In this section, we will explore the essential principles that form the foundation of economic theory. These concepts are crucial for understanding how the overall economy operates and the factors that influence its performance. Grasping these ideas is essential for anyone seeking to perform well in this area of study.

From understanding the factors that drive the economy’s total output to exploring the dynamics of inflation and employment, this guide will cover a wide range of topics. Each topic is designed to help you build a strong understanding of how these elements interact and influence real-world scenarios.

Whether you’re preparing for an exam or just looking to deepen your knowledge, this resource will offer you clear explanations and practical examples. By the end of this section, you will have a comprehensive grasp of the core ideas that are central to economic analysis and how to apply them in different contexts.

AP Macroeconomics Unit 2 Test Overview

This section focuses on the fundamental economic concepts that you will need to understand for this part of the course. You will be tested on your knowledge of key factors that influence economic performance and the tools used by governments and central banks to manage the economy. Mastering these concepts will not only help you succeed in assessments but also provide valuable insights into real-world economic conditions.

The material covers a variety of topics, including the measurement of economic activity, the effects of fiscal and monetary policies, and how different economic indicators relate to one another. It’s important to have a clear understanding of these topics, as they form the basis for analyzing and interpreting economic data.

Expect to encounter questions that challenge your ability to apply theoretical knowledge to practical scenarios. A strong grasp of these foundational ideas will allow you to approach the assessment with confidence and accuracy, ultimately helping you perform at your best.

Key Concepts to Focus On

Understanding the core principles that drive the overall economic performance is crucial for mastering this section. Key concepts provide the foundation for analyzing how different factors interact and impact the economy. By focusing on these fundamental ideas, you will be well-equipped to tackle more complex questions and scenarios.

Several critical topics are essential to grasp in this area. The following table outlines the most important concepts and their brief descriptions to guide your focus:

| Concept | Description |

|---|---|

| Aggregate Demand | The total demand for goods and services in an economy at various price levels. |

| Aggregate Supply | The total supply of goods and services that producers in an economy are willing to sell at various price levels. |

| Fiscal Policy | The use of government spending and tax policies to influence economic conditions. |

| Monetary Policy | The actions taken by a central bank to control the money supply and interest rates to manage inflation and stabilize the economy. |

| Inflation | The rate at which the general level of prices for goods and services is rising, eroding purchasing power. |

| Unemployment | The condition in which an individual who is capable of working, is actively seeking work but is unable to find any work. |

By focusing on these key areas, you will develop a strong foundation for both practical application and theoretical understanding, ensuring better preparation for any assessment in this field.

Understanding the Aggregate Demand Curve

The aggregate demand curve represents the total quantity of goods and services demanded in an economy at different price levels, holding other factors constant. It illustrates the relationship between the price level and the amount of output consumers, businesses, and the government are willing to purchase. Grasping this concept is essential to understanding how the economy responds to changes in demand and price.

Factors Affecting Aggregate Demand

Several key factors influence the position and shape of the aggregate demand curve. These include changes in consumer confidence, government spending, interest rates, and the level of investment in the economy. As any of these factors shift, they can cause the curve to move, reflecting a change in the overall demand for goods and services.

The Downward Slope of the Curve

The aggregate demand curve typically slopes downward, meaning that as the price level falls, the total quantity of goods and services demanded increases. This inverse relationship occurs for several reasons, including the wealth effect, interest rate effect, and exchange rate effect. Understanding these effects helps explain why lower prices tend to stimulate economic activity.

