Preparing for an insurance-related qualification can be a challenging yet rewarding experience. It requires a thorough understanding of various concepts and the ability to apply them in a practical context. For individuals looking to advance in their careers within the industry, passing this assessment is a crucial step in demonstrating expertise and professionalism.

The process of preparing for such an evaluation involves studying key topics, understanding the structure of the test, and familiarizing oneself with potential questions. This guide aims to provide insight into the preparation strategies and tools available to help you succeed. Whether you are new to the industry or seeking to refresh your knowledge, the following information will equip you with the essentials to approach this challenge confidently.

Maximizing your preparation involves identifying the most important subject areas, practicing with sample questions, and learning how to approach different types of queries. By breaking down the material into manageable sections, you can develop a clear study plan that increases your chances of success.

Throughout this article, we will discuss effective techniques to enhance your readiness, common pitfalls to avoid, and the resources that will support your journey towards achieving your professional goals.

Insurance Qualification Test Preparation

Successfully navigating a professional insurance assessment requires a deep understanding of the essential concepts related to the industry. The process of preparation involves not only grasping theoretical knowledge but also applying it to real-world scenarios. Being well-prepared will increase your confidence and performance when facing the actual evaluation.

Essential Topics to Master

The key to excelling in this qualification process is mastering the most relevant subject areas. These topics typically cover the core principles of insurance policies, risk management, claim handling, and industry-specific regulations. A strong foundation in these subjects will ensure you can tackle various questions effectively.

Techniques to Improve Your Performance

To enhance your chances of success, it is important to practice regularly with sample questions and mock tests. This allows you to familiarize yourself with the types of questions that may arise, as well as the format in which they will be presented. Developing a strategy to manage your time and approach difficult questions will also contribute to a higher score.

Overview of Insurance Qualification Process

Achieving a professional designation in the insurance industry requires passing a rigorous assessment that evaluates both knowledge and practical skills. This process is designed to ensure that candidates possess the necessary expertise to provide reliable service to clients and manage various insurance-related tasks effectively. Understanding the structure and expectations of this assessment is critical for successful preparation.

Key Components of the Qualification

The evaluation typically covers a wide range of topics, from policy types and claims procedures to legal and ethical considerations in the insurance field. The goal is to assess the candidate’s ability to apply this knowledge in real-world scenarios, ensuring they can make informed decisions when faced with client situations.

| Topic | Weight |

|---|---|

| Insurance Policies | 30% |

| Claims Process | 25% |

| Risk Management | 20% |

| Legal and Ethical Issues | 15% |

| Customer Service and Communication | 10% |

Test Duration and Format

The duration and structure of the qualification assessment can vary depending on the specific role and region. However, it typically includes both multiple-choice questions and scenario-based assessments to evaluate both theoretical knowledge and practical application. Understanding the format helps candidates manage their time and focus on the most important areas during preparation.

Key Topics Covered in the Test

The qualification process assesses a broad range of concepts essential to the insurance profession. To succeed, candidates must demonstrate their understanding of several critical subjects that are fundamental to providing comprehensive service and making informed decisions. Mastering these topics is key to performing well and passing the assessment.

Important Subject Areas

Each section of the test focuses on a specific aspect of the insurance industry, from understanding policy details to applying risk management strategies. The content tests both theoretical knowledge and practical problem-solving abilities, ensuring that candidates are well-prepared for real-world situations in their roles.

| Topic | Description |

|---|---|

| Insurance Policies | Understanding the types, terms, and coverage of different insurance plans. |

| Claims Handling | Knowledge of how to process, assess, and resolve claims effectively. |

| Risk Assessment | Ability to evaluate and mitigate potential risks related to policies and claims. |

| Legal and Ethical Standards | Familiarity with laws and ethical guidelines governing the insurance industry. |

| Customer Interaction | Effective communication skills for dealing with clients and providing advice. |

Preparation Strategies for Key Areas

To prepare for the assessment, it is essential to focus on these key areas. Reviewing industry standards, practicing with case studies, and familiarizing oneself with the legal frameworks and customer relations practices will significantly improve one’s chances of success. Proper study techniques are crucial for mastering these essential topics.

How to Prepare for the Assessment

Preparing for a professional insurance assessment requires a strategic approach, combining both theoretical study and practical application. The goal is to ensure that you fully understand the concepts being tested and are able to apply them confidently in real-world scenarios. A well-organized study plan will help you stay focused and ready when the time comes.

