The study of financial management plays a crucial role in shaping one’s understanding of how businesses track, analyze, and report their monetary activities. The complexities involved in interpreting financial data require a solid grasp of the underlying principles and methods that drive calculations and reporting.

In this section, we will explore the essential topics necessary for mastering the various aspects of financial statements, including income reports, balance sheets, and cash flow statements. By diving into specific exercises, we aim to clarify common challenges and offer clear solutions to improve accuracy and understanding.

Developing proficiency in these areas will not only prepare you for more advanced studies but also enhance your ability to apply these skills practically. With focused practice and methodical review, anyone can achieve a higher level of competency in this field.

Accounting Chapter 9 Test A Answers

This section covers a detailed breakdown of the most common challenges encountered when working through financial evaluation exercises. It provides an in-depth explanation of each question, offering clear and concise solutions that will help strengthen your understanding of key principles in financial reporting and analysis.

Understanding Financial Statements

One of the fundamental components in financial exercises is interpreting financial statements. These documents reflect a company’s performance and are crucial for assessing its financial health. By focusing on balance sheets, income reports, and cash flow analyses, we will clarify how to approach each type of statement effectively, ensuring accurate calculations and interpretations.

Common Mistakes and How to Avoid Them

It’s easy to make errors when working with complex financial data. Misunderstanding formulas, overlooking key figures, or misinterpreting the financial health indicators can lead to inaccurate results. This section will highlight the most frequent mistakes and offer strategies to prevent them, ensuring better results and a stronger grasp of financial concepts.

Overview of Accounting Chapter 9

This section provides a comprehensive overview of the key topics essential for understanding financial evaluation processes. It introduces the main concepts and techniques used in analyzing a company’s economic situation, focusing on how to interpret various financial records and reports.

Key Financial Concepts and Techniques

At the core of this section are the critical concepts that drive financial assessments, such as asset management, income tracking, and cash flow analysis. A solid understanding of these principles is necessary for making informed decisions based on the available financial data. The section will also delve into the various methods used for evaluating the financial stability of a business.

Applying Financial Principles in Practice

The real-world application of these techniques is vital for anyone working with financial records. By focusing on real-life scenarios and providing hands-on practice, this section ensures that you not only understand the theory behind financial statements but also how to apply them effectively in practical situations. Mastering these concepts will help improve your ability to evaluate financial health accurately.

Key Concepts in Chapter 9 Test

This section explores the fundamental principles that are central to understanding the key aspects of financial evaluation. By focusing on essential techniques and calculations, it aims to provide a clear understanding of the methods used to assess a company’s economic condition, ensuring accurate results when analyzing financial data.

Understanding Financial Statements

One of the primary concepts involves interpreting financial statements, which serve as the backbone for evaluating a company’s performance. These reports provide a snapshot of a business’s profitability, financial position, and cash flow. Accurately analyzing these documents is crucial for making informed financial decisions.

Important Ratios and Metrics

Key ratios such as liquidity, profitability, and solvency play a vital role in financial analysis. Understanding how to calculate and interpret these metrics allows for a clearer picture of a company’s financial health. Knowing which ratios to focus on can help identify strengths and weaknesses in financial performance.

| Ratio | Formula | Purpose |

|---|---|---|

| Current Ratio | Current Assets / Current Liabilities | Measures liquidity and short-term financial health |

| Return on Assets (ROA) | Net Income / Total Assets | Assesses profitability relative to assets |

| Debt to Equity Ratio | Total Liabilities / Shareholder Equity | Shows the financial leverage of a business |

Understanding Financial Statements in Chapter 9

Grasping the structure and components of financial records is essential for evaluating a business’s overall performance. These documents provide crucial insights into a company’s profitability, financial stability, and cash flow, making them indispensable tools for decision-making. This section will break down the core elements that constitute these statements, emphasizing how to interpret and use them effectively.

Balance Sheets and Their Components

The balance sheet is one of the most important financial documents, providing a snapshot of a company’s assets, liabilities, and equity at a given point in time. Understanding how to assess each section of the balance sheet helps in evaluating the financial health of a business. The relationship between assets and liabilities shows whether a company can cover its obligations with its resources.

