Mastering the fundamental principles of economics is essential for success in any assessment. A deep understanding of core topics can significantly improve your ability to tackle various challenges related to market behavior, production theory, and consumer choices. By focusing on essential areas, you will be better prepared to address the most common topics that may appear in your academic evaluations.

When studying for this type of evaluation, it is crucial to focus on key areas such as supply and demand dynamics, cost structures, and the role of government in shaping market outcomes. Strengthening your grasp on these concepts will not only help you answer theoretical queries but will also enable you to apply this knowledge to real-world situations.

Effective preparation involves not just memorizing definitions but also practicing application-based problems. By reviewing past exercises and learning to approach complex scenarios logically, you will build the confidence needed to perform at your best. Mastery of these topics requires dedication, critical thinking, and a structured study plan.

Microeconomic Final Exam Questions and Answers

Preparing for academic assessments in economics involves mastering essential principles and learning to apply them effectively. By focusing on critical topics such as market dynamics, consumer behavior, and firm strategy, students can approach the evaluation with confidence. It is not just about recalling theories but understanding how to use this knowledge in practical scenarios.

Understanding supply and demand, elasticity, and production costs are fundamental to tackling any challenge that arises. Strong preparation emphasizes both theoretical understanding and practical problem-solving skills. Working through various problems will help you recognize patterns and apply the right techniques under pressure, leading to better results in assessments.

Through targeted practice, you can become adept at recognizing key economic concepts in different contexts. This approach allows you to strengthen your decision-making ability and sharpen your analysis, equipping you to address a variety of potential topics with accuracy and precision.

Key Concepts to Review Before the Exam

Before tackling any assessment in the field of economics, it is essential to focus on the core principles that underpin the subject. A solid grasp of foundational topics allows for easier navigation of complex scenarios, ensuring better problem-solving and analytical abilities. To prepare effectively, it is crucial to identify the key areas that frequently appear in academic exercises.

Here are some of the critical areas to focus on:

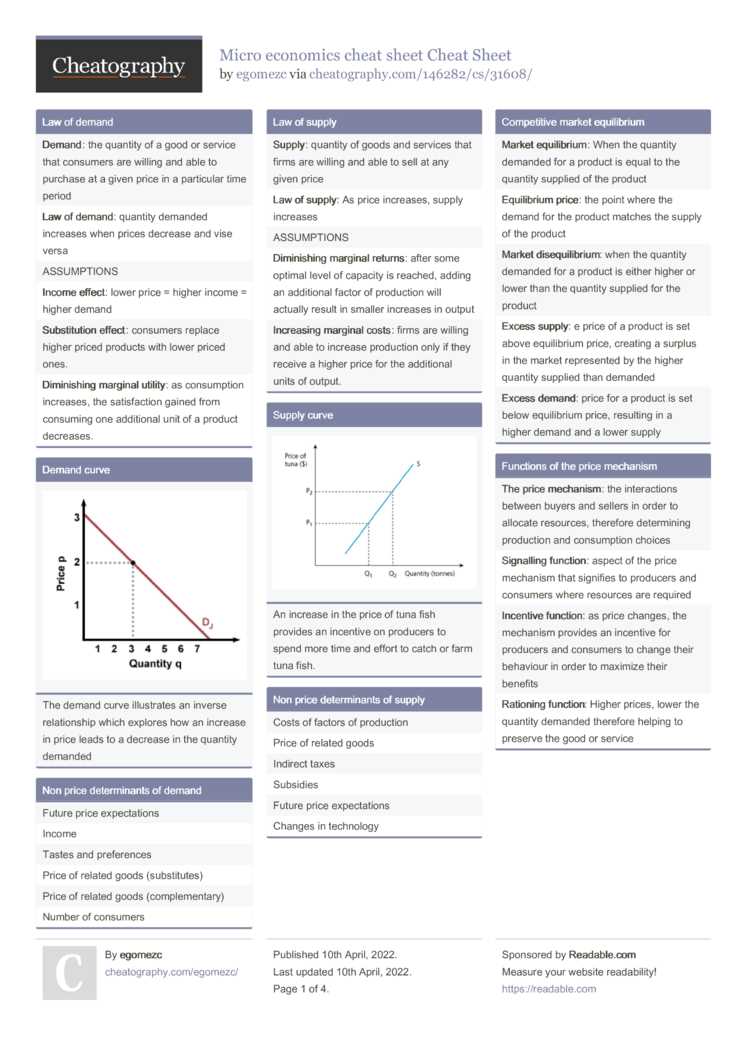

- Supply and Demand: Understand how shifts in supply or demand affect market equilibrium, prices, and quantities.

