest rates or stock prices, can impact the value of assets in unpredictable ways. On the other hand, credit risk arises when an entity or individual fails to meet their financial obligations. Understanding the unique characteristics of each type of risk is crucial to building a resilient strategy.

Measuring and Managing Risk

While risk cannot be entirely avoided, it can be quantified and controlled. Key tools such as diversification, asset allocation, and hedging strategies help minimize potential losses. A diversified portfolio spreads risk across multiple assets, which can help reduce the impact of negative events in any one area. Regularly reviewing and adjusting your risk tolerance is also essential to ensure that your strategy remains aligned with your long-term financial goals.

Investment Valuation Methods Explained

Evaluating the worth of an asset or financial instrument is a critical step in making informed decisions. By using various valuation techniques, one can determine whether an asset is overvalued or undervalued relative to its potential future performance. Understanding the different methods available allows individuals to choose the right approach based on their goals, the asset type, and available information.

There are several widely recognized techniques for estimating the value of assets, each focusing on different factors. Some methods are rooted in analyzing past performance, while others focus on future projections. Below are some of the most common approaches:

Discounted Cash Flow (DCF)

This method calculates the present value of an asset based on its projected future cash flows, adjusted for the time value of money. The DCF method is often used to evaluate companies, real estate, or projects where future earnings can be reliably predicted. A higher discount rate indicates higher perceived risk, while a lower rate suggests more certainty about future returns.

Comparable Company Analysis

Comparable company analysis involves comparing a company’s financial metrics with those of similar firms in the same industry. Key ratios such as the price-to-earnings (P/E) ratio or price-to-sales (P/S) ratio are commonly used. This approach relies on the idea that similar companies should trade at similar multiples, making it easier to estimate the value of a company based on market standards.

Precedent Transactions

This method looks at historical transactions involving similar assets to establish a benchmark for valuation. By analyzing the prices paid for comparable assets in the past, one can derive a reasonable estimate of value. This approach is especially useful in mergers, acquisitions, or other scenarios where comparable transactions can be easily identified.

Asset-Based Valuation

Asset-based valuation focuses on the value of an asset’s underlying components, such as its tangible assets or intellectual property. This method is typically used for real estate or companies with significant physical assets, as it helps provide a clear picture of what the assets are worth, independent of future earnings potential.

Each method has its strengths and weaknesses, and the best approach will depend on the asset being evaluated and the specific context. By combining multiple techniques, individuals can arrive at a more accurate and reliable valuation, increasing the chances of making profitable decisions.

Analyzing Stocks and Bonds

Understanding how to assess the potential of different financial instruments is essential for making informed decisions. Stocks and bonds are two of the most common forms of assets, each offering distinct advantages and risks. Analyzing these instruments requires an understanding of their underlying characteristics, market performance, and the factors that influence their value. By mastering the techniques used to evaluate both, investors can build a strategy that aligns with their financial goals.

Stocks Analysis

Stocks represent ownership in a company, and their value is influenced by both internal company performance and external market factors. To analyze stocks, investors typically look at several key metrics:

- Price-to-Earnings (P/E) Ratio: This ratio compares the price of a stock to its earnings per share, giving an indication of whether a stock is overvalued or undervalued relative to its earnings potential.

- Dividend Yield: For investors seeking regular income, the dividend yield shows the percentage return based on the dividend payout relative to the stock price.

- Growth Potential: Examining historical earnings growth and future projections helps investors assess the potential for continued appreciation in stock value.

- Debt Levels: A company’s debt-to-equity ratio is crucial in determining its financial stability. High debt levels can increase risk, especially if the company is unable to meet its obligations during economic downturns.

Bonds Analysis

Bonds are fixed-income securities that provide regular interest payments and return the principal amount at maturity. The analysis of bonds involves understanding both the creditworthiness of the issuer and the terms of the bond itself:

- Credit Rating: The credit rating of the bond issuer gives insight into the risk of default. Higher ratings indicate lower risk, while lower ratings suggest a higher probability of default.

- Yield to Maturity (YTM): YTM represents the total return an investor can expect to earn if the bond is held to maturity. It accounts for both the bond’s current price and the interest payments received.

