In the realm of finance, mastering the practical aspects of the subject is essential for building a solid foundation. This section delves into real-world scenarios where theoretical knowledge is applied to solve complex financial tasks. By tackling these exercises, learners can enhance their understanding and refine their problem-solving skills.

The focus here is on examining various challenges and exploring how best to approach them. Each exercise presents a unique situation that requires careful analysis and logical thinking. With each step, a deeper comprehension of financial principles is achieved, allowing for clearer decision-making in future situations.

Through this detailed exploration, learners will not only gain insights into solving specific tasks but also develop a strategic mindset for approaching financial issues. By reviewing the provided solutions, individuals can strengthen their ability to navigate the complexities of the subject with confidence.

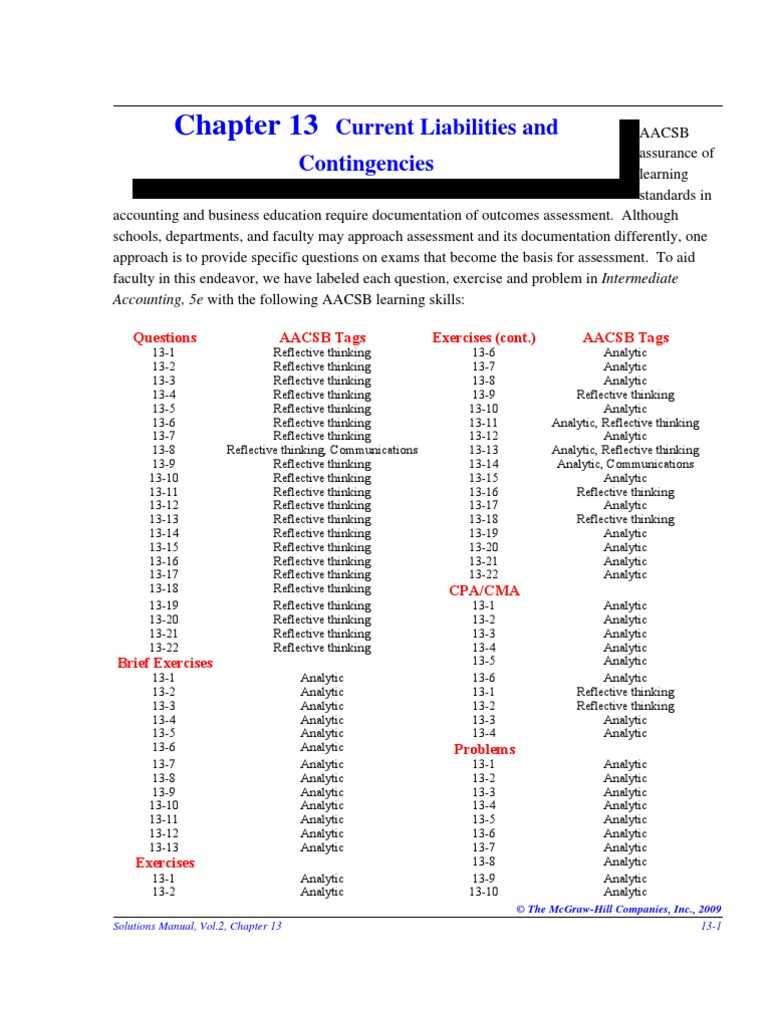

Accounting Chapter 13 Problem Solutions

In this section, we explore various financial tasks that challenge learners to apply theoretical knowledge in practical scenarios. By breaking down each task, we provide clear steps that can be followed to arrive at accurate conclusions. These exercises are designed to build critical thinking skills and enhance the ability to solve complex financial questions.

Each solution is explained in detail, ensuring that the approach is clear and accessible. Whether dealing with budgeting, forecasting, or financial analysis, the goal is to offer a comprehensive guide that prepares individuals for similar challenges in real-world situations.

| Task | Explanation | Solution |

|---|---|---|

| Budget Allocation | Determining how to allocate resources effectively across different departments. | Begin by identifying key priorities and estimating expenses. Then, distribute funds based on these needs. |

| Profit Margin Calculation | Finding the profitability of a company by comparing revenues to costs. | Subtract total expenses from revenue and divide the result by revenue to get the margin percentage. |

| Cash Flow Analysis | Examining the movement of money in and out of the business over a specific period. | Identify cash inflows and outflows, then calculate net cash flow to assess financial health. |

| Cost-Volume-Profit Analysis | Understanding the relationship between costs, production volume, and profitability. | Use the formula to calculate breakeven points and determine the impact of changes in volume on profit. |

Understanding Chapter 13 Application Challenges

This section focuses on the various hurdles encountered when applying theoretical concepts to real-world financial tasks. The aim is to build a deeper understanding of how to approach intricate financial situations by utilizing a combination of techniques and strategies. By examining these challenges, learners can gain a better grasp of the core principles that drive successful financial decision-making.

