Preparing for a comprehensive assessment in property-related subjects requires a solid understanding of fundamental principles and problem-solving skills. It involves mastering the core topics that frequently appear in evaluations and applying theoretical knowledge to practical scenarios. Whether it’s analyzing financial structures, calculating risks, or interpreting contracts, each aspect plays a crucial role in achieving success.

Key focus areas include understanding the critical aspects of property management, investment strategies, and various forms of agreements. A thorough review of essential terms and practical approaches will help you tackle any challenging question. Developing a strong grasp of the material will enhance both speed and accuracy during the evaluation process.

In this guide, we break down essential topics and provide tips on how to approach difficult problems. By focusing on common themes and typical formats, you’ll be better prepared to handle the complexities of the test and boost your performance. Let’s dive into the strategies that will help you succeed.

Property Evaluation and Financial Assessment

In any property-related evaluation, it is crucial to approach each question with a clear understanding of the fundamental concepts and mathematical techniques required. Effective problem-solving requires a strong grasp of various financial instruments, property appraisals, and investment strategies. By mastering key terms and calculation methods, you can confidently address complex scenarios and reach accurate conclusions.

Key Concepts to Review

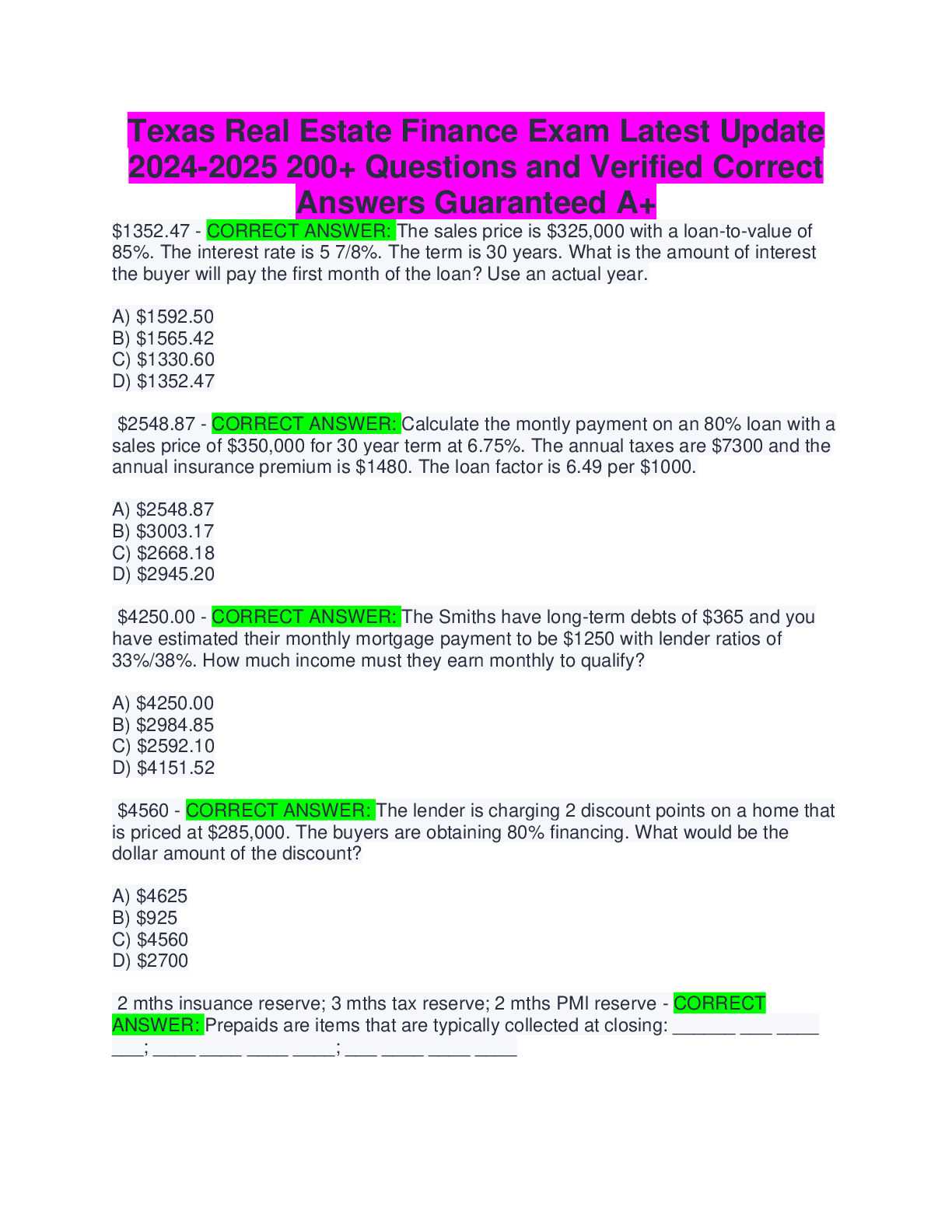

Preparation for this type of assessment involves focusing on several important areas. Understanding how to calculate mortgage payments, interest rates, and loan structures is essential. Similarly, mastering investment analysis and risk management can make a significant difference in the evaluation process.

