In this section, you’ll explore essential principles that lay the foundation for understanding personal finances and money management. The focus is on equipping you with the knowledge to make informed decisions in various financial situations.

Throughout the content, you’ll encounter various topics that build on one another, helping you to grasp the core concepts that are vital for financial well-being. These ideas are designed to enhance your ability to navigate complex financial scenarios and take control of your financial future.

Critical thinking and applying practical solutions to everyday financial challenges will be key as you progress. This section not only provides knowledge but also encourages you to think about real-world applications, giving you a deeper understanding of how financial principles influence daily life.

By the end, you’ll have a stronger grasp of crucial concepts that will serve you throughout your life. Each part of the content is structured to guide you step by step, ensuring you can confidently move forward with the skills and insights gained.

Module 7 Everfi Answers Overview

This section focuses on providing a clear understanding of key financial principles that are crucial for making informed decisions in everyday life. It aims to break down complex topics into manageable concepts, ensuring that learners can apply their knowledge to real-world scenarios with confidence.

As you progress through the content, you will encounter a variety of exercises designed to test your grasp of important financial ideas. These activities are intended to help reinforce the material, offering practical examples that illustrate the concepts being discussed. The goal is to equip you with the necessary tools to understand and manage your finances effectively.

Whether it’s budgeting, saving, or managing credit, this section lays the groundwork for building strong financial habits. The material encourages critical thinking, pushing you to not only memorize facts but also understand how to apply them in different contexts. By the end, you should feel more confident in your ability to navigate financial decisions and challenges.

Understanding the Module 7 Concepts

This section delves into the core principles that shape financial literacy, helping you develop a comprehensive understanding of how to manage money wisely. It covers a range of topics aimed at enhancing your ability to make sound financial decisions and plan for the future.

The key ideas presented focus on practical skills that are essential for everyday financial activities, such as budgeting, saving, and understanding the importance of credit. Each concept is designed to build on the last, creating a structured approach to mastering financial fundamentals.

By engaging with the material, you’ll gain insight into how financial choices impact your personal well-being. These concepts are not just theoretical–they are tools that you can use to make informed, confident decisions in your own financial journey. Through this process, you’ll develop a clearer understanding of how financial systems operate and how you can leverage them to meet your goals.

Key Objectives in Module 7

This section outlines the primary goals and learning targets designed to build a solid foundation in financial understanding. The focus is on providing you with the necessary skills to manage finances effectively, from everyday budgeting to making long-term financial plans.

Core Learning Goals

- Understanding the importance of budgeting and how to create a budget.

- Recognizing the role of saving in achieving financial goals.

- Grasping the concept of credit and its impact on financial decisions.

- Learning how to set financial goals and track progress over time.

Essential Skills to Master

- Assessing and managing expenses in different life scenarios.

- Building an emergency savings fund to prepare for unforeseen situations.

- Evaluating loan and credit options for responsible borrowing.

- Identifying strategies to maintain a healthy credit score.

By focusing on these objectives, you’ll be equipped with practical tools and insights to navigate the complexities of managing personal finances. These skills not only help in the short term but also lay the groundwork for financial independence and security in the future.

Step-by-Step Guide to Completing Module 7

This guide provides a structured approach to help you navigate through the content and tasks effectively. By following these steps, you’ll be able to comprehend and apply key financial principles with confidence, ensuring that you complete the section successfully.

Step 1: Review the Key Concepts

Start by familiarizing yourself with the main ideas presented in the section. This includes understanding the importance of budgeting, saving, and managing credit. Take time to read through the introductory material and any highlighted terms to ensure a solid foundation before moving on to exercises.