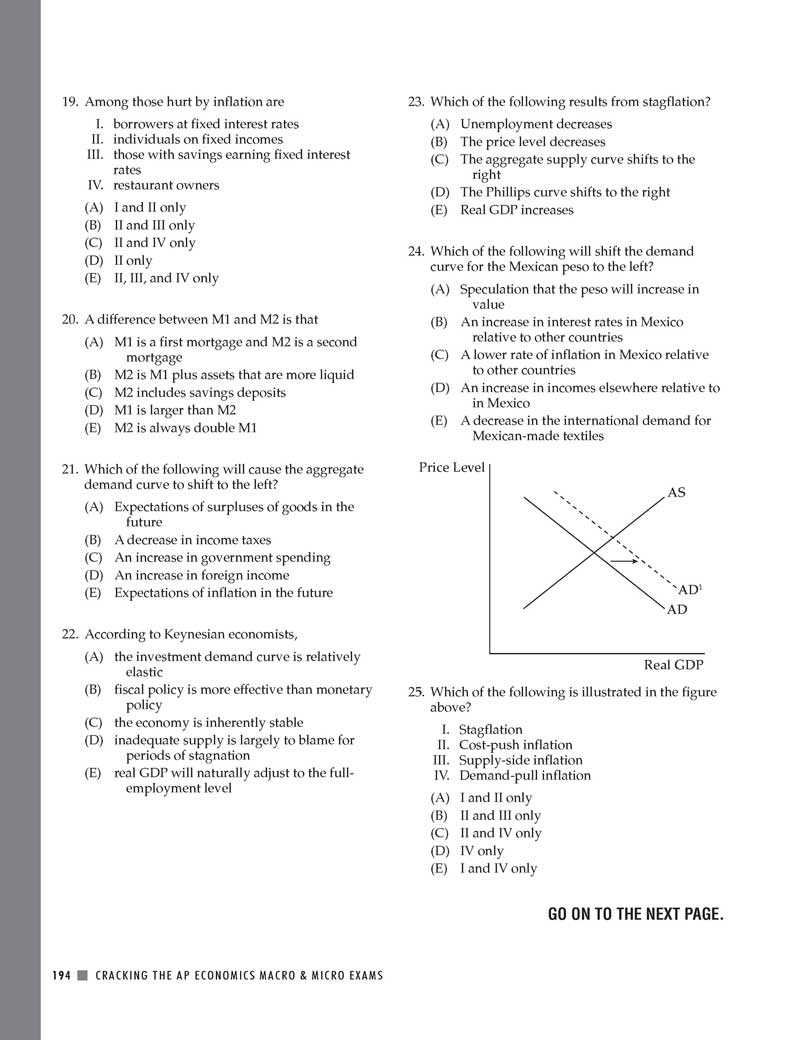

Factors Influencing Aggregate Supply

The total supply of goods and services in an economy is not static and can be influenced by various factors. These factors determine how much producers are willing and able to produce at different price levels. Understanding these elements is key to analyzing how the overall economy responds to shifts in supply.

Several aspects affect aggregate supply, including the availability and cost of resources, technological advancements, and changes in government policies. For example, an increase in resource prices or a decrease in productivity can reduce the total output an economy can produce at a given price level. Conversely, technological improvements or a reduction in regulations may boost production capabilities and increase supply.

By examining these factors, we gain insight into the potential for economic growth and stability. A deeper understanding of aggregate supply helps to explain shifts in production capacity and their impact on economic conditions, particularly in the context of policy decisions and external shocks.

Monetary Policy and Its Impact

Monetary policy refers to the actions taken by a central authority, usually a central bank, to control the money supply and influence interest rates in an economy. The primary goal is to achieve macroeconomic objectives, such as controlling inflation, stabilizing the currency, and promoting employment. By adjusting the availability of money and credit, monetary authorities can directly impact economic activity and overall financial stability.

Tools of Monetary Policy

The central bank uses several tools to implement monetary policy, each with different effects on the economy. Some of the most common tools include:

- Open Market Operations – Buying and selling government securities to regulate the money supply.

- Discount Rate – The interest rate charged to commercial banks for borrowing funds from the central bank.

- Reserve Requirements – The minimum amount of reserves banks must hold, affecting their ability to lend money.

Impact on the Economy

The actions of a central bank can have profound effects on various aspects of the economy. Some of the primary impacts include:

- Inflation Control: By tightening the money supply, central banks can reduce inflationary pressures.

- Economic Growth: Lowering interest rates can stimulate borrowing and investment, encouraging economic expansion.