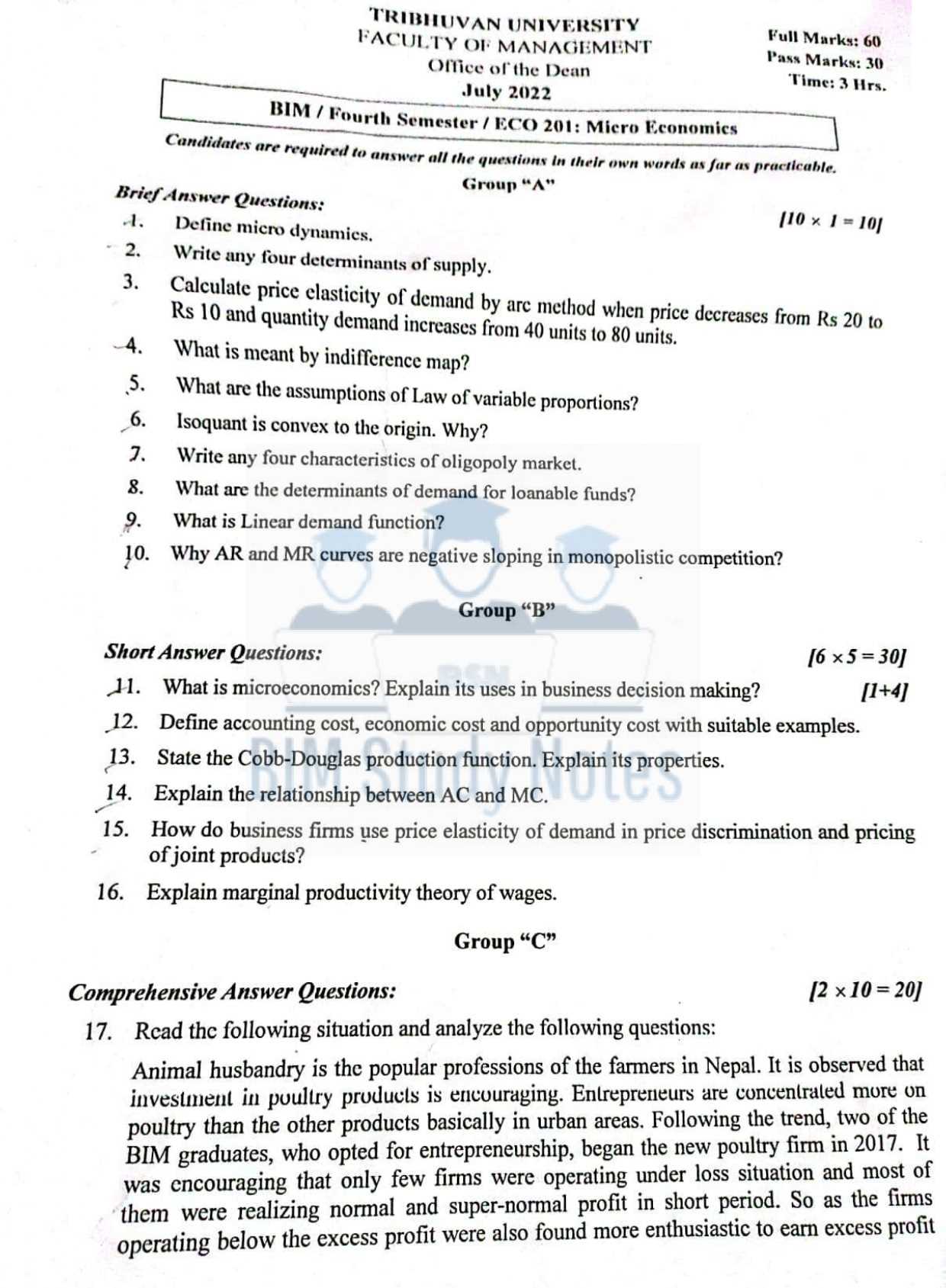

- Elasticity: Be able to calculate and interpret price elasticity, income elasticity, and cross-price elasticity.

