Mastering the basics of managing money is essential for making informed decisions about spending, saving, and investing. Understanding key concepts in this area can significantly impact your financial well-being and help you navigate everyday challenges. From budgeting effectively to planning for the future, knowledge in this field empowers individuals to take control of their financial lives.

Comprehending fundamental principles can guide you in making smarter choices when it comes to resources. Whether it’s understanding the importance of setting goals, managing debts, or building an emergency fund, having a clear grasp of these topics plays a crucial role in overall stability. By becoming more confident in these skills, individuals can avoid common pitfalls and secure a stronger financial foundation for the long term.

Exploring various scenarios and familiarizing yourself with the best practices is key to enhancing your understanding. This section provides an overview of essential elements, offering insights that will allow you to improve your decision-making and tackle financial challenges with greater confidence.

Understanding Money Management Concepts

Assessing your knowledge of key money management concepts is crucial for making informed decisions about your spending, savings, and investments. By examining your understanding of these areas, you can identify strengths and areas for improvement, leading to better financial choices in the future. This section outlines common questions and ideas, providing clarity on various financial topics that everyone should be familiar with.

| Topic | Explanation | Example |

|---|---|---|

| Budgeting | The process of creating a plan to manage your income and expenses. | Tracking monthly spending and setting limits on discretionary purchases. |

| Debt Management | Understanding how to handle outstanding debts responsibly. | Paying off high-interest credit cards before other bills. |

| Investing | Allocating money in various assets to grow wealth over time. | Buying stocks or bonds for long-term financial growth. |

| Emergency Fund | Setting aside money for unexpected situations or expenses. | Having three to six months of living expenses saved in a separate account. |

| Insurance | Protecting yourself and your assets from financial risks. | Purchasing health, home, or auto insurance to avoid major out-of-pocket costs. |

By familiarizing yourself with these core concepts, you can feel more confident in making decisions that align with your long-term goals. Regularly reviewing and applying these principles will help you achieve greater stability and security in your financial life.

