Becoming a qualified professional in the insurance claims industry requires both knowledge and preparation. The process involves mastering various topics related to policy assessment, damage evaluation, and customer service. Gaining this expertise is key to success in the field, ensuring accuracy and reliability when dealing with clients and their claims.

To succeed in the qualification process, it’s essential to understand the types of questions and scenarios you will encounter. Thorough preparation is necessary to demonstrate competence and to meet the standards required by the regulatory bodies. Whether you’re new to the field or seeking to advance your career, knowing the right approach to studying and answering questions can significantly impact your results.

Success in this qualification opens the door to numerous career opportunities in a growing and rewarding industry. Professionals in this field play a vital role in evaluating claims, determining the appropriate compensation, and ensuring smooth processes for both companies and customers. With the right guidance and practice, passing the assessment can set the foundation for a fulfilling career.

Insurance Claims Professional Qualification Guide

Successfully passing the qualification process for claims professionals requires a deep understanding of key concepts, regulations, and procedures. This guide provides a structured approach to mastering the necessary knowledge for navigating the assessment. Preparation is crucial for ensuring you are well-equipped to handle the challenges presented during the evaluation.

Effective Study Strategies

To excel, it is important to focus on the most relevant topics that will be covered. Familiarizing yourself with the types of questions and scenarios you may face will help you manage your time efficiently. Practice tests, study guides, and review materials are essential tools for reinforcing your knowledge and increasing confidence in your abilities.

Understanding Key Topics

Key areas typically include understanding insurance policies, property and casualty coverage, claims evaluation, and communication with clients. Mastering these topics is essential to demonstrate your competence and readiness for real-world situations. Taking the time to review and thoroughly understand these subjects will help you perform well during the qualification process.

Understanding the Qualification Process

Becoming a qualified professional in the claims industry requires completing a structured assessment process designed to test your knowledge and expertise. This process involves demonstrating proficiency in essential areas such as policy evaluation, loss determination, and effective communication with clients. Each step ensures that you are prepared for the responsibilities you will face in your role.

Steps to Achieve Professional Status

The path to achieving professional status typically starts with completing required courses or training programs. Afterward, you’ll need to pass a thorough assessment that measures your understanding of various industry topics. This step is critical for ensuring that you possess the skills needed to make informed decisions and provide quality service to clients.

Key Requirements and Expectations

Understanding the expectations for this qualification is essential. It’s important to know the areas covered, such as claims procedures, legal regulations, and customer interaction. Meeting these requirements demonstrates your readiness to work in the field and assures employers and clients of your competence. Mastering these areas is key to successfully navigating the qualification process and excelling in your career.

How to Prepare for the Assessment

Preparing for the professional evaluation in the claims industry requires a focused and strategic approach. Understanding the structure of the process and mastering key concepts is essential for success. Effective preparation involves a combination of study techniques, practice, and familiarization with the topics that will be tested.

Study Techniques for Success

Start by organizing your study materials and setting a clear schedule. Break down the topics into manageable sections and focus on one area at a time. Use a variety of resources, such as study guides, online tutorials, and sample questions, to reinforce your knowledge and identify areas where you may need additional practice. Prioritize subjects that are commonly tested to maximize your time.

Practicing Under Test Conditions

Simulating test conditions can significantly improve your performance. Take practice assessments under timed conditions to build your confidence and improve time management. This will help you become more comfortable with the format and reduce stress during the actual evaluation. Regular practice will ensure you are well-prepared for the challenges you will face.

Key Topics Covered in the Assessment

The professional evaluation in the claims field covers a wide range of important subjects, ensuring that candidates have a comprehensive understanding of the industry. These areas are designed to assess not only theoretical knowledge but also practical skills that are essential for success in real-world scenarios. Mastering these topics will prepare you for the challenges you may face in your career.

Essential Areas to Focus On

The following topics are commonly tested in the assessment and should be prioritized during your preparation:

- Policy Evaluation – Understanding different types of insurance policies and their coverage limits.

- Claims Processing – Knowledge of the step-by-step procedures for processing claims efficiently and accurately.

- Loss Determination – Techniques for assessing damages and determining the appropriate compensation.

- Legal and Regulatory Knowledge – Familiarity with laws and regulations that govern the claims process and industry standards.