- Cost Structures: Review the different types of costs (fixed, variable, total) and how they influence firm behavior.

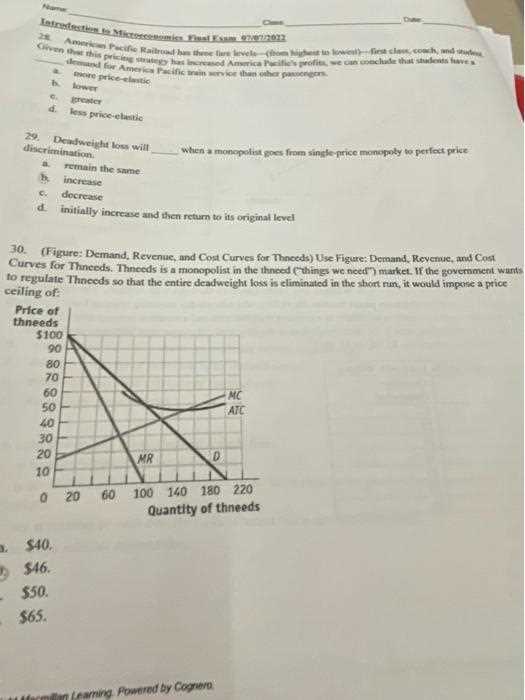

- Market Structures: Compare and contrast perfect competition, monopoly, oligopoly, and monopolistic competition.

- Consumer Behavior: Study the principles of utility, indifference curves, and consumer preferences.

- Profit Maximization: Understand how firms determine their optimal production levels to maximize profits.

Focusing on these topics will help you strengthen your understanding and improve your ability to apply these concepts in various scenarios. Make sure to review examples and solve related exercises to reinforce your knowledge and enhance your readiness.

Understanding Market Structures for Exams

Market structures are fundamental to the study of economics, as they explain how firms operate in different competitive environments. Understanding these structures is crucial for analyzing how businesses set prices, make production decisions, and interact with consumers. A clear grasp of these concepts is essential for solving problems related to pricing strategies, efficiency, and market outcomes.

Types of Market Structures

There are several types of market structures, each with unique characteristics and implications for competition and pricing:

- Perfect Competition: A market where many firms offer identical products, leading to no control over pricing and maximum efficiency.

- Monopoly: A single firm dominates the market, often leading to higher prices and lower output due to the lack of competition.

- Oligopoly: A market dominated by a few firms, where pricing and output decisions are interdependent and can lead to collusion.

- Monopolistic Competition: A market with many firms offering differentiated products, allowing for some control over pricing but still facing competition.

Implications of Market Structures

Each structure has different implications for efficiency, pricing, and the behavior of firms. For instance, in perfect competition, firms produce at an efficient scale with no economic profits, while in monopolies, firms may engage in price discrimination and reduce consumer welfare. Understanding these dynamics helps in analyzing real-world market behavior and predicting outcomes.

Demand and Supply Analysis Tips

Understanding the interplay between supply and demand is essential for analyzing market behavior. This fundamental concept helps explain how prices are determined and how changes in market conditions affect the availability of goods and services. Mastering this analysis will allow you to approach related problems with clarity and confidence.

Key Principles to Focus On

When analyzing the forces of supply and demand, keep in mind the following principles:

- Shift vs. Movement: Distinguish between a change in the quantity supplied or demanded (movement along the curve) and a shift in the curve itself (due to external factors like income, prices of related goods, etc.).

- Price Sensitivity: Understand how the elasticity of demand and supply can influence consumer and producer behavior. The more elastic the demand, the more responsive consumers are to price changes.

- Market Equilibrium: Know how to find equilibrium price and quantity, and understand how shifts in supply or demand can lead to shortages or surpluses.

Effective Strategies for Analysis

To apply these concepts effectively, follow these tips:

- Practice with Graphs: Regularly practice sketching supply and demand curves and identifying shifts. This will help solidify your understanding of how changes in external factors impact equilibrium.

- Analyze Real-World Examples: Apply theoretical concepts to real-world scenarios. Look at current market trends and try to explain the changes in terms of supply and demand forces.

