In the world of financial regulation, professionals play a crucial role in ensuring institutions follow laws and maintain stability. These roles require a blend of analytical skills, attention to detail, and a deep understanding of financial operations. One key aspect that often drives career decisions in this field is compensation, which varies based on several factors such as experience, location, and job responsibilities.

For those considering a career in financial oversight, understanding the earning potential and benefits associated with these positions is essential. The opportunities for growth, along with the challenges faced in this line of work, make it an attractive career path for many individuals. Exploring the details of compensation packages, job requirements, and long-term prospects can provide valuable insights for those looking to enter the field.

Understanding Financial Oversight Careers

Careers in financial oversight offer an opportunity to contribute to the stability and security of the financial system. These roles are centered around ensuring that institutions operate within legal frameworks, manage risks effectively, and maintain transparency in their operations. Professionals in this field are crucial for the health of the broader economy, often working behind the scenes to ensure trust and accountability in the financial sector.

Individuals in these positions are responsible for a variety of tasks, which may include:

- Assessing the financial health of institutions

- Conducting detailed audits to verify regulatory compliance

- Identifying potential risks and recommending corrective actions

- Advising on the implementation of sound financial practices

- Preparing reports for stakeholders and regulatory bodies

These careers require a combination of analytical skills, a deep understanding of financial regulations, and the ability to communicate findings clearly. The path to these roles often starts with strong academic qualifications in finance, economics, or related fields. As professionals gain experience, they have the opportunity to take on more complex responsibilities and move into leadership positions that influence policy and strategy.

Responsibilities of a Financial Oversight Professional

Professionals in financial oversight play a critical role in ensuring that institutions follow legal guidelines and operate efficiently. Their main responsibilities center around assessing the financial practices of organizations, identifying potential risks, and ensuring compliance with industry standards. These experts help maintain stability within the financial system by providing in-depth reviews and offering recommendations for improvements.

Key duties in these roles often include:

- Reviewing financial statements to evaluate an institution’s performance and health

- Conducting on-site inspections to verify compliance with regulations

- Identifying potential risks and financial irregularities

- Recommending corrective actions to improve financial stability

- Preparing detailed reports based on findings for management and regulatory bodies

Additionally, these professionals must stay informed about evolving regulations and industry trends to ensure their assessments remain relevant and accurate. Their work is vital for preventing financial mismanagement and fostering a secure environment for both institutions and their clients.

How Regulatory Agencies Support Financial Stability

Regulatory bodies are crucial in maintaining the overall stability of the financial system. They implement measures to ensure that financial institutions operate transparently, follow legal standards, and mitigate risks that could impact the broader economy. These efforts help create a secure environment for both consumers and businesses, preventing disruptions in the financial markets.

To achieve these goals, these organizations typically engage in the following activities:

- Overseeing the financial health of institutions to ensure compliance with regulations

- Identifying potential risks and vulnerabilities within financial systems

- Enforcing laws that protect both consumers and the economy from financial instability

- Providing guidance to organizations on best practices for risk management

- Coordinating with other governmental and financial entities to address systemic challenges

By playing an active role in monitoring and improving industry standards, these agencies contribute to a resilient and trustworthy financial infrastructure, fostering long-term economic growth and stability.

Educational Requirements for Financial Oversight Professionals

To succeed in financial oversight roles, individuals must possess a strong foundation of knowledge in areas such as finance, accounting, and economics. The complexity of the tasks involved–such as analyzing financial statements, assessing risks, and ensuring compliance with regulations–requires a deep understanding of both theory and practical application. As such, education plays a critical role in preparing candidates for these demanding positions.

Academic Background

A bachelor’s degree is typically the minimum requirement for these roles. Ideal fields of study include finance, economics, accounting, business administration, or related disciplines. Some employers may also prefer candidates with advanced degrees, such as a master’s in business administration (MBA) or a specialized finance degree, which can enhance career prospects and provide a deeper level of expertise.

Additional Qualifications

In addition to formal education, gaining relevant certifications or completing specialized training programs can significantly boost an individual’s qualifications. Certifications such as the Certified Public Accountant (CPA) or Chartered Financial Analyst (CFA) are highly regarded in the field, demonstrating proficiency in financial analysis and regulatory compliance. Furthermore, internships or entry-level positions in financial institutions can provide practical experience, offering an edge in competitive job markets.

Experience Needed for Regulatory Roles

In order to succeed in regulatory positions within the financial sector, candidates must demonstrate a combination of education and hands-on experience. While formal education provides the foundational knowledge, real-world experience is crucial for developing the practical skills necessary to perform in high-stakes environments. These roles require professionals to assess complex financial data, identify risks, and apply regulations to ensure compliance, all of which are enhanced by prior work experience.