Key Areas of Difficulty

- Understanding complex financial statements and how to interpret them in practical scenarios.

- Applying theoretical knowledge to real-life business operations.

- Handling variations in data and learning to adjust strategies accordingly.

- Integrating multiple concepts to solve multidimensional financial tasks.

Approaches to Overcome Challenges

- Break down each task into smaller, manageable steps to avoid feeling overwhelmed.

- Review relevant concepts and formulas that can aid in solving specific tasks.

- Practice consistently with real-life examples to improve problem-solving abilities.

- Consult available resources and seek feedback to better understand complex scenarios.

By focusing on these areas and following the suggested approaches, individuals will improve their ability to navigate these challenges with greater confidence and accuracy.

Key Concepts in Financial Accounting

Understanding fundamental principles is essential for navigating the complexities of financial tasks. These core ideas form the backbone of decision-making processes and are crucial for analyzing a company’s financial health. Mastery of these concepts allows for a clearer perspective when addressing various business challenges.

Core Principles to Focus On

- Revenue Recognition: Understanding when and how revenue should be recorded is key to accurate financial reporting.

- Expense Matching: Ensuring that expenses are recognized in the same period as the related revenue is vital for accurate profit calculation.

- Financial Position: Analyzing assets, liabilities, and equity provides a snapshot of the company’s financial stability.

- Liquidity and Solvency: Assessing a business’s ability to meet short-term and long-term obligations is critical for financial planning.

Essential Skills for Effective Application

- Interpreting Financial Statements: The ability to analyze and extract valuable insights from balance sheets, income statements, and cash flow reports.

- Forecasting: Using historical data to predict future trends and make informed decisions.

- Cost Management: Understanding how to control and optimize costs to maintain profitability.

- Ethical Decision-Making: Ensuring that all financial practices align with legal and ethical standards is paramount.

By gaining a deep understanding of these concepts, individuals will be better equipped to navigate the complexities of financial tasks and make more informed, strategic decisions.

Step-by-Step Problem-Solving Techniques

Breaking down complex financial tasks into manageable steps is crucial for finding accurate solutions. A structured approach not only helps in tackling individual challenges but also builds a framework for handling more difficult situations in the future. The process involves careful analysis, application of key concepts, and consistent review of results to ensure accuracy and relevance.

Approach to Structured Problem Solving

- Identify the Key Issue: Clearly define the core question or task to ensure the focus remains on the critical elements.

- Gather Relevant Information: Collect all necessary data, including financial statements, forecasts, and historical trends, to support the analysis.

- Apply Relevant Concepts: Use established theories, formulas, and methods to begin solving the task at hand.

- Work Through Calculations: Execute the necessary steps, ensuring each calculation is completed accurately and in the proper order.

- Review and Refine: After reaching a solution, review the results for accuracy, and refine any assumptions or calculations if needed.

Improving Problem-Solving Efficiency

- Practice Regularly: Consistent practice with similar tasks helps improve speed and accuracy in problem-solving.

- Develop Analytical Skills: Strengthening analytical skills through case studies and exercises enhances your ability to approach challenges with confidence.

- Use Tools and Resources: Leverage financial software, spreadsheets, and reference materials to streamline calculations and improve accuracy.

- Learn from Mistakes: Review errors carefully to understand why the initial approach didn’t work and adjust methods for future tasks.

By following these structured steps and continuously improving your approach, you can master the art of solving financial challenges efficiently and accurately.

Importance of Application Problems in Accounting

Real-world exercises that require applying theoretical knowledge are vital for reinforcing learning and improving practical skills. By engaging with these challenges, learners gain a deeper understanding of how to approach complex financial tasks. These activities not only help solidify concepts but also enhance critical thinking and decision-making abilities.

Benefits of Real-World Financial Tasks

- Bridging Theory and Practice: These exercises provide an opportunity to connect theoretical lessons with actual business scenarios, making the material more relevant and applicable.

- Improving Problem-Solving Skills: By tackling different types of challenges, learners develop a systematic approach to problem-solving that can be applied to a wide range of situations.

