When preparing for an evaluation on financial principles, understanding core concepts is essential. The key to excelling lies not just in memorizing formulas, but in being able to apply knowledge effectively to various scenarios. Familiarity with different types of challenges that could arise during testing will greatly improve your confidence and performance.

By focusing on the most commonly assessed topics, you can build a solid foundation. This guide aims to provide you with practical tips and examples to navigate through complex tasks with ease. From basic calculations to in-depth analyses, knowing what to expect can make all the difference when faced with a time-sensitive task.

It is important to approach your preparation with a strategic mindset. Understanding the structure of potential inquiries allows you to allocate time efficiently, ensuring that no topic is overlooked. With the right preparation, you can tackle any challenge with clarity and precision.

Management Accounting Exam Questions and Answers

When preparing for an assessment focused on financial strategies, it’s crucial to understand both theoretical principles and their real-world applications. Gaining familiarity with the types of tasks typically presented allows for more effective preparation, helping you confidently tackle a wide range of challenges. Whether you are facing numerical calculations or scenario-based analyses, practicing regularly is the key to mastering each section.

Types of Challenges You May Encounter

Different sections often require various approaches. Some common types of inquiries include:

- Calculations – These tasks test your ability to apply formulas and financial models to solve problems accurately.

- Explanations – Understanding key concepts and being able to describe their relevance in specific contexts is essential.

- Application – Scenario-based problems require you to use your knowledge to analyze a situation and propose solutions.

Effective Strategies for Success

To succeed, it’s important to focus on key techniques that help you answer each type of challenge efficiently:

- Familiarize yourself with common formulas – Practice applying them in different contexts so you can recognize when and how to use them.

- Understand the principles – Don’t just memorize; make sure you understand why each concept matters in real-world financial situations.

- Time management – During the test, allocate time wisely between tasks. Ensure you have enough time for more complex inquiries.

With thorough preparation and focused practice, you can approach any task with confidence, ensuring that you are well-equipped to perform well and demonstrate your knowledge effectively.

Key Concepts in Management Accounting

In any financial evaluation, understanding the foundational principles is essential to success. These concepts form the bedrock upon which all calculations and decision-making are based. A solid grasp of these ideas ensures that you can approach problems methodically, applying the right techniques to yield accurate and insightful results.

Here are some core ideas to focus on during your preparation:

| Concept | Description |

|---|---|

| Cost Behavior | Understanding how costs change with variations in production levels, and how fixed, variable, and mixed costs impact overall financial performance. |

| Break-even Analysis | Identifying the point at which total revenues equal total costs, meaning there is no profit or loss. |

| Budgeting | Creating financial plans that forecast future income and expenditures, helping businesses manage their resources efficiently. |

| Variance Analysis | Analyzing the differences between budgeted and actual figures to understand performance discrepancies. |

| Activity-Based Costing | Allocating overhead costs based on the activities that drive costs, rather than relying on a single cost driver like labor hours. |

Familiarizing yourself with these concepts will help you understand the practical applications in a financial environment and improve your ability to analyze various situations effectively. Each concept builds on the other, so mastering these core ideas is vital for solving complex financial problems efficiently.

Understanding Cost Behavior for Exams

One of the most crucial aspects to grasp in any financial assessment is how different expenses react to changes in activity levels. Whether the output increases or decreases, the ability to categorize costs correctly is essential for accurate analysis. By understanding how costs behave, you can make informed decisions and respond to financial challenges effectively during evaluations.

Types of Cost Behavior

Costs generally fall into three categories based on how they behave when activity levels change:

- Fixed Costs – These costs remain constant regardless of the volume of goods produced or services rendered.

- Variable Costs – These costs fluctuate directly with the level of output.

- Mixed Costs – These contain both fixed and variable elements, meaning part of the cost remains the same while another part changes with activity levels.

How to Approach Cost Behavior in Assessments

To tackle cost-related problems efficiently, consider the following strategies:

- Identify the cost structure – Determine whether costs are fixed, variable, or mixed. This will guide your calculations and ensure accurate results.

- Apply relevant formulas – For variable costs, use per-unit rates. For fixed costs, remember they do not change regardless of production levels.

- Use real-world examples – Relate theoretical concepts to practical scenarios to better understand how cost behavior impacts financial performance.

Mastering the concept of cost behavior allows you to predict financial outcomes more accurately and manage resources more effectively. Understanding these principles will help you approach problems with clarity and precision in any situation.