- Duration: Bond duration measures the sensitivity of a bond’s price to interest rate changes. The longer the duration, the more volatile the bond’s price will be when rates fluctuate.

By carefully analyzing both stocks and bonds, investors can make more informed decisions about how to allocate their assets in order to achieve their desired risk-reward balance.

Impact of Economic Factors on Investments

The performance of financial assets is influenced by a wide range of economic factors. These factors can have a profound effect on both short-term and long-term returns, shaping the decisions made by individuals and institutions alike. Understanding how economic conditions, such as inflation, interest rates, and economic growth, impact the value of assets is crucial for making sound financial decisions. By staying informed on these external conditions, investors can adjust their strategies to mitigate risk and capitalize on opportunities.

Inflation and Its Influence

Inflation is one of the most significant economic factors affecting the value of assets. As prices rise over time, the purchasing power of money decreases, impacting both stock prices and the value of bonds. For investors, inflation can erode the real returns of fixed-income securities, while equities may react differently depending on the company’s ability to pass on higher costs to consumers. Understanding the rate of inflation and its potential impact on different types of assets is key for managing risk effectively.

Interest Rates and Asset Valuation

Interest rates directly influence the cost of borrowing and the returns on fixed-income investments. When rates rise, borrowing becomes more expensive, which can lead to lower consumer spending and reduced corporate profits. This, in turn, can negatively affect stock prices. For bonds, rising interest rates lead to lower prices since the fixed interest payments become less attractive compared to newly issued bonds with higher yields. Conversely, when rates fall, it can boost asset prices, making it an essential factor to monitor when analyzing financial markets.

Investment Portfolio Diversification Strategies

Building a well-rounded financial strategy involves spreading risk across different assets and sectors. By diversifying, investors can reduce the impact of a poor-performing asset on the overall portfolio. A diversified approach helps to balance potential returns while minimizing the risk of significant losses. The key to successful diversification is understanding the correlation between various types of assets and how they perform under different economic conditions.

There are several approaches to diversifying a portfolio effectively. Below are some of the most common strategies that can help optimize risk-adjusted returns:

- Asset Class Diversification: By allocating funds across various asset types, such as stocks, bonds, commodities, and real estate, investors can reduce risk. Different asset classes tend to react differently to market events, which helps to smooth out fluctuations in the overall portfolio.

- Geographic Diversification: Expanding a portfolio beyond domestic markets to include international assets can provide exposure to different economies. This strategy can help reduce the impact of local economic downturns and take advantage of growth opportunities in other regions.

- Sector Diversification: Investing in a range of industries, such as technology, healthcare, energy, and consumer goods, allows for broader exposure to economic cycles. Some sectors may perform well in times of growth, while others are more resilient during periods of economic stress.

- Investment Style Diversification: Combining different investment strategies, such as growth, value, and income investing, can help capture a variety of market opportunities. This approach allows for balancing high-risk, high-reward investments with more stable, income-generating assets.

- Time Horizon Diversification: Staggering investments based on time horizons can reduce risk by aligning short-term and long-term goals. Short-term investments may focus on liquidity and stability, while long-term assets can be more growth-oriented, taking advantage of compounding returns over time.

By applying these diversification strategies, investors can better position themselves to weather market volatility while working toward their financial goals. A well-diversified portfolio not only manages risk but also enhances the potential for consistent, long-term returns.

Preparing for an Investment Exam

Successfully navigating an evaluation of financial knowledge requires careful planning, dedication, and an understanding of key concepts. Whether the goal is to assess your understanding of markets, strategies, or financial instruments, preparation plays a crucial role in achieving a strong result. Approaching the process with a clear strategy allows you to efficiently review essential material and sharpen your problem-solving skills.

Effective Study Techniques

Preparation begins with organizing your study materials and focusing on the most critical topics. Here are some effective strategies to help streamline your preparation:

- Create a Study Schedule: Break down your study sessions into manageable chunks. Set specific goals for each session and prioritize difficult topics first.