Sample Calculation Methods

Below is a table illustrating common calculation techniques for investment property assessments:

| Calculation Type | Formula | Example |

|---|---|---|

| Mortgage Payment | PMT = P [ r(1+r)^n ] / [ (1+r)^n – 1 ] | $1,000 for a $200,000 loan at 5% over 30 years |

| Loan-to-Value Ratio | LTV = Loan Amount / Property Value | 80% for a $160,000 loan on a $200,000 property |

| Net Operating Income (NOI) | NOI = Revenue – Operating Expenses | $50,000 in rent revenue minus $20,000 in expenses |

By practicing these calculations and understanding the theory behind them, you will be well-equipped to answer questions with accuracy and confidence. Focus on each area methodically to improve your ability to address varied financial questions effectively.

Key Topics to Focus On

To effectively prepare for assessments in property and financial management, it is essential to understand the core subjects that regularly appear in the questions. Mastering these topics will allow you to confidently tackle any challenges that may arise. A clear focus on the most relevant areas will not only improve your understanding but also help you perform well under pressure.

Investment Strategies and Risk Analysis

Investment analysis is a critical aspect of property management. Understanding how to assess the potential returns and risks associated with various investments is crucial for decision-making. Familiarize yourself with key concepts such as return on investment (ROI), capitalization rates, and cash flow analysis. These tools will help you make informed choices when evaluating the profitability of different ventures.

Financial Instruments and Loan Structures

Another important area is understanding the different financial instruments and how they affect property deals. Topics such as mortgages, lines of credit, and different types of loans must be well-understood, including their impact on both short-term and long-term goals. Additionally, knowing how to calculate interest, loan amortization, and debt service coverage ratios will help you evaluate loan terms and their effect on cash flow.

Understanding Mortgage Calculations

One of the most important aspects of property financing is understanding how to calculate the monthly payments, interest costs, and the overall financial burden of a loan. These calculations are vital for both the lender and the borrower, as they determine the affordability and long-term costs associated with borrowing funds. Being proficient in these calculations will enable you to make better financial decisions and avoid common pitfalls in lending agreements.

Key formulas such as the monthly mortgage payment formula are essential to know. Understanding how to break down principal and interest payments, as well as calculating the total interest paid over the life of a loan, can provide valuable insights into the financial commitment involved. Mastering these calculations will also help you interpret financial statements and investment analysis more effectively.

Example calculation: If you borrow $300,000 for a 30-year loan with a 4% annual interest rate, the monthly payment can be calculated using the following formula:

PMT = P [ r(1 + r)^n ] / [ (1 + r)^n – 1 ]

Where:

- P = Principal amount ($300,000)

- r = Monthly interest rate (4% / 12 = 0.00333)

- n = Number of payments (30 years * 12 months = 360)

This formula will give you the monthly payment amount that includes both principal and interest. Understanding this calculation is a key skill for anyone involved in property financing or lending practices.