- Customer Communication – Skills for effectively communicating with clients, managing expectations, and resolving conflicts.

Additional Key Concepts

In addition to the core topics, you should also focus on:

- Risk Assessment – Understanding how to evaluate potential risks and their impact on claims.

- Claims Investigation – Knowledge of how to gather and analyze evidence to support claims decisions.

- Ethical Standards – Awareness of ethical guidelines and practices for handling sensitive situations.

- Technology in Claims Management – Familiarity with software tools used in claims management and digital communication.

Tips for Answering Assessment Questions

Approaching the questions in the professional evaluation requires both strategy and careful thought. The ability to interpret the questions accurately and apply your knowledge effectively is key to achieving a strong result. By using the right techniques, you can increase your chances of selecting the correct responses and completing the assessment efficiently.

One of the most important tips is to read each question carefully before jumping to conclusions. Take your time to fully understand what is being asked. Often, questions are designed to test your ability to differentiate between similar concepts, so attention to detail is crucial.

Additionally, it’s helpful to eliminate obviously incorrect options first. This will narrow down your choices and increase the likelihood of selecting the correct answer. If you’re unsure about a particular question, try to make an educated guess based on your knowledge of the topic.

Another key strategy is managing your time effectively. Avoid spending too much time on a single question. If you’re stuck, move on and return to it later if necessary. This will help ensure that you complete all sections of the assessment within the allotted time.

Lastly, remember that preparation is critical. The more familiar you are with the material, the more confident and efficient you will be during the evaluation. Practice with sample questions and review key topics regularly to reinforce your understanding.

Study Resources for Professional Qualification

To succeed in the qualification process for claims professionals, it’s important to utilize the right study resources. These materials can help you build a solid foundation of knowledge and better prepare for the challenges you will face during the assessment. From textbooks to online tools, there are many options to choose from that cater to different learning styles.

Recommended Study Materials

Focus on resources that cover all the essential topics and provide practical examples. Here are some useful materials to consider:

- Study Guides – Comprehensive guides that explain key concepts in a structured format.

- Textbooks – Books focused on specific areas of the industry, such as policy evaluation and loss assessment.

- Online Courses – Interactive learning platforms that offer video lessons, quizzes, and assessments.

- Practice Tests – Simulated tests designed to mimic the real-world evaluation, helping you test your knowledge under time constraints.

- Reference Materials – Industry-specific glossaries, legal manuals, and regulatory guidelines.

Online Tools and Platforms

In addition to traditional resources, online platforms can provide valuable tools for preparation:

- Interactive Quizzes – Online quizzes that offer instant feedback to help you assess your strengths and weaknesses.

- Discussion Forums – Join online communities where you can ask questions, exchange insights, and share tips with other candidates.

- Webinars and Workshops – Attend live sessions with industry experts for additional guidance and practical tips.

Common Mistakes to Avoid

During the professional evaluation process, it’s easy to make mistakes that can negatively affect your performance. Understanding these common errors can help you avoid them and improve your chances of success. By being aware of typical pitfalls, you can approach the assessment with greater confidence and clarity.

Overlooking Key Details

One of the most frequent mistakes candidates make is overlooking important details in questions. The wording can often be tricky, and missing subtle clues may lead to choosing an incorrect answer. Always take the time to carefully read each question and ensure you understand all parts before selecting your response. Pay close attention to qualifiers like “always,” “never,” or “most likely,” which can change the meaning of a question.

Not Managing Time Properly

Another common mistake is failing to manage time effectively. Spending too long on one question or section can leave you with insufficient time to complete the entire assessment. It’s essential to pace yourself and prioritize questions you find more manageable. If you encounter a difficult question, mark it and move on, returning to it later when you have time to carefully consider your options.

How to Pass on the First Try

Successfully passing the professional assessment on your first attempt requires a combination of preparation, focus, and strategy. By adhering to a structured study plan and familiarizing yourself with the format and content of the assessment, you can approach the process with confidence and increase your chances of success. Below are key steps to help you achieve this goal efficiently.