Effective Study Methods

To maximize your preparation, consider these key strategies:

- Review Core Topics: Focus on the main areas of the insurance field, such as policy types, claims procedures, and risk management.

- Practice with Sample Questions: Take time to work through practice questions and mock tests to familiarize yourself with the question format and timing.

- Use Study Guides: Invest in comprehensive study guides or online courses that break down complex topics into easily digestible sections.

- Join Study Groups: Collaborating with peers can help reinforce your understanding and allow you to share insights on difficult topics.

Time Management Tips

Proper time management is crucial during both your study phase and the actual assessment:

- Create a Study Schedule: Set aside specific times each day to focus on different topics. A consistent routine will help you stay on track.

- Prioritize Weak Areas: Identify the subjects you find most challenging and allocate extra study time to those areas.

- Practice Time-Restricted Sessions: Simulate test conditions by setting time limits when practicing with mock tests to build speed and efficiency.

By adopting these preparation strategies and staying disciplined in your approach, you will significantly improve your chances of success in the assessment.

Common Mistakes to Avoid During the Assessment

During a professional qualification test, it’s easy to make mistakes that can affect your performance. These errors can range from misinterpreting questions to poor time management. By being aware of common pitfalls, you can avoid them and improve your chances of success. Preparation alone is not enough; knowing how to navigate the test effectively is equally important.

Misinterpreting Questions

One of the most frequent mistakes candidates make is misinterpreting the wording of questions. Some questions may be tricky or contain multiple parts, requiring careful reading. Be sure to fully understand what is being asked before selecting your answer.

- Read every question carefully: Avoid rushing through questions. Take your time to comprehend each one fully before responding.

- Watch out for negative wording: Be mindful of words like “not” or “except” which can completely change the meaning of a question.

Poor Time Management

Another common mistake is failing to manage time effectively. If you spend too long on difficult questions, you may not have enough time to answer the easier ones. Planning how long to spend on each section and keeping an eye on the clock is essential for completing the test within the allotted time.

- Set time limits for each section: Break the test into sections and allocate a set amount of time to each, ensuring you have enough time to address all questions.

- Skip difficult questions: If you’re stuck on a question, move on and return to it later, rather than wasting too much time on it.

Overconfidence

Overconfidence can lead to careless errors. While it’s important to be confident in your knowledge, underestimating the difficulty of the test or assuming you know everything can result in mistakes. Always stay focused and double-check your answers when possible.

- Review your answers: If time allows, revisit your responses to ensure they are accurate and complete.

- Stay humble: Even if you feel confident, don’t skip over questions or sections that you find challenging.

By staying vigilant and mindful of these common mistakes, you can approach the assessment with confidence and increase your likelihood of success.

Understanding the Qualification Test Format

Understanding the structure and format of a professional assessment is crucial for effective preparation. This insight allows you to tailor your study approach, manage your time during the test, and handle questions with confidence. Knowing what to expect on test day helps reduce anxiety and ensures a smoother experience as you progress through the evaluation.

The assessment typically consists of multiple types of questions that are designed to assess both theoretical knowledge and practical application. By familiarizing yourself with the structure, you can develop strategies to navigate the test more efficiently.

| Question Type | Details |

|---|---|

| Multiple-Choice | Questions with several answer choices, where only one is correct. These assess knowledge of specific concepts. |

| Scenario-Based | Real-world scenarios requiring you to apply your knowledge and make informed decisions. |

| True/False | Statements that must be evaluated as either true or false based on your understanding of policies and procedures. |

| Fill-in-the-Blank | Questions that test specific details or terms related to insurance practices. |

By understanding these different types of questions, you can better prepare yourself to tackle each one efficiently. Whether you’re familiar with multiple-choice questions or need practice with scenario-based inquiries, knowing the test format is essential for success.

Top Resources for Qualification Preparation

Preparing for a professional qualification requires more than just self-study; it involves utilizing various resources to ensure comprehensive understanding. From books and online platforms to practice tests and study groups, the right materials can help solidify your knowledge and boost your confidence. Using a mix of these tools ensures that you’re well-prepared for any challenge the assessment may present.

Books and Study Guides

Books and detailed study guides are fundamental resources for understanding key concepts and theories. These resources often provide structured lessons, explanations, and practice questions to reinforce learning.