Entry-Level Requirements

For individuals starting in the field, most entry-level roles require some relevant work experience, typically in areas such as accounting, finance, or business operations. Common entry-level opportunities that can help build necessary experience include:

- Internships with financial institutions or regulatory agencies

- Entry-level positions in accounting or financial analysis

- Junior roles in risk management or audit departments

These positions allow individuals to develop practical skills, understand industry regulations, and familiarize themselves with financial assessments, all of which are essential for advancing to more senior roles.

Advanced Experience for Senior Roles

As professionals move into senior-level positions, employers generally seek candidates with several years of experience in finance, accounting, or compliance. Senior professionals are expected to have proven expertise in analyzing complex financial statements, managing teams, and overseeing compliance procedures. Key areas of experience include:

- Leadership roles within financial analysis or compliance teams

- In-depth experience in risk management and regulatory frameworks

- Extensive background in auditing, both internally and externally

In addition, individuals aiming for senior roles often benefit from specialized certifications or continued professional development to stay current with evolving regulations and industry standards.

Factors Influencing Compensation in Financial Oversight Roles

The compensation for professionals in financial oversight roles varies widely due to a number of factors. These include the level of experience, geographic location, education, and specific industry certifications. Understanding these influences can provide valuable insights for individuals considering a career in this field and can help them better navigate career progression and salary expectations.

Some of the key factors that impact compensation in this sector include:

| Factor | Impact on Compensation |

|---|---|

| Experience | Professionals with more years of experience tend to earn higher compensation due to their increased expertise and ability to manage complex tasks. |

| Education Level | Individuals with advanced degrees, such as a Master’s in Business Administration or specialized certifications, often command higher salaries. |

| Geographic Location | Compensation can vary significantly depending on the cost of living in different regions. Positions in major cities or financial hubs often offer higher pay. |

| Industry Certifications | Certifications such as CPA, CFA, or others related to financial analysis and auditing can lead to higher compensation by demonstrating expertise in specific areas. |

| Job Level | Senior-level professionals with management or leadership responsibilities typically earn more compared to entry-level positions. |

These factors, along with others such as the size and scope of the institution, all contribute to the variation in compensation within this field. Understanding how these elements interplay can help individuals make informed decisions about their career paths and expectations for earning potential.

Regional Variations in Pay

Compensation for professionals in financial oversight roles can vary significantly depending on the region in which they are employed. Factors such as cost of living, local economic conditions, and the concentration of financial institutions in certain areas contribute to these regional differences. Understanding these variations can help individuals make informed decisions when considering job opportunities in different locations.

High-Paying Regions

In areas with a high concentration of financial institutions or major economic centers, compensation tends to be higher. For example, regions like New York City, San Francisco, and Washington, D.C. are known for offering competitive pay due to the demand for skilled professionals and the higher cost of living. These regions often offer better overall benefits and opportunities for career advancement as well.

Lower-Paying Regions

On the other hand, regions with fewer financial hubs or lower living costs may offer less competitive compensation. Rural areas or regions with less economic activity often see lower wages, though the cost of living is also typically more affordable. While the pay may be lower in these areas, professionals can benefit from a better work-life balance and a reduced cost of living.

When considering a role in financial oversight, it’s important to factor in both the potential compensation and the local economic conditions. Each region offers unique advantages and challenges that can impact your career growth and financial well-being.

Benefits of Working for the FDIC

Working for a government agency dedicated to ensuring financial stability offers numerous advantages that extend beyond just compensation. From job security to opportunities for career development, positions in this sector can provide a fulfilling and stable career path. The benefits associated with these roles help attract a diverse pool of professionals who are committed to supporting the economic system.

Job Security and Stability

One of the most significant benefits of working in this field is the strong job security it provides. Government agencies tend to offer more stability compared to the private sector, with fewer layoffs and a more predictable career trajectory. This stability can be particularly appealing for individuals seeking long-term employment opportunities with dependable benefits.

Comprehensive Benefits Package

In addition to competitive pay, roles in this sector often come with comprehensive benefits packages. These may include health insurance, retirement plans, paid leave, and other perks such as flexible work schedules or remote work options. These benefits contribute to a balanced work-life experience, making the position more attractive to potential candidates.

For professionals looking to contribute to the financial system while enjoying job security and valuable benefits, this sector offers an ideal career choice. It combines public service with personal fulfillment and long-term growth opportunities.

Career Advancement Opportunities

Positions in financial oversight offer significant potential for career growth and advancement. Employees in this sector can expect to expand their skill sets, take on increasing responsibilities, and move into higher-level roles over time. The career path is typically well-defined, with clear opportunities for those who demonstrate expertise and commitment to professional development.

Professionals can enhance their prospects by gaining additional qualifications, such as specialized certifications or advanced degrees, which can open doors to senior management roles. Many individuals start in entry-level positions and gradually move up through the ranks by acquiring more experience and taking on leadership responsibilities.

Advancement Routes: There are numerous paths available for career progression in this field, including:

- Team Leadership: Moving into supervisory or managerial positions overseeing teams and projects.