- Employment: Expanding the money supply may lead to more job creation as businesses invest and grow.

Understanding how monetary policy works is crucial for anticipating its effects on the broader economy. By adjusting key tools, policymakers can manage economic cycles and mitigate potential downturns or overheating in the economy.

Fiscal Policy Explained in Detail

Fiscal policy involves the use of government spending and taxation to influence a country’s economic performance. It is a critical tool for stabilizing the economy, addressing unemployment, and controlling inflation. Governments adjust their expenditure levels and tax rates to either stimulate or slow down economic activity, depending on the prevailing economic conditions.

Key Tools of Fiscal Policy

There are two primary tools through which fiscal policy is implemented: government spending and taxation. Both tools play a significant role in shaping economic activity:

- Government Spending: This includes all government expenditures on goods, services, infrastructure, and social programs. Increased spending can stimulate demand in the economy, while cuts in spending can reduce inflationary pressures.

- Taxation: Adjusting tax rates influences the amount of disposable income available to individuals and businesses. Tax cuts can lead to higher consumer spending and investment, while tax increases can help cool down an overheated economy.

Types of Fiscal Policy

Fiscal policy can be either expansionary or contractionary, depending on the economic goals:

- Expansionary Policy: Used during periods of economic downturn, this policy aims to stimulate economic growth. It typically involves increased government spending and lower taxes to boost demand and reduce unemployment.

- Contractionary Policy: Applied when the economy is growing too quickly or experiencing high inflation, this policy aims to slow down economic activity. It typically involves reducing government spending and raising taxes to decrease demand and control inflation.

Fiscal policy decisions are often influenced by the overall economic climate and the objectives of the government. By adjusting spending and tax policies, governments can help manage the economy, stabilizing it during recessions and preventing overheating during periods of rapid growth.

Real GDP vs Nominal GDP

When measuring the total output of an economy, two key indicators are often used: real GDP and nominal GDP. While both are useful for understanding the size and growth of an economy, they differ in how they account for changes in prices. Knowing the distinction between these two measures is essential for evaluating economic performance accurately.

Nominal GDP

Nominal GDP refers to the total value of all goods and services produced within an economy, measured using current market prices. This measure does not account for inflation or deflation, meaning it reflects the value of goods and services at the prices that are in effect during the time period in question.

- Pros: It is easy to calculate since it uses current prices, and it provides an immediate snapshot of the economy.

- Cons: It can be misleading during periods of inflation or deflation, as changes in prices may skew the true growth of economic output.

Real GDP

Real GDP, on the other hand, adjusts for changes in the price level by using constant prices from a base year. This allows for a more accurate comparison of economic output over time, as it eliminates the effects of inflation or deflation.

- Pros: Real GDP provides a clearer picture of an economy’s true growth, unaffected by price fluctuations.

- Cons: It is more complex to calculate, as it requires adjusting nominal GDP for changes in the price level.

In summary, while nominal GDP can offer a snapshot of the economy’s current size, real GDP is a more reliable indicator for comparing economic output across different time periods, as it accounts for changes in prices.

Unemployment Types and Their Effects

Unemployment is a critical economic indicator that reflects the health of an economy. There are various types of unemployment, each arising from different causes, and their effects can vary significantly. Understanding these types is crucial for identifying the underlying issues in the labor market and implementing appropriate policy responses.

Unemployment can occur due to shifts in demand, changes in technology, or economic policies. Each type of unemployment presents different challenges and impacts individuals and the broader economy in unique ways. Below are the primary categories of unemployment:

Frictional Unemployment

Frictional unemployment occurs when workers are temporarily between jobs or are entering the labor market for the first time. This type of unemployment is often short-term and is considered a natural part of a healthy, dynamic economy.

- Impact: While frictional unemployment can create temporary inefficiencies, it often reflects a healthy labor market with job mobility and opportunity for workers to find positions that best match their skills and preferences.

Structural Unemployment

Structural unemployment arises when there is a mismatch between the skills workers possess and the skills needed by employers. This often happens due to technological changes, shifts in industries, or global competition.