- Strengthening Analytical Abilities: Analyzing different financial situations helps build strong analytical skills that are crucial for success in the field.

- Enhancing Decision-Making: Engaging with real-world cases sharpens the ability to make informed, data-driven decisions based on sound reasoning and evidence.

Why They Matter in Professional Development

- Building Confidence: Successfully solving these exercises boosts self-assurance, preparing individuals for similar challenges in the workplace.

- Facilitating Continuous Learning: These tasks offer opportunities for ongoing learning and development, ensuring professionals stay up-to-date with current trends and techniques.

- Enhancing Career Readiness: Through practical engagement, individuals become better equipped to handle the responsibilities of a financial role.

- Developing a Strategic Mindset: Working through complex financial scenarios fosters the ability to think strategically and act with foresight.

These exercises are essential for turning knowledge into real skills, ultimately preparing individuals for success in their careers and helping them navigate the challenges they will encounter in the business world.

Common Mistakes in Chapter 13 Problems

When tackling complex financial tasks, it is easy to overlook key details or apply concepts incorrectly. Many individuals make similar mistakes that can lead to inaccurate results and misunderstandings. By recognizing these common errors, learners can take proactive steps to avoid them and improve their problem-solving skills.

Common Errors to Avoid

- Misinterpreting Data: Often, crucial information is misread or overlooked, leading to incorrect calculations or conclusions.

- Incorrect Application of Formulas: Using the wrong formulas or applying them incorrectly can result in misleading answers.

- Failing to Account for All Variables: Neglecting to include all necessary factors, such as depreciation or taxes, can lead to incomplete or inaccurate results.

- Rushing Through Calculations: In a hurry to finish, some skip important steps or make simple errors in arithmetic, affecting the overall outcome.

Examples of Mistakes and Corrections

| Error | Explanation | Correction |

|---|---|---|

| Miscalculating Profit Margin | Incorrectly subtracting total expenses from revenue or failing to use the correct formula. | Ensure that revenue minus expenses is divided by revenue to get the proper margin percentage. |

| Omitting Fixed Costs | Not factoring in fixed costs when calculating break-even points or profitability. | Review all costs and include both fixed and variable costs in your analysis to ensure accuracy. |

| Overlooking Cash Flow | Ignoring or misjudging the importance of cash inflows and outflows in decision-making. | Double-check cash flow statements to ensure all movements of money are accounted for. |

| Assuming Consistent Growth | Assuming a constant growth rate without considering fluctuations or external factors. | Use realistic projections and consider potential changes in the market when forecasting growth. |

By learning from these common mistakes, individuals can refine their approach to solving financial tasks, leading to more accurate and reliable results in future scenarios.

Practical Examples of Accounting Problems

Understanding real-world scenarios where financial principles are applied is essential for grasping the complexities of the field. These practical examples help bridge the gap between theoretical knowledge and the challenges faced in day-to-day financial management. By exploring such cases, one can gain insights into common financial tasks and how to solve them effectively.

Example Scenarios and Solutions

| Scenario | Details | Solution Approach |

|---|---|---|

| Revenue Recognition | A company signs a contract for services to be provided over several months, but the payment is made upfront. | Recognize revenue gradually as services are rendered, rather than recording the entire payment at once. |

| Expense Allocation | Operating expenses need to be distributed between multiple departments for accurate cost tracking. | Allocate expenses based on usage or pre-determined allocation rates for each department. |

| Inventory Valuation | A business must decide whether to use FIFO or LIFO for valuing its inventory of goods sold. | Choose the method that best reflects the company’s operational practices and market conditions. FIFO may be preferred during inflationary periods for accurate cost representation. |

| Tax Calculation | A small business needs to calculate its tax liability based on profit, taking into account deductions and credits. | Determine the taxable income by subtracting applicable deductions, and then apply the correct tax rate based on the jurisdiction. |

| Cash Flow Forecasting | A company forecasts its cash flow for the next quarter, taking into account expected sales and expenses. | Create a cash flow statement by projecting inflows from sales and outflows for operating expenses, ensuring a positive balance to cover liabilities. |

These examples highlight the diverse financial scenarios that businesses face regularly. By practicing with such examples, individuals can gain hands-on experience and refine their ability to apply financial concepts in real-world situations.