- Comprehensive Textbooks: These cover all the essential topics and are great for deep dives into complex subjects.

- Official Study Guides: Created by organizations, these guides are tailored to the specific assessment and provide targeted review material.

- Workbooks: Hands-on practice through exercises and quizzes is a great way to solidify your understanding of the material.

Online Learning Platforms

Online platforms offer flexibility and a wide variety of tools to aid in preparation. They allow for self-paced learning and access to a variety of formats, including video lessons and interactive quizzes.

- Interactive Courses: These courses often include video lectures, tutorials, and quizzes that help break down difficult concepts.

- Practice Tests: Online mock exams simulate the real test environment, helping you become familiar with the question types and time constraints.

- Forums and Discussion Groups: Engaging with peers online can help clarify doubts and share insights on challenging topics.

By combining these resources, you will have a well-rounded approach to preparation, ensuring that you cover all areas of knowledge and gain practical experience for the actual test.

Tips for Passing the Qualification Assessment

Successfully navigating a professional qualification evaluation requires more than just knowledge–it requires strategy. From time management to staying calm under pressure, adopting effective test-taking techniques can make all the difference. These tips will help ensure you’re fully prepared to tackle the test and perform at your best.

Effective Study Habits

Adopting the right study habits is key to mastering the material and ensuring long-term retention. Establishing a routine and focusing on key areas will help you build confidence before the assessment.

- Create a Study Schedule: Plan your study time well in advance and break down your review sessions by topic. Stick to your schedule for consistency.

- Focus on Weak Areas: Identify the areas you find most challenging and devote additional time to them to ensure you’re well-rounded in your knowledge.

- Take Breaks: Avoid burnout by taking short, regular breaks during study sessions. This helps keep your mind fresh and focused.

Test-Taking Strategies

Once you’re prepared, employing effective test-taking strategies will help you manage the pressure of the actual assessment. These techniques can maximize your chances of success during the test itself.

- Read Questions Carefully: Ensure you fully understand each question before answering. Pay close attention to keywords like “not” or “except,” which can change the meaning.

- Manage Your Time: Allocate a set amount of time for each section of the test and keep an eye on the clock to ensure you don’t run out of time.

- Skip and Return: If you’re stuck on a question, move on and return to it later. This prevents wasting valuable time and reduces frustration.

- Double-Check Answers: If time permits, review your answers to ensure you haven’t missed anything or misinterpreted a question.

By following these strategies and staying calm and focused, you’ll increase your chances of performing well on the assessment and achieving the results you desire.

How to Increase Your Success Rate

Achieving a high success rate on any professional assessment requires more than just basic knowledge–it involves strategic preparation, effective techniques, and mental readiness. By adopting a disciplined approach and focusing on key areas of improvement, you can significantly boost your chances of success. Here are several practical steps to help increase your performance and ensure you’re fully prepared for the evaluation.

Start by organizing your study sessions in a way that maximizes efficiency. Prioritize areas that require more attention, and tackle the more complex topics first. The key is not only reviewing material but also understanding how to apply it under pressure.

In addition to solid study habits, practicing with real-life scenarios can also be a game-changer. This will help you build confidence and develop the necessary problem-solving skills to handle different types of questions that might appear on the assessment.

Lastly, maintaining a positive mindset and managing stress can greatly affect your overall performance. Stay calm, focused, and confident as you approach the evaluation, and trust in the preparation you’ve put in.

