Achieving proficiency in widely used accounting software is a valuable asset for any professional in the finance and business world. Gaining expertise in this software not only boosts your credibility but also enhances your career opportunities. This process typically involves understanding a wide range of tasks and tools, each designed to streamline financial management and ensure accuracy in every aspect of accounting.

Whether you’re preparing for an official assessment or simply aiming to improve your skills, it’s important to focus on both theoretical knowledge and hands-on experience. Becoming familiar with the key features and functions of the software will help you navigate through practical challenges effectively. Understanding how to approach different scenarios and problems is critical for performing well in any formal evaluation of your knowledge.

In this guide, we’ll dive into the specific topics and areas that are most commonly tested, providing you with a roadmap for efficient preparation. With the right approach and resources, mastering the core aspects of the software can become a rewarding experience that opens up new professional doors.

QuickBooks Certification Exam Overview

Gaining official recognition for proficiency in accounting software requires a structured approach to understanding its features and applying them effectively in real-world scenarios. This formal process is designed to assess your ability to use the software’s tools for managing finances, generating reports, and maintaining accurate records. Mastery of these concepts will help you succeed in a practical assessment that evaluates your skills and knowledge.

The assessment process is organized into different levels, allowing you to demonstrate your expertise progressively. It typically covers various aspects of the software, from basic functions to more advanced tasks. Preparing for this recognition involves reviewing key topics, practicing with sample tasks, and familiarizing yourself with the overall structure of the test.

What You Will Be Tested On

- General navigation and setup within the software

- Creating and managing financial transactions, including invoices and expenses

- Generating financial reports and understanding their data

- Handling payroll and employee records efficiently

- Managing accounts payable and receivable

- Performing reconciliations and ensuring accuracy in data entry

How the Process Works

Once you feel prepared, you can schedule your assessment. The process typically involves a timed, structured evaluation that tests your ability to apply software features under practical conditions. Scenarios may include handling customer transactions, creating reports, or troubleshooting errors. Passing the assessment indicates your proficiency and validates your ability to work with the software professionally.

While preparation is key, having hands-on experience is essential to performing well. Practicing with real-life examples and common tasks will not only boost your confidence but also improve your chances of success when faced with practical challenges during the process.

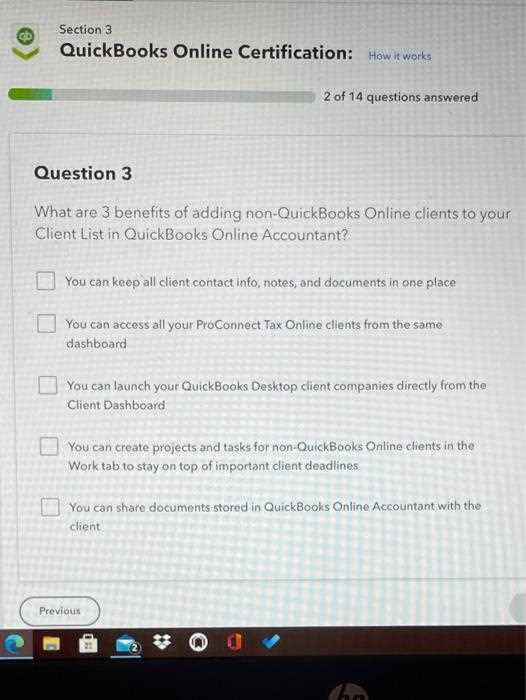

Understanding Exam Structure and Format

The formal assessment for mastering accounting software follows a specific structure designed to evaluate your knowledge and practical abilities. The format is created to test how well you understand the software’s core features and can apply them in various business scenarios. Familiarity with the layout and content of the assessment is essential to approach it with confidence and efficiency.

The structure typically includes different sections that cover both theoretical concepts and hands-on tasks. These sections are intended to assess your problem-solving skills and your ability to handle common tasks under time constraints. Understanding the layout of the evaluation will help you focus your preparation on the most relevant topics.

| Section | Content Focus | Time Limit |

|---|---|---|

| Section 1 | Basic Navigation and Setup | 15 minutes |

| Section 2 | Managing Financial Transactions | 25 minutes |

| Section 3 | Creating and Analyzing Reports | 20 minutes |

| Section 4 | Payroll Management and Employee Data | 20 minutes |

| Section 5 | Accounts Reconciliation | 20 minutes |

Each section is designed to evaluate different skill sets, with varying time limits to ensure you can manage your time effectively. The tasks are intended to reflect real-world scenarios where you’ll need to apply what you’ve learned. Practicing with similar tasks will help you feel more at ease when you face these sections during the official process.