Common Questions in Property Financial Management

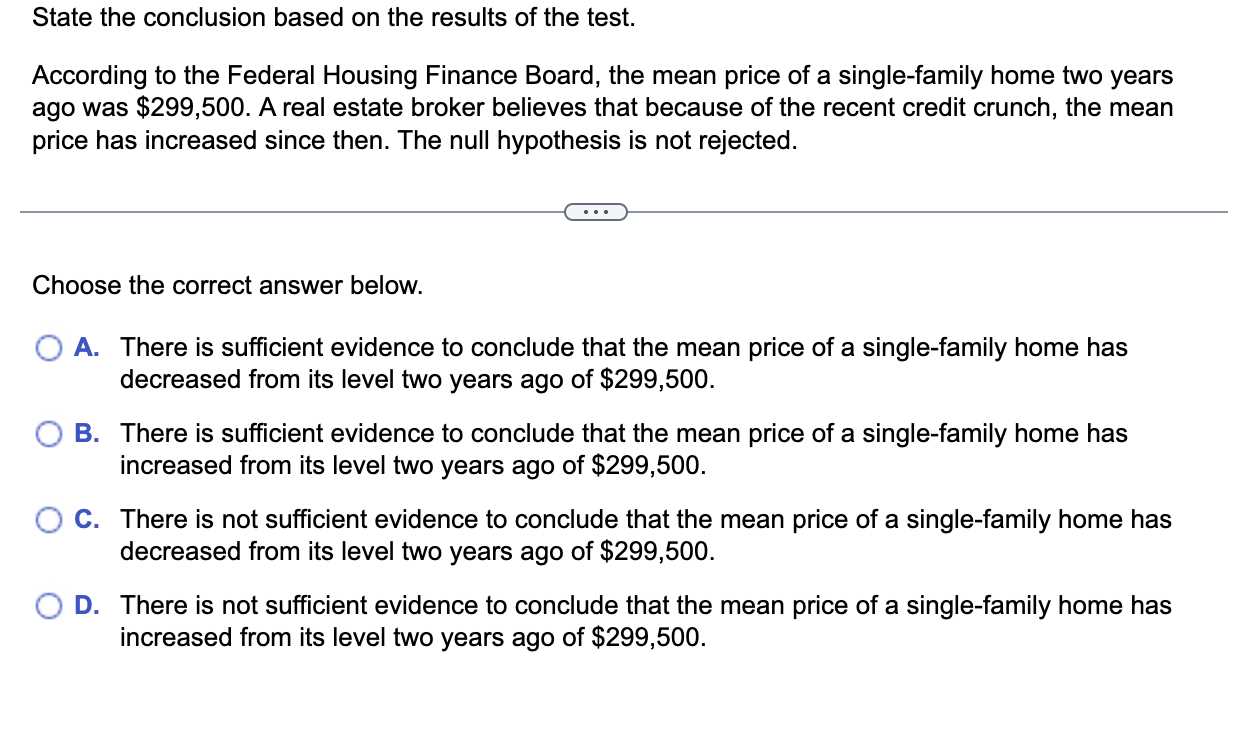

When preparing for assessments in property-related subjects, it is essential to familiarize yourself with the types of questions that frequently appear. These questions often focus on core principles such as loan structures, investment analysis, and valuation methods. By understanding the most common topics, you can streamline your preparation and ensure a well-rounded approach to the subject matter.

Typical Question Categories

- Loan Calculations: Questions may ask you to compute monthly payments, interest rates, or the total cost of a loan over time.

- Investment Analysis: Expect questions that test your ability to evaluate profitability, return on investment (ROI), and cash flow projections.

- Risk Management: Assessments often cover methods for evaluating potential risks in property ventures and how to mitigate them.

- Property Valuation: Be prepared to calculate the market value of a property based on various factors, such as location, condition, and income potential.

- Mortgage Types: Questions may focus on different types of loans and their impact on financing strategies, such as fixed-rate, adjustable-rate, or interest-only mortgages.

Example Question Formats

- Calculate the monthly payment for a loan of $250,000 at 5% interest for 20 years.

- Determine the cash flow from an investment property with a rental income of $3,000 per month and operating expenses of $1,200 per month.

- Identify the best mortgage option for a borrower looking for long-term stability with a 20% down payment.

- What is the impact of an increase in interest rates on a fixed-rate loan?

By practicing with these types of questions and understanding the logic behind them, you will be able to approach any assessment with confidence and precision.