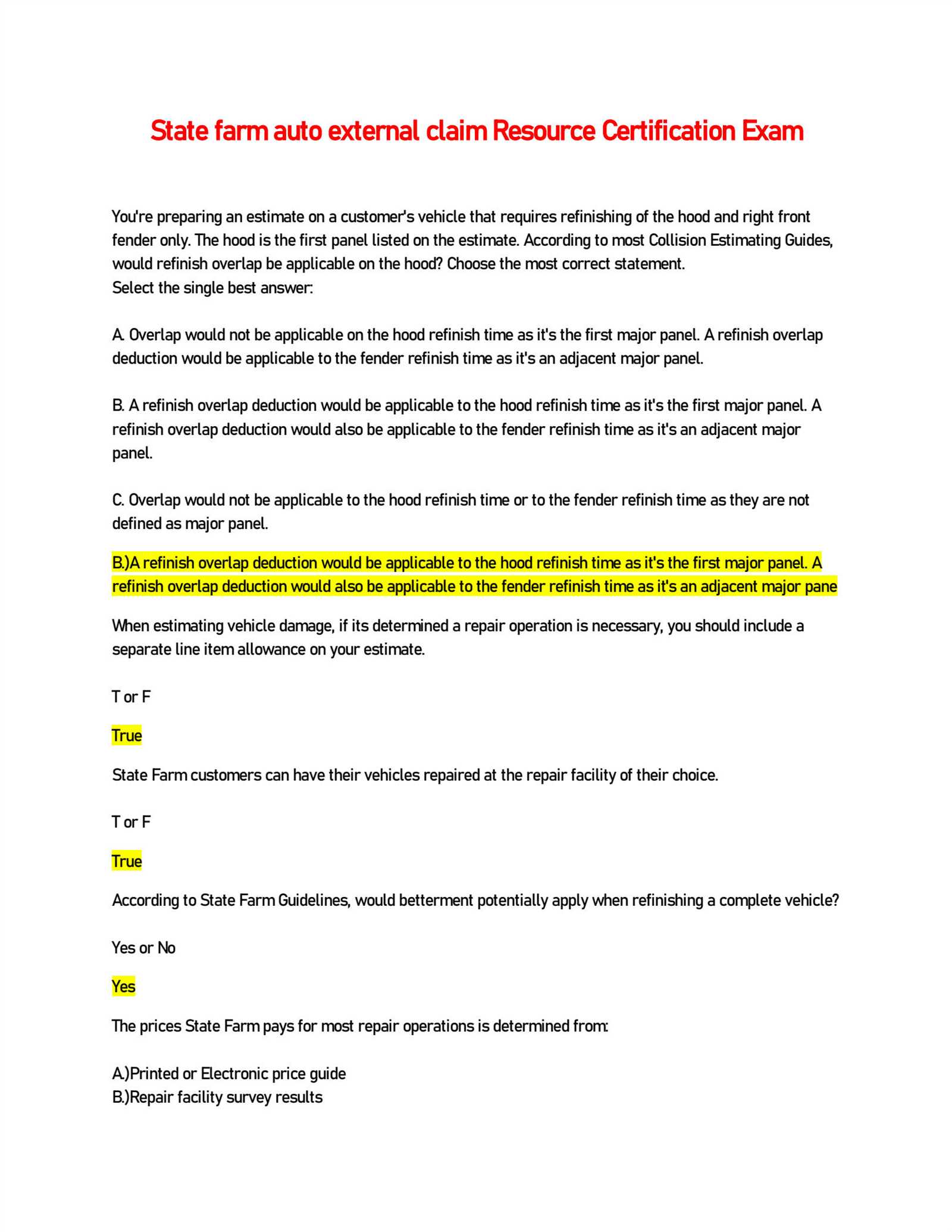

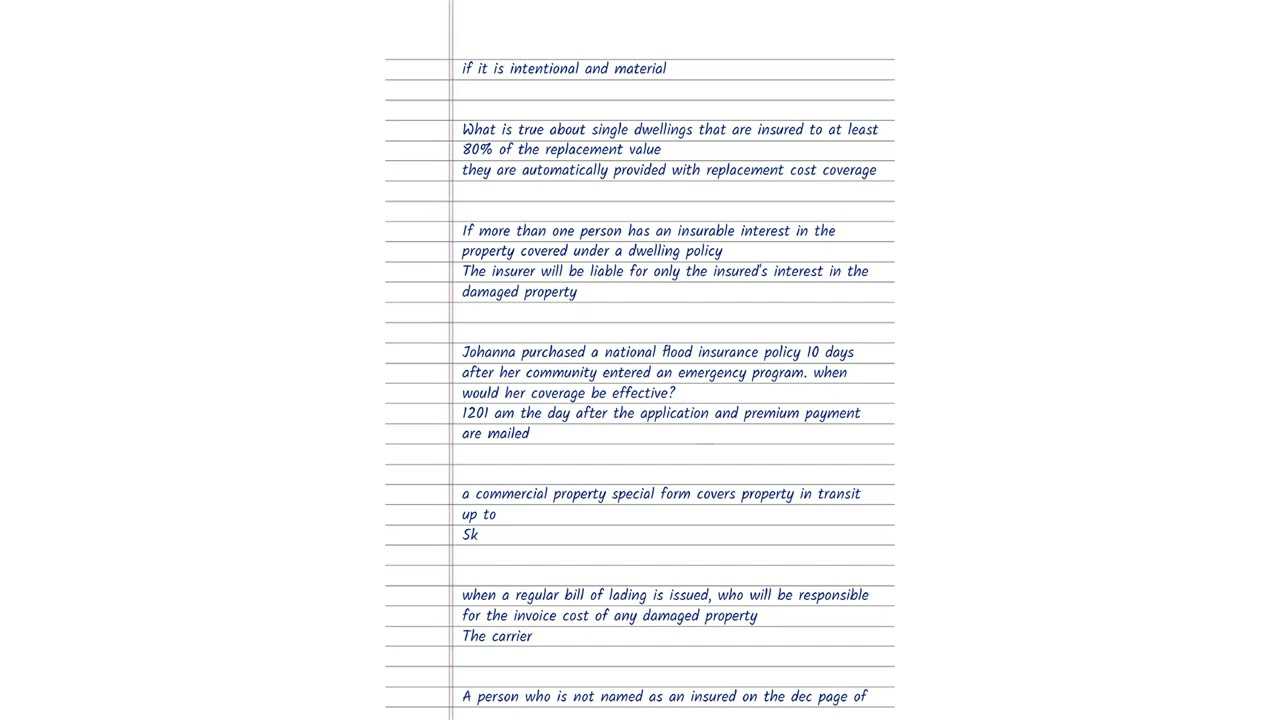

Test Question Types and Examples

Understanding the different types of questions on a professional assessment is essential for success. Each question format is designed to evaluate a specific aspect of your knowledge and ability to apply that knowledge. Familiarizing yourself with these question types and reviewing examples will help you approach the test with confidence and improve your chances of success.

There are several common question types you will encounter, each requiring different strategies to answer effectively. Below are some of the most frequently used formats and examples to help you prepare:

Multiple-Choice Questions

Multiple-choice questions are designed to test your understanding of specific concepts. You will be presented with a question followed by several possible answers, with only one correct response.

- Example: What is the primary factor in determining an individual’s insurance premium?

- A. Age

- B. Credit score

- C. Driving record

- D. Vehicle make and model

Correct answer: C. Driving record

Scenario-Based Questions

These questions provide a real-world situation and require you to apply your knowledge to solve a problem or make a decision. They assess your ability to think critically and logically.

- Example: If a client has been in an accident and has both comprehensive and collision coverage, which type of coverage will apply to damage caused by another vehicle?

- A. Comprehensive

- B. Collision

- C. Both

- D. Neither

Correct answer: B. Collision

True/False Questions

True/false questions present a statement, and you must decide whether the statement is correct or incorrect. These questions often test your knowledge of specific rules or facts.

- Example: A deductible is the amount a policyholder must pay out-of-pocket before their insurance covers the rest of the claim.

- A. True

- B. False

Correct answer: A. True

Fill-in-the-Blank Questions