Key Skills Tested in QuickBooks Certification

Successfully mastering accounting software requires a wide range of skills that go beyond just understanding basic functions. The formal assessment is designed to test your proficiency in various aspects of the software, ensuring that you can handle tasks related to financial management, reporting, and record-keeping with precision and confidence. It’s important to be familiar with both the core and advanced features to excel in this evaluation.

The assessment will focus on several key areas, each requiring practical knowledge and hands-on experience. The ability to navigate the software, enter data accurately, and generate meaningful reports is crucial for demonstrating your expertise. Below are the primary skills evaluated during the process:

- Software Navigation: Efficiently moving through the interface, using shortcuts, and understanding the layout.

- Data Entry: Accurately recording financial transactions, including expenses, invoices, and payments.

- Report Generation: Creating, customizing, and interpreting financial statements and summaries.

- Bank Reconciliation: Matching financial records with bank statements and resolving discrepancies.

- Payroll Management: Setting up and processing payroll, including tax calculations and deductions.

- Inventory Management: Tracking products and supplies, managing stock levels, and generating reports related to inventory.

- Accounts Payable and Receivable: Managing incoming and outgoing payments, creating invoices, and tracking overdue accounts.

Mastering these areas will ensure that you are fully prepared for the evaluation and can demonstrate a comprehensive understanding of the software’s capabilities. Through practice and review of these skills, you’ll be better equipped to handle the diverse tasks and challenges that may arise during the assessment process.