Preparing for Variance Analysis Questions

Variance analysis is a vital skill in evaluating financial performance, as it highlights the differences between expected and actual results. Understanding how to analyze these discrepancies is crucial for making informed decisions. Preparing for this type of assessment involves not just recognizing the causes of variances but also understanding the broader implications for financial planning and control.

Key Types of Variance

Variances are typically categorized into several types based on their nature:

- Price Variance – The difference between the expected cost of inputs and the actual cost incurred.

- Quantity Variance – The difference between the expected quantity of inputs and the actual quantity used.

- Efficiency Variance – The variance that arises when the input usage is more or less efficient than planned.

- Volume Variance – The difference in results caused by changes in the level of activity or production.

Steps for Analyzing Variances

When preparing to address variance-related tasks, follow these steps:

- Calculate the variance – Subtract the budgeted or standard amount from the actual amount to identify the difference.

- Determine the cause – Analyze whether the variance is due to price changes, usage inefficiencies, or changes in production levels.

- Interpret the impact – Assess whether the variance indicates an improvement or a potential issue that needs corrective action.

Mastering the process of variance analysis helps in identifying trends and areas that need attention, ensuring more effective decision-making. Understanding these concepts prepares you to handle variance-related tasks with confidence, demonstrating your ability to assess financial performance accurately.

Important Ratios for Management Accounting

In financial evaluations, ratios are essential tools that help assess a company’s performance, financial stability, and operational efficiency. These metrics provide valuable insights into areas such as profitability, liquidity, and leverage. Understanding which ratios to focus on during assessments is crucial for making informed financial decisions and accurately interpreting results.

Here are some of the key ratios you should be familiar with:

- Profit Margin – This ratio measures the profitability of a company, indicating how much of each dollar of revenue translates into profit.

- Return on Assets (ROA) – A measure of how effectively a company uses its assets to generate profit, showing the efficiency of asset utilization.

- Current Ratio – This ratio helps assess a company’s ability to cover its short-term liabilities with its short-term assets, indicating liquidity.

- Quick Ratio – A more conservative measure of liquidity that excludes inventory from current assets, focusing on more liquid assets.

- Debt-to-Equity Ratio – This ratio indicates the proportion of debt used to finance the company’s assets, providing insight into the firm’s financial leverage.

- Inventory Turnover – A ratio that measures how efficiently a company manages its inventory, indicating how many times inventory is sold and replaced over a period.

By understanding and calculating these ratios, you gain a clearer picture of a company’s financial health and operational efficiency. These metrics help you make better predictions and decisions, ensuring your ability to respond accurately to financial scenarios during any evaluation.

Budgeting Techniques You Must Know

Creating a solid financial plan is essential for any business or personal financial strategy. Effective budgeting techniques allow you to forecast expenses, allocate resources efficiently, and control costs. Familiarity with various budgeting methods is key to choosing the right approach for different financial scenarios. These techniques not only help you manage day-to-day operations but also guide long-term strategic planning.

Types of Budgeting Techniques

There are several approaches to budgeting, each suited to different needs and objectives. Below are some of the most commonly used methods:

| Technique | Description |

|---|---|

| Zero-Based Budgeting | Starts from scratch each period, where every expense must be justified, ensuring that only necessary expenditures are included. |

| Incremental Budgeting | Involves adjusting the previous period’s budget by adding or subtracting from the existing figures, based on projected changes. |

| Flexible Budgeting | Allows for adjustments based on actual performance, making it useful for businesses with variable income or expenses. |

| Activity-Based Budgeting | Focuses on budgeting for specific activities, ensuring that resources are allocated based on the cost drivers of each activity. |

| Rolling Budgeting | Updates the budget on a continuous basis, adding new months as the year progresses to ensure constant reevaluation. |

How to Choose the Right Approach

Choosing the appropriate budgeting technique depends on factors like the size of the organization, the level of uncertainty, and the available data. Consider these points when selecting the right method:

- Assess your financial goals – Align your budgeting method with the specific objectives you want to achieve.

- Understand your cost structure – Choose a technique that matches the way your expenses fluctuate and evolve.

- Monitor performance – Regularly review the budget’s effectiveness to ensure it’s helping you meet your financial targets.

By mastering these budgeting techniques, you can improve financial control and ensure that your resources are being used efficiently. Whether for personal use or business management, a well-crafted budget is an essential tool for long-term success.