- Work Through Different Scenarios: Consider various situations like price floors, price ceilings, and changes in input costs. Understanding these scenarios will help you adapt to different problem types in assessments.

Elasticity and Its Importance in Microeconomics

Elasticity measures the responsiveness of one variable to changes in another. In economics, it helps explain how consumers and producers react to price changes and how these reactions affect market outcomes. Understanding elasticity is crucial for assessing market behavior and making informed decisions about pricing and resource allocation.

Types of Elasticity

There are several types of elasticity that are particularly important when analyzing demand and supply:

| Type of Elasticity | Definition | Implication |

|---|---|---|

| Price Elasticity of Demand | Measures how much the quantity demanded changes in response to a change in price. | Helps determine how a price change will affect total revenue and consumer behavior. |

| Price Elasticity of Supply | Measures how much the quantity supplied changes in response to a change in price. | Indicates the ability of producers to increase or decrease production based on price changes. |

| Income Elasticity of Demand | Measures how demand for a good changes as income changes. | Important for understanding how economic growth affects the demand for different goods. |

Importance in Market Analysis

Elasticity plays a critical role in pricing decisions, especially for firms seeking to maximize revenue. If demand is elastic, a price increase can lead to a significant drop in sales, whereas inelastic demand means that price changes have little effect on quantity demanded. Understanding this concept allows businesses to set prices strategically and anticipate consumer behavior.

Production and Cost Theory Breakdown

Understanding production and cost theory is essential for analyzing how firms make decisions regarding output and resource allocation. This area focuses on how input factors are transformed into output and how costs are incurred during the production process. A solid grasp of these concepts helps in evaluating how firms optimize their production processes to maximize efficiency and profitability.

Key Concepts in Production

In production theory, the relationship between input and output is critical. Firms must determine the most efficient combination of resources to produce goods at the lowest possible cost. The concept of diminishing returns is particularly important in understanding how additional units of input lead to smaller increases in output.

| Production Concept | Description | Implication |

|---|---|---|

| Law of Diminishing Returns | As more of a variable input is added to a fixed amount of other inputs, the marginal output will eventually decrease. | Important for understanding the limits to production expansion and the need for balanced input allocation. |

| Marginal Product | The additional output generated from adding one more unit of input. | Helps in determining the optimal level of production and resource usage. |

| Returns to Scale | Refers to how output changes as all inputs are increased proportionally. | Indicates whether a firm experiences increasing, constant, or decreasing returns as it expands its production scale. |

Cost Concepts in Production

Costs are a crucial part of the decision-making process for firms. Understanding the different types of costs–such as fixed, variable, and total costs–enables firms to plan production more efficiently and assess their profitability. Cost theory also helps in determining the optimal production level where marginal cost equals marginal revenue.

| Cost Concept | Description | Implication |

|---|---|---|

| Fixed Costs | Costs that do not change with the level of output, such as rent and salaried wages. | Remain constant regardless of the firm’s production decisions. |

| Variable Costs | Costs that vary with the level of output, such as raw materials and labor hours. | Increase as production increases, and decrease when output is reduced. |

| Total Cost | The sum of fixed and variable costs at any given level of production. | Represents the overall expenditure required to produce a given output. |

Examining Consumer Behavior in Microeconomics

Understanding how individuals make purchasing decisions is central to analyzing market outcomes. Consumer behavior studies how preferences, income levels, and prices influence the choices that people make regarding the consumption of goods and services. This insight helps explain demand patterns and guides firms in targeting their products effectively.

Factors Influencing Consumer Decisions

Consumer choices are shaped by a variety of factors, including income, preferences, and the prices of related goods. These elements determine how much of a product a person is willing to buy at any given price, which in turn affects overall market demand. Key to this analysis is the concept of utility, which measures the satisfaction derived from consuming goods and services.

| Factor | Description | Impact on Behavior |

|---|---|---|

| Income | The amount of money a consumer has available to spend on goods and services. | Higher income increases the ability to purchase more goods, while lower income limits choices. |

| Preferences | Individual tastes and preferences for different types of goods or services. | Consumers are more likely to purchase goods they prefer, even at higher prices. |

| Price of Related Goods | Prices of substitute or complementary products that affect consumer choices. | Higher prices for substitutes may increase demand for the original good, while complementary goods can boost demand together. |

Utility and Consumption Choices

Utility is a key concept in understanding consumer behavior. It refers to the satisfaction or benefit derived from consuming a good or service. Consumers aim to maximize their utility, and this often leads to trade-offs as they decide between different products or services based on their preferences and budget constraints.