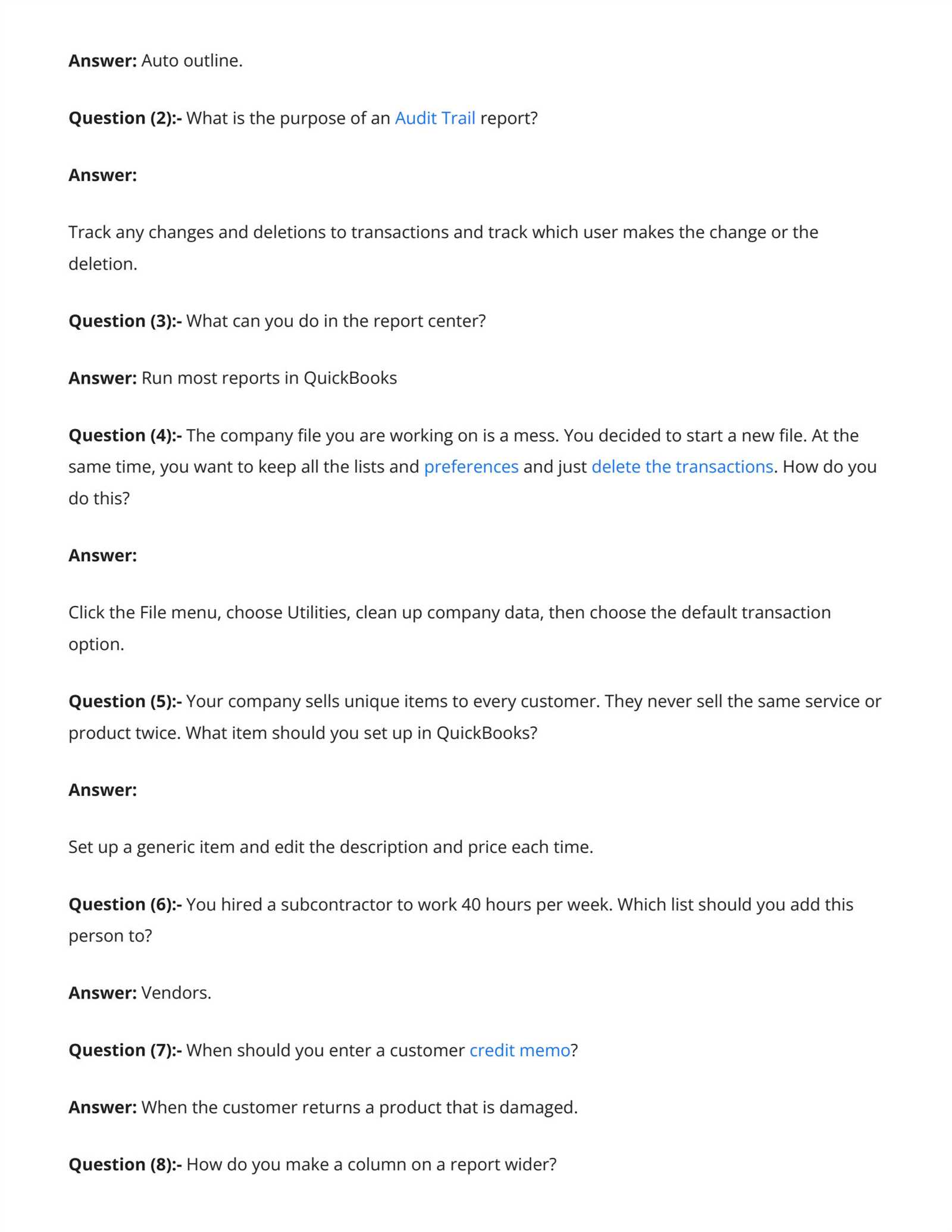

Common QuickBooks Exam Questions Explained

During the formal assessment for accounting software proficiency, you will encounter various scenarios designed to test your practical knowledge and problem-solving skills. These scenarios typically focus on common tasks and challenges that users face while using the software for everyday financial operations. Understanding the types of problems presented and knowing how to approach them is key to performing well.

Below, we’ll break down some of the most commonly encountered tasks and situations, explaining how to effectively address them. These tasks reflect the typical challenges you may encounter in real-world applications of the software.

Managing Financial Transactions

One of the most critical aspects of the assessment involves accurately recording financial transactions. This includes creating invoices, tracking expenses, and ensuring all entries are properly categorized. Below is a breakdown of common scenarios you may face:

| Task | Description | Action Required |

|---|---|---|

| Creating an Invoice | Generating a bill for a customer for products or services sold. | Choose the customer, enter the items, and apply payment terms. |

| Recording an Expense | Documenting an outgoing payment for a business expense. | Enter the vendor, amount, and categorize the expense appropriately. |

| Tracking Payments | Monitoring payments received or made. | Mark invoices or bills as paid once payments are received or processed. |

Generating Financial Reports

Another key skill tested is your ability to create and interpret financial reports. These reports provide insights into the overall financial health of a business and are crucial for decision-making. Here are some common report-related tasks:

| Task | Description | Action Required |

|---|---|---|

| Generating Profit and Loss | Reviewing business income and expenses over a specific period. | Select the time range and review income and expense categories. |

| Running a Balance Sheet | Summarizing assets, liabilities, and equity at a specific point in time. | Choose the reporting date and analyze the financial positions. |

| Customizing Reports | Modifying standard reports to include specific data points or time periods. | Adjust filters and settings to focus on relevant information. |

Understanding these common scenarios and tasks will help you feel more prepared and confident as you approach the formal assessment. Mastering the necessary skills and techniques ensures that you can apply the software effectively in a business setting, meeting all expectations and requirements.

How to Prepare for QuickBooks Certification

Preparing for an official assessment in accounting software requires a structured approach and dedication. The process tests your ability to use the software effectively in real-world business situations, so it’s essential to familiarize yourself with both basic and advanced features. Adequate preparation will ensure that you are not only ready for the test itself but also confident in applying your skills to everyday tasks.

To maximize your chances of success, focus on understanding the core functionalities of the software, practicing key tasks, and using available resources to deepen your knowledge. The more hands-on experience you gain, the more prepared you will be to handle any situation presented during the assessment.

Steps to Effective Preparation

- Review the Software Features: Understand the various tools and capabilities the software offers, from financial transactions to report generation.

- Practice Regularly: Use the software as much as possible. Hands-on practice with real-world scenarios helps solidify your understanding and boosts your confidence.

- Study Common Tasks: Focus on frequently tested functions, such as invoicing, tracking expenses, and managing accounts payable and receivable.

- Use Online Resources: Take advantage of online tutorials, video courses, and forums where you can learn from others’ experiences and solve problems you may encounter.

- Take Practice Tests: Many practice materials are available online. These tests will help you become familiar with the format and identify areas where you may need more focus.