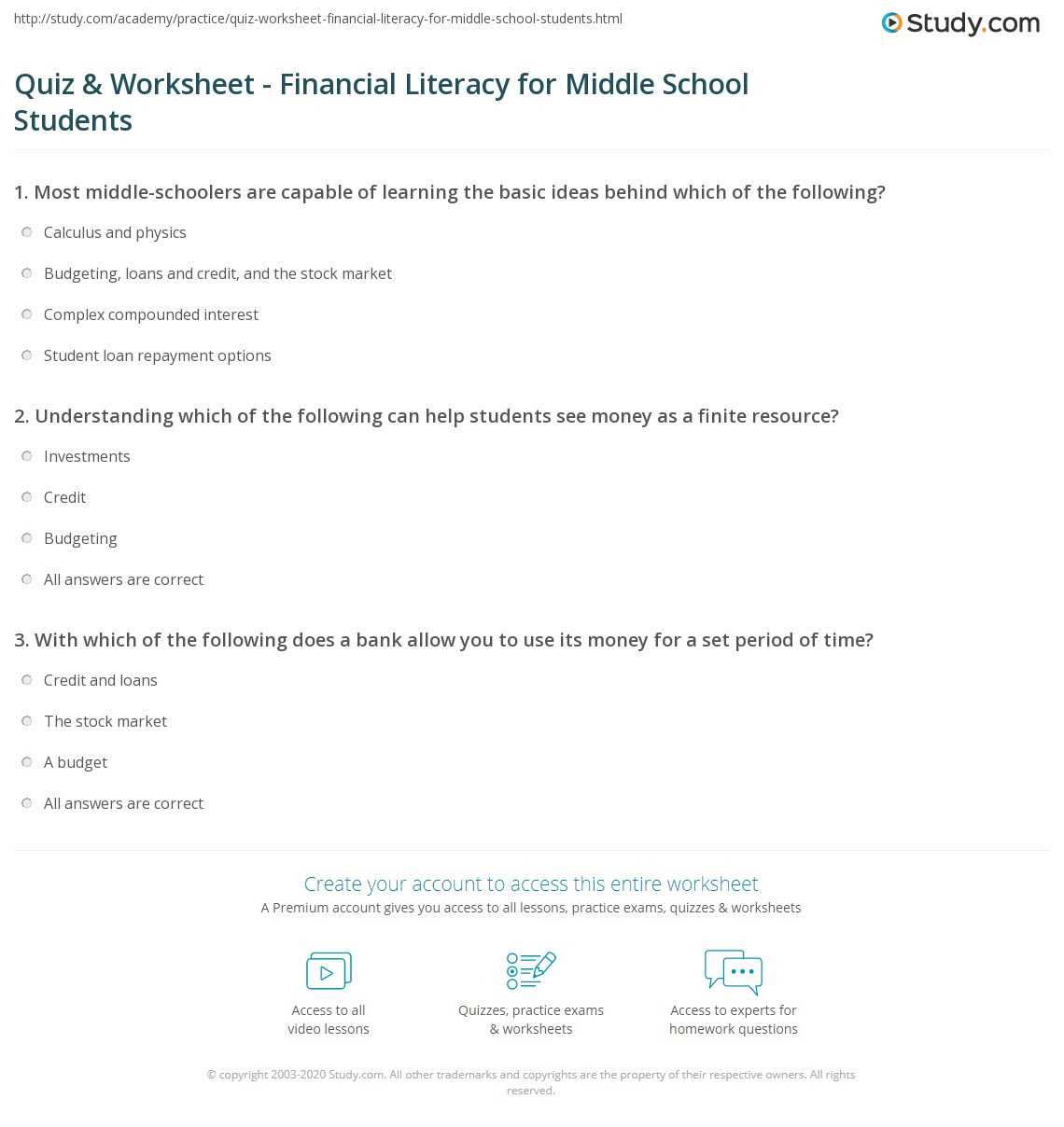

Understanding Financial Knowledge Assessments

Assessments designed to evaluate your understanding of key money management concepts are essential for recognizing how well you manage various aspects of your finances. These evaluations are typically structured to test your grasp of budgeting, saving, investing, and other important areas that impact your economic well-being. By reviewing these evaluations, individuals can pinpoint areas of strength and identify opportunities for improvement in their financial decision-making process.

Key Areas Covered in Financial Knowledge Assessments

Such evaluations usually focus on a few critical topics that influence daily financial decisions. These areas include how to handle resources, manage risks, and prepare for future needs. The goal is to gauge how effectively you can apply essential principles in real-world scenarios.

| Category | Description | Example Question |

|---|---|---|

| Budgeting | Evaluates your ability to plan and control income versus spending. | How do you prioritize your spending in a monthly budget? |

| Savings | Assesses your understanding of saving for short and long-term goals. | What is the recommended amount to set aside for emergencies? |

| Investments | Focuses on how well you understand various investment vehicles and risk management. | What type of investments are considered high-risk? |

| Debt Management | Tests your knowledge on how to handle and reduce outstanding obligations. | What is the best way to pay off credit card debt? |

Importance of Financial Knowledge Evaluations

These assessments play a significant role in enhancing your understanding of financial principles. They not only highlight areas for improvement but also motivate individuals to deepen their knowledge. Understanding the questions and concepts in these assessments can lead to more informed and confident financial decisions, paving the way for better control over your resources and future planning.

Key Concepts in Financial Knowledge

Understanding core principles related to managing money is essential for making sound decisions in various financial situations. These foundational concepts are critical in everyday life, from handling household budgets to planning for future goals. Gaining knowledge in these areas can help individuals optimize their resources, avoid financial pitfalls, and build a secure financial future.

- Budgeting: The practice of tracking and allocating income to cover expenses, savings, and investments.

- Saving: Setting aside a portion of income for future needs or emergencies.

- Investing: Putting money into assets like stocks, bonds, or real estate to grow wealth over time.

- Debt Management: Effectively managing and reducing outstanding loans or credit balances.

- Credit: Understanding how borrowing works and maintaining a healthy credit score for future financial opportunities.

Each of these concepts forms the backbone of sound financial management. A deeper understanding of them empowers individuals to make informed choices that align with both short-term needs and long-term goals. Without a solid grasp of these topics, it can be challenging to make progress towards financial stability and success.

- Emergency Fund: An essential reserve of money set aside to cover unexpected expenses.

- Insurance: Protection against significant financial loss from unforeseen events like accidents or illness.

- Retirement Planning: The process of saving and investing for the future to ensure financial security in later years.