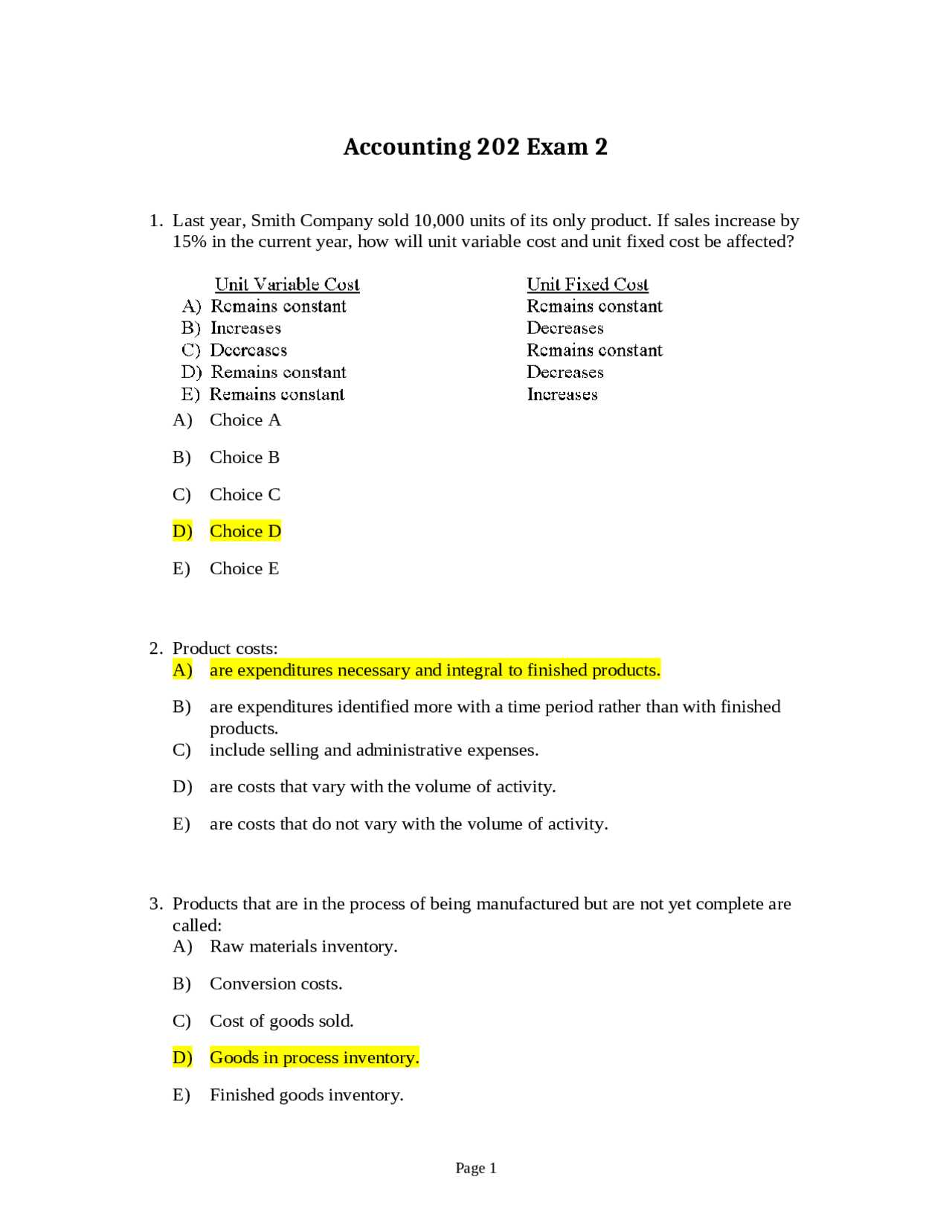

Common Multiple Choice Exam Questions

Multiple-choice assessments often test a wide range of concepts, including theory, calculations, and application of key principles. Understanding the most frequently asked topics can help you prepare effectively. These questions typically assess your ability to apply concepts in different contexts, testing both your knowledge and analytical skills.

Here are some of the common types of multiple-choice items that often appear in financial evaluations:

- Cost Behavior Analysis – Questions may focus on identifying how different types of costs change with variations in production levels, such as fixed, variable, or mixed costs.

- Break-Even Calculations – You may be asked to determine the break-even point based on given data, testing your understanding of cost-volume-profit relationships.

- Ratio Analysis – These questions will require you to compute and interpret key financial ratios such as profitability, liquidity, and leverage ratios.