Additional Tips for Success

- Time Management: During the evaluation, managing time effectively is crucial. Practice completing tasks within a set time limit to improve speed and efficiency.

- Focus on Accuracy: Precision is vital, especially when entering financial data. Double-check your entries and calculations to avoid errors.

- Stay Updated: Ensure you are using the latest version of the software, as features and functions may change with updates.

Following these steps will help you build the necessary skills and confidence to succeed in the assessment. With consistent practice and preparation, you can approach the official process with clarity and readiness.

Time Management Tips for the Exam

Effective time management is crucial when preparing for a formal assessment of your accounting software skills. During the process, you will face a series of tasks that need to be completed within a set timeframe. To perform well, you must balance speed with accuracy, ensuring that each task is handled properly without rushing through it. Learning how to allocate your time wisely will help you stay calm and focused under pressure.

Here are some practical tips to help you manage your time effectively during the evaluation:

- Know the Time Limits: Before starting, familiarize yourself with how much time is allocated for each section. Understanding the structure will help you pace yourself throughout the process.

- Prioritize Easy Tasks: Begin with the tasks you are most comfortable with. Completing these first will give you confidence and free up time for more complex challenges.

- Don’t Overthink: If you encounter a difficult task, move on to the next one and come back to it later. Spending too much time on a single problem can cause unnecessary stress and eat into your time.

- Set Mini-Deadlines: Break the overall time into smaller blocks for each task. For example, aim to complete a section within 75% of the allotted time to ensure you leave room for review.

- Practice Under Time Constraints: Before the official assessment, practice completing tasks within a specific time limit. This will help you get comfortable with the pace required and improve your efficiency.

- Review at the End: If time permits, allocate a few minutes at the end of the process to review your answers. Check for any errors or missed steps that could affect your results.

By applying these time management techniques, you will be able to approach the assessment with a clear strategy, maximizing your chances of success. With enough preparation and practice, you can handle the tasks efficiently and accurately, ensuring a smooth experience from start to finish.

Essential QuickBooks Features to Master

To succeed in any formal assessment of your accounting software proficiency, it’s important to master the essential tools and functionalities that the platform offers. These features are designed to simplify complex financial tasks, and understanding how to use them effectively will make you more efficient in handling business operations. Being well-versed in these key areas will not only help you navigate the software but also ensure you’re fully prepared for the evaluation.

The software includes a wide variety of tools that cover everything from invoicing and payroll management to financial reporting and data reconciliation. By mastering these essential features, you will be able to perform tasks with ease and demonstrate your proficiency during the assessment.

Core Features to Focus On

- Financial Transactions: Accurately entering and categorizing sales, expenses, and payments.

- Report Generation: Creating balance sheets, profit and loss statements, and other financial summaries.

- Payroll Management: Processing payroll, including tax calculations, employee deductions, and benefits.

- Inventory Tracking: Managing stock levels, generating inventory reports, and tracking product sales.

- Bank Reconciliation: Ensuring that financial records match with bank statements, identifying discrepancies, and making adjustments.

Feature Breakdown and Key Actions

| Feature | Description | Action to Master |

|---|---|---|

| Invoicing | Generating and sending invoices to customers for products or services. | Familiarize yourself with customization options and payment terms. |

| Expense Tracking | Recording and categorizing outgoing business expenses. | Ensure accuracy in entering details and choosing the correct categories. |

| Bank Reconciliation | Comparing financial records with bank transactions. | Practice matching transactions and resolving discrepancies in data. |

| Financial Reports | Creating reports like profit and loss, balance sheet, and cash flow. | Learn how to filter and customize reports to analyze specific data points. |

Mastering these essential features will help you become more efficient and confident in using the software. Understanding how each tool contributes to the broader financial management process ensures that you can handle a wide range of tasks effectively during the formal process. With hands-on experience and practice, you will be ready to demonstrate your expertise with ease.

Top Resources for QuickBooks Exam Success

Success in mastering accounting software relies not only on practice but also on the resources you use to guide your preparation. With the right materials, you can enhance your knowledge, improve your skills, and build confidence in using the software. Whether you’re a beginner or an experienced user, there are several excellent tools and resources available to support your journey.

These resources offer comprehensive lessons, practice tasks, and expert tips to help you understand the most important features and functions of the software. Relying on a combination of tutorials, forums, and practice tests will help you stay on track and approach the formal assessment with the confidence that you are well-prepared.