- Impact: Structural unemployment can be long-lasting as workers may need retraining or relocation to find new job opportunities. It can also be more difficult to address through traditional economic policies.

Cyclical Unemployment

Cyclical unemployment is linked to the fluctuations in the economy, particularly during periods of economic downturns or recessions. When demand for goods and services decreases, businesses may reduce their workforce, leading to higher unemployment rates.

- Impact: Cyclical unemployment tends to rise during recessions and fall during periods of economic growth. It is often the most affected by changes in government fiscal and monetary policies.

Seasonal Unemployment

Seasonal unemployment occurs in industries where demand for labor varies throughout the year, such as agriculture, tourism, or retail. Workers in these sectors may be employed during peak seasons but laid off during off-peak times.

- Impact: Seasonal unemployment is predictable and does not typically pose long-term issues for the economy, but it can create income instability for affected workers.

Each type of unemployment presents its own set of challenges and requires tailored solutions. Understanding these variations helps policymakers craft strategies to reduce unemployment and foster long-term economic stability.

Inflation and Its Measurement Methods

Inflation refers to the rate at which the general price level of goods and services rises, leading to a decrease in purchasing power. It is a key economic indicator, as it affects both consumers and businesses. Accurately measuring inflation is crucial for policymakers to make informed decisions regarding interest rates, wages, and overall economic strategies.

There are several ways to measure inflation, each capturing different aspects of price changes in the economy. By understanding these measurement methods, one can better assess the impact of inflation on daily life and the economy as a whole.

Consumer Price Index (CPI)

The Consumer Price Index (CPI) is one of the most widely used measures of inflation. It tracks the changes in the price of a fixed basket of goods and services typically consumed by households. The CPI reflects the cost of living and is often used to adjust wages, social benefits, and pensions to maintain purchasing power.

- How it works: The CPI is calculated by comparing the cost of this basket in the current year to the cost in a base year, allowing the calculation of inflation over time.

- Impact: It directly affects consumers, as an increase in CPI indicates that the average household will have to spend more for the same goods and services.

Producer Price Index (PPI)

The Producer Price Index (PPI) measures inflation from the perspective of producers. It tracks changes in the prices that domestic producers receive for their output. The PPI focuses on the prices of goods at the wholesale level before they reach the retail market.

- How it works: The PPI includes a wide range of goods and services, including raw materials, intermediate goods, and finished products, allowing for an early indicator of inflationary pressures in the supply chain.

- Impact: An increase in the PPI often signals future inflation at the consumer level, as producers may pass higher costs onto consumers.

Core Inflation

Core inflation measures the long-term trend in price changes by excluding volatile food and energy prices. This method aims to give a clearer picture of inflationary trends without the short-term fluctuations that these sectors can cause.

- How it works: By removing the most unstable components, core inflation focuses on underlying price movements that are more reflective of economic conditions.

- Impact: Core inflation is often used by central banks to set monetary policy, as it provides a more stable indicator of inflationary pressures.

These measurement methods provide valuable insights into inflation, each capturing different facets of price changes within the economy. By using a combination of these tools, economists and policymakers can better understand and address the effects of inflation on economic stability and growth.

How Interest Rates Affect the Economy

Interest rates play a fundamental role in shaping economic conditions. They represent the cost of borrowing money and the return on savings, influencing both consumer behavior and business investment. Fluctuations in interest rates can have widespread effects, impacting everything from household spending to corporate strategies and government policies.

Changes in interest rates can influence economic growth, inflation, and employment. When rates are low, borrowing becomes cheaper, encouraging consumers and businesses to spend and invest more. On the other hand, higher rates tend to reduce borrowing and spending, slowing down the economy. Understanding the relationship between interest rates and the economy is essential for policymakers and businesses alike.

Impact on Consumer Spending

When interest rates are low, consumers are more likely to borrow money for large purchases such as homes, cars, or appliances. With lower monthly payments on loans and mortgages, disposable income increases, which can lead to higher consumption.