These questions test your ability to recall specific terms or concepts. You will need to fill in the blank with the correct word or phrase.

- Example: The type of insurance that covers damage to a vehicle caused by natural disasters, such as floods or earthquakes, is called _______________.

Correct answer: Comprehensive

By practicing these different question types, you will be better prepared to approach each section of the test with the right mindset and strategy.

How Long Does the Assessment Take

The duration of any professional evaluation can vary depending on the complexity of the material being tested and the format of the questions. Knowing how long the assessment will take is crucial for planning your time and ensuring you remain focused throughout the entire process. Understanding the expected length helps you pace yourself, manage stress, and complete the evaluation successfully.

Typical Duration of the Test

Most assessments are designed to be completed within a set time frame, typically ranging from one to two hours. This allows enough time to answer all questions thoroughly while keeping the process efficient. However, the exact duration can depend on factors such as the number of questions, the difficulty of the material, and whether the assessment includes practical or scenario-based components.

Time Management Tips

Efficient time management is key to success. Here’s how you can make the most of the time allocated:

- Break down the time: Divide the total duration by the number of sections or questions to set mini time goals.

- Don’t dwell on one question: If you’re unsure of an answer, move on and come back to it later if time permits.

- Practice timed assessments: Familiarize yourself with working under time constraints to improve your pacing.

By being aware of the time limits and following these strategies, you can ensure that you complete the assessment in the given time frame while maintaining accuracy and confidence in your answers.