Income Statements and Profitability

The income statement highlights a company’s ability to generate profit over a specific period. By examining revenues, expenses, and net income, this document reveals how efficiently a company operates. It’s essential to understand how different expenses and income sources impact profitability and where potential improvements could be made.

Common Accounting Errors and Solutions

When working with financial records, errors are inevitable, but understanding the most frequent mistakes can help avoid costly miscalculations. This section highlights some of the most common pitfalls and provides effective solutions to ensure accuracy in financial reporting and analysis.

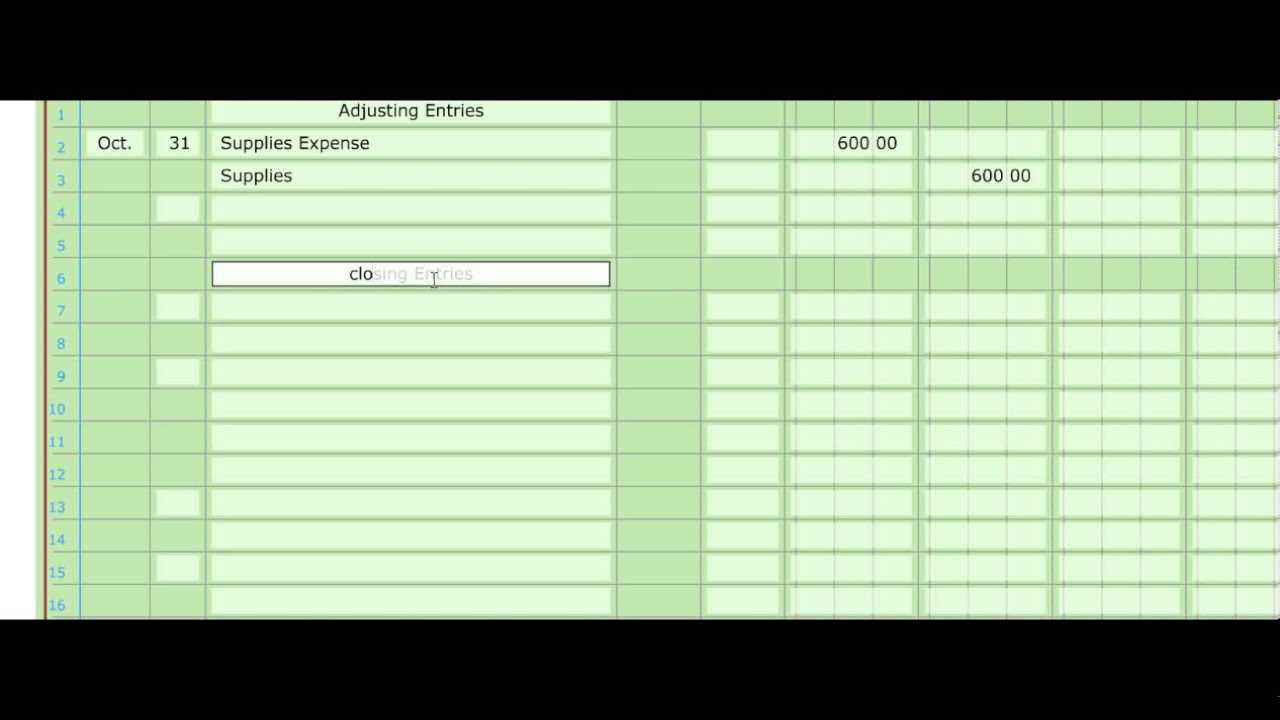

Errors in Calculations

One of the most frequent mistakes involves errors in basic calculations, which can lead to incorrect financial conclusions. These mistakes are often due to misapplying formulas or overlooking key figures. To prevent such errors, it’s essential to double-check all computations and use automated tools where possible.

- Incorrect addition or subtraction of numbers

- Misapplication of formulas, such as for ratios or depreciation

- Failure to account for all variables in a financial model

Misinterpretation of Financial Statements

Another common issue arises from misunderstanding the structure and components of key financial documents. Incorrectly reading balance sheets or income statements can result in flawed analysis. It’s crucial to fully understand the purpose of each statement and what the numbers represent.