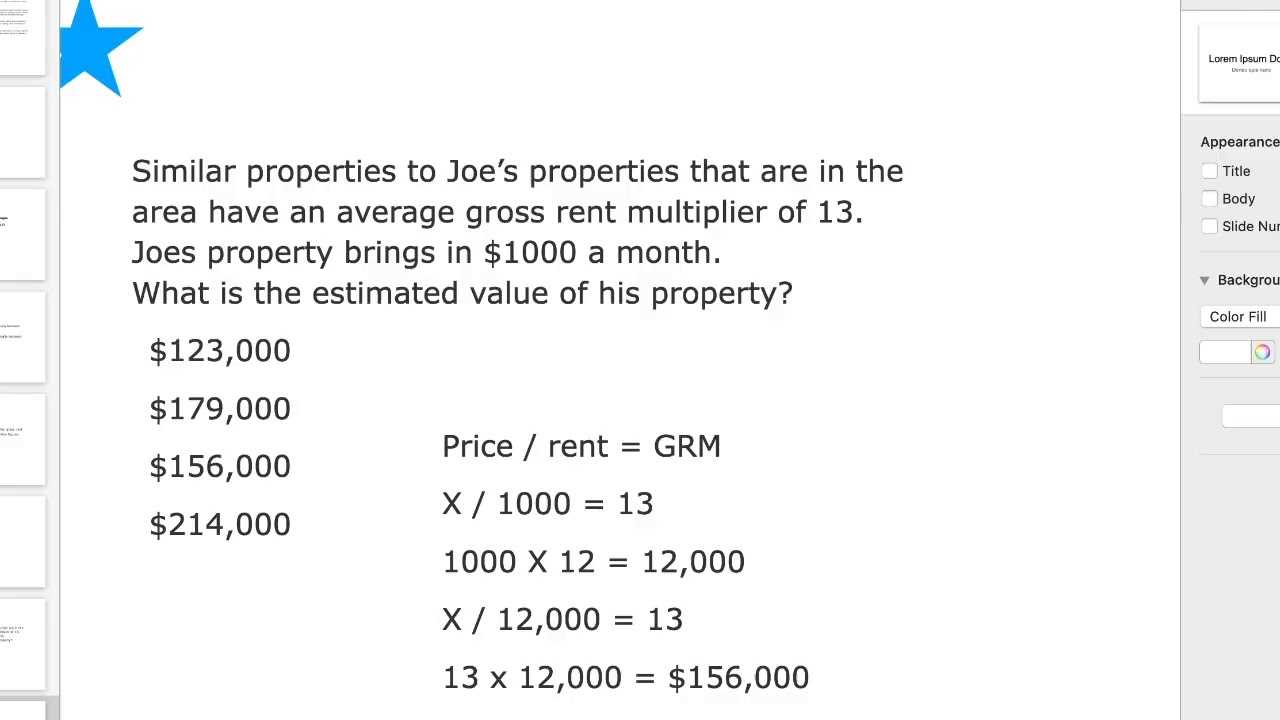

How to Analyze Investment Properties

Analyzing potential investment opportunities in properties requires a deep understanding of key financial metrics and the ability to assess various factors that influence the value and profitability of a property. Successful investors use a combination of analytical tools to evaluate cash flow, market trends, and long-term growth potential. By applying these methods, you can make informed decisions that align with your financial goals.

Key Metrics to Consider

To properly evaluate a property, focus on a few essential metrics:

- Cap Rate: The capitalization rate is a ratio used to estimate the return on an investment property, calculated by dividing the net operating income (NOI) by the property’s purchase price.

- Cash Flow: This is the net income from the property after expenses, including mortgage payments, property taxes, insurance, and maintenance costs. Positive cash flow is crucial for generating profits.

- Return on Investment (ROI): ROI measures the profitability of an investment relative to its cost. It is essential to calculate this before purchasing to understand potential returns.

Steps for Effective Property Analysis

Begin by assessing the market conditions where the property is located. Look for trends in demand, rental prices, and property values. Next, calculate the projected cash flow by considering rental income and subtracting all operating expenses. Finally, compare the investment’s ROI to other opportunities to determine if it meets your financial objectives.

By following these steps and analyzing the right data, you can confidently assess the potential of any investment property and make decisions that maximize profitability.