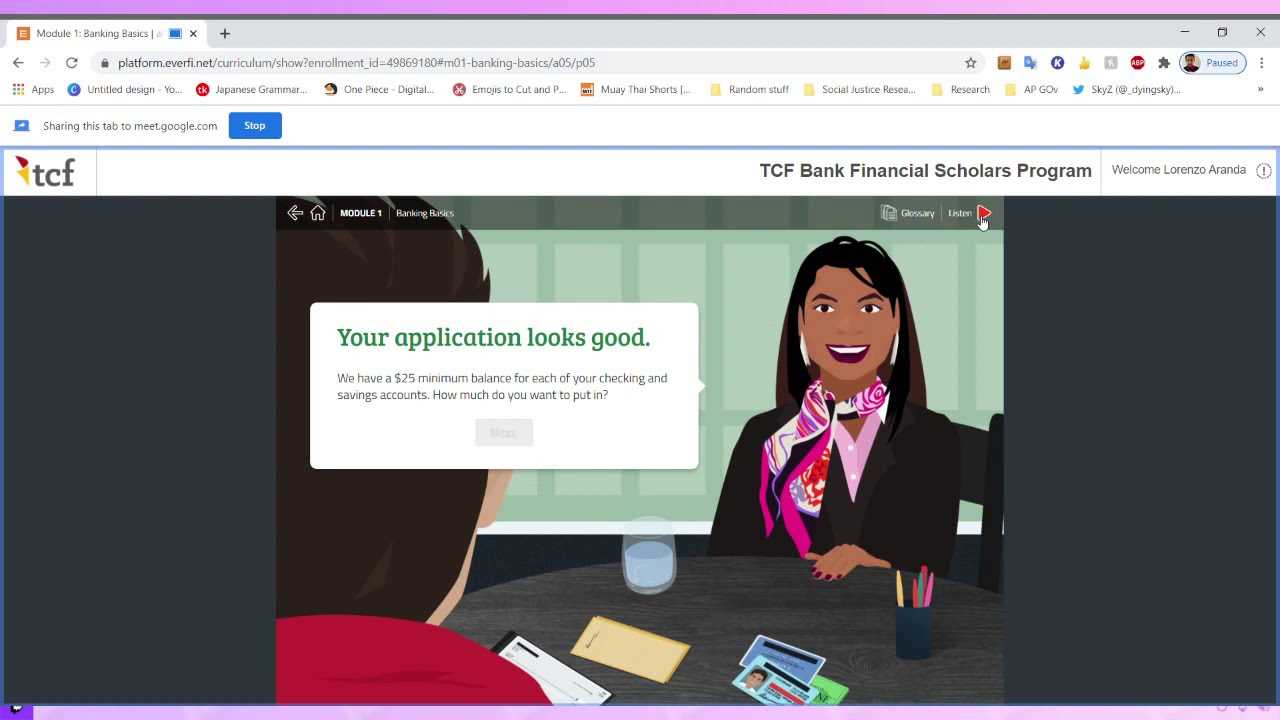

Step 2: Complete the Interactive Exercises

Engage with the practical exercises designed to reinforce what you’ve learned. These activities are created to help you apply the concepts in real-life scenarios. Carefully follow the instructions and reflect on how the solutions relate to your personal financial situation.

Step 3: Review Your Results

After completing the tasks, review your answers to ensure you fully understand the material. If you made any mistakes, take note of the correct answers and the reasoning behind them. This will help reinforce your learning and address any gaps in understanding.

Step 4: Reflect on Key Takeaways

Take a moment to reflect on the key takeaways from the section. Consider how the knowledge gained can be applied to your personal financial decisions moving forward. This reflection process will deepen your understanding and help you retain the information long-term.

Step 5: Ask for Help if Needed

If any part of the material is unclear or you need additional assistance, don’t hesitate to seek help. You can reach out to peers, instructors, or use supplementary resources to ensure that you have a thorough grasp of the concepts.

By following this step-by-step guide, you’ll be well-equipped to complete the tasks successfully and gain a deeper understanding of essential financial principles.

Common Mistakes to Avoid in Module 7

When learning about financial concepts, it’s easy to make some common errors that can lead to misunderstandings or mismanagement. Recognizing and avoiding these pitfalls is crucial for mastering the material and applying it effectively to your personal finances.

Below are some of the most frequent mistakes learners make, along with tips on how to avoid them:

| Common Mistake | How to Avoid It |

|---|---|

| Overcomplicating Budgeting | Start simple and focus on tracking essential expenses first. Gradually add categories as you become more comfortable. |

| Neglecting Emergency Savings | Prioritize saving a small amount regularly to build your emergency fund, even if it’s only a small percentage of your income. |

| Ignoring Credit Impacts | Understand how borrowing and repayment affect your credit score, and ensure that you pay bills on time to maintain a healthy credit history. |

| Failing to Set Clear Financial Goals | Break down long-term goals into smaller, achievable steps with clear timelines, helping you stay on track and motivated. |

| Not Reviewing Progress | Regularly assess your financial plan to ensure you’re meeting your goals and making adjustments as needed. |

Avoiding these common mistakes will help you gain a clearer understanding of how to manage your finances and apply the concepts learned. Keep these tips in mind as you continue your journey to financial literacy, ensuring that you stay on the right path and avoid setbacks along the way.