- Tax Planning: Understanding how taxes affect your income and planning accordingly to minimize liabilities.

- Risk Management: Evaluating and mitigating potential financial risks to protect assets and income.

Mastering these key concepts enables individuals to make smarter decisions about money, ensuring that they are well-prepared to handle both the expected and unexpected financial challenges life may present.

Assessing Your Financial Decision-Making

Evaluating how you make choices about managing your resources is an important step in achieving long-term financial stability. The ability to make informed, thoughtful decisions impacts your ability to grow wealth, manage debt, and protect against risks. Understanding how well you manage your finances can highlight areas for improvement and provide insight into how your choices align with your financial goals.

| Decision Area | Key Considerations | Impact of Good Decision |

|---|---|---|

| Spending | Track expenses and prioritize needs over wants. | Increased savings, reduced debt, and financial freedom. |

| Saving | Establish a savings routine for future goals or emergencies. | Financial security, ability to handle unexpected expenses. |

| Investing | Assess risk tolerance and invest for long-term growth. | Wealth accumulation and improved financial independence. |

| Debt Management | Pay down high-interest debt first and avoid new unnecessary loans. | Reduced financial stress, improved credit score, better borrowing options. |

| Risk Mitigation | Use insurance and diversification to protect assets. | Protection from financial setbacks, peace of mind. |

Regularly assessing your decision-making processes helps to refine strategies and ensure that each choice contributes positively to your overall financial picture. By understanding the impact of both smart and poor decisions, you can align your actions with your objectives and make adjustments as necessary to reach your financial goals.

How Financial Tests Improve Budgeting Skills

Evaluating your understanding of resource management can significantly enhance your ability to create and maintain an effective budget. By identifying areas where your knowledge may be lacking, these assessments help highlight the practical skills necessary for managing income and expenses efficiently. Improving budgeting skills enables better control over spending, increased savings, and the ability to plan for future goals.

Identifying Key Budgeting Challenges

When assessing your money management abilities, certain challenges commonly arise, particularly in areas like expense tracking, saving, and prioritizing spending. Recognizing these difficulties is the first step toward improvement. Financial evaluations often bring attention to these issues, encouraging individuals to develop more effective strategies for budgeting.

- Tracking Expenses: Many struggle to monitor daily or monthly spending, leading to overspending.

- Saving for Goals: It can be difficult to set aside funds regularly for long-term objectives.

- Prioritizing Needs Over Wants: Understanding the difference between essential and non-essential spending is often challenging.

Improving Budgeting Strategies

By reviewing the results of these assessments, you can gain insight into where to focus your efforts. Common improvements include:

- Expense Categorization: Learning to break down spending into categories (e.g., fixed costs, discretionary spending) helps make budgeting more manageable.

- Setting Realistic Goals: Establishing clear, achievable savings targets fosters better financial discipline.

- Reviewing and Adjusting: Regularly revisiting and adjusting your budget ensures that you stay on track despite changing circumstances.

Improving your budgeting skills through evaluations helps not only in day-to-day financial management but also in preparing for future milestones, such as buying a home or retiring comfortably.

The Importance of Saving and Investing

Building wealth over time requires a clear understanding of how to manage your income through both saving and investing. These two practices are essential for securing financial independence, preparing for unforeseen circumstances, and achieving long-term objectives. Without them, it becomes difficult to weather financial storms or capitalize on opportunities that arise.

Why Saving Matters

Saving is the foundation of financial security. By setting aside a portion of your income for short-term and long-term goals, you create a cushion that provides stability during emergencies and allows you to reach major milestones in life, such as buying a home or funding education. Savings are vital for covering unexpected expenses, which can otherwise derail financial plans.

- Emergency Fund: A safety net that covers unexpected events, such as medical bills or car repairs.

- Short-Term Goals: Saving for vacations, purchases, or other temporary expenses.

- Peace of Mind: Having funds available for emergencies reduces stress and increases confidence in managing finances.

Why Investing is Crucial

While saving is important, it is investing that has the potential to significantly grow your wealth. Investing allows you to put your money into assets that can appreciate over time, such as stocks, bonds, or real estate. With the right strategy, investing can provide higher returns than a standard savings account, helping you accumulate wealth faster and achieve financial goals more efficiently.

- Wealth Accumulation: Investments, especially long-term ones, can grow significantly, providing financial independence.