- Budgeting Techniques – Questions often ask for the selection or evaluation of different budgeting approaches, assessing your understanding of zero-based, incremental, or flexible methods.

- Variance Analysis – You might be asked to calculate or interpret variances, such as material, labor, or overhead variances, based on standard costs and actual outcomes.

To answer these questions effectively, it’s important to be familiar with the formulas and the steps involved in each type of analysis. Practice with a variety of problem-solving scenarios will help you build confidence and improve accuracy in selecting the correct response.

How to Tackle Short Answer Questions

Short response tasks require a direct and focused approach. These types of questions typically test your ability to recall key information, apply concepts quickly, and provide concise explanations. The key is to structure your answer in a clear, organized manner while ensuring all the necessary points are addressed.

Steps for Effectively Responding

When approaching short response items, keep the following steps in mind:

- Read Carefully – Ensure you understand exactly what the question is asking. Look for key terms and directives, such as “define,” “explain,” or “calculate.”

- Plan Your Answer – Quickly outline the main points you need to cover before writing your response. This helps you stay focused and ensures you address all aspects of the question.

- Be Concise – Provide a clear and to-the-point response. Avoid unnecessary elaboration or filler; short answers should be direct and relevant.

- Use Examples – When appropriate, use examples to clarify or support your explanation. Real-world applications can strengthen your answer and demonstrate your understanding.

Tips for Structured Responses

To improve the quality of your response, use the following guidelines:

| Strategy | Purpose |

|---|---|

| Use Bullet Points | Helps organize thoughts and ensures all critical aspects are covered in a readable manner. |

| Highlight Keywords | Ensure clarity by emphasizing important terms and concepts to make your response easier to follow. |

| Stay Focused | Avoid straying from the core topic. Stick to the question’s requirements without adding unrelated details. |

By following these steps and focusing on clarity, you can improve your ability to tackle short response items effectively, demonstrating both your knowledge and your ability to communicate it clearly.

Strategic Planning in Management Accounting

Strategic planning is a critical component for any organization aiming to align its operations with long-term objectives. It involves creating a roadmap that guides decision-making, resource allocation, and performance evaluation. Effective planning ensures that resources are optimally utilized to achieve organizational goals, while helping to anticipate and mitigate potential risks.

Key Elements of Strategic Planning

A well-rounded strategic plan incorporates several key components that shape its direction and effectiveness. These elements serve as the foundation for any business strategy and provide a structured approach to achieving the desired outcomes:

| Component | Description |

|---|---|

| Objective Setting | Defining clear, measurable, and time-bound goals that guide the organization’s efforts toward desired outcomes. |

| Resource Allocation | Distributing resources (capital, labor, and technology) efficiently to support strategic priorities. |

| Risk Management | Identifying potential risks and developing strategies to mitigate them, ensuring the organization can adapt to changes. |

| Performance Monitoring | Tracking progress through key performance indicators (KPIs) to ensure the plan stays on course and adjustments are made when necessary. |

Importance of Financial Insights in Planning

Financial data plays a pivotal role in guiding strategic decisions. By analyzing past performance, forecasting future trends, and evaluating various financial metrics, organizations can make informed choices that support long-term goals. Strategic planning relies heavily on the ability to interpret financial indicators and align them with broader business objectives, ensuring sustainable growth and profitability.

Cost-Volume-Profit Analysis Explained

Cost-volume-profit (CVP) analysis is a powerful tool used to understand the relationship between costs, sales volume, and profitability. By analyzing these variables, businesses can make informed decisions regarding pricing, production levels, and product mix. The analysis helps predict how changes in these factors will impact financial performance, making it an essential element of financial planning and decision-making.

At the core of CVP analysis is the concept of contribution margin, which represents the amount of revenue left after variable costs are subtracted. This margin contributes toward covering fixed costs and generating profit. By understanding this relationship, businesses can determine how much they need to sell to break even or reach a desired level of profit.

Key elements in cost-volume-profit analysis include:

- Fixed Costs – These costs remain constant regardless of the level of production or sales.

- Variable Costs – These costs fluctuate in direct proportion to the level of production or sales.

- Contribution Margin – The difference between sales revenue and variable costs, indicating how much is available to cover fixed costs.

- Break-even Point – The level of sales at which total revenues equal total costs, resulting in neither profit nor loss.

- Profitability Analysis – The process of determining how changes in volume, costs, and pricing affect profitability.