Recommended Learning Platforms

- Official Training Guides: The official website often provides in-depth manuals and step-by-step tutorials designed to walk you through the key features and common tasks within the software.

- Online Course Providers: Platforms like Udemy, LinkedIn Learning, and Coursera offer structured courses that cover all aspects of using the software, with lessons ranging from basic to advanced levels.

- Video Tutorials: YouTube is filled with tutorials that demonstrate how to perform specific tasks, helping you visualize processes and improve your hands-on skills.

- Webinars and Live Workshops: Many experts and software vendors host live training sessions and webinars where you can ask questions in real-time and interact with instructors.

Practice Resources and Tools

- Practice Tests: Many websites offer practice exams that simulate the real-world assessment, giving you an opportunity to familiarize yourself with the format and time limits.

- Community Forums: Joining online communities and discussion groups, such as Reddit or specialized forums, allows you to exchange tips, troubleshoot issues, and learn from others’ experiences.

- Interactive Simulations: Some platforms provide virtual environments where you can practice completing tasks in a controlled setting, helping you build familiarity with the software.

- Books and eBooks: Comprehensive textbooks offer detailed explanations of the software’s features, alongside practice exercises to reinforce your learning.

By leveraging these resources, you’ll not only strengthen your knowledge but also gain valuable hands-on experience. This combination of theory and practical application will ensure you’re fully equipped to perform well in the assessment and demonstrate your skills effectively.

Practice Questions to Boost Your Confidence

One of the most effective ways to prepare for any formal evaluation is to practice with sample scenarios that mimic the challenges you’ll face. Practicing real-world tasks not only helps you become familiar with the process but also boosts your confidence by reinforcing your ability to perform under pressure. By simulating the types of tasks that may appear in the assessment, you can identify areas where you need improvement and feel more assured in your skills.

Below are several practice scenarios designed to help you sharpen your problem-solving abilities and familiarize yourself with common tasks that you’ll encounter. These exercises focus on the core functions of the software, ensuring you’re well-prepared to handle similar situations during the actual evaluation.

Sample Tasks to Practice

- Task 1: Creating a Customer Invoice

A customer has purchased multiple items. Create an invoice, apply the appropriate payment terms, and ensure that the items are properly listed with accurate pricing and tax calculations. - Task 2: Recording a Business Expense

Record an outgoing payment for a business expense. Categorize it correctly, ensuring that it matches the correct account type and vendor information. - Task 3: Generating a Profit and Loss Report

You need to generate a profit and loss report for the last quarter. Customize the report to display the relevant data and ensure that it reflects the most up-to-date information. - Task 4: Reconciling Bank Transactions

Reconcile your business’s bank transactions with the accounting records. Identify and resolve any discrepancies that might appear between the two sets of data. - Task 5: Processing Payroll

Set up and process payroll for a group of employees. Ensure that taxes and other deductions are correctly applied, and the net pay matches what was reported to the employees.

Key Areas to Focus On

- Accuracy: Ensure that all financial data is entered correctly and reflects the appropriate accounts, amounts, and categories.

- Time Efficiency: While practicing, aim to complete tasks within a reasonable timeframe. Being able to work efficiently under time constraints is essential for success.

- Comprehension of Reports: Focus on your ability to generate, read, and interpret financial reports. These are crucial for decision-making and must be understood thoroughly.

By practicing these tasks regularly, you will enhance your ability to handle a wide variety of challenges. The more you practice, the more comfortable you will become, and the more confident you will feel going into the official evaluation. Mastering these key areas is the best way to ensure that you’re fully prepared and can demonstrate your skills effectively.

What to Expect on the QuickBooks Test Day

The day of your official assessment can feel a bit overwhelming, but understanding what to expect will help you approach it with confidence and clarity. On test day, you will be tasked with completing a series of practical scenarios that reflect real-world tasks you would encounter in your role as a user of the software. The goal is to assess your ability to perform common business functions such as invoicing, managing expenses, generating reports, and reconciling financial data.

The process is structured to evaluate your skill level and accuracy, so it’s important to approach each task carefully. With the right preparation, you can confidently navigate through the different sections and demonstrate your proficiency with the platform.

