Successfully navigating a certification in financial analysis requires understanding the key principles and methodologies used in this field. This guide provides essential insights into the knowledge and techniques necessary to perform well in a structured assessment of financial markets and instruments.

From foundational concepts to advanced calculations, mastering these areas will equip you with the expertise needed to excel. This section focuses on common challenges faced during testing and offers practical advice on how to address them effectively, ensuring a thorough grasp of the subject matter.

Practical preparation is a critical aspect of achieving a high score, and understanding the structure and nature of questions will enable you to approach the test confidently. By familiarizing yourself with various strategies, you can optimize your study sessions and improve your performance under timed conditions.

Financial Certification Test Preparation

Achieving success in a financial assessment involves a deep understanding of essential concepts and the ability to apply them in real-world scenarios. This section focuses on how to approach the various challenges commonly encountered during these tests, offering key strategies for effective preparation and improving your performance.

With a comprehensive knowledge of key topics, such as bond pricing, market dynamics, and risk management, you can confidently navigate through even the most complex sections. A strategic approach to studying will help you retain critical information and apply it when needed, ensuring you answer questions with accuracy and precision.

Practical exercises and sample questions are invaluable for testing your readiness. By reviewing past problems and practicing with similar formats, you’ll be able to refine your problem-solving skills, develop a better understanding of the material, and ultimately boost your chances of success.

In addition, time management plays a crucial role in performing well under exam conditions. It’s important to allocate your time wisely and avoid spending too much on any one question, leaving enough time to review your answers and ensure their correctness.

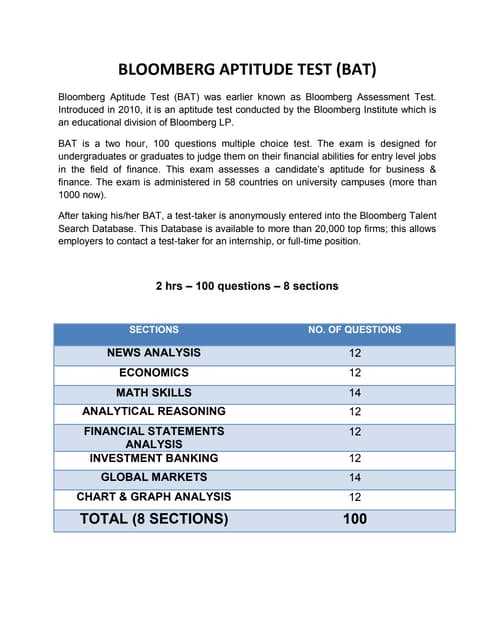

Overview of Financial Market Certification Assessment

Gaining proficiency in financial market assessments requires a solid understanding of key principles that drive investment decisions and market strategies. This evaluation tests your knowledge of various financial instruments, market mechanics, and risk analysis techniques, offering a comprehensive overview of your ability to apply these concepts effectively.

Key Areas of Focus

The certification evaluation covers several critical areas, including but not limited to:

- Market fundamentals and economic indicators

- Instrument valuation and pricing models

- Risk management and portfolio optimization techniques

- Regulatory frameworks and financial market laws

- Analytical methods used in asset allocation and investment strategies

Test Format and Structure

The structure of the assessment is designed to gauge both theoretical understanding and practical application. It typically includes:

- Multiple-choice questions focused on conceptual knowledge

- Scenario-based questions testing decision-making and problem-solving skills

- Mathematical calculations related to asset pricing and financial analysis

- Case studies that require applying knowledge to real-world situations

Understanding these components will help you prepare effectively, ensuring that you are ready to tackle each section with confidence and accuracy.