- Use Practice Tests: Simulating the actual test environment helps build familiarity with the format and improves time management. Practicing under timed conditions can reduce anxiety during the actual evaluation.

- Review Key Concepts: Focus on foundational concepts, such as risk management, asset valuation, and market behavior. Understanding the basics will help you approach complex scenarios with confidence.

- Use Flashcards: Flashcards are a great way to memorize key terms and formulas. Reviewing them regularly will reinforce your understanding and retention of important information.

- Join Study Groups: Collaborating with peers allows you to discuss challenging topics and gain new perspectives. It also helps to stay motivated and engaged.

Staying Calm and Focused

While preparation is key, maintaining mental clarity during the process is equally important. Here are a few tips to stay focused and calm:

- Take Breaks: Avoid burnout by taking regular breaks. Short, frequent breaks help refresh your mind and improve concentration.

- Get Enough Rest: Ensure you’re well-rested before the evaluation. Adequate sleep improves cognitive function and helps retain information.

- Stay Positive: Maintaining a positive attitude reduces stress and boosts your confidence. Trust your preparation and stay optimistic about the outcome.

By incorporating these strategies, you’ll enhance your ability to navigate the process successfully. Consistent preparation, coupled with a calm mindset, will help ensure that you’re ready to tackle the challenges ahead with confidence.

Practice Questions for Investment Exams

One of the best ways to prepare for an assessment of financial knowledge is by engaging in practice exercises that simulate the actual evaluation. By working through various scenarios, you can familiarize yourself with the format and identify areas that require more focus. These exercises test your understanding of key concepts, strengthen problem-solving skills, and help you build confidence for the real evaluation.

Below are some sample exercises to help you prepare:

Sample Practice Scenarios

- Understanding Risk in Portfolios: Given a portfolio consisting of stocks, bonds, and real estate, determine the risk level based on current market conditions. How would changes in interest rates or economic growth impact this portfolio?

- Calculating Returns: A stock was purchased for $50 and sold for $75 after one year. Calculate the return on investment and the annual percentage return. What factors could affect the future returns of this stock?

- Market Behavior Analysis: The price of gold has increased significantly over the past six months. What are the likely factors driving this change, and how should an investor adjust their strategy in response to market volatility?

- Debt and Equity Evaluation: A company has a debt-to-equity ratio of 1.5. What does this indicate about the company’s financial structure? How might this ratio affect its ability to attract investors?

Key Focus Areas

When practicing, make sure to focus on the following key areas:

- Asset Allocation: Understand how different types of assets perform under various economic conditions and how to optimize asset distribution for risk and return.

- Valuation Techniques: Get comfortable with various methods of valuing financial instruments, such as discounted cash flow analysis or price-to-earnings ratio.

- Market Indicators: Learn how to interpret financial indicators such as interest rates, inflation, and economic growth, and understand how they affect asset prices.

- Risk Management: Study different ways to mitigate risk in an investment portfolio, including diversification, hedging, and using different time horizons.

Regularly working through these types of exercises will not only enhance your ability to apply theoretical knowledge but also help you improve your speed and accuracy when approaching challenges in the real evaluation.

Investment Exam Time Management Tips

Effective time management is crucial to performing well in a financial evaluation. Proper planning and pacing ensure that each section is completed without unnecessary pressure, allowing you to allocate sufficient time for both easy and difficult parts. Organizing your approach and staying focused are key to navigating the process efficiently.

Allocating Time Wisely

When faced with a time-constrained assessment, managing your available time is essential. Follow these tips to distribute your time effectively:

- Plan Ahead: Before you begin, review the structure of the assessment and decide how long to spend on each section. Prioritize based on the complexity and length of each part.

- Start with Easy Tasks: Tackle simpler tasks first to build confidence and gain momentum. This will allow you to approach the more difficult sections with a clearer mind.

- Set a Timer: Keep track of time by using a timer or stopwatch. This will help you stay aware of your pace without constantly glancing at the clock.

- Save Difficult Tasks for Later: If you encounter a challenging task, don’t get stuck. Move on to other tasks and return to the harder ones once you’ve completed the easier ones.