- Effect: Increased consumer spending boosts demand for goods and services, stimulating economic growth.

- Long-term impact: If interest rates remain low for an extended period, it can lead to rising consumer debt, which may pose risks to economic stability if not managed carefully.

Impact on Business Investment

Interest rates also affect the decisions of businesses regarding expansion and investment. When borrowing costs are low, companies are more inclined to take out loans to finance new projects, purchase equipment, or hire additional employees.

- Effect: Lower borrowing costs foster growth in sectors such as construction, technology, and manufacturing, leading to increased production capacity and innovation.

- Risk: If interest rates rise too quickly, businesses may delay or scale back investments, potentially slowing down economic expansion.

Overall, interest rates serve as a powerful tool for controlling economic activity. Policymakers, particularly central banks, adjust rates to either stimulate the economy during slow periods or curb inflation when the economy is overheating. Understanding how these changes ripple through various sectors helps stakeholders make informed decisions in both business and financial planning.

The Role of Central Banks in Policy

Central banks play a crucial role in shaping a nation’s economic policies. Their primary objective is to manage the country’s monetary system, ensuring stability and fostering favorable conditions for economic growth. Central banks have the authority to regulate money supply, control interest rates, and intervene in financial markets to maintain a balanced economy.

Through their policy actions, central banks influence inflation, employment, and overall economic activity. By adjusting interest rates and using various financial tools, they can stimulate growth during periods of recession or cool down the economy if inflation becomes too high. Their actions are essential in maintaining the stability of both the financial system and the broader economy.

Key Functions of Central Banks

Central banks are responsible for a range of activities that directly impact the economy. The most prominent functions include regulating the money supply, overseeing financial institutions, and implementing monetary policy. Below is a table outlining the primary responsibilities of central banks:

| Function | Description |

|---|---|

| Monetary Policy Implementation | Central banks adjust interest rates and control the money supply to regulate inflation and stabilize the economy. |

| Banker to the Government | They manage government accounts, facilitate transactions, and sometimes assist in issuing national debt. |

| Financial Stability | Central banks monitor and regulate the banking system to prevent crises and ensure the stability of financial institutions. |

| Currency Issuance | Central banks have the exclusive authority to issue the national currency, managing its value and supply. |

Monetary Policy Tools

Central banks employ a variety of tools to influence the economy. Some of the most common tools include:

- Interest Rate Adjustments: By raising or lowering interest rates, central banks can make borrowing more expensive or affordable, thus influencing consumer and business spending.

- Open Market Operations: This involves buying or selling government securities to increase or decrease the money supply in the economy.

- Reserve Requirements: Central banks set reserve requirements for commercial banks, which affects how much they can lend and impacts overall economic activity.

Through these tools, central banks aim to balance economic growth with price stability, maintaining a healthy economic environment. The policies they implement are often closely watched by markets, as they have far-reaching implications for both short-term and long-term economic conditions.

AP Test Strategies for Unit 2

Approaching the assessment for this section requires a combination of strong foundational knowledge and strategic test-taking skills. To excel, students should focus on understanding key concepts while also being prepared to apply them to various scenarios. Whether it’s multiple-choice questions or free-response sections, the ability to recall information accurately and analyze questions effectively is essential.

Effective preparation involves reviewing core topics, practicing with mock questions, and understanding how to break down complex problems. By mastering these strategies, students can feel more confident and perform better during the assessment. Here are some practical strategies to maximize success during the exam.

Study Techniques for Success

Focusing on the right study methods can significantly enhance retention and understanding. Consider using the following strategies to guide your revision:

| Technique | Description |

|---|---|

| Active Recall | Test yourself regularly on key concepts to reinforce memory and ensure retention of important material. |

| Practice Questions | Complete as many practice questions as possible to become familiar with question formats and improve response time. |

| Concept Mapping | Create visual aids such as mind maps or charts to link related topics, helping to clarify complex ideas. |

| Timed Simulations | Simulate exam conditions by timing yourself when answering questions to practice managing time effectively. |

Test-Taking Tips

On the day of the exam, employing the right strategies during the test is just as important as preparation. Here are key approaches to follow:

- Read Instructions Carefully: Ensure you understand the specific requirements for each question before you begin answering.