- Confusing assets with liabilities

- Overlooking depreciation or amortization in calculations

- Misreading the cash flow statement as profit or loss

Inconsistent Application of Accounting Principles

Inconsistent application of standard accounting practices is another area where mistakes frequently occur. Adhering to established principles ensures uniformity and reliability in financial reporting. Regular training and updating knowledge of industry standards are key to preventing these mistakes.

- Using different methods for recognizing revenues

- Failing to account for changes in inventory valuation methods

- Inconsistent treatment of expenses in different periods

Breakdown of Test A Questions

In this section, we will analyze the different types of questions commonly found in financial evaluations. Understanding the structure of these questions is key to providing accurate responses and applying the right techniques for solving them. Each question type will be broken down to highlight the main concepts and calculation methods involved.

Conceptual and Theoretical Questions

These questions test your understanding of key principles and financial concepts. They typically ask you to explain or define terms, describe relationships between different financial elements, or demonstrate your knowledge of accounting frameworks.

- Defining key financial terms and concepts

- Explaining the purpose of financial reports

- Describing the relationships between different financial metrics

Practical Calculation Questions

Practical questions focus on your ability to perform calculations based on given data. These questions often require you to compute ratios, determine values from balance sheets, or calculate profitability and financial performance using specific formulas.

- Calculating profitability ratios

- Determining asset values and liabilities

- Performing calculations for depreciation and amortization

Step-by-Step Solutions for Chapter 9

This section provides detailed, step-by-step guidance to help you solve common problems related to financial analysis. Each solution is broken down into manageable steps to ensure clarity and understanding. By following these steps, you’ll be able to approach similar challenges with confidence and accuracy.

Breaking Down the Calculation Process

One of the first steps in solving financial problems is to carefully read the question and identify the key pieces of information. Once you have the data, you can apply the appropriate formulas to derive the required values. For instance, when calculating ratios or determining profitability, it’s important to isolate relevant figures from the financial statements.

- Identify the relevant financial data

- Apply the correct formula for calculation

- Verify your results by cross-checking against known benchmarks

Interpreting the Results

After completing the calculations, the next step is interpreting the results. It’s essential to understand what the numbers represent and how they reflect the financial health of the business. For example, a higher liquidity ratio may indicate a stronger ability to cover short-term debts, while lower profitability ratios might signal the need for operational adjustments.

- Understand what each ratio or result represents

- Compare your results to industry standards

- Draw conclusions based on the financial indicators

Common Pitfalls to Avoid in Test A

When tackling financial assessments, it’s easy to fall into certain traps that can lead to incorrect answers. These mistakes often stem from misunderstandings of key concepts or overlooking important details. This section will highlight the most common pitfalls and provide tips on how to avoid them for more accurate and reliable results.

Overlooking Key Information

One of the most frequent mistakes is failing to identify and utilize all relevant information provided in the problem. Financial data is often presented in complex formats, and missing crucial details can lead to incorrect conclusions. Be sure to read the problem carefully, noting all figures, and consider their role in the calculations.

- Failing to consider all financial components

- Overlooking small but significant data points

- Not analyzing the context of the problem before solving

Misapplying Formulas and Methods

Another common issue is the incorrect application of formulas or financial methods. This can occur when there is confusion about which formula to use or when applying a formula in the wrong context. Double-check your understanding of each method and make sure it’s appropriate for the given situation.

- Using the wrong financial ratio for a specific question

- Applying formulas without considering their assumptions

- Relying on memory without reviewing the steps

How to Approach Complex Accounting Problems

When faced with intricate financial issues, it can be overwhelming to know where to start. These problems often require a systematic approach to break them down into manageable parts. By following a structured process, you can approach even the most complex situations with confidence and clarity.

Step-by-Step Methodology

To tackle difficult problems effectively, start by understanding the key components and identifying what is being asked. Then, break the problem into smaller, more digestible pieces. This will help ensure you don’t overlook any critical information or steps.

- Read the problem thoroughly to grasp the context and requirements.

- Identify the key variables and data points that need to be used.

- Break the problem into smaller sections to tackle each one individually.

- Apply the appropriate methods and formulas for each step.