- Beating Inflation: Investing helps preserve purchasing power by outpacing inflation, which erodes savings over time.

- Retirement Security: Investing is a key strategy for building the necessary funds to maintain a comfortable lifestyle in retirement.

When combined, saving and investing are powerful tools that pave the way to achieving both immediate and future financial goals. By balancing both practices, individuals can create a robust financial plan that supports their current needs while preparing for future growth.

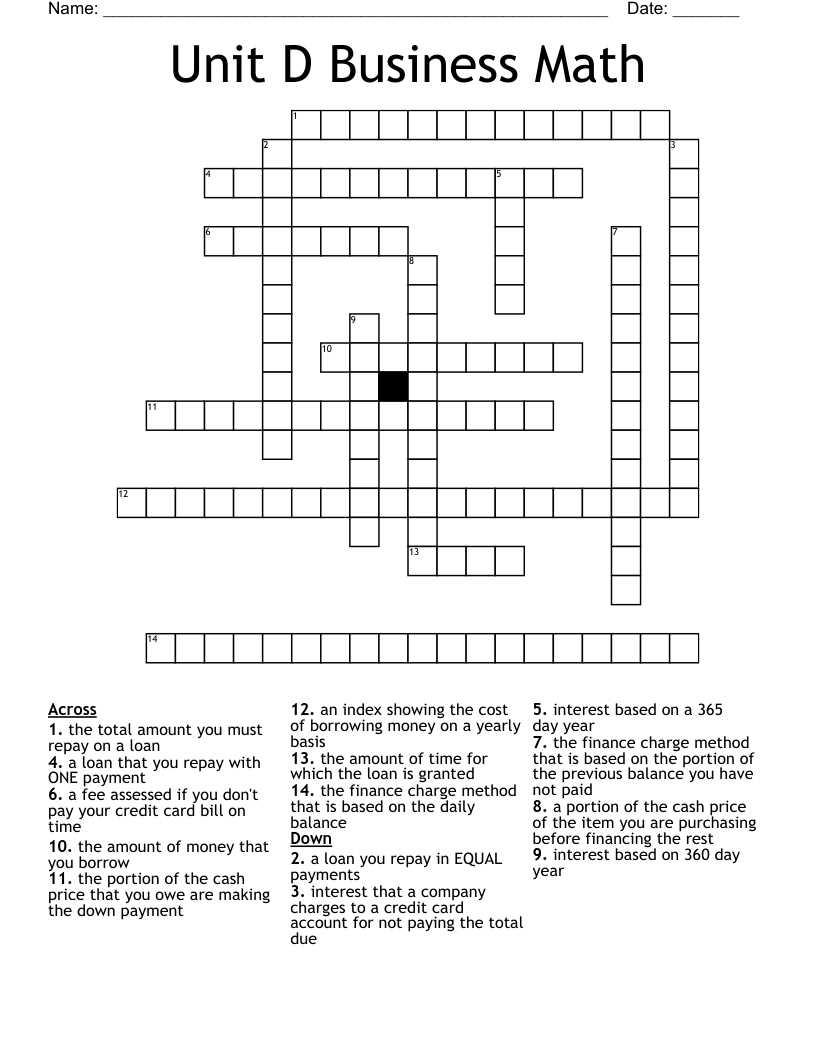

Debt Management Strategies Explained

Effectively managing debt is essential for maintaining financial stability and achieving long-term financial goals. With the right strategies, individuals can reduce their outstanding balances, improve their credit scores, and prevent future financial stress. By understanding various methods of handling debt, you can take control of your finances and avoid being overwhelmed by payments.

One of the first steps in managing debt is assessing your financial situation to identify how much you owe and to whom. Once you have a clear picture, you can choose from a range of approaches to tackle your obligations, each tailored to your specific needs and preferences.

- Debt Snowball Method: Focus on paying off the smallest debts first while making minimum payments on larger debts. This method helps build momentum and provides psychological rewards as you eliminate debts.

- Debt Avalanche Method: Prioritize high-interest debts, paying them off first while making minimum payments on others. This strategy saves you money on interest in the long run.

- Debt Consolidation: Combine multiple debts into one loan with a lower interest rate, making it easier to manage payments and reduce monthly obligations.

- Balance Transfer: Transfer high-interest credit card balances to a card with a 0% interest rate for a set period, allowing you to pay off the principal without accumulating additional interest.