Profit Maximization Strategies for Firms

Firms aim to achieve the highest possible profits by adjusting their production levels and pricing strategies. The objective is to produce at a level where the difference between total revenue and total cost is maximized. This involves not only understanding cost structures but also identifying opportunities to increase efficiency, reduce costs, and optimize pricing strategies in competitive markets.

Production Efficiency and Output Decisions

To maximize profits, firms must find the most efficient combination of inputs to produce the desired level of output. This involves analyzing the marginal cost and marginal revenue to determine the optimal production level where profits are highest. The law of diminishing returns plays a crucial role in this decision, as firms seek to avoid overutilizing resources that may lead to higher costs than necessary.

Pricing Strategies for Maximizing Revenue

Effective pricing strategies are essential in maximizing a firm’s revenue. Firms must carefully consider price elasticity of demand, understanding how changes in price will impact the quantity demanded. In some cases, firms may choose to use price discrimination, adjusting prices based on customer segments or purchase volume. In other cases, firms may use penetration pricing or premium pricing strategies depending on market conditions and competition.

Monopoly vs Perfect Competition: Key Differences

Market structures can vary significantly, with monopolies and perfect competition representing two extremes. In a monopoly, a single firm dominates the entire market, controlling both the supply and pricing of goods or services. In contrast, perfect competition is characterized by a large number of firms offering identical products, leading to competitive pricing and minimal barriers to entry. Understanding these differences helps explain the behavior of firms in different market conditions and their impact on consumers and overall economic efficiency.

The primary distinctions between these two market types lie in the number of competitors, the level of product differentiation, and the control over pricing. In a monopoly, the firm is the sole producer and has significant pricing power, while in perfect competition, firms are price takers with little ability to influence prices due to the large number of competitors and identical offerings.

Factor Markets and Labor Economics Overview

Factor markets play a crucial role in the economy by facilitating the exchange of resources used in production, such as land, capital, and labor. These markets determine the prices for the inputs that businesses need to produce goods and services. Labor economics, a key component of factor markets, focuses on how workers are compensated and how labor is allocated across various sectors of the economy. Understanding these markets helps to explain income distribution, wage levels, and the efficiency of resource allocation.

Labor Demand and Supply

The demand for labor is influenced by the productivity of workers and the demand for the goods and services they produce. Firms seek to hire workers up to the point where the value of the worker’s marginal product equals the wage paid. On the other hand, the supply of labor depends on factors like wage rates, working conditions, and individual preferences. Higher wages typically attract more workers into the labor force, while lower wages may discourage participation.

Factors Affecting Wage Determination

Wages are determined by a variety of factors, including the skills required for a particular job, the supply of labor in the market, and the bargaining power of workers or unions. Jobs that require specialized skills or education tend to offer higher wages due to the limited supply of qualified individuals. Additionally, factors such as labor unions, government policies, and geographic location can all impact wage levels in different sectors.

Government Intervention and Market Failure

Markets can sometimes fail to operate efficiently or equitably, leading to outcomes that are less than optimal for society. This often happens when private entities do not account for all the costs or benefits of their actions, resulting in market failures. When these failures occur, governments can step in to correct the situation, ensuring that resources are distributed more fairly or efficiently. Intervention can take many forms, including regulations, subsidies, and taxes, all designed to address the underlying causes of inefficiency or inequity.

Types of Market Failures

- Externalities: These arise when the actions of individuals or businesses have side effects–either positive or negative–that affect third parties. For example, pollution is a negative externality that harms the environment and public health.

- Public Goods: Public goods are those that are non-excludable and non-rivalrous, meaning that consumption by one person does not reduce availability for others. These goods, like national defense or clean air, are often underprovided in a free market.

- Imperfect Competition: When markets are dominated by a small number of firms or a single firm, such as in a monopoly, the resulting lack of competition can lead to higher prices and reduced innovation.

- Asymmetric Information: When one party in a transaction has more or better information than the other, it can lead to suboptimal decisions. For example, a seller may withhold important information about a product’s quality, leading to market inefficiencies.