- Manage Your Time: Divide the time wisely between different sections. Don’t spend too long on any single question.

- Eliminate Incorrect Choices: In multiple-choice questions, eliminate clearly wrong options first, narrowing down your choices.

- Focus on Key Concepts: Prioritize answering questions related to concepts you are most confident in before tackling more challenging ones.

- Review Your Work: If time permits, always go back and double-check your responses to ensure there are no mistakes.

By combining these strategies with consistent study habits, you can effectively prepare for the assessment and increase your chances of performing at your best.

Common Mistakes to Avoid on the Test

When preparing for an assessment, avoiding common pitfalls can make a significant difference in performance. Many students make similar mistakes, which often result from rushing through questions or misunderstanding the instructions. Recognizing and addressing these errors before the exam can help you approach the assessment with more confidence and precision.

Below are some of the most frequently made mistakes that can hinder success and how to avoid them. By being aware of these issues, you can improve your chances of achieving a better score.

Overlooking Key Instructions

One of the most common mistakes students make is not paying close attention to the instructions provided for each question. Here are a few ways this can impact your performance:

- Misunderstanding the Question: Sometimes, questions may contain specific directions, such as asking for the “best answer” or “most likely scenario.” Skipping these details can lead to incorrect answers.

- Failing to Follow Formats: For written responses, following the exact format or structure requested is essential. Deviating from the instructions could result in a lower score, even if the content is correct.

- Ignoring Word Limits: Some questions will specify a word count. Exceeding this limit or writing too little can affect the quality of your answer.

Time Mismanagement

Another mistake that many students make is not allocating their time wisely during the assessment. Poor time management can lead to incomplete answers and missed opportunities to earn points. Here are some ways to manage time effectively:

- Spending Too Much Time on One Question: Focus on answering all questions, and if you’re stuck, move on and come back later.

- Not Leaving Time for Review: Always leave time at the end to review your answers and check for mistakes.

- Skipping the Easier Questions: Tackling the most challenging questions first may not always be the best strategy. Start with questions you know well to build confidence.

Relying Too Much on Memory

While memorization plays an important role, relying solely on memory without a deeper understanding can lead to errors, especially in more complex questions. Here’s how you can avoid this mistake:

- Rushing Through Complex Concepts: Take the time to understand the concepts fully instead of memorizing vague facts that might not apply to all scenarios.

- Misapplying Formulas: Ensure you understand when and how to apply formulas correctly, as using them in the wrong context can lead to mistakes.

By recognizing these common pitfalls and being mindful of your approach, you can minimize errors and improve your performance during the assessment.

Sample Questions for Practice

To prepare effectively for your upcoming evaluation, practicing with sample questions can significantly boost your readiness. These practice questions are designed to simulate the types of queries you will encounter and help you familiarize yourself with the format. By working through these questions, you can identify areas for improvement and solidify your understanding of key concepts.

The following sample questions cover a variety of topics and can be used to refine your skills before the assessment. Make sure to time yourself and review your responses thoroughly to gauge your progress.

Sample Question 1

Scenario: A country experiences a sudden decrease in consumer confidence. This leads to a sharp decline in consumer spending, which, in turn, reduces the overall demand for goods and services in the economy. How is this likely to affect the economic equilibrium?

- A) The economy will move towards higher output and lower prices.

- B) The economy will experience reduced output and a potential decrease in prices.

- C) The economy will experience higher output and higher prices.

- D) There will be no impact on output or prices.

Sample Question 2

Scenario: The central bank of a nation decides to increase interest rates. This decision is made to control inflation and stabilize the economy. What is the likely short-term effect on investment spending?

- A) Investment spending will likely increase due to lower borrowing costs.

- B) Investment spending will decrease as borrowing costs rise, leading to reduced economic activity.

- C) Investment spending will remain unchanged regardless of interest rates.