Understanding Scoring and Results

When taking a professional assessment, it is essential to understand how your performance is evaluated and what the final results mean. Knowing the scoring system will help you interpret your outcomes accurately and assess where you stand in terms of meeting the required standards. Scoring not only reflects your ability to answer questions but also your depth of understanding and application of the material.

How the Scoring Works

Each question on the test is typically assigned a specific point value based on its complexity. In some cases, questions may have partial points, especially when multiple responses are required or if the question involves a scenario that demands detailed reasoning.

- Multiple-choice questions: Usually scored with one point for the correct answer.

- Scenario-based questions: May be worth more points due to the higher level of analysis required.

- True/false questions: Typically carry a lower point value.

Interpreting Your Results

After completing the test, your results will generally be provided in a score format, often indicating both your overall performance and your performance in specific areas. Here’s how to interpret those results:

- Pass or Fail: Some assessments are designed to give you a simple pass/fail result based on whether your score meets or exceeds a minimum threshold.

- Percent Correct: This score reflects the percentage of correct answers you provided out of the total number of questions.

- Sectional Scores: In some cases, your performance may be broken down by sections or topics, providing a clearer picture of strengths and weaknesses.

By understanding the scoring process, you can focus on the areas that need improvement for future assessments and better track your progress in mastering the necessary knowledge.

Certification Renewal and Continuing Education

Once you have completed an initial evaluation, maintaining your qualification is an ongoing process. This typically involves periodic renewals and engaging in educational activities to stay up to date with industry standards. Staying current ensures you remain knowledgeable and compliant with the evolving requirements of your profession.

Renewing Your Qualification

Most professional qualifications require renewal every few years. This process typically involves meeting specific requirements, such as completing additional training or accumulating a set number of professional development hours. Renewal ensures that professionals continue to meet the necessary knowledge and competency levels required by the industry.

- Renewal timeline: Be aware of the time frame in which you need to submit your renewal. This is often a few months before your qualification expires.

- Required credits: Certain number of hours of continued education or training may be mandatory for renewal.

- Documentation: Keep track of any courses or training programs you have completed for the renewal process.

Engaging in Ongoing Learning

To remain competitive and compliant, engaging in continuous professional development is key. Ongoing education allows you to expand your expertise, learn new skills, and adapt to changes in regulations or technology. Many organizations offer workshops, online courses, and webinars that contribute to your growth.

- Workshops and seminars: These can provide in-depth coverage of specific topics relevant to your field.

- Online courses: Convenient and flexible options for expanding your knowledge from anywhere.

- Networking opportunities: Connecting with peers during learning events can open doors to new insights and career opportunities.

By consistently renewing your qualifications and pursuing continued education, you ensure that you stay at the forefront of your profession, maintaining your expertise and credibility.

State Farm Exam vs Other Insurance Tests

When it comes to assessments in the insurance industry, different organizations have varying requirements and testing formats. While some tests focus on specific knowledge areas or regions, others assess a broader range of skills applicable across multiple companies. Understanding the differences between these assessments can help you prepare more effectively and choose the best path to achieve your career goals.

Key Differences in Test Structure

The tests conducted by different insurance providers vary significantly in their structure and focus areas. While certain exams are tailored to specific product lines or services, others might have a broader approach. Here’s an overview of some of the notable distinctions:

- Specialization: Some providers require exams focused on particular products (e.g., home, life, or health insurance), while others may focus on broader knowledge of the insurance industry.

- Content depth: Exams may vary in terms of difficulty, with some offering multiple-choice questions, others requiring case studies or simulations to test practical application of knowledge.

- Duration: The time allowed to complete different tests can differ. Some assessments are shorter, while others can span several hours depending on their complexity.

Comparison of Study Materials

Each assessment typically comes with a set of recommended or required study materials. These resources may vary from one provider to another, as each organization has specific expectations for their candidates. Understanding the study materials available can significantly enhance your preparation:

- Official study guides: Many insurers provide proprietary study guides, which offer insight into the types of questions likely to appear on the test.

- Online courses and practice tests: Some companies offer online courses or practice exams, which allow candidates to test their knowledge in a simulated environment before taking the real test.

- Third-party study resources: A variety of third-party providers also offer preparatory materials, which can give broader perspectives on test content and techniques.

Understanding the differences in testing formats and study materials will help you select the right resources and approach for your preparation. With careful planning, you can enhance your chances of success, whether you’re taking a test for a specific provider or a general industry assessment.