Government Solutions to Market Failures

- Taxes and Subsidies: Governments often impose taxes on negative externalities (e.g., carbon taxes) to discourage harmful behavior, or offer subsidies for beneficial activities (e.g., renewable energy incentives) to encourage positive externalities.

- Regulation: Government regulation can address issues such as monopolies or deceptive business practices, ensuring fair competition and protecting consumers from exploitation.

- Public Provision: In cases where markets fail to provide essential goods, the government may step in to supply those goods directly. For example, the provision of public education or healthcare services is often managed by the state to ensure that everyone has access, regardless of their income.

Understanding Pricing Strategies in Economics

Pricing is a fundamental element of any business strategy, influencing both market competition and consumer behavior. Firms use different approaches to set prices based on various factors such as production costs, competition, demand elasticity, and market positioning. Understanding these strategies is essential for maximizing revenue and achieving long-term success in any industry. The goal is often to find a price point that balances profitability with customer satisfaction, while also responding to external market conditions.

Common Pricing Models

Several pricing models are commonly employed by businesses, each with its own set of advantages and challenges. These strategies are often tailored to the specific needs of a company and the structure of the market it operates in:

- Cost-Plus Pricing: This method involves calculating the total cost of production and then adding a markup to ensure profitability. While simple, it may not always reflect market demand or competitor prices.

- Penetration Pricing: Often used by new businesses, this strategy involves setting a low initial price to attract customers and gain market share quickly. The price may increase once the company establishes its presence in the market.

- Price Skimming: This strategy involves setting a high initial price for a product to maximize revenue from early adopters, before gradually lowering the price to attract a broader customer base.

- Psychological Pricing: Prices are set to make products appear more affordable or valuable, such as setting prices at $9.99 instead of $10. This strategy plays on consumer perception and can boost sales.

Factors Influencing Pricing Decisions

Several key factors influence pricing strategies, ensuring they align with business goals and market conditions:

- Cost of Production: The cost of producing goods or services directly impacts the minimum price a business can charge to avoid losses.

- Demand and Supply: Consumer demand and the availability of a product in the market determine how flexible a business can be with its pricing.

- Competition: In competitive markets, pricing is often adjusted to stay competitive with similar offerings from rival businesses.

- Market Segmentation: Businesses may choose to set different prices for different customer groups based on their willingness to pay, often using discount pricing or premium pricing models.

Types of Market Equilibrium Explained

Market equilibrium occurs when the supply of a good or service matches its demand at a certain price level. In this state, there is no surplus or shortage of goods, and both consumers and producers are satisfied with the price and quantity of the product in the market. Understanding the different types of market equilibrium helps to analyze how markets react to changes in supply, demand, or external factors. These equilibria are important for predicting price adjustments, resource allocation, and overall market efficiency.

Types of Market Equilibrium

There are several types of market equilibrium, each representing different conditions in the market. Here are the key types:

- Perfect Equilibrium: This is an idealized state where supply equals demand, resulting in an efficient allocation of resources with no unintended surplus or shortage. In perfect equilibrium, all markets clear at the set price.

- Stable Equilibrium: In a stable equilibrium, any changes in market conditions, such as shifts in supply or demand, lead to adjustments that return the market to its equilibrium point. This type of equilibrium is resilient to minor disturbances.

- Dynamic Equilibrium: Unlike stable equilibrium, dynamic equilibrium refers to a market that is constantly evolving due to changes in external factors such as consumer preferences or technological innovations. The market moves in cycles but tends to stay near the equilibrium point over time.

- Unstable Equilibrium: In an unstable equilibrium, any small deviation from the equilibrium point can cause the market to move further away from equilibrium, leading to either a shortage or surplus. This type is typically seen in markets with volatile factors or speculative behavior.

How Equilibrium Affects Market Behavior

The equilibrium point plays a crucial role in determining the price level and quantity of goods exchanged. Understanding how different market conditions influence equilibrium can help predict price fluctuations, consumer purchasing behavior, and firm production decisions. The balance between supply and demand ultimately determines how efficiently resources are allocated within an economy.

- Surplus: When the price is above the equilibrium, producers are willing to supply more than consumers are willing to purchase, resulting in a surplus of goods.