How to Improve Your Module 7 Scores

Improving your performance in this section requires a strategic approach. By focusing on key areas and implementing specific strategies, you can enhance your understanding and retention of financial concepts, leading to higher scores and greater confidence.

Effective Study Techniques

- Review Key Concepts Regularly: Consistent review of the material helps reinforce your understanding and retain important information.

- Practice Active Learning: Engage with exercises and simulations to apply what you’ve learned in practical scenarios. This helps solidify your knowledge.

- Take Notes: Write down important points and explanations as you go through the material. This can improve retention and provide useful reference material later.

- Focus on Weak Areas: Identify the concepts that challenge you the most and dedicate extra time to mastering those topics.

Maximizing Test Performance

- Read Instructions Carefully: Ensure that you understand what each question or task is asking before attempting an answer.

- Manage Your Time: Allocate enough time to complete all tasks and review your answers before submitting.

- Check Your Work: After finishing, take a moment to review your answers for any mistakes or missed details.

- Stay Calm and Focused: A calm mind will help you think clearly and approach each task methodically, improving accuracy.

By adopting these strategies, you can improve your grasp of essential concepts and perform better in assessments. Consistency, focus, and practical application are the keys to success in mastering the material.

Frequently Asked Questions for Module 7

This section addresses some of the most common questions that learners have while navigating the financial concepts presented in this section. By providing clear and concise answers, we aim to clarify any uncertainties and help you stay on track as you progress through the material.

General Questions

| Question | Answer |

|---|---|

| What are the main topics covered in this section? | The content focuses on budgeting, saving, managing credit, and setting financial goals, all of which are key to understanding personal finance. |

| How long does it take to complete the activities? | The time needed varies depending on the individual, but typically, it takes about 1 to 2 hours to complete all the exercises and tasks. |

| Can I retake the exercises if I don’t score well? | Yes, you can revisit and retake the exercises as many times as needed to improve your understanding and score. |

Technical Questions

| Question | Answer |

|---|---|

| What should I do if the interactive tasks aren’t loading properly? | If you encounter technical issues, try refreshing the page or using a different browser. If the problem persists, contact technical support for assistance. |

| Can I access the materials on mobile devices? | Yes, the content is designed to be accessible on both desktop and mobile devices for ease of learning. |

| Are there any additional resources available? | Additional resources such as guides, videos, and articles are available to help deepen your understanding of the topics covered in this section. |

If you have other questions or need further clarification, don’t hesitate to ask for help. Understanding these key financial principles is an important step toward mastering your finances.

Strategies for Mastering Module 7 Topics

To truly grasp the concepts presented in this section, it’s essential to adopt effective learning strategies that not only improve your comprehension but also help you apply the principles in real-life scenarios. By using a combination of active engagement, structured practice, and consistent review, you can master the key topics and achieve success.

Active Learning Techniques

- Engage with Practical Exercises: Working through real-life scenarios helps deepen your understanding of how to apply the concepts, making them easier to retain.

- Teach What You’ve Learned: Explaining the material to someone else, or even just to yourself, can solidify your understanding and highlight areas where you need more practice.

- Use Flashcards: Create flashcards for important terms and concepts. This technique will help reinforce your memory and improve recall during assessments.

Focused Review and Repetition

- Review Regularly: Set aside time each day or week to revisit the key concepts. Spaced repetition has been shown to improve long-term retention.

- Break Down Complex Topics: If a concept feels overwhelming, break it down into smaller, more manageable pieces. Master each piece before moving on to the next.

- Stay Consistent: Consistency is key when mastering new material. Even if it’s just 20 minutes a day, steady study habits will yield the best results over time.

By incorporating these strategies into your learning routine, you’ll not only gain a better understanding of the material but also develop the skills to use the concepts effectively in practical situations. The more actively engaged you are, the more confident you’ll feel when applying these principles to your own financial decisions.

Quick Tips for Module 7 Success

Achieving success in this section requires focus, efficient study habits, and a strategic approach. By incorporating a few simple tips into your routine, you can boost your understanding and performance, making the learning process more manageable and rewarding.