By using CVP analysis, businesses can determine the best course of action to maximize profitability, set sales targets, or evaluate the potential impact of cost changes. This analysis is valuable for both short-term decision-making and long-term strategic planning.

Common Pitfalls in Management Accounting Exams

When preparing for assessments related to financial management, students often encounter several challenges that can lead to mistakes. These errors may arise from misunderstandings of concepts, poor time management, or careless calculations. Recognizing these pitfalls can help students avoid common traps and improve their performance during evaluations.

Lack of Understanding of Key Concepts

One of the most frequent mistakes is the inability to fully grasp essential principles. Without a solid understanding of core ideas, such as cost structures, financial performance analysis, or budget planning, it becomes difficult to apply them correctly in real-world scenarios. To avoid this, students should focus on mastering the fundamentals before attempting complex problems.

Overlooking Details in Questions

Another common issue is missing critical details within the task instructions. Small but important details–like whether a question asks for gross profit or net profit, or whether a cost should be treated as fixed or variable–can easily be overlooked under exam pressure. Carefully reading each question and noting key terms can prevent such oversights.

- Failure to Interpret Data Correctly – Misunderstanding financial data or misapplying formulas can lead to incorrect results.

- Time Management Issues – Spending too much time on one question and not leaving enough time for others can result in unfinished work.

- Not Showing Work Clearly – Leaving out intermediate steps or calculations can confuse evaluators and lead to lost marks, even if the final answer is correct.

By being mindful of these common mistakes and taking steps to address them, students can improve their chances of success in assessments and confidently navigate any challenge that comes their way.

Time Management Tips for Exam Day

Effective time management during assessments is crucial for maximizing performance and reducing stress. Being able to allocate sufficient time for each task while ensuring that you don’t rush through the more complex questions is key to success. By following a structured approach, you can complete each section efficiently and leave enough time for review.

- Plan Ahead – Before starting, quickly skim through the entire paper to get an overview of all the tasks. This allows you to estimate how long each section will take and prioritize accordingly.

- Allocate Time for Each Section – Divide your available time between different sections based on their weight or difficulty. For example, if one section carries more marks, allocate extra time to it.

- Start with Easier Tasks – Begin with the questions or tasks you find easiest. This boosts confidence and ensures that you are making steady progress early on.

- Avoid Overthinking – Don’t dwell too long on a single question. If you’re stuck, move on and return to it later with a fresh perspective.

Maintain Pace Throughout

It’s important to maintain a steady pace throughout the assessment to avoid running out of time. Monitor your progress periodically, and if you find yourself falling behind, adjust your approach by speeding up on easier tasks or revisiting time management during breaks.

- Monitor the Clock – Regularly check the time to stay aware of how much is left. Consider setting mini-deadlines for each section or question.

- Don’t Rush the Final Answer – Make sure to leave some time to check your work before submitting. A final review could catch any small mistakes or oversights.

By following these strategies, you can manage your time effectively, reduce anxiety, and improve your performance during the assessment.

How to Approach Long Essay Questions

Long essay tasks require a strategic approach to ensure that you address all aspects of the prompt while organizing your thoughts clearly and coherently. Unlike short questions, these tasks give you the opportunity to delve deeper into a subject, but they also demand more careful planning and structured responses.

- Understand the Prompt – Begin by carefully reading the instructions. Identify the key themes or concepts that you need to discuss and ensure you understand what is being asked. Look for any keywords that specify the type of response expected.

- Plan Before Writing – Spend a few minutes outlining your response before starting to write. This plan should include your main arguments, examples, and a logical structure for your essay. A clear outline can help you stay focused and organized as you write.

- Answer the Question Fully – Ensure that your response addresses all parts of the task. Don’t just focus on one aspect; be sure to cover every angle that the prompt asks you to explore. This shows that you fully understand the subject matter.

Craft a Clear Structure

A well-organized essay makes it easier for you to express your ideas clearly. Structure your response into distinct sections, each serving a specific purpose in supporting your argument or analysis.

- Introduction – Briefly introduce the topic and outline the points you will cover. This gives the reader a roadmap for your essay.

- Main Body – Break the body into paragraphs, each focusing on a single point or argument. Start each paragraph with a clear topic sentence, followed by supporting details, examples, or explanations.

- Conclusion – Summarize your main points and offer a final thought or conclusion. Avoid introducing new information here, as the conclusion should wrap up the discussion logically.