- Shortage: Conversely, if the price is set below equilibrium, demand exceeds supply, leading to a shortage of goods.

Role of Externalities in Economic Theory

Externalities are the unintended side effects of economic activities that affect third parties who are not directly involved in a transaction. These effects can be either positive or negative, and they play a significant role in shaping the efficiency and outcomes of markets. When externalities are present, the true social costs or benefits of a good or service are not reflected in its market price, leading to market failure. Understanding the role of externalities is essential for evaluating economic policies and finding solutions to issues like pollution, resource depletion, and public goods provision.

Types of Externalities

Externalities can be broadly classified into two main categories based on their impact on society:

- Negative Externalities: These occur when the production or consumption of a good or service imposes costs on third parties. For example, industrial pollution can harm the environment and public health, leading to higher costs for society.

- Positive Externalities: These occur when the actions of individuals or businesses create benefits for others. For instance, education not only benefits the individual receiving it but also contributes to a more educated and productive society.

Economic Implications of Externalities

The presence of externalities can lead to suboptimal market outcomes, where resources are either over-allocated or under-allocated to certain goods and services. When negative externalities exist, markets tend to produce more than is socially desirable, as producers do not account for the costs imposed on others. On the other hand, positive externalities may result in underproduction of beneficial goods, as private individuals or firms fail to capture all the benefits of their actions.

- Market Failure: Externalities are a key cause of market failure, where private market outcomes do not align with the socially optimal allocation of resources.

- Government Intervention: To correct market failures, governments may impose taxes, subsidies, or regulations to internalize the externalities, aligning private incentives with social welfare.

Understanding externalities allows economists to develop policies that encourage more efficient and equitable outcomes in the market, addressing issues like environmental damage, public health concerns, and the provision of public goods.

Microeconomic Policy and Real-World Applications

Economic policies play a crucial role in shaping the behavior of individuals, businesses, and governments. These policies aim to address issues such as resource allocation, market efficiency, income distribution, and overall societal welfare. While theoretical concepts provide a foundation for understanding economic phenomena, their true value lies in real-world applications, where they guide decision-making and influence outcomes across various sectors, from healthcare to education to environmental protection.

Real-World Policy Examples

Economic theories are often put to the test through government interventions and regulatory frameworks that seek to solve market imperfections or promote public goods. Below are some key examples:

- Price Controls: Governments often intervene in markets by setting price ceilings or floors to prevent prices from becoming excessively high or low. A common example is rent control policies, which aim to make housing more affordable for low-income residents in urban areas.

- Subsidies and Taxes: Governments may use subsidies to encourage the production or consumption of certain goods, such as renewable energy or electric vehicles. On the other hand, taxes are levied on products like tobacco or alcohol to discourage harmful behaviors and raise revenue.

- Environmental Regulations: Policies such as carbon taxes or emissions trading schemes seek to address environmental externalities by encouraging businesses to reduce pollution. These policies aim to internalize the social costs of environmental degradation, promoting more sustainable practices.

Impact on Economic Behavior

Policy measures have the power to significantly alter market outcomes and individual behavior. By aligning private incentives with broader social goals, these interventions can help correct market failures and promote more equitable and efficient resource distribution. However, the effectiveness of these policies depends on a variety of factors, including the responsiveness of consumers and producers, the design of the policy, and the broader economic environment.

- Incentive Shifts: Taxes or subsidies can shift consumer demand and producer supply, leading to changes in market behavior. For instance, subsidies for education or healthcare can increase accessibility and improve societal well-being.

- Market Efficiency: Well-designed policies can correct inefficiencies in markets where externalities or monopolistic behaviors exist, improving the overall allocation of resources.

- Equity Considerations: Policies also address fairness concerns, such as income inequality or access to basic services, by redistributing wealth or providing public goods to those in need.

By understanding how economic theories apply to the real world, policymakers can better navigate complex challenges, balancing efficiency, equity, and long-term sustainability in their decision-making processes.

How to Solve Economic Problems

Approaching complex economic problems requires a systematic process of analysis, comprehension of key concepts, and the ability to apply theoretical knowledge to practical situations. Whether dealing with supply and demand dynamics, cost functions, or market structures, a clear strategy will help in breaking down the problem into manageable parts. The key to success lies in understanding the underlying principles and methodically working through the steps to arrive at a solution.