Test Day Structure

Here’s a general overview of what you can expect on the day of your assessment:

- Arrival and Check-In: Arrive early to give yourself plenty of time to check in and get settled. Expect to provide identification and possibly sign an agreement about the testing conditions.

- Environment: The assessment will typically take place in a quiet, controlled environment. You may be asked to work on a computer or through an online platform, depending on the testing format.

- Time Limit: You will have a set amount of time to complete each section or task. Be prepared to manage your time effectively, as rushing through tasks can lead to mistakes.

- Task Instructions: Each task will come with specific instructions. Read them carefully to ensure you understand the requirements. If you encounter any confusion, try to proceed with your best judgment while keeping the instructions in mind.

- Tools and Resources: During the test, you may or may not have access to online resources or help features. Check the guidelines beforehand to understand the rules and limitations.

What to Bring

- Identification: Be sure to bring a valid ID for verification purposes.

- Comfortable Environment: Dress comfortably and bring any materials you may need, such as a notepad or pen for taking notes.

- Positive Mindset: While not a physical item, maintaining a calm and focused attitude is one of the most important things you can bring with you. Stay confident in the skills you’ve developed through your preparation.

Once the assessment begins, remember that you are being tested on your practical skills, so focus on accuracy and efficiency. Manage your time wisely, and don’t get discouraged if you encounter a difficult task–simply move on to the next one and return to the tricky task later if time allows. With proper preparation and a clear strategy, you’ll be able to handle whatever comes your way and demonstrate your expertise effectively.

Common Mistakes to Avoid During the Exam

While preparing for any formal assessment of your software proficiency, it’s essential to be aware of common pitfalls that can negatively affect your performance. Mistakes, especially when under time constraints, can result in unnecessary stress and lower your overall score. By knowing what to avoid, you can approach the test with greater confidence and increase your chances of success. Below are several key errors that many test-takers make, along with tips on how to steer clear of them.

1. Rushing Through Tasks

In the rush to complete the assessment within the given time frame, many individuals end up hurrying through tasks without fully reading the instructions or double-checking their work. This often leads to errors such as incorrect data entry, missed steps, or choosing the wrong settings. It’s important to strike a balance between speed and accuracy. While time management is key, avoid sacrificing precision in the process.

2. Overlooking Details

Small mistakes in details–such as incorrectly categorizing a transaction or missing an essential field–can have a significant impact on your results. Always take a moment to ensure that every input is accurate, from account numbers to dates. Pay special attention to formatting, tax calculations, and rounding where applicable. These details may seem minor but can affect the final outcome.

3. Ignoring Instructions

Each task comes with specific instructions that outline the steps required to complete it successfully. It’s easy to make assumptions or skip over parts of the guidance, but doing so can lead to missed steps and incomplete tasks. Take the time to carefully read the instructions for each task, and be sure you understand what is being asked before proceeding.

4. Failing to Review Work

After completing a task, it can be tempting to move on immediately, especially when time is running short. However, reviewing your work before moving on is essential. Take a few extra moments to check for errors or inconsistencies that may have slipped through while you were focused on the task at hand. This can help you catch mistakes early and avoid penalties.

5. Not Managing Time Effectively

Improper time management is one of the most common reasons for subpar performance. Test-takers often spend too much time on one task, leaving insufficient time for others. To avoid this, practice managing your time during mock sessions, and set mini-deadlines for each task to ensure you’re progressing at the right pace. Always allocate some buffer time at the end to review your work.

6. Overcomplicating Simple Tasks

It’s easy to second-guess yourself during a test, especially when you encounter a simple task. Test-takers often try to apply complex solutions to tasks that can be solved with straightforward actions. Stick to the basics, and don’t overthink simple tasks–follow the instructions and apply the most direct approach when possible.

7. Not Familiarizing Yourself with the Platform

Some test-takers are caught off guard by the platform or software interface itself. If you’re not familiar with the environment you’ll be working in, it can lead to wasted time as you try to figure out where certain functions are located. To avoid this, ensure that you are comfortable navigating the software, including locating tools and features quickly.

Avoiding these common mistakes will not only help you save time but also ensure that your work is accurate and complete. The key is to stay focused, manage your time effectively, and approach each task with a methodical mindset. With enough preparation and attention to detail, you’ll be well-positioned to perform at your best during the assessment.