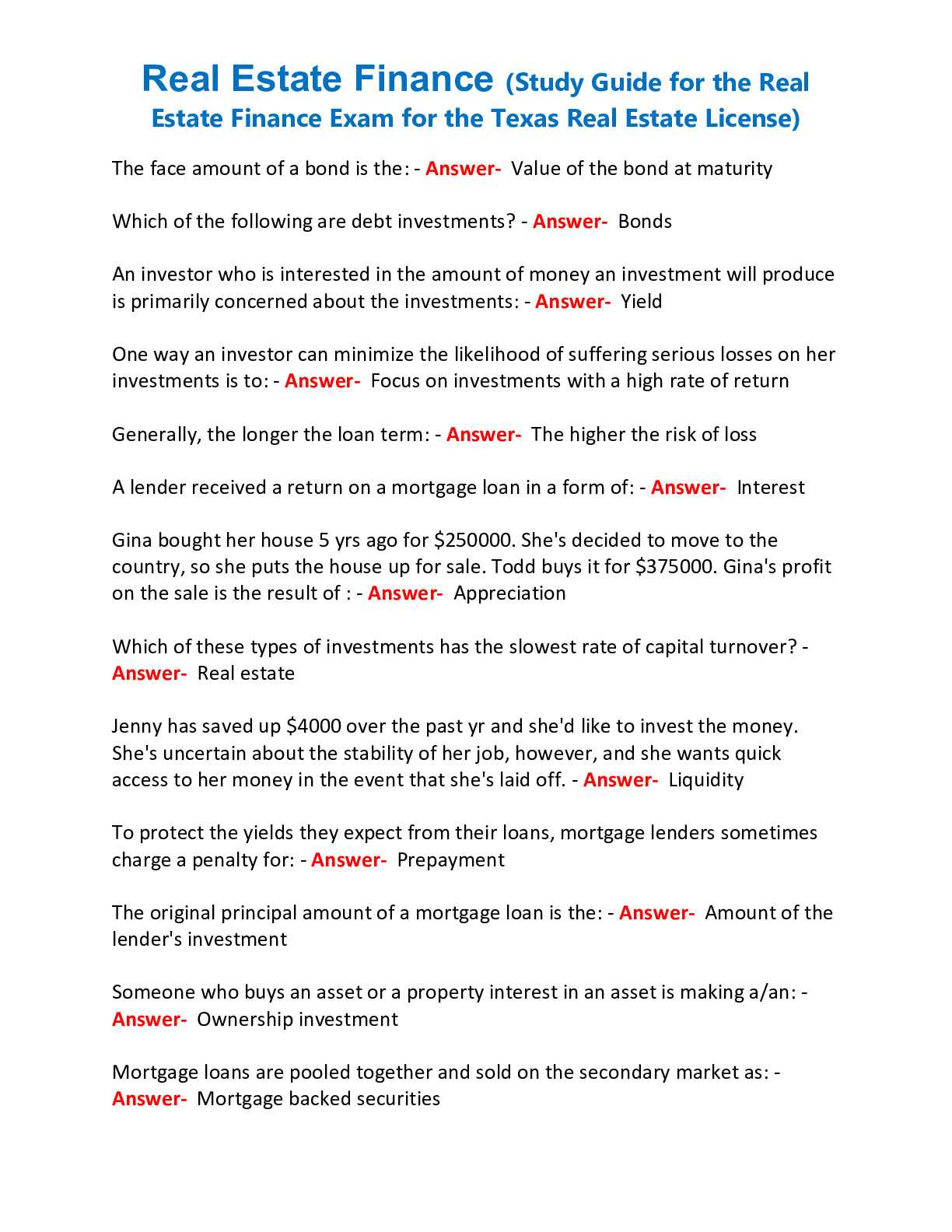

Essential Terminology for the Exam

Understanding key terminology is crucial when preparing for assessments in property-related financial topics. A solid grasp of the terms used in questions allows you to navigate complex scenarios and answer with confidence. This section covers the most important terms you should be familiar with to succeed in any related evaluation.

Commonly Used Terms

Below are some of the essential terms that frequently appear in assessments related to property investments, loans, and financial calculations:

| Term | Definition |

|---|---|

| Amortization | The process of paying off a loan over time through regular payments, typically consisting of both principal and interest. |

| Equity | The value of ownership interest in a property, calculated as the current market value minus any outstanding loans or mortgages. |

| Net Operating Income (NOI) | The total income generated by a property after operating expenses but before debt service, taxes, and capital expenditures. |

| Capitalization Rate (Cap Rate) | A ratio used to estimate the return on investment in a property, calculated by dividing the net operating income by the property’s value. |

| Debt Service Coverage Ratio (DSCR) | A financial ratio that compares a property’s net operating income to its debt obligations, indicating the ability to cover debt payments. |

Understanding Their Application

Knowing these terms is not only important for answering direct questions, but also for interpreting the data and scenarios you might encounter. For example, understanding how to calculate and apply the capitalization rate will allow you to evaluate the potential return of a property investment. Similarly, being able to explain amortization schedules will help you assess long-term costs associated with financing.

Tips for Managing Time Effectively

Effective time management during an assessment is crucial for ensuring that you can complete all questions thoroughly while maintaining a steady pace. Proper planning and strategy are essential to avoid feeling rushed or missing key details in your responses. By organizing your time wisely, you can maximize your performance and reduce stress.

Create a Time Allocation Plan

Before starting the assessment, quickly scan through all the questions to determine which ones will take the most time and which ones you can answer quickly. Allocate time accordingly. For example, if a question requires more in-depth analysis or calculation, set aside more time for it. Be sure to leave a few minutes at the end to review your answers.

Focus on Efficiency, Not Perfection

While it’s important to provide well-thought-out answers, spending too much time on a single question can limit the time available for others. Focus on answering each question to the best of your ability without getting stuck on one particular detail. If you’re unsure about an answer, move on and return to it later if time allows.

By prioritizing tasks and maintaining a balanced pace, you can ensure that you manage your time effectively and cover all areas of the assessment confidently.

Common Pitfalls to Avoid in Financial Assessments

When preparing for assessments related to property financing, understanding common mistakes can make a significant difference in your performance. Certain missteps can cost you valuable points and undermine your ability to present a clear and accurate analysis. By identifying and avoiding these pitfalls, you can improve your chances of achieving a successful outcome.

Frequent Mistakes to Watch Out For

| Common Pitfall | How to Avoid It |

|---|---|

| Overcomplicating Simple Questions | Avoid making simple problems more complex than necessary. Stick to the basics and don’t overthink straightforward calculations or concepts. |

| Skipping Important Details | Always read each question carefully and make sure to address all parts. Missing key details can lead to incomplete or incorrect answers. |

| Misunderstanding Terminology | Make sure you are clear on the definitions and applications of key terms. Misusing or misunderstanding terminology can lead to confusion and errors. |

| Ignoring Time Constraints | Failing to manage your time effectively can result in rushing through questions at the end. Keep track of the time and pace yourself. |

| Overlooking the Review Process | Never skip the final review. Take time to double-check calculations and ensure that all parts of each question have been answered correctly. |

By being aware of these pitfalls and taking steps to avoid them, you can improve your ability to perform confidently and accurately during your assessments. Proper preparation and attention to detail are key to success.

How to Approach Property Case Studies

Case studies are an essential part of any property-related assessment, requiring a comprehensive analysis of complex scenarios. They typically involve real-world situations where you must apply theoretical knowledge to solve practical problems. Approaching case studies strategically will help you break down the information and present well-reasoned solutions.

Start by carefully reading the case study to understand the key facts and identify the main issues. Look for the financial figures, market conditions, and any other relevant data that could influence your decisions. Once you have a clear grasp of the situation, outline the steps you’ll take to analyze the case. This will help you stay focused and ensure that you address all the necessary points in your response.

As you work through the case, apply the concepts and calculations you’ve learned to assess the viability of the scenario. Use relevant formulas, and don’t forget to explain your reasoning. Structure your response logically, addressing each part of the case in a clear and concise manner. By following this methodical approach, you can effectively tackle case studies and demonstrate your understanding of property-related financial concepts.