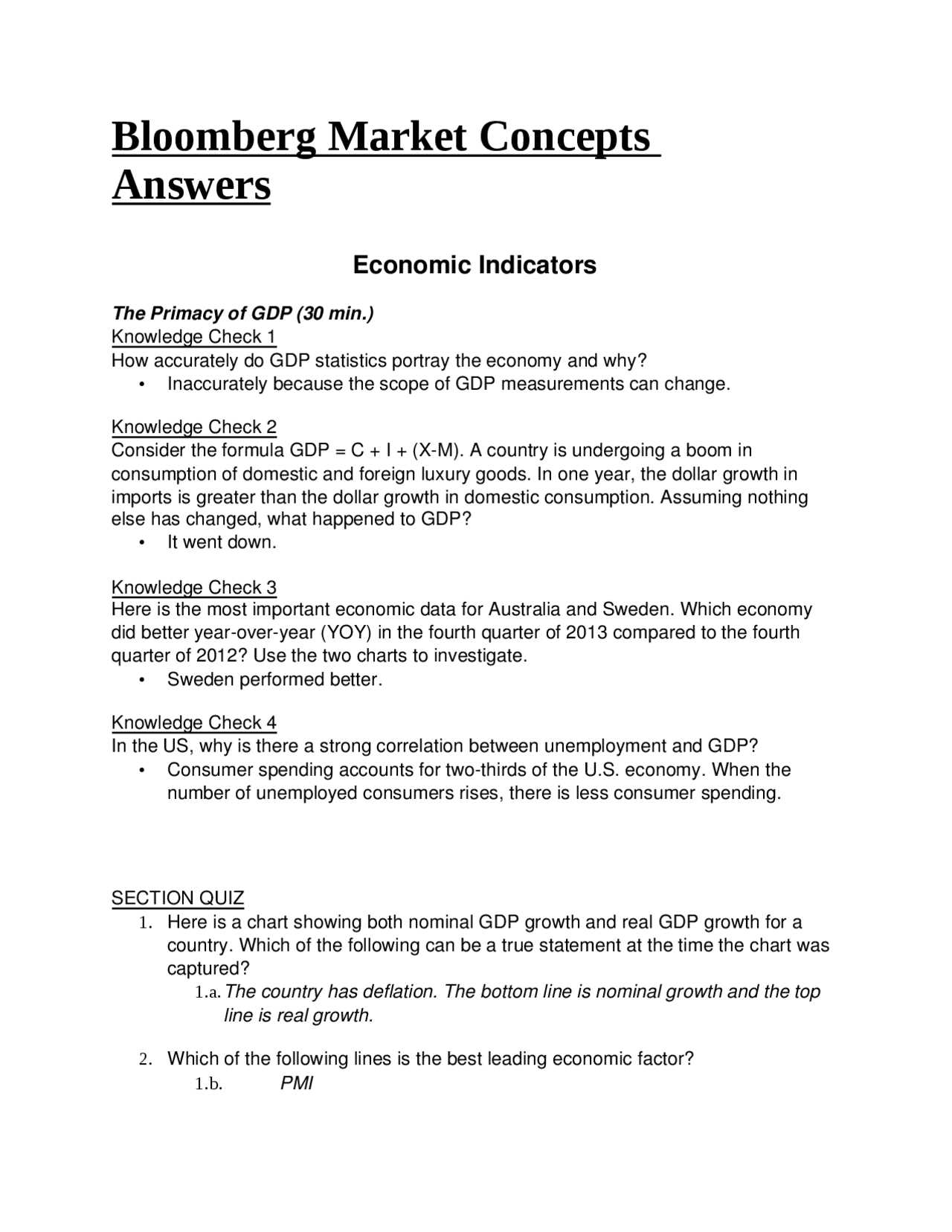

Key Topics Covered in the Assessment

The evaluation encompasses a wide range of essential topics designed to test your understanding of financial markets, instruments, and analytical methods. A strong grasp of these areas is critical for success, as they form the foundation of the assessment. The test covers theoretical concepts as well as practical applications that are central to making informed decisions in the financial sector.

Core subjects include market fundamentals, various types of financial assets, and methods of valuation. Additionally, the assessment evaluates risk management techniques, understanding of economic indicators, and the regulatory environment that governs financial markets. Mastering these topics will ensure you are well-prepared for the challenges presented in the evaluation.

Understanding the Assessment Structure

The assessment is carefully designed to evaluate both your theoretical knowledge and practical application of financial concepts. It is structured to test your understanding through a mix of question types, each assessing a different skill set, from basic knowledge recall to advanced problem-solving abilities. Understanding the structure will help you navigate the test with confidence and optimize your time during the evaluation.