- Stay Organized: Keep track of all your materials, notes, and assignments in one place to avoid confusion and last-minute stress.

- Set Clear Goals: Define what you want to accomplish each week and break it down into smaller, achievable tasks. This will help you stay focused and motivated.

- Engage with the Material: Take time to actively read through the content, make notes, and ask questions as you go. This will ensure that you are absorbing and retaining the material.

- Practice Regularly: Regular practice reinforces learning and helps you stay familiar with key concepts. Use quizzes, flashcards, or other methods to test yourself.

- Take Breaks: Don’t overload yourself with too much information at once. Short breaks between study sessions improve focus and prevent burnout.

- Stay Positive: Maintain a positive attitude and be patient with yourself. A confident mindset can enhance your learning experience and overall success.

By following these quick tips, you’ll enhance your grasp of the material, reduce stress, and improve your chances of success in assessments. Consistency and active engagement are key to mastering the concepts and making steady progress.

How Module 7 Builds Financial Knowledge

This section is designed to equip learners with the foundational skills needed to understand and manage personal finances effectively. Through a combination of interactive lessons, practical examples, and real-life applications, you will gain insight into the key principles that drive financial decision-making. By building on essential concepts such as budgeting, saving, and credit management, this section fosters a deeper understanding of financial independence and responsibility.

Understanding Personal Budgeting

One of the core components of this section is personal budgeting, a fundamental skill for managing your finances. Learners are guided through the process of creating and tracking a budget, which helps ensure that income is spent wisely and that savings goals are met. By simulating real-world scenarios, you’ll better understand how to allocate funds for different needs and how to avoid overspending.

Credit Management and Responsibility

Another key aspect of this section is credit management, which is vital for maintaining financial health. You’ll explore how credit works, the impact of credit scores, and strategies for managing debt. The knowledge gained in this area prepares you for responsible borrowing and helps you understand the consequences of financial decisions.

Through these lessons, you will not only improve your theoretical understanding of financial concepts but also develop the practical skills necessary to apply them in everyday life. The focus on real-life examples ensures that the concepts become applicable and relevant to your personal financial journey.

Important Terms to Know in Module 7

To fully understand the concepts covered in this section, it’s essential to become familiar with the key terminology. These terms form the foundation for mastering the content and applying it in real-life financial situations. Knowing these terms will help you navigate through various topics with ease and confidence.

- Budgeting: The process of planning and tracking income and expenses to ensure that you live within your means and meet savings goals.

- Credit Score: A numerical representation of an individual’s creditworthiness, based on their borrowing and repayment history.

- Debt-to-Income Ratio: A financial metric that compares an individual’s monthly debt payments to their monthly gross income, helping lenders assess loan eligibility.

- Emergency Fund: A savings reserve set aside for unexpected expenses or emergencies, such as medical bills or car repairs.

- Interest Rate: The percentage charged on borrowed money, or earned on savings, expressed as an annual percentage rate (APR).

- Investing: The act of allocating money into financial assets, such as stocks, bonds, or mutual funds, with the expectation of generating a return over time.

- Retirement Planning: The process of setting aside funds and making investments to secure financial stability during retirement years.

Understanding these terms will not only help you engage with the material more effectively but also prepare you to make informed financial decisions in the future. Mastery of this vocabulary is an important step toward achieving financial literacy and independence.