- Specialized Roles: Focusing on a niche area such as risk assessment, compliance, or audits.

- Executive Leadership: Advancing to executive or director-level roles responsible for strategic decision-making.

By taking advantage of these advancement opportunities, professionals can shape a long-lasting and rewarding career within the financial oversight industry.

Training Programs for New Examiners

Starting a career in financial oversight requires a comprehensive and structured training process to ensure individuals are well-prepared for their responsibilities. New recruits typically undergo rigorous training programs designed to provide them with the necessary knowledge and skills to assess financial institutions effectively and accurately. These programs offer a mix of theoretical learning and practical experience, allowing professionals to gain confidence in their roles while ensuring they meet industry standards.

Types of Training Programs:

- Orientation Sessions: These provide an introduction to the organization’s policies, procedures, and expectations, helping new recruits understand the scope of their roles.

- Technical Training: Focuses on financial analysis, risk assessment techniques, and regulatory compliance, equipping professionals with the tools they need to conduct detailed evaluations.

- On-the-Job Learning: Practical, hands-on training where recruits work alongside experienced professionals to apply their knowledge in real-world scenarios.

Key Components of the Training Process

The training process is often structured into phases to ensure a gradual buildup of knowledge and competency:

| Phase | Description |

|---|---|

| Phase 1: Classroom Learning | New recruits participate in formal classes covering essential theories, financial systems, and industry regulations. |

| Phase 2: Hands-on Experience | Recruits are paired with senior professionals for practical, real-time training on actual cases and assessments. |

| Phase 3: Assessment and Feedback | Continuous evaluations and feedback are provided to ensure recruits are meeting expectations and mastering required skills. |

With the combination of in-depth classroom instruction and hands-on experience, new professionals are given the tools to succeed and progress in their careers, ensuring they are fully prepared to carry out their duties effectively.

Work-Life Balance in FDIC Jobs

Achieving a healthy work-life balance is a key consideration for many professionals, and roles in this field are designed to support this balance. Employees in this sector benefit from structured work hours, ample vacation time, and various flexibility options, all contributing to a more manageable and fulfilling lifestyle. This emphasis on balance helps professionals maintain high levels of productivity while ensuring they have time to focus on personal interests and well-being.

Key Factors Supporting Work-Life Balance:

- Flexible Work Hours: Many roles offer the ability to adjust work hours, allowing individuals to manage both their professional and personal commitments more easily.

- Generous Time Off: Employees often receive a considerable amount of paid time off for vacations, personal days, and holidays, promoting relaxation and recuperation.

- Remote Work Options: Depending on the role, some employees may have the opportunity to work remotely, providing further flexibility in managing their personal lives.

By offering these benefits, the organization ensures that employees are able to balance the demands of their job with personal responsibilities, creating a more sustainable and rewarding career path. This approach not only enhances job satisfaction but also contributes to overall well-being, fostering a positive work environment.

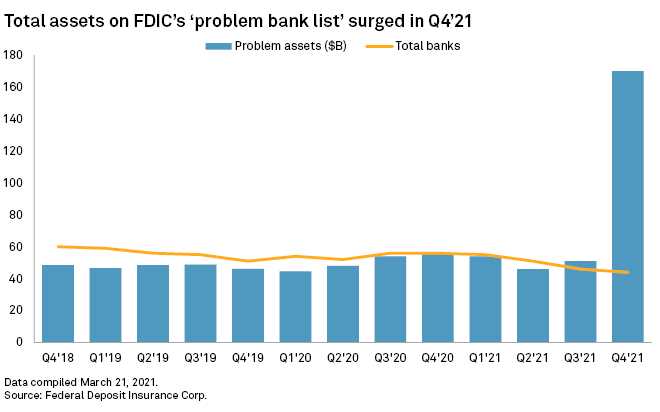

Impact of Economic Trends on Hiring

Economic shifts play a significant role in shaping the demand for certain job roles. Fluctuations in the economy, whether through periods of growth or downturn, often influence the number of available positions and the specific qualifications required. During times of economic expansion, companies may seek to expand their teams, increasing hiring efforts, while in more challenging economic conditions, hiring can slow down, and the focus may shift towards maintaining efficiency with existing resources.

Key factors influenced by economic trends include:

- Market Demand: As consumer and business spending increase or decrease, the need for regulatory and financial oversight often rises or falls, impacting hiring decisions.

- Technological Advancements: Economic growth often drives innovation, creating a need for new skills and specialized expertise, thereby affecting the types of roles that are in demand.

- Government Policies: Economic reforms and changes in regulations can lead to more or fewer positions being available, particularly in sectors directly impacted by policy shifts.

Understanding these dynamics is essential for both employers and job seekers, as it allows for better anticipation of trends and preparation for shifts in hiring patterns. The evolving economic environment directly shapes the workforce, influencing job availability and qualification requirements.