Each of these strategies has its advantages depending on your financial circumstances. Whether you need to tackle high-interest loans quickly or prefer smaller, more manageable victories, there is a solution to help you get back on track. Understanding and implementing these techniques is a crucial step toward achieving financial freedom and avoiding the pitfalls of unmanageable debt.

Understanding Credit Scores and Reports

Your credit score and report play a vital role in your overall financial health. They provide lenders with a snapshot of your ability to repay debts and manage credit. Understanding these tools is essential for making informed decisions about borrowing, managing existing debt, and achieving your long-term financial goals.

What is a Credit Score?

A credit score is a numerical representation of your creditworthiness, typically ranging from 300 to 850. It is calculated based on your credit history and reflects how well you’ve managed your debt. A higher score indicates a better track record, making it easier to qualify for loans and credit at favorable terms.

- Payment History: Your record of on-time payments is the most significant factor influencing your score.

- Credit Utilization: The ratio of your credit card balances to their limits; lower utilization rates are favorable.

- Length of Credit History: The longer your credit history, the better it is for your score.

- Credit Mix: A diverse mix of credit types can positively impact your score.

- Recent Credit Inquiries: Too many credit checks in a short time can lower your score.

What is a Credit Report?

A credit report is a detailed record of your credit activity, including information about your loans, credit cards, payment history, and outstanding balances. It also includes any accounts that have been sent to collections or any bankruptcies filed. Lenders, insurers, and even employers may review your credit report when making decisions about you.

It’s essential to regularly check your credit report for accuracy. Errors or fraudulent activities can negatively affect your credit score, so identifying and addressing these issues early can help maintain a healthy financial standing.

Evaluating Risk and Insurance Needs

Understanding the balance between risk and protection is crucial for maintaining financial stability. Insurance is an effective way to mitigate the impact of unforeseen events, such as accidents, illness, or property damage. By evaluating your personal risks and identifying appropriate coverage, you can safeguard your assets and ensure financial security for you and your family.

Identifying Potential Risks

Before determining which types of protection are necessary, it is important to assess the risks you face. These risks can vary greatly depending on your lifestyle, occupation, health, and family situation. Some common risks include:

- Health-related Risks: Medical emergencies, chronic illnesses, or long-term care needs.

- Property Risks: Damage or loss of assets like your home, car, or valuables.

- Income Loss: Job loss or disability that affects your ability to earn a living.

- Legal Risks: The potential for lawsuits or claims against you for accidents or negligence.

Choosing the Right Insurance Coverage

Once you understand the risks you are most likely to encounter, selecting the right types of insurance becomes a priority. Some of the most common policies include:

- Health Insurance: Helps cover medical expenses and provides financial support during illness or injury.

- Homeowners or Renters Insurance: Protects your property and personal belongings against damage or theft.

- Life Insurance: Provides financial support for your dependents in case of your passing.

- Disability Insurance: Offers income replacement if you become unable to work due to illness or injury.

- Auto Insurance: Covers damage to your vehicle and liability for accidents involving your car.

By understanding the types of risks you face and tailoring your insurance coverage to address these needs, you can ensure that you’re prepared for the unexpected and minimize the financial impact of unforeseen events.

Long-Term Financial Planning Tips

Planning for the future is a crucial aspect of ensuring financial stability and achieving your long-term objectives. By making informed decisions today, you can create a pathway to secure a comfortable lifestyle in the years to come. Effective planning involves understanding your goals, managing risks, and making the right choices for investments and savings.

To successfully plan for the future, here are some key strategies to consider:

- Set Clear Goals: Begin by defining your long-term objectives, such as retirement, buying a home, or funding your children’s education. Having clear goals helps you stay focused and motivated.

- Create a Budget: Track your income and expenses to ensure you’re living within your means. A well-maintained budget allows you to save more and invest in your future.

- Start Saving Early: The earlier you start saving, the more time your money has to grow. Take advantage of compound interest and set aside funds for both short-term needs and long-term goals.

- Build an Emergency Fund: Having a financial cushion is vital in case of unexpected events. Aim to save at least 3 to 6 months’ worth of expenses to provide security during emergencies.

- Diversify Investments: Spread your investments across different asset classes such as stocks, bonds, and real estate to reduce risk and maximize returns over time.