Effective Preparation Strategy

To maximize your chances of passing the evaluation on your first attempt, a solid preparation plan is crucial. The table below outlines the essential components of a preparation strategy:

| Step | Action | Expected Outcome |

|---|---|---|

| 1. Understand the Topics | Familiarize yourself with the main concepts and areas of focus for the assessment. | Becoming well-versed in key areas ensures you’re prepared for any question type. |

| 2. Use Study Materials | Utilize comprehensive study guides, practice tests, and reference books. | Enhanced retention of important details and concepts. |

| 3. Practice Time Management | Simulate real test conditions by taking timed practice assessments. | Improved time efficiency and confidence when answering under pressure. |

| 4. Review Mistakes | Go over incorrect answers and focus on understanding why you made them. | Strengthened understanding of weaker areas and reduced likelihood of repeating mistakes. |

| 5. Take Care of Your Well-being | Ensure you’re well-rested and mentally prepared before the assessment day. | Increased focus, energy, and overall performance during the test. |

By following these steps and dedicating ample time to preparation, you can significantly improve your chances of passing on the first attempt. A disciplined approach, combined with a thorough understanding of the material, will set you up for success.

Role of an Insurance Claims Specialist

The primary responsibility of a professional in the claims industry is to evaluate and assess the damage or loss incurred by policyholders. This role involves a combination of investigation, documentation, and communication to ensure that claims are processed fairly and efficiently. Professionals in this field must apply their knowledge of policies, regulations, and procedures to determine the validity of a claim and the appropriate compensation for the policyholder.

Key tasks often include inspecting property damage, reviewing insurance policies, and working closely with both clients and other industry professionals, such as contractors or medical personnel. A critical aspect of this role is the ability to make informed decisions based on available evidence, ensuring that the process is transparent and accurate.

In addition to technical skills, communication is an essential part of the job. Professionals must be able to explain their findings clearly and navigate challenging conversations with both clients and other parties involved in the claims process. Their decisions can significantly impact the outcomes of claims, which is why maintaining objectivity and professionalism is crucial in this line of work.

Time Management During the Assessment

Effective time management is essential when facing any professional assessment. Without proper planning, it can be easy to get caught up in difficult questions and run out of time, potentially leading to incomplete answers or rushed decisions. To succeed, it’s important to approach the evaluation with a clear strategy for pacing yourself throughout the process.

One of the first steps to effective time management is familiarizing yourself with the structure of the assessment. Knowing how many questions there are and how much time is allotted will help you divide your time wisely. A good rule of thumb is to allocate time based on the complexity of the questions. For example, if some sections are more challenging than others, you should spend more time on those while ensuring you leave time to complete the easier sections.

Additionally, consider using a time-tracking method during the assessment, such as setting checkpoints for yourself. This could involve setting mini-goals, like finishing a specific number of questions every 15 minutes, or keeping a close eye on the time and adjusting your pace as needed. Prioritize questions that you can answer quickly, and if you encounter a particularly challenging one, don’t hesitate to mark it and move on, returning to it later if time allows.