How to Retake the QuickBooks Certification

In some cases, after attempting the formal assessment, you may find that you need to retake it to improve your results. While this may seem discouraging, it is an opportunity to refine your skills and approach. Retaking the assessment allows you to focus on areas where you struggled and to demonstrate your improved proficiency. Understanding the process and taking the right steps will help you better prepare for a successful retake.

Steps to Retake the Assessment

If you do not pass the initial attempt, here are the steps you can follow to retake the assessment:

- Review the Feedback: After completing the assessment, review any feedback or results you received. Identify the areas where you performed poorly, and focus on improving those skills before retaking the test.

- Understand the Retake Policy: Many platforms have specific guidelines regarding retakes. Ensure that you are aware of any waiting periods, fees, or conditions for retaking the assessment. Check the official website for updated policies.

- Prepare Effectively: Focus on areas where you struggled previously. Revisit the software’s key functions, practice with sample tasks, and review resources such as guides, videos, and practice tests to strengthen your knowledge.

- Schedule the Retake: Once you feel prepared, schedule your retake through the same platform you initially used. Make sure to choose a time when you can focus fully on the task without distractions.

Tips for a Successful Retake

- Focus on Weak Areas: Target specific tasks or concepts that you had difficulty with during the first attempt. Spend extra time practicing those areas to build confidence.

- Use Practice Tests: Take advantage of practice tests or mock assessments to simulate the real experience. This will help you become familiar with the format and improve your time management.

- Stay Calm and Confident: Approaching the retake with a calm and confident mindset is crucial. Don’t let previous mistakes affect your performance. With the right preparation, you can improve and succeed on your second attempt.

Retaking the assessment can be an invaluable opportunity for growth. By reflecting on your previous performance, preparing strategically, and maintaining a positive mindset, you’ll be in a strong position to achieve the results you’re aiming for.

Understanding QuickBooks Exam Passing Scores

When preparing for a formal evaluation of your skills, it is essential to understand the criteria that determine whether you pass or fail. The passing score is a benchmark that indicates whether your knowledge and abilities align with the standards set for proficiency. Knowing what score you need to achieve helps you focus your efforts on key areas and allows you to track your progress as you study.

Each assessment has a specific passing threshold, which may vary depending on the platform and the level of difficulty. Typically, these assessments are scored on a scale that considers factors such as accuracy, completion of tasks, and the correct application of software features. Understanding the requirements of the test can help you approach it strategically and avoid unnecessary stress.

What is the Passing Score?

- Score Range: The passing score typically falls within a defined range, such as 70% to 80%. You need to score above this threshold to successfully complete the assessment.

- Scoring System: Most assessments use a point-based system where each completed task or question is assigned a value. Your final score is calculated based on your performance across all sections.

- Varied Weighting: Certain tasks may be weighted more heavily than others, meaning some sections of the assessment will contribute more to your overall score. Be sure to focus on these high-priority areas during your preparation.

How to Track Your Progress

- Practice Tests: Taking mock assessments can help you gauge your performance and get a feel for how much more preparation you need. These tests often mirror the scoring system of the real evaluation.

- Focus on Accuracy: While speed is important, it’s critical to focus on the accuracy of your answers. Incorrect answers, even if answered quickly, will negatively impact your score.

- Review Mistakes: After completing a practice test or assessment, review your errors carefully. Understanding where you went wrong can help you focus on improving specific skills before retaking the assessment.

In some cases, the platform may provide feedback on your performance, outlining which areas you excelled in and which need more attention. Use this feedback to tailor your preparation and enhance your chances of success on your next attempt. Understanding the passing score and how to achieve it is a crucial part of preparing effectively and boosting your confidence on test day.

Real-Life Scenarios on the QuickBooks Exam

During the assessment, you’ll encounter a variety of real-world scenarios that test your ability to apply your knowledge of accounting software to common business situations. These practical tasks are designed to simulate the types of challenges you would face in a real job setting, ensuring that you can effectively use the platform to perform everyday functions. The goal is to evaluate how well you can manage financial records, track transactions, and generate reports under typical business conditions.

In these scenarios, you may be asked to process transactions, reconcile bank statements, generate invoices, or create financial statements–all within a set period. Your performance on these tasks will determine your ability to work efficiently and accurately, which are key skills in the professional world. Here are a few examples of real-life situations you might encounter during the assessment.