Review and Adjust Regularly

Your circumstances and financial situation can change over time, so it’s important to review your plan periodically. Make adjustments as necessary to ensure that your strategy aligns with your evolving goals and priorities. Regularly assessing your progress will help you stay on track and make informed decisions based on the current financial environment.

Seek Professional Guidance

If you’re unsure about how to develop a comprehensive plan or manage your investments, consider consulting a financial advisor. A professional can provide personalized advice tailored to your specific goals and ensure that you are on the best path toward achieving your financial objectives.

How Taxes Impact Your Financial Future

Taxes are an essential part of managing your income and wealth. The amount you pay in taxes affects your disposable income, the ability to save, and the overall financial decisions you make. By understanding how taxes work, you can make more informed choices that positively influence your long-term wealth-building strategy.

Whether it’s income taxes, property taxes, or capital gains taxes, the financial obligations you face can significantly alter your financial planning. Here’s how taxes can impact your future:

- Income Taxes: The more you earn, the higher the percentage of your income you may owe in taxes. Understanding tax brackets and deductions can help you minimize tax liabilities and increase savings potential.

- Investment Growth: Tax policies on investment returns, such as dividends and capital gains, can affect your long-term investment strategy. Tax-efficient investment accounts and strategies, like retirement accounts, can help you reduce tax impact.

- Retirement Savings: Contributions to certain retirement plans may be tax-deferred, meaning you won’t pay taxes until you withdraw funds. This can lead to long-term growth of your retirement nest egg.

- Property Taxes: If you own real estate, property taxes will impact your overall budget and savings. It’s important to account for this ongoing expense when planning for future goals, such as home ownership or relocation.

- Inheritance Taxes: Estate taxes can affect how much wealth you pass on to heirs. Planning ahead for these taxes through trusts or other strategies can help protect your legacy.

Taxes are a fundamental aspect of wealth-building, and proactive tax planning is essential. By utilizing tax-advantage accounts, seeking professional tax advice, and planning for future tax obligations, you can improve your financial outcomes and secure a more stable future.

Recognizing Financial Scams and Fraud

Scams and fraudulent schemes can have a devastating impact on your wealth and security. These deceptive tactics often prey on individuals’ lack of knowledge and can occur in many forms, from fake investments to phishing schemes. Understanding how to identify these threats is essential in protecting your assets and personal information.

Recognizing warning signs early can help you avoid falling victim to these schemes. Here are some common indicators of fraud:

- Unrealistic Promises: Be cautious of opportunities that seem “too good to be true,” such as guaranteed returns or risk-free investments. Fraudsters often promise high rewards with little to no risk involved.

- Pressure to Act Quickly: Scammers often create a sense of urgency, urging you to act fast. They may pressure you to make decisions on the spot without giving you time to fully evaluate the offer.

- Requests for Personal Information: Fraudulent schemes frequently involve requests for sensitive details, such as bank account numbers or Social Security information. Be wary of unsolicited phone calls or emails that ask for this data.

- Lack of Transparency: Legitimate businesses and investment opportunities will provide clear, understandable information. If the details of an offer are vague or unclear, it’s a red flag.

- Unregistered Investment Products: If an investment is not registered with financial regulatory authorities or is offered by unlicensed individuals, it’s a strong indicator of fraud.

By staying vigilant and cautious, you can better protect yourself from scams and ensure that your hard-earned money is kept safe. If you suspect fraudulent activity, report it to the appropriate authorities and seek professional advice before taking any action.

Common Financial Mistakes to Avoid

Many individuals make decisions that can harm their long-term wealth and well-being. These missteps often stem from a lack of knowledge, impulsive actions, or simply not considering the consequences. Understanding what mistakes to avoid can help you stay on track and work toward your financial goals with greater confidence.

Here are some of the most frequent errors that people make:

- Excessive Spending: It’s easy to fall into the trap of living beyond your means, especially with the availability of credit. Spending more than your income can quickly lead to debt and financial strain.

- Failing to Save for Emergencies: Without a cushion to fall back on, unexpected events can become significant setbacks. Having an emergency fund is essential to managing life’s surprises without derailing your finances.

- Not Planning for Retirement: Many overlook the importance of saving for their future, thinking it’s something they can do later. Starting to save early, even in small amounts, can make a huge difference over time.