Types of Questions

The test typically includes a variety of question formats, such as:

- Multiple-choice questions for testing conceptual understanding

- Scenario-based questions that assess decision-making and problem-solving

- Calculation-based questions requiring the application of mathematical models

- Case studies that involve real-world financial analysis

Time Management and Strategy

Proper time management is crucial for completing the assessment effectively. Each section is designed to be completed within a set timeframe, so it’s important to pace yourself and allocate sufficient time to each part of the test. Practicing under timed conditions can help develop a strategy that ensures you tackle the most challenging sections first, leaving time to review your answers later.

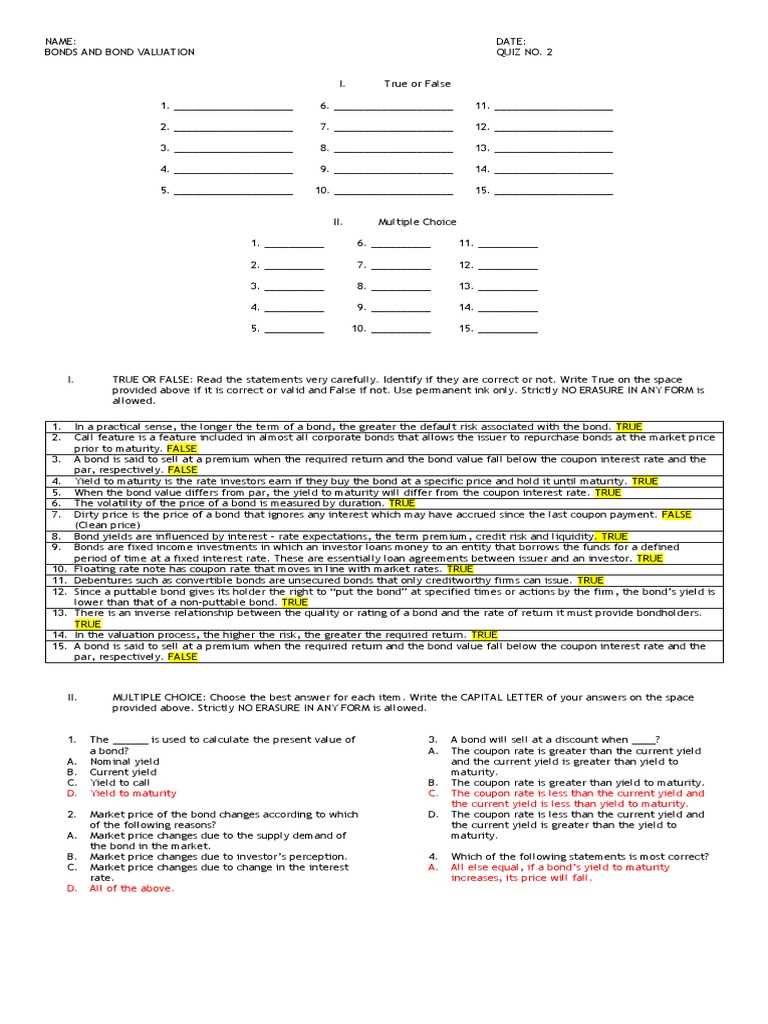

Common Questions in Financial Assessments

During financial assessments, candidates are often presented with a variety of questions that test both fundamental knowledge and practical application. These questions are designed to gauge your ability to understand financial concepts and apply them in real-world scenarios. Below are some of the most common types of questions you might encounter during the evaluation.

Types of Questions

- Questions related to bond pricing and yield calculations

- Scenarios involving interest rate changes and their impact on investment portfolios

- Risk assessment questions, focusing on how to mitigate potential losses

- Calculations of present and future values of financial instruments

- Regulatory and compliance-related questions regarding financial markets

Focus Areas in Practical Questions

In addition to theoretical knowledge, practical questions often test your ability to:

- Analyze market conditions and determine investment strategies

- Interpret financial data and apply it to solve complex problems

- Make informed decisions based on risk-return analysis

Preparing for these common types of questions will ensure you are ready for the challenges of the assessment and can tackle each section with confidence.

How to Prepare for Financial Certification

Effective preparation for a financial certification requires a strategic approach that blends theoretical understanding with practical application. Focusing on core concepts, practicing calculations, and reviewing case studies are key steps in ensuring you are ready for the challenges of the assessment. A structured study plan combined with consistent practice can help solidify your knowledge and boost your confidence.