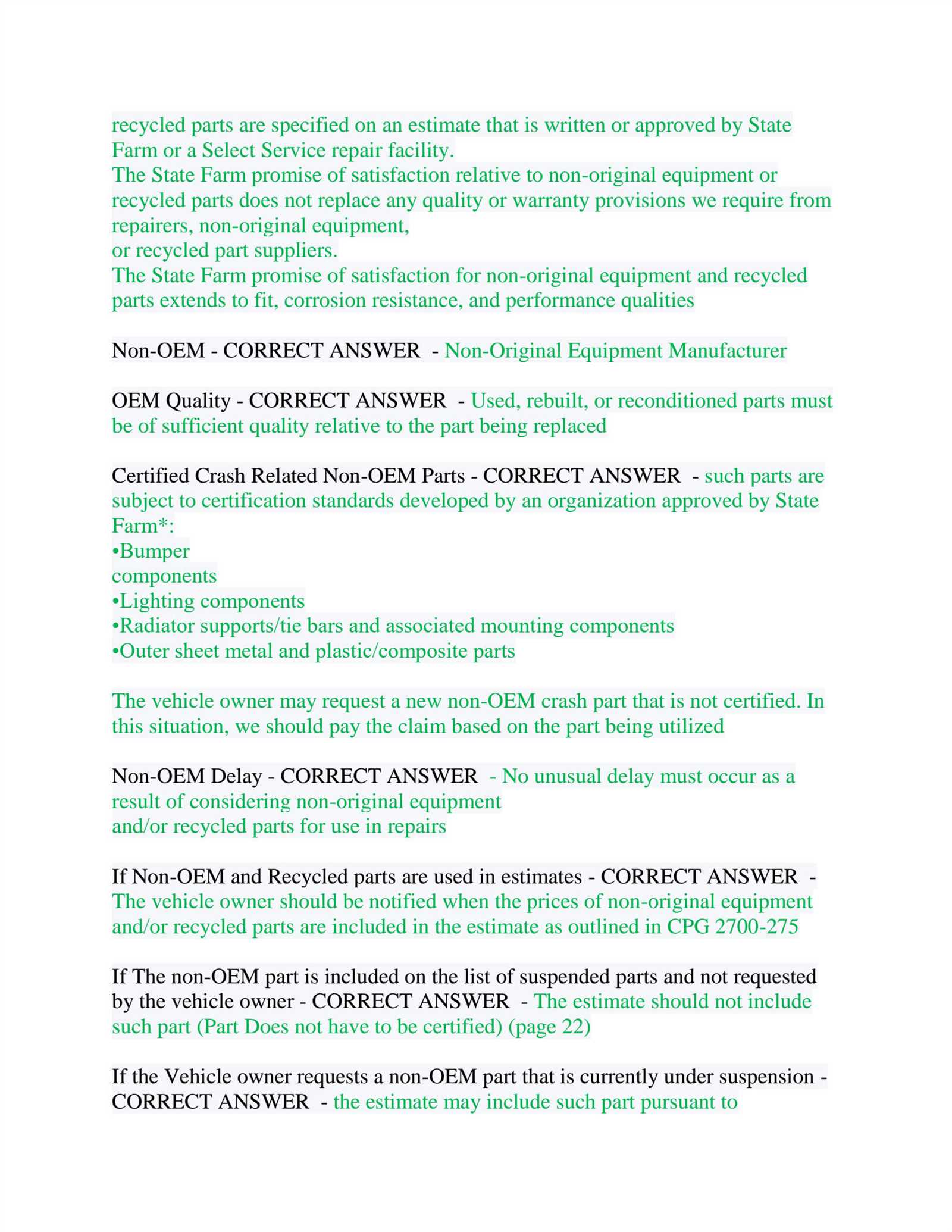

Understanding Insurance Terminology

Mastering the language of insurance is crucial for anyone involved in evaluating claims or processing policies. Insurance terminology can often seem complex, but understanding these terms is essential for making informed decisions. Knowing the key terms and concepts will not only improve your performance in assessments but also enhance your ability to navigate the claims process with confidence.

Commonly used terms such as “deductibles,” “premiums,” “coverage limits,” and “liability” are integral to understanding how insurance policies function. Each term represents a fundamental concept that influences how claims are assessed and how much compensation may be provided. A strong grasp of these terms will help you quickly interpret the details of policies and evaluate claims accurately.

Furthermore, many assessments will include scenarios or case studies that require applying your knowledge of these terms to real-world situations. By familiarizing yourself with insurance language and its practical applications, you will be better equipped to analyze each case and make informed decisions in a timely manner.