- Overlooking Debt Management: Carrying high-interest debt without a strategy for paying it down can cause financial stress. Prioritizing debt repayment helps reduce interest costs and improve overall financial health.

- Neglecting to Build Credit: Building and maintaining a strong credit score is crucial for securing loans at favorable rates. Ignoring credit management can hinder opportunities to make significant purchases, such as a home or car.

- Making Impulsive Investment Choices: Failing to research or letting emotions drive investment decisions can lead to poor returns. A well-thought-out investment strategy aligned with your goals is key to building wealth over time.

Avoiding these mistakes requires discipline and a long-term perspective. By staying focused, planning ahead, and educating yourself, you can achieve greater financial stability and make smarter decisions that pave the way for success.

Building a Strong Financial Foundation

Establishing a solid base is essential for managing your resources effectively and achieving long-term prosperity. The foundation you build today will influence your ability to weather economic challenges and reach your financial aspirations. It’s about creating habits and systems that allow you to not only manage day-to-day expenses but also to plan for future opportunities and setbacks.

Here are key steps to help you lay the groundwork for financial success:

- Creating a Budget: A clear budget helps you track income and expenses, ensuring that you live within your means while saving for the future. Setting up categories for necessary spending and discretionary income keeps you in control.

- Establishing an Emergency Fund: Life can be unpredictable, and having a financial cushion allows you to handle unexpected events without compromising your long-term goals. Aim for at least three to six months’ worth of living expenses.

- Reducing High-Interest Debt: Paying off high-interest debts should be a priority, as they can quickly grow and hinder your progress. Focus on eliminating these obligations to free up funds for savings and investments.

- Building Credit Wisely: A strong credit history can open doors to favorable loan terms and financial opportunities. Make timely payments, keep credit utilization low, and avoid unnecessary debt to improve your credit score.

- Setting Long-Term Goals: Whether it’s saving for retirement, purchasing a home, or funding education, having clear goals helps you stay motivated. Break them down into manageable milestones and track progress regularly.

- Investing for the Future: Once the basics are in place, start putting money into long-term investment options that align with your risk tolerance and financial goals. This helps your wealth grow over time and prepares you for future needs.

Building a strong foundation doesn’t happen overnight. It requires consistent effort, discipline, and a focus on what matters most in your journey toward financial stability. By following these steps, you can establish a secure and sustainable path forward.

The Role of Financial Advisors in Your Life

Having a professional guide to help manage your monetary decisions can provide invaluable insights and clarity, especially when navigating complex situations. Financial experts are trained to help individuals organize their resources, optimize investments, and plan for the future in a way that aligns with their specific goals. Whether you’re looking to grow wealth, save for major milestones, or protect your assets, advisors play a crucial role in ensuring that you make well-informed choices.

Here’s how these professionals can positively impact your financial journey:

- Personalized Guidance: An expert can assess your unique circumstances and provide tailored advice to help you achieve your goals, whether it’s retirement planning, home ownership, or creating a safety net.

- Expertise in Investment Strategies: Financial advisors are well-versed in market trends and investment options, helping you make informed decisions that align with your risk tolerance and long-term ambitions.

- Managing Risk: They assist in evaluating potential risks to your assets and recommend strategies to protect against financial uncertainty, such as insurance options or diversification in your portfolio.

- Tax Optimization: Advisors can help you navigate complex tax laws, ensuring that you take advantage of deductions, credits, and tax-efficient strategies to minimize liabilities and maximize savings.

- Long-Term Planning: A financial expert can help you plan for future needs, from retirement to legacy planning, by building a strategy that evolves as your life circumstances change.

- Emotional Support in Times of Crisis: When facing challenging financial situations, an advisor can offer guidance and help you make sound decisions without being swayed by emotional reactions or external pressures.

Ultimately, the value of working with an advisor lies in their ability to simplify complex decisions, making them more manageable and helping you stay focused on your overarching financial goals. They provide not only knowledge but also peace of mind in knowing that you have a trusted expert on your side.

Improving Your Money Management Skills

Effectively managing your resources is key to achieving financial stability and reaching long-term goals. It involves understanding how to budget, save, invest, and reduce debt in a way that supports both your current needs and future ambitions. By honing these skills, you gain control over your money, reduce stress, and increase your ability to make decisions that align with your objectives.