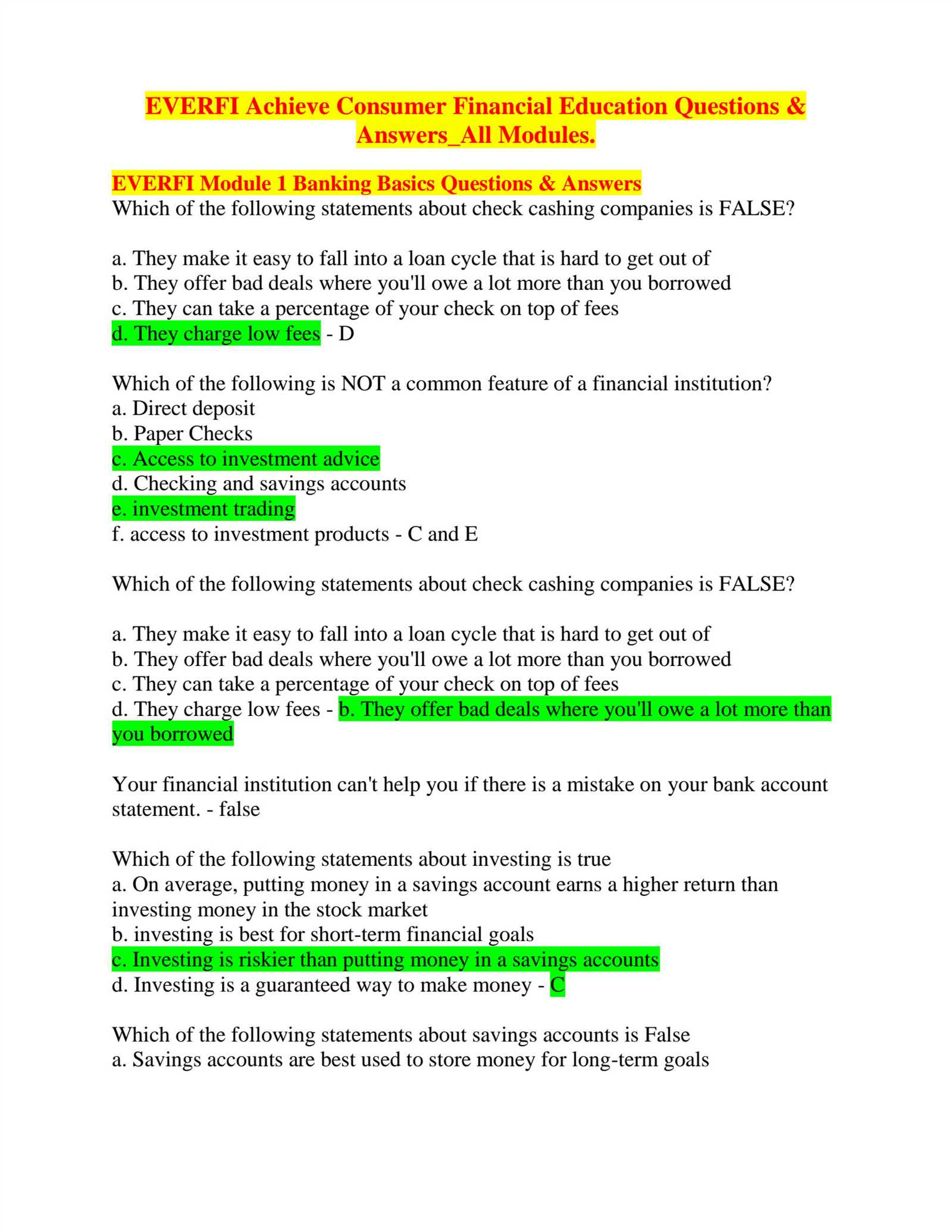

Module 7 Answers and Explanation

This section provides a detailed overview of the key concepts covered in the recent lessons, offering clarity and explanations for the most common questions and challenges. It is designed to help you understand the reasoning behind each answer and give you the tools to apply this knowledge in practical situations. With a clear breakdown of the material, you’ll gain a deeper understanding of the topics and feel more confident in your ability to make informed decisions.

1. Understanding Financial Planning: In this section, the importance of setting up a budget and planning for future expenses is emphasized. By allocating resources wisely and planning for unexpected costs, individuals can ensure financial stability. The key takeaway is to track all sources of income and expenses accurately to avoid unnecessary debt.

2. Building and Managing Credit: Another central concept is the role of credit in personal finance. Managing debt responsibly and maintaining a good credit score is crucial. The lesson explains how timely repayments and low credit utilization can improve one’s credit standing, while late payments and excessive debt can negatively impact financial health.

3. Savings and Investments: The material also touches on the importance of saving and investing for long-term financial goals. Understanding the various options available, such as high-interest savings accounts, retirement plans, and investment opportunities, is vital for growing wealth and securing financial independence.

4. Avoiding Common Pitfalls: Throughout the section, practical advice is given on avoiding common financial mistakes. These include overspending, failing to save, or taking on too much debt without a clear repayment strategy. Being aware of these pitfalls can help individuals make better decisions that lead to financial success.

By grasping these fundamental principles and their applications, you can ensure that your financial decisions are well-informed and aligned with your long-term goals. Each answer is an opportunity to solidify your understanding and continue progressing towards financial literacy and independence.