How to Tackle Complex Financial Questions

When faced with intricate financial scenarios, it’s important to approach each task methodically. Breaking down the problem into smaller components can help simplify complex concepts, making it easier to identify the necessary steps for a solution. This approach not only ensures accuracy but also builds confidence in handling challenging financial tasks.

Steps to Approach Complex Financial Tasks

- Understand the Problem: Read the question carefully to grasp the context and identify the main components that need to be addressed.

- Identify Key Variables: Highlight essential elements like revenue, expenses, and any other factors that will influence the calculations.

- Apply Relevant Formulas: Choose the correct formulas that align with the data provided and ensure proper application throughout the problem-solving process.

- Work Step by Step: Tackle the question incrementally, solving each part before moving on to the next to avoid confusion and mistakes.

- Double-Check Calculations: Revisit your numbers to confirm accuracy. Simple arithmetic errors can lead to significant discrepancies in the final result.

- Interpret Results: Once the calculations are complete, analyze the outcome to ensure it makes sense in the context of the problem.

Common Techniques for Complex Scenarios

- Use Diagrams or Charts: Visual aids can help clarify relationships between different variables, making it easier to identify patterns and trends.

- Break Down Large Problems: Wh

Applying Theory to Real-Life Situations

The true value of theoretical knowledge becomes apparent when it is applied to everyday situations. The ability to translate learned concepts into practical actions is essential for making informed decisions in financial management. Real-life scenarios often present challenges that require a deeper understanding and the application of principles to achieve the best outcomes.

How Theory Translates into Practice

- Real-World Decision Making: When faced with budgeting or financial planning, understanding key concepts allows for making choices that align with long-term goals and market conditions.

- Resource Allocation: Knowledge of cost management techniques enables better distribution of resources, ensuring efficiency in operations and maximizing profitability.

- Risk Management: Identifying potential risks and using risk assessment tools learned from theory helps in minimizing the impact of unforeseen events or market fluctuations.

- Compliance and Regulations: Applying theoretical frameworks regarding laws and regulations ensures that financial activities remain compliant, avoiding legal penalties or financial misstatements.

Examples of Applying Theory in Practice

- Investment Strategies: When investing in stocks or bonds, using theoretical models such as risk-return analysis can guide decisions about portfolio diversification and risk tolerance.

- Cash Flow Management: Understanding cash flow statements allows for more accurate predictions about a company’s ability to meet financial obligations, helping businesses plan for future expenditures.

- Cost-Volume-Profit Analysis: By applying cost-volume-profit theory, businesses can determine the break-even point and decide on pricing strategies that will maximize profit margins.

- Financial Forecasting: Using past data and forecasting models, businesses can predict future revenue and plan investments, staffing, and other operational needs accordingly.

Integrating theory with real-world practice is crucial for success in managing financial resources, as it provides the tools to solve complex problems and make well-informed decisions in dynamic environments.

Breaking Down Financial Accounting Methods

Understanding the different approaches to managing and reporting financial data is essential for effective decision-making in any business or organization. Each method serves a specific purpose, offering unique advantages and providing insights into various aspects of financial health. By breaking down these methods, it becomes easier to choose the most appropriate one based on the specific needs and circumstances of a company.

One common method is the accrual basis, which recognizes revenues and expenses when they are incurred, rather than when cash is exchanged. This provides a more accurate picture of a company’s financial position, especially when dealing with long-term contracts or complex transactions.

Another widely used approach is the cash basis method, which records revenues and expenses only when cash is actually received or paid. This method is simpler and more straightforward, but may not fully reflect the financial health of a business, particularly when there are significant amounts of outstanding receivables or payables.

The choice between these methods depends on the size of the business, the complexity of its operations, and the requirements of its stakeholders. Understanding the nuances of each approach allows businesses to manage their finances more effectively, ensuring better financial planning and reporting.

Detailed Answers to Chapter 13 Questions

Providing comprehensive explanations to common questions helps clarify key concepts and ensures a deeper understanding of the subject matter. In this section, we will break down complex queries and provide clear, step-by-step solutions. Each response will address specific aspects of the topics, providing practical insights that are easy to follow.

When tackling questions related to financial data management, it’s important to focus on key factors such as accuracy, consistency, and relevance. These elements play a critical role in ensuring the correct interpretation of the financial information presented. By thoroughly understanding the underlying principles, one can confidently approach even the most intricate problems.

We will also explore real-life examples to show how these principles are applied in practical situations. By connecting theory with practice, we aim to enhance both comprehension and application of essential financial practices.