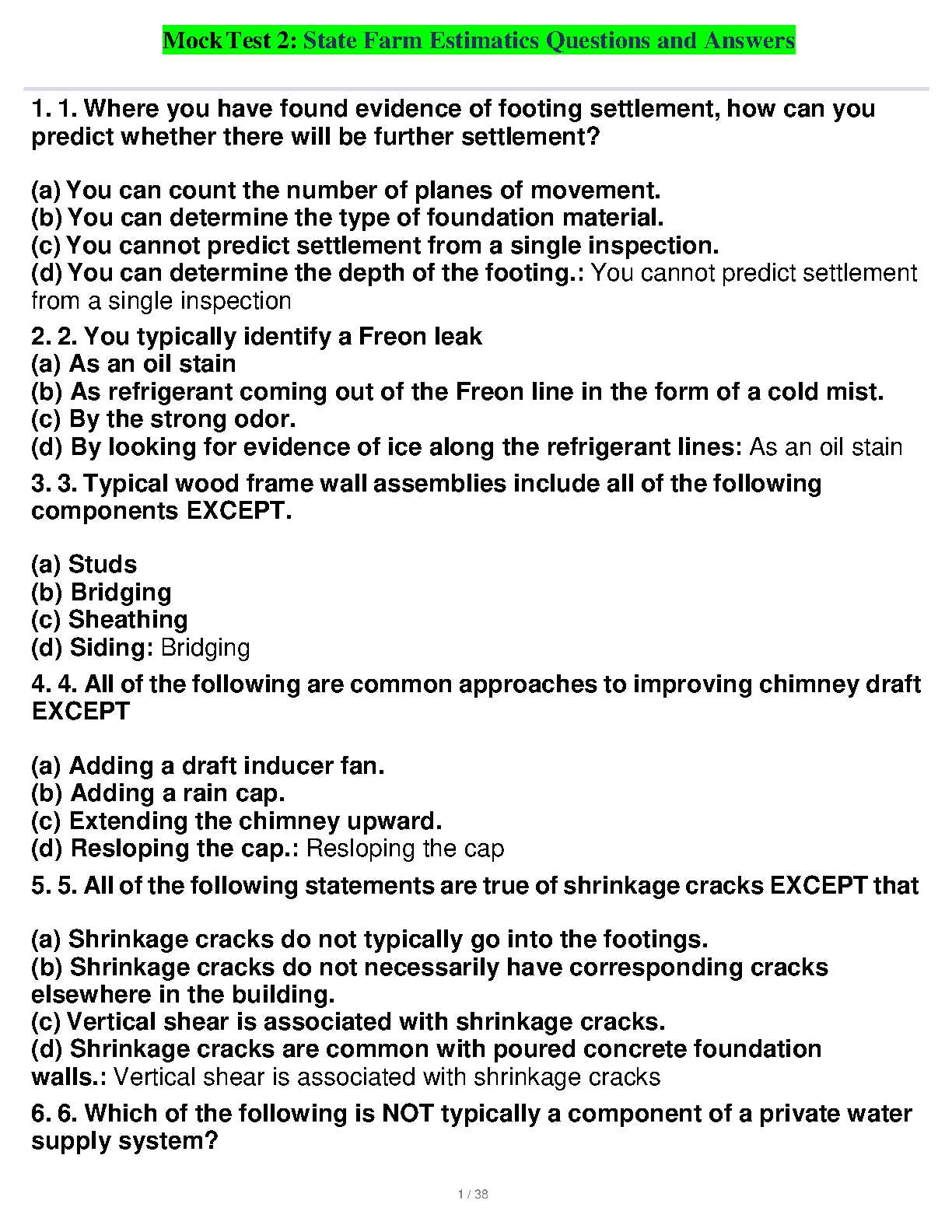

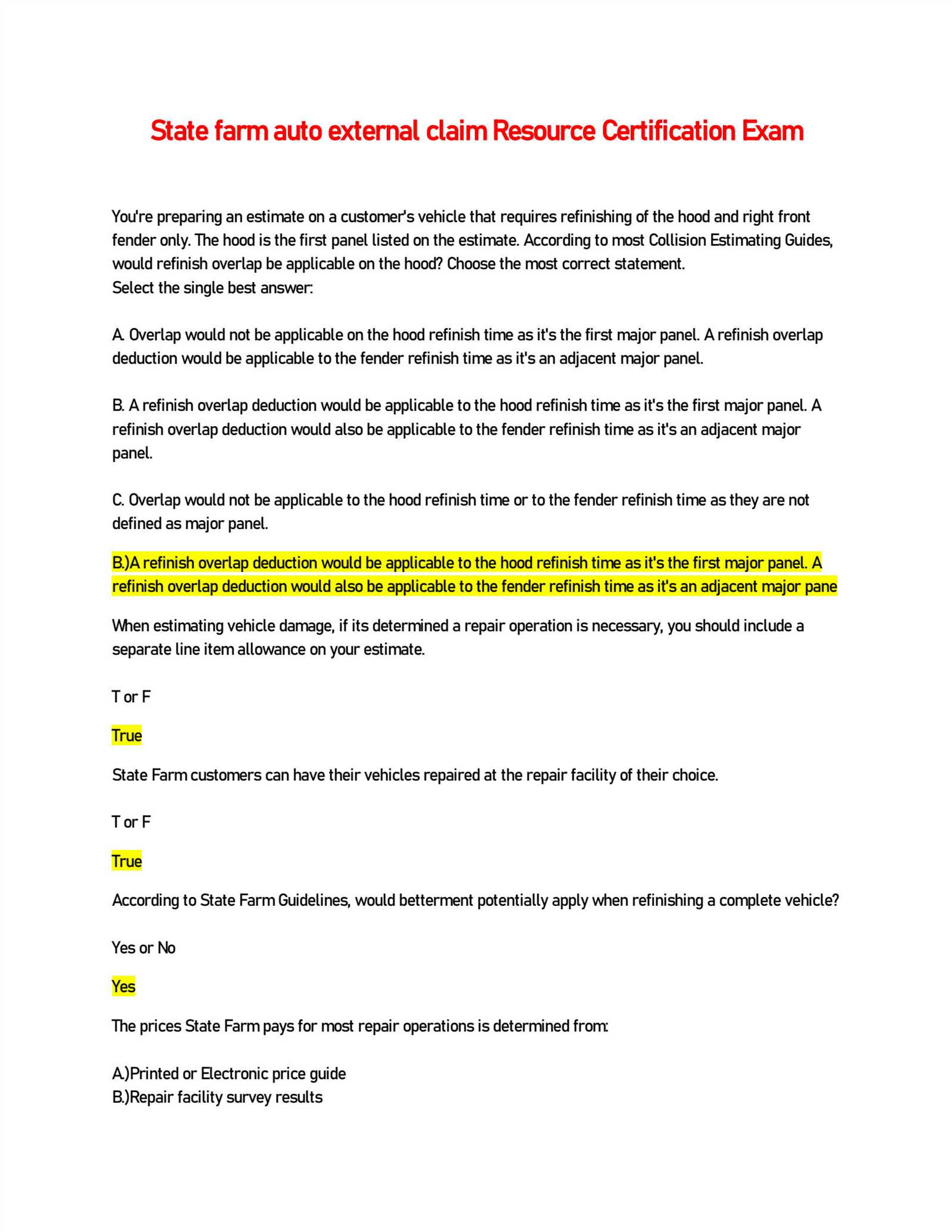

Sample Questions to Practice

Practicing with sample questions is one of the most effective ways to prepare for any professional evaluation. It allows you to familiarize yourself with the types of questions that may appear, improves your time management, and boosts your confidence. By working through various scenarios, you can better understand the reasoning required to answer questions accurately.

The table below provides sample questions designed to help you prepare for your assessment. These examples cover a range of topics you may encounter, offering a glimpse into the types of problems you will need to solve.

| Question | Topic | Correct Answer |

|---|---|---|

| A policyholder has submitted a claim for vehicle damage caused by a hailstorm. What should be the first step in the investigation? | Claims Assessment | Inspect the damage and review the policy details to determine coverage. |

| What is the maximum amount that will be paid out for a loss under a homeowner’s insurance policy with a $500,000 coverage limit? | Coverage Limits | The payout cannot exceed the policy’s coverage limit of $500,000. |

| If a claimant fails to provide required documentation for a loss, what is the next step? | Documentation and Requirements | Inform the claimant about the missing documents and request them for further processing. |

| Which of the following is typically not covered under a standard renter’s insurance policy? | Policy Coverage | Damage caused by floods (unless additional flood coverage is added). |

Regular practice with questions like these will help sharpen your skills, improve your understanding of the subject, and prepare you to perform effectively under time constraints. As you work through these sample questions, pay attention to the reasoning behind each answer and continue refining your approach.

Test Your Knowledge with Mock Exams

One of the best ways to gauge your readiness for any professional assessment is through mock exams. These practice tests simulate the actual testing environment, helping you familiarize yourself with the format, time constraints, and types of questions you’ll face. By completing mock exams, you can identify areas of strength as well as areas that need further study, allowing you to refine your approach before the real evaluation.

Mock exams are particularly useful for building confidence. They help reduce test anxiety by allowing you to practice under realistic conditions. As you work through these simulated tests, you’ll get a clearer sense of the pacing required to complete all questions within the given time limit. The more mock exams you take, the more comfortable you will become with the assessment process.

Additionally, reviewing your performance on mock exams is just as important as taking them. After completing a practice test, take the time to go over your answers, especially the ones you got wrong. This will provide valuable insights into the types of mistakes you might be making, and allow you to adjust your study plan accordingly.