Using Logical Reasoning and Cross-Checking

Once the problem is broken down, use logical reasoning to solve each section, ensuring that each step flows naturally into the next. After completing your calculations, cross-check the results with expected outcomes or benchmarks to verify accuracy.

- Check your calculations after each step to catch errors early.

- Compare results with known figures or previous examples for consistency.

- Use alternative methods or cross-references to ensure solutions are correct.

Reviewing Balance Sheets in Chapter 9

When evaluating financial statements, the balance sheet serves as a key document that provides insights into a company’s financial health. Understanding how to read and interpret this statement is crucial for identifying the relationship between assets, liabilities, and equity. In this section, we will guide you through the essential steps of reviewing balance sheets effectively.

Key Components of a Balance Sheet

The balance sheet is divided into two main sections: assets and liabilities, with equity acting as the balancing figure. Understanding the details within each of these sections is critical for making accurate financial assessments.

- Assets: These represent everything the company owns, including cash, inventory, and property.

- Liabilities: These are obligations the company owes to others, such as loans, accounts payable, and accrued expenses.

- Equity: This represents the residual interest in the assets after deducting liabilities, indicating the owners’ claim on the company’s value.

Steps for Effective Review

Reviewing a balance sheet requires a systematic approach to ensure all relevant data is considered. Start by checking the totals for assets and liabilities, then verify that the balance sheet equation is satisfied: Assets = Liabilities + Equity.

- Ensure all assets are accounted for and properly categorized (current vs. non-current).

- Review liabilities to ensure both short-term and long-term obligations are included.

- Verify that equity reflects accurate retained earnings and capital stock.

- Check for consistency across multiple periods if available to spot trends or discrepancies.

Mastering Income Statements for Test A

Understanding the income statement is crucial for evaluating a company’s profitability over a specific period. This financial document provides an overview of revenues, expenses, and net income, reflecting the overall performance of a business. Mastering the income statement allows for better decision-making and analysis of financial health.

Key Elements of the Income Statement

The income statement is typically structured to show a company’s performance from top to bottom, starting with revenue and ending with net income. Each section provides vital insights into different aspects of the business’s financial activity.

- Revenue: This section lists all the earnings generated from the company’s main operations, such as sales of goods or services.

- Cost of Goods Sold (COGS): This reflects the direct costs associated with producing goods or services sold by the company.

- Operating Expenses: These are the costs required to run the business but not directly tied to production, such as salaries, rent, and utilities.

- Net Income: The final figure that shows the company’s profit or loss after deducting all expenses from total revenue.

Steps to Effectively Analyze Income Statements

To fully understand the implications of an income statement, it is important to analyze each section methodically. The following steps can help in assessing its accuracy and what it reveals about the company’s performance.

- Start by reviewing the revenue section to ensure it accurately reflects sales and other income sources.

- Assess the cost of goods sold to determine if it aligns with production-related expenses.

- Evaluate operating expenses to identify potential areas for cost control or improvement.

- Check for consistency with prior periods to analyze trends in profitability and operational efficiency.

Understanding Cash Flow Analysis

Cash flow analysis is essential for understanding the liquidity and financial stability of a business. This analysis tracks the inflow and outflow of cash within a company, providing key insights into its ability to generate cash, manage expenses, and maintain financial health. By examining cash flow, businesses can assess their ability to meet obligations and invest in future growth.

Key Components of Cash Flow

The cash flow statement is divided into three main sections, each providing important insights into different aspects of financial operations. Understanding these components is vital for a comprehensive analysis.

| Section | Description |

|---|---|

| Operating Activities | Cash generated or spent through core business activities, such as sales, services, and production costs. |

| Investing Activities | Cash used or received from investments, including purchasing or selling assets like equipment, property, or securities. |

| Financing Activities | Cash raised or spent through financing, such as issuing stock, borrowing, or repaying debt. |

Interpreting Cash Flow Data

To accurately interpret cash flow, it’s important to examine the trends and relationships between different sections. A positive cash flow indicates that a business is generating sufficient cash to meet obligations and reinvest in operations, while negative cash flow may suggest liquidity issues or overextension.