Tips for Mastering Accounting Problems

Mastering financial challenges requires more than just a basic understanding of principles. It involves honing your analytical skills and developing a methodical approach to solving complex tasks. Whether you are new to financial management or looking to refine your expertise, these tips will help you build confidence and improve your problem-solving capabilities.

Effective Study Techniques

- Understand Key Concepts: Before diving into exercises, ensure you have a solid grasp of fundamental concepts such as balance sheets, income statements, and cash flow. These are the building blocks for solving more complex scenarios.

- Practice Regularly: The more you practice, the easier it becomes to recognize patterns and apply solutions quickly. Work through a variety of exercises to cover different types of situations.

- Break Down Problems: Instead of trying to solve everything at once, break down larger questions into smaller, manageable steps. This makes it easier to stay organized and avoid overlooking important details.

Common Mistakes to Avoid

- Neglecting to Double-Check Work: Even small errors can lead to significant inaccuracies. Always review your calculations and ensure that all entries align with the problem’s requirements.

- Misunderstanding Instructions: Read the instructions carefully to ensure you understand what is being asked. Misinterpreting the problem can lead to incorrect assumptions and errors in your approach.

- Relying Too Much on Formulas: While formulas are essential, it’s important to understand the reasoning behind them. Simply applying formulas without comprehension can result in mistakes, especially in more complex cases.

By following these tips, you can build a strong foundation for tackling financial challenges with greater ease and accuracy, ultimately leading to improved results and a better understanding of the subject.

Critical Thinking in Financial Accounting

Critical thinking is an essential skill when dealing with financial data, as it allows individuals to make informed decisions based on accurate analysis. This involves examining all aspects of a situation, questioning assumptions, and exploring alternative solutions before drawing conclusions. In the context of financial management, it helps professionals not only interpret data but also assess its implications for decision-making and strategy development.

Applying Analytical Skills

To effectively solve financial tasks, it is crucial to approach each situation with a clear and analytical mindset. Here are some key steps to improve your critical thinking skills:

- Examine All Available Information: Start by gathering all relevant data, ensuring that no key piece of information is overlooked.

- Question Assumptions: Challenge your initial assumptions and consider whether they hold true in every case.

- Explore Multiple Solutions: Before deciding on a course of action, evaluate different approaches to see which one best fits the circumstances.

Making Sound Decisions

By applying critical thinking, you can make better-informed decisions that lead to more accurate financial reporting and sound business strategies. This approach not only helps prevent errors but also contributes to long-term success by fostering a deeper understanding of the financial environment.

Tools for Solving Application Problems

When tackling complex financial challenges, having the right tools at your disposal can significantly improve accuracy and efficiency. Various resources, both manual and digital, assist in breaking down intricate tasks, providing clarity, and ensuring precise results. These tools support the process of analyzing data, testing hypotheses, and reaching conclusions based on solid reasoning.

Essential Tools for Efficient Problem Solving

Here are some tools commonly used for tackling financial questions and scenarios:

- Spreadsheets: Programs like Microsoft Excel or Google Sheets allow for dynamic data manipulation and visualization. They are especially useful for organizing and performing calculations on large datasets.

- Financial Software: Specialized software like QuickBooks, SAP, or other financial management tools can automate many tasks, from budgeting to forecasting, providing quick solutions and detailed insights.

- Online Calculators: Many websites offer financial calculators that help solve specific queries related to interest rates, loan amortization, tax rates, and more.

Improving Accuracy with Automation

By utilizing automated tools, professionals can avoid human errors that might arise from manual calculations. These tools also allow for more sophisticated analysis, providing users with a deeper understanding of complex financial structures. Automation in this context simplifies the decision-making process, saving both time and effort.

Strategies for Accuracy in Financial Tasks

Ensuring precision in financial work is crucial for producing reliable results and making informed decisions. Whether managing budgets, analyzing trends, or assessing performance, the right strategies can help avoid costly errors. By implementing organized practices and leveraging effective tools, one can achieve greater accuracy and consistency in all financial activities.

To maximize accuracy, consider applying the following strategies:

- Double-Checking Data: Before finalizing any calculations or reports, it’s essential to verify figures multiple times to ensure they align with the original data. A fresh look at the numbers can often reveal hidden mistakes.

- Using Templates and Standardized Formats: Developing and sticking to specific formats and templates can minimize errors by creating consistency in how data is entered, organized, and analyzed.

- Utilizing Checklists: Creating step-by-step lists for completing tasks ensures that no detail is overlooked and that each phase of the process is completed thoroughly.