Best Practices for Completing Module 7

To succeed in this section, it’s essential to approach the material with a clear strategy. Understanding the core concepts, applying critical thinking, and reviewing key points regularly can help you navigate through the lessons effectively. By following these best practices, you can maximize your learning and achieve a deeper understanding of personal finance topics.

1. Stay Organized and Plan Ahead

Before diving into the content, take a moment to organize your study materials and set clear goals. Breaking down the section into manageable tasks will allow you to focus on one concept at a time, making the information easier to digest. This approach will prevent overwhelm and help you stay on track.

2. Review Key Terms and Concepts

It’s important to familiarize yourself with key financial terms and principles early on. Review the terminology as you go through the lessons to reinforce your understanding. This will help ensure that you can easily apply the knowledge to real-world scenarios, enhancing your ability to solve financial challenges.

| Tip | Benefit |

|---|---|

| Read the Instructions Carefully | Ensures you understand the objectives and avoid mistakes. |

| Take Notes | Helps retain information and reinforces learning. |

| Practice With Real-Life Examples | Improves practical understanding and application of concepts. |

| Ask for Help When Needed | Clarifies doubts and ensures accurate comprehension. |

By following these best practices, you will be better equipped to complete the section efficiently and with a strong grasp of the material. Consistent review and thoughtful application of the lessons will ensure that you gain the most from this educational experience.

Resources to Help with Module 7

To enhance your understanding and mastery of the concepts covered in this section, it’s helpful to utilize various resources designed to provide deeper insights and additional practice. These resources can include guides, tutorials, forums, and more. By leveraging the right tools, you can gain clarity on difficult topics and improve your performance.

Here are some valuable resources that can assist you in mastering the material:

| Resource | Description |

|---|---|

| Online Tutorials | Step-by-step guides and video lessons that break down complex concepts into manageable segments. |

| Financial Blogs | Expert articles and discussions that explore practical applications of the topics and provide real-world examples. |

| Study Groups | Collaborating with peers can help reinforce learning through discussions and shared insights. |

| Online Forums | Interactive communities where you can ask questions and get answers from experienced individuals. |

| Interactive Quizzes | Test your knowledge with quizzes and practice exercises to gauge your understanding and pinpoint areas that need improvement. |

By making use of these tools, you’ll be able to deepen your understanding, clarify any doubts, and apply the knowledge to real-world scenarios. Utilizing these resources effectively will help ensure that you are well-prepared and confident in completing the section.

How Module 7 Prepares You for the Future

The lessons covered in this section offer valuable knowledge and skills that can help you navigate both personal and professional financial decisions in the years to come. By focusing on essential financial concepts, this material equips you with the tools needed to make informed choices, manage finances responsibly, and plan for long-term financial well-being.

Building Practical Skills

The practical applications of the content allow you to develop essential life skills that will serve you throughout your career and personal life. Key areas include:

- Understanding budgeting and savings strategies

- Making wise investment decisions

- Managing risks through insurance and other financial products

- Planning for long-term financial goals such as retirement

Adapting to Changing Financial Environments

As the global economy and financial markets evolve, the ability to adapt is crucial. The knowledge gained will allow you to:

- Stay informed about emerging trends in finance and technology

- Make confident decisions in unpredictable economic climates

- Utilize digital tools for managing finances effectively

Ultimately, this section sets the foundation for developing a robust financial mindset that will help you confidently face future challenges, whether it’s managing personal finances, navigating the job market, or making savvy investment choices.

Test Your Knowledge After Module 7

After completing this section, it’s essential to evaluate how well you’ve grasped the key concepts and principles discussed. Testing your understanding helps reinforce what you’ve learned and ensures you’re prepared to apply these concepts in real-life situations. Regular self-assessment is an effective way to identify strengths and areas that may need further attention.

Below are some methods and tips to test your knowledge and ensure you are ready to move forward:

- Take practice quizzes: These can help you identify areas of weakness and solidify your understanding of key topics.

- Review key concepts: Revisit any sections that were challenging to ensure clarity before applying them to future situations.

- Discuss with peers: Sharing insights and discussing topics with others can provide new perspectives and strengthen your knowledge.

- Apply real-world scenarios: Try to relate what you’ve learned to everyday financial decisions and challenges to see how well the concepts hold up in practical use.

Regular self-assessment not only enhances your understanding but also boosts your confidence in applying the material to future financial decisions. Keep testing yourself to stay sharp and continue mastering these important skills.