- D) The impact on investment spending will be minimal due to other influencing factors.

By practicing with these sample questions, you can enhance your problem-solving abilities and become more confident in applying economic principles. Be sure to explore different scenarios to fully prepare for any variation that may appear in the actual evaluation.

Interpreting Macroeconomic Data Effectively

Understanding economic indicators and data is crucial for assessing the health of an economy. Whether you are evaluating trends in production, employment, or inflation, the ability to interpret these figures accurately can help you make informed decisions. The process of analyzing such data involves identifying patterns, recognizing outliers, and understanding the broader economic context.

Key indicators such as GDP, unemployment rates, and inflation metrics provide valuable insights into how an economy is functioning. However, it’s essential to look beyond the numbers and consider the underlying factors that may be influencing these outcomes. By honing your skills in interpreting economic data, you can gain a deeper understanding of economic dynamics and predict potential future trends.

Common Economic Indicators

To interpret economic data effectively, it is important to become familiar with the most commonly used indicators. Some of these include:

- Gross Domestic Product (GDP): This measures the total output of an economy, helping assess the economic growth or contraction.

- Unemployment Rate: Indicates the percentage of the labor force that is unemployed and actively seeking work, reflecting the health of the job market.

- Inflation Rate: The rate at which prices for goods and services rise, affecting purchasing power and economic stability.

- Interest Rates: Set by central banks, these affect borrowing costs and can influence consumer spending and investment decisions.

Analyzing Data in Context

While individual data points are important, it is essential to consider them within the broader economic context. A spike in inflation might seem alarming on its own, but it may be temporary due to a specific event, such as an increase in commodity prices. Similarly, a decrease in unemployment might signal economic improvement, but if it is coupled with wage stagnation, it could indicate underlying structural problems in the labor market.

By considering these indicators together and understanding their interrelationships, you can form a more accurate picture of the economic situation. This holistic approach is key to making sound judgments and anticipating potential shifts in economic conditions.

Resources for Further Study

To strengthen your understanding of economic concepts and theories, it is essential to explore a variety of resources beyond basic textbooks. Supplementary materials can deepen your knowledge and help reinforce key ideas, offering practical examples and broader perspectives. Whether you prefer reading, watching, or interacting with learning tools, these resources provide valuable opportunities for growth.

From comprehensive books to online platforms and interactive courses, various options cater to different learning styles. Utilizing these resources effectively will enable you to grasp essential principles and enhance your problem-solving skills in the subject. With consistent engagement, you can expand your understanding and improve your ability to apply knowledge to real-world situations.

Books and Academic Texts

Books offer a structured and detailed approach to economic theories and principles. Some valuable titles include:

- The Wealth of Nations by Adam Smith: A foundational work that explores the roots of economic thought and market dynamics.

- Principles of Economics by N. Gregory Mankiw: A popular textbook that simplifies complex concepts and provides clear explanations for beginners and intermediate learners.

- Freakonomics by Steven Levitt and Stephen Dubner: An engaging book that explores the unexpected side of economic theory through real-world examples.

Online Learning Platforms

For a more interactive and flexible learning experience, consider online courses and educational platforms:

- Coursera: Offers a variety of free and paid courses from leading universities, allowing for in-depth study at your own pace.

- Khan Academy: Provides an extensive range of free tutorials on basic and advanced economic topics, designed for learners at all levels.

- EdX: Features courses from top universities and institutions that explore key economic theories and applications in a structured manner.

Interactive Tools and Practice Resources

Engaging with quizzes and interactive tools can help reinforce your understanding:

- Quizlet: Offers customizable flashcards and quizzes to test your knowledge and enhance memory retention.

- Investopedia: Provides articles, guides, and an economic dictionary that break down complex terms and concepts.

- Economics Games: Online platforms where you can simulate real-world economic decisions and understand their impact.

By exploring these resources and combining them with your regular study routine, you can develop a deeper understanding of the subject. Regularly engaging with these tools will not only improve your knowledge but also build your confidence in applying economic concepts to practical situations.