Steps for Problem Solving

To efficiently tackle economic problems, follow these essential steps:

- Understand the Question: Carefully read the problem to identify what is being asked. Look for key information such as given data, assumptions, and the desired outcome. Clarify any terms or concepts that are unfamiliar.

- Identify the Relevant Concepts: Determine which economic principles or models apply to the problem. Whether it’s supply and demand, elasticity, or cost theory, knowing the appropriate tools will help guide the solution process.

- Set Up the Problem: Translate the given data into mathematical terms, graphs, or equations. This could involve drawing supply and demand curves, setting up cost functions, or calculating equilibrium prices and quantities.

- Apply the Relevant Formulas: Use economic formulas and models to solve for the unknowns. This could include calculating consumer surplus, producer surplus, or identifying profit-maximizing levels of production.

- Analyze the Results: Once you’ve reached a solution, interpret the results in the context of the problem. Ensure that your answer makes sense in terms of economic theory and real-world implications.

- Check Your Work: Review each step to confirm your calculations are accurate and that you’ve applied the correct concepts. Ensure your final answer addresses all parts of the problem.

Common Techniques and Tips

Here are some techniques to enhance your problem-solving approach:

- Break It Down: If the problem seems complex, break it into smaller parts. Solve each part step by step and then combine the results for the final answer.

- Draw Diagrams: Graphical representations can help visualize relationships and facilitate understanding of economic concepts. Sketching supply and demand curves, for example, helps in analyzing shifts or equilibrium changes.

- Use Logical Reasoning: Approach each question with logical steps. Start by identifying the relationships between different variables and how changes in one might affect others.

- Review Key Models: Familiarize yourself with core economic models, such as perfect competition, monopoly, or game theory, as these often serve as the foundation for solving many problems.

- Time Management: During problem-solving, allocate your time wisely. Start with easier questions to build confidence and return to more challenging ones later.

By following these strategies and honing problem-solving skills, you’ll be well-equipped to handle a wide range of economic problems, applying theory to practice and drawing meaningful conclusions.

Common Pitfalls to Avoid in Assessments

When approaching assessments, it’s easy to fall into traps that can hinder your performance. Whether it’s misinterpreting questions, rushing through answers, or overlooking crucial details, these mistakes can significantly impact your results. Recognizing these common pitfalls and knowing how to avoid them is essential for maximizing success. By developing a thoughtful strategy and maintaining focus, you can navigate challenges more effectively.

Key Mistakes to Avoid

- Misunderstanding the Question: Often, students rush into answering without fully reading the problem. It’s important to identify exactly what the question asks before proceeding. Pay attention to keywords like “explain,” “compare,” or “calculate” to understand the required response.

- Skipping Key Steps: In the rush to finish, it’s tempting to skip over important steps in your solution process. Ensure that each part of your answer is well-supported by relevant concepts and calculations, as skipping steps can lead to incomplete or incorrect answers.

- Overlooking Assumptions: Many problems involve assumptions that must be acknowledged to solve the question correctly. Ignoring these assumptions or failing to account for them can lead to flawed conclusions. Always check if the assumptions are clearly stated or if you need to make reasonable assumptions yourself.

- Failing to Show Work: Sometimes, students provide answers without showing the process behind them. Even if the final result seems obvious, demonstrating your method helps clarify your understanding and often earns partial credit in case of an error.

- Not Reviewing the Answer: It’s easy to assume that your first answer is correct, especially under time pressure. Taking a moment to review your responses helps catch simple mistakes such as miscalculations, misinterpretations, or incomplete answers.

- Time Mismanagement: Spending too much time on one question and rushing through others is a common mistake. Allocate your time wisely, prioritizing questions based on difficulty, and leaving ample time to review your work before submission.

- Overcomplicating Solutions: It’s natural to want to demonstrate your knowledge, but overcomplicating a solution can lead to confusion and errors. Focus on clarity and simplicity, sticking to the most efficient methods for solving the problem.

- Ignoring Unit Conversions or Detail: When dealing with quantitative problems, failing to convert units or neglecting small but essential details can undermine the accuracy of your answer. Always double-check that your units match and that you’ve included all relevant details.

By being aware of these common pitfalls, you can adopt strategies to avoid them, ensuring more effective and accurate results in assessments.