Reviewing Financial Statements for the Exam

Understanding how to read and analyze financial statements is a critical skill for any assessment involving property investments or related subjects. These statements provide essential information that helps you evaluate the financial health of an investment or project. By reviewing key components carefully, you can identify trends, risks, and opportunities that are vital for decision-making.

Key Financial Statements to Review

There are several important financial statements you need to familiarize yourself with for your assessments:

- Income Statement: Reflects the profitability of a business or property, detailing revenues and expenses.

- Balance Sheet: Provides an overview of assets, liabilities, and equity, offering a snapshot of the financial position at a specific point in time.

- Cash Flow Statement: Shows the cash inflows and outflows over a given period, essential for understanding liquidity.

Steps for Effective Review

When reviewing these statements, follow these steps to ensure a comprehensive analysis:

- Understand the Structure: Familiarize yourself with the format and key components of each statement. Recognize where to find crucial data like net income, assets, and liabilities.

- Identify Key Ratios: Look for financial ratios, such as the debt-to-equity ratio or return on investment, to evaluate the performance and risk level.

- Analyze Trends: Review historical data for trends over time. Compare year-on-year figures to identify growth or declines in key financial areas.

- Evaluate Liquidity and Solvency: Assess the business’s ability to meet its short-term obligations and long-term financial stability.

By mastering the art of reviewing financial statements, you will be better prepared to assess the financial viability of various scenarios and answer related questions accurately during your assessments.

Understanding Interest Rates and Amortization

Interest rates and amortization are fundamental concepts when it comes to assessing financial agreements and understanding the long-term cost of loans. These elements directly affect the total amount paid over the life of a loan and are crucial for evaluating the profitability and sustainability of investments. A clear grasp of how interest works and how payments are structured can help make informed decisions in any financial assessment or investment strategy.

How Interest Rates Affect Loan Payments

Interest rates represent the cost of borrowing money, typically expressed as a percentage of the loan amount. This rate determines how much additional money is paid back over time, beyond the principal. The higher the interest rate, the more expensive the loan becomes in the long run. Understanding how different rates impact monthly payments is essential for calculating total loan costs and determining affordability.

The Process of Amortization

Amortization refers to the process of gradually repaying a loan over time through fixed payments. These payments usually consist of both interest and principal components. Early payments are primarily focused on interest, while later payments contribute more toward reducing the principal balance. This process is essential for understanding how a loan balance decreases over time and how it impacts cash flow.

By mastering these concepts, you can accurately evaluate financing options, assess the impact of different interest rates on overall payments, and make more informed decisions regarding investment opportunities.

How to Solve Complex Financing Problems

Tackling complicated financial scenarios requires a methodical approach and a deep understanding of key principles. These problems often involve multiple variables, such as interest rates, payment schedules, and different forms of capital. Breaking down the problem into manageable parts and systematically analyzing each element can help to find effective solutions.

Start by thoroughly reading the problem and identifying the key data points. Look for figures such as loan amounts, interest rates, repayment terms, and any other financial details that may influence the solution. Once you have all the necessary information, break the problem into smaller sections that are easier to address. For example, calculate the total cost of the loan, determine the interest paid over time, or evaluate cash flow patterns.

Once the basics are understood, apply the relevant formulas or models to solve for unknown variables. Be sure to double-check your calculations and ensure that they align with the problem’s requirements. Using a step-by-step approach will help you avoid common mistakes and ensure accuracy. Additionally, using financial tools or calculators can assist in simplifying complex calculations and provide more confidence in your results.

By mastering the process of solving these challenges, you will become more adept at analyzing and addressing intricate financial problems, leading to better decision-making and stronger financial planning skills.