By following these steps and ensuring that you stay focused and organized throughout, you can effectively tackle long essay assignments with confidence and clarity.

Using Real-Life Examples in Answers

Incorporating real-world scenarios into your responses helps to demonstrate a deeper understanding of the topic and makes your arguments more relatable. By connecting theory to practical examples, you can provide a more comprehensive and compelling explanation that resonates with readers or evaluators. Real-life situations also show how concepts apply outside of the classroom, which can be particularly useful for illustrating complex ideas.

When including real-life examples in your responses, it’s important to choose relevant and specific cases that align with the topic being discussed. Whether you are referencing case studies, industry trends, or personal experiences, your examples should be clear, concise, and directly related to the concepts at hand.

- Choose Relevant Cases – Ensure that the examples you provide are closely related to the core ideas you are explaining. Irrelevant examples can detract from your argument and may confuse your reader.

- Explain the Connection – Don’t just drop examples without context. Be sure to explain how the real-life situation connects to the theoretical concepts you are discussing, making it clear how the example enhances your argument.

- Use Variety – Where appropriate, use a variety of examples from different industries or fields. This shows that you understand how the topic can apply in different contexts and helps to enrich your response.

Using practical examples not only strengthens your argument but also helps to make complex topics more understandable. By demonstrating how abstract theories manifest in real-world situations, you are showing a well-rounded grasp of the material.

Best Practices for Exam Revision

Effective preparation is key to success when it comes to tackling assessments. The best approach involves a combination of active learning, time management, and understanding the underlying principles of the material. By adopting a structured revision strategy, you can ensure that you cover all necessary topics while also reinforcing your understanding of the key concepts.

Create a Structured Study Plan

A well-organized revision schedule is essential for staying on track. Start by breaking down the topics into manageable sections, allowing yourself enough time to cover each one thoroughly. Prioritize areas where you feel less confident, but make sure to review all material leading up to the assessment.

- Set Clear Goals – Define what you want to achieve in each revision session, whether it’s mastering a specific concept or practicing a set of problems.

- Stick to a Timetable – Allocate time for each topic and avoid procrastination. Regular study sessions will help to reinforce what you’ve learned.

- Review Progress – Take breaks to assess your understanding and adjust your plan if needed.

Utilize Active Learning Techniques

Rather than passively reading through notes, engage with the material actively. Practice applying concepts through exercises, mock tests, or by teaching others what you’ve learned. Active learning encourages better retention and a deeper understanding of the subject matter.

- Practice with Past Material – Use old assessments or example scenarios to simulate real conditions and get used to the format.

- Teach What You’ve Learned – Explaining concepts to others is an excellent way to reinforce your own understanding.

- Use Flashcards – For key terms or formulas, flashcards can be a quick and effective way to test your recall.

By integrating these strategies into your revision routine, you will approach the assessment with confidence, having a clear understanding of both the material and how to effectively apply it under timed conditions.

How to Interpret Financial Statements

Understanding the figures presented in financial documents is crucial for making informed decisions. These statements provide a snapshot of an organization’s financial health, allowing stakeholders to assess performance, liquidity, and profitability. By analyzing key components, you can uncover valuable insights into the overall stability and future potential of the entity.

Key Components of Financial Reports

There are several important elements in financial statements that help provide a comprehensive overview of a company’s performance. It’s essential to focus on specific sections and understand the relationships between them.

- Income Statement – This document shows the company’s revenues, expenses, and profit or loss over a specific period. It provides insights into operational efficiency and profitability.

- Balance Sheet – A snapshot of the company’s assets, liabilities, and equity at a particular point in time. It reveals the financial position and stability.

- Cash Flow Statement – This highlights the inflow and outflow of cash within the business, showing how well the company can generate cash to cover expenses.

Analyzing Key Ratios

By calculating and interpreting financial ratios, you can gain a deeper understanding of the company’s financial condition. These ratios help highlight areas of strength and concern in a more digestible format.

- Liquidity Ratios – Ratios like the current ratio or quick ratio measure the company’s ability to meet short-term obligations.

- Profitability Ratios – Metrics like return on assets (ROA) or return on equity (ROE) assess how well the company generates profit from its resources.

- Leverage Ratios – These ratios, such as the debt-to-equity ratio, examine the company’s debt level relative to its equity, indicating financial risk.

By focusing on these core elements and ratios, you can develop a clear picture of the company’s financial well-being and make more informed decisions based on your analysis.