- Positive cash flow from operating activities is a sign of financial health and operational efficiency.

- Investing activities show how the company is positioning itself for long-term growth or managing its resources.

- Financing activities indicate the company’s ability to raise capital and manage debt effectively.

How to Calculate Depreciation in Accounting

Depreciation is a method used to allocate the cost of tangible assets over their useful life. This process helps businesses reflect the wear and tear, obsolescence, or decline in value of their assets. Accurately calculating depreciation is crucial for financial reporting and tax purposes, as it impacts both the balance sheet and income statement.

Methods of Calculating Depreciation

There are several methods for calculating depreciation, each with its own advantages and suitability for different types of assets. The most common methods are:

- Straight-Line Method: This method spreads the depreciation evenly over the asset’s useful life. It is the most straightforward approach and works well for assets that have a consistent usage rate.

- Declining Balance Method: This method applies a fixed percentage rate of depreciation to the asset’s book value each year. It results in higher depreciation expenses in the early years of the asset’s life.

- Units of Production Method: This method calculates depreciation based on the asset’s actual usage or output. It is ideal for assets where depreciation is closely tied to how much the asset is used, such as machinery.

- Sum-of-the-Years’-Digits Method: This method accelerates depreciation by applying a decreasing fraction to the asset’s cost over its useful life.

Steps to Calculate Depreciation

Regardless of the method chosen, the basic steps to calculate depreciation include:

- Determine the Asset’s Initial Cost: This includes the purchase price and any associated costs, such as installation or shipping.

- Estimate the Useful Life: This is the number of years the asset is expected to be in service.

- Estimate the Residual Value: This is the expected value of the asset at the end of its useful life, also known as salvage value.

- Select the Depreciation Method: Choose the appropriate method based on the asset type and usage.

- Apply the Formula: Depending on the method, apply the respective formula to calculate the annual depreciation expense.

Important Ratios in Chapter 9 Test

Understanding financial ratios is essential for evaluating the health and performance of a business. These ratios provide valuable insights into various aspects of financial management, such as profitability, liquidity, and efficiency. In this section, we will explore the key ratios commonly assessed in financial evaluations and their significance.

Key Financial Ratios

Below is a table showcasing some of the most important ratios used to assess financial performance:

| Ratio | Formula | Interpretation |

|---|---|---|

| Current Ratio | Current Assets / Current Liabilities | Measures the company’s ability to pay short-term obligations with its current assets. |

| Quick Ratio | (Current Assets – Inventory) / Current Liabilities | Indicates the company’s ability to meet short-term obligations without relying on inventory. |

| Debt-to-Equity Ratio | Total Debt / Total Equity | Shows the proportion of debt used to finance the company’s assets relative to equity. |

| Return on Assets (ROA) | Net Income / Average Total Assets | Measures how efficiently the company uses its assets to generate profit. |

| Return on Equity (ROE) | Net Income / Shareholder’s Equity | Indicates how well the company generates profit from its equity investments. |

How to Use Ratios in Decision Making

Ratios serve as benchmarks for financial health. By analyzing these metrics, investors, managers, and stakeholders can make informed decisions about investments, financing, and strategic planning. Regularly reviewing these ratios helps to identify trends, potential issues, and areas for improvement within an organization.

Improving Accuracy in Financial Calculations

Precision is crucial when working with financial data. Small errors in calculations can lead to significant discrepancies, impacting decision-making and analysis. This section focuses on practical techniques and strategies to improve the accuracy of financial computations and ensure reliable results.

Key Techniques for Accurate Calculations

To enhance the precision of your financial calculations, consider implementing the following strategies:

- Double-Check Your Work: Always verify your calculations by reviewing the formulas and inputs used. Cross-checking helps identify any errors before they affect the outcome.

- Use Financial Software: Leverage specialized financial tools or spreadsheet software like Excel to automate complex calculations and minimize human error.

- Follow Standardized Procedures: Stick to established accounting methods and procedures to maintain consistency and reduce the likelihood of mistakes.

- Break Down Complex Calculations: Divide complicated calculations into smaller, manageable parts to avoid overlooking any detail.

- Understand the Formulas: Familiarize yourself with the formulas you’re working with to ensure that each component is applied correctly.