Develop a Study Plan

Creating a well-organized study plan is essential to cover all key topics. Start by breaking down the material into manageable sections, focusing on one concept at a time. Ensure that you allocate sufficient time for each area, giving extra attention to complex subjects that require more practice. Consistency is crucial, so set aside dedicated study hours each day.

Practice with Sample Questions

Familiarizing yourself with the format of questions is one of the best ways to prepare. Use practice questions and previous assessments to get a feel for the types of problems you may face. Work through both theoretical and practical exercises, paying attention to any areas where you struggle. This will help you build problem-solving skills and identify gaps in your understanding.

Additionally, practicing under timed conditions will help you manage your time effectively during the actual assessment. This will allow you to approach each section with greater confidence and accuracy.

Effective Study Strategies for Success

Success in any financial certification depends on more than just memorizing facts; it requires a strategic approach to studying that maximizes retention and comprehension. By adopting the right study methods, you can ensure that you not only understand the material but also apply it effectively under test conditions. The following strategies will help you optimize your preparation and improve your performance.

Key Strategies for Efficient Learning

- Active Learning: Engage with the material through active note-taking, summarizing key points, and discussing concepts with peers or mentors. This helps reinforce understanding and memory.

- Break Down Complex Topics: Divide complex subjects into smaller, manageable sections. Focus on mastering one concept at a time before moving on to the next.

- Use Real-World Examples: Relate theoretical concepts to practical examples from financial markets. This approach can make abstract ideas more tangible and easier to grasp.

- Practice Regularly: Regular practice is crucial for building confidence and speed. Work through sample problems, calculations, and case studies to sharpen your skills.

Time Management Tips

- Set Realistic Goals: Break your study sessions into achievable goals. Track your progress to stay motivated and ensure you cover all the necessary material.

- Use Timed Practice Sessions: Mimic exam conditions by setting time limits on practice questions. This will help improve your ability to manage time during the real assessment.

- Review and Revise Regularly: Don’t just study once and forget. Schedule regular revision sessions to reinforce your knowledge and ensure long-term retention.

By combining these strategies, you can enhance your study efficiency, reduce anxiety, and approach the assessment with a higher level of preparedness.

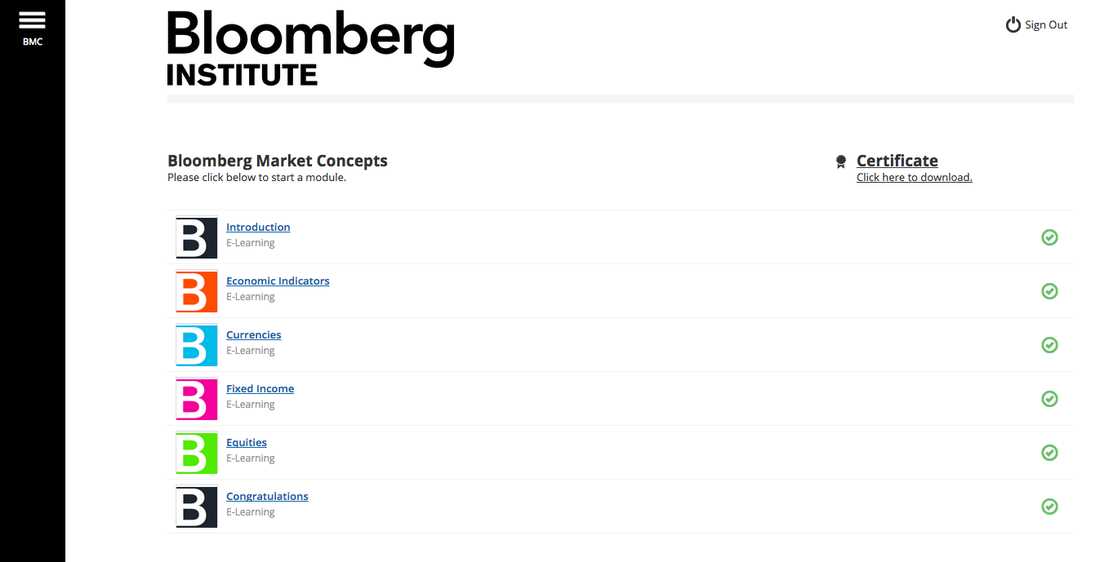

Resources for Financial Certification Preparation

To excel in a financial certification, it’s important to have access to quality resources that can provide both theoretical knowledge and practical insights. A variety of materials can help you strengthen your understanding and improve your skills. From textbooks and online courses to practice exams and financial tools, leveraging these resources can give you a competitive edge in your preparation.