Example 1: Managing Expenses

One common scenario involves entering and categorizing business expenses. You may be given a list of transactions, including receipts or bills, and asked to categorize them correctly into the appropriate accounts. This tests your knowledge of how to handle different expense types and ensure that they are recorded accurately for reporting purposes.

- Identify whether the expense is for operational costs, office supplies, or other categories.

- Assign appropriate tax categories and ensure the data is accurately reflected in the books.

Example 2: Generating Financial Reports

Another scenario could involve generating and analyzing key financial reports, such as balance sheets, profit and loss statements, or cash flow statements. You may be asked to create these reports based on a set of financial data or to interpret a given report to answer specific business questions.

- Use the available data to generate a profit and loss statement for a specific period.

- Interpret the financial report to provide insight into the company’s financial health.

Example 3: Reconciliation of Accounts

Reconciling bank and credit card accounts is a crucial task in financial management. You may be provided with bank statements and asked to match them with internal records, ensuring that all transactions align. This scenario assesses your attention to detail and your ability to ensure the accuracy of the financial data.

- Match transactions between the bank statement and the accounting records.

- Identify discrepancies and resolve them by making necessary adjustments.

These real-world scenarios not only assess your technical skills but also challenge you to think critically and solve problems efficiently. By practicing these types of tasks during your preparation, you can increase your confidence and readiness to tackle similar situations on the actual assessment. The more you familiarize yourself with these scenarios, the better you’ll perform under time constraints and pressure.

Best Strategies for QuickBooks Exam Review

Effective preparation and review strategies are essential for ensuring success in any formal assessment. Reviewing the material in a structured and focused manner helps reinforce your understanding and improves your ability to apply knowledge quickly and accurately. By adopting the right approach, you can maximize your chances of performing well. Below are some of the most effective strategies to help you prepare for your assessment.

1. Break Down the Study Material

Rather than cramming all the information at once, break your study sessions into smaller, manageable chunks. Focus on one area at a time, whether it’s managing financial transactions, generating reports, or reconciling accounts. This will help you concentrate on mastering each skill before moving on to the next. Use the following approach:

- Organize study sessions by task type (e.g., invoicing, payroll, reporting).

- Review key concepts and definitions for each task to understand their application.

- Focus on your weaker areas first, as these will require more attention.

2. Use Practice Scenarios

One of the best ways to reinforce your learning is by working through practical scenarios that mirror the types of tasks you’ll encounter. Practice with real-world examples allows you to become familiar with the format and structure of the tasks, as well as apply your knowledge in a realistic setting. This will help you improve both your speed and accuracy during the actual assessment.

- Simulate common business tasks, such as creating invoices, entering expenses, and generating reports.

- Time yourself while completing tasks to improve your efficiency.

- Identify any weak spots or areas that require more practice, and spend additional time on them.

3. Take Mock Assessments

Mock assessments are invaluable tools for reviewing the material and assessing your readiness. These practice tests replicate the structure of the real assessment, offering a chance to evaluate your performance and identify areas for improvement. Mock tests provide an opportunity to practice under timed conditions, helping you develop time management skills.

- Set aside time to complete mock tests without distractions, simulating the actual conditions.

- Review your answers after completing the test to identify mistakes and gaps in knowledge.

- Take multiple mock assessments to track your progress over time.

4. Review Feedback from Previous Attempts

If you have already attempted the assessment, carefully review the feedback you received. This feedback can provide valuable insights into areas where you need improvement and guide your review process. Pay close attention to common mistakes or areas where you scored poorly, and focus your review efforts on these topics.

- Identify patterns in your errors to determine which topics need the most attention.

- Use the feedback to adjust your study plan and prioritize challenging areas.

5. Create a Study Schedule

Planning your study time is critical to staying organized and ensuring that you cover all necessary material before the test. Create a study schedule that allocates time for each topic, leaving room for breaks and review sessions. Stick to your schedule and adjust it as needed based on your progress.

- Set specific goals for each study session, such as mastering a certain skill or completing a mock test.

- Allocate extra time for areas where you feel less confident.

- Use review days before the test to revisit key concepts and practice tasks.

By following these strategies, you can ensure a more thorough review process and enter the assessment with confidence. A structured approach to studying, practicing, and reviewing is the best way to strengthen your knowledge and increase your chances of success. Consistent preparation and focused effort will help you feel ready to tackle the challenges of the assessment and achieve your goals.