Staying Focused and Efficient

Maximizing efficiency involves more than just time management; maintaining focus and staying organized are just as important. Here are a few strategies:

- Avoid Multitasking: Focus on one task at a time. Multitasking may seem efficient but can reduce your concentration and lead to mistakes.

- Break Down Complex Tasks: If a task feels overwhelming, break it into smaller, more manageable steps. This will keep you on track and reduce stress.

- Don’t Overthink: Trust your knowledge and instincts. If you find yourself spending too much time on a particular task, move on and come back to it later with a fresh perspective.

- Stay Calm: Don’t let time pressure cause anxiety. Take deep breaths, stay composed, and focus on each task one at a time.

By managing your time effectively and staying organized, you’ll be able to approach each task with confidence, ensuring that you complete everything within the available time while maintaining a high level of accuracy.

How to Stay Focused During Exams

Maintaining concentration throughout a high-pressure evaluation is essential for success. Distractions can easily derail your progress, so it’s important to develop strategies that help keep your mind sharp and focused on the task at hand. Effective focus management ensures you make the most of your time, answer each section carefully, and remain calm under pressure.

Techniques to Enhance Focus

Staying focused requires both mental discipline and practical strategies. Here are some approaches to help you maintain concentration:

- Get Plenty of Rest: A well-rested mind performs better. Ensure you get enough sleep the night before to prevent fatigue from affecting your performance.

- Minimize Distractions: Set up your environment for success by removing potential distractions. Silence your phone, avoid unnecessary tabs on your computer, and work in a quiet space.

- Break Tasks into Segments: Focus on one task at a time. If you’re overwhelmed by the amount of material, break it down into smaller, manageable parts to maintain clarity.

- Stay Hydrated and Nourished: Proper nutrition can greatly improve cognitive function. Drink water and have a light, healthy snack if needed to stay energized.

- Practice Mindfulness: If you feel distracted, take a few deep breaths to regain focus. A short moment of mindfulness can reset your mind and help you refocus on the task.

Stay Calm and Confident

It’s normal to feel nervous during an evaluation, but anxiety can hinder your ability to focus. Here are ways to stay calm:

- Positive Self-Talk: Replace negative thoughts with affirmations. Remind yourself of the preparation you’ve done and the knowledge you have.

- Time Management: Break the evaluation into timed sections. Having a structured timeline will help you avoid feeling rushed and keep your mind on track.

- Visualization: Before beginning, take a moment to visualize yourself working through the tasks confidently. Mental preparation can set the tone for focused performance.

By adopting these strategies, you can maintain your focus throughout the entire process, ensuring you perform at your best and make the most of the time available.

Key Takeaways from Investment Exams

After completing a financial evaluation, it’s important to reflect on the key lessons learned. These takeaways not only highlight the areas where you performed well but also provide insight into the concepts that need further attention. Understanding these core points is crucial for continued learning and improvement in the future.

Critical Concepts to Retain

There are several important takeaways that can guide your future learning and sharpen your expertise:

- Thorough Understanding of Core Principles: Deep knowledge of the foundational principles, such as risk management, portfolio diversification, and valuation techniques, is essential for success in any financial evaluation.

- Time Management is Key: Being able to allocate time effectively across different tasks ensures that you complete each section with the right level of focus and accuracy.

- Focus on Practical Application: The ability to apply theoretical knowledge to real-world scenarios is critical. Practice with case studies and simulations to improve your practical understanding.

- Confidence and Clarity in Decision-Making: Building confidence in your knowledge helps to reduce anxiety and enables clearer decision-making under pressure.

Areas for Future Improvement

Reflecting on your performance will also reveal areas that may require more attention in the future:

- Review Weak Areas: Identify any sections where you struggled and make a plan to review those topics more thoroughly. This targeted approach will enhance your understanding.

- Practice Time Management: If you found yourself rushing through certain tasks, consider practicing with timed simulations to improve your pacing.

- Seek Feedback: Don’t hesitate to seek feedback from peers or mentors to get a fresh perspective on your strengths and weaknesses.

By reflecting on these key takeaways, you can better prepare for future evaluations and continue to build on your knowledge and skills.