Essential Study Materials

- Textbooks and Study Guides: Look for comprehensive textbooks and guides that cover key concepts in finance, investment strategies, and market analysis. These materials are often structured to align with the content of the assessment.

- Online Courses: Many platforms offer structured courses focused on financial instruments, portfolio management, and related topics. These courses often include video lectures, quizzes, and interactive exercises.

- Practice Exams: Taking practice tests is an essential step in preparing for any certification. These tests help familiarize you with the format and timing of the actual assessment.

- Study Groups: Joining a study group can provide valuable insights and allow you to discuss challenging topics with peers who are also preparing for the certification.

Tools for Financial Analysis

- Financial Calculators: Having a financial calculator that can perform bond pricing, yield calculations, and other financial functions can be helpful for practice and during the actual assessment.

- Online Resources and Forums: Websites, forums, and blogs focused on finance offer a wealth of knowledge, with experts sharing tips, problem-solving strategies, and answers to common questions.

- Financial Market Simulators: Using simulators can help you apply theoretical knowledge to real-world scenarios, giving you hands-on experience with trading, investment strategies, and risk management.

Using a combination of these resources will help ensure that you are well-prepared for the challenges of the financial certification process, enhancing both your knowledge and your test-taking ability.

Time Management Tips for the Test

Effective time management is crucial when preparing for a financial assessment. With limited time available, it’s important to prioritize tasks and allocate sufficient time to each section. By mastering time management, you can maximize your performance, minimize stress, and ensure that you have enough time to review your answers before submission.

Strategies for Efficient Time Allocation

- Understand the Test Format: Familiarize yourself with the structure and time limits of the test. Knowing how much time is allocated to each section helps you pace yourself accordingly.

- Prioritize Easy Questions: Start with the questions that are easiest for you. This ensures that you accumulate points quickly and gain confidence for more difficult sections.

- Set Time Limits for Each Section: Allocate a specific amount of time to each section of the test. Use a stopwatch or timer to stay on track and avoid spending too much time on any single question.

- Leave Challenging Questions for Later: If you come across a difficult question, don’t dwell on it for too long. Skip it and return to it later with a fresh perspective.

Review and Final Checks

- Reserve Time for Review: Set aside the last 5–10 minutes of the test to review your answers. This will allow you to correct any mistakes and ensure you haven’t overlooked any questions.

- Stay Calm and Focused: Keeping a clear mind throughout the test is essential for time management. Avoid panic if time is running short–stay calm and adjust your strategy as needed.

By following these time management tips, you can approach the test with confidence, ensuring that every minute counts towards achieving your best possible result.

Calculations You Should Know

In the world of finance, understanding key calculations is vital for evaluating the performance and value of different financial assets. Whether assessing debt instruments, investment opportunities, or determining the return on investment, these essential calculations enable analysts and investors to make informed decisions. Mastering these formulas provides a foundation for navigating the complexities of the financial landscape with confidence.

Key Financial Calculations

Below is a list of important calculations that professionals in finance should be familiar with, as they are commonly used in analysis and investment decisions:

| Calculation | Formula | Purpose | |

|---|---|---|---|

| Present Value (PV) | PV = FV / (1 + r)^t | Determines the current value of future cash flows, taking into account the time value of money and a specific discount rate. | |

| Future Value (FV) | FV = PV × (1 + r)^t | Calculates the value of a current investment at a future date, factoring in an expected rate of return over time. | |

| Yield to Maturity (YTM) | YTM = [Coupon Payment + (Face Value – Current Price) / Years to Maturity] / [(Current Price + Face Value) / 2] | Measures the annual return an investor would earn if the asset is held until maturity, considering both interest payments and price changes. | |

| Current Yield | Current Yield = Annual Coupon Payment / Current Market Price | Calculates the income return on an investment, such as a bond, based on its current market price. | |

| Common Mistake | How to Avoid It |

|---|---|

| Poor time management | Practice pacing yourself and allocate time for each question based on its complexity. |