Creating and Sticking to a Budget

The first step in managing your money is knowing exactly where it’s going. A well-structured budget helps track income and expenses, making it easier to identify areas where you can cut back or save. Start by categorizing your spending into fixed costs (like rent and utilities) and variable costs (like entertainment and dining). Allocate a certain percentage of your income to savings, debt repayment, and future goals.

Building Healthy Saving and Investment Habits

Beyond just budgeting, it’s important to consistently save a portion of your earnings. Having an emergency fund provides financial security, while investing can help grow your wealth over time. There are various strategies you can use, from setting up automatic transfers to retirement accounts to exploring low-risk investment options. The key is to start early and stay disciplined, adjusting your strategy as your financial situation evolves.

By taking these steps, you’ll improve your ability to make informed decisions, avoid overspending, and steadily work towards your financial aspirations. Strong money management skills are built over time, and they serve as the foundation for a secure and prosperous future.

How to Take a Financial Knowledge Evaluation

Taking an evaluation of your financial skills can help you understand where you stand in terms of money management. Whether you are preparing for a certification or simply want to improve your understanding, this process involves answering a variety of questions related to budgeting, investing, saving, and debt management. Here’s a simple guide to help you navigate through the process effectively.

1. Prepare Your Mindset

Before diving into any evaluation, it’s important to approach it with a clear mindset. Understand that this is an opportunity for growth. Consider the following steps:

- Stay Calm: Don’t worry about getting everything perfect. The goal is to learn and identify areas for improvement.

- Be Honest: Answer questions based on your current knowledge, not what you wish to know.

- Stay Focused: Set aside distractions and dedicate time to concentrate on the evaluation.

2. Review Key Topics

Financial knowledge is broad, so it’s essential to brush up on core areas before attempting an evaluation. Some important concepts to review include:

- Budgeting: Understanding how to track your income and expenses.

- Saving and Investing: Basics of building wealth over time.

- Debt Management: Strategies for paying off loans and avoiding excessive interest.

- Credit and Loans: How borrowing works and the importance of managing credit responsibly.

- Insurance: The role of insurance in safeguarding assets.

3. Answer the Questions Thoughtfully

When taking the evaluation, make sure to read each question carefully. Don’t rush through the answers, and think about real-life scenarios where the concepts might apply. If you’re unsure, use logic or choose the most reasonable answer based on your current knowledge. Often, the questions are designed to test your ability to apply knowledge, not just recall facts.

4. Learn from Mistakes

Once you complete the evaluation, take the time to review your mistakes. Most tests provide explanations for each answer, which can be a valuable learning tool. If you encounter concepts you’re unfamiliar with, take the opportunity to research and learn more about those areas.

By following these steps, you can approach the process with confidence, gaining valuable insights into your current financial understanding and identifying areas for improvement in your money management practices.

Resources for Enhancing Financial Knowledge

Improving your understanding of managing money and building wealth is essential for long-term financial success. There are a variety of resources available that can help you gain deeper insights into budgeting, investing, and planning for your future. These tools and materials provide structured guidance, practical advice, and the knowledge necessary to make informed financial decisions.

1. Online Learning Platforms

Numerous online platforms offer comprehensive courses to boost your understanding of various financial topics. These resources often provide step-by-step lessons and real-world applications to enhance learning. Some widely-recognized platforms include:

- Coursera: Offers free and paid courses from top universities, covering topics like investing, saving strategies, and debt management.

- Udemy: A wide variety of affordable courses on personal money management, investing, and financial planning.

- edX: Provides access to in-depth courses from prestigious institutions, focusing on practical skills in money management and economic principles.

2. Books and Guides

Books provide an in-depth exploration of money management strategies and concepts. Many experts offer practical wisdom that can help readers achieve financial stability and grow their wealth. Some must-read titles include:

- “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko: Focuses on the habits of wealthy individuals and the steps you can take to build lasting wealth.

- “The Simple Path to Wealth” by JL Collins: A guide on investing, with a focus on low-cost index funds and financial independence.

- “Your Money or Your Life” by Joe Dominguez and Vicki Robin: Offers advice on transforming your relationship with money and achieving financial independence through mindful spending.

By leveraging these resources, you can gain the knowledge and tools needed to manage your money effectively and make better decisions that will impact your financial future positively.