What Happens After Passing the Exam

After successfully completing a professional evaluation, there are several important steps that follow. Passing the assessment signifies that you have acquired the necessary knowledge and skills to proceed with your professional journey. However, the process doesn’t end with the results; there are essential actions to take to fully integrate into the industry.

Once you’ve passed, you will typically receive confirmation of your success. This acknowledgment serves as a foundation for your next steps in securing the necessary credentials to practice in your field. Depending on the type of profession, the next phase may involve completing additional paperwork, submitting documentation, or engaging in industry-specific training or orientation programs.

Here are a few common steps to expect after passing:

- Receiving Your Official Certification: You will usually be issued an official certification, which may include a certificate or a formal letter confirming your qualification.

- Industry Registration: In many cases, after passing, you’ll need to register with a governing body or professional organization to be officially recognized as qualified to practice.

- Additional Training or On-the-Job Learning: Depending on your chosen profession, further training may be required to stay updated on industry standards or gain hands-on experience.

- Job Placement or Client Engagement: Once accredited, you may begin seeking employment in your field or engaging with clients, depending on the nature of your role.

- Continuing Education: Many industries require ongoing learning to maintain your standing, including attending courses, seminars, or workshops to stay informed about new trends and best practices.

Achieving success in your assessment is just the beginning of a rewarding career. The next steps will involve applying your knowledge, building your professional network, and staying committed to continuous improvement throughout your career.

License Renewal Requirements

After obtaining your professional qualification, it’s essential to keep your credentials up to date. Renewal processes vary by region and industry, but they are generally designed to ensure that professionals continue to meet current standards and regulations. Understanding the specific renewal requirements is crucial for maintaining your eligibility to practice in your field.

The renewal process typically involves submitting an application, paying a fee, and completing a set of ongoing education or training. The exact requirements will depend on your location and the type of work you do, so it’s important to stay informed about any changes to the guidelines.

Here are some common elements of the license renewal process:

- Continuing Education: Most regions require professionals to complete a certain number of hours in continuing education courses. These courses may cover new industry regulations, trends, or best practices.

- Application Submission: You will typically need to submit a renewal application, which may require proof of continuing education or other documents to verify your eligibility.

- Fees: Renewal fees are often required to process your application and maintain your license. The fee structure can vary depending on the jurisdiction.

- Compliance with Local Regulations: Ensure that you are aware of any new local or state regulations that may affect your ability to renew your qualifications.

- Background Checks: In some cases, a background check may be required as part of the renewal process to ensure compliance with industry standards and legal requirements.

It’s important to begin the renewal process well before your license expires to avoid any lapses in your qualifications. Staying proactive in meeting these requirements will help you maintain your professional standing and continue working without interruptions.

Benefits of Becoming a Certified Professional

Obtaining formal recognition in your field can provide numerous advantages, both professionally and personally. A recognized qualification opens the door to more opportunities, higher earning potential, and greater job security. Whether you’re just starting your career or looking to advance, achieving this level of expertise demonstrates your commitment and knowledge, making you a more competitive candidate in the job market.

Here are some key benefits of becoming a certified professional in your industry:

- Enhanced Job Opportunities: A formal qualification is often a requirement for many employers, and it can make you stand out when applying for positions. Many companies prefer candidates who have proven their skills through a recognized credential.

- Increased Earning Potential: Professionals with certified qualifications often earn higher salaries compared to their non-certified counterparts. The credential is an indicator of expertise, which can justify higher compensation.

- Job Security: Certification can provide a level of job stability, as certified professionals are often seen as more reliable and qualified, making it harder to replace them with less experienced workers.

- Professional Credibility: Being recognized as a certified expert boosts your reputation among peers, clients, and employers. It signals that you have met industry standards and possess the knowledge needed to excel in your field.

- Access to Networking Opportunities: Certification programs often offer access to exclusive professional networks, conferences, and events. This can help you connect with other experts in your field and stay up-to-date with industry trends and practices.

- Career Advancement: Certification is often a stepping stone to higher-level positions. With your credentials, you may be able to advance to roles with greater responsibilities and challenges.

Becoming a certified professional not only boosts your career prospects but also enhances your personal growth by broadening your knowledge and skill set. As the demand for qualified experts continues to grow, earning a recognized qualification becomes a valuable asset in today’s competitive job market.