By incorporating these methods, the likelihood of errors is significantly reduced, resulting in more accurate financial insights and reporting.

How to Improve Problem-Solving Skills

Enhancing your ability to solve challenges efficiently and effectively is essential for success in any field. Developing strong problem-solving skills involves a combination of strategic thinking, practice, and learning from past experiences. The more you engage with different scenarios and approaches, the better you become at tackling complex situations with confidence.

Here are some key strategies to sharpen your problem-solving abilities:

- Break Down the Issue: Start by breaking the problem into smaller, more manageable parts. This makes it easier to identify the root cause and explore possible solutions.

- Analyze the Information: Gather all relevant data and evaluate it carefully. Look for patterns, inconsistencies, and key details that can help inform your decision-making.

- Practice Critical Thinking: Challenge yourself to think outside the box. Ask probing questions and consider alternative viewpoints to uncover more solutions.

- Learn from Mistakes: Reflect on previous attempts to solve similar issues. Recognizing what worked and what didn’t can help you refine your approach for the future.

By applying these techniques, you can enhance your analytical skills, improve your decision-making, and approach challenges with greater effectiveness.

Resources for Further Study and Practice

To enhance your skills and deepen your understanding, utilizing various resources is crucial. Continuous learning and practice are key to mastering any field, and there are numerous tools available that cater to different learning styles. Whether you’re looking for additional explanations, hands-on exercises, or advanced materials, there are plenty of ways to reinforce your knowledge and gain confidence in tackling complex scenarios.

Here are some valuable resources to consider:

- Online Courses: Platforms like Coursera, Udemy, and LinkedIn Learning offer in-depth courses that allow you to dive deeper into topics, often with video lectures, quizzes, and assignments to reinforce learning.

- Interactive Tools: Many websites provide interactive exercises, where you can practice solving different types of scenarios. These platforms give immediate feedback to help refine your skills.

- Textbooks and Study Guides: Comprehensive textbooks and study guides provide a wealth of theoretical knowledge, examples, and case studies to further your understanding of key concepts.

- Forums and Online Communities: Joining online communities such as Reddit or StackExchange can be a great way to ask questions, discuss topics with peers, and get different perspectives on complex challenges.

- Practice Software: Tools like simulation programs or practice tests allow you to practice and test your abilities in a controlled environment, mimicking real-world scenarios.

By leveraging these resources, you can continuously refine your skills, gain practical experience, and stay updated with the latest advancements in your field of study.

Preparing for Exams with Practice

Effective exam preparation requires more than just reviewing notes or memorizing concepts. It involves actively applying what you’ve learned to various scenarios and refining your understanding through consistent practice. By tackling sample questions and working through exercises, you can build confidence, identify areas for improvement, and strengthen your ability to solve complex situations under time constraints.

Why Practice is Essential

Practice is critical in developing a deep understanding of the material and in improving problem-solving speed. It allows you to:

- Identify Patterns: By working on numerous examples, you can recognize common patterns and solutions that will help you tackle similar tasks on the actual exam.

- Boost Confidence: Consistent practice helps reduce anxiety and boosts your confidence, allowing you to approach each question with a clear mindset.

- Improve Efficiency: Familiarity with various question types and formats helps you manage time effectively during exams.

- Reinforce Understanding: Practicing concepts in different contexts helps reinforce the theoretical knowledge and strengthens your grasp of the subject matter.

How to Maximize Practice Sessions

To ensure you get the most out of your practice sessions, consider the following strategies:

- Simulate Exam Conditions: Try to replicate exam conditions by setting a timer and working without distractions. This helps you become accustomed to managing time under pressure.

- Review Mistakes: After completing each practice session, carefully review your mistakes to understand where you went wrong and how to correct it.

- Mix Topics: Instead of focusing on one topic at a time, mix different concepts and types of questions to simulate the variety you will face during the exam.

- Use Multiple Resources: Don’t limit yourself to just one set of practice questions. Use different textbooks, websites, and resources to ensure you encounter a broad range of questions.

By adopting these strategies, you can better prepare for exams and enhance your ability to apply knowledge in a practical and effective way.

Strategy Benefit Simulate Exam Conditions Improves time management and stress handling during real exams. Review Mistakes Identifies weak areas and reinforces correct methods. Mix Topics Prepares you for a variety of questions and reduces monotony. Use Multiple Resources Broadens your exposure to different question formats and depths.