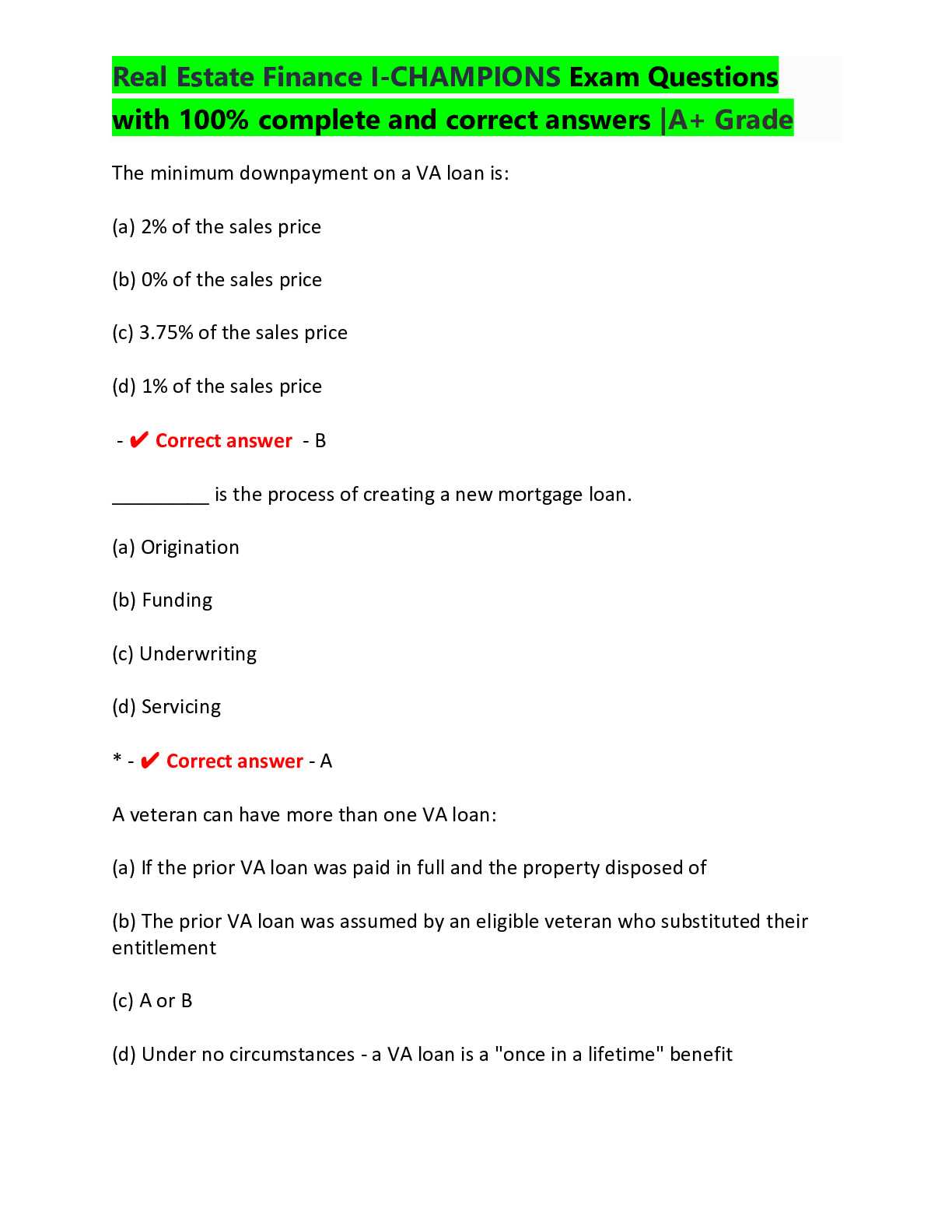

What to Expect in Real Estate Finance Questions

When approaching questions related to property investment and financial analysis, it’s important to understand the core topics that are likely to be covered. These questions typically assess your ability to apply mathematical principles, analyze financial data, and understand complex lending scenarios. The content often includes calculations, theoretical concepts, and real-world applications that require logical reasoning and problem-solving skills.

Common areas that are tested include the calculation of loan payments, the impact of different interest rates, the structure of investment returns, and an understanding of risk management techniques. You may also be asked to evaluate the financial feasibility of specific projects or investment opportunities, considering factors such as cash flow, market conditions, and long-term profitability.

Expect a mix of question types, including multiple-choice, short answer, and scenario-based problems. These questions are designed to challenge your understanding and ensure you can apply theoretical knowledge to practical situations. It’s essential to practice solving various types of problems, as this will help you become familiar with common question formats and increase your confidence in tackling them.

Study Strategies for Real Estate Finance

Successfully preparing for assessments in property investment and financial management requires a structured and focused approach. It’s not only about memorizing formulas and concepts, but also about applying them to solve real-world problems. Effective study strategies help ensure that you can master the key topics and perform confidently under pressure.

Organize Your Study Plan

Begin by creating a study schedule that allows sufficient time for each subject area. Prioritize the most complex or challenging topics and allocate more time to them. Breaking down the material into smaller sections makes it easier to absorb and reduces the feeling of being overwhelmed. Try the following:

- Set specific goals for each study session.

- Review a mix of theoretical concepts and practical exercises.

- Regularly assess your understanding with self-tests and practice problems.

Use Active Learning Techniques

Active learning helps reinforce your knowledge and improves retention. Instead of passively reading or watching videos, engage with the material by solving problems, explaining concepts aloud, or teaching someone else. Other methods include:

- Creating flashcards for key terms and formulas.

- Working through case studies and applying theories to different scenarios.

- Joining study groups to discuss difficult concepts and gain different perspectives.

By incorporating these techniques into your preparation, you’ll develop a deeper understanding of the material and be better equipped to handle challenging questions during assessments.

Practice Problems and Solutions

Practicing with problems and reviewing solutions is a crucial step in mastering the material related to property investment and financial calculations. By solving a variety of problems, you develop not only your technical skills but also your ability to apply theoretical knowledge in practical situations. This hands-on approach helps solidify your understanding and prepares you for the complexity of real-world financial decision-making.

Sample Problem 1: Loan Calculation

Problem: A borrower takes out a loan of $200,000 with an interest rate of 4.5% for 20 years. What is the monthly payment?