Benefits of Passing the Certification

Successfully completing a professional assessment in the insurance industry offers numerous advantages that can significantly impact both your career and personal development. The process not only helps validate your expertise but also opens doors to new opportunities, better job security, and higher earnings potential.

Career Advancement Opportunities

One of the most immediate benefits of passing the required assessments is the potential for career growth. With the validation of your knowledge and skills, you can qualify for higher-level positions, leadership roles, or specialized jobs within the field. Companies often seek certified professionals for key positions, recognizing the value they bring to the organization.

- Increased job prospects: With certification, your resume becomes more attractive to potential employers looking for verified expertise.

- Higher salary potential: Professionals who have completed such assessments are often eligible for better compensation packages due to their demonstrated competence.

- Career mobility: Certification may also provide the flexibility to work across various sectors or geographic regions, enhancing job security.

Enhanced Knowledge and Confidence

Passing the assessment not only boosts your resume but also strengthens your understanding of industry practices. As you study for and complete the evaluation, you gain deeper insights into the field, enhancing your ability to tackle complex challenges and perform effectively in your role.

- Increased confidence: Successfully navigating the process provides a sense of accomplishment, boosting your confidence in handling tasks and challenges.

- Better decision-making: With a deeper understanding of key concepts, you’ll be better equipped to make informed, effective decisions in your day-to-day work.

- Professional credibility: Achieving certification signals to colleagues and clients that you possess a high level of proficiency, earning respect and trust in the workplace.

Overall, passing such a professional assessment is an investment in your career and future, offering both tangible and intangible rewards that can help you thrive in a competitive field.

What to Do After Passing the Exam

After successfully completing the required assessment, there are several important steps to take that will ensure you make the most of your achievement. These steps will help solidify your position within the industry, enhance your professional reputation, and open doors to new opportunities for growth.

Update Your Resume and Professional Profiles

Once you have passed the assessment, it’s essential to reflect this accomplishment in your professional documentation. Update your resume, LinkedIn profile, and any other professional networks to highlight your newly acquired skills and qualifications. This will make you stand out to potential employers and increase your chances of securing higher-level roles.

- Include specific certifications: List your new qualifications and any relevant skills gained through the process to showcase your proficiency.

- Highlight accomplishments: Mention any special projects or achievements related to your newly validated knowledge.

Seek Opportunities for Career Advancement

With the validation of your skills, now is the time to explore new career opportunities. Whether you are looking for a promotion, a shift in your career path, or a new role altogether, your certification will give you an edge. Take advantage of networking, job boards, and internal opportunities within your organization.

- Apply for higher roles: Look for positions that require your newly acquired skills, ensuring your next role aligns with your career goals.

- Network with industry professionals: Attend relevant events, workshops, and networking opportunities to connect with other professionals in your field.

By taking these steps after passing the assessment, you’ll be well-positioned to maximize the benefits of your hard work and move forward in your professional journey.

Frequently Asked Questions About the Exam

This section addresses common queries and concerns related to the assessment process. Understanding the typical questions surrounding preparation, requirements, and post-assessment procedures can help alleviate any uncertainties and guide you towards successful completion. Below are some of the most frequently asked questions.

What is the format of the assessment?

The test typically consists of multiple-choice questions, scenario-based inquiries, and practical applications of the material. It is designed to evaluate both theoretical knowledge and practical problem-solving abilities within the field.

How long do I have to complete the assessment?

The duration for completing the test may vary depending on the specific guidelines set by the administering body. Generally, candidates are given several hours to finish, but it’s important to confirm the exact time limit in advance to ensure proper time management during the process.

What happens if I don’t pass on the first attempt?

If you do not pass the assessment on your initial try, don’t worry. Many programs allow you to retake the test after a certain waiting period. Be sure to review the study materials thoroughly before attempting again, and consider utilizing additional resources to strengthen areas of weakness.

Is there any support available during preparation?

Yes, there are various study guides, practice tests, and online forums that can offer assistance. Many individuals also find joining study groups or seeking mentorship from those who have already completed the assessment helpful in reinforcing key concepts and gaining insights into the process.

What is the significance of passing this assessment?

Successfully completing this process is often required to meet industry standards and can significantly enhance your professional credentials. It may also open doors to advanced roles, salary increases, and opportunities for further career development within the field.