Common Mistakes to Avoid

While striving for accuracy, it’s important to be aware of common pitfalls that can compromise your results. Here are some mistakes to watch out for:

- Inconsistent Data Inputs: Using inconsistent or outdated data can lead to incorrect calculations. Always use the most current and accurate information available.

- Ignoring Rounding Rules: Failing to round numbers correctly can accumulate small errors that affect larger calculations. Ensure you follow appropriate rounding guidelines.

- Overlooking Unit Conversions: When working with different currencies or units, neglecting to convert them correctly can skew the results. Always perform necessary conversions before finalizing calculations.

By implementing these techniques and being mindful of common errors, you can significantly improve the accuracy of your financial calculations and make more informed decisions.

Practice Questions and Answers for Test A

To solidify your understanding of the key concepts and improve your performance, practicing with sample questions is an essential part of preparation. This section provides a selection of practice questions along with their solutions, helping you gauge your readiness and identify areas for improvement.

Sample Question 1

Question: A company has total assets of $500,000 and total liabilities of $300,000. What is the equity of the company?

Solution: The equity of the company can be calculated using the basic accounting equation:

Equity = Assets – Liabilities

Therefore, Equity = $500,000 – $300,000 = $200,000

Sample Question 2

Question: If a company earns $120,000 in revenue and has expenses of $85,000, what is the net income for the period?

Solution: Net income is calculated by subtracting total expenses from total revenue:

Net Income = Revenue – Expenses

So, Net Income = $120,000 – $85,000 = $35,000

Additional Practice Questions

Try these additional practice questions to further test your knowledge:

- Question 1: What is the current ratio if the current assets of a company are $200,000 and the current liabilities are $150,000?

- Question 2: How do you calculate depreciation using the straight-line method if the cost of the asset is $50,000 and its useful life is 5 years?

Practice regularly and review solutions to improve your comprehension and problem-solving skills. The more you practice, the better prepared you’ll be for real-world scenarios and future evaluations.

Preparing for Chapter 9 Test Success

Achieving success in any assessment requires a combination of focused preparation, strategic review, and consistent practice. To excel in the upcoming evaluation, it is essential to develop a structured plan that emphasizes the most important concepts and problem-solving techniques. In this section, we’ll guide you through the steps needed to ensure you’re fully ready to perform at your best.

Step 1: Review Key Concepts

Begin by thoroughly reviewing all major topics covered. Make sure you understand the definitions, formulas, and applications of key principles. Focus on areas where you might feel less confident and make sure to revisit any complex problems. Analyzing sample problems and understanding their solutions will help reinforce these concepts.

Step 2: Practice with Sample Problems

Once you’re familiar with the material, the next step is practicing. Regularly solve sample problems to test your knowledge and identify weak spots. This practice will help you build confidence and improve speed. It also allows you to apply theoretical knowledge to real-world scenarios, which is critical for success.

Step 3: Time Management and Test Strategy

Effective time management is key during the exam. Allocate time to each section based on difficulty and your level of comfort with the material. Start with easier problems to build momentum and leave more challenging ones for later. During your practice sessions, try to simulate the time constraints of the actual assessment.

Step 4: Study Group or Peer Discussions

Working with peers or a study group can enhance your understanding of challenging topics. Discussing difficult problems with others can lead to different perspectives and problem-solving techniques. Consider joining a study group or seeking help from a tutor if necessary.

Step 5: Reviewing Past Mistakes

Finally, it’s important to learn from your mistakes. After practicing, review any incorrect answers and analyze why you made those errors. Understanding why you missed a question can prevent similar mistakes in the future and reinforce your learning.

Test Preparation Checklist

Use the following checklist to track your progress and ensure thorough preparation:

| Task | Completed |

|---|---|

| Review major topics and key concepts | [ ] |

| Solve practice problems | [ ] |

| Allocate time for each section | [ ] |

| Participate in study group discussions | [ ] |

| Review past mistakes and analyze errors | [ ] |

By following these steps and staying consistent in your preparation, you will improve your chances of excelling in the assessment. Stay focused, practice regularly, and be confident in your ability to succeed.