Solution: To calculate the monthly payment, use the formula for a fixed-rate loan:

Monthly Payment = P × r × (1 + r)^n / ((1 + r)^n – 1)

- P = $200,000 (loan amount)

- r = 4.5% / 12 = 0.00375 (monthly interest rate)

- n = 20 × 12 = 240 (number of payments)

Substituting the values into the formula:

Monthly Payment = 200,000 × 0.00375 × (1 + 0.00375)^240 / ((1 + 0.00375)^240 – 1) ≈ $1,265.04

The monthly payment for this loan is approximately $1,265.04.

Sample Problem 2: Return on Investment (ROI)

Problem: An investor purchases a property for $300,000. The property generates annual rental income of $30,000, and operating expenses total $10,000 per year. What is the annual return on investment?

Solution: To calculate the ROI, use the formula:

ROI = (Net Income / Investment) × 100

- Net Income = $30,000 – $10,000 = $20,000

- Investment = $300,000

Substituting the values into the formula:

ROI = (20,000 / 300,000) × 100 = 6.67%

The annual return on investment for this property is 6.67%.

By practicing problems like these, you can strengthen your ability to solve real-world financial scenarios and enhance your preparation for assessments.

Improving Your Real Estate Exam Score

Achieving a high score in assessments related to property investment and financial management requires a combination of effective study techniques, thorough understanding of key concepts, and the ability to apply knowledge under timed conditions. Whether you’re preparing for a certification or an academic test, focusing on areas of weakness and practicing key problem-solving strategies can greatly enhance your performance.

Effective Study Habits

To improve your score, it is essential to develop a structured study routine. Consider the following strategies:

- Review Core Concepts: Ensure you fully understand basic principles, such as interest rates, amortization, and investment returns. Mastery of these will provide a strong foundation.

- Practice Problems Regularly: Solve a variety of problems related to key topics to reinforce your understanding and develop problem-solving speed.

- Use Flashcards: Create flashcards for important terms and formulas. This helps reinforce your memory and quickly recall information during the test.

- Study in Intervals: Break study sessions into focused intervals (e.g., 45 minutes of study, 15-minute break). This method can help maintain concentration over longer periods.

Maximizing Test Performance

In addition to effective study habits, there are several strategies to optimize your performance during the assessment:

- Time Management: Familiarize yourself with the test format and allocate time to each section according to its weight. Avoid spending too much time on any single question.

- Read Instructions Carefully: Ensure you fully understand the question before answering. Pay close attention to any special instructions or details provided in the prompt.

- Stay Calm and Focused: During the test, remain calm and stay focused on the task at hand. Avoid getting stuck on difficult questions; move on and return to them later if needed.

By consistently applying these strategies, you can increase your chances of success and achieve a higher score in your assessment. Remember that preparation is key, and regular practice coupled with effective test-taking techniques will lead to improved outcomes.

Important Formulas to Memorize

Understanding key formulas is essential for solving complex problems related to property investment, financing, and management. These formulas are fundamental tools that can help you quickly calculate critical values, such as interest rates, investment returns, and loan amortization schedules. Memorizing these formulas allows you to apply them efficiently during assessments and in real-world scenarios.

Key Formulas for Property Investment Calculations

Below are some of the most important formulas to keep in mind when dealing with property financing and investment scenarios:

- Loan Payment Formula: This formula calculates the periodic payment for a loan based on the interest rate and loan amount.

PMT = P × [r(1+r)^n] / [(1+r)^n – 1]

Where:

- PMT = Monthly Payment

- P = Loan Amount

- r = Interest Rate per Period

- n = Number of Payments

- Future Value of an Investment (FV): This formula determines the future value of an investment given an initial amount, interest rate, and time period.

FV = PV × (1 + r)^n

Where:

- FV = Future Value

- PV = Present Value

- r = Interest Rate per Period

- n = Number of Periods

- Capitalization Rate (Cap Rate): This formula calculates the rate of return on a property investment based on the income it generates.

Cap Rate = Net Operating Income (NOI) / Property Value

Where:

- NOI = Net Operating Income

- Property Value = Market Value of the Property

Key Formulas for Analyzing Cash Flow

To properly assess the financial health of an investment, you need to understand the following cash flow formulas:

- Net Present Value (NPV): This formula is used to determine the present value of an investment by comparing the initial outlay with the sum of future cash inflows, discounted at a specific rate.

NPV = Σ (Cash Flow / (1 + r)^n) – Initial Investment

Where:

- Cash Flow = Expected Cash Flow at Each Period

- r = Discount Rate

- n = Period

- Internal Rate of Return (IRR): The IRR formula helps determine the discount rate that makes the NPV of the investment equal to zero.

0 = Σ (Cash Flow / (1 + IRR)^n) – Initial Investment

By memorizing and understanding these formulas, you will be better equipped to handle a wide range of financial calculations related to investment properties, loans, and other financial decisions. Regular practice with these equations is crucial for both academic assessments and real-world application in property management.